All Activity

- Past hour

-

[Newsletter] Working Better, Every Day

Hi there, Remote work has always suited me better than office life: letting me work at my own pace while staying close to those who matter most. Today, that’s my kids; before them, it was my mutt and favorite co-worker, Paro. Along the way, I’ve come to recognize the challenges of remote work too: loneliness, pajama days, and finding the right places to work from. If you’re like me, today’s reads offer practical advice on achieving a healthier work-life balance, with a bonus article to help you decide whether going remote is right for you in the first place. Enjoy the read. — Maja Our Favorite Articles 💯Is Remote Work Really for You? (Psychology Today)Psychologists outline four clear signs that remote work fits your personality—and a few hints that it might quietly be working against you. 👉 Read here. The Best Dogs for Working From Home (Best Life)Dogs make great co-workers—but having one demanding a game of fetch mid-Zoom isn’t always ideal. Some breeds are simply better suited for long, quiet days at home. 👉 Learn more. Why Remote Workers Are Struggling to Sleep (Tom’s Guide)Doctors explain why many remote workers are sleeping worse this winter, and share three simple fixes to reset boundaries between work, rest, and recovery. 👉 Find out how. The Best Ways to Negotiate Flexibility (Phys.org)Requesting remote or flexible work can be more, or less, successful depending on how you build your case. 👉 Keep reading. This Week's Sponsor 🙌Your new website, email address & cloud storage. Simple. Fast. Secure.Discover ace.me: Your all-in-one website, email and cloud storage. Ditch Linktree, Gmail and Dropbox for a privacy focused experience. Build amazing sites effortlessly, enjoy your mails in a modern messenger format, all free forever. Sign up now! Remotive Jobs 💼Let's get you hired! This great company is hiring now: 💻 Engineering 👉 Senior Independent Software Developer at A.Team (Americas, Europe, Israel) 👉 Senior Independent AI Engineer / Architect at A.Team (Americas, Europe, Israel) 👉 Senior Software Engineer, Global Contractor at Jump (Worldwide) 📱 Product 👉 Product Inventor / Engineer @ Fun Ecom Co | Great People & Flexible Hours at JLS Trading Co (Worldwide) 🧚 Customer service 👉 Client Support Specialist at Clipboard Health (Europe, Canada, South Africa, Philippines, Jamaica) Free Guides & ToolsPremium Job BoardWe curate 115,000+ fully remote jobs so you don't have to. ➡️ Find your remote job Job Search TipsLooking for a remote job? Here are our tips to help you work remotely. ➡️ Check it out Join the Remotive newsletter Subscribe to get our latest content by email. Success! Now check your email to confirm your subscription. There was an error submitting your subscription. Please try again. Email address Subscribe Powered by ConvertKit View the full article

-

Ginnie Mae speeds up loan-level MBS overhaul

The government mortgage securitization guarantor flagged the goal back during the first The President administration, warning then that it would be a long-term project. View the full article

-

AI is creating chaos at work

Although we’ve been told that AI is poised to “revolutionize” work, at the moment it seems to be doing something else entirely: spreading chaos. At Slate today, I wrote about how, throughout American offices, AI platforms like ChatGPT are delivering answers that sound right even when they aren’t, transcription tools that turn meetings into works of fiction, and documents that look polished on the surface but are riddled with factual errors and missing nuance. You can read it here. The post AI is creating chaos at work appeared first on Ask a Manager. View the full article

- Today

-

PayPal’s New Partnership Offers Free Tax Filing for Debit Card Users

Navigating the complexities of tax season can be a daunting task for small business owners, but PayPal has introduced a new solution designed to simplify this process. The company announced a partnership with april, a leading tax technology platform, to offer free DIY tax filing for U.S. customers using the PayPal Debit Card. This initiative aims to help small businesses and individual users file their federal and state tax returns at no cost, potentially saving them around $160 in traditional filing fees. The process is straightforward. Customers can utilize april’s tax engine to enter information and upload required documents, allowing the system to prefill relevant fields to expedite filing. With an average filing time of under twenty minutes and a maximum refund guarantee, the service claims to streamline what often feels like a complicated chore. Additionally, users have access to an AI-powered chatbot for quick questions or can opt for live support if needed. Shanthi Sarkar, VP of Debit and Money Management at PayPal, emphasized the benefits, stating, “Our partnership with april empowers customers to manage even more of their finances in one trusted place, helping them streamline tax preparation and take meaningful steps toward setting up their finances for the year ahead.” Not only does this initiative reduce the financial burden associated with tax preparation, but it also contributes to better financial planning. PayPal customers can use various payment methods to settle state and federal tax dues, including the ability to earn rewards on transactions made through PayPal Credit or PayPal Cashback Mastercard during tax payments. This flexibility allows business owners to choose a payment method that best suits their financial situation. Moreover, PayPal facilitates early access to tax refunds, enabling customers to receive federal tax returns up to five days ahead of the standard schedule. This can be particularly advantageous for small businesses seeking to reinvest that money promptly. Customers can even opt to deposit refunds into PayPal Savings, a high-yield savings account offered by Synchrony Bank, helping turn tax refunds into an opportunity for earning interest. This new tax filing service can also aid in financial goal planning for the coming year. Alongside tax preparation, small business owners can take advantage of flexible payment options and reward incentives. For instance, PayPal Cashback Mastercard users can receive 3% cash back during checkout, which can accumulate over time as a valuable cash return. However, small business owners should consider a few challenges. First, tax regulations can vary by state and personal circumstances, and while april’s AI provides significant support, complex tax situations may still require consultation with tax professionals. Furthermore, while the promise of a streamlined filing process is appealing, the reliance on technology, including document uploads and prefilled forms, may still be daunting for those less tech-savvy. In light of these considerations, PayPal’s initiative seeks to empower its users with tools that simplify financial management. As this feature rolls out, it aims to connect tax filing with existing payment workflows, fostering better financial outcomes. For more details on this service, customers can visit PayPal’s dedicated page on tax filing here. Additionally, to learn more about PayPal’s offerings or to sign up for a PayPal Debit Card, small business owners can find all necessary information on the PayPal website. This strategic move by PayPal not only helps minimize the time and cost associated with tax filing but also enhances the overall financial management experience for small business owners navigating the intricate landscape of taxes. More updates can be found in the original press release here. Image via Google Gemini This article, "PayPal’s New Partnership Offers Free Tax Filing for Debit Card Users" was first published on Small Business Trends View the full article

-

US Treasury cancels contracts with Booz Allen over tax return leaks

Former consulting firm employee revealed filings for The President and other wealthy people showing they paid little in levies View the full article

