All Activity

- Past hour

-

How Much Risk Do Clients Need?

Help them embrace it to reach their goals. By Aaron Klein and Dan Bolton The Holistic Guide to Wealth Management Go PRO for members-only access to more Rory Henry. View the full article

-

How Much Risk Do Clients Need?

Help them embrace it to reach their goals. By Aaron Klein and Dan Bolton The Holistic Guide to Wealth Management Go PRO for members-only access to more Rory Henry. View the full article

-

Four Options for Billing Clients

Of course we have a recommendation. By Jody Grunden Building the Virtual CFO Firm in the Cloud Go PRO for members-only access to more Jody Grunden. View the full article

-

Four Options for Billing Clients

Of course we have a recommendation. By Jody Grunden Building the Virtual CFO Firm in the Cloud Go PRO for members-only access to more Jody Grunden. View the full article

- Today

-

What Is a Hybrid Loan for Business and How Does It Work?

A hybrid loan for business is a unique financing solution that blends fixed and variable interest rates, making it adaptable to your financial needs. Initially, you’ll benefit from a fixed interest rate for a set period, often three to five years, which helps manage cash flow. After this introductory phase, the loan shifts to a variable rate. Comprehending how these loans function and their key features could be essential for your business’s financial strategy. Key Takeaways A hybrid loan combines fixed and variable interest rates, providing flexibility in business financing options. It typically starts with a fixed interest rate for 3-5 years, followed by variable payments. Borrowers can choose between a lump-sum loan or a line of credit, with interest-only payments during the draw period. Eligibility requires a minimum annual revenue of $100,000 and a credit score of 700 or higher. Common uses include refinancing debts, bridging cash flow gaps, and funding inventory purchases. Understanding Hybrid Loans When you’re considering financing options for your business, grasp of hybrid loans can be crucial. A hybrid loan for business combines fixed and variable interest rates within a single product, providing you with flexibility. These loans can either be structured as a lump-sum loan or a credit line hybrid, allowing access to funds customized to various business needs. Typically, they start with a fixed interest rate for an initial period of three to five years, which is beneficial for managing costs. Nevertheless, once this period concludes, the loan shifts to a variable rate, meaning your payments could fluctuate. This structure offers lower initial rates but requires you to be prepared for potential changes in your payment amounts. Comprehending these features will help you make informed decisions about financing that best suits your business’s financial strategy and goals. Key Features of Hybrid Loans Hybrid loans for businesses offer a unique combination of fixed and variable interest rates, giving you the advantage of lower payments during the initial fixed-rate period. You additionally have flexible borrowing options, whether you choose a lump-sum loan or a line of credit, which can adapt to your business needs. During the initial draw period, you can access funds and typically only pay interest, making it easier to manage your cash flow. Fixed and Variable Rates Comprehending the structure of fixed and variable rates in hybrid loans is vital for businesses considering this financing option. Usually, hybrid loans start with a fixed interest rate for three to five years, allowing for predictable monthly payments during this period. Once the fixed-rate term ends, the loan shifts to a variable interest rate, which can fluctuate based on market conditions, potentially leading to varying monthly payments. Fixed rates are typically influenced by the current Federal Reserve prime rate, with lenders adding two or more percentage points. As variable rates can change markedly, it’s important for borrowers to budget for possible increases in payments. This dual structure enables businesses to enjoy lower initial payments as they prepare for future rate adjustments. Flexible Borrowing Options Comprehending the flexible borrowing options offered by hybrid loans can greatly benefit your business’s financial strategy. These loans allow you to access funds as needed, providing a versatile approach to financing. You can choose between a lump-sum loan or a line of credit, depending on your unique needs. Make interest-only payments during the initial draw period, reducing upfront costs. Enjoy lower initial fixed rates compared to traditional loans, which helps manage cash flow. Convert to a fixed-rate installment loan after the draw period, ensuring predictable monthly payments. These features cater to various business scenarios, enhancing your ability to adapt to changing financial demands throughout keeping budgeting manageable. Initial Draw Period After exploring flexible borrowing options, it’s important to understand the specifics of the initial draw period in hybrid loans. This period usually lasts between six months to a year, allowing you to access funds up to the lender’s limit without needing to make full repayments right away. Throughout this time, you’ll typically make interest-only payments, which helps keep your upfront costs low as you meet your business needs. The loan often functions as a revolving line of credit, giving you the flexibility to withdraw and repay as required. After the draw period, the loan converts to a fixed-rate installment loan, providing predictable monthly payments. Keep in mind that interest rates during this period are usually variable, affecting future repayment amounts. Types of Hybrid Loans When exploring the types of hybrid loans available for businesses, you’ll find two primary structures that cater to different financial needs. The first type is a lump-sum loan, which comes with a fixed interest rate for an initial period, typically lasting three to five years. This structure often features lower initial rates before shifting to a variable interest rate. The second type is a hybrid business line of credit. This option allows you to withdraw funds up to a specified limit during a draw period, typically lasting six months to a year, requiring only interest payments during this time. After the draw period, it converts to a fixed-rate installment loan, which offers predictable monthly payments for the remaining term. Lump-sum loan with fixed initial rates Hybrid business line of credit for flexible access Predictable payments after the draw period How Hybrid Loans Work Hybrid loans combine fixed and variable interest rates, giving you a unique structure for financing your business. Initially, you’ll enjoy a fixed rate for three to five years, which then shifts to a variable rate that can fluctuate based on market conditions. Comprehending these payment terms and the dynamics of your interest rates is essential for managing your financial obligations effectively. Loan Structure Explained Comprehending how a hybrid loan works is essential for businesses considering this financing option. Hybrid loans typically start with a fixed interest rate for three to five years, then shift to a variable rate, which can lead to fluctuating payments. During the draw period of six months to a year, you can access funds up to the lender’s limit and usually make interest-only payments. After this period, the loan converts to a fixed-rate installment structure, allowing for predictable payments for the rest of the term. Key aspects to remember include: Fixed rates are often based on the Federal Reserve prime rate plus additional points. Lenders evaluate credit scores and business revenue. Minimum operational history of two years is required. Payment Terms Overview Comprehending the payment terms of a hybrid loan can greatly impact your business’s financial planning. Typically, these loans start with a fixed interest rate for an initial period of three to five years, giving you predictable payments. After this period, the loan adjusts to a variable interest rate, which can result in fluctuating monthly payments based on market conditions. This variability may challenge your budgeting efforts, leading some borrowers to contemplate refinancing options. Furthermore, hybrid business lines of credit often allow for interest-only payments during the initial draw period, lasting six months to a year, which helps ease immediate financial pressure. Interest Rate Dynamics Comprehending how interest rates function in hybrid loans is crucial for managing your business’s finances effectively. Typically, hybrid loans start with a fixed interest rate for three to five years, offering you predictable payments. Once this fixed-rate period ends, the loan changes to a variable interest rate, which can result in fluctuating monthly payments influenced by market conditions. Here are some key points to reflect on: The initial fixed rates are often based on the current Federal Reserve prime rate, plus an additional margin set by the lender. After the fixed period, you might face challenges with budgeting because of variable payments. Hybrid business lines of credit allow for interest-only payments during the initial draw period before moving to a fixed-rate installment loan. Benefits of Hybrid Loans As you explore financing options for your business, it’s essential to understand the benefits of hybrid loans, which effectively blend fixed and variable interest rates. These loans provide lower initial rates during the fixed-rate period, typically lasting three to five years, before shifting to a variable rate. They offer flexibility, allowing you to draw funds as needed and often requiring only interest payments initially, which helps minimize costs. Additionally, hybrid loans can simplify financial management by consolidating multiple debts into one loan, potentially reducing overall interest expenses and monthly payments. They’re particularly advantageous for businesses facing fluctuating cash flow, as you can access necessary funds without the immediate pressure of fixed repayments. With the potential for lower rates than traditional loans, hybrid loans improve overall financial stability and adaptability for businesses maneuvering various growth phases. Benefit Description Impact on Business Lower Initial Rates Enjoy reduced rates during the fixed period Decreased upfront costs Flexibility Draw funds as needed, with interest-only payments Improved cash flow management Debt Consolidation Combine multiple debts into one loan Simplified financial management Cash Flow Management Access funds without fixed repayment pressure Enhanced adaptability Potential Cost Savings Lower rates compared to traditional loans Improved financial stability Draw Period