All Activity

- Past hour

-

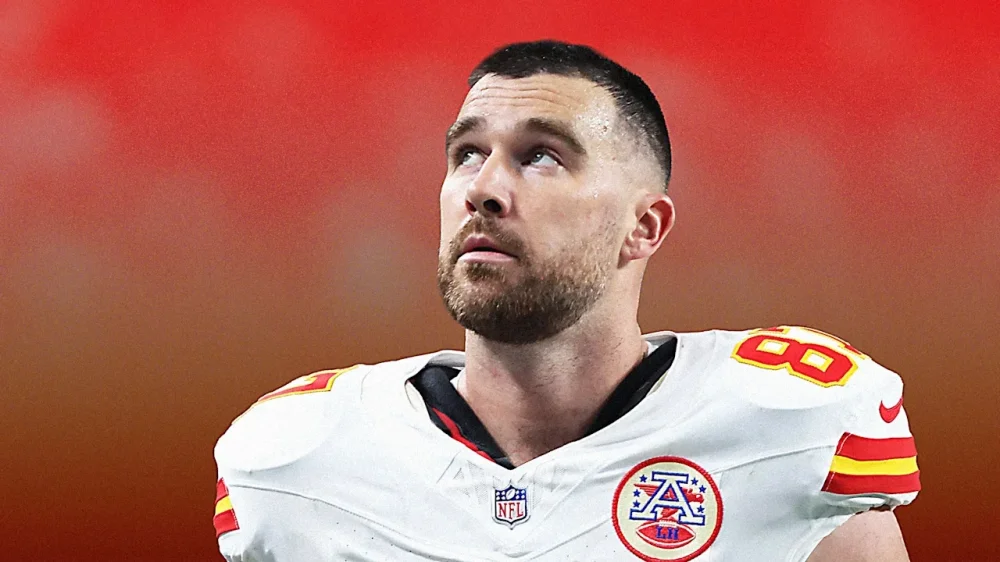

With one word, Travis Kelce may have (unintentionally) revealed his retirement plans

Will Kansas City Chiefs tight end Travis Kelce retire after this football season? Kelce has not yet delivered a public answer to this question, and there’s widespread speculation. But his choice of words when speaking about this decision may tell us which way he’s leaning. It’s a lesson for every communicator. Your choice of words carries meaning, whether you realize it or not. Sometimes that word choice can reveal more than you intended. The Chiefs just finished a dispiriting season, the first in Kelce’s pro career in which the team did not make the playoffs. Kelce’s current contract with the team ends in March. As many have pointed out, he’s a shoo-in for the Hall of Fame, having broken so many records it’s hard to count them all. He truly has nothing left to prove. On top of that, he’s engaged to Taylor Swift, with a rumored wedding date of June 13. His looks, charisma, and his incredibly famous fiancée mean there are many opportunities for him in the world of entertainment and sportscasting, beyond the wildly successful New Heights podcast he cohosts with his older brother, former Philadelphia Eagle Jason Kelce. So there are several good reasons for the younger Kelce to retire this year. On the other hand, many people suspected he would retire a year ago, after the Chiefs failed in their quest for three in a row Super Bowl wins in a humiliating loss to the Eagles. Despite those rumors, he returned to play another season. Kelce will never lose his love of the game In January, Kelce shared some of his thoughts on retirement during an episode of New Heights. “I’ve talked to a few people in the facility already, you know, having the exit meetings and everything, and they know where I stand, at least right now,” he said. “And I think there’s a lot of love for the game that’s still there, and I don’t think I’ll ever lose that. And, I don’t know, it’s a tough thing to navigate.” Then he described the conditions under which he’d continue to play. “If I think my body can heal up and rest up, and I can feel confident that I can go out there and give it another 18-, 20-, 21-week run, I think I would do it in a heartbeat.” Pay close attention to the word he used in that sentence. I would do it in a heartbeat, not I will do it in a heartbeat. The word would in this sentence indicates that at least some of the requirements he described have not been met. It may seem like a subtle distinction, but consider the two sentences, “I will go to the store” and “I would go to the store.” That second statement implies that there is some reason not to go and therefore the speaker will not go shopping. We all notice word choices Kelce isn’t a grammar expert. In fact, his entire sentence is ungrammatical. I doubt he’s ever considered will versus would. But whether we think about them consciously or not, native English speakers are aware of distinctions like this one. Because of that, what he said is so revealing. Kelce’s retirement may not be a certainty. He says he hasn’t decided yet, and that may be true. But “I would do it in a heartbeat” suggests that, at least right now, he thinks he’ll go. Either way, if you’re a speaker, entrepreneur, or business leader, pay close attention to your choice of words whenever you speak on any important topic. Otherwise, you could wind up telling careful listeners more than you intended. This article originally appeared on Fast Company’s sister website, Inc.com. Inc. is the voice of the American entrepreneur. We inspire, inform, and document the most fascinating people in business: the risk-takers, the innovators, and the ultra-driven go-getters that represent the most dynamic force in the American economy. View the full article