-

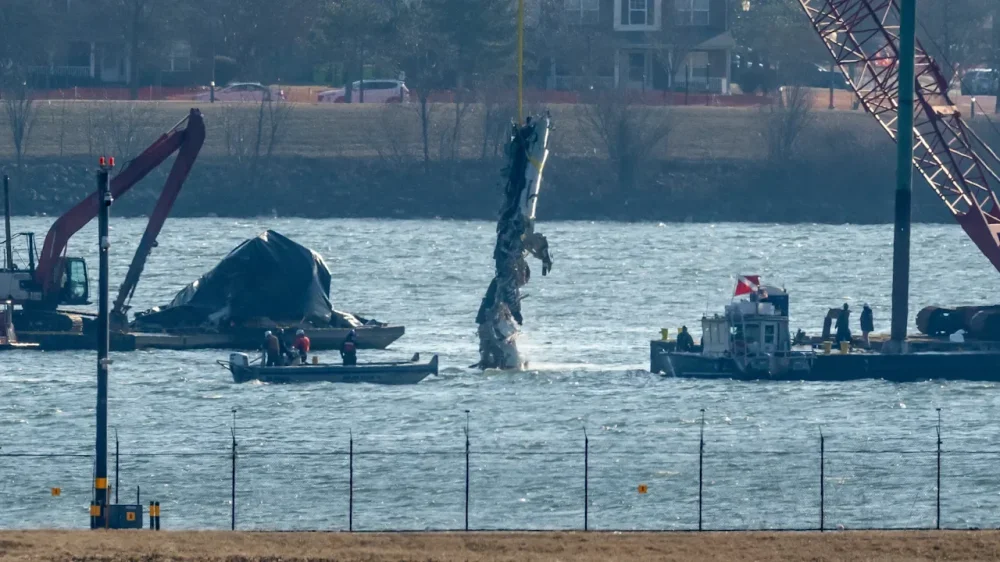

Investigators to reveal the causes of the deadly D.C. midair collision and recommend changes

So many things went wrong last Jan. 29 to contribute to the deadliest plane crash on American soil since 2001 that the National Transportation Safety Board isn’t likely to identify a single cause of the collision between an airliner and an Army helicopter near Washington, D.C., that killed 67 people at its hearing Tuesday. Instead, their investigators will detail what they found that played a role in the crash, and the board will recommend changes to help prevent a similar tragedy. Last week, the Federal Aviation Administration already took the temporary restrictions it imposed after the crash and made them permanent to ensure planes and helicopters won’t share the same airspace again around Reagan National Airport. Family members of victims hope those suggestions won’t be ignored the same way many past NTSB recommendations have been. Tim Lilley, whose son Sam was the first officer on the American Airlines plane, said he hopes officials in Congress and the administration will make changes now instead of waiting for another disaster. “Instead of writing aviation regulation in blood, let’s start writing it in data,” said Lilley, who is a pilot himself and earlier in his career flew Black Hawk helicopters in the Washington area. “Because all the data was there to show this accident was going to happen. This accident was completely preventable.” Over the past year, the NTSB has already highlighted a number of the factors that contributed to the crash including a poorly designed helicopter route past Reagan Airport, the fact that the Black Hawk was flying 78 feet (23.7 meters) higher than it should have been, the warnings that the FAA ignored in the years beforehand and the Army’s move to turn off a key system that would have broadcast the helicopter’s location more clearly. The D.C. plane crash was the first in a number of high-profile crashes and close calls throughout 2025 that alarmed the public, but the total number of crashes last year was actually the lowest since the COVID-19 pandemic hit in 2020 with 1,405 crashes nationwide. Experts say flying remains the safest way to travel because of all the overlapping layers of precautions built into the system, but too many of those safety measures failed at the same time last Jan. 29. Here is some of what we have learned about the crash: The helicopter route didn’t ensure enough separation The route along the Potomac River the Black Hawk was following that night allowed for helicopters and planes to come within 75 feet (23 meters) of each other when a plane was landing on the airport’s secondary runway that typically handles less than 5% of the flights landing at Reagan. And that distance was only ensured when the helicopter stuck to flying along the bank of the river, but the official route didn’t require that. Normally, air traffic controllers work to keep aircraft at least 500 feet (152 meters) apart to keep them safe, so the scant separation on Route 4 posed what NTSB Chairwoman Jennifer Homendy called “an intolerable risk to flight safety.” The controllers at Reagan also had been in the habit of asking pilots to watch out for other aircraft themselves and maintain visual separation as they tried to squeeze in more planes to land on what the Metropolitan Washington Airport Authority has called the busiest runway in the country. The FAA halted that practice after the crash. That night, a controller twice asked the helicopter pilots whether they had the jet in sight, and the pilots said they did and asked for visual separation approval so they could use their own eyes to maintain distance. But at the investigative hearings last summer, board members questioned how well the crew could spot the plane while wearing night vision goggles and whether the pilots were even looking in the right spot. The Black Hawk was flying too high The American Airlines plane flying from Wichita, Kansas, collided with the helicopter 278 feet (85 meters) above the river, but the Black Hawk was never supposed to fly above 200 feet (61 meters) as it passed by the airport, according to the official route. Before investigators revealed how high the helicopter was flying, Tim Lilley was asking tough questions about it at some of the first meetings NTSB officials had with the families. His background as a pilot gave him detailed knowledge of the issues. “We had a moral mandate because we had such an in-depth insight into what happened. We didn’t want to become advocates, but we could not shirk the responsibility,” said Lilley, who started meeting with top lawmakers in Congress, Transportation Secretary Sean Duffy and Army officials not long after the crash to push for changes. The NTSB has said the Black Hawk pilots may not have realized how high the helicopter was because the barometric altimeter they were relying on was reading 80 to 100 feet (24 to 30 meters) lower than the altitude registered by the flight data recorder. Investigators tested out the altimeters of three other Black Hawks of the same model from the same Army unit and found similar discrepancies. Past warnings and alarming data were ignored FAA controllers were warning about the risks all the helicopter traffic around Reagan airport created at least since 2022. And the NTSB found there had been 85 near misses between planes and helicopters around the airport in the three years before the crash along with more than 15,000 close proximity events. Pilots reported collision alarms going off in their cockpits at least once a month. Officials refused to add a warning to helicopter charts urging pilots to use caution when they used the secondary runway at Reagan the jet was trying to use before the collision. Rachel Feres said it was hard to hear about all the known concerns that were never addressed before the crash that killed her cousin Peter Livingston and his wife Donna and two young daughters, Everly and Alydia, who were both promising figure skaters. “It became very quickly clear that this crash should never have happened,” Feres said. “And as someone who is not particularly familiar with aviation and how our aviation system works, we were just hearing things over and over again that I think really, really shocked people, really surprised people.” —Josh Funk, AP transportation writer View the full article

-

Six Times to Pick Up the Phone This Tax Season

The personal touch goes a long way toward client retention. By Ed Mendlowitz Tax Season Opportunity Guide Go PRO for members-only access to more Edward Mendlowitz. View the full article

-

Six Times to Pick Up the Phone This Tax Season

The personal touch goes a long way toward client retention. By Ed Mendlowitz Tax Season Opportunity Guide Go PRO for members-only access to more Edward Mendlowitz. View the full article

