All Activity

- Past hour

-

Google Analytics adds AI insights and cross-channel budgeting to Home page

Google Analytics is adding AI-powered Generated insights to the Home page and rolling out cross-channel budgeting (beta), moves designed to help marketers spot performance shifts faster and manage paid spend more strategically. What’s happening. Generated insights now appear directly on the Google Analytics Home screen, summarizing the top three changes since a user’s last visit. That includes notable configuration updates, anomalies in performance and emerging seasonality trends — all without digging into detailed reports. The feature is built for speed. Instead of manually scanning dashboards, marketers get a quick snapshot of what changed and why it may matter. Cross-channel budgeting (Beta). Google is also introducing cross-channel budgeting in beta. The feature helps advertisers track performance across paid channels and optimize investments based on results. Access is currently limited, with broader availability expected over time. Why we care. These updates make it faster to spot performance shifts and easier to connect insights to budget decisions. Generated insights surface key changes automatically, reducing the time spent digging through reports, while cross-channel budgeting helps marketers allocate spend more strategically across paid channels. Together, they streamline analysis and improve how quickly teams can Bottom line. Together, Generated insights and cross-channel budgeting aim to reduce reporting friction and improve decision-making — giving marketers faster answers and more control over how they allocate budget across channels. View the full article

-

Mortgage rates settle above 6%, lowest in over three years

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday. View the full article

-

Pending home sales fell to record low in January

An index of contract signings fell 0.8% last month to the lowest level in data from 2001, following a revised 7.4% decline in December, according to National Association of Realtors figures released Thursday. View the full article

- Today

-

updates: swearing at work, letting difficult coworkers be wrong, and more

It’s “where are you now?” month at Ask a Manager, and all December I’m running updates from people who had their letters here answered in the past. Here are four updates from past letter-writers. 1. How common is swearing at work? (#2 at the link) I always thought that if you answered a question for me, I would engage with the commentariat and also send in an update! But when I saw the post was up, I was experiencing severe pregnancy-induced anxiety … and promptly avoided the site for around a year. Today I went and looked at the published post for the very first time. (And I felt like the responses from everyone were actually quite lovely, so I don’t know what I was anxious about.) Someone asked in the comments how I know all my coworkers’ religious affiliations. I don’t! But I belong to one of those religions where it’s pretty obvious if you aren’t a member. For example, you know when people aren’t Hasidic Jews because they don’t cover their heads or wear prayer shawls. Personally, I try to avoid talking about religion at work. It just doesn’t seem the place. In contrast, Lesley frequently talked about religion in offhand comments, and so did some of my other coworkers. So it felt blatant when he started acting completely differently. I think the main thing that bothered me was that Lesley was pretty unprofessional in general. It seemed like he was trying to be my friend (think Leslie Knope, but more tone deaf), but I just wanted him to be my boss. When his behavior around religion changed, it felt like he was forcing us all to be party to his faith crisis or whatever was happening. And as some people guessed on the original post, it was also jarring since frequent swearing wasn’t part of the workplace culture. The anxiety probably also wasn’t helping. On to the update. Since I wrote in, a lot has happened. While I was on parental leave, Lesley stopped being my boss and moved to a different department, so I no longer had to deal with anything he was doing. My baby had health problems, but instead of focusing on that, I spent a good portion of my leave responding to emails about medical paperwork issues that were supposedly taken care of before I left. It wasn’t a great time. When I returned, there were lots of crises at my job, including our CEO going viral for saying some insensitive things. I kept my head down and just tried to do my job despite everything crumbling around me. I recently had another baby, and this time, my company told me the day before I was supposed to return that they’d supplied paperwork with the wrong dates and that I therefore couldn’t come back to work (!). Long story short, that was the last straw. I have since resigned to do freelance work and spend more time with my beautiful infant and now-healthy toddler. I’m glad I was Lesley-less for the last few years working there, but I do sometimes wonder if I could have harnessed Lesley’s excessive, boundary-stomping friendliness to get him on “my team” to push back against the parental leave paperwork weirdness. I guess I’ll never know. 2. Can I just let difficult coworkers be wrong? Even before I wrote in, I guess things were brewing internally. I wasn’t the only person aware of this part of our culture. I think I was downplaying it too much. We ended up having a big company-wide meeting about not being jerks to each other. Then we all had some smaller meetings with HR individually and in groups just after your answer went live. From the scuttlebutt around the office, one of the HR managers got sick of exit interviews where people said they were leaving with nothing lined up because the company culture was too toxic. This made the CEO and executives send in a third party company to do an audit of culture, output, leadership, and stuff like that. I was asked to meet with someone from the audit company and HR to specifically discuss the logo incident. Other people had brought it up multiple times as an example of bad culture and bullying (1) because Leslie went on for a while and (2) none of the managers stepped in to redirect. HR asked why I didn’t say anything during the meeting or after the fact so I told them that I prefer to just let people be wrong, almost everyone knew that it was a contractor’s design, and I was more concerned about looking argumentative because engaging in these things tend to make it worse. They noted that but also told me not to accept bullying just because it’s easy. This and your response along with the comments really opened my eyes that I thought was staying out of things was actually a freeze-response to confrontation and this place is more confrontational than a boxing match. This is also what my partner and friends were trying to address with me, too. I guess they saw it for what it was early on. Because my field is entertainment-adjacent, it has a long history of backstabbing and bad behavior. My company is newer and they want to get rid of that industry environment, so we’ll see how this plays out. Leslie is now part of a group of my coworkers who are not necessarily in deep crap but they’re being monitored closely. Good. 3. How to respond when a candidate discloses autism in an interview (#2 at the link) I saw my initial question from a few years ago was reposted and thought this would be a good time for an update. First off, I changed some details for anonymity’s sake, but one important detail is that the colleague who responded to the candidate saying they shouldn’t disclose their autism diagnosis was actually my boss and the head of the organization. This was also my first time hiring anyone, and the unease I felt in my initial letter was my gut instinct telling me my boss was not handling this properly, but not feeling comfortable enough to say anything. We ended up getting a new head of the organization a couple years later and when I told them about this specific experience, they were horrified that our last boss had said that to a job candidate. We also learned over time that there were many, many things our old boss had said or done that were misguided at best and potentially illegal at worst, so … let’s just say there was a lot of unlearning that needed to happen. Thankfully, I learned and grew a lot from our new boss, and although I’m no longer at that job, I feel much more equipped to handle these situations if/when they come up. The post updates: swearing at work, letting difficult coworkers be wrong, and more appeared first on Ask a Manager. View the full article

