All Activity

- Past hour

-

Reddit tests AI shopping carousels in search results

Reddit is piloting a new AI-powered shopping experience that transforms its famously trusted community recommendations into shoppable product carousels — a move that could reshape how the platform monetizes its search traffic. What’s happening. A small group of U.S.-based users are seeing interactive product carousels appear in search results when their queries signal purchase intent — think “best noise-canceling headphones” or “top budget laptops.” The carousels sit at the bottom of search results and include pricing, images and direct retailer links. Products are surfaced from items actually mentioned in Reddit posts and comments — not just ad inventory. For consumer electronics queries, Reddit is also pulling from select Dynamic Product Ads (DPA) partner catalogs. How it works. The AI identifies purchase-intent queries, scans relevant Reddit conversations for product mentions, and assembles them into structured, shoppable cards. Users can tap a card to get more details and link out to retailers. Why we care. Reddit’s shopping carousels give advertisers a rare opportunity to reach consumers at peak purchase intent — at the exact moment they’re seeking peer validation for a buying decision. Unlike traditional display ads, products surfaced here benefit from the implicit trust of Reddit’s community context, making them feel less like ads and more like recommendations. For brands already running Dynamic Product Ads on Reddit, this is a direct pipeline from community buzz to conversion. Between the lines. Reddit is doing something its competitors haven’t quite cracked — using organic, peer-driven content as the foundation of a commerce experience rather than pure ad targeting. That’s a meaningful distinction. Consumers increasingly distrust sponsored recommendations, and Reddit’s entire value proposition is built on authentic community voice. Formalizing that into a shopping layer could give it a credibility edge over traditional retail media networks. The big picture. Retail media is a fast-growing business, and platforms with high-intent audiences are racing to claim their share. Reddit’s search traffic has grown significantly since its Google search partnership, making this a natural next frontier. The bottom line. Reddit is experimenting with turning intent-driven search into commerce, aiming to make it easier for users to move from recommendation to transaction — without leaving the community context that drives trust. Dig deeper. In Case You Saw It: We are Testing a New Shopping Product Experience in Search View the full article

-

EV Sales Dip After Tax Credit Expiration, Hybrid Vehicles Gain Ground

The U.S. automotive landscape is shifting, and small business owners need to pay attention. Recent data reveals that hybrid, battery electric, and plug-in hybrid vehicles comprised approximately 22% of light-duty vehicles sold in the U.S. in 2025, up from 20% in 2024. This change not only impacts the automotive industry but also various sectors reliant on transportation. “Efficiency and sustainability are driving this change,” notes Michael Dwyer from the U.S. Energy Information Administration. As electric vehicles (EVs) become more prevalent, they are influencing energy consumption patterns, making it crucial for small business owners to adapt to evolving market dynamics. The rise in hybrid electric vehicles (HEVs) indicates that these options are becoming increasingly attractive to consumers. Unlike battery electric vehicles (BEVs) and plug-in hybrids that rely on external power sources, HEVs utilize a conventional engine along with an electric motor, allowing them to sidestep some of the challenges associated with charging infrastructure. This resilience makes them a practical option for businesses, especially those that rely on fleet operations. From Q3 to Q4 of 2025, however, the market witnessed a sharp decline in BEV sales, coinciding with the expiration of significant tax credits aimed at green vehicle purchases. These credits—the New Clean Vehicle Credit and the Qualified Commercial Clean Vehicle Credit—expired on September 30, 2025, leading to battery electric vehicles dropping from a high of 12% in September to less than 6% in the subsequent months. This drop raises concerns for small business owners considering investments in electric vehicle fleets. Despite the current challenges, the luxury segment of the vehicle market is experiencing a surge in electric vehicle sales. Luxury vehicles made up 14% of total light-duty vehicle sales in 2025, with 23% of those being battery electric. This trend may not directly impact small businesses but signals a growing acknowledgment of EVs among consumer demographics with higher purchasing power. It underscores the importance of sustainability as consumers become increasingly eco-conscious. For businesses contemplating the integration of EVs into their operations, understanding how different vehicle types interact with energy sources can be beneficial. BEVs and plug-in hybrids pull from the grid, which can significantly impact energy demand and costs. Conversely, HEVs can provide a smoother transition into the electric vehicle market without the immediate need for a robust charging infrastructure. While the data suggests that battery electric vehicles constituted 7.5% of light-duty vehicle sales overall, the total share of electrics in the current vehicle fleet remains less than 9%. For small business owners, this presents both an opportunity and a challenge. On one hand, there is the potential for cost savings on fuel and maintenance. On the other, the fluctuating sales figures and market uncertainty call for cautious investment. As businesses examine their transportation strategies, staying informed about future tax incentives is essential. While the expiration of the tax credits resulted in reduced demand for BEVs, future policies may emerge to reinvigorate the market. Business owners should monitor developments closely, particularly as the need for commercial clean vehicles continues to escalate in tandem with regulatory pressures for sustainability. In summary, small business owners should seize the opportunity that hybrid and electric vehicle sales present, while also preparing for potential market fluctuations. Utilizing hybrid electric vehicles can offer immediate advantages while waiting for further growth in battery electric sales and supporting infrastructure. Adaptive strategies will be vital as the automotive landscape continues to evolve. For more detailed information on the current trends in electric vehicles, visit the original post from the U.S. Energy Information Administration here. Image via Google Gemini This article, "EV Sales Dip After Tax Credit Expiration, Hybrid Vehicles Gain Ground" was first published on Small Business Trends View the full article

- Today

-

will my angry work friend harm my reputation?

A reader writes: I’ve become very good friends both in and out of work with a small group of colleagues (four total). This question is about one of them, Samantha. Samantha has always been a bit dry and sarcastic in her sense of humor. Over the past several months, however, she has become increasingly, well, mean. Samantha is shockingly blunt in meetings, often pulls faces that show her keen displeasure, and has been condescending (in person and in emails) to support staff. While she is sometimes right in her complaints, her delivery is frankly atrocious. While everyone complains about work, she seems to really hate it here. At the same time, though, we work in a niche, prestigious field, and I think she derives much of her identity from that, so I don’t see her leaving. She’s become so deeply unpleasant to be around that I’ve taken to avoiding her at work. She’s been better in social situations outside of work, thankfully, so our friendship remains mostly intact. However, I worry that as she burns her reputation to the ground at work, mine is going to be collateral damage, as most people know that we are close friends. Is this something worth talking to my manager about? Samantha doesn’t report to her, so I don’t know what she’d be able to do, but I’ve also worked so incredibly hard to get where I am, and I also don’t want people to think I endorse Samantha’s behavior. Can you talk to Samantha instead? You describe her as a good friend, so is there room to sit down with her and say something like, “You seem really unhappy at work, to the point that I think it’s affecting how you’re perceived, and it’s making it hard to spend time around you at work. You’re not like that outside of our jobs, and I didn’t know if you knew how noticeable it’s become.” You could say you’re worried about the ramifications for her professionally, but you’re also worried about her as a friend. I don’t think you need to talk to your manager about it unless you’ve seen signs that the two of you are seen a unit in some way. It is true that if you’re known to be good friends with someone who is A Problem, their reputation can sometimes rub off on you. It’s most likely to happen if you’re seen to be following their lead, even in minor ways — like if someone overhears you complaining to/with them (even if it would be seen as less weighty if you were blowing off steam with someone else), or if you seem to fight each other’s battles. And one trap to particularly watch out for is if you’re trying to support her as a friend by saying sympathetic-sounding things, but it sounds to someone overhearing as if you’re agreeing with her. But if you avoid those things and you make a point of being scrupulously professional and you’re reasonably upbeat and otherwise un-Samantha, your manager is going to be able to tell that you’re two different people. The post will my angry work friend harm my reputation? appeared first on Ask a Manager. View the full article

-

Why Iran is betting on war

Tehran thinks a drawn-out conflict could eventually yield a better deal than what The President is offering todayView the full article

