All Activity

- Past hour

-

This Olympic skill can boost your job performance

Olympians aren’t just physically exceptional—they’re masters at managing where their attention and energy go. Cognitive research finds a key link between working memory and performance: elite athletes are better able to regulate their memory and attention than their less-trained peers, and this ability predicts better performance under pressure. What separates peak performers isn’t just effort, but also the discipline to balance their mental load. In other words: their “thoughtload.” Consider thoughtload the invisible tax on your ability to perform. It consists of three problems that erode your effectiveness: The cognitive demands of competing priorities The emotional burdens of uncertain times The depleted energy reserves that make everything feel more difficult When thoughtload is high, even talented, motivated people underperform. But Olympians succeed because they refuse to carry unnecessary thoughtload. So how do you begin to reduce your own load? Four strategies can help. 1. Flip your focus Olympians know that keeping their attention focused on performance is critical to achievement. Take the U.S. figure skating team, who had more than a few members skip this year’s opening ceremonies to stay locked in. At work, we tend to do the opposite. Instead of starting the day with our eyes on the prize, we let our inbox and calendar dictate our priorities, hoping that enough activity will lead to success. Lowering your thoughtload means flipping that logic. Begin with the outcome you’re being rewarded for: more paid users, lower churn, a better accounts receivable balance. Then identify the few outputs that will move the needle and the activities that will get you there. 2. Budget your attention Elite athletes also dedicate consistent hours to training, no matter how assured their place is as a champion: practice is always on the calendar. But at work, we frequently allow ourselves to switch priorities or allocate our time in the wrong places. Think of your time as a finite resource to spend. Pick one critical outcome and decide how much of your attention it deserves; only after that, allocate your remaining time for other important outputs and even a few side pursuits. Defer, decline, or delegate everything else that doesn’t fit in your attention budget. 3. Use an emotion track Even with your gaze locked in, emotional distractions can come from within. For an athlete, it might be a fall in practice or a menacing new competitor. For you, it’s a missed target, a tense exchange, or an unwelcome piece of feedback. Emotions are unavoidable, but unprocessed emotions slow you down. Olympians understand that emotional baggage from yesterday’s disappointment can sabotage today’s performance; take the many that use sports psychologists to work through poor performances and devastating crashes. You can reduce the hold of your feelings with an emotion track, which helps pinpoint and reroute distracting emotions. It consists of four simple steps: place, name, question, act. Notice the place you’re experiencing the feeling, like sweaty palms or a racing heart. Name the feeling you’re experiencing precisely, like frustration or anxiety. Question the story you’re telling yourself about why you’re feeling that way, and if it’s rational. Choose one action that helps you move forward, whether it addresses the issue directly or just helps you get in a better headspace. 4. Hold an energy audit Energy management isn’t about indulgence or self-care. It’s about making the right investments, so you have the physical, mental, and emotional energy when you need it most. Olympians plan exertion and recovery with rigor. But at work, we often treat energy as unlimited until it suddenly runs out. There are back-to-back meetings, deadlines strung one after the next, new change initiatives starting before you’ve had the chance to embed the previous ones. All that adds up to fatigue that leads to poor decisions. Instead, try an energy audit. List three activities that reliably energize you and three that inevitably drain you. Then make small shifts to increase your investment in the first group and reduce your exposure to the second. Even minor changes can make your thoughtload feel much lighter over time. Elite performance isn’t reserved for elite athletes. It’s available to anyone willing to carry less so they can accomplish more. View the full article

-

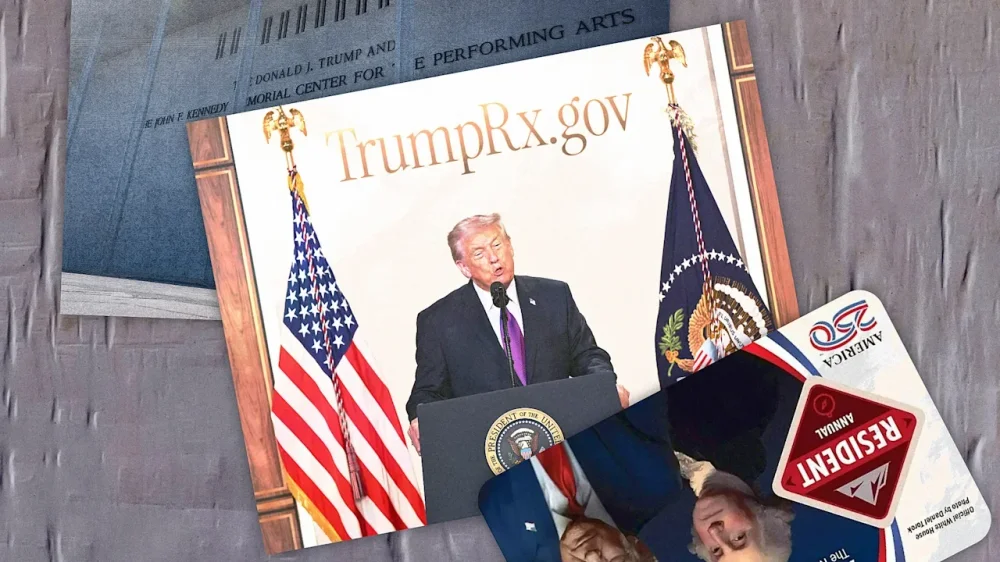

The government’s free speech doctrine allows Trump to name things after himself

In November 2025, the The President administration announced a special park pass commemorating the nation’s 250th anniversary that featured images of two presidents: George Washington and Donald The President. Featuring the current president—in place of the National Park Service’s usual landscape pictures—triggered both a lawsuit and a social media movement to put stickers over The President’s face. As a businessman, The President has frequently emblazoned buildings and consumer products—shoelaces, an airline, an edition of the Bible, among many others—with his own name. During his current presidential term, his administration has put his name on numerous government properties—perhaps most famously the Kennedy Center, but also money, monuments, and military equipment. In January 2026, The President floated the idea Congress would rename both New York’s Penn Station and Washington’s Dulles International Airport after him. With Florida lawmakers considering renaming the airport near Mar-a-Lago after the president, the The President Organization has filed an application to trademark his name for use in airports and ancillary activities, although the company said it would not charge a fee in the case of the Palm Beach airport. As a communication professor who studies the First Amendment, I was intrigued by the federal actions and the protests they’ve triggered. Citizens certainly have the right to protest these decisions, like any government action. The First Amendment prevents the government from making laws that abridge freedom of speech. But does the federal government itself have freedom of speech? And can a president put his name and image wherever he wants? Free speech for government The answer to the first question has already been answered. In a series of rulings, the Supreme Court has upheld the government speech doctrine, which allows the government as speaker to say whatever it wants. Moreover, if the forum is governmental, the government may even be able to compel people to express its messages—for example, with public employee speech that is part of job duties. The 2006 Supreme Court decision establishing that principle involved a deputy district attorney who’d questioned the validity of a warrant, but the rule applies to other employees, such as teachers who have to offer instruction in state-mandated curricula. The court’s decisions in government speech cases imply that if people do not like the government speech, they should change the government with their votes. However, some scholars and advocates argue that this relatively new constitutional doctrine gives the government too much power to drown out other viewpoints in the marketplace of ideas. In most instances, the government cannot compel speech or force citizens to express a certain message. Compelled speech is not allowed when the government is forcing a citizen to endorse an ideological message. For example, the Supreme Court allowed a Jehovah’s Witness to cover the words “or Die” on his license plate, which included the New Hampshire state motto, “Live Free or Die.” The First Amendment is not absolute, and some government regulations will infringe on speech. The federal government has strict regulations on how the American flag should be disposed of, but it cannot punish someone who is burning a flag as a form of political protest. Government control of its own products What happens when the government itself hosts forums for citizen speech, such as placing monuments in a park or flying flags on government property? Can the government deny certain speech based on the speaker or message? In such cases, courts have had to decipher whether the forum was purely governmental. To do so, they examine the history of the forum in which the contested speech takes place, who controls the forum, and the public perception of who controls it. This brings us back to the question of The President’s name and likeness. As a constitutional matter, the The President administration can express itself as it sees fit under the government speech doctrine. But in some cases, the administration may be bound by statute or formal contracts, as with the legal battle over the naming of the Kennedy Center, which was named by an act of Congress. The lawsuit over the National Park passes claims that the administration is violating a federal law requiring that the winning entry in a public lands photo contest be used for the passes. Still, I believe it would be difficult to win a lawsuit claiming that the new passes are a form of compelled speech, with bearers of the pass arguing they are being forced, in effect, to endorse The President. Most people would likely see the park passes’ artwork as being controlled by the government and therefore a form of government expression, not a form of private expression. Can people cover up The President? But the The President administration may not be able to defend its policy of declaring passes null and void if the president’s image is covered by a sticker. Citizens protesting The President’s appearance by covering up the president’s image is protected speech, in my view. The government’s action to void the passes is likely a violation of the First Amendment. On the face of it, placing stickers on passes would appear to violate the long-standing Interior Department rule that passes are “void if altered.” Those regulations were content neutral and incidental to any particular message or cardholder. However, the updated policy, voiding the pass if The President’s image is covered or marred, is more suspect. The new rules seem to be a direct response to the protesters’ political speech and, as applied, primarily aim to affect these stickers and speakers. With an administration known for its social media savviness, it may not be convincing for officials to argue they did not know about the protest or that the policy was not a direct attempt to chill such speech. The government will have the right to put The President’s name and images on more government property in many cases, but most resulting political protests, in my view, will also be protected speech. Jason Zenor is an associate professor of mass communication at the State University of New York Oswego. This article is republished from The Conversation under a Creative Commons license. Read the original article. View the full article