-

Private credit stocks slide after Blue Owl halts redemptions at fund

Investment group’s decision sends shivers through industryView the full article

-

Intuit Unveils Mailchimp Upgrades, Enhancing E-commerce Marketing Global Reach

Small business owners eager to enhance their e-commerce marketing efforts can look forward to fresh innovations from Intuit’s Mailchimp. On February 10, 2026, Intuit announced a suite of product upgrades designed to streamline data management and automate marketing processes. These enhancements target the core challenges many small and mid-sized businesses face in optimizing customer acquisition and growth strategies. Mailchimp’s updated capabilities now empower users to connect data sources more effectively, driving improved return on investment (ROI) for marketing campaigns. According to Diana Williams, Vice President of Product at Mailchimp, this release not only provides businesses with “26% more ecommerce triggers” but also creates a unified platform for data, automation, and analytics. This means better execution of campaigns and clearer visibility into how each marketing initiative translates to sales. For businesses grappling with the intricacies of marketing, the benefits are substantial. Mailchimp’s enhanced features help convert data into actionable insights, allowing entrepreneurs to build precise customer segments such as high-value buyers or at-risk customers. By integrating data from platforms like Shopify and customer review sites, small business owners can optimize their marketing campaigns without juggling multiple tools. Moreover, the expansion of SMS marketing into 34 new countries, including Belgium, Norway, and Greece, allows brands to engage customers via mobile messaging—an increasingly important avenue in today’s digital landscape. Features like unique discount codes and instant opt-ins through pop-ups can tie campaigns directly to sales, helping businesses track effectiveness in real time. Another significant innovation is the revamped omnichannel marketing dashboard, which unifies performance metrics across email, SMS, and ecommerce events. This holistic view enables entrepreneurs to see which strategies yield results and where they might need adjustments. Coupled with AI-driven analytics that predict customer behaviors, businesses can make data-backed decisions to drive revenue. Mailchimp also aims to ease the onboarding process for newcomers, offering new migration tools that facilitate a seamless transition. For businesses switching from other platforms, this means less downtime and more quick-to-market campaigns. Ali Mann, a customer from Kaylin + Kaylin Pickles, noted an impressive turnaround, stating, “I was so blown away…our open rates more than doubled” after making the switch. However, while these advancements present considerable opportunities for small business owners, it’s essential to consider potential challenges. The emphasis on data integration requires an ongoing commitment to maintaining accurate customer insights. Additionally, as competition in the e-commerce space intensifies, small business owners must be ready to adapt swiftly to leverage these new tools effectively. Many Mailchimp users report substantial time savings—averaging about 16 hours per week—after implementing these features. E-commerce clients leveraging SMS marketing have even witnessed ROIs soaring up to 22 times their investment. Such statistics suggest that the right tools can lead to significant efficiencies and heightened customer engagement. Intuit emphasizes that these innovations are crucial for small and mid-sized businesses looking to thrive in a competitive market. Ciarán Quilty, Senior Vice-President for International at Intuit, highlighted the essential nature of these tools: “We’re giving small and mid-size businesses connected data, automation and AI that simply work together.” This sentiment underscores a broader trend where accessible, efficient marketing solutions become indispensable for success. Overall, Mailchimp’s new features represent a pivotal step for small businesses aiming to hone their marketing strategies effectively. By leveraging integrated data, powerful automation, and meaningful insights, entrepreneurs can optimize their marketing efforts, drive profitability, and navigate the challenges of today’s e-commerce landscape. As these tools begin rolling out globally, businesses stand poised to capitalize on their potential impact. For more details about these innovations, you can check the original press release here. Image via Google Gemini This article, "Intuit Unveils Mailchimp Upgrades, Enhancing E-commerce Marketing Global Reach" was first published on Small Business Trends View the full article

-

Intuit Unveils Mailchimp Upgrades, Enhancing E-commerce Marketing Global Reach

Small business owners eager to enhance their e-commerce marketing efforts can look forward to fresh innovations from Intuit’s Mailchimp. On February 10, 2026, Intuit announced a suite of product upgrades designed to streamline data management and automate marketing processes. These enhancements target the core challenges many small and mid-sized businesses face in optimizing customer acquisition and growth strategies. Mailchimp’s updated capabilities now empower users to connect data sources more effectively, driving improved return on investment (ROI) for marketing campaigns. According to Diana Williams, Vice President of Product at Mailchimp, this release not only provides businesses with “26% more ecommerce triggers” but also creates a unified platform for data, automation, and analytics. This means better execution of campaigns and clearer visibility into how each marketing initiative translates to sales. For businesses grappling with the intricacies of marketing, the benefits are substantial. Mailchimp’s enhanced features help convert data into actionable insights, allowing entrepreneurs to build precise customer segments such as high-value buyers or at-risk customers. By integrating data from platforms like Shopify and customer review sites, small business owners can optimize their marketing campaigns without juggling multiple tools. Moreover, the expansion of SMS marketing into 34 new countries, including Belgium, Norway, and Greece, allows brands to engage customers via mobile messaging—an increasingly important avenue in today’s digital landscape. Features like unique discount codes and instant opt-ins through pop-ups can tie campaigns directly to sales, helping businesses track effectiveness in real time. Another significant innovation is the revamped omnichannel marketing dashboard, which unifies performance metrics across email, SMS, and ecommerce events. This holistic view enables entrepreneurs to see which strategies yield results and where they might need adjustments. Coupled with AI-driven analytics that predict customer behaviors, businesses can make data-backed decisions to drive revenue. Mailchimp also aims to ease the onboarding process for newcomers, offering new migration tools that facilitate a seamless transition. For businesses switching from other platforms, this means less downtime and more quick-to-market campaigns. Ali Mann, a customer from Kaylin + Kaylin Pickles, noted an impressive turnaround, stating, “I was so blown away…our open rates more than doubled” after making the switch. However, while these advancements present considerable opportunities for small business owners, it’s essential to consider potential challenges. The emphasis on data integration requires an ongoing commitment to maintaining accurate customer insights. Additionally, as competition in the e-commerce space intensifies, small business owners must be ready to adapt swiftly to leverage these new tools effectively. Many Mailchimp users report substantial time savings—averaging about 16 hours per week—after implementing these features. E-commerce clients leveraging SMS marketing have even witnessed ROIs soaring up to 22 times their investment. Such statistics suggest that the right tools can lead to significant efficiencies and heightened customer engagement. Intuit emphasizes that these innovations are crucial for small and mid-sized businesses looking to thrive in a competitive market. Ciarán Quilty, Senior Vice-President for International at Intuit, highlighted the essential nature of these tools: “We’re giving small and mid-size businesses connected data, automation and AI that simply work together.” This sentiment underscores a broader trend where accessible, efficient marketing solutions become indispensable for success. Overall, Mailchimp’s new features represent a pivotal step for small businesses aiming to hone their marketing strategies effectively. By leveraging integrated data, powerful automation, and meaningful insights, entrepreneurs can optimize their marketing efforts, drive profitability, and navigate the challenges of today’s e-commerce landscape. As these tools begin rolling out globally, businesses stand poised to capitalize on their potential impact. For more details about these innovations, you can check the original press release here. Image via Google Gemini This article, "Intuit Unveils Mailchimp Upgrades, Enhancing E-commerce Marketing Global Reach" was first published on Small Business Trends View the full article