-

How to Define a Term Loan – A Quick Guide

A term loan is a structured financial product that provides a lump sum of money for a specific purpose, such as purchasing equipment or broadening a business. Typically, these loans have fixed repayment schedules over a period of three to 25 years, depending on the amount borrowed and the lender’s policies. Comprehending how term loans function, their features, and the application process is essential for making informed financial decisions. Let’s explore these aspects in detail. Key Takeaways A term loan is a fixed-amount loan with set repayment periods ranging from three to 25 years. It provides a lump sum of cash for significant expenditures, such as equipment or real estate. Repayment schedules involve scheduled payments, typically monthly or quarterly, covering both principal and interest. Interest rates can be fixed for stability or variable, which may fluctuate based on market conditions. Borrowers must demonstrate creditworthiness through financial statements and may need to provide collateral. What Is a Term Loan? A term loan is a financial product designed to provide borrowers with a lump sum of cash upfront, which they can use for significant, one-time expenditures, such as purchasing equipment or real estate vital for business growth. To define term loan, it’s important to understand its structure. Typically, repayment occurs over a fixed period, with scheduled payments that can be monthly or quarterly. Loan term definition varies; short-term loans last less than a year, intermediate-term loans span one to three years, and long-term loans extend from three to 25 years. Lenders often require collateral to mitigate risks, and they assess your creditworthiness based on financial statements. This structured repayment schedule helps manage cash flow effectively throughout the loan’s duration. Key Features of a Term Loan When you consider a term loan, it’s vital to understand its key features, including the loan amount and its intended purpose. You’ll typically receive a lump sum that you can use for significant investments like equipment or real estate. Furthermore, the repayment schedule and interest rate variability can greatly impact your financial planning, so it’s important to assess these elements carefully. Loan Amount and Purpose Comprehending the loan amount and purpose is vital when considering a term loan, as these factors greatly influence the borrowing process. A term loan provides you with a lump sum of cash upfront, which you can use for specific purposes like purchasing fixed assets or funding business expansions. The loan amount typically depends on your creditworthiness, financial history, and the intended use of the funds, ensuring it aligns with your repayment capacity. Amounts can range from a few thousand dollars for small businesses to millions for larger enterprises, depending on your project’s scope. Clearly outlining the intended use of the loan funds in your application is important, as it greatly impacts the lender’s assessment of the loan’s risk and viability. Repayment Schedule Details Comprehending the repayment schedule is crucial for managing your term loan effectively, as it outlines how and when you’ll repay the borrowed amount. Typically, you’ll make regular payments monthly or quarterly, which include both principal and interest. The loan term can vary, with short-term loans under a year, intermediate loans lasting one to three years, and long-term loans extending up to 25 years. Some loans may require balloon payments at the end, so plan your cash flow accordingly. Loan Term Type Duration Short-term Less than 1 year Intermediate-term 1 to 3 years Long-term 3 to 25 years Balloon Payment Larger final payment at term end Interest Rate Variability Comprehending the variability in interest rates is vital for making informed decisions about your term loan. You’ll encounter two main types of rates: fixed and variable. Fixed rates provide stability, ensuring your monthly payments remain unchanged throughout the loan term, which protects you from potential rate hikes. Conversely, variable rates fluctuate based on market conditions and are often linked to benchmarks like LIBOR or the prime rate. If market rates decrease, you could benefit from lower payments. Nevertheless, it’s important to assess your financial forecasts, as your choice between fixed and variable rates can greatly impact the total interest paid over the loan’s life. Lenders base rates on your creditworthiness and the perceived risk of the loan. Types of Term Loans When considering term loans, it’s essential to understand the different types available to suit your financial needs. Short-term loans typically last less than a year and are perfect for immediate cash needs or operational expenses. Intermediate-term loans range from one to three years, making them suitable for projects needing a moderate repayment period. Long-term loans extend from three to 25 years and are usually used for substantial investments, like purchasing real estate or expensive machinery. Balloon loans offer smaller payments throughout the term but require a larger final payment, which can affect your cash flow. In addition, secured loans require collateral, whereas unsecured loans don’t, often resulting in higher interest rates because of increased lender risk. How Does a Term Loan Work? A term loan works by providing you with a lump sum of capital upfront, which you agree to repay over a fixed period, typically ranging from one to twenty-five years, depending on the type of loan you choose. You’ll make scheduled monthly or quarterly payments that cover both principal and interest, allowing you to manage cash flow effectively. Lenders assess your creditworthiness through your financial records and credit history, which influences your loan approval and terms. Interest rates can be fixed or variable, often reflecting your credit profile and market conditions. Once approved, you receive the loan amount and start payments according to the repayment schedule, which may include penalties for missed payments or early payoff. Benefits of Term Loans for Businesses Term loans offer businesses access to larger capital amounts, enabling you to make significant investments, like purchasing new equipment or broadening your facilities. With a fixed repayment structure, you can plan your budget more effectively, as you’ll know exactly how much you need to pay each month. This predictability not just helps in managing cash flow but likewise supports your long-term financial planning. Access to Larger Capital Securing substantial capital is often vital for businesses looking to invest in growth opportunities, and term loans provide a viable solution. These loans typically allow you to access funds ranging from $10,000 to several million dollars, depending on your qualifications and the lender’s terms. This access to larger capital can support significant expenditures, like purchasing equipment or broadening facilities. With lower interest rates compared to credit cards, term loans can be more cost-effective for your business. Furthermore, you retain full ownership, ensuring you maintain control over operations. Fixed Repayment Structure Grasping the fixed repayment structure of term loans is crucial for businesses seeking financial stability. With a structured plan, you can expect scheduled monthly or quarterly payments, making budgeting straightforward. This arrangement typically covers both principal and interest, ensuring the loan is fully paid off within a defined timeframe, ranging from one to 25 years. Consider these benefits of fixed repayment structures: Predictable cash flow aids in managing operational expenses. Regular payments can improve your credit score over time. Locked interest rates protect against market fluctuations. A clear repayment schedule helps you avoid unexpected financial strain. Common Attributes of Term Loans When considering a loan for your financial needs, comprehension of the common attributes of these loans is essential. Term loans provide you with a lump sum of capital, which you repay over a predetermined period, typically through fixed or variable interest rates. Most term loans require collateral, reducing the lender’s risk if you default. Payments are usually made monthly or quarterly, following a schedule outlined in the loan agreement. The maturity date varies: short-term loans last under a year, intermediate-term loans span one to three years, and long-term loans can extend from three to 25 years. You’ll need to demonstrate creditworthiness through financial statements, and be aware that early repayment penalties may apply, especially with long-term