-

Roundup: News from Synaptics, Cognitive Systems, WorldVue, and Bouygues Telecom

The world of Wi-Fi never stands still. Here's what we've picked as the past week's most important Wi-Fi news - enjoy. The post Roundup: News from Synaptics, Cognitive Systems, WorldVue, and Bouygues Telecom appeared first on Wi-Fi NOW Global. View the full article

-

Tehran on edge as residents fear US attack

Many in Iran’s capital think it is only a matter of time until war returns to their livesView the full article

- Today

-

Fun Games to Build Teamwork Skills

Building teamwork skills is vital for any organization, as collaboration and communication drive success. Engaging in fun games can greatly improve these skills among team members. From icebreakers that encourage sharing to problem-solving activities that promote critical thinking, these games cultivate trust and camaraderie. Comprehending the types of activities available is fundamental. So, which games can you implement to strengthen your team’s dynamics and enhance overall productivity? Key Takeaways “Human Knot” requires teamwork to untangle without breaking handholds, enhancing collaboration and communication skills. “Group Juggle” encourages coordination and engagement, promoting teamwork through a fun, fast-paced activity. “Trust Fall” builds reliance on team members, fostering trust and strengthening interpersonal bonds. “Two Truths and a Lie” allows personal sharing, helping team members learn about each other and build rapport. Problem-solving challenges stimulate critical thinking and creativity, enhancing collaboration under pressure while improving team cohesion. Why Team Bonding Matters Team bonding matters since it directly influences how well a team functions together. Engaging in team building activities for PE class can improve team cohesion, leading to a 21% increase in productivity when team members connect on a personal level. These activities promote a deeper appreciation for each other’s unique perspectives, which strengthens interpersonal relationships. Regular participation in team bonding exercises not merely improves communication but also builds trust, resulting in better overall team performance and morale. When you engage consistently in these activities, you boost collaboration and problem-solving skills, creating a more effective team dynamic. Furthermore, cultivating a positive work culture through team bonding greatly increases employee satisfaction and retention rates. In the end, prioritizing team bonding activities can lead to a more harmonious and productive environment, benefiting both individual team members and the organization as a whole. Icebreaker Team Bonding Games Engaging in icebreaker team bonding games can greatly boost communication and connection among team members. These activities, such as “Two Truths and a Lie,” encourage personal sharing, nurturing trust and openness vital for team cohesion. Similarly, games like “Human Knot” promote effective collaboration, as participants must work together to untangle without breaking their hold. Incorporating icebreakers into team gatherings can elevate morale and satisfaction, providing opportunities to learn about each other in a fun environment. This is particularly beneficial for teams involving elementary students, as it lays the groundwork for future collaboration. Game Purpose Benefits Two Truths and a Lie Build trust and openness Encourages sharing personal stories Human Knot Promote teamwork and problem-solving Improves communication skills Trust Fall Cultivate reliance on team members Strengthens bonds and reduces anxiety Group Juggle Improve coordination and teamwork Boosts engagement and cooperation Problem-Solving Team Bonding Games Even though icebreaker activities lay the foundation for team bonding, problem-solving team bonding games take collaboration to a new height by challenging participants to work together under pressure. These games improve critical thinking skills, requiring teams to tackle complex scenarios collectively. As you engage in these activities, you’ll find that they encourage creativity and innovation, pushing you to think outside the box and develop unique approaches to problem-solving. Effective communication becomes essential, as team members must articulate their ideas clearly and listen actively. By working together to overcome obstacles, you’ll build trust and strengthen interpersonal relationships, which leads to improved overall team dynamics. Additionally, participating in problem-solving team bonding games has been shown to increase team cohesion and productivity, contributing to a more positive work environment. In-Person Team Bonding Activities In-person team bonding activities play a crucial role in nurturing effective communication and building trust among team members. These gatherings promote face-to-face interactions, which are fundamental for enhancing collaboration. Engaging in physical games during these events, such as team building PE games like the Human Knot or the Marshmallow Challenge, energizes participants. These activities encourage a sense of community through shared experiences, which can greatly boost employee morale and satisfaction. Regularly scheduled in-person events make team members feel valued and connected, leading to improved productivity. Studies show that meaningful connections can increase productivity by up to 21%. Virtual Team Bonding Strategies As remote work becomes increasingly common, finding effective ways to encourage teamwork in a virtual environment is crucial. Virtual team bonding strategies adapt activities for online participation, ensuring engagement among remote team members. Utilizing video conferencing tools promotes communication and collaboration, connecting everyone in spite of physical distance. Regularly scheduled virtual bonding activities, like team vs team games, maintain morale and strengthen interpersonal relationships, contributing to a positive work culture. Incorporating digital platforms for interactive sessions encourages creativity and inclusivity, allowing all team members to participate irrespective of location. Creative online challenges and games, such as trivia contests or escape rooms, promote problem-solving skills and trust among team members. These activities not only improve team dynamics but likewise boost overall performance. By prioritizing these strategies, you can cultivate a cohesive and productive team, even in a virtual setting. Frequently Asked Questions What Are Some Games That Encourage Teamwork? To encourage teamwork, you can engage in several effective games. The Marshmallow Challenge has teams construct a tall structure from limited materials, promoting collaboration and creativity. In the Human Knot, participants untangle themselves as they hold hands, nurturing communication. Blind Drawing requires clear verbal instructions for drawing an object. Two Truths and a Lie helps team members learn about each other, whereas a Scavenger Hunt encourages strategic planning and cooperation in finding items. What Are Some Fun Team Building Activities for Work? When considering fun team-building activities for work, you might explore options like the Marshmallow Challenge, where you build a structure using limited materials, promoting creativity. Icebreaker games, such as “Two Truths and a Lie,” help team members share personal stories, enhancing trust. Furthermore, activities like “Human Knot” require collaboration to untangle, whereas scavenger hunts encourage strategic planning and teamwork, allowing colleagues to bond as they work toward common goals in a competitive atmosphere. What Is the 30 Seconds Game for Team Building? The 30 Seconds Game is a fast-paced activity where you and your team have 30 seconds to describe words or phrases without using the actual terms. This game improves your communication skills and quick thinking, as teammates must interpret your descriptions. It’s adaptable for various group sizes and can be played in different settings. What Is the 20 Questions Game for Team Building? The 20 Questions game involves one person thinking of an object as others ask yes-or-no questions to guess it within 20 questions. This activity promotes critical thinking, as you need to formulate clear questions based on the answers given. It improves communication skills, encourages collaboration, and nurtures teamwork, as participants share insights and strategies. Adaptable for in-person or virtual settings, the game likewise serves as an icebreaker, helping team members understand each other better. Conclusion Incorporating fun games into your team’s routine is essential for enhancing teamwork skills. By participating in icebreakers and problem-solving activities, you nurture communication, trust, and collaboration among members. Whether in-person or virtual, these games provide opportunities for employees to engage meaningfully, ultimately resulting in a more cohesive work environment. By prioritizing these activities, you invest in stronger interpersonal relationships that can greatly improve productivity and morale in the workplace. Image via Google Gemini This article, "Fun Games to Build Teamwork Skills" was first published on Small Business Trends View the full article