and Repayment Terms Comprehending the draw period and repayment terms of a hybrid loan is crucial for effective financial planning. The draw period typically lasts between six months to a year, during which you can withdraw funds as needed and make interest-only payments. This flexibility helps manage cash flow and cover unexpected expenses. Once the draw period ends, the loan converts to a fixed-rate installment loan, resulting in predictable monthly payments over about 60 months. Here are some key points to reflect on: The fixed-rate period usually lasts three to five years before shifting to a variable interest rate. Budgeting can become challenging once the repayment begins, as your monthly payment amount will change. Some borrowers may explore refinancing options to maintain more stable payment terms. Understanding these elements will help you plan effectively and avoid potential financial strain. Interest Rates Explained When you take out a hybrid loan, you’ll first encounter a fixed interest rate for a set period, usually three to five years, which makes your payments predictable. After that, the rate shifts to a variable one that can change based on market conditions, impacting your monthly payments considerably. Comprehending this shift and how it affects your budget is essential for effective financial planning. Fixed vs. Variable Rates Comprehending the differences between fixed and variable interest rates is crucial for anyone contemplating a hybrid loan for business. Hybrid loans typically begin with a fixed interest rate for three to five years, allowing for predictable payments. After this period, they shift to a variable rate, which can fluctuate based on market conditions and lender pricing. Here are some key points to reflect on: Fixed rates are often based on the Federal Reserve prime rate plus a lender’s margin, making them competitive with traditional loans. Variable rates can change considerably, impacting your monthly payments and overall borrowing costs. Be prepared for payment adjustments after the fixed-rate period, as this can complicate budgeting and repayment planning. Rate Adjustment Period Grasping the rate adjustment period in a hybrid loan is vital for effectively managing your finances. Typically, these loans start with a fixed interest rate for three to five years, based on the Federal Reserve prime rate plus a margin of at least two percentage points. Once this fixed-rate period ends, your loan converts to a variable interest rate, which means your monthly payments can fluctuate based on market conditions. This variability can complicate your budgeting, making it important to prepare for potential changes in your payments. You might even want to reflect on refinancing into another fixed-rate loan before the variable-rate phase begins to maintain more predictable payments. Comprehending this period helps you navigate financial planning effectively. Impact on Payments Comprehending how interest rates in hybrid loans affect your payments is crucial for effective financial management. Hybrid loans typically start with a fixed interest rate for three to five years before shifting to a variable rate, which can lead to fluctuating monthly payments. Here are a few key points to reflect on: Fixed rates are often based on the Federal Reserve prime rate plus a margin, impacting your overall borrowing costs. After the fixed period, your payments may change notably, influenced by market conditions and the lender’s variable rate structure. During the initial draw period, interest-only payments are usually required, helping you manage cash flow before switching to a fixed repayment schedule. Understanding these dynamics can help you plan your finances effectively. Eligibility Requirements for Hybrid Loans To qualify for a hybrid loan, businesses must meet several key eligibility requirements that demonstrate their financial stability and operational history. Typically, lenders look for a minimum annual revenue of around $100,000 and at least two years of operational history. Requirement Description Importance Annual Revenue Minimum of $100,000 Indicates business viability Credit Score Score of 700 or higher, clean history Reflects creditworthiness Business Plan Clear outline of loan usage Shows responsible planning Collateral Possible requirement for larger loans Secures favorable loan terms Additionally, lenders assess personal credit scores, requiring a clean history free from liens or bankruptcies. A solid business plan, along with financial documentation like balance sheets and cash flow statements, is often necessary. Thankfully, hybrid loans usually demand fewer documents than traditional loans, making the application process simpler. Pros and Cons of Hybrid Loans Although hybrid loans can be a strategic financing option for businesses, they come with a mix of advantages and disadvantages. On one hand, you benefit from lower initial interest rates during the fixed-rate period, making it a cost-effective choice. Moreover, the flexibility of interest-only payments in the early stages can help manage your cash flow effectively. Nevertheless, these loans have their drawbacks. After the fixed-rate period, your monthly payments may fluctuate, complicating your budgeting. The shorter draw periods may limit your access to funds when you need them most. If interest rates rise, you risk facing considerably higher payments during the variable rate phase. Understanding these pros and cons can help you make an informed decision about whether a hybrid loan aligns with your business’s financial needs and goals. Alternatives to Hybrid Loans When considering financing options for your business, it is essential to explore alternatives to hybrid loans that may better suit your needs. Here are some viable options: Option Description Pros Traditional Business Loans Fixed amounts, predictable repayments, often require collateral Good for those with weaker credit profiles Business Lines of Credit Flexible withdrawals, longer draw periods Extended access to capital Business Credit Cards Short-term funding, potential cashback rewards Attractive promotional offers SBA Loans Lower interest rates, longer terms Suitable for small businesses Invoice Factoring Sell accounts receivable for immediate cash flow Quick funding solution without debt Each of these alternatives has its own benefits and considerations, so evaluate them carefully to find the best fit for your unique situation. Common Uses for Hybrid Loans Hybrid loans serve a variety of purposes for businesses, making them a versatile financing option. They can be particularly beneficial in several key areas, allowing you to meet different financial needs efficiently. Refinancing existing debts: You can consolidate multiple loans into one, simplifying repayment and potentially lowering interest rates. Bridging cash flow gaps: Hybrid loans provide crucial funds during slow periods, helping you cover operational expenses without stress. Funding inventory purchases: These loans allow you to buy in bulk, taking advantage of discounts as you manage your cash flow effectively. Additionally, hybrid loans can serve as a financial safety net, giving you access to funds for unexpected expenses or emergencies. Tips for Managing a Hybrid Loan Managing a hybrid loan effectively requires careful planning and attention to detail, especially given the unique structure of these loans. Start by creating a detailed budget that considers both the fixed-rate and variable-rate periods. This guarantees you’re prepared for payment fluctuations once the initial fixed term ends. Keep an eye on market interest rates; refinancing to a fixed-rate loan before the variable period can save money if rates are expected to rise. During the draw period, make interest-only payments to ease cash flow strain, giving you more flexibility for operational expenses. It’s vital to maintain a good credit score, as a strong credit history and low debt-to-income ratio will help you qualify for better refinancing options. Regularly review your financial statements to assess cash flow and confirm you can meet repayment obligations, particularly during the shift to fixed payments. Frequently Asked Questions What Is a Hybrid Business Loan? A hybrid business loan blends fixed and variable interest rates, giving you initial lower rates and predictable payments for a set time. Usually, it’s available as a lump sum or line of credit, providing flexibility as your business grows. You might pay only interest during the initial draw period, minimizing upfront costs. To qualify, you’ll typically need a solid business plan, good credit, and annual revenue of at least $100,000. What Is the Monthly Payment on a $50,000 Business Loan? The monthly payment on a $50,000 business loan depends on several factors, including the interest rate and loan term. For a traditional loan with a 7% fixed interest rate over five years, you’d pay about $1,000 per month. If it’s a hybrid loan, initial payments might be lower, possibly interest-only for the first six months. Always consider additional fees, as they can greatly impact your total monthly payment amount. What Is an Example of a Hybrid Loan? An example of a hybrid loan could be a business loan that starts with a fixed interest rate of 4% for the first three years. After that period, it shifts to a variable rate, which might change based on market conditions. This structure allows you to manage initial cash flow better, as your payments remain predictable initially. You can additionally consider refinancing before the variable rate kicks in to maintain budget control. How Does Hybrid Financing Work? Hybrid financing works by combining fixed and variable interest rates, giving you a stable payment initially, usually for three to five years. After this period, your rate shifts to a variable one, which can fluctuate based on market conditions. You might receive the funds as a lump sum or a line of credit, allowing for flexible cash flow management. Lenders assess your credit score and revenue to determine eligibility for this financing option. Conclusion In conclusion, a hybrid loan for business offers a blend of fixed and variable interest rates, providing initial stability with the potential for flexibility as your financial needs evolve. It can help manage cash flow during the early stages, making it easier to handle payments. Nevertheless, it is crucial to weigh the benefits against potential risks, such as fluctuating rates after the initial period. By comprehending how hybrid loans work, you can make informed decisions that align with your business goals. Image via Google Gemini and ArtSmart This article, "What Is a Hybrid Loan for Business and How Does It Work?" was first published on Small Business Trends View the full article

