All Activity

- Past hour

-

How to optimize for AI search: 12 proven LLM visibility tactics

One of the biggest SEO challenges right now isn’t AI. It’s the irresponsible misinformation surrounding it. SEO isn’t dying — it’s evolving. That means it’s on us to understand how the industry is changing, and to be careful about who we listen to. I’m not easily shocked, but some of the AEO (or GEO) talks I’ve seen over the past year have been genuinely eyebrow-raising — even for someone with Botox. I still remember one speaker telling a room full of marketers they were “sorry for anyone still working in SEO,” then immediately recommending outdated tactics as the “secret sauce” for LLM visibility. It’s been… painful. Thankfully, the adults have entered the room. This week, four of the industry’s most trusted voices — Lily Ray, Kevin Indig, Steve Toth, and Ross Hudgens — came together for a roundtable on the future of search. It was easily the most useful AEO session I’ve attended. Each shared specific tactics they’ve personally used to achieve LLM visibility. Here’s what they had to say. 1. Advertorials work LLMs don’t currently distinguish between paid and organic editorial. That means well-placed advertorials on reputable publishers can help brands show up in AI search, much like earned coverage. As with traditional PR, the publication’s credibility still matters most. 2. Syndication can scale visibility Paid syndication can increase reach, but quality matters more than quantity. Focus on reputable, relevant publications and use this tactic carefully. 3. Map pages to every audience and use case you serve Brands that create clearly defined pages for each audience, industry, and use case are better positioned as AI search becomes more personalized. This structure helps LLMs understand relevance and remains a strong SEO practice, with or without AI. 4. Homepage clarity Your homepage should clearly communicate who you serve and what you do. LLMs parse homepage content far more easily than navigation menus, so relying on your nav to explain your offering is a missed opportunity. 5. Optimize your footer Don’t overlook your footer. Brand and service signals placed here are being picked up by LLMs. Wil Reynolds shared a great case study showing how footer content can directly influence AI visibility. 6. Don’t prioritize llm.txt Despite the speculation, no major LLM has confirmed using llm.txt files, and Google has explicitly said it does not. Your time and effort are better spent elsewhere. 7. Go multimodal Repurpose your core content across text, video, audio, and imagery. The goal is to build brand recognition across the full range of sources an LLM may pull from. 8. Actively shape your brand narrative Actively shape your brand narrative. It’s estimated that 250 documents are needed to meaningfully influence how an LLM perceives a brand. Brands that don’t publish and promote content consistently risk letting others define that narrative for them. 9. Freshness carries disproportionate weight Recent content tends to perform especially well in AI search, reflecting LLMs’ preference for up-to-date information. That said, artificial “refreshing” without meaningful updates is a bad idea. 10. Social works fast Posts on platforms like LinkedIn—including Pulse articles—can appear in AI search within hours, sometimes minutes, especially for accounts with strong followings. Reddit, YouTube, and other high-trust platforms show similar behavior. 11. Authority accelerates inclusion Publishing on respected, niche industry sites can lead to rapid inclusion in LLM responses — sometimes within hours. 12. Don’t hide FAQs FAQs should be visible and substantial, not hidden behind accordions. Don’t hold back on content either— eight to 10 well-answered questions can clearly signal expertise, intent, and relevance to both users and LLMs. Is AEO the same as SEO? This much-debated question was addressed directly by John Mueller at Google Search Live in December. Putting the AEO cowboys in their place, he made it clear that good AEO still relies on good SEO: “AI systems rely on search. and there is no such thing as GEO or AEO without doing SEO fundamentals. Tricks will come out and they will work for a short time, companies that want to be around for the long term should focus on something that is proven with long term stability and not tricks.” The overlap makes sense when you look at how modern LLMs like GPT-5 actually work. They use Retrieval-Augmented Generation (RAG). Rather than relying only on frozen training data, RAG lets an LLM query search engines and trusted sources in real time before answering. Put simply: if you want LLM visibility, you need to show up in search first. Lily Ray has an excellent video explaining this process in more detail, which is well worth watching. So yes, good AEO is good SEO — but there’s nuance. The tactics above work right now, but they will inevitably evolve as LLMs continue to advance. The best AI search strategy for 2026 Forget the magic button. Keep testing. Stay skeptical of the hype. And be selective about who you let into your ear — or your LinkedIn feed. Thanks to Bernard Huang and Clearscope for hosting this excellent panel. View the full article

-

When to expect your tax refund from the IRS

Tax filing season is underway, and the IRS expects 164 million people will file returns by April 15. The average refund last year was $3,167. This year, analysts have projected it could be $1,000 higher, thanks to changes in tax law. More than 165 million individual income tax returns were processed last year, with 94% submitted electronically. People with straightforward returns should not encounter delays, but because of an exodus of IRS workers since the start of the The President administration, the national taxpayer advocate has cautioned that the 2026 tax filing season is likely to present challenges for those who run into problems filing. While last year IRS employees were not permitted to accept a buyout offer from the The President administration until after the taxpayer filing deadline, many of those customer service workers have now left. The IRS started 2025 with about 102,000 employees and finished with roughly 74,000 after a series of firings and layoffs led by the Department of Government Efficiency. Here’s what to know: When refunds will go out If you file electronically, the IRS says it should take 21 days or less to receive your refund. If you choose direct deposit, it should take even less time. If you file a paper return, the refund could take four weeks or more, and if your return requires amendments or corrections, it could take longer. The IRS cautions that taxpayers not rely on receiving a refund by a certain date, especially when making major purchases or paying bills. How to check the status of your refund Taxpayers can use the online tool Where’s My Refund? to check the status of their refund within 24 hours of e-filing and generally within four weeks of filing a paper return. The “Where’s My Refund?” tool will also provide projected deposit dates for most early EITC/ACTC refund filers by Feb. 21, according to the IRS. Information related to this tool is updated once daily, overnight. To access the status of your refund, you’ll need: — Your Social Security or individual taxpayer ID number (ITIN) Taxpayers can also consult the IRS2Go app, or their IRS Individual Online Account, to check their refund status. How tax refunds work If you paid more through the year than you owe in tax, due to withholding or other reasons, you should get money back. Even if you didn’t pay excess tax, you may still get a refund if you qualify for a refundable credit, like the Earned Income Tax Credit (EITC) or Child Tax Credit. To get your refund, you must file a return, and you have three years to claim a tax refund. Who qualifies for the Earned Income Tax Credit To qualify for the EITC, you must have under $11,950 in investment income and earn less than a specific income level from working. If you’re single with no children, your income level must be $19,104 or below. And if you’re married filing jointly with three or more children, you must make $68,675 or below. To determine if your household qualifies based on your marital status and your number of dependents you can use the online EITC Assistant tool. Who qualifies for the Child Tax Credit and Additional Child Tax Credit If you have a child, you are most likely eligible for the Child Tax Credit. The credit is up to $2,200 per qualifying child. To qualify, a child must: — Have a Social Security number — Be under age 17 at the end of 2025 — Be your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (for example, a grandchild, niece or nephew) — Not provide more than half of his or her own support for the tax year — Have lived with you for more than half the tax year — Be claimed as a dependent on your tax return — Not file a joint return for the year (or filed the joint return only to claim a refund of taxes withheld or estimated taxes) — Be a U.S. citizen, U.S. national or a U.S. resident alien You qualify for the full amount of the Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return). You qualify for the Additional Child Tax Credit if ($1,700 per qualifying child) if you meet these factors and have little or no federal income tax liability. You must have earned income of at least $2,500 to be eligible for the ACTC. When the tax credits will become available The IRS expects most refunds for the Earned Income Tax Credit, the Child Tax Credit and the Additional Child Tax Credit to be available in bank accounts or on debit cards by March 2 for taxpayers who choose direct deposit. Some taxpayers may receive their refund earlier, depending on their financial institution. What’s different this year This year, most taxpayers must provide their routing and account numbers to receive refunds directly deposited into their bank accounts. That’s because the IRS began phasing out paper tax refund checks on Sept. 30 in accordance with an executive order. ___ The Associated Press receives support from the Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy. The independent foundation is separate from Charles Schwab and Co. Inc. The AP is solely responsible for its journalism. —Cora Lewis, Associated Press View the full article