-

AI’s biggest problem isn’t intelligence. It’s implementation

Welcome to AI Decoded, Fast Company’s weekly newsletter that breaks down the most important news in the world of AI. You can sign up to receive this newsletter every week via email here. The AI ‘arms race’ may be more of an ‘arm-twist’ The big AI companies tell us that AI will soon remake every aspect of business in every industry. Many of us are left wondering when that will actually happen in the real world, when the so-called “AI takeoff” will arrive. But because there are so many variables, so many different kinds of organizations, jobs, and workers, there’s no satisfying answer. In the absence of hard evidence, we rely on anecdotes: success stories from founders, influencers, and early adopters posting on X or TikTok. Economists and investors are just as eager to answer the “when” question. They want to know how quickly AI’s effects will materialize, and how much cost savings and productivity growth it will generate. Policymakers are focused on the risks: How many jobs will be lost, and which ones? What will the downstream effects be on the social safety net? Business schools and consulting firms have turned to research to find those answers the question. One of the most consequential recent efforts was a 2025 MIT study, which found that despite spending between $30 billion and $40 billion on generative AI, 95% of large companies had seen “no measurable P&L [profit and loss] impact.” More recent research paints a somewhat rosier picture. A recent study from the Wharton School found that three out of four enterprise leaders “reported positive returns on AI investments, and 88% plan to increase spending in the next year.” My sense is that the timing of AI takeoff is hard to grasp because adoption is so uneven and depends a lot on the application of the AI. Software developers, for example, are seeing clear efficiency gains from AI coding agents, and retailers are benefiting from smarter customer-service chatbots that can resolve more issues automatically. It also depends on the culture of the organization. Companies with clear strategies, good data, some PhDs, and internal AI enthusiasts are making real progress. I suspect that many older, less tech-oriented, companies remain stuck in pilot mode, struggling to prove ROI. Other studies have shown that in the initial phases of deployment, human workers must invest a lot of time correcting or training AI tools, which severely limits net productivity gains. Others show that in AI-forward organizations, workers do see substantial productivity improvements, but because of that, they become more ambitious and end up working more, not less. The MIT researchers included an interesting disclaimer on their research results. Their sobering findings, they noted, did not reflect the limitations of the AI tools themselves, but rather the fact that organizations often need years to adapt their people and processes to the new technology. So while AI companies constantly hype the ever-growing intelligence of their models, what ultimately matters is how quickly large organizations can integrate those tools into everyday work. The AI revolution is, in this sense, more of an arm-twist than an arms race. The road to ROI runs through people and culture. And that human bottleneck may ultimately determine when the AI industry, and its backers, begin to see returns on their enormous investments. New benchmark finds that AI fails to do most digital gig work AI companies keep releasing smarter models at a rapid pace. But the industry’s primary way of proving that progress—benchmarks—doesn’t fully capture how well AI agents perform on real-world projects. A relatively new benchmark called the Remote Labor Index (RLI) tries to close that gap by testing AI agents on projects similar to those given to remote contractors. These include tasks in game development, product design, and video animation. Some of the assignments, based on actual contract jobs, would take human workers more than 100 hours to complete and cost over $10,000 in labor. Right now, some of the industry’s best models don’t perform very well on the RLI. In tests conducted late last year, AI agents powered by models from the top AI developers including OpenAI, Anthropic, Google, and others could complete barely any of the projects. The top-performing agent, powered by Anthropic’s Opus 4.5 model, completed just 3.5% of the jobs. (Anthropic has since released Opus 4.6, but it hasn’t yet been evaluated on the RLI.) The test puts the question of the current applicability of agents in a different light, and may temper some of the most bullish claims about agent effectiveness coming from the AI industry. Silicon Valley’s pesky ‘principals’ re-emerge, irking the White House and Pentagon The Pentagon and the White House are big mad at the safety-conscious AI company Anthropic. Why? Because Anthropic doesn’t want its AI being used for the targeting of humans by autonomous drones, or for mass surveilling U.S. citizens. Anthropic now has a $200 million contract allowing the use of its Claude chatbot and models by federal agency workers. It was among the first companies to get approval to work with sensitive government data, and the first AI company to build a specialized model for intelligence work. But the company has long had clear rules in its user guidelines that its models aren’t to be used for harm. The Pentagon believes that after paying for the technology it should be able to use it for any legal application. But acceptable use for AI is different from that for traditional software. AI’s potential for autonomy makes it more dangerous by nature, and its risks increase the closer to the battle it gets used. The disagreement, if not resolved, could potentially jeopardize Anthropic’s contract with the government. But it could get worse. Over the weekend, the Pentagon said it was considering classifying Anthropic as a “supply chain risk,” which would mean the government views Anthropic as roughly as trustworthy as Huawei. Government contractors of all kinds would be pushed to stop using Anthropic. Anthropic’s limits on certain defense-related uses are laid out in its Constitution, a document that describes the values and behaviors it intends its models to follow. Claude, it says, should be a “genuinely good, wise, and virtuous agent.” “We want Claude to do what a deeply and skillfully ethical person would do in Claude’s position.” To critics in the The President administration, that language translates to a mandate for wokeness. The whole dust-up harkens back to 2018, when Google dropped its Project Maven contract with the government after employees revolted against Google technology being used for targeting humans in battle. Google still works with the government, and has softened its ethical guidelines over the years. The truth is, tech companies don’t stand on principle like they used to. Many have settled into a kind of patronage relationship with the current regime, a relatively inexpensive way to avoid MAGA backlash while keeping shareholders satisfied. Anthropic, in its way, seems to be taking a different course, and it may suffer financially for it. But, in the longer term, the company could earn some respect, trust, and goodwill from many consumers and regulators. For a company whose product is as powerful and potentially dangerous as consumer AI, that could count for a lot. More AI coverage from Fast Company: OpenAI, Google, and Perplexity near approval to host AI directly for the U.S. government New AI models are losing their edge almost immediately Meta patents AI that lets dead people post from the great beyond These 6 quotes from OpenClaw creator Peter Steinberger hint at the future of personal computing Want exclusive reporting and trend analysis on technology, business innovation, future of work, and design? Sign up for Fast Company Premium. View the full article

-

Lego’s new Monet-inspired set is full of hidden details

From afar, Lego’s new set inspired by Claude Monet’s painting Bridge over a Pond of Water Lilies looks like a slightly more vivid version of the original. Step a bit closer, though, and you’ll find that its intricate brushstrokes are composed of Lego bananas, katana swords, and carrot tops. The new 3,179-piece set was created in collaboration with The Metropolitan Museum of Art, where Monet’s original 1899 artwork, inspired by his idyllic garden in Giverny, is on display. Lego’s designers spent more than a year working in tandem with the museum’s curators to faithfully re-create the original painting’s iconic Impressionist scene. The set will be available to the public starting on March 4 for $249.99. Over the past few years, as Lego has begun to invest heavily in its sets and products targeted at an adult audience, its designers have had to develop new construction techniques to re-create a wide range of historical artworks. These include sets based on Vincent van Gogh’s Starry Night and Sunflowers, which use chunky Lego bricks to represent thick layers of paint; a set based on Art Hokusai’s The Great Wave, which achieves a 3D effect though cleverly layered bricks; and a re-creation of Keith Haring’s dancing figures, which relies on clear Lego pieces to imitate Haring’s line work. The new Bridge over a Pond of Water Lilies may be their most technically challenging effort yet. How Lego’s designers cleverly mimicked Monet’s style From the beginning, Lego’s collaboration with The Met was a hands-on process. “This piece was chosen through close dialogue between The LEGO Group and The Met,” says Stijn Oom, a Lego designer. “Together, we identified a fan‑favorite artwork that would translate well into an immersive build. Throughout the process, we worked with curators, reviewed color references, and explored how to mirror the painting’s layered techniques with LEGO elements. The aim was to let the build itself echo the feeling of creating the original artwork, while giving fans new entry points into Monet’s world.” The process started with Lego’s design team visiting The Met to see Bridge over a Pond of Water Lilies in person. There, they got an up-close look at Monet’s image of the Japanese-style bridge arching over his backyard pond, rendered in soft hues and small, densely packed brushstrokes. As Oom’s team began work on the Lego version, Met staffers also made trips to Lego’s headquarters in Denmark to review their drafts. In an interview with Artnet, Alison Hokanson, a European paintings curator at The Met, explained that the painting represented a major undertaking for Lego’s team because of its intricate Impressionist technique, which is difficult to replicate with small Lego pieces. Oom describes the process as “both thrilling and challenging.” Because Lego’s color palette was “more limited than what Monet could mix on his canvas,” Oom’s team opted for a brighter palette and blended tones to strike the right color balance. Another key obstacle was accurately recreating the painting’s sense of scale and depth. To create the optical illusion of forced perspective, Lego’s designers carefully layered smaller, darker elements behind the bridge, while positioning larger, brighter elements in front. While experimenting with ways to mimic Monet’s depictions of light and movement, Oom’s team stumbled across several clever uses for some unexpected Lego bricks. The work’s waterlily pads, for example, are made from a combination of tiles, painter’s palettes, brushes, and shields, all layered and overlapped to echo the varied thickness and direction of the real paint strokes. The willow tree in the work’s top left corner uses bars and carrot tops to mimic long, cascading green strokes. And in the vegetation under the bridge, horns, bananas, and katana swords are all carefully placed to guide the eye across the scene. “There are plenty of delightful ‘wait, is that…?’ moments built into the model, as we used a diverse array of LEGO elements including many pieces chosen to reflect Monet’s love of the natural world,” Oom says, adding, “Those unexpected parts are what make the build so enjoyable. You’re not just recreating a masterpiece—you’re discovering it piece by piece.” View the full article

-

How a proposed tax on California billionaires is dividing Democrats ahead of the midterms