-

Puppies, not politics, won Super Bowl Sunday

Americans expressed their preference for alternatives to the Super Bowl this year, and Kid Rock wasn’t it. The Puppy Bowl brought in 15.3 million viewers last Sunday according to official Neilsen numbers released Thursday, the pup-centered event’s biggest audience since 2018. The Super Bowl side event featuring romping baby dogs, now in its 22nd year, offers a lighthearted alternative for anyone alienated by the yearly American football ritual. In the Puppy Bowl, two teams of puppies (Team Ruff and Team Fluff) wrestle, romp and nap their way down a miniature football field featuring live play-by-play commentary, referees, and even a “Lombarky” trophy. The event raises money for animal shelters and also adopts out most of its own star pups, whether they emerge victorious or not. Last year, 12.8 million viewers tuned in to the Puppy Bowl, which airs on Animal Planet, Discovery, TBS, truTV, and HBO Max. The fluffy Super Bowl alternative drew in 6 million viewers in its first year and has been averaging around 12 million viewers in the last handful of years. “This year’s Puppy Bowl delivered its strongest performance in nearly a decade, and its success across linear and streaming highlights our unique ability to unite audiences around content that feels good and does good,” Discovery Channel Head of Content Joseph Boyle said in a press release. “We’re grateful to bring viewers so much joy and are deeply proud of the purpose at the heart of this event.” The Puppy Bowl wasn’t the only alternative Super Bowl show in town. Billed as the “All-American Halftime Show,” conservative org Turning Point USA promoted a MAGA-approved alternative show headlined by Kid Rock for people angry about Bad Bunny’s booking at Super Bowl LX. This year, Super Bowl LX’s official halftime show starring Bad Bunny averaged 128.2 million viewers – enough to put it in the all-time top four, but a dip from Kendrick Lamar’s record-setting 133.5 million viewers in 2025. The performance was almost exclusively in Spanish, a choice that inspired outrage from President The President and others in his orbit, but still inspired a massive swath of people to tune in. MAGA’s hater halftime While the Kid Rock halftime show was originally expected to stream on X, by game time Turning Point USA hit a snag and was pointing followers solely to its YouTube stream. “UPDATE: Due to licensing restrictions, we are unable to stream The All-American Halftime Show on X,” the organization wrote on X. “Head on over to our YouTube channel tonight around 8PM ET to watch the full show 🇺🇸.” On YouTube, the competing performance pulled six million concurrent viewers at its peak. On MAGA-friendly video site Rumble, the concert had been viewed 2.3 million times as of Thursday morning. If all two million of those views happened live, which isn’t likely, that could leave the Kid Rock-led show at around 8 million viewers without factoring in some of the niche networks with relatively small audiences like OAN that aired the performance. Much like the Puppy Bowl, Turning Post USA’s alternative Super Bowl halftime show was pre-taped. An intro video from U.S. Defense Secretary Pete Hegseth kicked things off, praising the organization founded by the late Charlie Kirk for its courage. During the headline performance, Kid Rock visibly struggled to lip sync the words to his own hit song “Bawitaba,” joining the backing track only occasionally – a fact made even more puzzling given that it was pre-recorded. MAGA-approved musicians Brantley Gilbert, Lee Brice and Gabby Barrett also performed during the alternative halftime show. By Thursday afternoon, Turning Point USA’s video of the Kid Rock-led concert was up to 21 million views, which is closer to the only numbers that Turning Point has provided publicly. The NFL’s official YouTube channel racked up more than 78 million views of Bad Bunny’s performance during the same time frame. Republicans vs. Bad Bunny In a Truth Social post following Bad Bunny’s halftime show, President The President called the international superstar’s notably joyful celebration “absolutely terrible.” “Nobody understands a word this guy is saying,” The President said, sidestepping the fact that the NFL itself chose Bad Bunny to reach a massive, untapped audience within the U.S. and abroad. The game itself wasn’t always riveting, but Bad Bunny’s Super Bowl halftime show was widely considered to be a performance for the ages. The inventive Spanish language set showcased energetic choreography, intricate street scenes of New York and Puerto Rico, many nods to the island’s culture and its struggles, and even a real, live wedding. The President wasn’t the only one to criticize Bad Bunny. House Speaker Mike Johnson told a reporter last year that the NFL made a “terrible” decision when it invited Bad Bunny, one of the most popular musicians in the world. “There are so many eyes on the Super Bowl, a lot of young, impressionable children,” Johnson said. The irony is rich given the fact that Kid Rock’s own songs have glorified statutory rape. The 2001 Kid Rock song “Cool, Daddy Cool” features the lines “Young ladies, young ladies, I like ’em underage,” and “See, some say that’s statutory, but I say it’s mandatory” – lines that drew fresh outrage leading up to the Super Bowl. Other members of the MAGA base questioned or outright denied Bad Bunny’s status as an American citizen, including super influencer-turned-boxer Jake Paul, who called the performer a “fake American citizen” – a claim so plainly racist that even his brother called him out. “Puerto Ricans are Americans & I’m happy they were given the opportunity to showcase the talent that comes from the island,” Logan Paul wrote on X. View the full article

-

This MIT grad built an AI tool to show how hard Olympic figure skating actually is

Part of a figure skater’s job is to make their routine look as effortless and graceful as possible, as if they’re floating on ice and soaring into the air through sheer force of will. In reality, they’re often launching themselves multiple feet into the air with what amounts to sand bags on their feet; generating hundreds of pounds of centripetal force through rotations; and landing on a blade that’s just 3/16 of an inch wide. At the 2026 Winter Games in Milan and Cortina, Italy, NBC is using an AI tool developed by a former MIT researcher to help audiences understand just how mind-boggling the feats of today’s Olympic athletes are. Jerry Lu Jerry Lu is a 2024 MIT graduate and the founder of OOFSports, a sports analytics company that uses AI to analyze program footage, document performance data in real time, and allow commentators to give viewers a more concrete understanding of athletes’ feats. At Milan Cortina, he’s partnering with NBC Sports on its figure skating, snowboarding, and skiing programming, collecting data like the height of jumps, athletes’ speed, and their rotational paths. As figure skaters continue to break new ground in the sport—like landing more and more jumps with quadruple rotations (see American skater Ilia Malinin’s first-ever quad axel landed at the Olympics), Lu’s AI-powered tech can help make sense of their routines, moment by moment. A big ask from NBC Lu’s career in sports analytics began with his own interest in competitive swimming. During his undergraduate studies at the University of Virginia, he worked with the mathematician Ken Ono to develop a wearable device that let the school’s swimmers analyze their strokes, which helped them to increase propulsion and reduce drag. Lu later served as a technical consultant for five swimmers who won medals at the Tokyo Olympics in 2020, followed by 16 medalists at the Paris Olympics in 2024. During his time at MIT in its dedicated sports lab, Lu began experimenting with sports analytics technology for other fields, including a program designed to help Australia’s BMX freestyle team optimize its strategy. Following the Paris Olympics, he says, NBC approached him directly to ask if he could create a data analytics system for figure skating in Milan Cortina. “At that point, some of the artistic sports were missing this data-driven storytelling ability—if you watch hockey on TV, it looks slow, but if you watch it in person, it looks fast,” Lu says. Similarly, he explains, if one were to watch American figure skater Amber Glenn perform a jump on screen, it might not look mind-blowing—but in person, she would be soaring unbelievably high in the air. NBC needed a way to bridge the gap between those two experiences. Building an AI model for the Olympics For Lu and his team—none of whom are skaters—the first step toward building this tool was jumping on a call with former Olympic skaters and longtime NBC analysts Tara Lipinski and Johnny Weir. Unlike sports like swimming or track and field, the judging parameters for figure skating can involve quite a bit of grey area, meaning that Lu’s team needed a full run-down of what the judges would be looking for. “They essentially taught us the sport,” Lu says. “They taught us exactly what they were looking for, what the judges are looking for, what, from their understanding, is a virtue, and what’s a vice. We needed to come up with ways to quantify those and essentially give them the metrics with which they can compare across athletes.” Making a tool for analyzing figure skating required a completely different system from swimming, Lu says. Whereas propulsion and drag were the two main variables in that sport, figure skating is all about the speed and rotation needed to complete complicated jumps. To calculate those metrics without wearables, his team trained an AI model to analyze program footage and identify a variety of rotational points on the athlete’s body, from their head to shoulders, elbows, hips, and ankles. Using those data points, the team then taught the model to categorize different jumps based on body positioning—like the toe loop, luxe, and axel—and, further, to count the athlete’s total rotations in order to classify the jumps as a double, triple, or quad. By understanding exactly where the skater is at any given point, the AI model can calculate statistics like their speed when entering a jump, total jump height, jump exit speed, and the ground they cover across the rink; all crucial elements of their performance. These kinds of numbers can help commentators like Lipinsky and Weir paint a much more detailed picture for this year’s Olympic viewers. Will AI ever replace Olympic figure skating judges? This researcher says no Outside of his collaboration with NBC, Lu has turned his figure skating model into an app called OOFSkate, which lets skaters of any level film their routines and instantly understand their own stats. The app became an official partner of U.S. Figure Skating in December 2025. Lu’s next step is creating a version of this technology that not only tracks skaters’ routines, but also scores them. Right now, he already has a model in the works, which he plans on debuting some time during the skating off-season. Ultimately, he says, the model will be able to assist in evaluating technical performance on a select number of skills, but it will never replace human judgements on athletes’ artistic performance. “Figure skating is this very unique blend of artistic and technical abilities,” Lu says. “The Olympics is all about athletes going higher, faster, stronger—otherwise you don’t deserve to be here. Figure skating has a part of that, which is that the bigger jumps get awarded bigger points, which is correct—if you did a quad and I did a triple, you should get more points. But at the same time, this artistic element is also part of the thesis of figure skating.” View the full article