loans. Real-World Examples of Term Loans When considering real-world examples of term loans, it’s clear how they can effectively support various business needs. For instance, a resort company secured a $1.1 million loan for infrastructure repair, opting for a long-term solution over costly recurring repairs. Similarly, an equipment rental business used a long-term loan to purchase new machinery, which not only broadened their service offerings but additionally helped attract new clients, showcasing the diverse applications of term loans in business financing. Business Equipment Financing Term loans serve as an essential financing option for businesses looking to acquire necessary equipment that can improve operational efficiency and productivity. For instance, a bakery might secure a $150,000 term loan to purchase a commercial oven, with a five-year repayment plan at a fixed 6% interest rate. Similarly, a construction company could acquire new heavy machinery through a $300,000 term loan, enabling them to bid on larger projects and potentially increase revenue. Key benefits of using term loans for equipment financing include: Fixed interest rates providing predictable payments Tax deductions on interest payments improving cash flow Flexible repayment periods ranging from three to seven years Improved operational capabilities leading to growth opportunities Infrastructure Repair Funding Securing funding for infrastructure repairs can be a pivotal step for businesses wanting to maintain and improve their operational efficiency. Term loans can provide significant financial support, allowing you to tackle vital projects without straining your cash flow. For instance, a resort company secured $1.1 million for permanent bridge reconstruction, effectively eliminating ongoing repair costs. These loans typically come with structured repayment schedules, making fixed monthly payments manageable. Lenders often require collateral, such as the assets being repaired or other properties, ensuring the loan is backed by tangible value. By demonstrating a solid financial history and a clear plan for advancements, you can expedite the approval process, leading to improved facilities that attract more customers and contribute to long-term growth. Pros and Cons of Term Loans Comprehending the pros and cons of term loans is essential for making informed financial decisions. Here’s what you should consider: Lower Interest Rates: Term loans usually have lower rates than credit cards, making them cost-effective for large purchases. Fixed Repayment Schedules: These loans allow you to budget effectively, aiding in cash flow management. Collateral Requirement: Most term loans need collateral, which can put your business assets at risk if you can’t meet payments. Qualification Challenges: Securing a term loan can be tough for new or struggling businesses, as lenders favor those with established credit histories and consistent revenue. When to Consider a Term Loan Comprehending when to evaluate a term loan can greatly influence your business’s financial strategy. Consider a term loan when you need significant funding for long-term investments, like purchasing machinery or broadening operations, which can boost revenue over time. If your business has a strong financial history and faces large, one-time expenses, a term loan could be suitable. It can additionally help if you’re dealing with cash flow gaps that impede growth or efficiency. A clear plan for fund utilization is crucial, allowing for structured repayments that align with anticipated income. Finally, if you expect steady revenue growth, a term loan can facilitate managing costs during potentially enhancing your credit score through consistent, timely repayments. Application Process for Term Loans Applying for a term loan involves several important steps that can determine the success of your funding strategy. First, you’ll need to complete a loan application, detailing the purpose and requested amount, along with supporting financial documents like tax returns and bank statements. Lenders will assess your application by evaluating your creditworthiness through financial statements and credit checks. To improve your application process, consider the following: Prepare a thorough loan application. Gather necessary financial documents. Assess your creditworthiness beforehand. Apply with multiple lenders for better terms. Once approved, you’ll receive a loan agreement outlining repayment schedules, interest rates, and possible fees. You’ll get the loan amount as a lump sum and start making scheduled payments based on the agreement. Understanding Loan Terms and Conditions After securing a term loan, comprehending the loan’s terms and conditions becomes crucial for effective financial management. Loan terms typically include the borrowed amount, interest rate—either fixed or variable—repayment schedule, and maturity date. The repayment schedule outlines how often you’ll make payments, such as monthly or quarterly, covering both principal and interest to guarantee the loan is paid off by the maturity date. Interest rates depend on factors like your creditworthiness and whether the loan is secured or unsecured. Many loans require collateral, which can impact your loan terms based on the asset’s value. Furthermore, be aware of any clauses regarding prepayment penalties, as they can affect the total cost if you choose to pay off the loan early. Tips for Successful Loan Management Successful loan management is essential for maintaining financial health and ensuring that your business can meet its obligations. To manage your term loan effectively, follow these tips: Maintain a detailed repayment schedule, tracking due dates and amounts to avoid late fees and credit score damage. Regularly review your cash flow against loan obligations, ensuring you have enough liquidity for timely payments without straining your operations. Communicate proactively with your lender about any financial difficulties, exploring options like loan restructuring or temporary payment relief. Utilize financial software to monitor your loan’s progress, calculating remaining balances and staying organized about your commitments. Frequently Asked Questions What Is Term Loan in Simple Words? A term loan is a type of financing where you receive a lump sum of money upfront, which you’ll repay over a set period. These loans often have fixed repayment schedules, with payments made monthly or quarterly. You might use a term loan to buy equipment or expand your business. The loan’s duration can range from a few months to several years, and collateral may be required to secure the loan. What Is the Best Way to Define the Term of a Loan? To define the term of a loan, consider its duration, which dictates how long you’ll repay the borrowed amount. Loan terms can range from a few months for short-term loans to several years for long-term loans, affecting your monthly payments and total interest. For instance, a 15-year mortgage typically results in lower payments compared to a 30-year loan, but you’ll pay more interest over time. Comprehending this helps you manage your cash flow effectively. What Is the Formula for a Term Loan? To calculate your monthly payment on a term loan, use the formula: M = P[r(1 + r)^n] / [(1 + r)^n – 1]. Here, M is the monthly payment, P is the principal amount, r is the monthly interest rate (annual rate divided by 12), and n is the number of payments. This formula helps you understand your payment obligations and manage your cash flow effectively throughout the loan’s duration. What Is the Basis of a Term Loan? The basis of a term loan lies in its structured repayment plan, where you receive a lump sum upfront and pay it back over time. This loan is typically used for significant purchases, like equipment or property. You’ll need to demonstrate creditworthiness, often providing collateral to secure the loan. Interest rates can be fixed or variable, affecting your overall repayment amount. Comprehending these elements helps you manage your finances effectively. Conclusion In conclusion, a term loan can be a valuable financial tool for businesses seeking to fund significant projects or investments. By comprehending its key features, types, and how it works, you can make informed decisions that align with your financial goals. Consider the benefits and potential drawbacks, and make certain you’re prepared for the application process. With proper management, a term loan can help you achieve substantial growth during maintaining financial stability. Image via Google Gemini This article, "How to Define a Term Loan – A Quick Guide" was first published on Small Business Trends View the full article