As national Democrats search for a unifying theme ahead of the fall’s midterm elections, a California proposal to levy a hefty tax on billionaires is turning some of the party’s leading figures into adversaries just when Democrats can least afford division from within. Vermont Sen. Bernie Sanders traveled to Los Angeles on Wednesday to campaign for the tax proposal, which has Silicon Valley in an uproar, with tech titans threatening to leave the state. Democratic Gov. Gavin Newsom is among its outspoken opponents, warning that it could leave government finances in crisis and put the state at a competitive disadvantage nationally. At an evening rally near downtown, Sanders told cheering supporters that the nation has reached a crisis point in which “massive income and wealth inequality” has concentrated power over business, technology, government and the media within the “billionaire class,” while millions of working-class Americans struggle to pay household bills. He said enactment of the proposed tax would show “we are still living in a democratic society where the people have some power.” “Enough is enough,” Sanders said to a pulse of applause. “The billionaire class cannot have it all. This nation belongs to all of us.” The senator, a democratic socialist, is popular in California — he won the 2020 Democratic presidential primary in the state in a runaway. He’s been railing for decades against what he characterizes as wealthy elites and the growing gap between rich and poor. Health care union is pushing proposed tax to fund services A large health care union is attempting to place a proposal before voters in November that would impose a one-time 5% tax on the assets of billionaires — including stocks, art, businesses, collectibles and intellectual property — to backfill federal funding cuts to health services for lower-income people that were signed by President Donald The President last year. Debate on the proposal is unfolding at a time when voters in both parties express unease with economic conditions and what the future will bring in a politically divided nation. Distrust of government — and its ability to get things done — is widespread. The proposal has created a rift between Newsom and prominent members of his party’s progressive wing, including Sanders, who has said the tax should be a template for other states. “The issues that are really going to be motivating Democrats this year, affordability and the cost of health care and cuts to schools, none of these would be fixed by this proposal. If fact, they would be made worse,” said Brian Brokaw, a longtime Newsom adviser who is leading a political committee opposing the tax. Split among Democrats comes as midterm elections loom Midterm elections typically punish the party in control of the White House, and Democrats are hoping to gain enough U.S. House seats to overturn the chamber’s slim Republican majority. In California, rejiggered House districts approved by voters last year are expected to help the party pick up as many as five additional seats, which would leave Republicans in control of just a handful of districts. “It is always better for a party to have the political debate focused on issues where you are united and the other party is divided,” said Eric Schickler, a professor of political science at the University of California, Berkeley. “Having an issue like this where Newsom and Sanders — among others — are on different sides is not ideal.” With the idea of taxing billionaires popular among many voters “this can be a good way for Democratic candidates to rally that side and break through from the pack,” Schickler added in an email. It’s already trickled into the race for governor and contests down the ballot. Republicans Chad Bianco and Steve Hilton, both candidates for governor, have warned the tax would erase jobs. San Jose Mayor Matt Mahan, a Democratic candidate for governor, has said inequality starts at the federal level, where the tax code is riddled with loopholes. Sanders did not mention Newsom in his nearly 30-minute speech but name-checked a handful of billionaires, including Meta CEO Mark Zuckerberg and Google co-founder Sergey Brin, as examples of a wealthy elite that in many respects “no longer sees itself as part of American society.” Sanders urges support for billionaires tax Citing protests against federal immigration raids in Minnesota, he urged the crowd to support the tax, saying Californians can show that “when we stand together, we can take on the oligarchs and the billionaires.” Coinciding with the Sanders visit and an upcoming state Democratic convention this weekend, opponents are sending out targeted emails and social media ads intended to sway party insiders. It’s not clear if the proposal will make the ballot — supporters must gather more than 870,000 petition signatures to place it before voters. The nascent contest already has drawn out a tangle of competing interests, with millions of dollars flowing into political committees. Newsom has long opposed state-level wealth taxes, believing such levies would be disadvantageous for the world’s fourth-largest economy. At a time when California is strapped for cash and he is considering a 2028 presidential run, he is trying to block the proposal before it reaches the ballot. Analysts say an exodus of billionaires could mean a loss of hundreds of millions of tax dollars for the nation’s most populous state. But supporters say the funding is needed to offset federal cuts that could leave many Californians without vital services. —Michael R. Blood, AP Political Writer View the full article

-

Bissett Bullet: Not All Business Owners are Created the Same

Today's Bissett Bullet: “Every business owner you meet will have a unique set of goals, both business and personal, but they will fall under one of three motivations.” By Martin Bissett See more Bissett Bullets here Go PRO for members-only access to more Martin Bissett. View the full article

-

Bissett Bullet: Not All Business Owners are Created the Same

Today's Bissett Bullet: “Every business owner you meet will have a unique set of goals, both business and personal, but they will fall under one of three motivations.” By Martin Bissett See more Bissett Bullets here Go PRO for members-only access to more Martin Bissett. View the full article