-

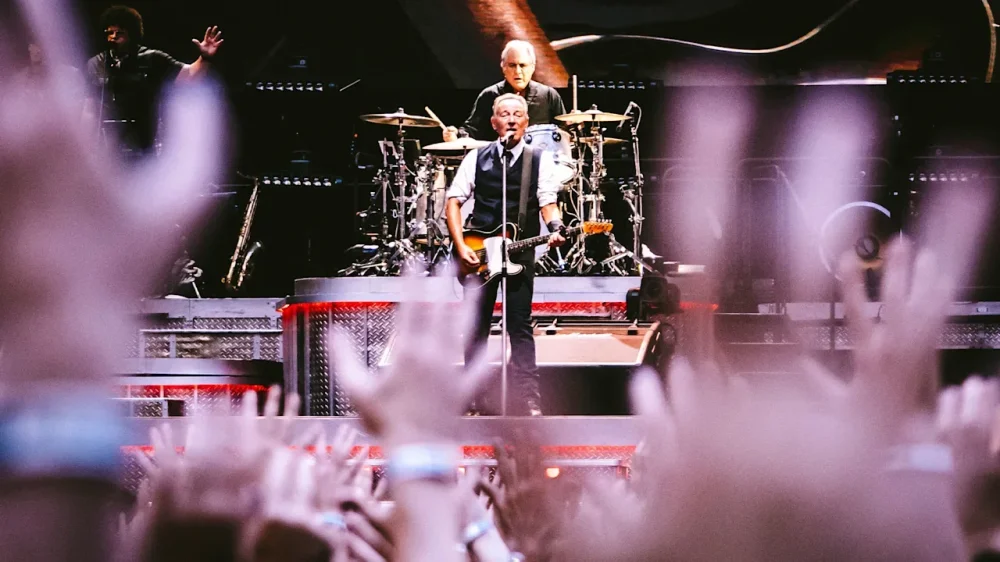

‘No Kings’ spring 2026: Bruce Springsteen concerts are a protest against ICE and Trump. Where and when to see the shows

On the heels of his recent, political hit song “Streets of Minneapolis” about President Donald The President’s deployment of Immigration and Customs Enforcement (ICE) agents into that city, Bruce Springsteen and The E Street Band announced the spring 2026 dates for their “Land Of Hope And Dreams Tour” dubbing it the “No Kings” Tour. The tour kicks off in Minneapolis on March 31. Last month, Springsteen performed the single there during a live benefit concert organized by former Rage Against the Machine guitarist, Tom Morello. Springsteen also dedicated his song “Promised Land” to Renee Good during a recent concert in his home state of New Jersey, and spoke out against the president and ICE. “Right now we are living through incredibly critical times,” Springsteen told the audience. “The values and the ideas [of the United States] have never been as endangered as they are right now… If you believe in democracy, in liberty, if you believe truth still matters, and it’s worth speaking out and worth fighting for, if you believe in the power of law and that no one stands above it, if you stand against heavily armed masked federal troops invading an American city, using gestapo tactics against our fellow citizens… send a message to this president… ‘ICE should get the f– k out of Minneapolis.” Good, the mother of three, was shot and killed by an ICE agent in Minneapolis, as was a 37-year-old ICU nurse Alex Pretti. “The movement is growing, and we’re glad to have the Boss join the chorus,” Eunic Epstein-Ortiz, a national spokesperson for the “No Kings,” said. “He understands what Americans know: we don’t do kings.” Here are the tour dates: March 31: Minneapolis, MN – Target Center April 3: Portland, OR – Moda Center April 7: Inglewood, CA – Kia Forum April 9: Inglewood, CA – Kia Forum April 13: San Francisco, CA – Chase Center April 16: Phoenix, AZ – Mortgage Matchup Center April 20: Newark, NJ – Prudential Center April 23 Sunrise, FL – Amerant Bank Arena April 26: Austin, TX – Moody Center April 29: Chicago, IL – United Center May 2: Atlanta, GA – State Farm Arena May 5: Belmont Park, NY – UBS Arena May 8: Philadelphia, PA – Xfinity Mobile Arena May 11: New York, NY – Madison Square Garden May 14: Brooklyn, NY – Barclays Center June 6: New York, NY – Madison Square Garden June 19: Pittsburgh, PA – PPG Paints Arena June 22: Cleveland, OH – Rocket Arena June 24: Boston, MA – TD Garden June 27: Washington, D.C. – Nationals Park Tickets go on sale Friday, February 20 and Saturday, February 21. When is the next ‘No Kings’ protest? The third “No Kings” nationwide protest is set to take place in a little over a month on March 28, in all 50 states, with over 1,000 locally organized events already confirmed, including a flagship gathering in the Twin Cities, with thousands more anticipated. Organizers predict the March event will be larger than the previous ones: In June, over five million people attended the first “No Kings” protest, growing to over seven million people at the second “No Kings” protests in October. View the full article

-

What Are Key Conflict Management Principles Everyone Should Know?