-

Fun Games to Build Teamwork Skills

Building teamwork skills is vital for any organization, as collaboration and communication drive success. Engaging in fun games can greatly improve these skills among team members. From icebreakers that encourage sharing to problem-solving activities that promote critical thinking, these games cultivate trust and camaraderie. Comprehending the types of activities available is fundamental. So, which games can you implement to strengthen your team’s dynamics and enhance overall productivity? Key Takeaways “Human Knot” requires teamwork to untangle without breaking handholds, enhancing collaboration and communication skills. “Group Juggle” encourages coordination and engagement, promoting teamwork through a fun, fast-paced activity. “Trust Fall” builds reliance on team members, fostering trust and strengthening interpersonal bonds. “Two Truths and a Lie” allows personal sharing, helping team members learn about each other and build rapport. Problem-solving challenges stimulate critical thinking and creativity, enhancing collaboration under pressure while improving team cohesion. Why Team Bonding Matters Team bonding matters since it directly influences how well a team functions together. Engaging in team building activities for PE class can improve team cohesion, leading to a 21% increase in productivity when team members connect on a personal level. These activities promote a deeper appreciation for each other’s unique perspectives, which strengthens interpersonal relationships. Regular participation in team bonding exercises not merely improves communication but also builds trust, resulting in better overall team performance and morale. When you engage consistently in these activities, you boost collaboration and problem-solving skills, creating a more effective team dynamic. Furthermore, cultivating a positive work culture through team bonding greatly increases employee satisfaction and retention rates. In the end, prioritizing team bonding activities can lead to a more harmonious and productive environment, benefiting both individual team members and the organization as a whole. Icebreaker Team Bonding Games Engaging in icebreaker team bonding games can greatly boost communication and connection among team members. These activities, such as “Two Truths and a Lie,” encourage personal sharing, nurturing trust and openness vital for team cohesion. Similarly, games like “Human Knot” promote effective collaboration, as participants must work together to untangle without breaking their hold. Incorporating icebreakers into team gatherings can elevate morale and satisfaction, providing opportunities to learn about each other in a fun environment. This is particularly beneficial for teams involving elementary students, as it lays the groundwork for future collaboration. Game Purpose Benefits Two Truths and a Lie Build trust and openness Encourages sharing personal stories Human Knot Promote teamwork and problem-solving Improves communication skills Trust Fall Cultivate reliance on team members Strengthens bonds and reduces anxiety Group Juggle Improve coordination and teamwork Boosts engagement and cooperation Problem-Solving Team Bonding Games Even though icebreaker activities lay the foundation for team bonding, problem-solving team bonding games take collaboration to a new height by challenging participants to work together under pressure. These games improve critical thinking skills, requiring teams to tackle complex scenarios collectively. As you engage in these activities, you’ll find that they encourage creativity and innovation, pushing you to think outside the box and develop unique approaches to problem-solving. Effective communication becomes essential, as team members must articulate their ideas clearly and listen actively. By working together to overcome obstacles, you’ll build trust and strengthen interpersonal relationships, which leads to improved overall team dynamics. Additionally, participating in problem-solving team bonding games has been shown to increase team cohesion and productivity, contributing to a more positive work environment. In-Person Team Bonding Activities In-person team bonding activities play a crucial role in nurturing effective communication and building trust among team members. These gatherings promote face-to-face interactions, which are fundamental for enhancing collaboration. Engaging in physical games during these events, such as team building PE games like the Human Knot or the Marshmallow Challenge, energizes participants. These activities encourage a sense of community through shared experiences, which can greatly boost employee morale and satisfaction. Regularly scheduled in-person events make team members feel valued and connected, leading to improved productivity. Studies show that meaningful connections can increase productivity by up to 21%. Virtual Team Bonding Strategies As remote work becomes increasingly common, finding effective ways to encourage teamwork in a virtual environment is crucial. Virtual team bonding strategies adapt activities for online participation, ensuring engagement among remote team members. Utilizing video conferencing tools promotes communication and collaboration, connecting everyone in spite of physical distance. Regularly scheduled virtual bonding activities, like team vs team games, maintain morale and strengthen interpersonal relationships, contributing to a positive work culture. Incorporating digital platforms for interactive sessions encourages creativity and inclusivity, allowing all team members to participate irrespective of location. Creative online challenges and games, such as trivia contests or escape rooms, promote problem-solving skills and trust among team members. These activities not only improve team dynamics but likewise boost overall performance. By prioritizing these strategies, you can cultivate a cohesive and productive team, even in a virtual setting. Frequently Asked Questions What Are Some Games That Encourage Teamwork? To encourage teamwork, you can engage in several effective games. The Marshmallow Challenge has teams construct a tall structure from limited materials, promoting collaboration and creativity. In the Human Knot, participants untangle themselves as they hold hands, nurturing communication. Blind Drawing requires clear verbal instructions for drawing an object. Two Truths and a Lie helps team members learn about each other, whereas a Scavenger Hunt encourages strategic planning and cooperation in finding items. What Are Some Fun Team Building Activities for Work? When considering fun team-building activities for work, you might explore options like the Marshmallow Challenge, where you build a structure using limited materials, promoting creativity. Icebreaker games, such as “Two Truths and a Lie,” help team members share personal stories, enhancing trust. Furthermore, activities like “Human Knot” require collaboration to untangle, whereas scavenger hunts encourage strategic planning and teamwork, allowing colleagues to bond as they work toward common goals in a competitive atmosphere. What Is the 30 Seconds Game for Team Building? The 30 Seconds Game is a fast-paced activity where you and your team have 30 seconds to describe words or phrases without using the actual terms. This game improves your communication skills and quick thinking, as teammates must interpret your descriptions. It’s adaptable for various group sizes and can be played in different settings. What Is the 20 Questions Game for Team Building? The 20 Questions game involves one person thinking of an object as others ask yes-or-no questions to guess it within 20 questions. This activity promotes critical thinking, as you need to formulate clear questions based on the answers given. It improves communication skills, encourages collaboration, and nurtures teamwork, as participants share insights and strategies. Adaptable for in-person or virtual settings, the game likewise serves as an icebreaker, helping team members understand each other better. Conclusion Incorporating fun games into your team’s routine is essential for enhancing teamwork skills. By participating in icebreakers and problem-solving activities, you nurture communication, trust, and collaboration among members. Whether in-person or virtual, these games provide opportunities for employees to engage meaningfully, ultimately resulting in a more cohesive work environment. By prioritizing these activities, you invest in stronger interpersonal relationships that can greatly improve productivity and morale in the workplace. Image via Google Gemini This article, "Fun Games to Build Teamwork Skills" was first published on Small Business Trends View the full article

-

Yacht boom propels $700mn-plus Stonepeak marina deal

US infrastructure investor hopes to use Southern Marinas as launch pad for further acquisitions in sectorView the full article

-

Virgin Atlantic on track to poach ‘tens of thousands’ of BA frequent flyers

Airline has offered to upgrade rival carrier’s members to a higher status during February campaignView the full article

-

Nearly 6,000 entrepreneurs quit UK in past two years, say wealth managers

Most work in tech sector with top destinations the UAE, followed by Spain and the US, according to RathbonesView the full article

-

What Is an Employee Payroll System and How Does It Work?