-

10 Key Insights on Business Interest Rates Today

Comprehending today’s business interest rates is essential for making informed financial decisions. Current loan rates can vary greatly, with term loans averaging between 10% to 28% APR and SBA loans ranging from 10% to 15%. Several factors influence these rates, including credit profiles and economic conditions. Knowing whether to choose fixed or variable rates can impact your financial stability. As you navigate this environment, strategic timing for loan applications can play a key role in securing the best terms. There’s much more to explore. Key Takeaways Current business loan interest rates range from 9.9% to 36% depending on the loan type and lender. Fixed rates provide stable monthly payments, while variable rates can fluctuate based on market conditions. SBA loans typically offer lower rates compared to conventional loans, making them a favorable option for businesses. Timing loan applications after Federal Reserve rate cuts can secure better terms and lower rates. Securing loans with collateral can lead to more favorable interest rates and reduced borrowing costs. Current Business Loan Interest Rates As of November 2025, business loan interest rates vary greatly, depending on the type of financing you’re considering. Business term loans typically range from 10% to 28% APR, whereas SBA loans offer variable rates between 10.00% and 13.50%, with fixed rates from 12.00% to 15.00%. If you’re looking for flexible financing, business lines of credit likewise have rates between 10% and 28% APR. Equipment financing ranges from 9.9% to 24% APR, reflecting the associated risks. Nevertheless, if you need immediate cash flow, Accounts Receivable financing can carry higher rates, ranging from 24% to 36% APR. To effectively navigate these options, you can use an IRS compound interest calculator to better understand your potential costs. Learning how to determine interest rate is essential, as business interest rates today can markedly impact your financial decisions. Always consider the specifics of each loan before making a commitment. Factors Influencing Interest Rates Interest rates on business loans aren’t set in stone; they’re shaped by several key factors that you should know about. First, the type of lender matters; traditional Bank of America typically offer lower rates than online lenders. Your credit profile is essential too; a higher credit score usually means better rates, whereas new businesses often face higher rates owing to perceived risk. Economic conditions likewise play a notable role, as the federal funds rate set by the Federal Reserve directly impacts borrowing costs. When rates are low, borrowing becomes cheaper. Furthermore, the loan type matters; for instance, SBA loans typically provide more favorable rates compared to conventional loans. Finally, collateral influences loan terms markedly; secured loans usually come with lower interest rates than unsecured ones as they present less risk for lenders. Comprehending these factors can help you make informed decisions when seeking business financing. Fixed vs. Variable Interest Rates When choosing a business loan, you’ll encounter fixed and variable interest rates, each with distinct characteristics. Fixed rates offer stability, ensuring your monthly payments stay the same throughout the loan term, which can simplify budgeting. Conversely, variable rates may start lower but can change over time based on market conditions, leading to potential cost fluctuations that you need to take into account. Definition of Fixed Rates Fixed rates provide businesses with a stable borrowing option, as the interest remains unchanged throughout the life of the loan. This stability allows for predictable monthly payments, making budgeting easier. Fixed rates are commonly offered on business loans, appealing to those who prioritize financial predictability. Typically, the annual percentage rates (APRs) for fixed loans range from 10% to 28%. Feature Fixed Rates Variable Rates Interest Stability Unchanged Fluctuates Payment Predictability High Low Common APR Range 10% – 28% 10% – 28% (variable) When choosing between fixed and variable rates, carefully consider your financial situation and market forecasts, as this choice can profoundly affect affordability. Definition of Variable Rates Variable rates on business loans can be an appealing option for borrowers looking to take advantage of changing market conditions. Unlike fixed interest rates, which offer predictable monthly payments that remain unchanged throughout the loan term, variable rates fluctuate based on market conditions. This means you might enjoy lower initial payments when market rates are low, but there’s a risk of increasing costs if economic conditions change. Most small business loans are structured with fixed rates, providing stability for budgeting. Comprehending the difference between fixed and variable rates is essential for you to make informed decisions based on your financial situation and market predictions. Weighing these options carefully can help you choose the right loan structure for your needs. Pros and Cons Choosing between fixed and variable interest rates involves weighing various pros and cons that can considerably impact your business’s financial health. Fixed interest rates offer predictable monthly payments, making budgeting straightforward, whereas variable rates might start lower but can increase based on market conditions. As of November 2025, fixed SBA loan rates range from 12.00% to 15.00%, compared to variable rates between 10.00% and 13.50%. Fixed-rate loans protect you from future rate hikes, ensuring stability. Nevertheless, if you have strong cash flow, a variable rate might provide initial savings. Ultimately, comprehending these pros and cons is crucial for aligning your financing choices with your financial strategy and risk tolerance, ensuring you make the best decision for your business. Impact of Federal Rate Cuts When the Federal Reserve cuts interest rates, as it did by 0.25% in October 2025, businesses often experience immediate financial benefits that can improve their operations. Lower business loan interest rates typically follow such cuts, which makes borrowing more affordable. This reduction in borrowing costs can encourage you to make large purchases, as financing becomes more financially attractive. If you have adjustable-rate loans, expect your payments to decrease within one billing cycle after the rate cut, positively impacting your cash flow. Moreover, lower borrowing costs can boost consumer spending, enhancing your business revenues and stimulating overall economic activity. Although businesses with fixed-rate loans won’t see immediate changes in their payments, they should consider refinancing options if rates continue to decline, allowing for potential long-term savings. Timing for Financing Applications When you’re considering financing, timing can considerably impact your loan’s terms and rates. Applying right after a rate cut might help you secure a better deal, whereas waiting too long could mean facing higher rates if economic conditions shift. It’s vital to stay informed about market trends and consult with a financial professional to pinpoint the best moment for your application. Best Timing Strategies Comprehending the best timing strategies for financing applications can greatly influence your borrowing costs. The ideal time to apply often aligns with anticipated rate cuts, allowing you to secure better rates than previously offered. Applying right after a rate cut can lead to significant savings, especially for long-term loans. Nevertheless, consider your financial outlook and goals when deciding whether to wait for potentially lower rates or secure financing now. Remember, there are risks in waiting, such as possible rate increases or economic downturns that could limit your options. Consulting a financial professional can provide customized guidance based on current market conditions and your unique circumstances. Timing Strategy Description Apply after rate cuts Secure lower rates immediately post-cut. Assess financial goals Decide based on your business’s financial outlook. Consult professionals Get expert advice customized to your situation. Rate Cut Considerations Comprehending the timing of your financing applications is vital, especially in light of potential rate cuts. Applying for financing during a rate decrease can secure lower borrowing costs, making it an advantageous time for large purchases. Nevertheless, if you choose to wait for further cuts, there’s the risk of rate increases or economic downturns that may affect loan availability. After recent Federal Reserve cuts, it’s important to evaluate your application timing to maximize savings. Consulting with financial professionals can offer insights into the best course of action, whereas monitoring economic indicators and Fed meetings will help you make informed decisions. Staying proactive about these factors guarantees you optimize interest rates and improve your financing strategy. Economic Environment Impact The economic environment plays a significant role in determining the right timing for financing applications. With recent Federal Reserve rate cuts, businesses should evaluate their financial outlook and goals. As anticipating further cuts might tempt you to delay applications for better rates, this strategy carries risks, including potential rate increases or economic downturns. Current market conditions suggest that securing financing now could lead to lower borrowing costs, making it a favorable time for many businesses. Consulting a financial professional can offer customized insights to navigate this changing terrain effectively. Timing Strategy Advantages Risks Apply Now Lower current rates Potential for future rate hikes Wait for Further Cuts Chance for even lower rates Risk of economic downturns Assess Market Conditions Customized approach Missed opportunities Understanding Business Loan Fees When you’re considering a business loan, it’s important to look beyond just the interest rate, as various fees can greatly impact the total cost of borrowing. Business loan fees, like origination, underwriting, and closing costs, can add several percentage points to your loan amount. If you’re exploring SBA loans, keep in mind that they often include a guarantee fee that varies based on the loan size, increasing your overall expenses. Moreover, you should account for annual service fees on outstanding balances, which can accumulate over time. Some lenders might likewise impose processing fees or prepayment penalties, so it’s critical to review the loan agreement carefully. Comprehending all associated fees, including those not included in the APR, is fundamental for accurately calculating the true cost of a business loan, helping you make informed financial decisions. How to Secure the Best Rates Securing the best business loan rates can markedly impact your company’s financial health, especially since even a small difference in interest rates can lead to substantial savings over time. To start, maintain a strong credit profile; higher credit scores often result in lower interest rates, potentially saving you thousands in total interest. Consider exploring various loan types, such as SBA loans, which typically offer lower fixed rates between 12.00% and 15.00%, compared to traditional bank loans that may reach 28% APR. Providing collateral can also improve your chances of obtaining a loan with better terms, as secured loans typically come with lower rates. Furthermore, timing your application around expected interest rate cuts can lock in favorable borrowing conditions. Finally, use business loan calculators to compare offers and understand the total cost, ensuring you factor in both interest and any extra fees. Rate Change Frequency Interest rates for business loans can change frequently, often on a monthly basis, based on economic conditions and market dynamics. Lenders have the flexibility to adjust rates at any time, influenced by factors like inflation and unemployment figures. Since even minor fluctuations can affect your borrowing costs, it’s essential to keep an eye on rates and anticipate possible changes before applying for financing. Monthly Rate Adjustments Comprehending how monthly rate adjustments can impact your business is crucial for effective financial planning. Interest rates on business loans can fluctuate from month to month, driven by various economic factors. These adjustments often reflect decisions made by the Federal Reserve and current market conditions. Here are some key points to reflect upon: Banks can update rates as needed, ensuring they align with prime rates. Rate cuts from the Federal Reserve usually lead to immediate borrowing cost changes. Economic indicators, like inflation and employment data, heavily influence rate adjustments. Regularly monitoring interest rates helps you stay informed and prepared for potential changes. Economic Indicator Influence Comprehending the frequent fluctuations in business loan interest rates requires a look at the economic indicators that drive these changes. Business loan rates can shift monthly, influenced by economic conditions and market dynamics. Key indicators, such as inflation rates and employment data, play an essential role in the Federal Reserve’s decisions on interest rate adjustments. When these indicators signal economic shifts, lenders, particularly banks, can adjust their rates accordingly. Typically, rate changes are implemented quickly, with adjustable-rate loans reflecting new rates within one billing cycle after a federal rate cut. To navigate these changes effectively, you should stay informed and monitor economic reports and Federal Reserve meetings, as they can provide valuable insights into potential future changes in interest rates. Lender Rate Flexibility During the process of traversing the terrain of business financing, it’s important to recognize that lenders have significant flexibility in adjusting their loan rates. Loan rates can change frequently, influenced by various economic conditions. Here are some key points to keep in mind: Lenders often adjust rates on a month-to-month basis. Changes are typically driven by economic indicators like inflation. A shift in the Federal Reserve’s interest rate can lead to immediate lender adjustments. Regularly monitoring rates can help you identify potential savings or increased costs. Understanding when and how rates change is essential for your financing strategy, as it directly impacts the overall cost of loans and your decision-making process. Stay informed to make better financial choices. Future Predictions for Interest Rates As businesses navigate the evolving economic terrain, it’s essential to understand the potential future of interest rates. The Federal Reserve’s recent rate cuts may lead to lower business loan rates in the coming months, presenting opportunities for you to secure financing at reduced costs. Economic indicators suggest that the Fed will likely continue monitoring labor market conditions, which could influence future decisions and potentially result in further cuts. Predictions indicate that if current trends persist, you might see a stable or declining interest rate environment throughout 2025. Nevertheless, anticipated delays in economic data releases because of government shutdowns could affect the Fed’s decision-making process regarding future adjustments. Overall, market sentiment leans toward a favorable outlook for businesses seeking loans, as softening labor market conditions provide the Fed with the flexibility to implement additional rate cuts. This makes it an essential time to evaluate your financing options. Strategies for Managing Borrowing Costs Comprehending how to manage borrowing costs is crucial for businesses, especially in a fluctuating interest rate environment. To effectively reduce your borrowing expenses, consider implementing the following strategies: Refinance high-interest debt into lower-interest loans when rates drop, greatly lowering your repayment amounts. Monitor current business loan rates regularly, as they change with economic conditions, allowing you to secure financing at favorable times. Utilize business loan calculators to estimate monthly payments and total interest, aiding informed decision-making based on different loan terms. Secure loans with collateral, which can lead to better interest rates; evaluate your assets when seeking financing. Additionally, explore microloans or business lines of credit for competitive rates and flexible qualifications, particularly if you’re a newer business. Frequently Asked Questions What Is the Business Interest Rate Right Now? The current business interest rates vary considerably depending on the type of financing. For term loans and lines of credit, rates range from 10% to 28% APR. SBA loans offer variable rates between 10.00% and 13.50%, with fixed rates from 12.00% to 15.00%. Equipment financing has rates from 9.9% to 24% APR, whereas accounts receivable financing is higher, with rates between 24% and 36% APR, reflecting greater risk. What Is the Impact of Interest Rates on Businesses? Interest rates greatly impact your business’s financial decisions. When rates are low, borrowing becomes more affordable, allowing you to invest in growth, equipment, or expansion without straining your budget. Conversely, high interest rates increase borrowing costs, potentially discouraging you from seeking loans for crucial projects. Moreover, fluctuations in rates as a result of economic conditions can affect your overall financing strategy, leading to adjustments in your cash flow management and long-term planning. What Is a Good Interest Rate for a Business? A good interest rate for a business loan usually ranges from 6.7% to 11.5% when offered by banks, depending on factors like loan type and your credit profile. If you’re considering an SBA loan, expect rates between 10% and 15%. Nevertheless, online loans often have higher rates, ranging from 10% to 28%. It’s essential to evaluate the total borrowing cost, including fees and terms, to determine the best rate for your specific situation. Are Interest Rates Projected to Go up or Down? Interest rates are projected to trend down in the near future, largely influenced by recent economic indicators such as a cooling labor market. Analysts anticipate that the Federal Reserve may implement further rate cuts to stimulate economic activity, which could lower borrowing costs for businesses. Nevertheless, fluctuations may occur as a result of new economic developments and inflation uncertainty. Keeping an eye on these factors will help you stay informed about potential changes. Conclusion In conclusion, grasping current business interest rates is crucial for making informed financing decisions. By considering factors like credit profiles and economic conditions, you can better navigate fixed and variable rates. Timing your loan applications strategically, especially post-Federal Reserve rate cuts, can lead to more favorable terms. To secure the best rates, stay informed about market trends and manage your borrowing costs effectively. This knowledge empowers you to optimize your business financing and achieve your financial goals. Image via Google Gemini and ArtSmart This article, "10 Key Insights on Business Interest Rates Today" was first published on Small Business Trends View the full article