Grasping key conflict management principles is crucial for steering workplace disputes effectively. You’ll find that emotional intelligence helps you manage your feelings and respond appropriately. Effective communication, especially through “I statements,” encourages respectful dialogue. Moreover, active listening cultivates trust and comprehension. Recognizing different conflict types and applying suitable resolution strategies can lead to constructive outcomes. As you explore these principles, you’ll discover how they can improve professional relationships and create a more positive work environment. Key Takeaways Recognize and address conflicts early to prevent escalation and reduce negative impacts on productivity and morale. Foster open communication by creating a safe environment for dialogue and encouraging diverse perspectives. Develop emotional intelligence and active listening skills to enhance understanding and reduce misunderstandings during conflicts. Utilize the Thomas-Kilmann Conflict Model to choose appropriate resolution strategies based on the situation and relationships involved. Implement stress management techniques to maintain a calm atmosphere, facilitating constructive discussions and effective conflict resolution. The Importance of Conflict Management in the Workplace Conflict management is fundamental in the workplace since unresolved issues can lead to significant losses for businesses. American companies lose about $359 billion yearly because of these conflicts. You mightn’t realize it, but workers spend nearly 2.8 hours each week dealing with problems, which distracts them from their primary tasks. High-performing teams thrive on effective communication and trust, both of which suffer when conflict isn’t managed properly. By addressing issues early, you can achieve a 37% reduction in resignations linked to stress, demonstrating the effectiveness of proactive conflict management strategies. To cultivate a positive workplace culture, implementing conflict management principles is vital. Consider exploring resources like conflict resolution strategies PDFs to improve your comprehension and skills. When you create an environment that encourages open communication, you not just boost employee engagement but also enhance overall organizational morale, making conflict management a critical aspect of any successful business. Understanding Different Types of Conflict Maneuvering workplace dynamics can be challenging, especially when various types of conflict arise. Conflicts can occur at different levels: intrapersonal, interpersonal, intergroup, and interorganizational. Intrapersonal conflicts usually happen when your personal values clash with workplace expectations, making it tough to align your beliefs with your responsibilities. Interpersonal conflicts often arise from miscommunications or differing opinions between colleagues, leading to tension in professional relationships. Intergroup conflicts can occur because of competition for resources or differing objectives between teams, which can strain collaboration. Finally, interorganizational conflicts often involve contractual disputes or challenges in joint ventures, affecting relationships between companies. Comprehending these types of conflict is crucial, as it impacts decision-making, team dynamics, and overall workplace morale. Recognizing the specific type of conflict can help you choose the right resolution strategy, in the end contributing to a more harmonious work environment. Key Skills for Effective Conflict Resolution Steering workplace conflicts requires a solid set of skills for effective resolution. First, emotional intelligence is vital; it helps you manage your emotions and respond thoughtfully during disputes. Next, clear communication is fundamental. Use “I statements” to express your feelings without blaming others, which encourages constructive dialogue. Furthermore, practicing empathy allows you to appreciate different perspectives, promoting respect and cooperation among team members. Moreover, active listening is critical, as it nurtures comprehension and validation, helping parties feel heard and reducing tension. Implementing stress management techniques, like taking breaks or addressing root causes of tension, is also important. These strategies maintain a calm atmosphere conducive to open discussions. By honing these skills, you can effectively navigate conflicts, leading to resolutions that benefit everyone involved. Active Listening: The Foundation of Understanding Even though many skills contribute to effective conflict resolution, active listening stands out as a fundamental foundation for comprehension. This technique requires you to fully focus on the speaker, which improves understanding and demonstrates respect. Research shows that practicing active listening can enhance communication effectiveness by up to 50%, greatly reducing misunderstandings during conflicts. By paraphrasing and asking clarifying questions, you can confirm your grasp and address underlying issues. Studies indicate that active listening nurtures a sense of safety and trust, making others more willing to express their feelings and opinions openly. In the workplace, implementing active listening strategies can decrease conflicts, as it helps uncover the real interests behind stated positions. Emotional Intelligence: Managing Emotions Emotional intelligence (EI) serves as a vital component in effectively managing conflicts, as it encompasses the ability to recognize and regulate your own emotions during the process of empathizing with the feelings of others. By developing your EI, you can maintain composure during conflicts, which sets a calm tone that cultivates trust and encourages open dialogue among team members. Research shows that individuals with strong emotional intelligence are more adept at handling interpersonal conflicts, leading to better communication and collaborative problem-solving. Key skills within EI, such as active listening and empathy, help de-escalate tensions and promote comprehension. This not merely resolves the immediate conflict but additionally reduces the likelihood of future disputes. In addition, enhancing your emotional intelligence can greatly improve overall workplace morale and cohesion, equipping you with the tools to manage emotions constructively in challenging situations. In the end, EI is vital for effective conflict management. Effective Communication: Clarity and Respect Effective communication plays a pivotal role in conflict management, as it guarantees that all parties involved comprehend the issues clearly. Using clear and direct language minimizes misunderstandings. Implementing “I statements,” like “I feel concerned when deadlines slip,” keeps the focus on the problem, nurturing a respectful dialogue. Active listening is crucial; it involves being fully present, reducing misinterpretations, and uncovering underlying issues. Nonverbal cues, such as maintaining eye contact and open body language, greatly improve perceptions of respect and trust. Establishing a respectful tone encourages open communication and promotes a culture where disagreements are viewed as growth opportunities. Strategy Purpose Use “I statements” Focus on feelings, not personal attacks Practice active listening Reduce misinterpretations, uncover issues Maintain eye contact Build trust and respect during discussions Encourage open dialogue Create a safe environment for sharing ideas Encourage feedback Promote continuous improvement and comprehension Negotiation: Finding Common Ground Finding common ground in negotiations is fundamental for resolving conflicts and nurturing collaboration. To achieve this, you should identify shared goals and interests, which can reduce divisive attitudes among conflicting parties. Active listening techniques are imperative; they clarify misunderstandings and encourage respectful dialogue, leading to productive outcomes. Instead of focusing on rigid positions, skilled negotiators emphasize interests, allowing for a deeper comprehension of underlying motivations and facilitating win-win solutions. Clear and assertive communication is critical; vague language can breed confusion and impede resolution efforts. Furthermore, engaging in creative problem-solving can uncover innovative solutions that satisfy everyone’s needs. This approach not just resolves the immediate conflict but also strengthens relationships between parties. By emphasizing these negotiation strategies, you can create an atmosphere of collaboration that ultimately benefits all involved, paving the way for sustainable resolutions and ongoing partnerships. Steps for Managing Conflict Successfully Conflict management requires a structured approach to secure resolution and maintain relationships. Start by acknowledging the conflict early; this can reduce resignations linked to stress by 37%. Next, set up a resolution-focused conversation in a private setting, allowing everyone to express their perspectives without interruption. Step Action Acknowledge Conflict Recognize the issue before it escalates. Create Safe Space Provide a private setting for open dialogue. Brainstorm Solutions Collaboratively generate ideas for resolution. Assign Responsibilities Agree on the best solution and clarify roles for each party. Follow Up Assess the effectiveness of the solution and maintain communication. Common Conflict Management Strategies When managing conflict, comprehension of common strategies can greatly influence the outcome. You’ll find that the Thomas-Kilmann Conflict Model outlines five main approaches: Avoiding, Competing, Accommodating, Compromising, and Collaborating, each with its own strengths and weaknesses. Effective communication techniques play a vital role in applying these strategies, helping you navigate complex situations during the maintenance of relationships. Types of Conflict Strategies Grasping different conflict management strategies can greatly improve your ability to navigate disputes effectively. The Thomas-Kilmann Conflict Model identifies five key strategies: Avoiding, Competing, Accommodating, Compromising, and Collaborating. Avoiding works in low-stakes situations but falls short in workplaces where relationships matter. Competing focuses on personal goals over relationships, useful in emergencies but can harm trust if overused. Accommodating emphasizes relationships by yielding to others’ needs, which is effective for de-escalation but may limit innovation. Compromising seeks a middle ground, balancing assertiveness and cooperativeness. Finally, Collaborating aims for win-win outcomes, valuing both goals and relationships, making it ideal for complex situations requiring multiple perspectives. Comprehending these strategies helps you choose the best approach for each conflict scenario. Effective Communication Techniques Effective communication techniques play a pivotal role in resolving disputes and preventing misconceptions. By utilizing “I statements,” you can express your feelings without blaming others, which improves comprehension and reduces defensiveness. Active listening is equally important; techniques like paraphrasing and asking clarifying questions guarantee all perspectives are acknowledged, making resolution more attainable. Clear, direct communication, free of vague language, helps align expectations and minimizes further confusion. Moreover, maintaining positive nonverbal cues, such as open body language and steady eye contact, reinforces your message and signals approachability during discussions. The Role of Leaders in Conflict Resolution Leaders play a pivotal role in conflict resolution, as they are often the first line of defense in addressing personal disputes and encouraging a collaborative work environment. They must proactively address conflicts, ensuring fair treatment during promoting employee well-being. By cultivating a culture of open communication, leaders allow team members to express concerns and navigate disagreements constructively. Moreover, unresolved conflict can cost organizations up to $359 billion annually, highlighting the need for leaders to manage disputes actively. Utilizing strategies from the Thomas-Kilmann Conflict Model, leaders can guide their teams by selecting appropriate approaches that balance personal goals and relationships. Leadership Role Key Actions Conflict Identification Address personal disputes proactively Open Communication Cultivate a culture of dialogue Strategy Implementation Use the Thomas-Kilmann model effectively Building a Positive Work Environment Through Conflict Management Conflict management is a vital component of nurturing a positive work environment, as it directly influences how employees interact and collaborate. When you effectively manage conflicts, you cultivate a culture of respect and open communication, which allows employees to voice their concerns without fear. Organizations that prioritize conflict resolution can see a 37% reduction in turnover rates, as it shows employees that their well-being matters. High-performing teams that address conflicts openly often experience improved collaboration and innovation, leading to enhanced productivity. By establishing clear communication protocols and safe dialogue spaces, you can prevent misunderstandings and minimize escalation, creating a more harmonious workplace. Moreover, training employees in conflict management skills not only strengthens professional relationships but also encourages a positive work culture, resulting in a more engaged and motivated workforce. Frequently Asked Questions What Are the 5 C’s of Conflict Management? The 5 C’s of conflict management are Communication, Collaboration, Compromise, Consistency, and Calmness. You need to communicate clearly and listen actively to reduce misunderstandings. Collaboration involves working together for win-win solutions, promoting teamwork. Compromise requires making concessions to meet everyone’s needs. Consistency guarantees fair practices in conflict resolution, building trust among team members. Finally, maintaining calmness throughout the process is crucial to create a productive environment for resolving disputes effectively. What Are the Main Principles of Conflict Management? To effectively manage conflict, focus on addressing issues early and directly. Use active listening to guarantee everyone feels heard, which promotes cooperation. Stay calm and composed to cultivate a positive environment, preventing impulsive decisions. Concentrate on interests rather than positions, as this helps uncover underlying motivations for better solutions. Finally, maintain fairness and transparency throughout the process to build trust and loyalty among team members, reinforcing your integrity as a leader. What Are the 5 A’s of Conflict Management? The 5 A’s of conflict management are Acknowledge, Assess, Address, Adapt, and Assess Again. You start by acknowledging the conflict, which sets the stage for resolution. Next, you assess the situation by comprehending all perspectives involved. Then, you address the conflict through open communication and collaboration to find solutions. After implementing a resolution, you adapt your approach as needed and reassess to guarantee the solution remains effective, promoting continuous improvement in handling conflicts. What Are the 4 C’s of Conflict? The 4 C’s of conflict are Clarity, Communication, Collaboration, and Compassion. Clarity means comprehending the root causes of disputes, ensuring all parties grasp the issues involved. Communication nurtures open dialogue, allowing everyone to voice their perspectives and feel acknowledged, which reduces escalation risks. Collaboration encourages working together for win-win solutions, reinforcing trust. Finally, Compassion involves recognizing emotions and needs, promoting empathy, which greatly improves the resolution process for all individuals involved. Conclusion In conclusion, comprehending key conflict management principles is vital for nurturing a productive workplace. By recognizing different types of conflict and honing skills like active listening and emotional intelligence, you can navigate disputes more effectively. Implementing appropriate resolution strategies not just addresses issues but additionally strengthens professional relationships. Leaders play an important role in guiding conflict resolution efforts. In the end, embracing these principles contributes to a positive work environment where collaboration and respect thrive, benefitting everyone involved. Image via Google Gemini This article, "What Are Key Conflict Management Principles Everyone Should Know?" was first published on Small Business Trends View the full article