An employee payroll system is a vital tool for managing payroll tasks efficiently. It automates wage calculations based on hours worked or salaries, applies tax deductions, and generates detailed pay statements. This system operates in three key phases: pre-payroll, actual payroll, and post-payroll. Each phase guarantees accurate employee payments and compliance with regulations. Comprehending how these systems function can help you make informed decisions about payroll management, which is fundamental for any organization. Key Takeaways An employee payroll system automates the management of payroll tasks, ensuring accurate and timely payments to employees. It calculates wages, tracks hours worked, and manages tax deductions and other withholdings. The payroll process consists of pre-payroll, actual payroll, and post-payroll phases to ensure compliance and accuracy. Payroll systems can be manual, software-based, online, or outsourced, each with unique benefits and challenges. Key features include automation, tax compliance, integration capabilities, and employee self-service portals for transparency. Definition of an Employee Payroll System An employee payroll system serves as an important tool for businesses, automating various aspects of payroll management. This software application streamlines how you process pay for your workforce by calculating wages, tracking hours worked, and managing deductions for taxes and other withholdings. By providing detailed pay statements, or workforce paystubs, it guarantees employees receive accurate and timely payments. The system’s flexibility accommodates various pay structures, including hourly, salary, commission, and piece rate, which is crucial for different employment types. Furthermore, it helps maintain compliance with federal, state, and local labor laws, automatically updating tax rates and regulations to reduce the risk of penalties. Many employee payroll systems additionally feature self-service portals, empowering employees to access their pay information and manage personal details efficiently. Importance of Payroll Systems Payroll systems play a crucial role in the smooth operation of any business by guaranteeing that employees are paid accurately and on time. Their importance extends beyond simple payments, impacting various aspects of your organization: Enhanced Morale: Timely payments build trust and boost employee morale. Tax Compliance: Automated tax calculations help you adhere to local, state, and federal laws, preventing costly penalties. Streamlined Processes: By reducing administrative burdens, payroll systems free up HR teams to focus on strategic initiatives. Transparency: Self-service portals allow employees to track attendance, access pay statements, and manage benefits, encouraging engagement. Furthermore, payroll systems facilitate compliance with labor laws and recordkeeping regulations, protecting your organization from legal issues and wage claims. How Payroll Systems Benefit Employees Payroll systems play an essential role in ensuring you receive your payments on time and accurately, which can greatly reduce your financial stress. With features like self-service portals, you can easily track your hours and access important pay information, promoting transparency in your compensation. This level of clarity not merely builds trust but additionally improves your overall job satisfaction and morale. Timely Payments Assurance When employees can rely on timely payments, their trust in the employer strengthens considerably. Payroll systems automate wage calculations and adhere to set schedules, ensuring that you receive your paycheck on time. This reliability boosts your satisfaction and confidence in your workplace. Here’s how timely payments benefit you: Accurate Tracking: Your hours worked are recorded accurately, preventing delays in salary distribution. Direct Deposit: Funds transfer quickly and securely to your bank account, eliminating manual check processing. Automatic Tax Deductions: Payroll systems handle tax withholding, avoiding complications at year-end. Financial Peace of Mind: You gain reassurance knowing your payments are consistent and compliant with regulations. With these features, you can focus on your work, knowing your compensation is managed effectively. Transparency in Compensation Grasping your compensation is crucial for building trust and satisfaction in the workplace, especially since transparency in payroll systems plays a significant role in this process. Payroll systems offer self-service portals, letting you view pay stubs, tax deductions, and benefits. This transparency helps you understand your financial situation better. Automated tax withholding prevents year-end surprises, enhancing your confidence. Accurate and timely payroll processing guarantees you receive your wages on schedule, boosting job satisfaction. Detailed records are accessible to both you and management, promoting accountability. Regular reporting features allow you to track earnings and benefits over time, showcasing your financial growth. Feature Benefit to You Emotional Impact Self-service portal Easy access to pay info Empowerment Automated deductions Avoid surprises Security Timely payments Reliability Trust Detailed records Clarity in compensation Confidence Overview of Payroll Management Software In an increasingly complex business environment, utilizing payroll management software can greatly streamline your payroll processes. This software automates essential tasks, ensuring accuracy and compliance. Here are some key features you can expect: Automated Calculations: It calculates employee wages during considering deductions for federal, state, and local taxes, minimizing manual errors. Time Tracking Integration: Accurate recording of hours worked allows for proper pay calculations, whether hourly, salary, or commission-based. Employee Self-Service Portals: Staff can view pay statements, track attendance, and access tax documents, enhancing transparency. Detailed Reporting: Generate reports on labor costs and payroll expenses, aiding in financial planning and compliance with reporting requirements. Additionally, this software often includes automated alerts for changes in tax regulations, helping you adapt quickly and avoid potential penalties. How Payroll Systems Work Comprehending how payroll systems function is crucial for precise employee compensation. These systems calculate wages based on hours worked or set salaries, meanwhile managing employee data effectively. Payroll Calculation Process To guarantee accurate payroll calculations, the process begins with gathering essential input data, such as hours worked and pay rates, along with any applicable deductions. This data must be validated against company policies before processing. The payroll system then calculates gross pay by: Multiplying hours worked by the pay rate. Including bonuses or commissions applicable for the pay period. Deducting required taxes like federal, state, and local taxes. Subtracting other deductions, such as Social Security and retirement contributions, to arrive at net pay. Once calculations are complete, the system verifies them through reconciliation processes, ensuring accuracy and compliance. Finally, it facilitates timely payments to employees, maintaining detailed records for future audits and reporting. Employee Data Management Effective employee data management is vital for the smooth operation of payroll systems, as it assures that accurate and up-to-date information is always available for processing payroll. This process involves collecting and maintaining important employee details, such as personal information, tax forms, and compensation agreements. Below is a table summarizing key aspects of employee data management: Data Type Purpose Importance Personal Details Identifies employees Guarantees accurate record-keeping Time Tracking Data Calculates gross pay Assures fair compensation Deductions Complies with regulations Guarantees legal adherence Employee Portals Provides access to pay stubs, updates Improves employee engagement Reporting Data Generates compliance reports Supports labor law adherence Accurate management of this data streamlines payroll processing and assures compliance with labor laws. Types of Payroll Systems When considering the various types of payroll systems, it’s essential to recognize that each option offers distinct advantages and drawbacks, depending on your organization’s size and specific needs. Here are four common payroll systems you might explore: Manual Payroll System: A low-cost option using spreadsheets, but it’s prone to errors and time-consuming, making it less suitable for larger organizations. Payroll Software System: This automated solution minimizes calculation errors and streamlines processes, requiring an upfront investment and regular updates for compliance. Online Payroll Services: Cloud-based systems provide accessibility from anywhere and integrate with other software, though they need a stable internet connection and may incur subscription costs. Outsourced Payroll Systems: Hiring third-party providers to manage payroll can save time, but it may raise concerns about data security and could be more expensive than in-house solutions. Phases of the Payroll Process Comprehending the phases of the payroll process is crucial for guaranteeing accurate and timely employee compensation. The payroll process consists of three main phases: pre-payroll, actual payroll, and post-payroll activities. Each phase demands careful management and attention to detail. Phase Key Activities Pre-Payroll Gather and validate data like hours worked Actual Payroll Calculate gross pay, deduct taxes, verify data Post-Payroll Process deductions, maintain records, generate reports In the pre-payroll phase, you’ll collect input data to guarantee accuracy. The actual payroll phase focuses on calculations and deductions, making certain everything is correct before distribution. Finally, the post-payroll phase involves compliance with statutory requirements, which includes maintaining records and generating reports for management review. Effective payroll management integrates these phases, guaranteeing timely compensation during adherence to legal obligations. Pre-Payroll Activities Before plunging into payroll processing, it’s essential to outline company policies related to pay, leave, benefits, and attendance. Establishing clear guidelines sets the stage for smooth operations. Here are the key pre-payroll activities you need to focus on: Define Policies: Document your company’s stance on pay rates, leave entitlements, and employee benefits. Gather Input Data: Collaborate with various departments to collect accurate salary and attendance information. Conduct Input Validation Checks: Verify that all data aligns with company policy, ensuring employee status is correct before payroll is processed. Utilize Payroll Software: Implementing software can streamline managing leave, attendance, and improve employee self-service. Ensuring that these pre-payroll activities are thoroughly executed helps maintain compliance and efficiency, paving the way for a successful actual payroll process. Actual Payroll Process In the actual payroll process, you calculate employee wages based on hours worked and salary agreements, making certain to apply the necessary deductions to arrive at net pay. Verification is essential here, as it helps you reconcile payroll values to