-

10 Key Insights on Business Interest Rates Today

Comprehending today’s business interest rates is essential for making informed financial decisions. Current loan rates can vary greatly, with term loans averaging between 10% to 28% APR and SBA loans ranging from 10% to 15%. Several factors influence these rates, including credit profiles and economic conditions. Knowing whether to choose fixed or variable rates can impact your financial stability. As you navigate this environment, strategic timing for loan applications can play a key role in securing the best terms. There’s much more to explore. Key Takeaways Current business loan interest rates range from 9.9% to 36% depending on the loan type and lender. Fixed rates provide stable monthly payments, while variable rates can fluctuate based on market conditions. SBA loans typically offer lower rates compared to conventional loans, making them a favorable option for businesses. Timing loan applications after Federal Reserve rate cuts can secure better terms and lower rates. Securing loans with collateral can lead to more favorable interest rates and reduced borrowing costs. Current Business Loan Interest Rates As of November 2025, business loan interest rates vary greatly, depending on the type of financing you’re considering. Business term loans typically range from 10% to 28% APR, whereas SBA loans offer variable rates between 10.00% and 13.50%, with fixed rates from 12.00% to 15.00%. If you’re looking for flexible financing, business lines of credit likewise have rates between 10% and 28% APR. Equipment financing ranges from 9.9% to 24% APR, reflecting the associated risks. Nevertheless, if you need immediate cash flow, Accounts Receivable financing can carry higher rates, ranging from 24% to 36% APR. To effectively navigate these options, you can use an IRS compound interest calculator to better understand your potential costs. Learning how to determine interest rate is essential, as business interest rates today can markedly impact your financial decisions. Always consider the specifics of each loan before making a commitment. Factors Influencing Interest Rates Interest rates on business loans aren’t set in stone; they’re shaped by several key factors that you should know about. First, the type of lender matters; traditional Bank of America typically offer lower rates than online lenders. Your credit profile is essential too; a higher credit score usually means better rates, whereas new businesses often face higher rates owing to perceived risk. Economic conditions likewise play a notable role, as the federal funds rate set by the Federal Reserve directly impacts borrowing costs. When rates are low, borrowing becomes cheaper. Furthermore, the loan type matters; for instance, SBA loans typically provide more favorable rates compared to conventional loans. Finally, collateral influences loan terms markedly; secured loans usually come with lower interest rates than unsecured ones as they present less risk for lenders. Comprehending these factors can help you make informed decisions when seeking business financing. Fixed vs. Variable Interest Rates When choosing a business loan, you’ll encounter fixed and variable interest rates, each with distinct characteristics. Fixed rates offer stability, ensuring your monthly payments stay the same throughout the loan term, which can simplify budgeting. Conversely, variable rates may start lower but can change over time based on market conditions, leading to potential cost fluctuations that you need to take into account. Definition of Fixed Rates Fixed rates provide businesses with a stable borrowing option, as the interest remains unchanged throughout the life of the loan. This stability allows for predictable monthly payments, making budgeting easier. Fixed rates are commonly offered on business loans, appealing to those who prioritize financial predictability. Typically, the annual percentage rates (APRs) for fixed loans range from 10% to 28%. Feature Fixed Rates Variable Rates Interest Stability Unchanged Fluctuates Payment Predictability High Low Common APR Range 10% – 28% 10% – 28% (variable) When choosing between fixed and variable rates, carefully consider your financial situation and market forecasts, as this choice can profoundly affect affordability. Definition of Variable Rates Variable rates on business loans can be an appealing option for borrowers looking to take advantage of changing market conditions. Unlike fixed interest rates, which offer predictable monthly payments that remain unchanged throughout the loan term, variable rates fluctuate based on market conditions. This means you might enjoy lower initial payments when market rates are low, but there’s a risk of increasing costs if economic conditions change. Most small business loans are structured with fixed rates, providing stability for budgeting. Comprehending the difference between fixed and variable rates is essential for you to make informed decisions based on your financial situation and market predictions. Weighing these options carefully can help you choose the right loan structure for your needs. Pros and Cons Choosing between fixed and variable interest rates involves weighing various pros and cons that can considerably impact your business’s financial health. Fixed interest rates offer predictable monthly payments, making budgeting straightforward, whereas variable rates might start lower but can increase based on market conditions. As of November 2025, fixed SBA loan rates range from 12.00% to 15.00%, compared to variable rates between 10.00% and 13.50%. Fixed-rate loans protect you from future rate hikes, ensuring stability. Nevertheless, if you have strong cash flow, a variable rate might provide initial savings. Ultimately, comprehending these pros and cons is crucial for aligning your financing choices with your financial strategy and risk tolerance, ensuring you make the best decision for your business. Impact of Federal Rate Cuts When the Federal Reserve cuts interest rates, as it did by 0.25% in October 2025, businesses often experience immediate financial benefits that can improve their operations. Lower business loan interest rates typically follow such cuts, which makes borrowing more affordable. This reduction in borrowing costs can encourage you to make large purchases, as financing becomes more financially attractive. If you have adjustable-rate loans, expect your payments to decrease within one billing cycle after the rate cut, positively impacting your cash flow. Moreover, lower borrowing costs can boost consumer spending, enhancing your business revenues and stimulating overall economic activity. Although businesses with fixed-rate loans won’t see immediate changes in their payments, they should consider refinancing options if rates continue to decline, allowing for potential long-term savings. Timing for Financing Applications When you’re considering financing, timing can considerably impact your loan’s terms and rates. Applying right after a rate cut might help you secure a better deal, whereas waiting too long could mean facing higher rates if economic conditions shift. It’s vital to stay informed about market trends and consult with a financial professional to pinpoint the best moment for your application. Best Timing Strategies Comprehending the best timing strategies for financing applications can greatly influence your borrowing costs. The ideal time to apply often aligns with anticipated rate cuts, allowing you to secure better rates than previously offered. Applying right after a rate cut can lead to significant savings, especially for long-term loans. Nevertheless, consider your financial outlook and goals when deciding whether to wait for potentially lower rates or secure financing now. Remember, there are risks in waiting, such as possible rate increases or economic downturns that could limit your options. Consulting a financial professional can provide customized guidance based on current market conditions and your unique circumstances. Timing Strategy Description Apply after rate cuts Secure lower rates immediately post-cut. Assess financial goals Decide based on your business’s financial outlook. Consult professionals Get expert advice customized to your situation. Rate Cut Considerations Comprehending the timing of your financing applications is vital, especially in light of potential rate cuts. Applying for financing during a rate decrease can secure lower borrowing costs, making it an advantageous time for large purchases. Nevertheless, if you choose to wait for further cuts, there’s the risk of rate increases or economic downturns that may affect loan availability. After recent Federal Reserve cuts, it’s important to evaluate your application timing to maximize savings. Consulting with financial professionals can offer insights into the best course of action, whereas monitoring economic indicators and Fed meetings will help you make informed decisions. Staying proactive about these factors guarantees you optimize interest rates and improve your financing strategy. Economic Environment Impact The economic environment plays a significant role in determining the right timing for financing applications. With recent Federal Reserve rate cuts, businesses should evaluate their financial outlook and goals. As anticipating further cuts might tempt you to delay applications for better rates, this strategy carries risks, including potential rate increases or economic downturns. Current market conditions suggest that securing financing now could lead to lower borrowing costs, making it a favorable time for many businesses. Consulting a financial professional can offer customized insights to navigate this changing terrain effectively. Timing