-

This Soundcore Bluetooth Speaker Is $75 Right Now

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. The Soundcore Boom 3i is clearly built with water-first trips in mind. It has an IP68 rating, so it’s fully resistant to dust and water, and it’s also designed to handle saltwater, which in itself is pretty rare even for outdoor speakers. That’s the kind of detail that matters if your idea of “outside” means beaches, boats, or time near the ocean. It also floats, and it does so with the speakers facing upward, which keeps the sound usable instead of muffled when it’s bobbing around. In practice, that makes it less annoying to live with than other floating speakers that constantly flip or drift sideways. The Boom 3i normally sits at $129.99, but it’s currently down to $74.99, which is the lowest price it has reached so far, according to price-trackers. Soundcore Boom 3i by Anker, Rugged Outdoor Speakers, IP68 Waterproof, Floating Playback, Saltwater-Resistant, BassUp 2.0, 50W Portable Speaker, Bluetooth 5.3, 16H, TWS, Kayak/Fishing/Camping-Brown $74.99 at Amazon $129.99 Save $55.00 Get Deal Get Deal $74.99 at Amazon $129.99 Save $55.00 At just over three pounds, this speaker is portable enough to sling across your shoulder with the included strap, but sturdy enough not to feel cheap. It pushes out up to 50 watts of sound, which is more than enough for a beach hang or a camping trip with a small group. You won’t get floor-shaking bass, but the mid-bass hits nicely, and the overall tone stays warm. That said, there’s a BassUp button if you want to dial things up, and the companion Soundcore app has a nine-band EQ, if you want more control. Battery life hovers around 15–16 hours at moderate volume, and it keeps playing while charging over USB-C, which is useful if you’re running it off a power bank. The Boom 3i also has a Buzz Clean mode that uses a low-frequency vibration to loosen sand and grit stuck inside the speaker. It’s surprisingly effective, though it doesn’t replace a quick rinse after a full day at the beach. You also get an emergency alarm and a voice amplifier, which won’t matter much in everyday use but could come in handy on the water or during group activities. If what you want is a speaker that shrugs off salt, sand, and splashes without interrupting playback, this one makes sense at its current price. The Soundcore Boom 3i is a rugged Bluetooth speaker built for beach days, boating, and other water-heavy trips. It has an IP68 rating, saltwater resistance, and a float-and-play design that keeps audio clear on the water. With 50 watts of output and 15–16 hours of battery life, it’s made for durability over deep bass. It’s currently available for $74.99, down from $129.99. Our Best Editor-Vetted Tech Deals Right Now Apple AirPods 4 Active Noise Cancelling Wireless Earbuds — $148.99 (List Price $179.00) Apple Watch Series 11 [GPS 46mm] Smartwatch with Jet Black Aluminum Case with Black Sport Band - M/L. Sleep Score, Fitness Tracker, Health Monitoring, Always-On Display, Water Resistant — $407.47 (List Price $429.00) Amazon Fire TV Stick 4K Plus — (List Price $24.99 With Code "FTV4K25") Samsung Galaxy Tab A9+ 64GB Wi-Fi 11" Tablet (Silver) — $159.99 (List Price $219.99) Deals are selected by our commerce team View the full article

-

Succession Planning? Time Is Running Out

M&A BONUS: A 22-point due diligence kit. By Domenick J. Esposito 8 Steps to Great Go PRO for members-only access to more Dom Esposito. View the full article

-

Succession Planning? Time Is Running Out

M&A BONUS: A 22-point due diligence kit. By Domenick J. Esposito 8 Steps to Great Go PRO for members-only access to more Dom Esposito. View the full article

-

5 things experts want you to know about the data in sleep-tracking devices

Your watch says you had three hours of deep sleep. Should you believe it? Millions of people rely on phone apps and wearable devices like rings, smartwatches and sensors to monitor how well they’re sleeping, but these trackers don’t necessarily measure sleep directly. Instead, they infer states of slumber from signals like heart rate and movement, raising questions about how reliable the information is and how seriously it should be taken. The U.S. sleep-tracking devices market generated about $5 billion in 2023 and is expected to double in revenue by 2030, according to market research firm Grand View Research. As the devices continue to gain popularity, experts say it is important to understand what they can and cannot tell you, and how their data should be used. Here’s a look at the technology — and why one expert thinks its full potential has yet to be realized. What your sleep tracker actually measures Whether it’s an Apple Watch, a Fitbit, an Oura Ring or one of innumerable other competitors, health and fitness trackers largely take the same basic approach by recording the wearer’s movements and heart rate while at rest, according to Daniel Forger, a University of Michigan math professor who researches the science behind sleep wearables. The algorithms used by major brands have become highly accurate for determining when someone is asleep, Forger said. The devices are also somewhat helpful for estimating sleep stages, though an in-lab study would be more precise, he said. “If you really want to know definitively how much non-REM sleep you’re having versus REM sleep, that’s where the in-lab studies really excel,” Forger said. The sleep numbers that matter most Dr. Chantale Branson, a neurologist and professor at the Morehouse School of Medicine, said she frequently has patients showing up with sleep scores from fitness trackers in hand, sometimes fixated on granular details such as how much REM sleep they got on a certain night. Branson says those patients are taking the wrong approach: the devices help highlight trends over time but should not be viewed as a definitive measure of one’s sleep health. Nor should any single night’s data be seen as significant. “We would have believed them with or without the device and worked on trying to figure out why they can’t sleep — and that is what the wearables do not do,” she said. Branson said she thinks people who check their sleep statistics every morning would be better served by spending their efforts on “sleep hygiene” such as creating a relaxing bedtime routine, avoiding screens before bed and making sure their sleep environment is comfortable. She advises those concerned about their sleep to consult a clinician before spending money on a wearable. Forger takes a more favorable view toward the devices, which he says help keep the overlooked importance of sleep front of mind. He recommends them even for people without significant sleep issues, saying they can offer insights that help users fine-tune their routines and feel more alert during the day. “Seeing if your biological clock is in sync is a huge benefit because even if you’re giving yourself the right amount of time, if you’re sleeping at the wrong times, the sleep won’t be as efficient,” Forger said. How sleep data can drive better habits Kate Stoye, an Atlanta-area middle school teacher, bought an Oura Ring last summer, having heard positive things from friends who used it as a fertility tracker: “It’s so accurate,” she said. Stoye found the ring to be just as helpful with tracking her sleep. After noticing that the few nights she drank alcohol coincided with poorer sleep quality, she decided to give up alcohol. “I don’t see much reason to drink if I know that it’s going to affect how I feel,” said Stoye, who always wears her device except when she is playing tennis or needs to charge it. Another trend she says she detected in the ring’s data: the importance of not eating too late if she wants to get good rest. “I always struggle with going to bed, and it’s often because I eat late at night,” Stoye said. “I know that about myself, and it knows it too.” When sleep tracking becomes a problem Mai Barreneche, who works in advertising in New York City, used to wear her Oura Ring constantly. She said it helped her develop good sleep habits and encouraged her to maintain a daily morning exercise regimen. But as a metric-driven person, she became “obsessed” enough with her nightly sleep scores that it began to cause her anxiety — a modern condition that researchers have dubbed “orthosomnia.” “I remember I would go to bed thinking about the score I was going to get in the morning,” Barreneche said. Barreneche decided not to wear her ring on a beach vacation a few years ago, and when she returned home, she never put it back on. She said she has maintained the good habits the device pointed her toward, but no longer wants the stress of monitoring her nightly scores. Branson, of the Morehouse School of Medicine, said she’s observed similar score-induced anxiety as a recurring issue for some patients, particularly those who set goals to achieve a certain amount of REM sleep or who shared their nightly scores with friends using the same device. Comparing sleep types and stages is ill-advised since individual needs vary by age, genetics and other factors, she said. “These devices are supposed to help you,” Branson said. “And if you feel anxious or worried or frustrated about it, then it’s not helpful, and you should really talk to a professional.” The future of wearables Forger thinks the promise of wearables has been underestimated, with emerging research suggesting the devices could one day be designed to help detect infections before symptoms appear and to flag sleep pattern changes that may signal the onset of depression or an increased risk of relapse. “The body is making these really interesting and really important decisions that we’re not aware of to keep us healthy and active and alert at the right times of day,” he said. “If you have an infection, that rhythm very quickly starts to disappear because the body goes into overdrive to start fighting the infection. Those are the kind of things we can pick up.” The technology could be particularly useful in low-resource communities, where wearables could help health issues to be identified more quickly and monitored remotely without requiring access to doctors or specialized clinics, according to Forger. “There’s this really important story that’s about to come out: About just how understanding sleep rhythms and sleep architecture is going to generally improve our lives,” he said. —R.J. Rico and Emilie Megnien, Associated Press View the full article