-

How to Define a Term Loan – A Quick Guide

A term loan is a structured financial product that provides a lump sum of money for a specific purpose, such as purchasing equipment or broadening a business. Typically, these loans have fixed repayment schedules over a period of three to 25 years, depending on the amount borrowed and the lender’s policies. Comprehending how term loans function, their features, and the application process is essential for making informed financial decisions. Let’s explore these aspects in detail. Key Takeaways A term loan is a fixed-amount loan with set repayment periods ranging from three to 25 years. It provides a lump sum of cash for significant expenditures, such as equipment or real estate. Repayment schedules involve scheduled payments, typically monthly or quarterly, covering both principal and interest. Interest rates can be fixed for stability or variable, which may fluctuate based on market conditions. Borrowers must demonstrate creditworthiness through financial statements and may need to provide collateral. What Is a Term Loan? A term loan is a financial product designed to provide borrowers with a lump sum of cash upfront, which they can use for significant, one-time expenditures, such as purchasing equipment or real estate vital for business growth. To define term loan, it’s important to understand its structure. Typically, repayment occurs over a fixed period, with scheduled payments that can be monthly or quarterly. Loan term definition varies; short-term loans last less than a year, intermediate-term loans span one to three years, and long-term loans extend from three to 25 years. Lenders often require collateral to mitigate risks, and they assess your creditworthiness based on financial statements. This structured repayment schedule helps manage cash flow effectively throughout the loan’s duration. Key Features of a Term Loan When you consider a term loan, it’s vital to understand its key features, including the loan amount and its intended purpose. You’ll typically receive a lump sum that you can use for significant investments like equipment or real estate. Furthermore, the repayment schedule and interest rate variability can greatly impact your financial planning, so it’s important to assess these elements carefully. Loan Amount and Purpose Comprehending the loan amount and purpose is vital when considering a term loan, as these factors greatly influence the borrowing process. A term loan provides you with a lump sum of cash upfront, which you can use for specific purposes like purchasing fixed assets or funding business expansions. The loan amount typically depends on your creditworthiness, financial history, and the intended use of the funds, ensuring it aligns with your repayment capacity. Amounts can range from a few thousand dollars for small businesses to millions for larger enterprises, depending on your project’s scope. Clearly outlining the intended use of the loan funds in your application is important, as it greatly impacts the lender’s assessment of the loan’s risk and viability. Repayment Schedule Details Comprehending the repayment schedule is crucial for managing your term loan effectively, as it outlines how and when you’ll repay the borrowed amount. Typically, you’ll make regular payments monthly or quarterly, which include both principal and interest. The loan term can vary, with short-term loans under a year, intermediate loans lasting one to three years, and long-term loans extending up to 25 years. Some loans may require balloon payments at the end, so plan your cash flow accordingly. Loan Term Type Duration Short-term Less than 1 year Intermediate-term 1 to 3 years Long-term 3 to 25 years Balloon Payment Larger final payment at term end Interest Rate Variability Comprehending the variability in interest rates is vital for making informed decisions about your term loan. You’ll encounter two main types of rates: fixed and variable. Fixed rates provide stability, ensuring your monthly payments remain unchanged throughout the loan term, which protects you from potential rate hikes. Conversely, variable rates fluctuate based on market conditions and are often linked to benchmarks like LIBOR or the prime rate. If market rates decrease, you could benefit from lower payments. Nevertheless, it’s important to assess your financial forecasts, as your choice between fixed and variable rates can greatly impact the total interest paid over the loan’s life. Lenders base rates on your creditworthiness and the perceived risk of the loan. Types of Term Loans When considering term loans, it’s essential to understand the different types available to suit your financial needs. Short-term loans typically last less than a year and are perfect for immediate cash needs or operational expenses. Intermediate-term loans range from one to three years, making them suitable for projects needing a moderate repayment period. Long-term loans extend from three to 25 years and are usually used for substantial investments, like purchasing real estate or expensive machinery. Balloon loans offer smaller payments throughout the term but require a larger final payment, which can affect your cash flow. In addition, secured loans require collateral, whereas unsecured loans don’t, often resulting in higher interest rates because of increased lender risk. How Does a Term Loan Work? A term loan works by providing you with a lump sum of capital upfront, which you agree to repay over a fixed period, typically ranging from one to twenty-five years, depending on the type of loan you choose. You’ll make scheduled monthly or quarterly payments that cover both principal and interest, allowing you to manage cash flow effectively. Lenders assess your creditworthiness through your financial records and credit history, which influences your loan approval and terms. Interest rates can be fixed or variable, often reflecting your credit profile and market conditions. Once approved, you receive the loan amount and start payments according to the repayment schedule, which may include penalties for missed payments or early payoff. Benefits of Term Loans for Businesses Term loans offer businesses access to larger capital amounts, enabling you to make significant investments, like purchasing new equipment or broadening your facilities. With a fixed repayment structure, you can plan your budget more effectively, as you’ll know exactly how much you need to pay each month. This predictability not just helps in managing cash flow but likewise supports your long-term financial planning. Access to Larger Capital Securing substantial capital is often vital for businesses looking to invest in growth opportunities, and term loans provide a viable solution. These loans typically allow you to access funds ranging from $10,000 to several million dollars, depending on your qualifications and the lender’s terms. This access to larger capital can support significant expenditures, like purchasing equipment or broadening facilities. With lower interest rates compared to credit cards, term loans can be more cost-effective for your business. Furthermore, you retain full ownership, ensuring you maintain control over operations. Fixed Repayment Structure Grasping the fixed repayment structure of term loans is crucial for businesses seeking financial stability. With a structured plan, you can expect scheduled monthly or quarterly payments, making budgeting straightforward. This arrangement typically covers both principal and interest, ensuring the loan is fully paid off within a defined timeframe, ranging from one to 25 years. Consider these benefits of fixed repayment structures: Predictable cash flow aids in managing operational expenses. Regular payments can improve your credit score over time. Locked interest rates protect against market fluctuations. A clear repayment schedule helps you avoid unexpected financial strain. Common Attributes of Term Loans When considering a loan for your financial needs, comprehension of the common attributes of these loans is essential. Term loans provide you with a lump sum of capital, which you repay over a predetermined period, typically through fixed or variable interest rates. Most term loans require collateral, reducing the lender’s risk if you default. Payments are usually made monthly or quarterly, following a schedule outlined in the loan agreement. The maturity date varies: short-term loans last under a year, intermediate-term loans span one to three years, and long-term loans can extend from three to 25 years. You’ll need to demonstrate creditworthiness through financial statements, and be aware that early repayment penalties may apply, especially with long-term