-

Google Analytics adds AI insights and cross-channel budgeting to Home page

Google Analytics is adding AI-powered Generated insights to the Home page and rolling out cross-channel budgeting (beta), moves designed to help marketers spot performance shifts faster and manage paid spend more strategically. What’s happening. Generated insights now appear directly on the Google Analytics Home screen, summarizing the top three changes since a user’s last visit. That includes notable configuration updates, anomalies in performance and emerging seasonality trends — all without digging into detailed reports. The feature is built for speed. Instead of manually scanning dashboards, marketers get a quick snapshot of what changed and why it may matter. Cross-channel budgeting (Beta). Google is also introducing cross-channel budgeting in beta. The feature helps advertisers track performance across paid channels and optimize investments based on results. Access is currently limited, with broader availability expected over time. Why we care. These updates make it faster to spot performance shifts and easier to connect insights to budget decisions. Generated insights surface key changes automatically, reducing the time spent digging through reports, while cross-channel budgeting helps marketers allocate spend more strategically across paid channels. Together, they streamline analysis and improve how quickly teams can Bottom line. Together, Generated insights and cross-channel budgeting aim to reduce reporting friction and improve decision-making — giving marketers faster answers and more control over how they allocate budget across channels. View the full article

-

Mortgage rates settle above 6%, lowest in over three years

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday. View the full article

-

Eileen Gu, most-decorated female freestyle skier in Olympics history, shuts down reporter’s ‘ridiculous’ question about her performance

Eileen Gu, the 22-year-old Chinese freeskier who just became the most decorated Olympian in women’s freestyle skiing, stood up for herself when speaking to a reporter at a press conference this week. In doing so, the skier unwittingly gave women everywhere an absolute masterclass in knowing their worth. The skier, who previously earned a gold medal and two silvers at the Beijing winter games in 2022, has earned two more silver medals at the current Milan Cortina games, becoming the most decorated athlete in her sport. And she’s not finished yet—Gu is still set to compete in the women’s halfpipe qualifier on Thursday and the halfpipe final on Saturday. The skier is also the only female freeskier to compete in three disciplines (slopestyle, halfpipe and big air) at the 2026 Winter Olympics. Regardless of the athlete’s incredible run thus far, a reporter asked Gu a question that raised some eyebrows on Monday. Most notably, Gu’s. The reporter asked the Olympian whether she was proud of her two new silver medals, or if she considered them to be “two golds lost.” The question seemed to minimize Gu’s incredible accomplishments in her sport, given her success. However, the athlete (who burst out laughing at first) did not shy away from making one thing abundantly clear: no one is going to cast a shadow over her or her achievements. Gu launched into an articulate and fierce response that was brimming with self-assuredness. “I’m the most decorated female freeskier in history, I think that’s an answer in and of itself,” she began. “How do I say this? Winning a medal at the Olympics is a life-changing experience for every athlete. Doing it five times is exponentially harder because every medal is equally hard for me, but everybody else’s expectations rise, right?” She continued: “The ‘two medals lost’ situation, to be quite frank with you, I think is kind of a ridiculous perspective to take. I’m showcasing my best skiing, I’m doing things that quite literally have never been done before so I think that is more than good enough, but thank you.” The exchange was nothing short of extraordinary. Not just because the question was, well, embarrassing (for the reporter), but because it showed that you can be the most decorated female athlete in your sport and still have your accomplishments diminished. More frustratingly, it’s hard to imagine a male athlete being asked if he considered his Olympic medals a failure. Still, the phenomenon of diminishing women’s most incredible accomplishments isn’t new. In fact, most successful women experience it at some point. According to a 2023 study led by Women of Influence+, women in the workplace feel persistently penalized for being ambitious. In a survey of 4,710 respondents across 103 countries, over 86% of women said they experienced being undermined, cut down, or diminished due to their success. Who is doing the cutting down? When it comes to successful women, usually, a man. Specifically, it’s male leaders who are the most likely to dim women’s accomplishments, the survey found. For women, that’s part of why being at the top of your game can feel like a blessing and a curse. Because while women often feel they have to work harder than men to get recognized, earning their keep can also come with this unpleasant side effect. Thankfully, Gu just showed us exactly how to stand tall, own our success, and name our accomplishments in the face of dismissal. Because, whether you’re on top of a mountain, or starting at the lowest rung in the office—there will likely be someone who doubts you no matter what. Knowing your worth is the only surefire way to win. View the full article

-

This iPhone Feature Can Save Your Life in an Emergency

This week, an avalanche killed eight people who were on a backcountry skiing expedition on Lake Tahoe. One person is also missing, but presumed dead. This story is tragic, but, miraculously, six members of the group survived the disaster. According to the New York Times, those skiers were rescued thanks to a standard iPhone feature, Emergency SOS via satellite, which let them connect to emergency services from where they were trapped by snow. If you have an iPhone, you probably have this feature available to you, as well. Better yet, it's not hard to activate in the event of an emergency, though it doesn't hurt to know exactly how it works ahead of time. This isn't the first time Emergency SOS via satellite was credited with saving lives during disasters, and knowing about it now could potentially save your life in a future emergency. What is Emergency SOS via satellite?You might be familiar with your iPhone's Emergency SOS feature—you may have even set it off accidentally when clicking the buttons too many times in a row. Emergency SOS makes it easy to quickly dial 911 in the event of an emergency. But Emergency SOS via satellite is different. This feature connects you to emergency services when you're in an area with no cellular service. Where a typical 911 call would route through your carrier's network, Emergency SOS via satellite connects your call or message to the nearest satellite above your head. That means, so long as conditions are right, you're able to contact emergency services from basically anywhere in the world, regardless of whether that area is covered by cell networks. Of course, since communications are being routed via satellite, the experience is much different than a standard cellular connection. Apple says that in "ideal conditions" with a clear sky, it might take 30 seconds for messages to send. Less ideal conditions, say, if your view of the sky is blocked by trees, could slow a message down to 60 seconds or more. Apple first launched this feature with the iPhone 14, but since iOS 18, you've been able to text anyone via satellite. The principle is the same, but you can reach out to friends and family rather than 911. If there's an emergency, but not one you need police, fire fighters, or EMTs for, this can connect you to close friends no matter where you are. How to use Emergency SOS via satelliteTo connect to satellite with your iPhone, you'll need an iPhone 14 or later. You'll also need to be running iOS 16.1 in the U.S. and Canada, though other regions have their own software requirements. The feature is currently available in the following countries: Australia, Austria, Belgium, Canada, France, Germany, Ireland, Italy, Japan, Luxembourg, Mexico, the Netherlands, New Zealand, Portugal, Spain, Switzerland, the UK, and the U.S. You won't have the option to connect to satellite services when you have a connection, either cellular or wifi. Instead, the option appears when you have no service. Once this happens, iOS' Connection Assistant will ask if you want to connect to satellite. If you miss the prompt, you can launch it from the Cellular tile in Control Center, or from Settings > Satellite. Once the Connection Assistant launches, it'll walk you through connecting to your nearest satellite, including with on-screen visuals, but here's the gist: You'll need to be outside with as clear a view of the sky as you can. Apple says that "light" to "medium" foliage from trees could slow down messages, while "dense" foliage, hills, mountains, or tall structures could prevent connection at all. Apple says you can hold your iPhone as you usually would—no need to point it at the sky—but you may be instructed to move left or right depending on the location of the satellite. Apple also says the connection might not work in places above 62° latitude, which includes northern parts of Alaska. Once connected, the first thing you should do is try calling 911. The call might go through even over satellite, but if it doesn't, you'll find the option to send an "Emergency Text." Tap this option, then choose the appropriate services (roadside assistance or emergency services.). You can also open the Messages app, text 911, then choose "Emergency Services." Here, tap "Report Emergency," then answer questions when prompted to describe the situation you're in. You can also choose to automatically notify emergency contacts that you contacted 911. From here, your iPhone shares all this information, along with your location, remaining iPhone battery life, and Medical ID (if set up), with responders. Is Emergency SOS via satellite free?Yes! (For now.) Since its launch, Emergency SOS via satellite has been free to use, though Apple officially says that the feature is free for two years after an iPhone is activated. The company pushed back that deadline for iPhone 14 and iPhone 15 users last year, so no iPhone has actually had to pay for the feature yet. The company might continue to push it back, or begin charging, but there's no word on pricing at this time. It's worth noting T-Mobile has its own satellite feature, as well. If you have the service, and an iPhone 13 or later, you could use their satellite connectivity services instead. View the full article