catch any potential errors before payments are issued. Timely processing is additionally important; completing payroll on schedule not merely cultivates employee trust but likewise guarantees smooth operations. Payroll Calculation Steps Comprehension of the payroll calculation steps is vital for accurate and timely payment of employees. The actual payroll process involves several key steps: Input Data: Gather hours worked and salary agreements to calculate gross pay. Deductions: Calculate applicable taxes and deductions, such as federal, state, and local taxes, along with Social Security and Medicare. Net Pay: Subtract these deductions from gross pay to arrive at the employee’s net pay. Timeliness: Confirm processing aligns with the established payroll schedule to maintain employee trust and satisfaction. Verification Process Importance Though the verification process may seem like an extra step in the payroll expedition, it plays a crucial role in guaranteeing the accuracy of employee payments. This critical step involves reconciling payroll calculations with input data, allowing you to double-check entries related to hours worked, pay rates, and deductions before finalizing payments. Timely verification helps maintain employee trust by making sure payroll is processed correctly, minimizing discrepancies in paychecks. By utilizing payroll systems, you can automate many verification tasks, greatly reducing the risk of human error and providing real-time alerts for inconsistencies. A thorough verification process additionally guarantees compliance with tax regulations, as inaccuracies can lead to penalties and issues with government reporting, safeguarding your organization’s financial health. Timely Processing Necessity Timely processing of payroll is vital for sustaining employee trust and satisfaction, as delays can create financial stress for staff members. To guarantee that payroll is processed efficiently and correctly, consider these fundamental steps: Calculate employee wages accurately, considering hours worked and pay rates. Deduct taxes and other contributions, guaranteeing compliance with regulations. Determine net pay, which is the amount employees will actually receive. Verify all calculations to prevent errors and reconcile figures before issuing payments. Using an automated payroll system can streamline these processes, reducing manual errors and enhancing timeliness. Furthermore, maintaining confidentiality of payroll information is paramount, as secure handling of sensitive data protects employee privacy and meets regulatory requirements. Post-Payroll Activities Once payroll is completed, several important post-payroll activities must take place to guarantee compliance and financial accuracy. First, you need to process necessary deductions like EPF, TDS, and ESI, ensuring these are reported to the relevant government agencies. This step is essential for meeting statutory requirements. Next, maintain accurate payroll accounting by recording all transactions in your company’s accounting system, which supports financial transparency and is critical during audits. Salaries are commonly distributed through direct deposit, checks, or cash, with direct deposit being the most efficient option. After payroll processing, generate a bank advice statement to provide a detailed account of employee salary payments, aiding in record-keeping. Finally, compile reports on employee costs for management review; this information is crucial for making informed decisions about budgeting and resource allocation in your organization. Pros and Cons of Payroll Systems When you consider payroll systems, it’s essential to weigh their advantages against potential challenges. Conversely, these systems can save you time and reduce errors, enhancing employee satisfaction with timely payments. However, you may encounter issues like inaccurate data entry and compliance risks if your system isn’t flexible enough to adapt as your business grows. Advantages of Payroll Systems Payroll systems offer substantial benefits for businesses looking to streamline their payroll processes. By automating calculations and wage distribution, you can save significant time and reduce manual effort. Here are some key advantages: Enhanced Accuracy: Minimizes human errors, reducing costly payroll mistakes. Integration Potential: Works seamlessly with time tracking tools, ensuring precise wage calculations based on actual hours. Compliance Support: Facilitates timely tax deductions, helping you maintain compliance with various labor laws and avoiding penalties. Efficiency Boost: Streamlines payroll operations, allowing you to focus on core business activities rather than administrative tasks. These advantages make payroll systems a valuable asset for businesses seeking efficiency and reliability in their payroll management. Challenges of Payroll Systems Though payroll systems offer numerous advantages, they likewise come with their own set of challenges that businesses must navigate. One major issue is the reliance on accurate input data; even minor data entry errors can lead to significant payroll inaccuracies and compliance problems. You’ll need thorough verification processes to catch these mistakes. Furthermore, payroll systems must keep up with ever-changing tax laws and regulations, which can complicate compliance and require regular updates to guarantee accuracy. Scalability is another concern; some systems may struggle to accommodate a growing workforce or diverse pay structures, potentially hindering your business’s growth. Staying aware of these challenges can help you choose the right payroll system for your needs. Common Challenges in Payroll Management Managing payroll can be a complex task, especially as businesses face numerous challenges that can affect their efficiency and compliance. Here are some common hurdles you might encounter: Tax Regulation Updates: Keeping up with frequent changes can lead to compliance issues if not properly monitored. Integration Issues: When payroll systems aren’t compatible with your existing business software, data sharing becomes complicated and prone to errors. Payroll Accuracy: Bugs in the system or incorrect data entry can result in overpayments or underpayments, which can damage employee trust and satisfaction. Data Security: Handling sensitive employee information increases the need for robust security measures to prevent breaches and protect privacy. Navigating these challenges requires diligence and effective strategies to guarantee your payroll process runs smoothly and complies with regulations. Key Features to Consider When Choosing a Payroll System When selecting a payroll system, it’s important to contemplate various key features that can greatly improve your payroll management process. Automation is crucial, as it streamlines operations and reduces manual tasks, minimizing calculation errors. Look for tax compliance capabilities, which guarantee the system automatically calculates and withholds federal, state, and local taxes, helping you avoid penalties and stay compliant with regulations. Integration with time tracking tools is another significant feature, as it directly pulls employee hours into the payroll system, eliminating manual entry errors. Furthermore, consider employee self-service portals that improve transparency; these allow employees to access their pay information, track leave balances, and download tax documents, leading to enhanced satisfaction. Finally, robust reporting features are critical for generating detailed payroll reports, assisting in budgeting and compliance, whilst providing management insights into labor costs. Next Steps for Implementing a Payroll System Implementing a payroll system requires careful planning and execution to guarantee it meets your organization’s needs. Start by evaluating your business needs, like employee count and payroll complexity. Next, research and compare different payroll systems to find one that fits your requirements. Here are the next steps to follow: Evaluate Options: Decide between in-house payroll, software solutions, or outsourcing payroll services based on your evaluation. Establish a Payroll Policy: Create a clear policy that outlines compensation, pay schedules, and employee benefits. Gather Employee Information: Collect crucial details such as tax documents and direct deposit information to guarantee accurate processing. Train Staff: Provide training for HR personnel and staff on the chosen system to maximize functionality and guarantee compliance with labor laws. Frequently Asked Questions What Is an Employee Payroll System? An employee payroll system automates wage calculations and guarantees employees receive timely payments. It handles various payment types like salaries and bonuses, whereas it too calculates deductions for taxes and Social Security. You benefit from features like self-service portals, allowing you to view pay statements and access tax documents easily. These systems help businesses comply with labor laws, making it easier to track payroll data and avoid legal issues or penalties. How Does Employee Payroll Work? Employee payroll works by calculating gross wages based on hours worked or salaries, incorporating overtime, bonuses, and commissions. It automatically deducts taxes and other contributions, guaranteeing compliance with legal requirements. You receive your net pay through direct deposit or checks on scheduled paydays. The system additionally maintains detailed records for audits and compliance. Regular updates are vital to reflect changes in tax rates, labor laws, and employee statuses to guarantee ongoing accuracy. What Are the Three Types of Payroll? There are three main types of payroll systems you can choose from: Manual Payroll, Payroll Software, and Outsourced Payroll. Manual Payroll involves spreadsheets and calculations done by hand, which can be time-consuming and error-prone. Payroll Software automates these processes, reducing mistakes but requiring an upfront investment. Outsourced Payroll relies on third-party providers to handle everything, offering expertise but potentially raising data security concerns and costs. Each option has specific advantages and challenges to evaluate. How Do You Set up a Payroll System? To set up a payroll system, you’ll first need to obtain an Employer Identification Number (EIN) from the IRS. Next, gather crucial employee tax documents, like Form W-4, for accurate withholding. Choose a payroll schedule that suits your cash flow, such as weekly or bi-weekly. Decide whether to manage payroll in-house or outsource it, considering costs and workforce size. Finally, document compensation terms and guarantee employees understand these details for compliance. Conclusion In conclusion, an employee payroll system is crucial for managing payroll efficiently and accurately. By automating calculations and deductions, it streamlines the payroll process and guarantees employees are paid on time. Although there are pros and cons to evaluate, the benefits often outweigh the challenges. When selecting a payroll system, focus on key features that meet your organization’s needs. Implementing a reliable payroll system can improve compliance, boost financial transparency, and eventually contribute to a more organized workplace. Image via Google Gemini This article, "What Is an Employee Payroll System and How Does It Work?" was first published on Small Business Trends View the full article