loans. Real-World Examples of Term Loans When considering real-world examples of term loans, it’s clear how they can effectively support various business needs. For instance, a resort company secured a $1.1 million loan for infrastructure repair, opting for a long-term solution over costly recurring repairs. Similarly, an equipment rental business used a long-term loan to purchase new machinery, which not only broadened their service offerings but additionally helped attract new clients, showcasing the diverse applications of term loans in business financing. Business Equipment Financing Term loans serve as an essential financing option for businesses looking to acquire necessary equipment that can improve operational efficiency and productivity. For instance, a bakery might secure a $150,000 term loan to purchase a commercial oven, with a five-year repayment plan at a fixed 6% interest rate. Similarly, a construction company could acquire new heavy machinery through a $300,000 term loan, enabling them to bid on larger projects and potentially increase revenue. Key benefits of using term loans for equipment financing include: Fixed interest rates providing predictable payments Tax deductions on interest payments improving cash flow Flexible repayment periods ranging from three to seven years Improved operational capabilities leading to growth opportunities Infrastructure Repair Funding Securing funding for infrastructure repairs can be a pivotal step for businesses wanting to maintain and improve their operational efficiency. Term loans can provide significant financial support, allowing you to tackle vital projects without straining your cash flow. For instance, a resort company secured $1.1 million for permanent bridge reconstruction, effectively eliminating ongoing repair costs. These loans typically come with structured repayment schedules, making fixed monthly payments manageable. Lenders often require collateral, such as the assets being repaired or other properties, ensuring the loan is backed by tangible value. By demonstrating a solid financial history and a clear plan for advancements, you can expedite the approval process, leading to improved facilities that attract more customers and contribute to long-term growth. Pros and Cons of Term Loans Comprehending the pros and cons of term loans is essential for making informed financial decisions. Here’s what you should consider: Lower Interest Rates: Term loans usually have lower rates than credit cards, making them cost-effective for large purchases. Fixed Repayment Schedules: These loans allow you to budget effectively, aiding in cash flow management. Collateral Requirement: Most term loans need collateral, which can put your business assets at risk if you can’t meet payments. Qualification Challenges: Securing a term loan can be tough for new or struggling businesses, as lenders favor those with established credit histories and consistent revenue. When to Consider a Term Loan Comprehending when to evaluate a term loan can greatly influence your business’s financial strategy. Consider a term loan when you need significant funding for long-term investments, like purchasing machinery or broadening operations, which can boost revenue over time. If your business has a strong financial history and faces large, one-time expenses, a term loan could be suitable. It can additionally help if you’re dealing with cash flow gaps that impede growth or efficiency. A clear plan for fund utilization is crucial, allowing for structured repayments that align with anticipated income. Finally, if you expect steady revenue growth, a term loan can facilitate managing costs during potentially enhancing your credit score through consistent, timely repayments. Application Process for Term Loans Applying for a term loan involves several important steps that can determine the success of your funding strategy. First, you’ll need to complete a loan application, detailing the purpose and requested amount, along with supporting financial documents like tax returns and bank statements. Lenders will assess your application by evaluating your creditworthiness through financial statements and credit checks. To improve your application process, consider the following: Prepare a thorough loan application. Gather necessary financial documents. Assess your creditworthiness beforehand. Apply with multiple lenders for better terms. Once approved, you’ll receive a loan agreement outlining repayment schedules, interest rates, and possible fees. You’ll get the loan amount as a lump sum and start making scheduled payments based on the agreement. Understanding Loan Terms and Conditions After securing a term loan, comprehending the loan’s terms and conditions becomes crucial for effective financial management. Loan terms typically include the borrowed amount, interest rate—either fixed or variable—repayment schedule, and maturity date. The repayment schedule outlines how often you’ll make payments, such as monthly or quarterly, covering both principal and interest to guarantee the loan is paid off by the maturity date. Interest rates depend on factors like your creditworthiness and whether the loan is secured or unsecured. Many loans require collateral, which can impact your loan terms based on the asset’s value. Furthermore, be aware of any clauses regarding prepayment penalties, as they can affect the total cost if you choose to pay off the loan early. Tips for Successful Loan Management Successful loan management is essential for maintaining financial health and ensuring that your business can meet its obligations. To manage your term loan effectively, follow these tips: Maintain a detailed repayment schedule, tracking due dates and amounts to avoid late fees and credit score damage. Regularly review your cash flow against loan obligations, ensuring you have enough liquidity for timely payments without straining your operations. Communicate proactively with your lender about any financial difficulties, exploring options like loan restructuring or temporary payment relief. Utilize financial software to monitor your loan’s progress, calculating remaining balances and staying organized about your commitments. Frequently Asked Questions What Is Term Loan in Simple Words? A term loan is a type of financing where you receive a lump sum of money upfront, which you’ll repay over a set period. These loans often have fixed repayment schedules, with payments made monthly or quarterly. You might use a term loan to buy equipment or expand your business. The loan’s duration can range from a few months to several years, and collateral may be required to secure the loan. What Is the Best Way to Define the Term of a Loan? To define the term of a loan, consider its duration, which dictates how long you’ll repay the borrowed amount. Loan terms can range from a few months for short-term loans to several years for long-term loans, affecting your monthly payments and total interest. For instance, a 15-year mortgage typically results in lower payments compared to a 30-year loan, but you’ll pay more interest over time. Comprehending this helps you manage your cash flow effectively. What Is the Formula for a Term Loan? To calculate your monthly payment on a term loan, use the formula: M = P[r(1 + r)^n] / [(1 + r)^n – 1]. Here, M is the monthly payment, P is the principal amount, r is the monthly interest rate (annual rate divided by 12), and n is the number of payments. This formula helps you understand your payment obligations and manage your cash flow effectively throughout the loan’s duration. What Is the Basis of a Term Loan? The basis of a term loan lies in its structured repayment plan, where you receive a lump sum upfront and pay it back over time. This loan is typically used for significant purchases, like equipment or property. You’ll need to demonstrate creditworthiness, often providing collateral to secure the loan. Interest rates can be fixed or variable, affecting your overall repayment amount. Comprehending these elements helps you manage your finances effectively. Conclusion In conclusion, a term loan can be a valuable financial tool for businesses seeking to fund significant projects or investments. By comprehending its key features, types, and how it works, you can make informed decisions that align with your financial goals. Consider the benefits and potential drawbacks, and make certain you’re prepared for the application process. With proper management, a term loan can help you achieve substantial growth during maintaining financial stability. Image via Google Gemini This article, "How to Define a Term Loan – A Quick Guide" was first published on Small Business Trends View the full article

