All Activity

- Past hour

-

3 recent success stories from readers

Here are three recent success stories submitted by readers. 1. A successful raise request I wanted to share that I used your advice for asking for a raise to successfully increase my salary. I presented salary surveys from nonprofit industry groups and local job postings for similar positions that showed my old salary was low compared to current listings in my metro area. In the end, I received a 9% raise, which I feel pretty good about. It isn’t as much as I hoped, but my supervisor did acknowledge it was the most they could give me at this time and that at first the proposed raise from HR was 6%. 2. A successful salary negotiation This is not me but my Gen Z daughter. She works in a field that is renown for contract work — and she just recently was able to secure a full-time, benefitted position in a field she loves. They offered her $X, which she was over the moon for, having been considerably underpaid in a prior teaching job. Figuring she might be able to eke out a bit more, she called her cousin (who worked in the field) and a career coach who has been wonderful at providing some pro bono assistance, and then called the hiring manager. She asked if there was any wiggle room in the salary. The hiring manager asked her what she was thinking and so she provided a range. The hiring manager replied with, “How about $Y?” This was higher than the range she had named and 12% higher than what she was initially offered. Now she’s really over the moon. It makes one wonder if there was even more wiggle room in that number, but that’s okay. She is going to be doing something she loves and is also now not afraid of asking for what she wants. It confirms the saying that you miss 100% of the shots you don’t take. 3. A successful skip-level meeting I changed roles in my organization in October. In December, the CIO sent a divisional all-hands email inviting all new joiners to a morning tea for welcome and networking. I wasn’t able to attend due to a preexisting health appointment. I emailed the CIO’s PA to apologize for missing it, and I channelled my inner-AAM hard: “I’d hoped to introduce myself to [CIO] as I know they were tracking a major incident two weeks ago that I was the technical lead for resolving.” The PA replied that the CIO would like to meet with me and offered a 15-minute slot in January. Because I’m in a large international organization, the CIO is my skip-level’s skip-level. In preparation, I read everything you’ve ever advised your readers about making the most of a skip-level meeting. I had a good — and fast! 90 seconds! — answer ready to “Tell me about what you do here and what you did before.” I asked them if they were curious about a ground-level view of the incident. They said no, in a friendly way, so I instantly pivoted to, “What’s front of mind for you for this quarter and this year?” They spent 10 minutes on five major initiatives and paused each time to invite comment. I correctly read the room and gave one or at most two sentences for each. I hit the jackpot with one, where the CIO paused and said, “Interesting that you saw that right away. Most of my team didn’t.” We finished in 13 minutes, and they congratulated me for “knowing how to speak with a CIO”. :) They also gave me two names of people who report to them that they wanted me to meet. Will anything come of it? Who knows? I don’t even really care — it was great practice, and I couldn’t have done it without your excellent advice. Thank you! The post 3 recent success stories from readers appeared first on Ask a Manager. View the full article

-

Rocket sues broker over repurchases in case involving UWM

The lender isn't accusing United Wholesale Mortgage of wrongdoing, but says a broker secured loans for the same customers from both companies weeks apart. View the full article

-

Ten Tips for a Better Busy Season

Some of these you may want to keep year round. By Sandi Leyva Go PRO for members-only access to more Sandi Smith Leyva. View the full article

-

Ten Tips for a Better Busy Season

Some of these you may want to keep year round. By Sandi Leyva Go PRO for members-only access to more Sandi Smith Leyva. View the full article

-

The Best Budget ANC Earbuds Just Got Even Cheaper

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. There's a certain level of performance you expect from active noise-cancelling earbuds (ANC) or headphones—even if they are "budget" priced. If you're looking for a great pair of ANC earbuds for a price that won't make you cry if you lose them, consider the Anker Space A40, currently $44.98 (originally $99.99 at launch). I've been using these earbuds for over a year and cannot recommend them enough for the price. Soundcore by Anker Space A40 Adaptive Active Noise Cancelling Wireless Earbuds, Reduce Noise by Up to 98%, Ultra Long 50H Playtime, 10H Single Playtime, Hi-Res Sound, Comfortable Fit, Wireless Charge $44.98 at Amazon $79.99 Save $35.01 Get Deal Get Deal $44.98 at Amazon $79.99 Save $35.01 The Soundcore by Anker Space A40 gives you as many features and even better ANC than some higher-end pairs for a budget-friendly price tag. I've had my pair for over a year now, and I can compare the ANC performance to some high-end earbuds I've sampled. For the price, the ANC is surprisingly good and also rivals earbuds that go over the $200 price mark. The earbuds have microphones that pick up the sound around you to adjust the ANC accordingly. You can read the full review from PCMag here if you want to go more in-depth about its features. Another impressive quality about these earbuds is their long battery life, with 10 hours of playtime and an additional 50 hours from the charging case. The Soundcore app lets you customize your EQ controls to your liking, but the default audio setting right from the box is already great, so there's no need to adjust it unless you want to. The earbuds fit well and don't come out easily, which is a must for any ANC. It is water-resistant with an IPX4 rating. The main place where these earbuds fall short is the audio if you're an Apple user because it relies on the AAC codec. But for the price, the Anker Space A40 does a great job at everything else and is my favorite ANC earbud under $100 dollars. Our Best Editor-Vetted Tech Deals Right Now Apple AirPods 4 Active Noise Cancelling Wireless Earbuds — $139.99 (List Price $179.00) Apple Watch Series 11 [GPS 46mm] Smartwatch with Jet Black Aluminum Case with Black Sport Band - M/L. Sleep Score, Fitness Tracker, Health Monitoring, Always-On Display, Water Resistant — $329.00 (List Price $429.00) Apple iPad 11" 128GB A16 WiFi Tablet (Blue, 2025) — $299.99 (List Price $349.00) Blink Mini 2 1080p Security Camera (White) — $23.99 (List Price $39.99) Ring Outdoor Cam Pro Plug-In With Outdoor Cam Plus Battery (White) — $189.99 (List Price $259.99) Amazon Fire TV Stick 4K Plus — $29.99 (List Price $49.99) Deals are selected by our commerce team View the full article