-

1/3rd of publishers say they will block Google Search AI-generative features like AI Overviews

Google announced yesterday that it is exploring ways for sites to opt out of Google using their content for its AI-generative search features, such as AI Mode and AI Overviews. I asked the SEO community on X if they would opt out of these Google Search AI-generative features or not. The results. Of the over 350 responses that took the poll yesterday, most said they would not opt out. However, about 1/3 of respondents said they would block or opt out of these features. Here is the breakdown: Question: Would you block Google from using your content for AI Overviews and AI Mode? 33.2% – Yes, I’d block Google 41.9% – No, I wouldn’t block 24.9% – I am not sure yet. Here is the actual poll: Would you block Google from using your content for AI Overviews and AI Mode – Google may be giving us more controls – take my poll below. https://t.co/60M3Vt0YlN — Barry Schwartz (@rustybrick) January 28, 2026 How to opt out. We don’t know. Google only said it is “exploring” ways to handle this but has not provided any mechanism for this. So we don’t know how hard or easy it would be to opt out. The easier it is, the more likely sites will opt out; the harder, the less likely. Why we care. The true number of sites that might opt out of AI Mode or AI Overviews won’t be known until the mechanism is out to handle this. And trust me, there will be many reports on how many sites are opting out. Like recently, “Some 79% of almost 100 top news websites in the UK and US are blocking at least one crawler used for AI training out of OpenAI’s GPTBot, ClaudeBot, Anthropic-ai, CCBot, Applebot-Extended and Google-Extended,” reported The Press Gazette. My recommendation; once it is out, it is something you will want to test and see the results of opting out or opting in. View the full article

- Today

-

Major baby food company recalls ‘crawler snacks’ nationwide. Watch out for these products

Virginia-based Gerber Products Company is voluntarily recalling limited batches of Gerber Arrowroot Biscuits, a cookie-like snack meant for children 10 months or older. On January 26, the baby food and snack producer issued the voluntary recall due to the potential presence of soft plastic and paper pieces that “should not be consumed,” the company said this week. The material comes from a supplier of arrowroot flour that initiated its own recall, Gerber said. The company said it was no longer working with the supplier, though it did not name the supplier in its recall notice on Monday. No illnesses or injuries have been reported. Gerber says it is issuing the recall “out of an abundance of caution.” On Wednesday, the Food and Drug Administration (FDA) published the recall notice on its website. What products are included in the recall? The nationwide recall applies to limited batches of 5.5-ounce Gerber Arrowroot Biscuits, produced between July 2025 and September 2025. Gerber emphasizes that no other products are impacted. Product packaging images and other details are included n the FDA’s website. Gerber markets the products as “crawler snacks,” and “baby’s first biscuit,” noting that the treats dissolve easily. It alternatively describes the product as cookies. Customers should check the back of the product packaging to verify whether their package is included in the recall. Each package has a 10-digit batch code listed next to the best-before date. The best-before dates range from mid-October into mid-December 2026. The full list of batch codes is available on Gerber’s website. FDA Fast Company contacted Gerber to ask for more information about the arrowroot flour supplier. We will update this story if we get a reply. Impacted products should not be consumed Customers who have purchased the impacted product should not feed it to their child. They should return the product to the retailer where it was purchased for a refund. All-day consumer support is available by calling 1-800-4-GERBER (1-800-443-7237). Gerber is a subsidiary of Swiss multinational food giant Nestlé S.A. View the full article

-

You’re not alone in feeling unprepared for the AI boom

Journalist Ira Glass, who hosts the NPR show “This American Life,” is not a computer scientist. He doesn’t work at Google, Apple, or Nvidia. But he does have a great ear for useful phrases, and in 2024, he organized an entire episode around one that might resonate with anyone who feels blindsided by the pace of AI development: “Unprepared for what has already happened.” Coined by science journalist Alex Steffen, the phrase captures the unsettling feeling that “the experience and expertise you’ve built up” may now be obsolete—or, at least, a lot less valuable than it once was. Whenever I lead workshops in law firms, government agencies, or nonprofit organizations, I hear that same concern. Highly educated, accomplished professionals worry whether there will be a place for them in an economy where generative AI can quickly—and relatively cheaply—complete a growing list of tasks that an extremely large number of people currently get paid to do. Seeing a future that doesn’t include you In technology reporter Cade Metz’s 2022 book, “Genius Makers: The Mavericks Who Brought AI to Google, Facebook, and the World,” he describes the panic that washed over a veteran researcher at Microsoft named Chris Brockett when Brockett first encountered an artificial intelligence program that could essentially perform everything he’d spent decades learning how to master. Overcome by the thought that a piece of software had now made his entire skill set and knowledge base irrelevant, Brockett was actually rushed to the hospital because he thought he was having a heart attack. “My 52-year-old body had one of those moments when I saw a future where I wasn’t involved,” he later told Metz. In his 2018 book, “Life 3.0: Being Human in the Age of Artificial Intelligence,” MIT physicist Max Tegmark expresses a similar anxiety. “As technology keeps improving, will the rise of AI eventually eclipse those abilities that provide my current sense of self-worth and value on the job market?” The answer to that question, unnervingly, can often feel outside of our individual control. “We’re seeing more AI-related products and advancements in a single day than we saw in a single year a decade ago,” a Silicon Valley product manager told a reporter for Vanity Fair back in 2023. Things have only accelerated since then. Even Dario Amodei—the co-founder and CEO of Anthropic, the company that created the popular chatbot Claude—has been shaken by the increasing power of AI tools. “I think of all the times when I wrote code,” he said in an interview on the tech podcast “Hard Fork.” “It’s like a part of my identity that I’m good at this. And then I’m like, oh, my god, there’s going to be these (AI) systems that [can perform a lot better than I can].” The irony that these fears live inside the brain of someone who leads one of the most important AI companies in the world is not lost on Amodei. “Even as the one who’s building these systems,” he added, “even as one of the ones who benefits most from (them), there’s still something a bit threatening about (them).” Autor and agency Yet as the labor economist David Autor has argued, we all have more agency over the future than we might think. In 2024, Autor was interviewed by Bloomberg News soon after publishing a research paper titled Applying AI to Rebuild Middle-Class Jobs. The paper explores the idea that AI, if managed well, might be able to help a larger set of people perform the kind of higher-value—and higher-paying—“decision-making tasks currently arrogated to elite experts like doctors, lawyers, coders and educators.” This shift, Autor suggests, “would improve the quality of jobs for workers without college degrees, moderate earnings inequality, and—akin to what the Industrial Revolution did for consumer goods—lower the cost of key services such as healthcare, education and legal expertise.” It’s an interesting, hopeful argument, and Autor, who has spent decades studying the effects of automation and computerization on the workforce, has the intellectual heft to explain it without coming across as Pollyannish. But what I found most heartening about the interview was Autor’s response to a question about a type of “AI doomerism” that believes that widespread economic displacement is inevitable and there’s nothing we can do to stop it. “The future should not be treated as a forecasting or prediction exercise,” he said. “It should be treated as a design problem—because the future is not (something) where we just wait and see what happens. … We have enormous control over the future in which we live, and [the quality of that future] depends on the investments and structures that we create today.” At the starting line I try to emphasize Autor’s point about the future being more of a “design problem” than a “prediction exercise” in all the AI courses and workshops I teach to law students and lawyers, many of whom fret over their own job prospects. The nice thing about the current AI moment, I tell them, is that there is still time for deliberate action. Although the first scientific paper on neural networks was published all the way back in 1943, we’re still very much in the early stages of so-called “generative AI.” No student or employee is hopelessly behind. Nor is anyone commandingly ahead. Instead, each of us is in an enviable spot: right at the starting line. Patrick Barry is a clinical assistant professor of law and director of Digital Academic Initiatives at the University of Michigan. This article is republished from The Conversation under a Creative Commons license. Read the original article. View the full article