- Today

-

How Much Does It Cost to Budget for a Franchise Investment?

When budgeting for a franchise investment, it’s vital to understand the various costs involved. Initial franchise fees typically range from $20,000 to $50,000, but that’s just the beginning. You’ll likewise need to take into account real estate, inventory, ongoing royalty fees, and other operational expenses. Each component plays a significant role in your overall financial plan, so being thorough is fundamental. But how do you guarantee that your budget covers everything necessary for a successful franchise operation? Key Takeaways Initial franchise investments typically range from $100,000 to $300,000, with fees often between $20,000 and $50,000 for franchise rights. Real estate costs, including down payments and renovations, can add $50,000 to $350,000 to your budget. Ongoing royalty fees of 5% to 9% of gross sales must be factored into your operating costs. Professional fees for legal and accounting services range from $25,000 to $75,000, influencing overall budget planning. Comprehensive training and support may require an additional investment of $10,000 to $30,000 for franchise success. Understanding Franchise Startup Costs When considering a franchise investment, it’s vital to understand the startup costs involved, which can range considerably based on various factors. Typically, how much does it cost to get a franchise? Initial investments can vary from $10,000 to $5 million, with many franchises falling between $100,000 and $300,000. This includes legal costs for the Franchise Disclosure Document (FDD), which can be $15,000 to $45,000. You might additionally need to develop an Operations Manual, costing anywhere from $0 to $30,000. Franchise fees, usually non-negotiable, cover crucial resources and support. In the end, your franchise owner salary will depend on various elements, but the average franchise owner salary can provide a realistic expectation of your potential earnings. Initial Franchise Fees Explained When you’re considering a franchise investment, comprehension of the initial franchise fees is essential. Typically ranging from $20,000 to $50,000, these fees grant you the rights to use the franchise name and business model, but they can vary based on brand reputation and market conditions. Be sure to review the Franchise Disclosure Document (FDD) for detailed information on these fees and any additional startup costs you might encounter. Franchise Fee Structure Comprehending the franchise fee structure is crucial for anyone considering a franchise investment, as it provides insight into the initial costs involved. Initial franchise fees typically range from $20,000 to $50,000, granting you rights to use the franchise’s name and business model. These franchise fees are typically non-negotiable and reflect the support and resources you’ll receive as a new franchisee. The Franchise Disclosure Document (FDD) outlines these fees in detail, helping you understand your financial commitment. It additionally highlights any extra ongoing fees that may apply. Some franchisors may offer incentives, like deferred fees or limited-time discounts, making it easier for you to enter the market. Always review the FDD carefully to budget effectively for your investment. Additional Initial Costs Comprehending the initial franchise fees is just the beginning of your financial planning for a franchise investment. Typically ranging from $20,000 to $50,000, these franchise fees grant you rights to the brand name and business model. Nonetheless, the initial investment doesn’t stop there; you’ll need to take into account further costs as well. The Franchise Disclosure Document (FDD) lays out specifics, including expenses for training, support, and marketing resources. You’ll also need to budget for real estate acquisition, which can include rental or purchase expenses, plus potential renovations. Moreover, initial inventory is vital and varies by franchise type—think stock for food or retail businesses. Being aware of these further costs is fundamental for effective budgeting. Real Estate and Inventory Considerations When budgeting for your franchise investment, you’ll need to take into account real estate costs, which can include down payments, commissions, and security deposits that vary by location. Furthermore, think about your initial inventory requirements, as these depend heavily on the type of franchise you choose—whether it’s retail or food service. Finally, don’t overlook lease negotiation strategies, as they can greatly influence your ongoing expenses and overall financial health. Real Estate Costs Real estate costs play an important role in your franchise investment, and comprehending these expenses can help you make informed decisions. These costs can vary considerably based on location and property type, often ranging from $50,000 to $250,000. Furthermore, you’ll need to account for renovations and leasehold improvements, which might add another $10,000 to $100,000. Consider these factors: Down payments and commissions associated with property acquisition Security deposits that often accompany leasing agreements Local market conditions affecting lease and purchase prices Understanding real estate costs is vital, as they can impact your franchise owner income and overall investment. Inventory Requirements Comprehending inventory requirements is just as crucial as grasping real estate costs regarding franchise investment. Different franchises have varying inventory needs, impacting your budget markedly. For instance, food franchises might require specialized stock, whereas service-based businesses may need minimal inventory. Here’s a quick overview of potential inventory costs: Franchise Type Estimated Initial Inventory Cost Food Franchise $10,000 – $50,000 Retail Franchise $5,000 – $30,000 Service Franchise $2,000 – $10,000 Understanding how much do franchisees make involves knowing these inventory requirements and ongoing replenishment costs, as they influence cash flow. In the end, knowing how much can a franchise owner make also depends on effective inventory management. Lease Negotiation Strategies Securing a favorable lease is crucial for any franchise investment, and you need to approach negotiations strategically. Start by researching local market rates to understand comparable spaces, which will empower you during negotiations. Consider these key strategies: Factor in upfront costs like security deposits and tenant improvement allowances. Negotiate flexible lease terms that adjust based on your franchise performance to mitigate financial risks. Establish a clear exit strategy with termination clauses or subleasing options to adapt to future changes. Ongoing Royalty Fees and Their Impact When considering a franchise investment, it’s vital to understand how ongoing royalty fees can affect your bottom line. These fees typically range from 5% to 9% of gross sales, greatly impacting your overall profitability. Some franchises, like Dream Vacations, charge a lower fee of 1.5% to 3%, whereas others, such as Complete Weddings + Events, may require up to 8% of annual gross revenue. These royalty fees are usually non-negotiable, funding the franchisor’s support and brand development. As a