-

Google releases Discover core update – February 2026

Google has released the February 2026 Discover core update, this is a core update specific to how Google surfaces content within Google Discover. Google wrote, “This is a broad update to our systems that surface articles in Discover.” This is first rolling out to English language users in the US, and will expand it to all countries and languages in the months ahead, Google said. What is expected. Google said the Discover update will improve the Google Discover “experience in a few key ways,” including: Showing users more locally relevant content from websites based in their country Reducing sensational content and clickbait in Discover Showing more in-depth, original, and timely content from websites with expertise in a given area, based on our systems’ understanding of a site’s content Since this update is aimed at showing more locally-relevant content from sites based in their country, it may impact the traffic of non-US websites that publish news for a US audience. The impact may lessen or disappear once the update expands globally, as it rolls out. More details. Google added that since there are many sites that “demonstrate deep knowledge across a wide range of subjects,” Google’s “systems are designed to identify expertise on a topic-by-topic basis.” There is an equal opportunity to show up in Discover, whether a site has expertise in multiple areas or has a deep focus on a single topic, Google explained. The example Google provided was “a local news site with a dedicated gardening section could have established expertise in gardening, even though it covers other topics. In contrast, a movie review site that wrote a single article about gardening would likely not.” Google also added it will continue to “show content that’s personalized based on people’s creator and source preferences.” Expect fluctuations. With this Discover core update, you should expect fluctuations in traffic from Google Discover. “Some sites might see increases or decreases; many sites may see no change at all,” Google added. Rollout. Google said it is “releasing this update to English language users in the US, and will expand it to all countries and languages in the months ahead. “ Why we care. If you get traffic from Google Discover, you may notice changes in that traffic in the coming days. Google recommends that if you need guidance, Google has “general guidance about core updates applies, as does our Get on Discover help page” in those help documents. Finally, Google said that during its testing, it found that “people find the Discover experience more useful and worthwhile with this update.” View the full article

- Today

-

Urban multifamily looks like the new subprime

Rising defaults, fraud risks, and collapsing rents are converging in urban multifamily, threatening lenders and taxpayers, according to the Chairman of Whalen Global Advisors. View the full article

-

Bissett Bullet: What Are The Outcomes?

Today's Bissett Bullet: “Listing the services of your firm – bad. Demonstrating the outcomes ...” By Martin Bissett See more Bissett Bullets here Go PRO for members-only access to more Martin Bissett. View the full article

-

Bissett Bullet: What Are The Outcomes?

Today's Bissett Bullet: “Listing the services of your firm – bad. Demonstrating the outcomes ...” By Martin Bissett See more Bissett Bullets here Go PRO for members-only access to more Martin Bissett. View the full article

-

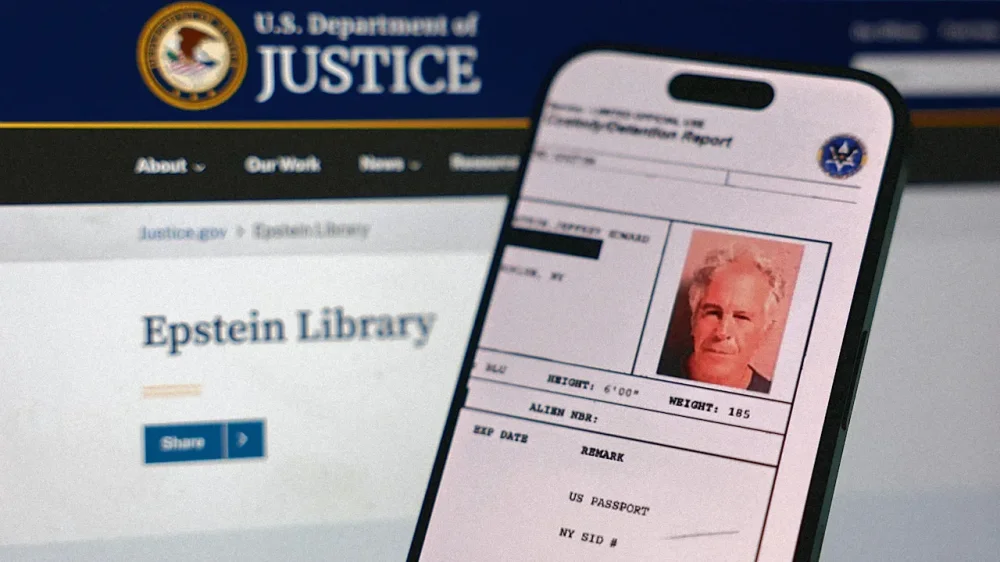

Barclays drops Mandelson lobbying firm after Epstein revelations

UK bank cuts ties with Global Counsel over frustrations with the way it has handled its founder’s remaining stakeView the full article