-

Google research points to a post-query future for search intent

Google is working toward a future where it understands what you want before you ever type a search. Now Google is pushing that thinking onto the device itself, using small AI models that perform nearly as well as much larger ones. What’s happening. In a research paper presented at EMNLP 2025, Google researchers show that a simple shift makes this possible: break “intent understanding” into smaller steps. When they do, small multimodal LLMs (MLLMs) become powerful enough to match systems like Gemini 1.5 Pro — while running faster, costing less, and keeping data on the device. The paper, “Small Models, Big Results: Achieving Superior Intent Extraction through Decomposition,” explains how Google infers what someone is trying to do based on how they use apps and websites. That includes taps, clicks, scrolling, and screen changes over time. The future is intent extraction. Large AI models can already infer intent from user behavior, but they usually run in the cloud. That creates three problems. They’re slower. They’re more expensive. And they raise privacy concerns, because user actions can be sensitive. Google’s solution is to split the task into two simple steps that small, on-device models can handle well. Step one: Each screen interaction is summarized separately. The system records what was on the screen, what the user did, and a tentative guess about why they did it. Step two: Another small model reviews only the factual parts of those summaries. It ignores the guesses and produces one short statement that explains the user’s overall goal for the session. By keeping each step focused, the system avoids a common failure mode of small models: breaking down when asked to reason over long, messy histories all at once. How the researchers measure success. Instead of asking whether an intent summary “looks similar” to the right answer, they use a method called Bi-Fact. Using its main quality metric, an F1 score, small models with the step-by-step approach consistently outperform other small-model methods: Gemini 1.5 Flash, an 8B model, matches the performance of Gemini 1.5 Pro on mobile behavior data. Hallucinations drop because speculative guesses are stripped out before the final intent is written. Even with extra steps, the system runs faster and cheaper than cloud-based large models. How it works. Intent is broken into small pieces of information, or facts. Then they measure which facts are missing and which ones were invented. This: Shows how intent understanding fails, not just that it fails. Reveals where systems tend to hallucinate meaning versus where they drop important details. The paper also shows that messy training data hurts large, end-to-end models more than it hurts this step-by-step approach. When labels are noisy — which is common with real user behavior — the decomposed system holds up better. Why we care. If Google wants agents that suggest actions or answers before people search, it needs to understand intent from user behavior (how people move through apps, browsers, and screens). This research moves this idea closer to reality. Keywords will still matter, but the query will be just one signal. In this future, you’ll have to optimize for clear, logical user journeys — not just the words typed at the end. The Google Research blog post. Small models, big results: Achieving superior intent extraction through decomposition View the full article