-

What Is an Employee Payroll System and How Does It Work?

An employee payroll system is a vital tool for managing payroll tasks efficiently. It automates wage calculations based on hours worked or salaries, applies tax deductions, and generates detailed pay statements. This system operates in three key phases: pre-payroll, actual payroll, and post-payroll. Each phase guarantees accurate employee payments and compliance with regulations. Comprehending how these systems function can help you make informed decisions about payroll management, which is fundamental for any organization. Key Takeaways An employee payroll system automates the management of payroll tasks, ensuring accurate and timely payments to employees. It calculates wages, tracks hours worked, and manages tax deductions and other withholdings. The payroll process consists of pre-payroll, actual payroll, and post-payroll phases to ensure compliance and accuracy. Payroll systems can be manual, software-based, online, or outsourced, each with unique benefits and challenges. Key features include automation, tax compliance, integration capabilities, and employee self-service portals for transparency. Definition of an Employee Payroll System An employee payroll system serves as an important tool for businesses, automating various aspects of payroll management. This software application streamlines how you process pay for your workforce by calculating wages, tracking hours worked, and managing deductions for taxes and other withholdings. By providing detailed pay statements, or workforce paystubs, it guarantees employees receive accurate and timely payments. The system’s flexibility accommodates various pay structures, including hourly, salary, commission, and piece rate, which is crucial for different employment types. Furthermore, it helps maintain compliance with federal, state, and local labor laws, automatically updating tax rates and regulations to reduce the risk of penalties. Many employee payroll systems additionally feature self-service portals, empowering employees to access their pay information and manage personal details efficiently. Importance of Payroll Systems Payroll systems play a crucial role in the smooth operation of any business by guaranteeing that employees are paid accurately and on time. Their importance extends beyond simple payments, impacting various aspects of your organization: Enhanced Morale: Timely payments build trust and boost employee morale. Tax Compliance: Automated tax calculations help you adhere to local, state, and federal laws, preventing costly penalties. Streamlined Processes: By reducing administrative burdens, payroll systems free up HR teams to focus on strategic initiatives. Transparency: Self-service portals allow employees to track attendance, access pay statements, and manage benefits, encouraging engagement. Furthermore, payroll systems facilitate compliance with labor laws and recordkeeping regulations, protecting your organization from legal issues and wage claims. How Payroll Systems Benefit Employees Payroll systems play an essential role in ensuring you receive your payments on time and accurately, which can greatly reduce your financial stress. With features like self-service portals, you can easily track your hours and access important pay information, promoting transparency in your compensation. This level of clarity not merely builds trust but additionally improves your overall job satisfaction and morale. Timely Payments Assurance When employees can rely on timely payments, their trust in the employer strengthens considerably. Payroll systems automate wage calculations and adhere to set schedules, ensuring that you receive your paycheck on time. This reliability boosts your satisfaction and confidence in your workplace. Here’s how timely payments benefit you: Accurate Tracking: Your hours worked are recorded accurately, preventing delays in salary distribution. Direct Deposit: Funds transfer quickly and securely to your bank account, eliminating manual check processing. Automatic Tax Deductions: Payroll systems handle tax withholding, avoiding complications at year-end. Financial Peace of Mind: You gain reassurance knowing your payments are consistent and compliant with regulations. With these features, you can focus on your work, knowing your compensation is managed effectively. Transparency in Compensation Grasping your compensation is crucial for building trust and satisfaction in the workplace, especially since transparency in payroll systems plays a significant role in this process. Payroll systems offer self-service portals, letting you view pay stubs, tax deductions, and benefits. This transparency helps you understand your financial situation better. Automated tax withholding prevents year-end surprises, enhancing your confidence. Accurate and timely payroll processing guarantees you receive your wages on schedule, boosting job satisfaction. Detailed records are accessible to both you and management, promoting accountability. Regular reporting features allow you to track earnings and benefits over time, showcasing your financial growth. Feature Benefit to You Emotional Impact Self-service portal Easy access to pay info Empowerment Automated deductions Avoid surprises Security Timely payments Reliability Trust Detailed records Clarity in compensation Confidence Overview of Payroll Management Software In an increasingly complex business environment, utilizing payroll management software can greatly streamline your payroll processes. This software automates essential tasks, ensuring accuracy and compliance. Here are some key features you can expect: Automated Calculations: It calculates employee wages during considering deductions for federal, state, and local taxes, minimizing manual errors. Time Tracking Integration: Accurate recording of hours worked allows for proper pay calculations, whether hourly, salary, or commission-based. Employee Self-Service Portals: Staff can view pay statements, track attendance, and access tax documents, enhancing transparency. Detailed Reporting: Generate reports on labor costs and payroll expenses, aiding in financial planning and compliance with reporting requirements. Additionally, this software often includes automated alerts for changes in tax regulations, helping you adapt quickly and avoid potential penalties. How Payroll Systems Work Comprehending how payroll systems function is crucial for precise employee compensation. These systems calculate wages based on hours worked or set salaries, meanwhile managing employee data effectively. Payroll Calculation Process To guarantee accurate payroll calculations, the process begins with gathering essential input data, such as hours worked and pay rates, along with any applicable deductions. This data must be validated against company policies before processing. The payroll system then calculates gross pay by: Multiplying hours worked by the pay rate. Including bonuses or commissions applicable for the pay period. Deducting required taxes like federal, state, and local taxes. Subtracting other deductions, such as Social Security and retirement contributions, to arrive at net pay. Once calculations are complete, the system verifies them through reconciliation processes, ensuring accuracy and compliance. Finally, it facilitates timely payments to employees, maintaining detailed records for future audits and reporting. Employee Data Management Effective employee data management is vital for the smooth operation of payroll systems, as it assures that accurate and up-to-date information is always available for processing payroll. This process involves collecting and maintaining important employee details, such as personal information, tax forms, and compensation agreements. Below is a table summarizing key aspects of employee data management: Data Type Purpose Importance Personal Details Identifies employees Guarantees accurate record-keeping Time Tracking Data Calculates gross pay Assures fair compensation Deductions Complies with regulations Guarantees legal adherence Employee Portals Provides access to pay stubs, updates Improves employee engagement Reporting Data Generates compliance reports Supports labor law adherence Accurate management of this data streamlines payroll processing and assures compliance with labor laws. Types of Payroll Systems When considering the various types of payroll systems, it’s essential to recognize that each option offers distinct advantages and drawbacks, depending on your organization’s size and specific needs. Here are four common payroll systems you might explore: Manual Payroll System: A low-cost option using spreadsheets, but it’s prone to errors and time-consuming, making it less suitable for larger organizations. Payroll Software System: This automated solution minimizes calculation errors and streamlines processes, requiring an upfront investment and regular updates for compliance. Online Payroll Services: Cloud-based systems provide accessibility from anywhere and integrate with other software, though they need a stable internet connection and may incur subscription costs. Outsourced Payroll Systems: Hiring third-party providers to manage payroll can save time, but it may raise concerns about data security and could be more expensive than in-house solutions. Phases of the Payroll Process Comprehending the phases of the payroll process is crucial for guaranteeing accurate and timely employee compensation. The payroll process consists of three main phases: pre-payroll, actual payroll, and post-payroll activities. Each phase demands careful management and attention to detail. Phase Key Activities Pre-Payroll Gather and validate data like hours worked Actual Payroll Calculate gross pay, deduct taxes, verify data Post-Payroll Process deductions, maintain records, generate reports In the pre-payroll phase, you’ll collect input data to guarantee accuracy. The actual payroll phase focuses on calculations and deductions, making certain everything is correct before distribution. Finally, the post-payroll phase involves compliance with statutory requirements, which includes maintaining records and generating reports for management review. Effective payroll management integrates these phases, guaranteeing timely compensation during adherence to legal obligations. Pre-Payroll Activities Before plunging into payroll processing, it’s essential to outline company policies related to pay, leave, benefits, and attendance. Establishing clear guidelines sets the stage for smooth operations. Here are the key pre-payroll activities you need to focus on: Define Policies: Document your company’s stance on pay rates, leave entitlements, and employee benefits. Gather Input Data: Collaborate with various departments to collect accurate salary and attendance information. Conduct Input Validation Checks: Verify that all data aligns with company policy, ensuring employee status is correct before payroll is processed. Utilize Payroll Software: Implementing software can streamline managing leave, attendance, and improve employee self-service. Ensuring that these pre-payroll activities are thoroughly executed helps maintain compliance and efficiency, paving the way for a successful actual payroll process. Actual Payroll Process In the actual payroll process, you calculate employee wages based on hours worked and salary agreements, making certain to apply the necessary deductions to arrive at net pay. Verification is essential here, as it helps you