-

This is the next big thing in corporate AI

For the past two years, artificial intelligence strategy has largely meant the same thing everywhere: pick a large language model, plug it into your workflows, and start experimenting with prompts. That phase is coming to an end. Not because language models aren’t useful, with their obvious limitations they are, but because they are rapidly becoming commodities. When everyone has access to roughly the same models, trained on roughly the same data, the real question stops being who has the best AI and becomes who understands their world best. That’s where world models come in. From rented intelligence to owned understanding Large language models look powerful, but they are fundamentally rented intelligence. You pay a monthly fee to OpenAI, Anthropic, Google or some other big tech, you access them through APIs, you tune them lightly, and you apply them to generic tasks: summarizing, drafting, searching, assisting. They make organizations more efficient, but they don’t make them meaningfully different. A world model is something else entirely. A corporate world model is an internal system that represents how a company’s environment actually behaves — its customers, operations, constraints, risks, and feedback loops — and uses that representation to predict outcomes, test decisions, and learn from experience. This distinction matters. You can rent fluency. You cannot rent understanding. What a “world model” really means for a company Despite the academic origins of the term, world models are not abstract research toys. Executives already rely on crude versions of them every day: Supply chain simulations Demand forecasting systems Risk and pricing models Digital twins of factories, networks, or cities Digital twins, in particular, are early and incomplete world models: static, expensive, and often brittle, but directionally important. What AI changes is not the existence of these models, but their nature. Instead of being static and manually updated, AI-driven world models can be: Adaptive, learning continuously from new data Probabilistic, rather than deterministic Causal, not just descriptive Action-oriented, able to simulate “what happens if…” scenarios This is where reinforcement learning, simulation, and multimodal learning start to matter far more than prompt engineering. A concrete example: logistics and supply chains Consider global logistics: an industry that already runs on thin margins, tight timing, and constant disruption. A language model can: Summarize shipping reports Answer questions about delays Draft communications to customers A world model can do something far more valuable. It can simulate how a port closure in Asia affects inventory levels in Europe, how fuel price fluctuations cascade through transportation costs, how weather events alter delivery timelines, and how alternative routing decisions change outcomes weeks in advance. In other words, it can reason about the system, not just describe it. This is why companies like Amazon have invested heavily in internal simulation environments and decision models rather than relying on generic AI tools. In logistics, the competitive advantage doesn’t come from just talking about the supply chain better. It comes from anticipating it better. Why building a world model is hard (and why that’s the point) If this sounds complex, it’s because it is. Building a useful world model is not a matter of buying software or hiring a few prompt engineers. It requires capabilities many organizations have postponed developing. At a minimum, companies need: High-quality, well-instrumented data, not just large volumes of it Clear definitions of outcomes, not vanity metrics Feedback loops that connect decisions to real-world consequences Cross-functional alignment, because no single department “owns” reality Time and patience, since world models improve through iteration, not demos This is exactly why most companies won’t do it — and why those that do will pull away. The hardest part of AI is not the models, but the systems and incentives around them. Why LLMs alone are not enough Language models remain invaluable, but in a specific role. They are excellent interfaces between humans and machines. They explain, translate, summarize, and communicate. What they don’t do well is reason about how the world works. LLMs learn from text, which is an indirect, biased, and incomplete representation of reality. They reflect how people talk about systems, not how those systems behave. This is why hallucinations are not an accident, but a structural limitation. As Yann LeCun has argued repeatedly, language alone is not a sufficient substrate for intelligence. In architectures that matter going forward, LLMs will play along with world models, not replace them. The strategic shift executives should make now The most important AI decision leaders can make today is not which model to choose, but what parts of their reality they want machines to understand. That means asking different questions: Where do our decisions consistently fail? What outcomes matter but aren’t well measured? Which systems behave in ways we don’t fully understand? Where would simulation outperform intuition? Those questions are less glamorous than launching a chatbot. But they are far more consequential. The companies that win will model their own reality Large language models flatten the playing field. Everyone gets access to impressive capabilities at roughly the same time. World models tilt it again. In the next decade, competitive advantage will belong to organizations that can encode their understanding of the world (their world) into systems that learn, adapt, and improve. Not because those systems talk better, but because they understand better. AI will not replace strategy. But strategy will increasingly belong to those who can model reality well enough to explore it before acting. Every company will need its own world model. The only open question is who starts building theirs first. View the full article

-

AI agents are prompting human boom scrolling

Moltbook and Claude Cowork are pushing the ‘vibe coding’ revolution forwardView the full article

-

What Is a Trade Loan and How Does It Work?