-

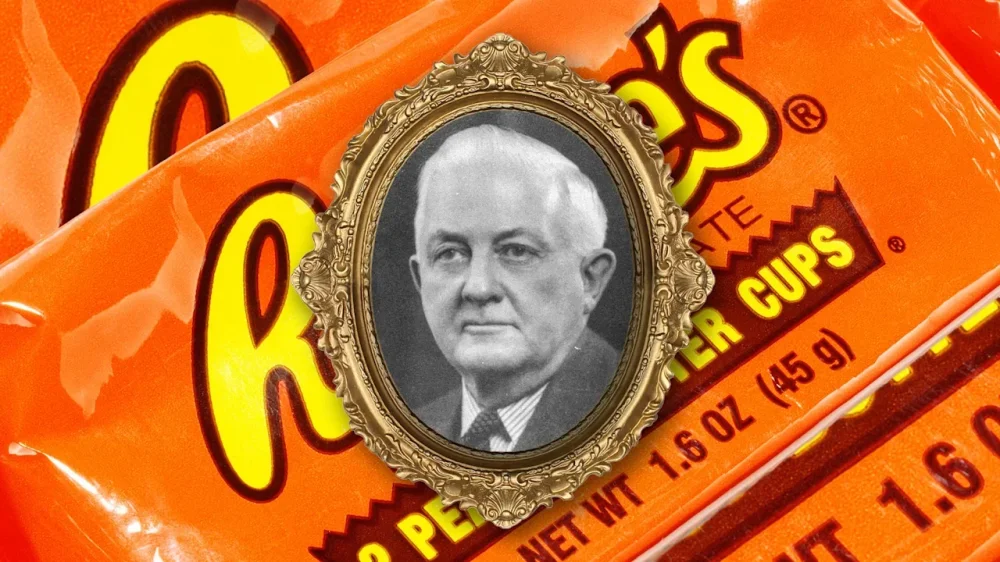

Reese’s Peanut Butter Cup inventor’s grandson says the candy has gotten worse in this specific way. Social media agrees

The Reese’s brand just took a hit from an unlikely source: the descendant of its founder. In 1919, H.B. Reese created his eponymous candy company. In 1928, he invented the flagship peanut butter cups that would define his brand, and in 1963, his sons sold the company to The Hershey Co. Now, H.B. Reese’s grandson Brad Reese is standing up for his grandpa’s original recipe, alleging that Hershey has replaced a portion of Reese’s Peanut Butter Cups’ key ingredients with lower-quality alternatives. Reese addressed Hershey via a LinkedIn post on Valentine’s Day that has since gone viral, claiming that the company now uses “compound coatings” instead of milk chocolate, and “peanut‑butter‑style crèmes” instead of peanut butter. “How does The Hershey Company continue to position REESE’S as its flagship brand, a symbol of trust, quality and leadership, while quietly replacing the very ingredients (Milk Chocolate + Peanut Butter) that built REESE’S trust in the first place?” Reese asked in his post. In a statement to Fast Company, Hershey defended its recipes, saying that Reese’s Peanut Butter Cups “are made the same way they always have been,” from milk chocolate and peanut butter. “As we’ve grown and expanded the Reese’s product line, we make product recipe adjustments that allow us to make new shapes, sizes and innovations that Reese’s fans have come to love and ask for, while always protecting the essence of what makes Reese’s unique and special: the perfect combination of chocolate and peanut butter,” Hershey said. But Hershey consumers across social media are siding with Reese, claiming that they’ve noticed the difference in taste across Reese’s products and lamenting the apparent decline of their favorite candy. “I love my Reese’s but I stopped eating them last Halloween because that’s when I noticed a big change. They got mad nasty. The chocolate was off and the peanut butter got really grainy and disgusting,” one user shared. he's absolutely right. they are different. started realizing it when little kids in our classrooms started wasting them or not picking them from the treat jar UNLESS they were the Miniatures. we thought we got a stale batch, then tried different sizes. the only way to describe… https://t.co/20dWSUrzAp — Sassington, M.C. (@MissSassbox) February 18, 2026 I have been saying this for years and no one believed me https://t.co/Gvmfruui5e — Jessica Smetana (@jessica_smetana) February 19, 2026 I love my Reese's but I stopped eating them last Halloween because that's when I noticed a big change. They got mad nasty. The chocolate was off and the peanut butter got really grainy and disgusting. They just weren't the same anymore. I didn't ask for any for Christmas either. https://t.co/dVeGsgauNs pic.twitter.com/YdJ4hzC8AK — Southern Fried StoNerD (@southernstonerd) February 19, 2026 Others took Reese’s claim as evidence that the “enshittification” phenomenon is coming not just for our online platforms, but for our candy. Why is so much of the stuff we all grew up with slowly getting shittier with each passing year? https://t.co/1k6v89dd1Z — Oliver Jia (オリバー・ジア) (@OliverJia1014) February 19, 2026 EXCUSE ME WHY HAVEN'T WE HEARD ABOUT THIS YET THE ENSHITIFICATION MARCHES ON https://t.co/HHMxoLcP3Y — mastaprincess (@mastaprincess) February 19, 2026 Reese himself also offered a firsthand account in an interview with the Associated Press. He tried a new Valentine’s Day-themed product, Reese’s Mini Hearts, but ultimately threw out the bag. The candy’s packaging seemed to affirm Reese’s suspicions, listing “chocolate candy and peanut butter creme” as primary ingredients, not milk chocolate and peanut butter. “It was not edible,” Reese told the AP. “You have to understand. I used to eat a Reese’s product every day. This is very devastating for me.” He added that Hershey should take a cue from its own founder, Milton Hershey, who famously said, “Give them quality, that’s the best advertising.” “I absolutely believe in innovation, but my preference is innovation with quality,” Reese said. View the full article