reconcile payroll values to catch any potential errors before payments are issued. Timely processing is additionally important; completing payroll on schedule not merely cultivates employee trust but likewise guarantees smooth operations. Payroll Calculation Steps Comprehension of the payroll calculation steps is vital for accurate and timely payment of employees. The actual payroll process involves several key steps: Input Data: Gather hours worked and salary agreements to calculate gross pay. Deductions: Calculate applicable taxes and deductions, such as federal, state, and local taxes, along with Social Security and Medicare. Net Pay: Subtract these deductions from gross pay to arrive at the employee’s net pay. Timeliness: Confirm processing aligns with the established payroll schedule to maintain employee trust and satisfaction. Verification Process Importance Though the verification process may seem like an extra step in the payroll expedition, it plays a crucial role in guaranteeing the accuracy of employee payments. This critical step involves reconciling payroll calculations with input data, allowing you to double-check entries related to hours worked, pay rates, and deductions before finalizing payments. Timely verification helps maintain employee trust by making sure payroll is processed correctly, minimizing discrepancies in paychecks. By utilizing payroll systems, you can automate many verification tasks, greatly reducing the risk of human error and providing real-time alerts for inconsistencies. A thorough verification process additionally guarantees compliance with tax regulations, as inaccuracies can lead to penalties and issues with government reporting, safeguarding your organization’s financial health. Timely Processing Necessity Timely processing of payroll is vital for sustaining employee trust and satisfaction, as delays can create financial stress for staff members. To guarantee that payroll is processed efficiently and correctly, consider these fundamental steps: Calculate employee wages accurately, considering hours worked and pay rates. Deduct taxes and other contributions, guaranteeing compliance with regulations. Determine net pay, which is the amount employees will actually receive. Verify all calculations to prevent errors and reconcile figures before issuing payments. Using an automated payroll system can streamline these processes, reducing manual errors and enhancing timeliness. Furthermore, maintaining confidentiality of payroll information is paramount, as secure handling of sensitive data protects employee privacy and meets regulatory requirements. Post-Payroll Activities Once payroll is completed, several important post-payroll activities must take place to guarantee compliance and financial accuracy. First, you need to process necessary deductions like EPF, TDS, and ESI, ensuring these are reported to the relevant government agencies. This step is essential for meeting statutory requirements. Next, maintain accurate payroll accounting by recording all transactions in your company’s accounting system, which supports financial transparency and is critical during audits. Salaries are commonly distributed through direct deposit, checks, or cash, with direct deposit being the most efficient option. After payroll processing, generate a bank advice statement to provide a detailed account of employee salary payments, aiding in record-keeping. Finally, compile reports on employee costs for management review; this information is crucial for making informed decisions about budgeting and resource allocation in your organization. Pros and Cons of Payroll Systems When you consider payroll systems, it’s essential to weigh their advantages against potential challenges. Conversely, these systems can save you time and reduce errors, enhancing employee satisfaction with timely payments. However, you may encounter issues like inaccurate data entry and compliance risks if your system isn’t flexible enough to adapt as your business grows. Advantages of Payroll Systems Payroll systems offer substantial benefits for businesses looking to streamline their payroll processes. By automating calculations and wage distribution, you can save significant time and reduce manual effort. Here are some key advantages: Enhanced Accuracy: Minimizes human errors, reducing costly payroll mistakes. Integration Potential: Works seamlessly with time tracking tools, ensuring precise wage calculations based on actual hours. Compliance Support: Facilitates timely tax deductions, helping you maintain compliance with various labor laws and avoiding penalties. Efficiency Boost: Streamlines payroll operations, allowing you to focus on core business activities rather than administrative tasks. These advantages make payroll systems a valuable asset for businesses seeking efficiency and reliability in their payroll management. Challenges of Payroll Systems Though payroll systems offer numerous advantages, they likewise come with their own set of challenges that businesses must navigate. One major issue is the reliance on accurate input data; even minor data entry errors can lead to significant payroll inaccuracies and compliance problems. You’ll need thorough verification processes to catch these mistakes. Furthermore, payroll systems must keep up with ever-changing tax laws and regulations, which can complicate compliance and require regular updates to guarantee accuracy. Scalability is another concern; some systems may struggle to accommodate a growing workforce or diverse pay structures, potentially hindering your business’s growth. Staying aware of these challenges can help you choose the right payroll system for your needs. Common Challenges in Payroll Management Managing payroll can be a complex task, especially as businesses face numerous challenges that can affect their efficiency and compliance. Here are some common hurdles you might encounter: Tax Regulation Updates: Keeping up with frequent changes can lead to compliance issues if not properly monitored. Integration Issues: When payroll systems aren’t compatible with your existing business software, data sharing becomes complicated and prone to errors. Payroll Accuracy: Bugs in the system or incorrect data entry can result in overpayments or underpayments, which can damage employee trust and satisfaction. Data Security: Handling sensitive employee information increases the need for robust security measures to prevent breaches and protect privacy. Navigating these challenges requires diligence and effective strategies to guarantee your payroll process runs smoothly and complies with regulations. Key Features to Consider When Choosing a Payroll System When selecting a payroll system, it’s important to contemplate various key features that can greatly improve your payroll management process. Automation is crucial, as it streamlines operations and reduces manual tasks, minimizing calculation errors. Look for tax compliance capabilities, which guarantee the system automatically calculates and withholds federal, state, and local taxes, helping you avoid penalties and stay compliant with regulations. Integration with time tracking tools is another significant feature, as it directly pulls employee hours into the payroll system, eliminating manual entry errors. Furthermore, consider employee self-service portals that improve transparency; these allow employees to access their pay information, track leave balances, and download tax documents, leading to enhanced satisfaction. Finally, robust reporting features are critical for generating detailed payroll reports, assisting in budgeting and compliance, whilst providing management insights into labor costs. Next Steps for Implementing a Payroll System Implementing a payroll system requires careful planning and execution to guarantee it meets your organization’s needs. Start by evaluating your business needs, like employee count and payroll complexity. Next, research and compare different payroll systems to find one that fits your requirements. Here are the next steps to follow: Evaluate Options: Decide between in-house payroll, software solutions, or outsourcing payroll services based on your evaluation. Establish a Payroll Policy: Create a clear policy that outlines compensation, pay schedules, and employee benefits. Gather Employee Information: Collect crucial details such as tax documents and direct deposit information to guarantee accurate processing. Train Staff: Provide training for HR personnel and staff on the chosen system to maximize functionality and guarantee compliance with labor laws. Frequently Asked Questions What Is an Employee Payroll System? An employee payroll system automates wage calculations and guarantees employees receive timely payments. It handles various payment types like salaries and bonuses, whereas it too calculates deductions for taxes and Social Security. You benefit from features like self-service portals, allowing you to view pay statements and access tax documents easily. These systems help businesses comply with labor laws, making it easier to track payroll data and avoid legal issues or penalties. How Does Employee Payroll Work? Employee payroll works by calculating gross wages based on hours worked or salaries, incorporating overtime, bonuses, and commissions. It automatically deducts taxes and other contributions, guaranteeing compliance with legal requirements. You receive your net pay through direct deposit or checks on scheduled paydays. The system additionally maintains detailed records for audits and compliance. Regular updates are vital to reflect changes in tax rates, labor laws, and employee statuses to guarantee ongoing accuracy. What Are the Three Types of Payroll? There are three main types of payroll systems you can choose from: Manual Payroll, Payroll Software, and Outsourced Payroll. Manual Payroll involves spreadsheets and calculations done by hand, which can be time-consuming and error-prone. Payroll Software automates these processes, reducing mistakes but requiring an upfront investment. Outsourced Payroll relies on third-party providers to handle everything, offering expertise but potentially raising data security concerns and costs. Each option has specific advantages and challenges to evaluate. How Do You Set up a Payroll System? To set up a payroll system, you’ll first need to obtain an Employer Identification Number (EIN) from the IRS. Next, gather crucial employee tax documents, like Form W-4, for accurate withholding. Choose a payroll schedule that suits your cash flow, such as weekly or bi-weekly. Decide whether to manage payroll in-house or outsource it, considering costs and workforce size. Finally, document compensation terms and guarantee employees understand these details for compliance. Conclusion In conclusion, an employee payroll system is crucial for managing payroll efficiently and accurately. By automating calculations and deductions, it streamlines the payroll process and guarantees employees are paid on time. Although there are pros and cons to evaluate, the benefits often outweigh the challenges. When selecting a payroll system, focus on key features that meet your organization’s needs. Implementing a reliable payroll system can improve compliance, boost financial transparency, and eventually contribute to a more organized workplace. Image via Google Gemini This article, "What Is an Employee Payroll System and How Does It Work?" was first published on Small Business Trends View the full article