-

Google Ads API v23 kicks off faster releases for 2026

Google has released v23 of the Google Ads API, the first update of 2026 and the start of a faster release cadence, introducing deeper Performance Max reporting, more granular invoicing, new AI-powered audience tools, and expanded campaign controls. What’s new: Performance Max transparency: Ad network type breakdowns are now available for PMax campaigns. More detailed invoices: Campaign-level costs, regulatory fees, and adjustments can be retrieved via InvoiceService. More precise scheduling: Campaigns can now use start and end date-times instead of date-only fields. Local data access: Store location details are available through PerStoreView, matching the Stores report. New audience dimension: LIFE_EVENT_USER_INTEREST enables life-event-based audience building in Insights tools. Smarter Demand Gen planning: Conversion rate forecasts now vary by surface (e.g., Gmail, Shorts). Generative AI audiences: Free-text audience descriptions can be translated into structured audience attributes. Expanded Shopping metrics: New competitive and conversion metrics are available by conversion date. Why we care. A quicker update cycle means advertisers and developers will get new capabilities sooner, especially as Google leans further into automation, AI-driven planning, and visibility across campaign types. Between the lines. Some of these updates require upgrading client libraries and code, meaning that teams may need to plan development time to take full advantage of v23. Bottom line. Google Ads API v23 sets the pace for 2026, pairing faster releases with more AI-driven insights, better reporting, and tighter campaign control for advertisers building at scale. View the full article

-

Mortgage rates rise as FOMC inaction adds to uncertainty

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said. View the full article

-

Pennymac, Rocket, UWM: What analysts expect in Q4 earnings

Analysts estimate Pennymac, Rocket, UWM and Loandepot will post an improved earnings per share and total loan origination volume than the same time a year prior. View the full article

-

What Is the Family Medical Leave Act?