-

DraftKings just posted blowout earnings. So why did the stock crater?

For investors, DraftKings has been anything but a sure bet. The company reported earnings on Thursday, which showed revenue of nearly $2 billion—an increase of 43% year-over-year—and earnings per share of $0.25. “We closed 2025 on a high note. Fourth quarter revenue increased 43% year-over-year and we achieved records for revenue and Adjusted EBITDA. Our core business is strong as we enter 2026,” said Jason Robins, DraftKings’ Chief Executive Officer and Co-founder, in a statement included with the earnings release. However, despite the strong numbers, DraftKings’ stock was down more than 15% during pre-trading on Friday morning, and is now down almost 30% since the beginning of the year. Further, over the past calendar year, it’s down more than 45%. The catalyst? Future uncertainty. Specifically, the company is forecasting “fiscal year 2026 revenue guidance range of $6.5 billion to $6.9 billion and a fiscal year 2026 Adjusted EBITDA guidance range of $700 million to $900 million,” which is below estimates and softer than anticipated. The broader issue is that the sports gambling and prediction markets are evolving quickly, and there’s the distinct possibility that regulation could rein things in, or that individual states could start to tax the companies or users themselves to different degrees. Further, prediction market companies like Kalshi and Polymarket are now in the fray, and both of those companies may offer users a different way to scratch their itch by offering betting products that are exempt from state taxes due to the way they’re structured. DraftKings, too, has a predictions app (DraftKings Predictions) available to users in 38 states, while its sports betting app is available in 28 states. DraftKings isn’t alone in taking it on the chin from the markets. Flutter Entertainment, the largest sports betting stock by market cap, and parent company of FanDuel and others, was likewise down more than 4% before the market opened on Friday, and down more than 35% year-to-date. MGM, which also runs a betting app, was down by similar amount, as was Caesars. View the full article

-

10 Hacks for Hanging Pictures Perfectly Every Time

We may earn a commission from links on this page. Who among us has not looked at a newly framed picture, then looked at their wall and thought, "Eh, surely I can eye-ball it this time." Hanging pictures should be an easy feat, but so often they end up uncentered or slightly crooked, causing us to add more holes the wall than intended or desired. The next time you hang pictures or artwork in your home, use one of these 10 hacks so they're level and evenly spaced on the first try. Use a small ball as a makeshift level to hang picturesA level is essential when hanging art—a frame that’s even slightly crooked will be an eyesore, and if you’re hanging multiple pieces in a group, it’s even more important that everything be level. If you forgot to grab your level, or you don’t have one, you can use a small ball, like a ping pong ball or a marble. Place it on top of the frame and adjust until the ball sits still, then mark it on the wall. Use painter’s tape to accurately space two nails when hanging a pictureIf your frame has two widely spaced hooks, knowing where to insert your nail, screw, or other fastener on the wall can be a mind-bending challenge. But if you have some painter’s tape on hand, it’s easy: Place a piece of tape across the back of the frame, with the top of the tape lined up with the top of the hooks. Mark the position of the hooks with a marker or pen, then remove the tape and place it on the wall at the desired height. Using a level, adjust the tape until it’s placed correctly. Then drive your nails right through the tape at the marked locations, remove the tape, and hang your picture. Here's a visual tutorial. Use toothpaste to help you mark the spots where hooks or nails need to goAn alternative to the painter’s tape method is to use some toothpaste (or any gooey, sticky stuff that will wash off your wall easily). Mark the hooks on the back of the frame with a gob of toothpaste, check that it's level and at the desired height on your wall, then press the frame against the wall. The toothpaste will mark the precise spot where you need to drive your nails to hang the frame. Insert your fasteners, clean everything up, and hang that picture in the perfect spot. Here's a visual tutorial. Make this quick DIY tool to mark the spot for a hook or nail when hanging a pictureIf you have spare cardboard (a cereal box will do) and a pin or thumbtack, you can make a little DIY tool that will make marking the spot for a hook or nail easy. Cut out a rectangle of cardboard, then cut a tab at the bottom that’s narrow enough to fit through the hook on the back of the frame. Slide the tab through, and push a pin or tack through from the back. Then push the picture into the wall at the right spot, and the pin will create a tiny hole where your hook or nail needs to be. Here's a visual tutorial. Use string to guide a hook onto a nail when hanging a pictureGot the nail in the wall, but can’t seem to catch the hook on the picture frame? Get a piece of string and loop it around the nail, then adjust so the ends are even. Take both ends together and run them through the hook, then pull the string tight as you bring the frame toward the wall. The string will guide the hook right onto the nail, no guesswork required. Here's a visual tutorial. Use a fork to guide wire onto a nail when hanging a pictureIf your frame uses a wire across the back to catch a nail or hook in the wall, you know that sometimes you question your own perception of reality as you repeatedly fail to catch the hook on the wire. There’s an easy hack: Grab a fork from the kitchen and place it on the nail or hook in the wall so it leans outward. Then hook the wire onto the stem of the fork and slide the frame down, letting the fork guide the wire down. When it’s hooked, remove the fork and admire your work. (And wash the fork, probably.) Here's a visual tutorial. Hang pictures with Monkey Hooks if you don't want to use any toolsHanging art on drywall and dread all the mess and trouble of drilling or nailing? Skip it by using Monkey Hooks instead. These are self-drilling pieces of wire—you just poke them through the wall with a tiny bit of elbow grease—that spin around and provide strong, secure hooks that can hold up to 50 pounds of weight, all without a single tool. Here's a visual tutorial. Monkey Hooks Picture Hangers Home and Office Pack, Gorilla Hook, Drywall Hooks for Hanging Pictures, Wall Hooks, Picture Hangers, Picture Hanging Kit, 30 pc set $15.49 at Amazon Shop Now Shop Now $15.49 at Amazon Make this paper template when you're hanging multiple pictures in one areaIf you’re going to be hanging multiple frames on the wall, grab some paper and create a template first. You can use wrapping paper, butcher paper or any kind of paper you have lying around or can get your hands on cheap (you can also use cardboard if that’s what you have on hand). Lay your frames out on the paper and trace them carefully. Then use the toothpaste or cardboard/nail hacks described above to mark where the nails need to be placed. Hang the template on the wall (ensuring it’s level), hammer in your nails, remove the template, and hang your frames. Here's a visual tutorial. Use an envelope to catch dust when drilling to hang a pictureIf you’re going to drill or nail into your walls to hang pictures, you’re going to get a lot of annoying dust all over the place, unless you use a very simple hack: Tape an envelope to the wall underneath where you’ll be drilling. It will catch all that dust and save you the extra step of vacuuming afterward. If you don’t have any envelopes (or tape), some Post-it Notes will do in a pinch—just fold one in half and stick it to the wall under the spot where you’ll be drilling, and it will catch that dust. You can combine more than one Post-it if you need to. Here's a visual tutorial. Use your own saliva to mark the spot where you need to hang a pictureIf all else fails, and you need to hang a framed picture but you are short on time or patience, there’s a simple solution: Lick the back of your finger, curl it over the hanging hook on the back of the frame, and place it against the wall at the desired height (typically around 57-60 inches from the floor). Your own saliva will leave a faint, temporary mark on the wall where you can confidently place your hook without fuss or delay. View the full article