-

Key Requirements for a Commercial Real Estate Loan

When you’re considering a commercial real estate loan, it’s essential to understand the key requirements that lenders look for. This includes a solid credit score, typically 680 or higher, a down payment ranging from 15% to 35%, and a debt service coverage ratio between 1.20 and 1.40. Each of these factors helps lenders gauge your ability to repay the loan. Knowing these details can greatly impact your financing options, so let’s explore what each requirement entails. Key Takeaways A solid credit score of 680 or higher is typically essential for loan approval. Down payments usually range from 15% to 35%, impacting loan-to-value ratio. Debt service coverage ratio (DSCR) must often meet minimums of 1.20 to 1.40. Clear documentation of business income and property value is required for assessment. Understanding loan terms, including fees and penalties, is crucial before applying. What Is a Commercial Real Estate Loan? A commercial real estate loan is a financial product designed to help you purchase, renovate, or construct properties intended for business use, such as office buildings, retail spaces, or industrial facilities. When considering this type of financing, you’ll encounter specific commercial real estate loan requirements that lenders use to evaluate your eligibility. These loans typically come with shorter repayment terms, ranging from 5 to 20 years, and often demand larger down payments of 15-35%. Lenders assess various criteria, including your credit score, loan-to-value ratio (typically up to 75%), and debt service coverage ratio, with higher ratios being more favorable. It’s essential to acknowledge that many commercial loans are non-recourse, meaning your personal assets are protected in case of default, as the property serves as the sole collateral. Typically, loan amounts start at around $1 million, though exceptions exist based on property type and financing scenarios. Types of Commercial Real Estate Loans When exploring financing options for commercial real estate, you’ll find several types of loans customized to meet different needs. Bank loans are traditional financing options secured by the property, ideal for many investors. SBA loans, backed by the U.S. Small Business Administration, cater particularly to owner-occupied properties. If you prefer less scrutiny, CMBS loans funded by commercial mortgage-backed securities might suit you, as they often require fewer borrower qualifications. For unique financing situations, consider debt fund loans from private debt funds, which offer more flexible terms. Finally, hard money loans provide quick access to capital with minimal borrower scrutiny, even though they come with higher interest rates and short repayment periods. Each of these different types of commercial loans varies in down payment requirements, typically ranging from 15 to 35%, and repayment terms, usually lasting between 5 to 20 years. Qualifying for a Commercial Real Estate Loan When you’re looking to qualify for a commercial real estate loan, several key factors come into play. A solid credit score, typically 680 or higher, is essential, along with a favorable loan-to-value ratio, which usually requires a down payment of 20% to 35%. Furthermore, lenders will scrutinize your debt service coverage ratio to guarantee the property generates enough income to meet its financial obligations. Credit Score Importance Grasping the importance of your credit score is essential for qualifying for a commercial real estate loan, as it serves as a key indicator of your financial reliability to lenders. A strong credit score reflects your creditworthiness, making you more appealing to lenders and influencing loan approval rates and terms. Typically, lenders look for a minimum credit score of 650; nonetheless, higher scores (700+) can lead to better interest rates and conditions. Your credit score likewise affects the commercial real estate loan down payment you might need, with higher scores allowing for up to 80% financing. Maintaining a good credit score not merely eases access to loans but also empowers you to negotiate more favorable terms, like lower fees. Loan-to-Value Ratio Comprehending your credit score is just one piece of the puzzle when applying for a commercial real estate loan; another key factor is the Loan-to-Value (LTV) ratio. This ratio helps lenders assess the risk of your loan, usually ranging from 65% to 80% based on the property type and current market conditions. A lower LTV ratio not just reduces lender risk but can secure you more favorable loan terms, whereas a higher LTV may lead to increased scrutiny and higher interest rates. Even a 5% difference in LTV can greatly affect your financing options. Keep in mind that minimum LTV requirements can vary, with properties in stable markets often qualifying for higher ratios than those in more volatile areas. Debt Service Coverage Ratio The Debt Service Coverage Ratio (DSCR) plays a vital role in determining your eligibility for a commercial real estate loan, as it measures your property’s capacity to meet its debt obligations. To calculate the DSCR, divide your net operating income (NOI) by the total debt service. Here are some key points to keep in mind: A minimum DSCR requirement typically ranges from 1.20 to 1.40. A DSCR below 1.0 indicates insufficient income to cover debt payments. Lenders may adjust requirements based on property type and market conditions. Monitoring your debt service coverage ratio is important to detect cash flow issues early. Understanding the DSCR can greatly impact your loan approval and financial stability. Key Financial Metrics When seeking a commercial real estate loan, grasp of key financial metrics is essential for making informed decisions. The Loan-to-Value (LTV) ratio typically ranges from 65% to 80%, affecting your financing options and the lender’s risk exposure, depending on the property’s type and market conditions. Furthermore, the Debt Service Coverage Ratio (DSCR) helps assess a property’s capability to cover its debt obligations, with minimum requirements often set between 1.20 and 1.40. For higher-risk properties, you might need a DSCR of 1.30 to 1.50 to secure favorable terms. Remember, the minimum loan amount usually starts at $1 million, though some exceptions exist. Finally, your credit score greatly impacts your loan eligibility, with different thresholds based on the type of commercial loan you’re pursuing. Grasping these metrics can streamline your commercial loan process and improve your chances of success. Understanding Loan Terms and Fees How do you navigate the often complex terrain of loan terms and fees when pursuing a commercial real estate loan? Comprehending the commercial loan meaning is crucial, as it encompasses various fees and stipulations that can greatly impact your financial obligations. Here are key components to reflect on: Origination Fees: Typically range from 0.5% to 1.5% of the loan amount, alongside costs for appraisals and legal services. Prepayment Penalties: Common in commercial loans, these may include yield maintenance or declining percentage penalties to protect lenders. Loan Covenants: You may need to adhere to financial ratios, such as minimum debt service coverage and maximum loan-to-value ratios. Fee Transparency: Clear disclosure of fees promotes trust and prevents disputes over unexpected costs during the loan process. Properly structuring these terms guarantees that both lender risks and your financial capabilities are addressed effectively. The Role of a Commercial Mortgage Calculator A commercial mortgage calculator is a crucial tool for evaluating your loan payments, helping you understand what you’ll owe each month based on various factors. By using this calculator, you can compare different financing options and gain insights into your affordability, making it easier to plan your investment. Furthermore, it allows you to simulate various scenarios, ensuring you make informed choices that align with your financial goals. Loan Payment Assessment Comprehending the financial implications of a commercial real estate loan is essential for any potential borrower, and a commercial mortgage calculator serves as an important tool in this process. It helps you understand how do commercial property loans work by calculating your monthly payments based on key parameters. Here’s how it can assist you: Input loan amount, interest rate, and term length for precise payment estimates. Evaluate cash flow needs with different loan scenarios, including interest rate variations. Understand the total cost over the loan’s term, including interest paid. Compare various loan products side by side for informed decision-making. Using this calculator encourages transparency, streamlining the loan application process for both you and your lender. Financing Options Comparison Comprehending your financing options is an essential step in securing a commercial real estate loan, and a commercial mortgage calculator plays a pivotal role in this evaluation. By entering key financial parameters like interest rates and loan terms, you can estimate monthly payments for various options, including an owner occupied commercial loan. This tool lets you compare payment structures between traditional SBA loans, helping you make informed choices. Furthermore, you can analyze how different loan-to-value (LTV) ratios affect your financing, as most calculators assume values up to 75% for commercial properties. Utilizing this calculator not only clarifies your affordability but likewise aligns your financial goals with available loan products, finally guiding your decision-making process. Affordability Insights Grasping your affordability is crucial when maneuvering through the intricacies of a commercial real estate loan, and a commercial mortgage calculator serves as a valuable tool in this process. It helps you understand how do commercial loans work by providing key insights. Here’s how it can benefit you: Calculate monthly payments based on loan amount, interest rate, and repayment term. Compare different loan scenarios to see how varying interest rates or terms affect costs. Input specific parameters like loan-to-value and debt service coverage ratios to assess borrowing limits. Determine the necessary down payment, typically ranging from 15% to 35%. Using this calculator guarantees you make informed decisions and maintain financial stability throughout your commercial real estate expedition. Frequently Asked Questions What Are the 5 Cs of Commercial Lending? The five Cs of commercial lending are character, capacity, capital, collateral, and conditions. Lenders assess your credit history and reputation to determine character, whereas capacity evaluates your ability to repay the loan through metrics like the Debt Service Coverage Ratio. Capital refers to your financial resources, particularly the down payment. Collateral is the property securing the loan, and conditions involve external factors affecting your repayment ability, like market trends and economic climate. What Are the 4 Cs of Commercial Lending? The 4 Cs of commercial lending are crucial for lenders evaluating your loan application. First, there’s Character, which reflects your reputation and track record in business. Next is Credit, focusing on your credit score and history, with higher scores attracting better terms. Then, Capacity examines your ability to generate cash flow, often measured by the Debt Service Coverage Ratio. Finally, Collateral involves the assets you pledge, typically the commercial property itself, securing the loan. What Is the 2% Rule in Commercial Real Estate? The 2% Rule in commercial real estate suggests you should aim for a property that generates at least 2% of its purchase price in monthly rent. For instance, if you buy a property for $1 million, you’d expect around $20,000 in rent monthly. This guideline helps you analyze cash flow potential, ensuring the property can cover mortgage payments and expenses, making it a useful metric for evaluating investment opportunities in a competitive market. What Are the Three Cs of Commercial Lending? The three Cs of commercial lending are Credit, Collateral, and Cash Flow. Credit refers to your credit history and score, which impact your risk profile and loan terms. Collateral is the property or assets securing the loan; lenders often require the property itself. Cash Flow assesses your property’s income against its debt obligations, typically measured by the Debt Service Coverage Ratio (DSCR). A solid combination of these factors boosts your chances of loan approval. Conclusion In conclusion, securing a commercial real estate loan involves comprehending key requirements like credit scores, loan-to-value ratios, and debt service coverage ratios. By familiarizing yourself with these metrics and the associated loan terms and fees, you can navigate the financing process more effectively. Utilizing tools like a commercial mortgage calculator can additionally aid in making informed decisions. With the right preparation, you’ll be better positioned to qualify for the financing needed for your commercial property investment. Image via Google Gemini and ArtSmart This article, "Key Requirements for a Commercial Real Estate Loan" was first published on Small Business Trends View the full article