franchisee, you should budget for these fees as part of your operating costs to guarantee sufficient cash flow. High royalty fees can reduce your net income, making it important to assess potential earnings against these costs when choosing a franchise. Estimating Operating Expenses Estimating operating expenses is vital for any franchisee looking to secure the long-term viability of their business. You’ll need to account for several ongoing costs, including a royalty fee ranging from 5% to 9% of gross sales. Furthermore, recurring expenses such as employee salaries, utilities, and maintenance are critical for daily operations. It’s wise to establish a reserve fund for unexpected costs, like emergency repairs, to guarantee financial stability in the early stages. Don’t forget to include professional fees for legal and accounting services in your budget. Royalty fees for brand support Recurring costs like utilities and salaries Reserve funds for unexpected expenses Marketing and Advertising Budgeting When budgeting for marketing and advertising, you’ll want to allocate a significant portion of your franchise funds, typically around 20-30% in the first year. Digital advertising strategies are crucial for reaching your target audience, so consider how much to invest in online ads alongside traditional methods. Moreover, don’t forget to budget for local initiatives and required promotional materials that can improve your franchise’s visibility and appeal. Allocating Marketing Funds Allocating marketing funds effectively is crucial for the success of any franchise. Franchisees typically contribute 1% to 5% of their gross sales to an advertising fund that supports both national and regional marketing efforts. Local marketing initiatives are equally important, encompassing costs for online ads, print materials, and event sponsorships. Consider these key points when budgeting for marketing: Allocate 20-30% of your total franchising budget to marketing expenses in the first year. Budget for materials like banners and promotional items to improve visibility. Reserve funds for unexpected local marketing opportunities to engage customers effectively. Digital Advertising Strategies Digital advertising strategies play a significant role in maximizing the reach and effectiveness of your marketing efforts as a franchisee. Typically, you should allocate about 1% to 3% of your gross sales to a national or regional advertising fund, which helps improve brand visibility. In addition, local marketing initiatives are imperative; budget for online ads, print materials, and event sponsorships to attract customers to your location. Don’t forget to set aside funds for important marketing materials like banners and promotional items. Your digital advertising can likewise involve extra costs for social media campaigns, search engine marketing, and website optimization. Professional Fees and Insurance Costs Steering through the terrain of professional fees and insurance costs is fundamental for anyone considering a franchise investment. You’ll likely face professional fees for legal and accounting services ranging from $25,000 to $75,000. These guarantee compliance with franchise laws and documentation. Moreover, budgeting for insurance coverage is critical, covering aspects like workers’ compensation, property, and auto insurance, which are both initial and ongoing expenses. Professional fees can considerably impact your budget. Insurance costs vary greatly, so accurate estimation is crucial. Close management of these expenses is key to maintaining profitability. Understanding these costs helps you weigh them against potential benefits, leading to smarter investment decisions in the long run. Financing Options for Franchise Investment When you’re considering a franchise investment, comprehension of your financing options is essential, as they can greatly affect your ability to launch and sustain your business. You can explore traditional commercial bank loans, which typically require a solid credit history and a detailed business plan for approval. The Small Business Administration (SBA) likewise offers favorable loan programs with partial repayment guarantees, making them a popular choice. Alternatively, you might consider funding from alternative lenders, though they often charge higher interest rates. Crowdfunding platforms and personal loans from friends or family can provide additional capital. Finally, many franchisors partner with lenders to offer customized financing programs particularly aimed at helping you cover initial investment costs. Additional Costs to Consider When budgeting for your franchise, it’s vital to account for ongoing royalty fees, which can take a significant chunk of your gross sales. You’ll additionally need to set aside funds for marketing and advertising expenses, as these contributions help strengthen the brand’s presence. Finally, don’t overlook training and support costs, as they play a critical role in your franchise’s success and overall operational efficiency. Ongoing Royalty Fees Ongoing royalty fees are a significant aspect of franchise investment that every potential franchisee should understand. These fees typically range from 5% to 9% of gross sales, providing fundamental support for brand operations. Nonetheless, some franchises charge considerably less or more, so it’s imperative to do your research. Consider these points: Fees can vary widely; for instance, Dream Vacations charges only 1.5% to 3%, whereas Complete Weddings + Events may require 8%. Motto Mortgage offers an initial six-month royalty-free period, followed by a monthly fee of $4,500. Always review the Franchise Disclosure Document (FDD) to grasp the specific royalty fee structure and its impact on your profitability. Understanding these fees is crucial for making informed financial decisions. Marketing and Advertising Expenses Marketing and advertising expenses play a vital role in the success of your franchise investment. You’ll typically contribute a percentage of your gross sales, often between 1% to 5%, to an advertising fund for national or regional promotions. Moreover, local marketing initiatives are important, covering online ads, print materials, and community sponsorships. It’s also significant to budget for marketing materials like banners and flyers, as these improve your visibility. Here’s a quick breakdown of typical marketing costs: Expense Type Percentage of Sales Advertising Fund 1% – 5% Local Marketing Initiatives Varies Ongoing Marketing Support 2% – 4% Initial Marketing Budget 20% – 30% Understanding these costs helps you plan effectively for your franchise’s success. Training and Support Costs During investing in a franchise, comprehending training and support costs is vital for your overall budget. These costs can greatly impact your financial planning, so it’s important to account for them accurately. Initial training platform development can range from $10,000 to $30,000. Ongoing support staff expenses typically fall between $60,000 and $120,000 annually per position. Monthly technology fees for franchise management systems usually cost between $200 and $800 per unit. Furthermore, many franchises allocate 20-30% of their total budget to marketing and brand development, which