A trade loan is a short-term financing option that helps businesses manage their cash flow during buying and selling goods. It provides access to immediate funds, allowing you to secure inventory or manage expenses until customers pay their invoices. To qualify, you’ll need to present documentation like purchase orders and shipping details. Comprehending how trade loans function can be essential for your business strategy, especially when exploring their advantages and potential pitfalls. Key Takeaways A trade loan is short-term financing for businesses engaged in buying and selling goods, aiding in cash flow during transactions. It acts as a revolving credit line against the value of goods until customer payments are received, requiring specific documentation. Commonly used for purchasing goods, it supports wholesalers and manufacturers in acquiring raw materials and capitalizing on supplier discounts. Interest rates typically range from 250 to 550 basis points above SOFR, influenced by creditworthiness and transaction risks. The application process requires financial statements and a credit score above 650, with approvals generally taking one to four weeks. Definition of a Trade Loan A trade loan is a essential financial tool for businesses engaged in buying and selling goods. This short-term financing facility particularly supports importers, exporters, and domestic traders in funding particular transactions, which improves cash flow during the trading cycle. Often considered a form of trade finance, trade loans act as revolving credit lines, allowing you to borrow against the value of goods being traded until you receive payment from your customers. To secure a trade loan, you’ll need to provide documentation like purchase orders and shipping details. Lenders evaluate transaction-specific risks and your trading history to determine approval and set interest rates, which can fluctuate based on risk levels. Typically, the arrangement timeframe for trade loans ranges from one to four weeks, with higher interest rates associated with shorter-term trades, making them a crucial component of international trade finance. Purpose and Functionality Amidst maneuvering the intricacies of international trade, comprehending the purpose and functionality of trade loans becomes crucial for businesses looking to thrive. Trade loans are short-term financing solutions that particularly support importers and exporters in funding their transactions. These loans bridge the gap between product purchase and buyer repayment, allowing you to maintain healthy cash flow during critical trading cycles. By providing necessary funds without requiring immediate cash, trade loans help you seize opportunities in the market. To secure a trade loan, you’ll need to present documentation like purchase orders and shipping documents, as lenders assess risks based on your trading history and transaction details. Moreover, trade loans enable you to take advantage of supplier discounts through timely payments, enhancing your competitiveness and broadening your supplier networks. Typically, arranging a trade loan takes one to four weeks, with interest rates and fees reflecting the transaction’s complexity and associated risks. Common Uses of Trade Loans Trade loans serve as vital financial tools for businesses engaged in international trade, offering immediate funding to meet various operational needs. You can use trade loans in several impactful ways, including: Purchasing Goods: They help importers and exporters secure immediate funding to buy goods, easing cash flow strains. Financing Raw Materials: Wholesalers and manufacturers can finance regular or one-off purchases of raw materials, ensuring timely supplier payments. Capitalizing on Discounts: Trade loans allow for immediate payments, helping you take advantage of supplier discounts that improve profitability. Supporting Sector-Specific Needs: Industries such as soft commodities, metals, and energy trading utilize trade loans for cross-border transactions, showcasing their versatility. Key Features of Trade Loans Trade loans offer flexible short-term financing customized to specific import or export transactions, helping you manage cash flow effectively. With the ability to borrow and repay multiple times within a set term, these loans cater to your unique needs as they require crucial documentation, such as purchase orders and invoices, as collateral. Comprehending these key features can empower you to leverage trade loans for better supplier relationships and financial efficiency. Flexible Short-Term Financing Flexible short-term financing options, like trade loans, play an essential role for businesses engaged in international commerce. These loans help bridge the gap between purchasing goods and receiving payments from customers. Here are some key features that make trade loans particularly advantageous: Revolving Credit: You can draw funds as needed for specific transactions, enhancing your cash flow. Documentation Required: To access loans, you’ll need to provide purchase orders and shipping documents. Variable Interest Rates: Rates typically range from SOFR plus 250 to 550 basis points, depending on your credit profile and transaction risks. Currency Flexibility: Trade loans can accommodate various currencies, helping you manage risks like currency fluctuations effectively. This flexibility can be critical for maintaining smooth operations in international trade. Transaction-Specific Borrowing When businesses engage in international transactions, they often turn to transaction-specific borrowing as a fundamental financial strategy. Trade loans offer flexible, short-term financing customized to individual import or export transactions, providing immediate cash flow between buying goods and receiving payments. These loans typically function as revolving credit, allowing you to borrow multiple times against the same credit line for different transactions. To access these funds, you’ll need to provide transaction-specific documentation, like purchase orders and shipping invoices, ensuring the financing directly relates to actual trade activities. Interest rates depend on the transaction’s risk level and your credit profile, with you only paying interest on the amounts drawn. Planning ahead is important, as loan arrangements can take one to four weeks. Documentation and Collateral Requirements To successfully secure trade loans, you’ll need to gather specific documentation and collateral that verify the legitimacy of your transactions. Here’s a list of crucial items you should prepare: Purchase Orders – These confirm the details of the goods being traded. Invoices – These provide proof of the transaction amount and terms. Bills of Lading – These documents detail shipping and receipt of goods. Insurance Certificates – These protect against potential losses. Collateral typically includes the goods being traded, shipping documents, and expected payments from customers. The facility agreement with your lender will specify the required documentation and collateral, ensuring clarity in the borrowing process. Properly preparing these aspects can streamline the loan approval process, which may take one to four weeks. Benefits of Trade Loans Trade loans frequently provide significant advantages for businesses looking to improve their financial agility. They boost cash flow by offering immediate funding for purchasing goods, allowing you to take advantage of supplier discounts and maintain smooth operations during trading cycles. Moreover, these loans support the expansion of your supplier network by enabling timely payments, which can strengthen relationships and secure better pricing agreements. Furthermore, trade loans improve your competitiveness in the market, allowing you to quickly respond to customer demands without waiting for buyer payments. Their flexibility as fully revolving credit facilities means you can borrow and repay multiple times within the loan term, optimizing your working capital management. This feature is especially beneficial for small and medium-sized enterprises (SMEs), which often find it challenging to access traditional financing options. By utilizing trade loans, you can grow and thrive in competitive markets, ensuring your business remains agile and responsive. Costs Associated With Trade Loans When considering trade loans, it’s essential to understand the costs involved, as these can markedly impact your financial decisions. Interest rates tend to be higher than those of traditional loans, especially for SMEs, and arrangement fees can add to the overall expense based on your transaction’s complexity. Furthermore, you should account for any risk assessment charges and other fees associated with trade finance products, ensuring you fully grasp the financial implications before proceeding. Interest Rates Influencing Costs Comprehending how interest rates influence the costs associated with trade loans is crucial for making informed financial decisions. Typically, interest rates for trade loans range from 250 to 550 basis points above the Secured Overnight Financing Rate (SOFR). Here’s what you need to evaluate: Credit Profile: Your creditworthiness directly affects your interest rate. Transaction Risk: Higher risk transactions can lead to increased interest rates. SME vs. Corporations: Small and medium-sized enterprises often face higher rates, nearly double that of larger corporations. Overall Costs: Interest rates, along with any arrangement fees, impact the overall cost of your loan. Understanding these factors can help you assess the financial viability of utilizing trade loans effectively. Arrangement Fees Overview Comprehending arrangement fees is a vital part of evaluating the overall costs associated with trade loans. These fees typically cover commitment or administration charges linked to reserving funds for you, the borrower. They can vary based on the complexity and size of your transaction. The lender’s evaluation of your business’s risk profile plays a significant role in determining these costs, with higher-risk transactions often leading to increased arrangement fees. Furthermore, the timeframe for arranging trade loans, which may take one to four weeks, can likewise influence costs. Longer setup times usually result in higher fees because of the intricacies involved in the deal. Therefore, factoring in arrangement fees is fundamental for evaluating the financial viability of trade financing. Risk Assessment Charges Risk assessment charges are a crucial aspect of trade loans, as they reflect the lender’s evaluation of your business’s creditworthiness and the specific transaction at hand. These charges can greatly influence your loan costs, especially if you’re a small or medium-sized enterprise (SME). Here are some key