-

Meta Is Being Sued Over Whether WhatsApp Really Encrypts Your Messages

Shortly after Meta (then Facebook) bought WhatsApp in 2014, it promised to implement a surprisingly un-Facebooky feature: End-to-end encryption. The move was supposed to be a boon for privacy, ensuring nobody could see your messages aside from the recipient and yourself. Even now, WhatsApp's website claims, "No one outside of the chat, not even WhatsApp, can read, listen to, or share [your messages]." However, a new lawsuit filed in the U.S. District Court in San Francisco is now claiming that's not the case. According to reporting from Bloomberg, an international group of plaintiffs has sued Meta, saying that the app's claims of end-to-end encryption are a lie. The lawsuit alleges that Meta and WhatsApp "store, analyze, and can access virtually all of WhatsApp user's purportedly 'private' communications." The plaintiffs include users from Australia, Brazil, India, Mexico, and South Africa, who are being represented by attorneys from several firms. The allegations cite "whistleblowers" who helped bring this information to light, but no more is known as of yet. In an email to Bloomberg, Meta strongly denied the allegations. The company called the lawsuit "frivolous," assuring users that WhatsApp uses the open-source Signal protocol for encryption and adding that "[a]ny claim that people's WhatsApp messages are not encrypted is categorically false and absurd." If the lawsuit succeeds, it could affect billions of users around the world. That's because the plaintiffs' lawyers are asking the court to certify a class-action lawsuit. In the meantime, WhatApp is far from the only option for encrypted messaging apps. While it's unclear how the lawsuit will proceed, those looking to jump ship might want to look at alternatives like Signal or Viber instead. Note that some apps, like Telegram, do offer end-to-end encryption, but don't enable it by default. (Personally I use Line, because of the anime stickers.) I've reached out to Meta for further comment, and will update this story once I hear back. View the full article

-

Why Google Gemini Has No Ads Yet: ‘Trust In Your Assistant’ via @sejournal, @MattGSouthern

Google DeepMind CEO Demis Hassabis says Google doesn't have any current plans for ads in Gemini, as OpenAI moves toward ChatGPT advertising. The post Why Google Gemini Has No Ads Yet: ‘Trust In Your Assistant’ appeared first on Search Engine Journal. View the full article

-

Apple Finally Announced a New AirTag

We may earn a commission from links on this page. It's been nearly five years since Apple released the first—and only—AirTag, but that's not necessarily a surprise: These trackers aren't really the kind of product you expect to update every year or two. Unlike an iPhone, which gets new processors, cameras, and other hardware features every year, AirTags just ... track your stuff. The only thing that needs replacing annually are their batteries; otherwise, they do exactly what you expect them to. That said, Apple has made changes over the years. In response to initial criticism, the company made it much more difficult for someone to slip one of these AirTags in your bag or car and track you without your knowledge. Plus, there's plenty you can do with the current AirTag that wouldn't make you think you needed an upgraded one. Nonetheless, I suppose the original AirTag wasn't going to be the AirTag for all time. As such, Apple just announced a brand-new AirTag. It likely won't get you out to replace your existing Apple trackers, but these new features will come in handy if you decide to expand your AirTag collection. What's new with the latest AirTagApple isn't really calling this new AirTag anything in particular: It's still just AirTag. I'm a bit surprised, since, even if Apple replaces the existing AirTag with this one, they'll have a difficult time distinguishing between the first and second gen models. But that's a problem for Apple Store Geniuses, not us. The new AirTag comes with Apple's second-gen Ultra Wideband (UWB) chip. This is the UWB chip Apple uses with the iPhone 17 Line, as well as the iPhone Air, the Apple Watch Ultra 3, and Apple Watch Series 11. That new chip, plus the new Bluetooth chip, boosts Precision Finding's range by 50%. Precision Finding uses your iPhone to guide you to your AirTag, using haptics and visual and audio feedback to tell you when you're getting closer or further away. To be clear, the original AirTag also has a UWB chip that is compatible with Precision Finding, but this new UWB chip will make it easier to find an AirTag that isn't as close by. If you have an Apple Watch Series 9 or Apple Watch Ultra 2, the new AirTag marks the first time you'll be able to use Precision Finding. I'm not sure that's worth the upgrade, since you can always use Precision Finding with your iPhone, but it's certainly a nice perk if you happen to own one of these watches. Precision Finding is helpful for finding your AirTag's whereabouts, but it might not help you locate it if it's hiding, like if it's stuck under a cushion. That's what the speaker is for: You can make your AirTag chirp, so you can find it easier when you're within listening range. The new AirTag's speaker is 50% louder than the original, which should help when you really can't find your AirTag in your couch. What isn't new with the latest AirTagThat's about all the updates Apple added to this newest AirTag—though you wouldn't know it from the press release. Apple sprinkles in existing AirTag features that might make you think they're fresh, but, really, these are just core features of all AirTags, both new and old. This AirTag, like all AirTags, works within the Find My network: There's no inherent internet connection to enable tracking. Instead, the AirTag passively connects to any and all internet-connected Apple devices that are also connected to Find My—often, that means iPhones, but it can mean other devices like iPads and Macs. That enables features like Share Item Location, which lets you share your AirTags location with a third-party, like an airline. In that example, the airline can use that info to help find your luggage. The new AirTag also carries over the same privacy and security features as the previous model. No data is stored on device, and all Find My communications are end-to-end encrypted. Whether you have this AirTag or the first, Apple can't see your AirTag, or any devices that connected it to the Find My network. How much does the latest AirTag cost?Apple also didn't change the price of the second-gen AirTag. One of these trackers runs you $29, while a four pack costs $99—a small savings if you want to buy that many. Unless you really need the newest ones, however, you might want to consider the previous gen, since you can pick up a four-pack for $69.99 on Amazon right now. View the full article

-

my boss wants me to buy a fitness tracking device

A reader writes: I hold a leadership role and report to the co-founders of a small company, which has both an office hub and a remote workforce. The co-founders work in the office, and my team and I work remotely. Lately, a fitness tracking device that also monitors sleep and stress levels became popular in the office. It seems like nearly everyone in the office got one, and they started a global group that compares performance and it became a friendly competition. My boss, one of the co-founders, asked me to buy one so I can be part of the competition. When I refused to pay $240 for something I didn’t intend on buying, they offered to pay for it. I feel pressured to say yes, but I really don’t want to wear it or share my stress / sleep levels with the team. This is being brought up every time we talk, and my boss states I should be part of it to encourage the team and set an example. Neither our company nor my role are related to fitness, health, or mental health. That said, the vibe in the company is very health and fitness conscious, and the employees in the office tend to work out together. Should I agree to let them buy it and participate or should I stand my ground on this one? Keep declining. There are lots of job-appropriate ways for you to encourage the team and set an example: having a good work ethic, being warm and approachable, doing what you say you’re going to do, acting with integrity, mentoring others, being inclusive, offering public praise, taking responsibility for mistakes, and on and on. Buying a fitness tracking device and sharing your stress and sleep levels? Not a necessary component. In fact, if your boss wants you to “set an example,” why can’t that example be that’s it’s okay to have boundaries and enforce them respectfully? I’d bet there’s at least one person in that office who feels pressured to participate in the fitness tracking and would appreciate someone in leadership reinforcing that it’s okay not to. Of course, this is all about the principle and not the practicality of actually dealing with a boss who’s pressuring you. Since she’s bringing it up every time you talk and not taking no for an answer, you’re going to need to be pretty direct: “You’ve brought this up a few times, and I really don’t want to use a device like that. I know you’ve mentioned setting an example for the team, but I actually think it’s important that people know they don’t have to participate if they don’t want to, especially since this risks getting into health and privacy issues.” If she’s confused by what you mean by that, you could say, “At some point we’re going to have an employee with medical issues that will make it rough for them to be pressured to participate in this — if we don’t already, which we might! It’s great that people who want the group bonding element of this can participate if they want to, but when we’re dealing with something health-related, we’re asking for trouble if we don’t make it easy for people to opt out without pressure.” (Alternately, you can let them buy the tracking device for you and just put it on your dog.) The post my boss wants me to buy a fitness tracking device appeared first on Ask a Manager. View the full article