The Family Medical Leave Act (FMLA) is an important law for employees facing significant life events. It allows eligible workers to take up to 12 weeks of unpaid leave for reasons like childbirth or caring for a seriously ill family member. To qualify, you must meet specific criteria related to your employment duration and hours worked. Comprehending these requirements is vital, as they can impact your rights and protections during leave. What else should you know about this significant legislation? Key Takeaways The Family Medical Leave Act (FMLA) was enacted in 1993 to provide unpaid leave for family and medical reasons with job protection. Eligible employees can take up to 12 weeks of unpaid leave for childbirth, adoption, or caring for a seriously ill family member. Employers must have at least 50 employees within a 75-mile radius for FMLA coverage to apply. Employees are entitled to job restoration and health insurance benefits during their leave period. Violations of FMLA rights can lead to damages for lost wages and benefits, with reporting procedures in place for grievances. Overview of FMLA The Family Medical Leave Act (FMLA), which was enacted in 1993, provides a crucial safety net for employees who need time off for specific family and medical reasons. Under the FMLA, eligible employees can take up to 12 weeks of unpaid leave during receiving job protection. This means that employers must restore employees to their original or equivalent positions upon their return. The Act covers circumstances such as childbirth, adoption, caring for a seriously ill family member, or addressing the employee’s own serious health condition. To qualify for FMLA leave, employees must meet certain criteria, including working for their employer for at least 12 months and logging at least 1,250 hours in the previous year. The Family Medical Leave Act applies to both public and private-sector employers with a minimum of 50 employees within a 75-mile radius, ensuring broad coverage across various workplaces. Eligibility Requirements To qualify for FMLA leave, you need to meet specific eligibility criteria, which include having worked for your employer for at least 12 months and clocking in at least 1,250 hours in the past year. Furthermore, your employer must have 50 or more employees within a 75-mile radius for the FMLA to apply. It’s likewise important to note that certain roles, like elected officials and highly compensated employees, aren’t eligible, alongside special rules for airline and educational workers. Employee Eligibility Criteria Comprehending employee eligibility criteria under the Family Medical Leave Act (FMLA) is crucial for both employees and employers. To qualify for FMLA leave, you must meet specific requirements. Here’s a quick overview: Criteria Description Employment Duration Worked for the employer for at least 12 months Hours Worked Logged a minimum of 1,250 hours in the past year Employer Size Employer must have 50+ employees within 75 miles Exclusions Certain categories, like elected officials, are excluded Special Rules Different criteria may apply for airline staff or educational employees Understanding these FMLA eligibility factors will help you navigate how does FMLA work, ensuring you know your rights under FMLA guidelines for employers and applicable state laws like FMLA in AZ or FMLA leave Ohio. Employer Coverage Requirements Comprehending employer coverage requirements under the Family Medical Leave Act (FMLA) is essential for both employers and employees alike. To be covered by the FMLA, employers must have at least 50 employees within a 75-mile radius. This law guarantees eligible employees can access unpaid FMLA leave for family or medical reasons. To qualify, you must have worked for at least 12 months and logged a minimum of 1,250 hours during that period. Public agencies and local educational agencies are included under these employer coverage requirements, granting their workers the same FMLA protections as private-sector employees. Nevertheless, certain categories, like elected officials and highly compensated employees, are excluded, affecting their employee eligibility for FMLA leave. Covered Employers Grasping the parameters of the Family Medical Leave Act (FMLA) is essential for both employers and employees, especially in terms of who qualifies as a covered employer. Covered employers include those with 50 or more employees within a 75-mile radius, encompassing both public agencies and private sector organizations. This means that if you work for a larger organization, you’re likely considered a covered employee under the FMLA. Nevertheless, employers with fewer than 50 employees aren’t subject to FMLA requirements, limiting the Act’s coverage. It’s important to note that specific categories, like airline employees and highly compensated individuals, may have distinct rules concerning their employer coverage. Furthermore, some states may enact more expansive family leave laws that provide further protections, which can influence the applicability of employer coverage. Grasping these distinctions helps guarantee that you know your rights regarding family leave. Scope of Leave When you need to take time off for family or medical reasons, comprehending the scope of leave under the Family Medical Leave Act (FMLA) is vital. This act allows eligible employees to take up to 12 weeks of unpaid leave within a 12-month period for particular reasons, such as childbirth, adoption, or a serious health condition. You can additionally take up to 26 weeks to care for a seriously injured or ill servicemember. The leave can be taken in one block or intermittently for ongoing medical conditions if you coordinate with your employer. To qualify, you must meet FMLA requirements, including working for at least 12 months and logging 1,250 hours in the past year. The act covers both public and private-sector employees, particularly those working for employers with at least 50 employees within a 75-mile radius. Grasping how family medical leave works is vital for eligible employees. Rights During Leave What rights do you have during leave under the Family Medical Leave Act (FMLA)? You’re entitled to 12 weeks of unpaid leave for qualifying family and medical reasons, and job restoration is guaranteed. This means you can return to your same or a substantially equivalent position after your FMLA leave. Employers must maintain group health insurance benefits as if you were still working, ensuring you stay covered during your time away. It’s likewise important to know that you can’t face retaliation for taking FMLA leave, as the law protects you from any interference with your rights. If you’re in states like Ohio or Texas, know the specific FMLA requirements and guidelines for your area. In Pennsylvania, or under the Family Medical Leave Act for family members in Arizona, your rights remain consistent. Job Protection Job protection under the Family Medical Leave Act (FMLA) guarantees that you can return to your position or a substantially equivalent one after taking up to 12 weeks of unpaid leave for qualifying family and medical reasons. To qualify for this job protection, you must meet specific eligibility requirements, such as working for your employer for at least 12 months and logging 1,250 hours prior to your leave. Significantly, the FMLA guarantees that your group health insurance remains intact during your unpaid leave. Employers are prohibited from retaliating against employees who exercise their rights under the Family Medical Leave Act, meaning they can’t discourage you from taking leave or take adverse actions based on your absence. Nevertheless, if you’re among the top 10% of highest-paid workers, your job restoration rights may be limited, which is something to evaluate before taking leave. Group Health Benefits Maintaining group health benefits during your FMLA leave is a significant aspect of the protections offered under the Family Medical Leave Act. Employers are required to keep your health coverage intact as if you were actively working. Nevertheless, you must continue to pay your portion of health insurance premiums to maintain coverage during your leave. If you don’t return after your FMLA leave expires, your employer can recover those premiums. Here are some key points to remember: FMLA guarantees your group health insurance benefits remain active. Coverage includes medical, dental, and vision plans. You have the right to maintain coverage without discrimination. Employers can’t retaliate for exercising your employee rights under FMLA. Understanding these aspects can help you navigate your health insurance during necessary time off. Your benefits should stay secure during your leave, allowing you to focus on recovery and family needs. Requesting Leave When you need to take leave under the Family Medical Leave Act (FMLA), it’s essential to request it as soon as possible to confirm you meet all requirements. Start by submitting your leave requests, clearly stating your intention to take family medical leave. Although these requests can be informal, they must indicate that you’re seeking FMLA coverage. If your situation involves ongoing medical conditions, you might want to contemplate intermittent leave, which allows you to take leave in smaller increments. Be prepared for your employer to request certification to verify your need for leave, which may require you to provide relevant medical documentation. Remember, your employer may similarly require you to use any available vacation or sick time concurrently with your FMLA leave if applicable. Intermittent Leave Intermittent leave under the Family Medical Leave Act (FMLA) lets you take leave in separate blocks rather than all at once, which can be helpful if you’re dealing with a chronic health issue. When you need intermittent leave, you must notify your employer as soon as possible, and they might ask for a healthcare provider’s certification to confirm your need. It’s equally important to keep in mind that your employer may require you to use any accrued paid leave during this time. Definition of Intermittent Leave Under the Family Medical Leave Act (FMLA), eligible employees have the option to take leave in separate blocks of time, making it easier to manage ongoing medical needs or caregiving responsibilities. This is known as intermittent leave. You can request intermittent leave for serious health conditions affecting yourself or a family member, in addition to for qualifying exigencies related to military service. Here are some key points about intermittent leave: It can be taken in small increments, like hours or days. Employers may require healthcare provider certification to verify the need. You must notify your employer as soon as possible when you need to take leave. Employers can mandate the use of accrued paid leave during this time. Requesting Intermittent Leave How do you go about requesting intermittent leave under the Family Medical Leave Act (FMLA)? First, you need to provide notice to your employer as soon as practicable. Your request can be informal, but it should indicate your potential FMLA coverage. You may need to use accrued paid leave, like vacation or sick time, except you choose unpaid leave. Employers can ask for certification from a healthcare provider to verify your need for intermittent leave. This type of leave is especially beneficial for those with chronic health conditions or caregiving responsibilities, allowing for flexibility. Step Action Notes 1. Notify Employer Inform as soon as possible Indicate potential FMLA coverage 2. Use Leave Accrued paid leave or unpaid Depends on your choice 3. Provide Certification From healthcare provider Verify need for leave 4. Flexibility Adapt schedule as needed Manage chronic conditions or caregiving Employer Responsibilities and Rights When employees request intermittent leave under the Family Medical Leave Act (FMLA), employers have specific responsibilities they must uphold to guarantee compliance and support their workforce. Employers must provide job protection, ensuring employees can return to the same or equivalent position after taking intermittent leave. They must maintain group health insurance benefits for employees on FMLA leave, regardless of whether it’s taken intermittently. Employers can require certification to verify the need for leave based on a serious health condition. Clear procedures for managing leave requests should be established, including how vacation or sick time may affect intermittent leave. Special Provisions for Service Members The Family Medical Leave Act (FMLA) includes specific provisions for service members that aim to address the unique challenges faced by military families. Under these provisions, eligible employees can take up to 26 weeks of leave to care for a servicemember with a serious injury or illness. This includes time off for medical treatment or recuperation. Additionally, military family leave allows family members to take leave for qualifying exigencies, such as deployment-related activities. The FMLA’s military family leave amendments guarantee that military families receive necessary FMLA protections during critical times. Provision Duration Purpose Care for seriously injured Up to 26 weeks Support during medical treatment Qualifying exigencies Varies Attend military events, arrange childcare Family medical leave act extension As needed Extend protections for military families These provisions help ease the burden on servicemembers and their families during challenging periods. Enforcement of FMLA Rights Comprehending your rights under the Family Medical Leave Act (FMLA) is crucial, particularly regarding enforcement. Both employees and the Secretary of Labor can initiate enforcement actions against employers for FMLA rights violations. If you believe your rights have been infringed, you have a two-year limit to file a claim, extending to three years for willful violations. You may seek damages for lost wages and benefits, and in some cases, liquidated damages. Employers must show good faith efforts to comply with the FMLA to avoid penalties. Violations can include discouraging leave requests or retaliating against you for exercising your FMLA rights. You can report these issues to the Department of Labor (DOL). Know your filing deadlines. Understand the types of damages available. Recognize employer obligations. Report violations without delay. Staying informed empowers you to protect your FMLA rights effectively. Violations and Remedies Grasping the types of violations under the Family Medical Leave Act (FMLA) is essential for both employees and employers. If you experience issues like not being reinstated to your original position after taking leave, there are specific remedies available to address these problems, including potential claims for lost wages. Knowing the proper reporting procedures can help you take action if you believe your FMLA rights have been violated. Types of Violations When you consider the Family Medical Leave Act (FMLA), it’s crucial to recognize the various types of violations that can occur, as these directly impact your rights as an employee. Common FMLA violations include: Denying leave requests for eligible employees Retaliating against employees who exercise their FMLA rights Discouraging employees from taking leave Failing to maintain proper documentation for compliance If you experience lost wages as a result of these violations, you may have the right to seek damages. Employers must demonstrate good faith compliance to avoid penalties, and the statute of limitations for filing claims is typically two years, extending to three years for willful violations. You can initiate enforcement actions through the Secretary of Labor. Remedies Available If you find yourself facing violations of the Family Medical Leave Act (FMLA), several remedies may be available to you. You can pursue damages for lost wages and benefits, which could likewise include liquidated damages if your employer willfully violated the act. It’s crucial to recognize that filing claims under the FMLA must be done within two years, or three years for willful violations. Employers are required to demonstrate good faith to avoid penalties for these FMLA violations, emphasizing the need for compliance with FMLA regulations. Keep in mind that claims typically resolve through administrative or judicial processes, as the FMLA doesn’t grant a jury right for reinstatement claims, which adds another layer to reflect on in your pursuit of remedies. Reporting Procedures Reporting violations of the Family Medical Leave Act (FMLA) is a critical step in securing your rights as an employee. If you suspect FMLA violations, it’s important to follow the proper reporting procedures. You can file complaints about FMLA violations with the Department of Labor (DOL) either online or via phone. Here are some key points to keep in mind: Keep detailed documentation of violations to support your claims. Claims must be filed within two years, or three for willful violations. Employers must demonstrate good faith compliance to avoid penalties. You have the right to seek reinstatement, even though there’s no jury right for these claims. Understanding these aspects will empower you to take action effectively. State Family Leave Laws State family leave laws vary greatly from federal regulations, often providing improved protections and benefits for employees. For instance, the California Family Leave Act allows for broader family definitions, including domestic partners. In the state of Florida, FMLA guidelines align closely with federal standards but may have lower employee thresholds, allowing more individuals to qualify. Several states, including Massachusetts and New Jersey, have enacted paid family leave, with Washington state leading the way since 2017. FMLA laws in Texas and other states likewise address unique situations, like domestic violence or organ donation, which aren’t covered under the federal FMLA. Furthermore, the Paid Medical Leave Act in various states gives employees the opportunity to take necessary time off, enhancing PFL eligibility for caregivers. Comprehending these state-specific regulations can greatly impact your rights and benefits when facing family or medical needs. Frequently Asked Questions What Are the Rules Around FMLA? To understand the rules around FMLA, you need to know that you must have worked for your employer for at least 12 months and logged 1,250 hours in the past year. If your employer has 50 or more employees within a 75-mile radius, you’re eligible. You must give 30 days’ notice for foreseeable leave, and your employer can ask for certification. You’ll continue receiving health benefits during leave, and your job must be protected. What Is the Disadvantage of FMLA? FMLA has several disadvantages. You might face financial strain since it only guarantees unpaid leave, making it tough if you can’t afford time off. Furthermore, not all employers provide paid leave, creating disparities. If you’re a high-earning employee, your job restoration rights are limited, and smaller businesses aren’t covered, leaving many workers without protections. Finally, the law could inadvertently discourage employers from hiring women because of the health insurance maintenance requirement during leave. What Is the Longest You Can Be on FMLA? The longest you can be on FMLA leave is 12 work weeks within a 12-month period for most situations. Nevertheless, if you’re caring for a seriously injured or ill servicemember, you can take up to 26 weeks in a single 12-month timeframe. You can choose to take this leave all at once or intermittently, depending on your situation, as long as you meet the eligibility requirements set by your employer. What Benefits Do You Get While on FMLA? During the time you’re on FMLA leave, you’re entitled to several benefits. You can take up to 12 weeks of unpaid, job-protected leave for specific family or medical reasons. Your employer must maintain your health insurance, ensuring you keep your coverage. You can additionally use your accrued paid leave, such as vacation or sick time, to supplement your income. Upon returning, you’re entitled to your original job or an equivalent position. Conclusion In conclusion, the Family Medical Leave Act provides vital protections for employees needing time off for family or medical reasons. By comprehending eligibility requirements and employer obligations, you can navigate your rights effectively. Whether you’re dealing with a serious illness or welcoming a new family member, knowing your options under FMLA is important. Moreover, be aware of state laws that may offer further benefits. Always advocate for your rights to guarantee you receive the leave you’re entitled to. Image via Google Gemini and ArtSmart This article, "What Is the Family Medical Leave Act?" was first published on Small Business Trends View the full article