-

open thread – February 13, 2026

It’s the Friday open thread! The comment section on this post is open for discussion with other readers on any work-related questions that you want to talk about (that includes school). If you want an answer from me, emailing me is still your best bet*, but this is a chance to take your questions to other readers. * If you submitted a question to me recently, please do not repost it here, as it may be in my queue to answer. The post open thread – February 13, 2026 appeared first on Ask a Manager. View the full article

-

Should partnered people give their ‘work spouse’ a Valentine?

Maybe you first bonded over shared workplace frustrations. You gradually started finding each other every lunch break and synchronizing trips to the coffee machine. Eventually they become a confidant for venting about your real life outside of work. They become your work spouse. And if you find yourself strolling the greeting card aisle sometime today, you may even feel compelled to get this person in your life a trinket for celebrating the most romantic day of the year. Turns out, there are options available. “For my work wife on Valentines day,” one option reads from Card Factory. “I’ve finally found someone just as inappropriate as me!” A card to show appreciation for your work spouse on Valentine’s Day might seem like a sweet gesture. But if you have an actual spouse or partner waiting at home. . .they might think differently. “Im sorry,” one TikTok creator posted after spotting the card in the wild, “but the argument that would ensue if my partner came home from work with one of these cards from his colleague on Valentine’s day.” “I’m already mad thinking about it,” one user commented. The video quickly racked up almost 700,000 views and hundreds of comments. Another quipped: “I didn’t know card factory even sold divorce papers.” A third wrote: “the person who designed them cards just LIVES to stir up drama, i just know it.” While honoring a colleague on Valentine’s Day might be taking things a little far if you’re otherwise spoken for, the idea of a work wife or work husband has been a feature of American offices for decades. It’s also been much-parodied online, with the overly flirtatious colleague stereotype a trigger for many. “I’m not even married but I’m already planning an argument with my husband,” one comment under a viral skit read. “I punched my phone by reflex,” another added. The boundaries of the work spouse relationship can get blurry. It’s by nature more intimate from other workplace relationships, but it must remain strictly platonic. Some scholars have argued that the connection actually sits somewhere between friendship and romance. “Having lunch with my work wife,” one TikTok creator posted. “Hoping my ‘wife wife’ doesn’t find out.” Of course, having close friendships at work is no bad thing. In fact, it’s good for both productivity and performance. According to a new study from KPMG, employees said that having workplace friendships increases their motivation to go above and beyond their job description. More than half (57%) would even take a salary 10% below market rate if it meant being able to have close friends at work. But labeling someone other than your spouse your “wife” or “husband”, however innocently, can easily spiral into conflict, especially given the close proximity that working together necessitates. A 2023 Newsweek poll found that 45% of adults in the U.S. don’t think it’s appropriate to have a work spouse. Only 21% deemed it okay. Having a work spouse is one thing. But getting them a Valentine’s Day card if you have an actual spouse at home? That might be a one-way ticket to the doghouse. View the full article

-

Jeff Bezos could save ‘The Washington Post,’ but he won’t. Here’s why

News that the Washington Post had laid off hundreds of workers and scrapped several sections of the storied paper altogether stunned the journalism community last week. The Post cut roughly one-third of its staff, reduced local coverage, and completely destroyed its sports and international departments. The paper is owned by Jeff Bezos. The Amazon founder, who has a staggering net worth of approximately $250 billion, bought the Post for $250 million in 2013. The newspaper has consistently lost more money than it has made since the 2020 election, yet has long been considered a stalwart of American dailies. But last week, The Post’s editor-in-chief Matt Murray told employees the layoffs were part of a “strategic reset” meant to attract more customers. Though he acknowledged the cuts were “painful,” the overall messaging seemed to be that they were necessary. Of course, not everyone agrees. Martin Baron, who served as the outlet’s executive editor until 2021, told The Guardian, “This ranks among the darkest days in the history of one of the world’s greatest news organizations.” But one question has persistently risen out of the fog of disappointment and disillusionment: if Jeff Bezos understood that owning such a vital newspaper was a “sacred trust,” why is he no longer willing to keep it running at a loss for a tiny percentage of his net worth? Yes, the financial optics for the Post aren’t the most promising: the New York Times reported in 2022 that the paper’s online ad revenue fell to $70 million that year, a 15% drop from 2021. Last year the number of print subscriptions fell to below 100,000 for the first time in 55 years. The Post hoped to gain 5 million digital subscribers by 2025; in late 2024, the outlet reported having approximately 2.5 million digital subscribers. And the Post lost $177 million in 2023 and 2024 combined, per the New Yorker. Trebor Scholz, a scholar-activist and Associate Professor for Culture & Media at The New School in New York who has authored several books on labor and economics, hinted that it might just be that Bezos simply doesn’t find the Post “useful” anymore. Bezos is a businessman first and foremost, and if the paper isn’t making money, cuts have to be made. “I think financially, [the Post] is not a great consideration for him, right?” Scholz says. He also pointed out that Bezos may have “lost interest” in the newspaper after owning it for several years and called to mind Elon Musk’s decision to purchase X, then Twitter, in 2022. Musk intended to own the social media platform as a means to “control discourse” and “swing the political atmosphere in a particular direction,” Scholz says. That plan appears to have worked, he added, as X, which was considered an online gathering space for politically engaged people of all persuasions during Twitter’s heyday, is now “fairly useless for social movements” and has “really turned into this sort of toxic right-wing space.” (The platform has spent considerable time and money battling a surge in bots and misinformation since Musk’s takeover.) The Post isn’t the only newspaper that’s been taken over by a seemingly “benevolent billionaire,” Christina Bellantoni, director of USC’s Annenberg Center and former Los Angeles Times editor told Fast Company by phone. Patrick Soon-Shiong swooped in to save the Los Angeles Times in 2018, when he paid $500 million for the paper, a transaction that was initially celebrated by the media. But Soon-Shiong’s decision to order the paper to cancel its endorsement of Kamala Harris ahead of the 2024 election pushed most of its editorial staff out, and the outlet began to lose money. He fired 20% of the paper’s staff in the same year, and in late 2025 Soon-Shiong announced plans to take the paper public. Soon-Shiong didn’t buy the paper just to come in and fire people, Bellantoni said. “I think he really did believe in himself and the ability to save it, to turn it around and make it this thing he’d be very proud of and also make money on,” she added. “That’s not what happened, and I think people are really angry about him — but also because they’re mad they put him on a pedestal.” Both newspapers benefitted from the surge in public interest in reading the news that marked the first The President administration; both ended up gutted by their owners after later declining to endorse a political candidate in 2024 (on top of that, both owners have been criticized for their professional and personal ties to the The President administration). That decision “caused a lot of damage” for the Post and the Times, Bellantoni also said. Subscribers departed both in large numbers despite the pleas of journalists to stick with them. But things can also work out: in 2013 John Henry (who founded his own investment firm and is the owner of several sports teams, including the Boston Red Sox and Pittsburgh Penguins), paid $70 million for the Boston Globe. Though print subscriptions to the paper have dropped, digital subscriptions are over 250,000. The intersection of morality and business isn’t one-size-fits-all, which makes questions of Bezos’ own internal philosophy toward the Post and the value of the free press difficult to discern. After all, he could have just shut the paper down, Bellantoni noted, but he didn’t. “Obviously, he knows how important the Post is — that’s why he bought it,” she said. “And I think he does know its value … and in the end, you know, if he wanted to kill it, he could do that too.” The Post is “still doing great journalism every day, and there are a lot of people there who really care about their work,” Bellantoni concluded. “And so the question is: what’s next?” To that end, Bezos has praised the newspaper’s “essential journalistic mission” and said he will continue to focus on the data that “tells us what is valuable and where to focus.” Though conversations about data over the enormous benefits the public can reap from a fully-staffed, storied news outlet such as the Post raise the hackles of some (as former Post Opinions writer Molly Roberts put it, “Democracy dies in ‘The Data’”), business owners have been data-driven for years. The Post is and will continue to produce great work, Bellantoni said, “and in the end, there will always be that institutional love for the Washington Post because it has been there forever, and it has had such an important place in society, whether it is struggling financially or not.” The tale of what happened after Jeff Bezos bought the Washington Post may be a “cautionary tale” to billionaires everywhere who invest in the news in the future. “This is not a recipe for lining your pockets with money anymore. It’s a hard, expensive industry to finance.” View the full article