factors to keep in mind: Interest Rates: Higher risk often leads to increased interest rates. Arrangement Fees: These fees vary based on the complexity and size of your business. Additional Charges: Depending on your financing methods, extra charges like documentary credits may apply. Loan Limits: Lenders assess your trading history to determine your loan limits and potential costs. Understanding these elements can help you better prepare for the financial implications of trade loans. The Application Process for Trade Loans When you’re ready to apply for a trade loan, it’s important to understand that the process typically unfolds in four main stages. First, you’ll need to submit required documents like financial statements, bank statements, and commercial invoices. Make certain you have at least two years of trading history and a credit score above 650, as these factors can affect the loan terms you qualify for. Next, you can use an online application system, which simplifies access to various trade loan types. If you’re an importer, solid supplier agreements are crucial, whereas exporters must provide proof of confirmed orders. After submitting your application, the approval timeline usually ranges from one to four weeks, so early planning is critical for securing timely funding. Required Documentation for Trade Loans After you’ve navigated the application process for a trade loan, gathering the required documentation becomes your next step. Lenders need specific paperwork to evaluate your request and guarantee everything’s legitimate. Here’s a checklist of what you’ll typically need: Purchase Orders and Invoices: These confirm the goods or services you plan to finance. Shipping Documents: Proof of shipment helps validate the transaction. Financial Statements: You’ll need at least two years of operational history to demonstrate creditworthiness. Business Plan: This should outline how you’ll use the funds and project cash flows. Additionally, collateral documentation like bills of lading and insurance certificates may be required. Timeframe for Arranging Trade Loans When you’re looking to arrange a trade loan, you should expect the process to take anywhere from one to four weeks, depending on various factors. The complexity of your transaction, the required documentation, and your lender’s assessment all play significant roles in this timeframe. Duration of Loan Arrangement Arranging a trade loan can take anywhere from one to four weeks, depending on the transaction’s complexity. Quick arrangements are essential in the fast-paced trading environment where delays can strain supplier relationships. To improve your loan arrangement timeframe, consider these steps: Plan Early: Start the process as soon as you identify your funding needs. Prepare Documentation: Gather all required documents, such as financial statements and commercial invoices, ahead of time. Understand Complexity: Recognize how the type of goods and financing methods can affect the arrangement duration. Communicate with Lenders: Stay in touch with your lender to guarantee all requirements are met without delay. Factors Affecting Timeframe Several factors can influence the timeframe for arranging trade loans, making it essential to comprehend what might affect your experience. Typically, you can expect the process to take one to four weeks. The complexity of your transaction and the documentation required play significant roles in determining this timeframe. For instance, straightforward transactions with less risk often get processed more quickly, whereas complex deals involving extensive documentation and thorough risk assessment may take longer. Lenders usually require various documents, such as financial statements, bank statements, and commercial invoices. The more complete and accurate your documentation is from the start, the better your chances are of securing favorable terms and timely funding. Grasping these factors can help you plan effectively. Importance of Early Planning Comprehending the importance of early planning can greatly influence your success in securing trade loans. Arranging a trade loan can take one to four weeks, so starting early is crucial. Here are key steps to take into account: Review your trading history: Lenders will assess this to determine loan terms. Prepare documentation: Gather financial statements and commercial invoices well in advance. Engage with lenders proactively: This can improve your chances of obtaining funding on time. Reflect on your suppliers: Timely arrangements can help maintain strong relationships and guarantee you meet payment deadlines. Risks and Considerations During traversing the terrain of trade loans, it’s vital to recognize the various risks and considerations that can greatly impact your borrowing experience. Trade loans often carry varying interest rates based on the risk profile of the transaction. Higher risks can lead to increased fees, affecting your overall borrowing costs. Lenders assess factors like your trading history and the nature of the trade before approving a loan, so thorough preparation is fundamental. Defaults on trade loans can harm your credit score and may result in legal proceedings, highlighting the need for timely repayments. The complexity of trade transactions can likewise prolong the approval period, typically taking between one and four weeks, which could disrupt your operations. For small and medium-sized enterprises (SMEs), high transaction costs and interest rates pose significant challenges, making access to finance a vital consideration in your operational strategy. Comparison With Other Financing Options Comprehending the different financing options available can greatly influence your business’s operational efficiency and growth potential. When comparing trade loans to other options, consider these key points: Purpose: Trade loans are customized for import and export activities, unlike long-term loans aimed at larger investments. Accessibility: Trade loans often require less credit history and collateral, using traded goods and expected payments as security, making them accessible for newer businesses. Flexibility: They offer revolving credit, allowing you to borrow and repay multiple times, whereas traditional loans provide a lump sum with fixed repayment terms. Cost: Interest rates for trade loans are typically higher because of their short-term nature, which can lead to higher costs if repayments aren’t managed well. Expert Insights on Trade Loans What makes trade loans a vital tool for businesses engaged in international trade? These short-term financing facilities help you manage cash flow by bridging the gap between purchasing products and receiving payments from customers, typically within 30 to 180 days. Trade loans act as revolving credit, allowing you to draw funds particularly for import or export transactions. Collateral often includes the goods being traded and relevant shipping documents. Interest rates for these loans depend on the risk level of the transaction, ranging from SOFR plus 250 to 550 basis points based on your credit profile. Lenders evaluate factors like your trading history and transaction complexity to determine credit limits and applicable fees, which may include arrangement fees and interest charges. Future Trends in Trade Loans The terrain of trade loans is evolving quickly as businesses adapt to new challenges and opportunities in international trade. Here are some future trends you should keep an eye on: Tech Integration: Digital platforms and fintech solutions are making the application process more efficient, especially for small and medium-sized enterprises (SMEs). E-commerce Growth: As global e-commerce expands, businesses increasingly seek quick financing to manage cash flow and seize purchasing opportunities. ESG Considerations: Lenders are focusing more on borrowers’ sustainability practices, which could affect loan terms and availability. Blockchain Use: The integration of blockchain technology is set to improve transparency and security in trade financing, reducing fraud risks and streamlining document verification. These trends indicate a shift toward more flexible financing options, helping businesses secure trade loans that meet their specific needs in a quickly changing environment. Frequently Asked Questions What Is the Purpose of a Trade Loan? The purpose of a trade loan is to provide short-term financing for businesses engaged in importing and exporting. It helps you manage cash flow by covering the gap between purchasing goods and receiving payments. This type of loan allows you to draw funds repeatedly as needed, ensuring liquidity. What Is a Disadvantage of Trade Credit? One significant disadvantage of trade credit is the potential for accumulating late payment fees. If you fail to pay on time, these fees can increase your overall costs. Furthermore, nonpayment or delayed payments can harm your relationship with suppliers, which may lead to stricter credit terms or even loss of access to vital goods and services. It’s vital to manage payments effectively to avoid cash flow issues and maintain a healthy business relationship. Is It Smart to Trade in a Car That Isn’t Paid Off? Trading in a car that isn’t paid off can be tricky. If your car’s trade-in value is less than the remaining loan balance, you could end up “upside down,” which means rolling that debt into your next loan. This situation can increase your monthly payments. Nevertheless, if you have positive equity, you can use that difference as a down payment, potentially lowering your new loan amount. Always check your car’s market value before making a decision. Do You Have to Pay Back Trade Credit? Yes, you have to pay back trade credit. When you purchase goods or services on credit, you agree to repay the supplier within a specified time frame, usually between 7 to 120 days. If you miss this deadline, you might face late fees, which can increase your total costs. Timely payments can improve your credit history and strengthen relationships with suppliers, whereas late payments can lead to unfavorable credit terms in the future. Conclusion In conclusion, a trade loan serves as an essential financial tool for businesses engaged in the buying and selling of goods. It helps maintain cash flow and manage transaction costs by providing quick access to funds secured against inventory. As trade loans offer several benefits, including flexibility and prompt financing, they concurrently come with risks that require careful consideration. Comprehending how trade loans work can empower you to make informed decisions that support your business growth and operational efficiency. Image via Google Gemini This article, "What Is a Trade Loan and How Does It Work?" was first published on Small Business Trends View the full article