-

What Is the Family Medical Leave Act?

The Family Medical Leave Act (FMLA) is an important law for employees facing significant life events. It allows eligible workers to take up to 12 weeks of unpaid leave for reasons like childbirth or caring for a seriously ill family member. To qualify, you must meet specific criteria related to your employment duration and hours worked. Comprehending these requirements is vital, as they can impact your rights and protections during leave. What else should you know about this significant legislation? Key Takeaways The Family Medical Leave Act (FMLA) was enacted in 1993 to provide unpaid leave for family and medical reasons with job protection. Eligible employees can take up to 12 weeks of unpaid leave for childbirth, adoption, or caring for a seriously ill family member. Employers must have at least 50 employees within a 75-mile radius for FMLA coverage to apply. Employees are entitled to job restoration and health insurance benefits during their leave period. Violations of FMLA rights can lead to damages for lost wages and benefits, with reporting procedures in place for grievances. Overview of FMLA The Family Medical Leave Act (FMLA), which was enacted in 1993, provides a crucial safety net for employees who need time off for specific family and medical reasons. Under the FMLA, eligible employees can take up to 12 weeks of unpaid leave during receiving job protection. This means that employers must restore employees to their original or equivalent positions upon their return. The Act covers circumstances such as childbirth, adoption, caring for a seriously ill family member, or addressing the employee’s own serious health condition. To qualify for FMLA leave, employees must meet certain criteria, including working for their employer for at least 12 months and logging at least 1,250 hours in the previous year. The Family Medical Leave Act applies to both public and private-sector employers with a minimum of 50 employees within a 75-mile radius, ensuring broad coverage across various workplaces. Eligibility Requirements To qualify for FMLA leave, you need to meet specific eligibility criteria, which include having worked for your employer for at least 12 months and clocking in at least 1,250 hours in the past year. Furthermore, your employer must have 50 or more employees within a 75-mile radius for the FMLA to apply. It’s likewise important to note that certain roles, like elected officials and highly compensated employees, aren’t eligible, alongside special rules for airline and educational workers. Employee Eligibility Criteria Comprehending employee eligibility criteria under the Family Medical Leave Act (FMLA) is crucial for both employees and employers. To qualify for FMLA leave, you must meet specific requirements. Here’s a quick overview: Criteria Description Employment Duration Worked for the employer for at least 12 months Hours Worked Logged a minimum of 1,250 hours in the past year Employer Size Employer must have 50+ employees within 75 miles Exclusions Certain categories, like elected officials, are excluded Special Rules Different criteria may apply for airline staff or educational employees Understanding these FMLA eligibility factors will help you navigate how does FMLA work, ensuring you know your rights under FMLA guidelines for employers and applicable state laws like FMLA in AZ or FMLA leave Ohio. Employer Coverage Requirements Comprehending employer coverage requirements under the Family Medical Leave Act (FMLA) is essential for both employers and employees alike. To be covered by the FMLA, employers must have at least 50 employees within a 75-mile radius. This law guarantees eligible employees can access unpaid FMLA leave for family or medical reasons. To qualify, you must have worked for at least 12 months and logged a minimum of 1,250 hours during that period. Public agencies and local educational agencies are included under these employer coverage requirements, granting their workers the same FMLA protections as private-sector employees. Nevertheless, certain categories, like elected officials and highly compensated employees, are excluded, affecting their employee eligibility for FMLA leave. Covered Employers Grasping the parameters of the Family Medical Leave Act (FMLA) is essential for both employers and employees, especially in terms of who qualifies as a covered employer. Covered employers include those with 50 or more employees within a 75-mile radius, encompassing both public agencies and private sector organizations. This means that if you work for a larger organization, you’re likely considered a covered employee under the FMLA. Nevertheless, employers with fewer than 50 employees aren’t subject to FMLA requirements, limiting the Act’s coverage. It’s important to note that specific categories, like airline employees and highly compensated individuals, may have distinct rules concerning their employer coverage. Furthermore, some states may enact more expansive family leave laws that provide further protections, which can influence the applicability of employer coverage. Grasping these distinctions helps guarantee that you know your rights regarding family leave. Scope of Leave When you need to take time off for family or medical reasons, comprehending the scope of leave under the Family Medical Leave Act (FMLA) is vital. This act allows eligible employees to take up to 12 weeks of unpaid leave within a 12-month period for particular reasons, such as childbirth, adoption, or a serious health condition. You can additionally take up to 26 weeks to care for a seriously injured or ill servicemember. The leave can be taken in one block or intermittently for ongoing medical conditions if you coordinate with your employer. To qualify, you must meet FMLA requirements, including working for at least 12 months and logging 1,250 hours in the past year. The act covers both public and private-sector employees, particularly those working for employers with at least 50 employees within a 75-mile radius. Grasping how family medical leave works is vital for eligible employees. Rights During Leave What rights do you have during leave under the Family Medical Leave Act (FMLA)? You’re entitled to 12 weeks of unpaid leave for qualifying family and medical reasons, and job restoration is guaranteed. This means you can return to your same or a substantially equivalent position after your FMLA leave. Employers must maintain group health insurance benefits as if you were still working, ensuring you stay covered during your time away. It’s likewise important to know that you can’t face retaliation for taking FMLA leave, as the law protects you from any interference with your rights. If you’re in states like Ohio or Texas, know the specific FMLA requirements and guidelines for your area. In Pennsylvania, or under the Family Medical Leave Act for family members in Arizona, your rights remain consistent. Job Protection Job protection under the Family Medical Leave Act (FMLA) guarantees that you can return to your position or a substantially equivalent one after taking up to 12 weeks of unpaid leave for qualifying family and medical reasons. To qualify for this job protection, you must meet specific eligibility requirements, such as working for your employer for at least 12 months and logging 1,250 hours prior to your leave. Significantly, the FMLA guarantees that your group health insurance remains intact during your unpaid leave. Employers are prohibited from retaliating against employees who exercise their rights under the Family Medical Leave Act, meaning they can’t discourage you from taking leave or take adverse actions based on your absence. Nevertheless, if you’re among the top 10% of highest-paid workers, your job restoration rights may be limited, which is something to evaluate before taking leave. Group Health Benefits Maintaining group health benefits during your FMLA leave is a significant aspect of the protections offered under the Family Medical Leave Act. Employers are required to keep your health coverage intact as if you were actively working. Nevertheless, you must continue to pay your portion of health insurance premiums to maintain coverage during your leave. If you don’t return after your FMLA leave expires, your employer can recover those premiums. Here are some key points to remember: FMLA guarantees your group health insurance benefits remain active. Coverage includes medical, dental, and vision plans. You have the right to maintain coverage without discrimination. Employers can’t retaliate for exercising your employee rights under FMLA. Understanding these aspects can help you navigate your health insurance during necessary time off. Your benefits should stay secure during your leave, allowing you to focus on recovery and family needs. Requesting Leave When you need to take leave under the Family Medical Leave Act (FMLA), it’s essential to request it as soon as possible to confirm you meet all requirements. Start by submitting your leave requests, clearly stating your intention to take family medical leave. Although these requests can be informal, they must indicate that you’re seeking FMLA coverage. If your situation involves ongoing medical conditions, you might want to contemplate intermittent leave, which allows you to take leave in smaller increments. Be prepared for your employer to request certification to verify your need for leave, which may require you to provide relevant medical documentation. Remember, your employer may similarly require you to use any available vacation or sick time concurrently with your FMLA leave if applicable. Intermittent Leave Intermittent leave under the Family Medical Leave Act (FMLA) lets you take leave in separate blocks rather than all at once, which can be helpful if you’re dealing with a chronic health issue. When you need intermittent leave, you must notify your employer as soon as possible, and they might ask for a healthcare provider’s certification to confirm your need. It’s equally important to keep in mind that your employer may require you to use any accrued paid leave during this time. Definition of Intermittent Leave Under the Family Medical Leave Act (FMLA), eligible employees have the option to take leave in separate blocks of time, making it easier to manage ongoing medical needs or caregiving responsibilities. This is known as intermittent leave. You can request intermittent leave for serious health conditions affecting yourself or a family