often includes training initiatives. Initial training programs cover various aspects like operational procedures and inventory management, ensuring you’re well-equipped for success as a franchisee. Assessing Potential Revenue and ROI How do you determine the potential revenue and return on investment (ROI) when considering a franchise? Start by examining the average initial investment, which usually ranges from $100,000 to $300,000, with some low-cost options available under $15,000. Next, consider the revenue potential; for instance, Image One franchisees can earn up to $1 million, whereas Dream Vacations averages around $336,971 annually. Keep in mind that royalty fees, typically 5% to 9% of gross sales, will affect your profitability. Most franchisees recoup their initial investment within 2.5 to 3 years, indicating a reasonable ROI. With around 90% of franchise systems achieving profitability, franchises can be a safer investment compared to independent startups, presenting various revenue opportunities. Importance of the Franchise Disclosure Document (FDD) Grasping the significance of the Franchise Disclosure Document (FDD) is crucial for anyone considering a franchise investment. This legal document provides critical information about the franchise system that you need to make informed decisions. The FDD must be shared with you at least 14 days before signing any agreements, guaranteeing you have ample time to review it. With 23 items included, Item 7 helps you estimate your total investment by outlining initial purchase funds and ongoing capital needs. Audited financial statements included in the FDD promote transparency, whereas Item 19 may present financial performance representations, offering insights into potential earnings based on existing franchisee success. Understanding the FDD can notably impact your investment choice and future profitability. Support and Training Provided to Franchisees Support and training are critical components of a successful franchise investment, as they directly impact your ability to operate effectively and achieve your business goals. Many franchises provide thorough training programs covering vital skills like cleaning methods, marketing strategies, and inventory management. After signing, you typically receive an Operations Manual, which serves as your daily guide. Ongoing support often includes coaching and operational assistance, along with access to updated marketing resources. Some franchises may even offer specialized training platforms, requiring an initial investment of $10,000 to $30,000 for development. The level of support and training available can greatly improve your performance and increase your chances of achieving financial success in your franchise venture. Navigating State Filing and Registration Fees When you commence your franchise investment expedition, comprehending state filing and registration fees is crucial, as these costs can substantially affect your budget. Depending on the state and specific requirements, state filing fees can range from $1,000 to $4,500. Incorporation fees typically average around $300, whereas trademark filings with the USPTO cost about $250 per class. Furthermore, Franchise Disclosure Document (FDD) registration fees can vary from $250 to $750 per state. Consider these key points: Total costs fluctuate based on the number of states you’re operating in. Always account for state-specific fees in your budget. Research each state’s specific requirements to avoid surprises. Understanding these fees will help you plan effectively for your franchise investment. Strategies for Budgeting Effectively Effective budgeting for your franchise investment is vital to guarantee financial stability and success. Start by estimating your initial setup costs, ranging from $26,000 to $84,500, and don’t forget about first-year sales costs, which typically run between $22,500 and $75,500. Incorporate legal expenses for the Franchise Disclosure Document, costing between $15,000 and $45,000, and consider operational manual development, which can vary from $0 to $30,000. Furthermore, plan for state filing fees, usually $1,000 to $4,500, and budget for financial services, which may cost $2,500 to $5,000. Finally, account for ongoing expenses like royalty fees of 6-10% of gross sales and marketing costs, which can consume 20-30% of your first-year budget. Frequently Asked Questions How Much Does It Cost to Invest in a Franchise? Investing in a franchise typically costs between $48,500 and $160,000, influenced by the brand and support level. Initial franchise fees usually range from $20,000 to $50,000, meanwhile legal costs for the Franchise Disclosure Document can be $15,000 to $45,000. Furthermore, ongoing royalty fees of 5% to 9% of gross sales support franchisor services. Why Does It Only Cost $10k to Own a Chick-Fil-A Franchise? It only costs $10,000 to own a Chick-Fil-A franchise since the company retains ownership of the restaurant’s real estate and equipment. This approach greatly reduces the financial burden on franchisees. Nevertheless, you’ll need substantial financial resources, as total investments can range from $250,000 to $1 million, depending on location and size. Furthermore, Chick-Fil-A requires franchisees to be actively involved in daily operations, ensuring high service standards and effective management. What Is the 7 Day Rule for Franchise? The 7 Day Rule for franchises requires franchisors to provide you with the Franchise Disclosure Document (FDD) at least 14 days before signing any agreement. This gives you time to review the terms, obligations, and financial commitments involved. You can conduct due diligence, evaluating financial aspects and consulting existing franchisees. Adhering to this rule promotes transparency, protects both parties, and guarantees informed decision-making during safeguarding against potential legal repercussions for franchisors. What Are the 4 P’s of Franchising? The 4 P’s of franchising are Product, Price, Place, and Promotion. Product focuses on the quality and variety of goods or services your franchise offers, ensuring customer satisfaction. Price includes franchise fees, royalties, and other costs that can greatly impact your investment. Place refers to the locations and distribution channels essential for your franchise’s success. Finally, Promotion encompasses marketing strategies aimed at building brand awareness and attracting customers, often requiring contributions from franchisees. Conclusion In conclusion, budgeting for a franchise investment involves careful consideration of various costs, including initial franchise fees, real estate, inventory, and ongoing royalty fees. By estimating operating expenses and comprehending the Franchise Disclosure Document, you can make informed financial decisions. Furthermore, don’t overlook state filing fees and the importance of training and support from the franchisor. With thorough planning and accurate budgeting, you can set yourself up for a successful franchise operation. Image via Google Gemini This article, "How Much Does It Cost to Budget for a Franchise Investment?" was first published on Small Business Trends View the full article

-

How Much Does It Cost to Budget for a Franchise Investment?