-

ICE and America’s flailing autocrat

Easily discredited propaganda is undermining The President’s assault on the constitutionView the full article

-

Treasury curve sends conflicting signals pre-Fed

Treasury yields are diverging, charts are breaking down and trading looks two-sided into the FOMC, according to the CEO of IF Securities. View the full article

-

These NYC real estate brokers are facing a sex-trafficking trial that could send them to prison for life

The brothers operated in the glitz and glamour of the Hamptons and South Beach. Two were high-end real estate brokers dubbed “The A Team.” The third went to law school and ran their family’s private security firm, which caters to heads of state and the rich and famous. They frequented nightclubs, cruised on yachts and flew on private jets. One lived alongside celebrities and corporate titans on Manhattan’s Billionaires’ Row. The others had multimillion-dollar waterfront mansions in Miami. But behind their posh, peripatetic facade, prosecutors say, Tal, Oren and Alon Alexander — known collectively as the Alexander Brothers — were predators who sexually assaulted, trafficked and raped dozens of women from 2008 to 2021, often after incapacitating them with drugs and sometimes recording their crimes on video. The brothers met victims at nightclubs, parties and on dating apps, and recruited others for trips to ritzy locales, paying for their flights and lodging at high-end hotels or luxe vacation rentals before drugging and raping them, prosecutors said. In all, dozens of women have accused them of wrongdoing. Now, the brothers — Tal, 39, and twins Alon and Oren, 38 — face a reckoning that prosecutors say was more than a decade in the making: a sex-trafficking trial that could put them in prison for the rest of their lives. Opening statements are slated for Tuesday in the brothers’ trial in federal court in Manhattan, after they were delayed a day because of heavy snowfall over the weekend in New York. Oren and Tal Alexander, the real estate dealers who specialized in high-end properties in Miami, New York and Los Angeles, have pleaded not guilty, along with their brother Alon, who graduated from New York Law School before taking his position with the security firm. All three have been held without bail since their December 2024 arrests. They were indicted months after several women filed lawsuits alleging sexual misconduct. A spokesperson for the Alexander Brothers said they “categorically deny that anyone was drugged, assaulted, or coerced, and the government has presented no physical evidence, medical records, contemporaneous complaints, or objective proof to establish those claims.” “This case highlights a broader concern about how the federal sex-trafficking statute is being applied,” said the spokesperson, Juda Engelmayer. “Congress enacted that law to address force, coercion, and exploitation; not to retroactively criminalize consensual adult relationships through inference or narrative.” “As the defense has consistently said, allegations are not evidence,” Engelmayer added. The brothers’ attorneys have promised to show the jury of six men and six women that prosecutors have taken innocent romantic and sexual encounters and converted them into criminal activity through clever lawyering. Oren Alexander’s attorney, Marc Agnifilo, has said the defense plans to prove that witnesses have lied to the government and that their testimony can’t be trusted. Judge Valerie E. Caproni, who will preside over the trial, has rejected defense requests to toss out the charges or send the case to state court. The Alexanders’ lawyers have said the allegations against them resemble “date rape” crimes more commonly prosecuted in state courts, but Caproni disagreed. “That badly misrepresents the nature of the charges,” the judge wrote. Agnifilo has said the jury will hear evidence of group sex, threesomes and promiscuity. During jury selection last week, prospective jurors were asked questions related to sexual activity and sex crimes. “The case is about sex and sexuality,” said Agnifilo, who represented Sean “Diddy” Combs last year as the hip-hop mogul was acquitted of sex trafficking and racketeering conspiracy charges but convicted on lesser prostitution-related counts. In court papers, the Alexander Brothers’ lawyers wrote that among the accusers they expect to testify at trial, they had located evidence “that undermines nearly every aspect of the alleged victims’ narratives.” Prosecutors have said their evidence will show that the brothers “have acted with apparent impunity — forcibly raping women whenever they wanted to do so.” —Michael R. Sisak and Larry Neumeister, Associated Press View the full article