-

Plans to tax cash in stocks-and-shares Isas to be watered down, investment sites expect

Platforms ‘optimistic’ government will take a lighter touch approach View the full article

-

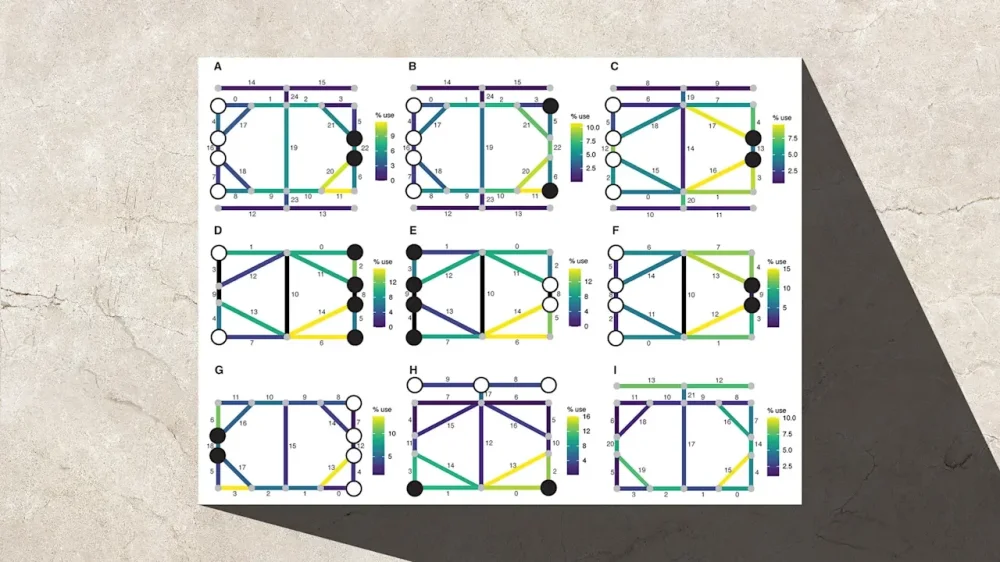

A Roman board game has mystified researchers for years. AI discovered how to play

Somewhere around the turn of the 20th century, archaeologists in Heerlen, Netherlands, came across an odd-looking smooth white stone. They knew the territory was once the Roman settlement of Coriovallum, but had never seen anything like it and had no idea what it was for. For the better part of the next 100 years, it sat in a storage unit at the Thermenmuseum, a mystery taunting researchers. Then, six years ago, archaeologist Walter Crist spotted the stone while wandering the museum. Crist specializes in ancient board games and recognized it as one, though not one he had ever seen before. That sparked his curiosity. Now, with the help of artificial intelligence, he thinks he has figured it out—and even knows how to play. The stone isn’t much to look at. It’s an eight-inch piece of white Jurassic limestone. Lines etched into it form an oblong, diamond-like shape within a rectangle. But in a paper published Wednesday in the journal Antiquity, Crist and his team discuss what happened when they programmed two AI agents from the AI-driven play system Ludii to try to solve it. Playing Ludus Coriovalli The researchers had the AI play the game against itself thousands of times, testing more than 100 different sets of rules drawn from other known European games, both modern and ancient. They compared the AI’s moves with patterns of wear on the board, tracking which gameplay styles most closely matched the grooves on the stone. The board, it appeared, was used for a blocking game—a type of board game in which the goal is to prevent your opponent from moving. (Think of modern titles like Go or Blokus.) Blocking games were rare in ancient Europe and, before this, had only been dated to the Middle Ages. This discovery suggests they were played several centuries earlier. In the end, the AI and the team identified nine sets of rules consistent with the board’s wear. Crist and his team named the game Ludus Coriovalli, “the game from Coriovallum.” “By combining AI simulation with use-wear analysis to identify and model traces of game play, it is possible to not only identify potential game boards, but also to rebuild playable rulesets that may provide indications regarding the ways that people played games in the past,” the paper reads. So what were the rules? Here’s what researchers determined: One player controls four “dogs.” The other controls two “hares.” The dogs start on the four leftmost points; the hares start on the inner two points on the rightmost side. Players alternate turns moving a piece to an adjacent empty spot on the board. The dogs attempt to block the hares, while the hares try to remain unblocked for as long as possible. If the hares are blocked, players swap roles and play again. The player who lasts the longest as the hares wins. Got it? Good. Because this isn’t just a theoretical reconstruction. It’s a game you can actually play online now. Crist and his team uploaded a simulation of Ludus Coriovalli to Ludii, and it’s available to anyone who wants to give it a try. So why study the games ancient civilizations played? Beyond simple curiosity, Crist notes, they offer a clearer picture of everyday life in the past—and a connection to history that isn’t just dry numbers or broken pot shards. “The ability to identify play and games in archaeology strengthens the understanding of our ludic heritage, and makes ancient life more accessible to people in the present, as the act of playing a board game is fundamentally the same today as it was in past millennia,” he writes in the paper. View the full article