-

What Is a Trade Loan and How Does It Work?

A trade loan is a short-term financing option that helps businesses manage their cash flow during buying and selling goods. It provides access to immediate funds, allowing you to secure inventory or manage expenses until customers pay their invoices. To qualify, you’ll need to present documentation like purchase orders and shipping details. Comprehending how trade loans function can be essential for your business strategy, especially when exploring their advantages and potential pitfalls. Key Takeaways A trade loan is short-term financing for businesses engaged in buying and selling goods, aiding in cash flow during transactions. It acts as a revolving credit line against the value of goods until customer payments are received, requiring specific documentation. Commonly used for purchasing goods, it supports wholesalers and manufacturers in acquiring raw materials and capitalizing on supplier discounts. Interest rates typically range from 250 to 550 basis points above SOFR, influenced by creditworthiness and transaction risks. The application process requires financial statements and a credit score above 650, with approvals generally taking one to four weeks. Definition of a Trade Loan A trade loan is a essential financial tool for businesses engaged in buying and selling goods. This short-term financing facility particularly supports importers, exporters, and domestic traders in funding particular transactions, which improves cash flow during the trading cycle. Often considered a form of trade finance, trade loans act as revolving credit lines, allowing you to borrow against the value of goods being traded until you receive payment from your customers. To secure a trade loan, you’ll need to provide documentation like purchase orders and shipping details. Lenders evaluate transaction-specific risks and your trading history to determine approval and set interest rates, which can fluctuate based on risk levels. Typically, the arrangement timeframe for trade loans ranges from one to four weeks, with higher interest rates associated with shorter-term trades, making them a crucial component of international trade finance. Purpose and Functionality Amidst maneuvering the intricacies of international trade, comprehending the purpose and functionality of trade loans becomes crucial for businesses looking to thrive. Trade loans are short-term financing solutions that particularly support importers and exporters in funding their transactions. These loans bridge the gap between product purchase and buyer repayment, allowing you to maintain healthy cash flow during critical trading cycles. By providing necessary funds without requiring immediate cash, trade loans help you seize opportunities in the market. To secure a trade loan, you’ll need to present documentation like purchase orders and shipping documents, as lenders assess risks based on your trading history and transaction details. Moreover, trade loans enable you to take advantage of supplier discounts through timely payments, enhancing your competitiveness and broadening your supplier networks. Typically, arranging a trade loan takes one to four weeks, with interest rates and fees reflecting the transaction’s complexity and associated risks. Common Uses of Trade Loans Trade loans serve as vital financial tools for businesses engaged in international trade, offering immediate funding to meet various operational needs. You can use trade loans in several impactful ways, including: Purchasing Goods: They help importers and exporters secure immediate funding to buy goods, easing cash flow strains. Financing Raw Materials: Wholesalers and manufacturers can finance regular or one-off purchases of raw materials, ensuring timely supplier payments. Capitalizing on Discounts: Trade loans allow for immediate payments, helping you take advantage of supplier discounts that improve profitability. Supporting Sector-Specific Needs: Industries such as soft commodities, metals, and energy trading utilize trade loans for cross-border transactions, showcasing their versatility. Key Features of Trade Loans Trade loans offer flexible short-term financing customized to specific import or export transactions, helping you manage cash flow effectively. With the ability to borrow and repay multiple times within a set term, these loans cater to your unique needs as they require crucial documentation, such as purchase orders and invoices, as collateral. Comprehending these key features can empower you to leverage trade loans for better supplier relationships and financial efficiency. Flexible Short-Term Financing Flexible short-term financing options, like trade loans, play an essential role for businesses engaged in international commerce. These loans help bridge the gap between purchasing goods and receiving payments from customers. Here are some key features that make trade loans particularly advantageous: Revolving Credit: You can draw funds as needed for specific transactions, enhancing your cash flow. Documentation Required: To access loans, you’ll need to provide purchase orders and shipping documents. Variable Interest Rates: Rates typically range from SOFR plus 250 to 550 basis points, depending on your credit profile and transaction risks. Currency Flexibility: Trade loans can accommodate various currencies, helping you manage risks like currency fluctuations effectively. This flexibility can be critical for maintaining smooth operations in international trade. Transaction-Specific Borrowing When businesses engage in international transactions, they often turn to transaction-specific borrowing as a fundamental financial strategy. Trade loans offer flexible, short-term financing customized to individual import or export transactions, providing immediate cash flow between buying goods and receiving payments. These loans typically function as revolving credit, allowing you to borrow multiple times against the same credit line for different transactions. To access these funds, you’ll need to provide transaction-specific documentation, like purchase orders and shipping invoices, ensuring the financing directly relates to actual trade activities. Interest rates depend on the transaction’s risk level and your credit profile, with you only paying interest on the amounts drawn. Planning ahead is important, as loan arrangements can take one to four weeks. Documentation and Collateral Requirements To successfully secure trade loans, you’ll need to gather specific documentation and collateral that verify the legitimacy of your transactions. Here’s a list of crucial items you should prepare: Purchase Orders – These confirm the details of the goods being traded. Invoices – These provide proof of the transaction amount and terms. Bills of Lading – These documents detail shipping and receipt of goods. Insurance Certificates – These protect against potential losses. Collateral typically includes the goods being traded, shipping documents, and expected payments from customers. The facility agreement with your lender will specify the required documentation and collateral, ensuring clarity in the borrowing process. Properly preparing these aspects can streamline the loan approval process, which may take one to four weeks. Benefits of Trade Loans Trade loans frequently provide significant advantages for businesses looking to improve their financial agility. They boost cash flow by offering immediate funding for purchasing goods, allowing you to take advantage of supplier discounts and maintain smooth operations during trading cycles. Moreover, these loans support the expansion of your supplier network by enabling timely payments, which can strengthen relationships and secure better pricing agreements. Furthermore, trade loans improve your competitiveness in the market, allowing you to quickly respond to customer demands without waiting for buyer payments. Their flexibility as fully revolving credit facilities means you can borrow and repay multiple times within the loan term, optimizing your working capital management. This feature is especially beneficial for small and medium-sized enterprises (SMEs), which often find it challenging to access traditional financing options. By utilizing trade loans, you can grow and thrive in competitive markets, ensuring your business remains agile and responsive. Costs Associated With Trade Loans When considering trade loans, it’s essential to understand the costs involved, as these can markedly impact your financial decisions. Interest rates tend to be higher than those of traditional loans, especially for SMEs, and arrangement fees can add to the overall expense based on your transaction’s complexity. Furthermore, you should account for any risk assessment charges and other fees associated with trade finance products, ensuring you fully grasp the financial implications before proceeding. Interest Rates Influencing Costs Comprehending how interest rates influence the costs associated with trade loans is crucial for making informed financial decisions. Typically, interest rates for trade loans range from 250 to 550 basis points above the Secured Overnight Financing Rate (SOFR). Here’s what you need to evaluate: Credit Profile: Your creditworthiness directly affects your interest rate. Transaction Risk: Higher risk transactions can lead to increased interest rates. SME vs. Corporations: Small and medium-sized enterprises often face higher rates, nearly double that of larger corporations. Overall Costs: Interest rates, along with any arrangement fees, impact the overall cost of your loan. Understanding these factors can help you assess the financial viability of utilizing trade loans effectively. Arrangement Fees Overview Comprehending arrangement fees is a vital part of evaluating the overall costs associated with trade loans. These fees typically cover commitment or administration charges linked to reserving funds for you, the borrower. They can vary based on the complexity and size of your transaction. The lender’s evaluation of your business’s risk profile plays a significant role in determining these costs, with higher-risk transactions often leading to increased arrangement fees. Furthermore, the timeframe for arranging trade loans, which may take one to four weeks, can likewise influence costs. Longer setup times usually result in higher fees because of the intricacies involved in the deal. Therefore, factoring in arrangement fees is fundamental for evaluating the financial viability of trade financing. Risk Assessment Charges Risk assessment charges are a crucial aspect of trade loans, as they reflect the lender’s evaluation of your business’s creditworthiness and the specific transaction at hand. These charges can greatly influence your loan costs, especially if you’re a small or medium-sized enterprise (SME). Here are some key factors to keep in mind: Interest Rates: Higher risk often leads to increased interest rates. Arrangement Fees: These fees vary based on the complexity and size of your business. Additional Charges: Depending on your financing methods, extra charges like documentary credits may apply. Loan Limits: Lenders assess your trading history to determine your loan limits and potential costs. Understanding these elements can help you better prepare for the financial implications of trade loans. The Application Process for Trade Loans When you’re ready to apply for a trade loan, it’s important to understand that the process typically unfolds in four main stages. First, you’ll need to submit required documents like financial statements, bank statements, and commercial invoices. Make certain you have at least two years of trading history and a credit score above 650, as these factors can affect the loan terms you qualify for. Next, you can use an online application system, which simplifies access to various trade loan types. If you’re an importer, solid supplier agreements are crucial, whereas exporters must provide proof of confirmed orders. After submitting your application, the approval timeline usually ranges from one to four weeks, so early planning is critical for securing timely funding. Required Documentation for Trade Loans After you’ve navigated the application process for a trade loan, gathering the required documentation becomes your next step. Lenders need specific paperwork to evaluate your request and guarantee everything’s legitimate. Here’s a checklist of what you’ll typically need: Purchase Orders and Invoices: These confirm the goods or services you plan to finance. Shipping Documents: Proof of shipment helps validate the transaction. Financial Statements: You’ll need at least two years of operational history to demonstrate creditworthiness. Business Plan: This should outline how you’ll use the funds and project cash flows. Additionally, collateral documentation like bills of lading and insurance certificates may be required. Timeframe for Arranging Trade Loans When you’re looking to arrange a trade loan, you should expect the process to take anywhere from one to four weeks, depending on various factors. The complexity of your transaction, the required documentation, and your lender’s assessment all play significant roles in this timeframe. Duration of Loan Arrangement Arranging a trade loan can take anywhere from one to four weeks, depending on the transaction’s complexity. Quick arrangements are essential in the fast-paced trading environment where delays can strain supplier relationships. To improve your loan arrangement timeframe, consider these steps: Plan Early: Start the process as soon as you identify your funding needs. Prepare Documentation: Gather all required documents, such as financial statements and commercial invoices, ahead of time. Understand Complexity: Recognize how the type of goods and financing methods can affect the arrangement duration. Communicate with Lenders: Stay in touch with your lender to guarantee all requirements are met without delay. Factors Affecting Timeframe Several factors can influence the timeframe for arranging trade loans, making it essential to comprehend what might affect your experience. Typically, you can expect the process to take one to four weeks. The complexity of your transaction and the documentation required play significant roles in determining this timeframe. For instance, straightforward transactions with less risk often get processed more quickly, whereas complex deals involving extensive documentation and thorough risk assessment may take longer. Lenders usually require various documents, such as financial statements, bank statements, and commercial invoices. The more complete and accurate your documentation is from the start, the better your chances are of securing favorable terms and timely funding. Grasping these factors can help you plan effectively. Importance of Early Planning Comprehending the importance of early planning can greatly influence your success in securing trade loans. Arranging a trade loan can take one to four weeks, so starting early is crucial. Here are key steps to take into account: Review your trading history: Lenders will assess this to determine loan terms. Prepare documentation: Gather financial statements and commercial invoices well in advance. Engage with lenders proactively: This can improve your chances of obtaining funding on time. Reflect on your suppliers: Timely arrangements can help maintain strong relationships and guarantee you meet payment deadlines. Risks and Considerations During traversing the terrain of trade loans, it’s vital to recognize the various risks and considerations that can greatly impact your borrowing experience. Trade loans often carry varying interest rates based on the risk profile of the transaction. Higher risks can lead to increased fees, affecting your overall borrowing costs. Lenders assess factors like your trading history and the nature of the trade before approving a loan, so thorough preparation is fundamental. Defaults on trade loans can harm your credit score and may result in legal proceedings, highlighting the need for timely repayments. The complexity of trade transactions can likewise prolong the approval period, typically taking between one and four weeks, which could disrupt your operations. For small and medium-sized enterprises (SMEs), high transaction costs and interest rates pose significant challenges, making access to finance a vital consideration in your operational strategy. Comparison With Other Financing Options Comprehending the different financing options available can greatly influence your business’s operational efficiency and growth potential. When comparing trade loans to other options, consider these key points: Purpose: Trade loans are customized for import and export activities, unlike long-term loans aimed at larger investments. Accessibility: Trade loans often require less credit history and collateral, using traded goods and expected payments as security, making them accessible for newer businesses. Flexibility: They offer revolving credit, allowing you to borrow and repay multiple times, whereas traditional loans provide a lump sum with fixed repayment terms. Cost: Interest rates for trade loans are typically higher because of their short-term nature, which can lead to higher costs if repayments aren’t managed well. Expert Insights on Trade Loans What makes trade loans a vital tool for businesses engaged in international trade? These short-term financing facilities help you manage cash flow by bridging the gap between purchasing products and receiving payments from customers, typically within 30 to 180 days. Trade loans act as revolving credit, allowing you to draw funds particularly for import or export transactions. Collateral often includes the goods being traded and relevant shipping documents. Interest rates for these loans depend on the risk level of the transaction, ranging from SOFR plus 250 to 550 basis points based on your credit profile. Lenders evaluate factors like your trading history and transaction complexity to determine credit limits and applicable fees, which may include arrangement fees and interest charges. Future Trends in Trade Loans The terrain of trade loans is evolving quickly as businesses adapt to new challenges and opportunities in international trade. Here are some future trends you should keep an eye on: Tech Integration: Digital platforms and fintech solutions are making the application process more efficient, especially for small and medium-sized enterprises (SMEs). E-commerce Growth: As global e-commerce expands, businesses increasingly seek quick financing to manage cash flow and seize purchasing opportunities. ESG Considerations: Lenders are focusing more on borrowers’ sustainability practices, which could affect loan terms and availability. Blockchain Use: The integration of blockchain technology is set to improve transparency and security in trade financing, reducing fraud risks and streamlining document verification. These trends indicate a shift toward more flexible financing options, helping businesses secure trade loans that meet their specific needs in a quickly changing environment. Frequently Asked Questions What Is the Purpose of a Trade Loan? The purpose of a trade loan is to provide short-term financing for businesses engaged in importing and exporting. It helps you manage cash flow by covering the gap between purchasing goods and receiving payments. This type of loan allows you to draw funds repeatedly as needed, ensuring liquidity. What Is a Disadvantage of Trade Credit? One significant disadvantage of trade credit is the potential for accumulating late payment fees. If you fail to pay on time, these fees can increase your overall costs. Furthermore, nonpayment or delayed payments can harm your relationship with suppliers, which may lead to stricter credit terms or even loss of access to vital goods and services. It’s vital to manage payments effectively to avoid cash flow issues and maintain a healthy business relationship. Is It Smart to Trade in a Car That Isn’t Paid Off? Trading in a car that isn’t paid off can be tricky. If your car’s trade-in value is less than the remaining loan balance, you could end up “upside down,” which means rolling that debt into your next loan. This situation can increase your monthly payments. Nevertheless, if you have positive equity, you can use that difference as a down payment, potentially lowering your new loan amount. Always check your car’s market value before making a decision. Do You Have to Pay Back Trade Credit? Yes, you have to pay back trade credit. When you purchase goods or services on credit, you agree to repay the supplier within a specified time frame, usually between 7 to 120 days. If you miss this deadline, you might face late fees, which can increase your total costs. Timely payments can improve your credit history and strengthen relationships with suppliers, whereas late payments can lead to unfavorable credit terms in the future. Conclusion In conclusion, a trade loan serves as an essential financial tool for businesses engaged in the buying and selling of goods. It helps maintain cash flow and manage transaction costs by providing quick access to funds secured against inventory. As trade loans offer several benefits, including flexibility and prompt financing, they concurrently come with risks that require careful consideration. Comprehending how trade loans work can empower you to make informed decisions that support your business growth and operational efficiency. Image via Google Gemini This article, "What Is a Trade Loan and How Does It Work?" was first published on Small Business Trends View the full article