-

AI Could Make Your Next TV More Expensive

We may earn a commission from links on this page. The scarcity of RAM brought on by the artificial intelligence boom, dubbed RAMageddon, is affecting more than just the price of PCs. AI could make new televisions more expensive too—as well as—game consoles, cell phones, high-tech coffee makers, and anything else with memory and a processor. But if you're in the market for a new TV, you might be better off buying sooner rather than later. As Axios reports, televisions generally require 1GB to 8GB of RAM to run "smart TV" features and to process video and data, and the memory units widely found in 4K TVs have more than quadrupled in price over the last year. That extra cost could be passed on to consumers: Analyst TrendForce said last month that a price hike on TVs was "unavoidable," while Samsung acknowledged it may need to reprice its products. That said, a typical television uses less memory, and less advanced memory, than some other key devices, so a potential price-spike is likely to be less dramatic than it is for things like PCs and smartphones. We'll see for sure when manufacturers announce the prices of their 2026 models. What's causing the RAM shortage?Companies like Microsoft, Google, and Nvidia are scooping up memory supply to run AI data centers, and most TV makers don't have the market power of these gigantic corporations. "When memory tightens, prices rise, product launches shift...margins compress and smaller companies struggle more than large tech giants," Marco Mezger, executive vice president of memory tech company Neumonda, told Axios. There is good news for consumers, however. Why right now is a good time to buy a new televisionHigher RAM prices have yet to hit the retail TV market, making now an unusually good time to buy a television. Overall, the price of smart TVs decreased by 15% between 2024 and the start of 2026, so you're starting from a good place. In addition, manufacturers generally offer lower prices at this time of year to clear shelf space ahead of new model releases. While more expensive RAM could be baked into the price of 2026 televisions, sets on the shelves now were priced before the effects of the shortage hit the retail market. Plus, some companies price their TVs lower because they make a lot of money collecting your data—unless you do you what you can to stop them, of course. All of which leads to ridiculously good deals, like $900 for a 65-inch OLED TV from Samsung. Bottom line: if you're in the market for a new TV, don't wait. (Though, chances are, you might not need a new TV.) Samsung - 65" Class S84F OLED 4K UHD Vision AI Smart Tizen TV (2025) $899.99 at Best Buy $1,999.99 Save $1,100.00 Get Deal Get Deal $899.99 at Best Buy $1,999.99 Save $1,100.00 How long is the RAM shortage likely to last?No one can say for sure how long the memory shortage will last, but the consensus of industry analysts is that we likely won't see a return to anything we'd consider normal before 2028. AI demand is projected to consume 70% of all high-end DRAM in 2026, so manufacturers are prioritizing it over the less advanced, less in-demand memory chips used for TVs and appliances. While investors are sinking billions into ramping up memory manufacturing, it takes around 19 months to get a factory up and running in Taiwan, and even longer in the U.S., so TV prices will likely remain high into 2028. View the full article

-

weekend open thread – February 21-22, 2026