member, in addition to for qualifying exigencies related to military service. Here are some key points about intermittent leave: It can be taken in small increments, like hours or days. Employers may require healthcare provider certification to verify the need. You must notify your employer as soon as possible when you need to take leave. Employers can mandate the use of accrued paid leave during this time. Requesting Intermittent Leave How do you go about requesting intermittent leave under the Family Medical Leave Act (FMLA)? First, you need to provide notice to your employer as soon as practicable. Your request can be informal, but it should indicate your potential FMLA coverage. You may need to use accrued paid leave, like vacation or sick time, except you choose unpaid leave. Employers can ask for certification from a healthcare provider to verify your need for intermittent leave. This type of leave is especially beneficial for those with chronic health conditions or caregiving responsibilities, allowing for flexibility. Step Action Notes 1. Notify Employer Inform as soon as possible Indicate potential FMLA coverage 2. Use Leave Accrued paid leave or unpaid Depends on your choice 3. Provide Certification From healthcare provider Verify need for leave 4. Flexibility Adapt schedule as needed Manage chronic conditions or caregiving Employer Responsibilities and Rights When employees request intermittent leave under the Family Medical Leave Act (FMLA), employers have specific responsibilities they must uphold to guarantee compliance and support their workforce. Employers must provide job protection, ensuring employees can return to the same or equivalent position after taking intermittent leave. They must maintain group health insurance benefits for employees on FMLA leave, regardless of whether it’s taken intermittently. Employers can require certification to verify the need for leave based on a serious health condition. Clear procedures for managing leave requests should be established, including how vacation or sick time may affect intermittent leave. Special Provisions for Service Members The Family Medical Leave Act (FMLA) includes specific provisions for service members that aim to address the unique challenges faced by military families. Under these provisions, eligible employees can take up to 26 weeks of leave to care for a servicemember with a serious injury or illness. This includes time off for medical treatment or recuperation. Additionally, military family leave allows family members to take leave for qualifying exigencies, such as deployment-related activities. The FMLA’s military family leave amendments guarantee that military families receive necessary FMLA protections during critical times. Provision Duration Purpose Care for seriously injured Up to 26 weeks Support during medical treatment Qualifying exigencies Varies Attend military events, arrange childcare Family medical leave act extension As needed Extend protections for military families These provisions help ease the burden on servicemembers and their families during challenging periods. Enforcement of FMLA Rights Comprehending your rights under the Family Medical Leave Act (FMLA) is crucial, particularly regarding enforcement. Both employees and the Secretary of Labor can initiate enforcement actions against employers for FMLA rights violations. If you believe your rights have been infringed, you have a two-year limit to file a claim, extending to three years for willful violations. You may seek damages for lost wages and benefits, and in some cases, liquidated damages. Employers must show good faith efforts to comply with the FMLA to avoid penalties. Violations can include discouraging leave requests or retaliating against you for exercising your FMLA rights. You can report these issues to the Department of Labor (DOL). Know your filing deadlines. Understand the types of damages available. Recognize employer obligations. Report violations without delay. Staying informed empowers you to protect your FMLA rights effectively. Violations and Remedies Grasping the types of violations under the Family Medical Leave Act (FMLA) is essential for both employees and employers. If you experience issues like not being reinstated to your original position after taking leave, there are specific remedies available to address these problems, including potential claims for lost wages. Knowing the proper reporting procedures can help you take action if you believe your FMLA rights have been violated. Types of Violations When you consider the Family Medical Leave Act (FMLA), it’s crucial to recognize the various types of violations that can occur, as these directly impact your rights as an employee. Common FMLA violations include: Denying leave requests for eligible employees Retaliating against employees who exercise their FMLA rights Discouraging employees from taking leave Failing to maintain proper documentation for compliance If you experience lost wages as a result of these violations, you may have the right to seek damages. Employers must demonstrate good faith compliance to avoid penalties, and the statute of limitations for filing claims is typically two years, extending to three years for willful violations. You can initiate enforcement actions through the Secretary of Labor. Remedies Available If you find yourself facing violations of the Family Medical Leave Act (FMLA), several remedies may be available to you. You can pursue damages for lost wages and benefits, which could likewise include liquidated damages if your employer willfully violated the act. It’s crucial to recognize that filing claims under the FMLA must be done within two years, or three years for willful violations. Employers are required to demonstrate good faith to avoid penalties for these FMLA violations, emphasizing the need for compliance with FMLA regulations. Keep in mind that claims typically resolve through administrative or judicial processes, as the FMLA doesn’t grant a jury right for reinstatement claims, which adds another layer to reflect on in your pursuit of remedies. Reporting Procedures Reporting violations of the Family Medical Leave Act (FMLA) is a critical step in securing your rights as an employee. If you suspect FMLA violations, it’s important to follow the proper reporting procedures. You can file complaints about FMLA violations with the Department of Labor (DOL) either online or via phone. Here are some key points to keep in mind: Keep detailed documentation of violations to support your claims. Claims must be filed within two years, or three for willful violations. Employers must demonstrate good faith compliance to avoid penalties. You have the right to seek reinstatement, even though there’s no jury right for these claims. Understanding these aspects will empower you to take action effectively. State Family Leave Laws State family leave laws vary greatly from federal regulations, often providing improved protections and benefits for employees. For instance, the California Family Leave Act allows for broader family definitions, including domestic partners. In the state of Florida, FMLA guidelines align closely with federal standards but may have lower employee thresholds, allowing more individuals to qualify. Several states, including Massachusetts and New Jersey, have enacted paid family leave, with Washington state leading the way since 2017. FMLA laws in Texas and other states likewise address unique situations, like domestic violence or organ donation, which aren’t covered under the federal FMLA. Furthermore, the Paid Medical Leave Act in various states gives employees the opportunity to take necessary time off, enhancing PFL eligibility for caregivers. Comprehending these state-specific regulations can greatly impact your rights and benefits when facing family or medical needs. Frequently Asked Questions What Are the Rules Around FMLA? To understand the rules around FMLA, you need to know that you must have worked for your employer for at least 12 months and logged 1,250 hours in the past year. If your employer has 50 or more employees within a 75-mile radius, you’re eligible. You must give 30 days’ notice for foreseeable leave, and your employer can ask for certification. You’ll continue receiving health benefits during leave, and your job must be protected. What Is the Disadvantage of FMLA? FMLA has several disadvantages. You might face financial strain since it only guarantees unpaid leave, making it tough if you can’t afford time off. Furthermore, not all employers provide paid leave, creating disparities. If you’re a high-earning employee, your job restoration rights are limited, and smaller businesses aren’t covered, leaving many workers without protections. Finally, the law could inadvertently discourage employers from hiring women because of the health insurance maintenance requirement during leave. What Is the Longest You Can Be on FMLA? The longest you can be on FMLA leave is 12 work weeks within a 12-month period for most situations. Nevertheless, if you’re caring for a seriously injured or ill servicemember, you can take up to 26 weeks in a single 12-month timeframe. You can choose to take this leave all at once or intermittently, depending on your situation, as long as you meet the eligibility requirements set by your employer. What Benefits Do You Get While on FMLA? During the time you’re on FMLA leave, you’re entitled to several benefits. You can take up to 12 weeks of unpaid, job-protected leave for specific family or medical reasons. Your employer must maintain your health insurance, ensuring you keep your coverage. You can additionally use your accrued paid leave, such as vacation or sick time, to supplement your income. Upon returning, you’re entitled to your original job or an equivalent position. Conclusion In conclusion, the Family Medical Leave Act provides vital protections for employees needing time off for family or medical reasons. By comprehending eligibility requirements and employer obligations, you can navigate your rights effectively. Whether you’re dealing with a serious illness or welcoming a new family member, knowing your options under FMLA is important. Moreover, be aware of state laws that may offer further benefits. Always advocate for your rights to guarantee you receive the leave you’re entitled to. Image via Google Gemini and ArtSmart This article, "What Is the Family Medical Leave Act?" was first published on Small Business Trends View the full article