-

Cut your 2025 tax bill with these 4 smart moves

The One Big Beautiful Bill Act (OBBBA) made some long-awaited permanent changes to the tax code. It also introduced short-term tax breaks that come with strict limits and phaseouts, and many of them are only available through 2028 or 2029. Here are four ways to get the most out of the OBBBA’s temporary provisions as you file your 2025 taxes and plan ahead. Don’t dismiss itemizing your deductions The OBBBA temporarily boosts the state and local tax deduction cap, or SALT, from $10,000 to $40,000 (for married couples filing jointly and single filers). This higher cap applies from 2025 through 2029. Run the numbers: For 2025, the standard deduction is $31,500 for married couples and $15,750 for singles. If your total itemized deductions — including mortgage interest, charitable giving, and state and local taxes (up to the new $40,000 cap) — add up to more than your standard deduction, you should itemize. Watch your income: The new $40,000 SALT cap isn’t for everyone. It begins to phase out if your modified adjusted gross income is over $500,000 (for all filers). If your MAGI reaches $600,000, your SALT deduction reverts to the original $10,000 limit. Maximize the new targeted deductions—if you qualify The OBBBA introduced several temporary above-the-line deductions (available whether you itemize or not) to help middle-income workers. But they have very strict income and benefit limits. The qualified overtime pay deduction: Capped at $25,000 for married couples filing jointly and $12,500 for singles. Only the extra “half-time” portion of your time-and-a-half pay qualifies for the deduction. For a married couple, this benefit begins to disappear if your MAGI hits $300,000 and is entirely gone once your MAGI reaches $550,000. The qualified tips income deduction: Allows you to write off qualified tip income up to $25,000 per tax return, whether you file as married or single. The deduction is only available for tips that are formally reported on a Form W-2 or Form 1099. It phases out sharply for higher earners, starting at a MAGI of $300,000 for married couples and $150,000 for singles, and is fully eliminated at $550,000 and $400,000, respectively. The auto loan interest deduction: This temporary deduction allows you to write off up to $10,000 of interest paid on a loan for a new, personal-use vehicle with final assembly in the US. (Leases are excluded.) It starts to phase out at $200,000 for married couples and $100,000 for singles and is completely gone by $250,000 and $150,000. Seniors, time your 2026 Roth conversions carefully If you are 65 or older, the OBBBA offers a new, temporary deduction for seniors of up to $12,000 for married couples ($6,000 per eligible spouse) and $6,000 for single filers. This is a welcome tax break, but it’s fragile. Beware the MAGI trap: This deduction begins to disappear for married couples with a MAGI over $150,000 and for singles over $75,000. Model Roth conversions for 2026: If you are a senior who is close to the $150,000 MAGI limit, a Roth conversion done in 2026 could push your income over the threshold, causing you to lose this entire $12,000 deduction. Work with your adviser to model any planned 2026 conversions. Optimize income to qualify for the best breaks Many of the OBBBA’s most valuable temporary provisions are income-sensitive, particularly those new targeted deductions and the elevated SALT cap. Keep these rules in mind for 2025 filing and 2026 tax planning. For your 2025 return: You can still influence your 2025 MAGI by: Making 2025 HSA contributions (before the April 2026 tax deadline). Making 2025 deductible IRA contributions, if you’re eligible. Plan for 2026 income: If your 2026 income is likely to approach any phaseout thresholds (such as the $300,000 limit for tips/overtime or the $500,000 limit for the elevated SALT cap), consider strategies that help keep it within the qualifying range. Postponing the sale of highly appreciated stock to avoid realizing large capital gains in 2026. Delaying the exercise of nonqualified stock options if doing so would push you over a phaseout threshold. Maximizing 401(k) and health savings account contributions to reduce your 2026 MAGI. Holding off on large Roth conversions if they would increase your income above key limits. Don’t let the technical limitations and phaseouts catch you by surprise. With a little smart planning, you can lock in significant tax savings. This article was provided to The Associated Press by Morningstar. For more personal finance content, go to https://www.morningstar.com/personal-finance. Sheryl Rowling, CPA, is an editorial director, financial adviser for Morningstar. Related Links How to Name a Charity as Your IRA Beneficiary https://www.morningstar.com/personal-finance/how-name-charity-your-ira-beneficiary 6 Steps to Claiming Your Baby’s Free $1,000 From Uncle Sam https://www.morningstar.com/personal-finance/6-steps-claiming-your-babys-free-1000-uncle-sam 8 Tips to Stop Worrying About Running Out of Money in Retirement https://www.morningstar.com/personal-finance/8-tips-stop-worrying-about-running-out-money-retirement —Sheryl Rowling of Morningstar View the full article