-

The big red flag working parents look for in a job

For all the talk from employers who claim to understand the needs of working parents, childcare benefits remain elusive in many workplaces. Surveys have repeatedly shown that employees strongly value these benefits, which can run the gamut from childcare subsidies to backup care options. As working parents have demanded more from their employers, these perks have grown in popularity in certain workplaces, alongside more generous parental leave policies. But the companies that offer childcare benefits are still in the minority. The latest edition of an annual study from national childcare provider KinderCare compiled in partnership with the Harris Poll finds that one in three employers do not offer any kind of childcare benefits. And yet, the vast majority of parents surveyed—85%—said childcare benefits were “essential,” on par with health insurance and retirement benefits. Childcare ranks as a top-three benefit Of the more than 2,500 respondents, 70% expressed that health insurance was the most crucial workplace benefit, while 56% cited paid time off. But childcare ranked just after healthcare and PTO—making it one of the top three benefits that was most important to working parents. For a quarter of low-income parents, childcare was actually the leading benefit. Even when companies do offer childcare benefits, however, many working parents find that there is little clarity around what that means for them. Over half of the people surveyed said it was “difficult to understand my current childcare benefits,” while 71% claimed their employer “rarely highlights support for working parents.” In fact, 69% said it was a red flag if a company did not broach the subject of support for parents during a job interview. Less support equals more pressure These findings underscore the bind many working parents find themselves in, as they struggle to juggle their caregiving responsibilities and cover the sky-high cost of childcare. A growing number of parents now expect their employers to help them bridge the gap, in no small part because raising children can take a toll on their careers and require a job with more flexibility. KinderCare found that over 60% of people surveyed would reduce their hours or take on a less demanding job—or had already done so—due to their childcare needs. That was even more common among low-income parents, with 80% of them saying they had switched jobs or would consider doing so because of childcare issues. Younger parents who identified as Gen Z were also more likely to make career changes to accommodate having children. Two-thirds of parents say that unreliable childcare has had an impact on their productivity at work, while about three in four parents say that even jobs with more flexibility still put implicit pressure on them to be “always available.” Women bearing the brunt—again The lack of adequate support is impacting plenty of working parents, as this study makes evident: Over half of the parents surveyed by KinderCare claim to be searching for new jobs that promise better childcare benefits, and 60% worry they will have to dial back work commitments to accommodate their parenting duties. But it is women who often bear the brunt of caregiving responsibilities—and, in turn, tend to get penalized in the workplace for those obligations. During the pandemic, many women were forced to step away from work when their childcare arrangements fell through and schools went remote, which left them struggling to continue working while watching their children. After years of a strong recovery, working mothers seem to be facing hurdles yet again, as childcare costs continue to climb and perks like remote work have slipped away; the The President administration has also repeatedly targeted childcare funding for low-income families. In 2025, about 212,000 women exited the workforce between January and June; according to a Washington Post analysis, the number of working mothers between the ages of 25 and 44 dropped by nearly three percentage points. The December jobs report showed that 81,000 workers left the labor force—and an analysis by the National Women’s Law Center revealed that all of those workers were women. There’s a lot at stake for companies that fail to invest in childcare benefits or support workers who are parents, between employee turnover and declining productivity. In the KinderCare study, nearly 80% of people surveyed said they would be more loyal to their employer if they felt more supported as parents. As working parents increasingly look to their employers to help navigate childcare challenges, companies have an opportunity—and perhaps a responsibility, too, to try and retain some of their best workers. View the full article

-

What does Andrew Mountbatten-Windsor’s arrest mean?

Police action sets up extraordinary possibility of senior royal standing trial View the full article

-

Pending home sales fell to record low in January

An index of contract signings fell 0.8% last month to the lowest level in data from 2001, following a revised 7.4% decline in December, according to National Association of Realtors figures released Thursday. View the full article

-

updates: swearing at work, letting difficult coworkers be wrong, and more

It’s “where are you now?” month at Ask a Manager, and all December I’m running updates from people who had their letters here answered in the past. Here are four updates from past letter-writers. 1. How common is swearing at work? (#2 at the link) I always thought that if you answered a question for me, I would engage with the commentariat and also send in an update! But when I saw the post was up, I was experiencing severe pregnancy-induced anxiety … and promptly avoided the site for around a year. Today I went and looked at the published post for the very first time. (And I felt like the responses from everyone were actually quite lovely, so I don’t know what I was anxious about.) Someone asked in the comments how I know all my coworkers’ religious affiliations. I don’t! But I belong to one of those religions where it’s pretty obvious if you aren’t a member. For example, you know when people aren’t Hasidic Jews because they don’t cover their heads or wear prayer shawls. Personally, I try to avoid talking about religion at work. It just doesn’t seem the place. In contrast, Lesley frequently talked about religion in offhand comments, and so did some of my other coworkers. So it felt blatant when he started acting completely differently. I think the main thing that bothered me was that Lesley was pretty unprofessional in general. It seemed like he was trying to be my friend (think Leslie Knope, but more tone deaf), but I just wanted him to be my boss. When his behavior around religion changed, it felt like he was forcing us all to be party to his faith crisis or whatever was happening. And as some people guessed on the original post, it was also jarring since frequent swearing wasn’t part of the workplace culture. The anxiety probably also wasn’t helping. On to the update. Since I wrote in, a lot has happened. While I was on parental leave, Lesley stopped being my boss and moved to a different department, so I no longer had to deal with anything he was doing. My baby had health problems, but instead of focusing on that, I spent a good portion of my leave responding to emails about medical paperwork issues that were supposedly taken care of before I left. It wasn’t a great time. When I returned, there were lots of crises at my job, including our CEO going viral for saying some insensitive things. I kept my head down and just tried to do my job despite everything crumbling around me. I recently had another baby, and this time, my company told me the day before I was supposed to return that they’d supplied paperwork with the wrong dates and that I therefore couldn’t come back to work (!). Long story short, that was the last straw. I have since resigned to do freelance work and spend more time with my beautiful infant and now-healthy toddler. I’m glad I was Lesley-less for the last few years working there, but I do sometimes wonder if I could have harnessed Lesley’s excessive, boundary-stomping friendliness to get him on “my team” to push back against the parental leave paperwork weirdness. I guess I’ll never know. 2. Can I just let difficult coworkers be wrong? Even before I wrote in, I guess things were brewing internally. I wasn’t the only person aware of this part of our culture. I think I was downplaying it too much. We ended up having a big company-wide meeting about not being jerks to each other. Then we all had some smaller meetings with HR individually and in groups just after your answer went live. From the scuttlebutt around the office, one of the HR managers got sick of exit interviews where people said they were leaving with nothing lined up because the company culture was too toxic. This made the CEO and executives send in a third party company to do an audit of culture, output, leadership, and stuff like that. I was asked to meet with someone from the audit company and HR to specifically discuss the logo incident. Other people had brought it up multiple times as an example of bad culture and bullying (1) because Leslie went on for a while and (2) none of the managers stepped in to redirect. HR asked why I didn’t say anything during the meeting or after the fact so I told them that I prefer to just let people be wrong, almost everyone knew that it was a contractor’s design, and I was more concerned about looking argumentative because engaging in these things tend to make it worse. They noted that but also told me not to accept bullying just because it’s easy. This and your response along with the comments really opened my eyes that I thought was staying out of things was actually a freeze-response to confrontation and this place is more confrontational than a boxing match. This is also what my partner and friends were trying to address with me, too. I guess they saw it for what it was early on. Because my field is entertainment-adjacent, it has a long history of backstabbing and bad behavior. My company is newer and they want to get rid of that industry environment, so we’ll see how this plays out. Leslie is now part of a group of my coworkers who are not necessarily in deep crap but they’re being monitored closely. Good. 3. How to respond when a candidate discloses autism in an interview (#2 at the link) I saw my initial question from a few years ago was reposted and thought this would be a good time for an update. First off, I changed some details for anonymity’s sake, but one important detail is that the colleague who responded to the candidate saying they shouldn’t disclose their autism diagnosis was actually my boss and the head of the organization. This was also my first time hiring anyone, and the unease I felt in my initial letter was my gut instinct telling me my boss was not handling this properly, but not feeling comfortable enough to say anything. We ended up getting a new head of the organization a couple years later and when I told them about this specific experience, they were horrified that our last boss had said that to a job candidate. We also learned over time that there were many, many things our old boss had said or done that were misguided at best and potentially illegal at worst, so … let’s just say there was a lot of unlearning that needed to happen. Thankfully, I learned and grew a lot from our new boss, and although I’m no longer at that job, I feel much more equipped to handle these situations if/when they come up. The post updates: swearing at work, letting difficult coworkers be wrong, and more appeared first on Ask a Manager. View the full article