-

Apple buys Israeli start-up Q.AI for close to $2bn in race to build AI devices

Deal worth close to $2bn for secretive group that creates technology that analyses facial expressionsView the full article

-

update: did I cross a line with the (messy, chaotic) organization I volunteer for?

Remember the letter-writer who asked if they had crossed a line with the (messy, chaotic) organization they volunteered for? Here’s the update. I’m the person who was angry about an Instagram post from the nonprofit that I was volunteering at. Duncan and Isadora did leave the board, although they still volunteered on a lower level. You mentioned that the nonprofit might not have great results towards its mission, and the truth is that the results are mixed. The organization’s goals are met, for the most part, but not without the great over-efforts of five or six people, myself included (which had earned me the nickname “Superstar” within the org). Things came to a head when I was laid off from my job. The good news was that when I told a previous manager about the layoff, he immediately put a good word in for me at his company, which landed me a job with better pay and projects that I love. The bad news was that it was still stressful for me, especially since I was also in the middle of moving to a new apartment. My sleep schedule and appetite were negatively affected, so I had to pause volunteering to take care of myself. I was only required to tell the board members about my hiatus so they could reassign my responsibilities. In this time that I was away from the organization, none of the members or other volunteers reached out to me. When I had settled down into the new job and apartment, I texted a fellow volunteer to wish her a happy birthday. She said, “Thank you! I haven’t heard from you in a few weeks, how are things?” I explained everything that had been happening in my life, and she replied, “Oh, that makes sense. Nobody told us that you had to take a break. You just suddenly turned invisible, and we all wondered why you weren’t showing up.” I was furious. First of all, if the other volunteers didn’t know why I was gone, it was because they weren’t told by anyone on the board about the hiatus, which was yet another example of a lack of communication within the org. Which confused me because, uh, who’s doing all the tasks that I was doing if I’m not there? Second of all, it was just so hurtful. I joked off her “invisible” comment, but in reality, I wanted to cuss her out and throw my phone. I had assumed that everyone was just busy with their own lives, but I was angry because people apparently did notice that I wasn’t showing up but never bothered to think, “This is unusual. Is she okay? Maybe I should check on her.” A lot of the commenters mentioned that I’m a person who cares a lot about things, which is true. It hurts because one would believe that the reason nobody cares about you is because you never cared in turn, except when you know that’s not true at all, so you’re left hurt and confused as to why these otherwise lovely people never thought about you. It was the straw that broke the camel’s back to get me to stop volunteering with them. I just ghosted the organization and decided to move on with my life (which, based on my experience, is really all you have to do!). I was sad because the nonprofit was the only one addressing a need in the area, which was why I had stuck with it for so long. It wasn’t worth the dysfunction and stress in the end, though, especially if I’ll only ever be either “superstar” or “invisible” and nothing else. I felt like a weight has come off my shoulders, and my schedule has been freed up to find something better to put my heart into. The post update: did I cross a line with the (messy, chaotic) organization I volunteer for? appeared first on Ask a Manager. View the full article

-

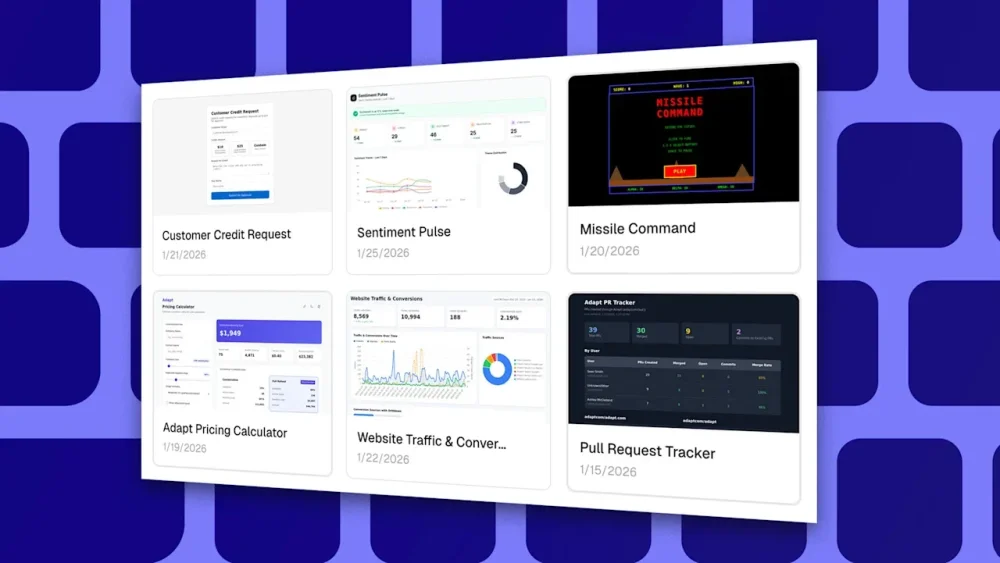

This AI startup wants to be your virtual ‘computer for business’