-

How to Do Bookkeeping for Small Business €“ a Step-By-Step Guide

Managing bookkeeping for your small business might seem intimidating, but with a clear approach, it becomes manageable. Start by organizing your financial documents, like receipts and invoices, which form the foundation of your records. Next, categorize your transactions into key areas such as assets and expenses. By reconciling these with your bank statements, you can guarantee accuracy. Comprehending the step-by-step process is crucial, especially when you encounter common issues. What comes next can considerably impact your business’s financial health. Key Takeaways Gather all financial documents, including receipts, invoices, and bank statements for accurate bookkeeping. Categorize transactions into assets, liabilities, equity, revenue, and expenses for organized records. Reconcile transactions by matching your records with bank statements to ensure accuracy. Prepare essential financial statements like balance sheets and income statements for insights into business performance. Regularly review and analyze financial reports to inform decision-making and maintain financial health. What Is Bookkeeping? Bookkeeping is the backbone of financial management for small businesses, as it involves the systematic process of recording, organizing, and tracking all financial transactions. When you understand how to do bookkeeping for a small business, you can maintain accurate records that reflect your financial health. Through DIY bookkeeping, you’ll gain insights into income, expenses, and cash flow, which are vital for informed decision-making. This process not just helps with tax compliance but prepares you for audits and filings as well. By identifying spending patterns and profitability, effective finance and bookkeeping practices enable you to plan for the long term and secure funding. Different Bookkeeping Methods Selecting the right bookkeeping method is crucial for accurately tracking your small business’s financial activities. Here are three common methods you can consider: Single-entry bookkeeping: This method records each transaction only once, making it ideal for small businesses with simple financial transactions. It’s easier to manage but less thorough. Double-entry bookkeeping: Here, each transaction is recorded in two accounts (debit and credit). This method is recommended for growing businesses, as it improves reporting and accountability. Cash-based vs. Accrual-based accounting: Cash-based accounting recognizes income and expenses only when money changes hands, providing real-time cash flow insights. Conversely, accrual-based accounting tracks transactions when they’re earned or incurred, allowing for better long-term financial planning. Choose wisely based on your business size and financial goals. Step-by-Step Bookkeeping Process Establishing a clear step-by-step bookkeeping process is vital for managing your small business finances effectively. Start by gathering all financial documents, such as receipts, invoices, and bank statements, to guarantee every transaction is recorded. Next, categorize these transactions into key financial categories: assets, liabilities, equity, revenue, and expenses. Then, reconcile your transactions by matching your business’s opening balance with your bank account records to identify discrepancies. After that, prepare important financial statements, including the balance sheet, income statement, and cash flow statement. Finally, review these statements regularly to analyze performance and make informed decisions. Step Description Gather Documents Collect receipts, invoices, bank statements Categorize Transactions Organize into assets, liabilities, equity, revenue, expenses Reconcile Transactions Match opening balance with bank records Prepare Financial Statements Create balance sheet, income statement, cash flow statement Common Bookkeeping Issues During managing your small business finances, you may encounter several common bookkeeping issues that can hinder your operations. Addressing these problems swiftly is crucial for maintaining financial health. Here are three common issues: Messy Records: Disorganized records often result in misclassified expenses, complicating tax preparations and impacting financial reporting accuracy. Data Entry Backlogs: Falling behind on data entry can create a stressful backlog as tax deadlines approach, making it harder to manage your finances. Ignored Financial Reports: Neglecting to review financial reports can obscure your financial health, preventing you from spotting areas for improvement. Utilizing small business software like Wave can help streamline your bookkeeping tasks, reducing errors and keeping your records organized. Business-Specific Bookkeeping Needs Comprehending your business-specific bookkeeping needs is essential for effective financial management. For freelancers, implementing receipt tracking tools helps guarantee accurate billing and organization, whereas e-commerce businesses must keep a close eye on inventory levels to prevent costly stock issues. Similarly, consultants should scrupulously monitor project details to maintain cash flow and provide transparent invoicing for their clients. Freelancers’ Receipt Tracking Effective receipt tracking is essential for freelancers looking to maintain accurate financial records and maximize their earnings. Here are some key strategies to improve your receipt management: Organize receipts by project or client: This helps streamline expense reporting and simplifies tax preparation, reducing the risk of lost documentation. Utilize cloud-based tools: Apps allow you to capture and categorize expenses directly from your mobile device, making it easier to keep everything in one place. Maintain a separate business bank account: This distinction between personal and business expenses facilitates better financial management and clearer budgeting. Regularly reviewing your financial records can help you identify spending trends, enabling more informed planning for future projects. E-commerce Inventory Monitoring When running an e-commerce business, monitoring your inventory isn’t just a good practice—it’s essential for maintaining a healthy bottom line. You need to keep a close eye on inventory levels to meet customer demand without incurring overstock costs. Implementing inventory management software can automate stock tracking, sales trends, and reorder points, improving your bookkeeping efficiency. Regularly reconciling your inventory records with financial statements helps identify discrepancies and offers a clearer view of your business’s financial health. Categorizing inventory into groups, like raw materials and finished goods, can pinpoint profitable products and those needing marketing boosts. Finally, choosing between FIFO or LIFO accounting methods is critical, as it directly impacts your cost of goods sold and overall profitability. Consultant Project Cash Flow Accurate cash flow management is vital for consultants, as it directly impacts your ability to sustain and grow your business. To effectively manage cash flow, consider these strategies: Track Billable Hours and Expenses: Carefully record your billable hours and any project-related expenses to guarantee accurate client invoicing and maintain profitability. Use Project Management Tools: Implement a project management tool to monitor cash flow across multiple projects, providing better financial insights and planning. Establish a Clear Invoicing Schedule: Align your invoicing with project milestones to improve cash flow predictability and guarantee timely payments, which are critical for maintaining financial stability. When to Seek Professional Help As you manage your small business, you might notice signs that indicate it’s time to seek professional help with your bookkeeping. If sorting transactions takes away from serving your clients or if tax deadlines feel overwhelming, it’s wise to contemplate hiring a bookkeeper. Professional assistance can streamline your financial processes, clarify complex statements, and in the end allow you to focus on growing your business. Signs You Need Help Have you ever felt overwhelmed by your bookkeeping tasks, wondering if it’s time to seek professional help? Here are three clear signs that indicate you might need assistance: Time Consumption: If sorting through transactions takes more time than serving clients, a professional bookkeeper could streamline your operations and free up your schedule. Frequent Errors: Missing tax deadlines or making regular mistakes in your records suggests that expert assistance is necessary for ensuring compliance and accuracy. Rapid Growth: If your business is growing quickly and cash flow management feels complicated, a bookkeeper can provide strategies for sustainable financial health, allowing you to focus on your core business activities. Benefits of Professional Assistance When managing a small business, guaranteeing accurate and timely financial records is crucial for success. Hiring a professional bookkeeper can streamline your bookkeeping tasks, allowing you to focus on core operations and client service instead of juggling financial records. If sorting transactions and entering data takes up too much of your time, it’s wise to seek professional help to maintain efficiency and accuracy. Missing tax deadlines is another strong indicator that you need assistance; a bookkeeper guarantees timely filing and compliance with tax regulations. Furthermore, if you’re uncertain about cash flow or financial reports, consulting a professional can provide expertise in analyzing your financial health. Quickly growing businesses can likewise benefit from a bookkeeper to manage increasing transaction volumes effectively. Frequently Asked Questions What Is the Easiest Way to Do Bookkeeping for a Small Business? The easiest way to do bookkeeping for a small business is to use cloud-based accounting software like QuickBooks or Wave. These tools automate data entry and transaction categorization, saving you time and reducing errors. Set a regular monthly schedule to review and reconcile your accounts for accuracy. Furthermore, using mobile apps for capturing receipts can streamline documentation, whereas a simple chart of accounts helps track income and expenses effectively. How to Do Bookkeeping Manually Step by Step? To do bookkeeping manually step by step, start by gathering all your financial documents, like receipts and invoices. Next, create a chart of accounts to categorize transactions into assets and expenses. Record each transaction in a ledger, noting the date, amount, and purpose. Regularly reconcile your accounts with bank statements to catch discrepancies. Finally, prepare financial statements, such as balance sheets, to assess your business’s financial health and inform your decisions. What Are the Three Golden Rules of Bookkeeping? The three golden rules of bookkeeping are crucial for maintaining accurate financial records. First, you debit the receiver and credit the giver, meaning you record the account receiving value as a debit and the one giving value as a credit. Second, debit all expenses and losses to reflect outflows accurately. Finally, credit all income and gains to guarantee all profits are included. Following these rules helps you maintain a clear financial picture. What Are the 5 Stages of Bookkeeping? The five stages of bookkeeping are crucial for maintaining accurate financial records. First, you gather financial documents like receipts and bank statements. Next, categorize transactions into assets, liabilities, revenue, and expenses for clarity. Then, reconcile accounts by matching your records with bank statements to catch discrepancies. After that, prepare financial statements such as balance sheets and income statements. Finally, review these statements to gain insights into your business’s financial health and inform decision-making. Conclusion In summary, effective bookkeeping is crucial for your small business’s financial health. By gathering documents, categorizing transactions, and regularly reconciling accounts, you can maintain accurate records. Preparing key financial statements like the balance sheet and income statement provides valuable insights into your business’s performance. Address common bookkeeping issues quickly, and recognize when to seek professional assistance. By following this step-by-step guide, you’ll be better equipped to make informed decisions and guarantee compliance with tax regulations. Image via Google Gemini This article, "How to Do Bookkeeping for Small Business €“ a Step-By-Step Guide" was first published on Small Business Trends View the full article

-

How to Do Bookkeeping for Small Business €“ a Step-By-Step Guide