-

Private credit stocks slide after Blue Owl halts redemptions at fund

Investment group’s decision sends shivers through industryView the full article

-

Intuit Unveils Mailchimp Upgrades, Enhancing E-commerce Marketing Global Reach

Small business owners eager to enhance their e-commerce marketing efforts can look forward to fresh innovations from Intuit’s Mailchimp. On February 10, 2026, Intuit announced a suite of product upgrades designed to streamline data management and automate marketing processes. These enhancements target the core challenges many small and mid-sized businesses face in optimizing customer acquisition and growth strategies. Mailchimp’s updated capabilities now empower users to connect data sources more effectively, driving improved return on investment (ROI) for marketing campaigns. According to Diana Williams, Vice President of Product at Mailchimp, this release not only provides businesses with “26% more ecommerce triggers” but also creates a unified platform for data, automation, and analytics. This means better execution of campaigns and clearer visibility into how each marketing initiative translates to sales. For businesses grappling with the intricacies of marketing, the benefits are substantial. Mailchimp’s enhanced features help convert data into actionable insights, allowing entrepreneurs to build precise customer segments such as high-value buyers or at-risk customers. By integrating data from platforms like Shopify and customer review sites, small business owners can optimize their marketing campaigns without juggling multiple tools. Moreover, the expansion of SMS marketing into 34 new countries, including Belgium, Norway, and Greece, allows brands to engage customers via mobile messaging—an increasingly important avenue in today’s digital landscape. Features like unique discount codes and instant opt-ins through pop-ups can tie campaigns directly to sales, helping businesses track effectiveness in real time. Another significant innovation is the revamped omnichannel marketing dashboard, which unifies performance metrics across email, SMS, and ecommerce events. This holistic view enables entrepreneurs to see which strategies yield results and where they might need adjustments. Coupled with AI-driven analytics that predict customer behaviors, businesses can make data-backed decisions to drive revenue. Mailchimp also aims to ease the onboarding process for newcomers, offering new migration tools that facilitate a seamless transition. For businesses switching from other platforms, this means less downtime and more quick-to-market campaigns. Ali Mann, a customer from Kaylin + Kaylin Pickles, noted an impressive turnaround, stating, “I was so blown away…our open rates more than doubled” after making the switch. However, while these advancements present considerable opportunities for small business owners, it’s essential to consider potential challenges. The emphasis on data integration requires an ongoing commitment to maintaining accurate customer insights. Additionally, as competition in the e-commerce space intensifies, small business owners must be ready to adapt swiftly to leverage these new tools effectively. Many Mailchimp users report substantial time savings—averaging about 16 hours per week—after implementing these features. E-commerce clients leveraging SMS marketing have even witnessed ROIs soaring up to 22 times their investment. Such statistics suggest that the right tools can lead to significant efficiencies and heightened customer engagement. Intuit emphasizes that these innovations are crucial for small and mid-sized businesses looking to thrive in a competitive market. Ciarán Quilty, Senior Vice-President for International at Intuit, highlighted the essential nature of these tools: “We’re giving small and mid-size businesses connected data, automation and AI that simply work together.” This sentiment underscores a broader trend where accessible, efficient marketing solutions become indispensable for success. Overall, Mailchimp’s new features represent a pivotal step for small businesses aiming to hone their marketing strategies effectively. By leveraging integrated data, powerful automation, and meaningful insights, entrepreneurs can optimize their marketing efforts, drive profitability, and navigate the challenges of today’s e-commerce landscape. As these tools begin rolling out globally, businesses stand poised to capitalize on their potential impact. For more details about these innovations, you can check the original press release here. Image via Google Gemini This article, "Intuit Unveils Mailchimp Upgrades, Enhancing E-commerce Marketing Global Reach" was first published on Small Business Trends View the full article

-

Intuit Unveils Mailchimp Upgrades, Enhancing E-commerce Marketing Global Reach

Small business owners eager to enhance their e-commerce marketing efforts can look forward to fresh innovations from Intuit’s Mailchimp. On February 10, 2026, Intuit announced a suite of product upgrades designed to streamline data management and automate marketing processes. These enhancements target the core challenges many small and mid-sized businesses face in optimizing customer acquisition and growth strategies. Mailchimp’s updated capabilities now empower users to connect data sources more effectively, driving improved return on investment (ROI) for marketing campaigns. According to Diana Williams, Vice President of Product at Mailchimp, this release not only provides businesses with “26% more ecommerce triggers” but also creates a unified platform for data, automation, and analytics. This means better execution of campaigns and clearer visibility into how each marketing initiative translates to sales. For businesses grappling with the intricacies of marketing, the benefits are substantial. Mailchimp’s enhanced features help convert data into actionable insights, allowing entrepreneurs to build precise customer segments such as high-value buyers or at-risk customers. By integrating data from platforms like Shopify and customer review sites, small business owners can optimize their marketing campaigns without juggling multiple tools. Moreover, the expansion of SMS marketing into 34 new countries, including Belgium, Norway, and Greece, allows brands to engage customers via mobile messaging—an increasingly important avenue in today’s digital landscape. Features like unique discount codes and instant opt-ins through pop-ups can tie campaigns directly to sales, helping businesses track effectiveness in real time. Another significant innovation is the revamped omnichannel marketing dashboard, which unifies performance metrics across email, SMS, and ecommerce events. This holistic view enables entrepreneurs to see which strategies yield results and where they might need adjustments. Coupled with AI-driven analytics that predict customer behaviors, businesses can make data-backed decisions to drive revenue. Mailchimp also aims to ease the onboarding process for newcomers, offering new migration tools that facilitate a seamless transition. For businesses switching from other platforms, this means less downtime and more quick-to-market campaigns. Ali Mann, a customer from Kaylin + Kaylin Pickles, noted an impressive turnaround, stating, “I was so blown away…our open rates more than doubled” after making the switch. However, while these advancements present considerable opportunities for small business owners, it’s essential to consider potential challenges. The emphasis on data integration requires an ongoing commitment to maintaining accurate customer insights. Additionally, as competition in the e-commerce space intensifies, small business owners must be ready to adapt swiftly to leverage these new tools effectively. Many Mailchimp users report substantial time savings—averaging about 16 hours per week—after implementing these features. E-commerce clients leveraging SMS marketing have even witnessed ROIs soaring up to 22 times their investment. Such statistics suggest that the right tools can lead to significant efficiencies and heightened customer engagement. Intuit emphasizes that these innovations are crucial for small and mid-sized businesses looking to thrive in a competitive market. Ciarán Quilty, Senior Vice-President for International at Intuit, highlighted the essential nature of these tools: “We’re giving small and mid-size businesses connected data, automation and AI that simply work together.” This sentiment underscores a broader trend where accessible, efficient marketing solutions become indispensable for success. Overall, Mailchimp’s new features represent a pivotal step for small businesses aiming to hone their marketing strategies effectively. By leveraging integrated data, powerful automation, and meaningful insights, entrepreneurs can optimize their marketing efforts, drive profitability, and navigate the challenges of today’s e-commerce landscape. As these tools begin rolling out globally, businesses stand poised to capitalize on their potential impact. For more details about these innovations, you can check the original press release here. Image via Google Gemini This article, "Intuit Unveils Mailchimp Upgrades, Enhancing E-commerce Marketing Global Reach" was first published on Small Business Trends View the full article