A startup called Adapt is betting that it can be an AI hub connecting other software tools to help answer questions and get things done. When users pose questions or ask for help with a business task, Adapt can answer based on information from the web and business data to which it’s been given access, similar to other AI tools. But it can also automatically launch a virtual machine, essentially a computer in the cloud from which it can connect to a wide range of internet-based software, pull information from databases, and craft custom code to analyze data and create charts and visualizations. It’s an approach that cofounder and CEO Jim Benton says lets users with minimal coding experience work with data from a wide variety of sources, from customer-relationship management software to email programs, without needing to involve engineers or download and manipulate cumbersome datasets on their own computers. Adapt’s AI can provide detailed information about everything from sales trends to marketing spending based on live access to relevant data, and it can freely merge and compare data from multiple cloud-based business software products in ways that the AI increasingly built into those individual products often can’t, says Benton. “The challenge that we see in the market right now is that people have all sorts of different, fragmented tools in their company,” Benton says. “So if you want to understand the business, you are trying to stitch together all these different pieces.” Adapt ships with built-in integrations with a variety of common software, and it can generate the SQL code needed to pull information from database systems. And it can also write code to connect to less common tools and custom software if it’s provided with API documentation and the right credentials. That means that to answer a question about, say, customer churn, the AI might pull numbers and written notes from a CRM, a credit card processor, and a customer support ticketing system, merging and processing all that data without the need for human coding expertise. Once it accesses and analyzes the relevant data, it can provide quick answers through chat or Slack, generate charts and slideshows, and—unlike some competing AI tools—push updated information to external cloud systems. “One of the most incredible things about Adapt is giving it permission to write data, which I never thought I would be okay with an AI getting,” says Jonathan Nahin, founder of corporate gift-giving platform RevSend. Nahin says RevSend uses Adapt for tasks like crunching sales numbers and validating that custom gifts that its customers commission match their design requirements. But RevSend also uses the tool to update its sales contact databases, merging in information like contact locations from other data sources. That’s a pain to do manually and even to automate with other tools, Nahin says, but easy to explain verbally to the Adapt AI, which can set up a suitable process and run it on a regular schedule. Tech-savvy users can also review Adapt-generated code before relying on it for important figures or database updates, and users can ask the AI to make tweaks to its processes as needed, Benton says. “You can go through the code and see exactly what the query was,” says Benton. Other companies have also recently announced AI tools that can help with work tasks and data analysis, like Anthropic’s Claude Cowork and Slack’s recently upgraded Slackbot. But Benton says he believes that San Francisco-based Adapt—which just announced a $10 million seed round, on top of a $3 million pre-seed round announced in August—has an edge through its ease of integration with other software and its virtual machine approach, which doesn’t require users to locally run its software or data. The company initially onboarded new customers individually, aiding with integration, and recently added self-service options. Unlike some other AI tools, Adapt doesn’t charge a monthly per-user fee, instead charging based on usage. Charges cover the cost of connecting to a variety of AI models, with Adapt routing different queries to different models based on their expertise, and computation by the virtual machines. Businesses can set up spending alerts and thresholds to avoid surprise charges, says Benton. And Adapt, which calls itself the “AI computer for business,” works with customers to help ensure they get a good return on their spending, often by letting humans focus on work other than data manipulation. “I think you’re just going to find that there’s more time for the humans to tackle the real work and the real value than stitching together and chasing down the metrics,” Benton says. View the full article

-

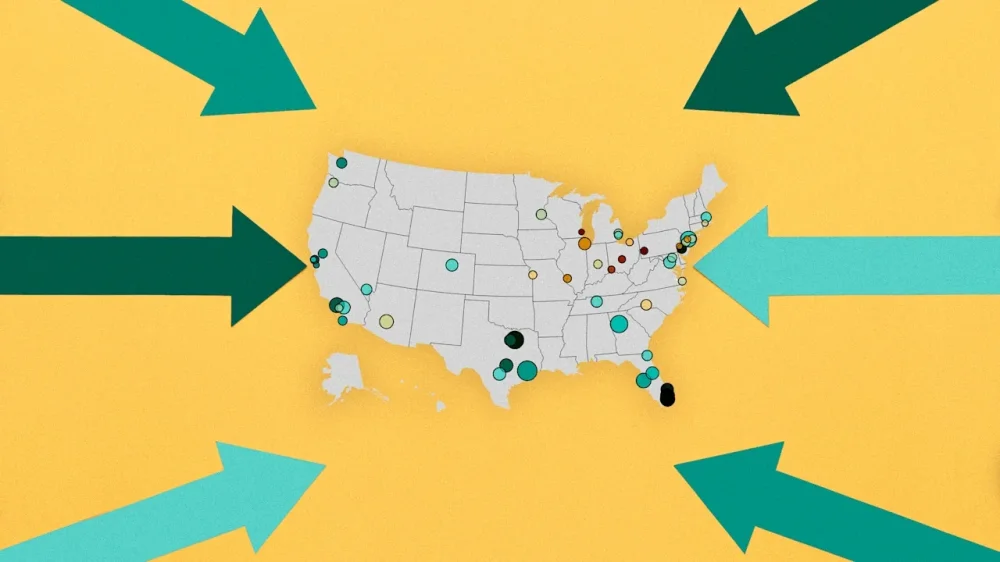

An inventory boomerang just hit the housing market

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. In the second half of 2025, there was a notable jump in delistings, as some home sellers—particularly in the Sun Belt—who couldn’t get their desired price decided to pull their homes off the market. Indeed, U.S. delistings as a share of inventory ticked up to 5.5% in fall 2025—a decade-high reading for that time of year. In December 2025, ResiClub noted to readers: “Looking ahead, in markets seeing the biggest jumps in delistings right now, many of those listings will likely return to the resale market in spring 2026—or test out the rental market.” Fast-forward to January 2026, and we are indeed seeing an upswing in relistings, according to Compass chief economist Mike Simonsen’s analysis of Altos Research data. A relisted property is a home that was previously listed for sale, taken off the market (expired, withdrawn, or canceled), and then later put back on the market. Relistings as a share of single-family housing inventory for sale: January 24, 2025 —> 10.1% January 23, 2026 —> 11.0% Total relistings: January 24, 2025 —> 64,410 January 23, 2026 —> 76,426 What housing markets are most likely to see the biggest upswing in relistings over the coming months? The answer, of course, is the markets that saw the most delistings last fall. Last fall, Midwestern markets—which, relatively speaking, remain on the tighter side—saw the fewest delistings. Meanwhile, weaker and softer housing markets in places like Texas and Florida saw the highest levels of delistings. Why should buyers pay attention? Rising relistings can create buying opportunities. A relisted home often signals that the property was previously marketed, failed to transact at the seller’s desired price, and is now returning with perhaps more realistic expectations. That dynamic can produce real seller fatigue, as months of showings, price cuts, and stalled negotiations reset pricing psychology and increase willingness to negotiate on price, concessions, repairs, or rate buydowns. Relistings also give buyers an information advantage by revealing prior list prices, time on market, and whether earlier deals fell apart, helping anchor offers to true market-clearing levels rather than aspirational pricing. Savvy buyers—and their agents—should always do their homework and confirm whether a property was listed in the prior year, how pricing evolved, and why it didn’t sell, as that context can materially strengthen negotiating leverage. View the full article

-

How to dial down the AI slop on platforms