Strategy Advantages Risks Apply Now Lower current rates Potential for future rate hikes Wait for Further Cuts Chance for even lower rates Risk of economic downturns Assess Market Conditions Customized approach Missed opportunities Understanding Business Loan Fees When you’re considering a business loan, it’s important to look beyond just the interest rate, as various fees can greatly impact the total cost of borrowing. Business loan fees, like origination, underwriting, and closing costs, can add several percentage points to your loan amount. If you’re exploring SBA loans, keep in mind that they often include a guarantee fee that varies based on the loan size, increasing your overall expenses. Moreover, you should account for annual service fees on outstanding balances, which can accumulate over time. Some lenders might likewise impose processing fees or prepayment penalties, so it’s critical to review the loan agreement carefully. Comprehending all associated fees, including those not included in the APR, is fundamental for accurately calculating the true cost of a business loan, helping you make informed financial decisions. How to Secure the Best Rates Securing the best business loan rates can markedly impact your company’s financial health, especially since even a small difference in interest rates can lead to substantial savings over time. To start, maintain a strong credit profile; higher credit scores often result in lower interest rates, potentially saving you thousands in total interest. Consider exploring various loan types, such as SBA loans, which typically offer lower fixed rates between 12.00% and 15.00%, compared to traditional bank loans that may reach 28% APR. Providing collateral can also improve your chances of obtaining a loan with better terms, as secured loans typically come with lower rates. Furthermore, timing your application around expected interest rate cuts can lock in favorable borrowing conditions. Finally, use business loan calculators to compare offers and understand the total cost, ensuring you factor in both interest and any extra fees. Rate Change Frequency Interest rates for business loans can change frequently, often on a monthly basis, based on economic conditions and market dynamics. Lenders have the flexibility to adjust rates at any time, influenced by factors like inflation and unemployment figures. Since even minor fluctuations can affect your borrowing costs, it’s essential to keep an eye on rates and anticipate possible changes before applying for financing. Monthly Rate Adjustments Comprehending how monthly rate adjustments can impact your business is crucial for effective financial planning. Interest rates on business loans can fluctuate from month to month, driven by various economic factors. These adjustments often reflect decisions made by the Federal Reserve and current market conditions. Here are some key points to reflect upon: Banks can update rates as needed, ensuring they align with prime rates. Rate cuts from the Federal Reserve usually lead to immediate borrowing cost changes. Economic indicators, like inflation and employment data, heavily influence rate adjustments. Regularly monitoring interest rates helps you stay informed and prepared for potential changes. Economic Indicator Influence Comprehending the frequent fluctuations in business loan interest rates requires a look at the economic indicators that drive these changes. Business loan rates can shift monthly, influenced by economic conditions and market dynamics. Key indicators, such as inflation rates and employment data, play an essential role in the Federal Reserve’s decisions on interest rate adjustments. When these indicators signal economic shifts, lenders, particularly banks, can adjust their rates accordingly. Typically, rate changes are implemented quickly, with adjustable-rate loans reflecting new rates within one billing cycle after a federal rate cut. To navigate these changes effectively, you should stay informed and monitor economic reports and Federal Reserve meetings, as they can provide valuable insights into potential future changes in interest rates. Lender Rate Flexibility During the process of traversing the terrain of business financing, it’s important to recognize that lenders have significant flexibility in adjusting their loan rates. Loan rates can change frequently, influenced by various economic conditions. Here are some key points to keep in mind: Lenders often adjust rates on a month-to-month basis. Changes are typically driven by economic indicators like inflation. A shift in the Federal Reserve’s interest rate can lead to immediate lender adjustments. Regularly monitoring rates can help you identify potential savings or increased costs. Understanding when and how rates change is essential for your financing strategy, as it directly impacts the overall cost of loans and your decision-making process. Stay informed to make better financial choices. Future Predictions for Interest Rates As businesses navigate the evolving economic terrain, it’s essential to understand the potential future of interest rates. The Federal Reserve’s recent rate cuts may lead to lower business loan rates in the coming months, presenting opportunities for you to secure financing at reduced costs. Economic indicators suggest that the Fed will likely continue monitoring labor market conditions, which could influence future decisions and potentially result in further cuts. Predictions indicate that if current trends persist, you might see a stable or declining interest rate environment throughout 2025. Nevertheless, anticipated delays in economic data releases because of government shutdowns could affect the Fed’s decision-making process regarding future adjustments. Overall, market sentiment leans toward a favorable outlook for businesses seeking loans, as softening labor market conditions provide the Fed with the flexibility to implement additional rate cuts. This makes it an essential time to evaluate your financing options. Strategies for Managing Borrowing Costs Comprehending how to manage borrowing costs is crucial for businesses, especially in a fluctuating interest rate environment. To effectively reduce your borrowing expenses, consider implementing the following strategies: Refinance high-interest debt into lower-interest loans when rates drop, greatly lowering your repayment amounts. Monitor current business loan rates regularly, as they change with economic conditions, allowing you to secure financing at favorable times. Utilize business loan calculators to estimate monthly payments and total interest, aiding informed decision-making based on different loan terms. Secure loans with collateral, which can lead to better interest rates; evaluate your assets when seeking financing. Additionally, explore microloans or business lines of credit for competitive rates and flexible qualifications, particularly if you’re a newer business. Frequently Asked Questions What Is the Business Interest Rate Right Now? The current business interest rates vary considerably depending on the type of financing. For term loans and lines of credit, rates range from 10% to 28% APR. SBA loans offer variable rates between 10.00% and 13.50%, with fixed rates from 12.00% to 15.00%. Equipment financing has rates from 9.9% to 24% APR, whereas accounts receivable financing is higher, with rates between 24% and 36% APR, reflecting greater risk. What Is the Impact of Interest Rates on Businesses? Interest rates greatly impact your business’s financial decisions. When rates are low, borrowing becomes more affordable, allowing you to invest in growth, equipment, or expansion without straining your budget. Conversely, high interest rates increase borrowing costs, potentially discouraging you from seeking loans for crucial projects. Moreover, fluctuations in rates as a result of economic conditions can affect your overall financing strategy, leading to adjustments in your cash flow management and long-term planning. What Is a Good Interest Rate for a Business? A good interest rate for a business loan usually ranges from 6.7% to 11.5% when offered by banks, depending on factors like loan type and your credit profile. If you’re considering an SBA loan, expect rates between 10% and 15%. Nevertheless, online loans often have higher rates, ranging from 10% to 28%. It’s essential to evaluate the total borrowing cost, including fees and terms, to determine the best rate for your specific situation. Are Interest Rates Projected to Go up or Down? Interest rates are projected to trend down in the near future, largely influenced by recent economic indicators such as a cooling labor market. Analysts anticipate that the Federal Reserve may implement further rate cuts to stimulate economic activity, which could lower borrowing costs for businesses. Nevertheless, fluctuations may occur as a result of new economic developments and inflation uncertainty. Keeping an eye on these factors will help you stay informed about potential changes. Conclusion In conclusion, grasping current business interest rates is crucial for making informed financing decisions. By considering factors like credit profiles and economic conditions, you can better navigate fixed and variable rates. Timing your loan applications strategically, especially post-Federal Reserve rate cuts, can lead to more favorable terms. To secure the best rates, stay informed about market trends and manage your borrowing costs effectively. This knowledge empowers you to optimize your business financing and achieve your financial goals. Image via Google Gemini and ArtSmart This article, "10 Key Insights on Business Interest Rates Today" was first published on Small Business Trends View the full article