-

AI’s biggest problem isn’t intelligence. It’s implementation

Welcome to AI Decoded, Fast Company’s weekly newsletter that breaks down the most important news in the world of AI. You can sign up to receive this newsletter every week via email here. The AI ‘arms race’ may be more of an ‘arm-twist’ The big AI companies tell us that AI will soon remake every aspect of business in every industry. Many of us are left wondering when that will actually happen in the real world, when the so-called “AI takeoff” will arrive. But because there are so many variables, so many different kinds of organizations, jobs, and workers, there’s no satisfying answer. In the absence of hard evidence, we rely on anecdotes: success stories from founders, influencers, and early adopters posting on X or TikTok. Economists and investors are just as eager to answer the “when” question. They want to know how quickly AI’s effects will materialize, and how much cost savings and productivity growth it will generate. Policymakers are focused on the risks: How many jobs will be lost, and which ones? What will the downstream effects be on the social safety net? Business schools and consulting firms have turned to research to find those answers the question. One of the most consequential recent efforts was a 2025 MIT study, which found that despite spending between $30 billion and $40 billion on generative AI, 95% of large companies had seen “no measurable P&L [profit and loss] impact.” More recent research paints a somewhat rosier picture. A recent study from the Wharton School found that three out of four enterprise leaders “reported positive returns on AI investments, and 88% plan to increase spending in the next year.” My sense is that the timing of AI takeoff is hard to grasp because adoption is so uneven and depends a lot on the application of the AI. Software developers, for example, are seeing clear efficiency gains from AI coding agents, and retailers are benefiting from smarter customer-service chatbots that can resolve more issues automatically. It also depends on the culture of the organization. Companies with clear strategies, good data, some PhDs, and internal AI enthusiasts are making real progress. I suspect that many older, less tech-oriented, companies remain stuck in pilot mode, struggling to prove ROI. Other studies have shown that in the initial phases of deployment, human workers must invest a lot of time correcting or training AI tools, which severely limits net productivity gains. Others show that in AI-forward organizations, workers do see substantial productivity improvements, but because of that, they become more ambitious and end up working more, not less. The MIT researchers included an interesting disclaimer on their research results. Their sobering findings, they noted, did not reflect the limitations of the AI tools themselves, but rather the fact that organizations often need years to adapt their people and processes to the new technology. So while AI companies constantly hype the ever-growing intelligence of their models, what ultimately matters is how quickly large organizations can integrate those tools into everyday work. The AI revolution is, in this sense, more of an arm-twist than an arms race. The road to ROI runs through people and culture. And that human bottleneck may ultimately determine when the AI industry, and its backers, begin to see returns on their enormous investments. New benchmark finds that AI fails to do most digital gig work AI companies keep releasing smarter models at a rapid pace. But the industry’s primary way of proving that progress—benchmarks—doesn’t fully capture how well AI agents perform on real-world projects. A relatively new benchmark called the Remote Labor Index (RLI) tries to close that gap by testing AI agents on projects similar to those given to remote contractors. These include tasks in game development, product design, and video animation. Some of the assignments, based on actual contract jobs, would take human workers more than 100 hours to complete and cost over $10,000 in labor. Right now, some of the industry’s best models don’t perform very well on the RLI. In tests conducted late last year, AI agents powered by models from the top AI developers including OpenAI, Anthropic, Google, and others could complete barely any of the projects. The top-performing agent, powered by Anthropic’s Opus 4.5 model, completed just 3.5% of the jobs. (Anthropic has since released Opus 4.6, but it hasn’t yet been evaluated on the RLI.) The test puts the question of the current applicability of agents in a different light, and may temper some of the most bullish claims about agent effectiveness coming from the AI industry. Silicon Valley’s pesky ‘principals’ re-emerge, irking the White House and Pentagon The Pentagon and the White House are big mad at the safety-conscious AI company Anthropic. Why? Because Anthropic doesn’t want its AI being used for the targeting of humans by autonomous drones, or for mass surveilling U.S. citizens. Anthropic now has a $200 million contract allowing the use of its Claude chatbot and models by federal agency workers. It was among the first companies to get approval to work with sensitive government data, and the first AI company to build a specialized model for intelligence work. But the company has long had clear rules in its user guidelines that its models aren’t to be used for harm. The Pentagon believes that after paying for the technology it should be able to use it for any legal application. But acceptable use for AI is different from that for traditional software. AI’s potential for autonomy makes it more dangerous by nature, and its risks increase the closer to the battle it gets used. The disagreement, if not resolved, could potentially jeopardize Anthropic’s contract with the government. But it could get worse. Over the weekend, the Pentagon said it was considering classifying Anthropic as a “supply chain risk,” which would mean the government views Anthropic as roughly as trustworthy as Huawei. Government contractors of all kinds would be pushed to stop using Anthropic. Anthropic’s limits on certain defense-related uses are laid out in its Constitution, a document that describes the values and behaviors it intends its models to follow. Claude, it says, should be a “genuinely good, wise, and virtuous agent.” “We want Claude to do what a deeply and skillfully ethical person would do in Claude’s position.” To critics in the The President administration, that language translates to a mandate for wokeness. The whole dust-up harkens back to 2018, when Google dropped its Project Maven contract with the government after employees revolted against Google technology being used for targeting humans in battle. Google still works with the government, and has softened its ethical guidelines over the years. The truth is, tech companies don’t stand on principle like they used to. Many have settled into a kind of patronage relationship with the current regime, a relatively inexpensive way to avoid MAGA backlash while keeping shareholders satisfied. Anthropic, in its way, seems to be taking a different course, and it may suffer financially for it. But, in the longer term, the company could earn some respect, trust, and goodwill from many consumers and regulators. For a company whose product is as powerful and potentially dangerous as consumer AI, that could count for a lot. More AI coverage from Fast Company: OpenAI, Google, and Perplexity near approval to host AI directly for the U.S. government New AI models are losing their edge almost immediately Meta patents AI that lets dead people post from the great beyond These 6 quotes from OpenClaw creator Peter Steinberger hint at the future of personal computing Want exclusive reporting and trend analysis on technology, business innovation, future of work, and design? Sign up for Fast Company Premium. View the full article

-

Lego’s new Monet-inspired set is full of hidden details

From afar, Lego’s new set inspired by Claude Monet’s painting Bridge over a Pond of Water Lilies looks like a slightly more vivid version of the original. Step a bit closer, though, and you’ll find that its intricate brushstrokes are composed of Lego bananas, katana swords, and carrot tops. The new 3,179-piece set was created in collaboration with The Metropolitan Museum of Art, where Monet’s original 1899 artwork, inspired by his idyllic garden in Giverny, is on display. Lego’s designers spent more than a year working in tandem with the museum’s curators to faithfully re-create the original painting’s iconic Impressionist scene. The set will be available to the public starting on March 4 for $249.99. Over the past few years, as Lego has begun to invest heavily in its sets and products targeted at an adult audience, its designers have had to develop new construction techniques to re-create a wide range of historical artworks. These include sets based on Vincent van Gogh’s Starry Night and Sunflowers, which use chunky Lego bricks to represent thick layers of paint; a set based on Art Hokusai’s The Great Wave, which achieves a 3D effect though cleverly layered bricks; and a re-creation of Keith Haring’s dancing figures, which relies on clear Lego pieces to imitate Haring’s line work. The new Bridge over a Pond of Water Lilies may be their most technically challenging effort yet. How Lego’s designers cleverly mimicked Monet’s style From the beginning, Lego’s collaboration with The Met was a hands-on process. “This piece was chosen through close dialogue between The LEGO Group and The Met,” says Stijn Oom, a Lego designer. “Together, we identified a fan‑favorite artwork that would translate well into an immersive build. Throughout the process, we worked with curators, reviewed color references, and explored how to mirror the painting’s layered techniques with LEGO elements. The aim was to let the build itself echo the feeling of creating the original artwork, while giving fans new entry points into Monet’s world.” The process started with Lego’s design team visiting The Met to see Bridge over a Pond of Water Lilies in person. There, they got an up-close look at Monet’s image of the Japanese-style bridge arching over his backyard pond, rendered in soft hues and small, densely packed brushstrokes. As Oom’s team began work on the Lego version, Met staffers also made trips to Lego’s headquarters in Denmark to review their drafts. In an interview with Artnet, Alison Hokanson, a European paintings curator at The Met, explained that the painting represented a major undertaking for Lego’s team because of its intricate Impressionist technique, which is difficult to replicate with small Lego pieces. Oom describes the process as “both thrilling and challenging.” Because Lego’s color palette was “more limited than what Monet could mix on his canvas,” Oom’s team opted for a brighter palette and blended tones to strike the right color balance. Another key obstacle was accurately recreating the painting’s sense of scale and depth. To create the optical illusion of forced perspective, Lego’s designers carefully layered smaller, darker elements behind the bridge, while positioning larger, brighter elements in front. While experimenting with ways to mimic Monet’s depictions of light and movement, Oom’s team stumbled across several clever uses for some unexpected Lego bricks. The work’s waterlily pads, for example, are made from a combination of tiles, painter’s palettes, brushes, and shields, all layered and overlapped to echo the varied thickness and direction of the real paint strokes. The willow tree in the work’s top left corner uses bars and carrot tops to mimic long, cascading green strokes. And in the vegetation under the bridge, horns, bananas, and katana swords are all carefully placed to guide the eye across the scene. “There are plenty of delightful ‘wait, is that…?’ moments built into the model, as we used a diverse array of LEGO elements including many pieces chosen to reflect Monet’s love of the natural world,” Oom says, adding, “Those unexpected parts are what make the build so enjoyable. You’re not just recreating a masterpiece—you’re discovering it piece by piece.” View the full article

-

How a proposed tax on California billionaires is dividing Democrats ahead of the midterms