-

Best LLC Structures for Tax Benefits

When establishing an LLC, comprehension of the tax structures available is essential for maximizing benefits. You can choose between pass-through taxation and S Corporation status, each offering unique advantages. For instance, single-member LLCs typically default to sole proprietorship taxation, whereas multi-member LLCs are usually treated as partnerships. These options can help you avoid double taxation. Nonetheless, determining the best structure for your needs involves more than just these basics. Considerations like self-employment taxes and specific state regulations can greatly impact your decision. Key Takeaways LLCs benefit from pass-through taxation, allowing profits and losses to be reported on personal tax returns, avoiding double taxation. Electing S Corporation status can reduce self-employment taxes, as only salaries are subject to these taxes. Single-member LLCs default to sole proprietorship taxation, while multi-member LLCs are taxed as partnerships, offering flexibility in tax classification. Deductible business expenses, including operational costs and start-up expenses, enhance cash flow and reduce taxable income. Consulting a tax professional helps customize tax strategies, ensuring optimal classification and compliance with state-specific franchise taxes. Understanding LLC Basics When you consider starting a business, comprehending the basics of a Limited Liability Company (LLC) is crucial. An LLC combines the liability protection of a corporation with the tax flexibility of a partnership, offering significant limited liability company tax benefits. For instance, single-member LLCs default to sole proprietorship taxation, whereas multi-member LLCs are taxed as partnerships, both benefiting from pass-through taxation. This means profits and losses appear on your personal tax returns, simplifying your tax filing. Furthermore, LLC tax classification allows you to elect S-corporation or C-corporation status, tailoring your tax strategies. You can likewise deduct business expenses, such as startup and operational costs, enhancing cash flow and reducing taxable income, showcasing the tax advantages of LLCs. The Benefits of Pass-through Taxation Pass-through taxation offers significant advantages for LLC owners, ensuring that business profits and losses are reported directly on your personal income tax returns. This approach helps you avoid double taxation, which C corporations face. As an LLC member, you can potentially lower your overall tax liability by offsetting business losses against your personal income, like wages or investment earnings. The IRS automatically classifies LLCs as pass-through entities except you choose C corporation taxation, giving you flexibility in planning. Simplifying tax compliance, you typically only need to file your personal tax return without a separate corporate one. Furthermore, by leveraging pass-through taxation, you can claim various deductions on business expenses, making it one of the best LLC structures for tax purposes. Choosing Your Tax Classification How do you determine the best tax classification for your LLC? Start by considering your business structure. Single-member LLCs typically default to sole proprietorship taxation, whereas multi-member LLCs default to partnership taxation. Both options benefit from pass-through taxation, which avoids double taxation. If you want to save on self-employment taxes, electing S Corporation status might be beneficial, as only salaries incur these taxes, not distributions. On the other hand, if your LLC generates high earnings, opting for C Corporation classification could provide advantages, given the corporate tax rate of 21% might be lower than individual rates for high-income earners. To make sure you choose the most advantageous classification, consult with a tax professional to evaluate your specific financial situation and tax liability. Deducting Business Expenses Comprehending the range of business expenses you can deduct is vital for maximizing your LLC’s tax benefits. LLCs can deduct various costs, including advertising, training, and travel, which considerably reduce taxable income. Furthermore, ongoing operational expenses like cell phone bills, internet services, and office rent improve your cash flow. Start-up costs incurred before the LLC begins operations can be deducted up to $5,000 in the first year, subject to phase-out limits. You can likewise write off legitimate business expenses on your personal tax returns, lowering your overall tax liability. Proper documentation and adherence to IRS guidelines are critical for maximizing deductions. Deductible Expense Description Advertising Costs related to promoting your LLC Training Expenses for employee education Travel Business-related travel costs Operational Expenses Regular bills like rent and utilities Start-up Costs Initial expenses before opening Comparing LLCs to Other Business Structures When considering the right business structure for your venture, it’s essential to understand how LLCs stack up against other options like sole proprietorships and corporations. LLCs offer limited liability protection, safeguarding your personal assets from business debts, unlike sole proprietorships and partnerships. They also benefit from pass-through taxation, which means you report profits and losses on your personal tax return, avoiding the double taxation faced by C corporations. Furthermore, LLCs allow for flexible tax classification, enabling customized strategies to fit your financial situation. Compared to corporations, LLCs have fewer administrative burdens and lower operational costs. Moreover, LLC owners can deduct business losses from personal income, providing tax advantages not available to sole proprietorships or partnerships. Tax Implications of S Corporation Election Electing S Corporation status for your LLC can markedly alter your tax terrain, primarily by allowing profits to bypass double taxation. Here are some key tax implications to examine: Profits pass directly to shareholders, taxed at individual rates. Shareholders can draw salaries and receive dividends, potentially lowering self-employment taxes. To qualify, your LLC must have no more than 100 shareholders and only one class of stock. You can utilize the Qualified Business Income (QBI) deduction, allowing up to a 20% deduction on pass-through income. The S Corporation election locks in for 60 months, so weigh the benefits and implications carefully before proceeding. Understanding these factors can help you make informed decisions about your LLC’s structure. Managing Self-Employment Taxes Managing self-employment taxes is essential for self-employment members, especially if you’re taxed as a sole proprietor or partner, since you’re liable for both the employer and employee portions of Social Security and Medicare taxes. By electing S-corporation status, you can reduce your self-employment tax burden by designating a portion of your income as salary, whereas the rest can be taken as distributions that aren’t subject to these taxes. It’s also significant to make estimated tax payments quarterly if you expect to owe $1,000 or more in self-employment taxes, helping you stay compliant with IRS regulations. Self-Employment Tax Implications Comprehending self-employment tax implications is crucial for LLC members, as they’re treated as self-employed and must pay self-employment taxes on their share of the business’s profits. This includes both the employer and employee portions of Social Security and Medicare taxes, currently totaling 15.3%. Here are some key points to take into account: Self-employment taxes apply to all net earnings from the LLC. Members must file estimated tax payments quarterly to avoid penalties. LLCs taxed as S-corporations can reduce self-employment tax liabilities by classifying income into salary and distributions. Members of LLCs taxed as partnerships face self-employment tax on all income. Consulting a tax professional is advisable to navigate these intricacies effectively. Tax Deduction Strategies When you own an LLC, taking advantage of tax deduction strategies can greatly mitigate your self-employment tax burden. If you’re taxed as a sole proprietor or partner, you face a self-employment tax rate of up to 15.3%. Nevertheless, electing S-corporation status allows you to classify part of your income as salary and the rest as distributions, reducing your self-employment tax impact. Furthermore, you can deduct the employer portion of self-employment taxes on your personal tax return, lowering your taxable income. Keeping detailed records of business expenses is essential, as these can likewise be deducted, further reducing your tax liability. To optimize your tax position, consult a tax professional for customized strategies regarding the timing of income and expenses. State-specific Franchise Tax Considerations Grasping state-specific franchise tax considerations is vital for LLC owners, as these taxes can greatly impact your business’s financial health. Franchise taxes differ markedly from state to state, so it’s important to understand the rules applicable to your LLC. Here are some key points to take into account: Texas imposes a franchise tax on LLCs with revenue over $1.23 million, with rates from 0.375% to 0.75%. Delaware charges no franchise tax for LLCs that don’t operate in the state, but has a $300 annual fee. California’s minimum franchise tax is $800, regardless of income, plus additional fees for those earning over $250,000. Research your state’s specific requirements. Guarantee compliance to optimize your tax strategy effectively. Leasing Personal Assets for Business Use Leasing personal assets to your LLC can offer significant tax benefits, such as deductible lease payments that reduce your taxable income. For example, if you lease your home office or equipment, the LLC can write off those expenses, whilst you gain additional income from the arrangement. Nevertheless, it’s essential to verify that the lease agreements are formalized and reflect fair market value to meet IRS requirements and avoid potential issues. Deductible Lease Payments Even though many business owners may not realize it, LLCs have the opportunity to lease personal assets from their members, which can create significant tax benefits. By doing this, your LLC can treat lease payments as deductible business expenses, reducing taxable income. Here are some key points to reflect on: You can lease your home office to the LLC, enabling you to claim rental expenses. Equipment, vehicles, and office space can likewise be leased. Confirm you have a formal Commercial Lease agreement in place to substantiate deductions. Document all lease payments carefully to comply with IRS guidelines. Verify that the assets are necessary for the business’s operation to qualify for deductions. These strategies can effectively improve your LLC’s financial efficiency. Asset Depreciation Benefits Using personal assets in your IRS can offer significant tax advantages, particularly through the process of asset depreciation. You can lease personal items, like a home office or equipment, allowing your IRS to deduct these leasing expenses. The IRS mandates that these assets must serve business purposes to qualify for depreciation, ensuring compliance. This arrangement not only generates income for you but likewise reduces your IRS’s taxable income through deductible expenses. To substantiate these claims, formal lease agreements are crucial. Here’s a quick overview: Aspect Details Leased Items Home office, equipment Tax Deductions Leasing expenses, depreciation Requirements Business use, formal lease agreements This strategy can improve your overall tax benefits effectively. Personal vs. Business Use How do you determine the appropriate balance between personal and business use when leasing assets to your LLC? It’s essential to formalize lease agreements in writing, guaranteeing compliance with IRS regulations. Consider these key points when leasing personal assets: Verify the leased asset is primarily for business use to qualify for tax deductions. Set a reasonable rental rate consistent with market values to avoid IRS scrutiny. Document the lease agreement to clarify terms and conditions. Keep detailed records of usage, separating personal and business use. Understand that income generated from leasing can provide additional cash flow during benefiting your LLC’s tax situation. Consulting a Tax Professional for Tailored Advice Have you considered the benefits of consulting a tax professional for your tax professional? A tax advisor can help you determine the best classification for tax purposes, aligning with your income and goals. They can provide insights on S-corporation status, potentially reducing self-employment taxes on distributions. Moreover, steering through deductible business expenses becomes easier with expert guidance, maximizing your write-offs. They can likewise evaluate state-specific franchise taxes, assisting you in choosing a registration state that minimizes your liabilities. Overall, customized advice helps you develop a bespoke strategy for your business needs. Benefit Description Tax Classification Determine the best classification for your LLC. S-Corporation Insights Explore potential tax savings on distributions. Deductible Expenses Maximize write-offs to minimize taxable income. Franchise Tax Evaluation Assess state-specific franchise taxes. Customized Tax Strategy Align tax strategy with your business goals. Frequently Asked Questions What Is the Best Tax Structure for LLC? The best tax structure for your LLC depends on various factors, including your business goals and income level. For single-member LLCs, being taxed as a sole proprietorship usually works well, whereas multi-member LLCs often benefit from partnership taxation. If you’re looking to reduce self-employment taxes, consider electing S Corporation status. Consulting a tax professional can help you assess the most advantageous option customized to your specific situation and future growth potential. What Is the Most Tax Efficient Way to Pay Yourself in an LLC? To pay yourself tax-efficiently in an LLC, consider a combination of salary and distributions. You’ll pay self-employment taxes only on your salary, whereas distributions aren’t subject to these taxes. If your LLC elects S Corporation status, you can further reduce your tax burden by classifying some income as distributions, taxed at a lower rate. Verify your salary is reasonable to comply with IRS regulations, and maintain proper documentation for all payments. Should My LLC Be an S or C Corp? When deciding whether your LLC should be an S Corporation or C Corporation, consider your business’s profit levels and growth potential. An S Corporation avoids double taxation, allowing profits to pass through to your personal tax return, which can save on self-employment taxes. Conversely, a C Corporation faces double taxation, taxing corporate income and dividends separately. If your LLC plans to attract investors, an S Corporation’s structure may likewise facilitate easier capital raising. Which Business Structure Has the Best Tax Benefits? When considering tax benefits, an LLC often stands out because of its pass-through taxation, meaning profits and losses appear on your personal tax return, avoiding double taxation. You can likewise elect to be taxed as an S Corporation, which may lower self-employment taxes by allowing part of your income to be treated as distributions. Furthermore, LLCs offer flexibility in tax treatment and allow deductions for various business expenses, enhancing your overall cash flow. Conclusion In summary, selecting the right LLC structure for tax benefits can greatly impact your overall financial health. By comprehending pass-through taxation, considering S Corporation status, and deducting legitimate business expenses, you can optimize your tax situation. Furthermore, managing self-employment taxes and being aware of state-specific fees are essential. Consulting a tax professional can provide customized advice, ensuring you choose the most advantageous structure based on your unique circumstances and goals. Making informed decisions now can lead to considerable savings later. Image via Google Gemini This article, "Best LLC Structures for Tax Benefits" was first published on Small Business Trends View the full article

-

Best LLC Structures for Tax Benefits