-

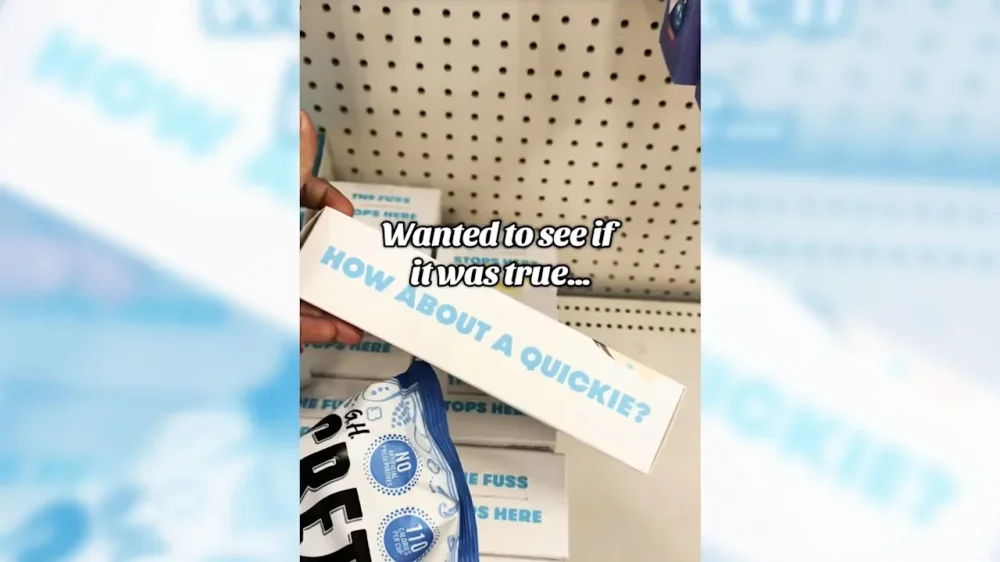

Frida built its brand on dirty jokes for parents. Now the internet isn’t laughing

Baby care brand Frida is facing online backlash after screenshots of sexual innuendos in its marketing materials began circulating on social media. Frida, which describes itself as “the brand that gets parents,” sells a range of baby care, fertility, and postpartum products through major retailers, including Target. Last week, an X user shared images of several products’ packaging, writing: “sexual jokes to market baby products is actually sick and twisted @fridababy this is absolutely appalling and disgusting.” The post has since gained almost five million views on X. Among the examples highlighted is a social media graphic promoting the company’s 3-in-1 True Temp thermometer. The image shows the device next to a baby’s bottom, accompanied by the caption: “This is the closest your husband’s gonna get to a threesome.” sexual jokes to market baby products is actually sick and twisted @fridababy this is absolutely appalling and disgusting pic.twitter.com/cXhiksoaY8 — stace 🩵🪲 (@staystaystace) February 12, 2026 Other screenshots highlighted by critics include phrases such as “How about a quickie?” printed on a thermometer box. An apparent Instagram post from 2020 that has since resurfaced also features a baby with what seems to be snot on its face. The caption reads: “What happens when you pull out too early.” Parents and critics online have accused the company of sexualizing children in its marketing choices, with posts on parenting forums calling for boycotts of the company’s products. A Change.org petition to “hold Frida Baby accountable” has more than 4,000 verified signatures at the time of writing. Not everyone agrees with the criticism. “IMO, this is akin to Disney putting in jokes that only parents will get,” one Reddit user wrote. “They know who the decision-makers are. Frida is marketing to the parents.” Others argue the tone crosses a clear line. A statement from Frida emailed to multiple publications reads in part: “Our products are designed for babies, but our voice has always been written for the adults caring for them. Our intention has consistently been to make awkward and difficult experiences feel lighter, more honest, and less isolating for parents. It continued: “That said, humor is personal. What’s funny to one parent can feel like too much to another.” Fast Company has reached out to Frida Baby for comment. A scroll through Frida’s social media shows the brand has long leaned into a deliberately risqué tone, often relying on double entendres and innuendo to target parents. In April, it teased a new product on Instagram with the line, “Take your top off.” Its current “Show us what your boobs can do” campaign aims to destigmatize breastfeeding by spotlighting what it calls “milk-making boobs.” As more brands adopt informal, attention-grabbing voices online, the lesson here is clear: context matters. View the full article

-

Top Fed official says White House is escalating its assault on central bank

Neel Kashkari hits out at The President adviser who criticised research showing tariffs harm AmericansView the full article

-

Delinquencies rise, vacancies stay flat

About 1.3% of residential properties in the United States were vacant at the beginning of the year, Attom found. View the full article

-

LLM consistency and recommendation share: The new SEO KPI