-

What your organization can learn from the NFL’s decision to feature Bad Bunny in the Super Bowl

Rewind to 2025. The National Football League is fresh off an unbelievable, yet controversial, Super Bowl halftime performance by the superstar hip hop artist Kendrick Lamar. The country has just been introduced to a diversity-hostile administration, which has practically squashed any zeal toward diversity, equity, or inclusion that corporate America once seemingly held. As the NFL’s leadership team explores talent considerations for next year’s performance in the midst of this cultural backdrop, someone recommends Bad Bunny, the Puerto Rican-born megastar whose songs are performed almost entirely in Spanish, and, surprisingly, the league acquiesces. The public blowback is immediate, yet the NFL stands strong on its decision. On the outside, this may have seemed like a difficult decision for the league to make. But according to Javier Farfan, the global brand and consumer marketing consultant for the NFL, the decision was much easier than one would think. Farfan, a career marketer executive and media professor at Syracuse University’s New School of Communications, has worked with the NFL for the past six years to help the organization broaden its audience and achieve its ambition for global expansion. He has sat in the small rooms where big decisions were made with regard to the league’s cultural engagement with talent and growth audiences. With the Super Bowl happening this week, we thought that he’d be the perfect guest to join us for this week’s episode of the From The Culture podcast to explore how organizations make difficult decisions. Clarity of Conviction The NFL has an ambition to become the biggest sports platform in the world, a vision set by league commissioner Roger Goodell. With a conviction to make American football a worldwide game under Goodell’s leadership, the NFL began playing regular season matches in international markets to broaden its reach. It even petitioned the Olympics to successfully institute flag football as an official event to help further its global adoption. But the universality of music as cultural production is unparallelled, making the Super Bowl halftime show a unique front door into the football universe, one that transforms a sporting competition into a pop-culture event. And it’s the clarity of the organization’s commitment to expansion that makes Bad Bunny an obvious decision for the NFL. His tours sell millions of tickets around the world and his music is streamed billions of times on Spotify—crowning him the most globally-streamed artist for four of the last five years. Even with the local resistance from conservatives and the The President administration, Bad Bunny’s global reach is undeniable. As Farfan asserts, it was easy for the organization and all its many stakeholders to get on board because they all subscribed to a shared ambition. The league, its teams, its partners, and Bad Bunny himself are all aligned, each bringing their talents and resources to help the collective realize its potential. The same can be said within our own organizations. Our companies’ convictions not only help orient their direction but also guide their decision-making such that hard decisions aren’t so difficult. When the conviction is clear, decisions are made easy. Take the outdoor brand Patagonia. The company has long been committed to mitigating human evasiveness on the planet. This is the ambition that unites all its stakeholders. Along with its retail business, Patagonia outfitted high-end corporate clients with company apparel. Company vests and fleece jackets with the Patagonia logo etched on the chest became a sort of unofficial uniform for Wall Street bankers and Silicon Valley techies. This was a significant revenue driver for the company. However, when Patagonia realized that some of its corporate clients dealt in ventures that did not prioritize the planet, it decided to end its business dealings with them. Despite the loss of revenue, this was an easy decision for Patagonia because its convictions were clear. Hard decisions are only truly hard when conviction is ill-defined. In the case of the NFL, if the ambition is to be a global sport, then you choose the options that get you closer to that ambition—even if it means facing some headwinds. Easy. If you’re Patagonia and your conviction is to protect the planet, then you take the path that preserves the Earth, although you may lose some revenue in the short run. Again, easy. Difficulty lies where your conviction is questioned and your commitment to it is uncertain. For organizations that know what they’re after and know who they are, the only real loss is loss of self when they deviate from it. Check out our full interview with Javier Farfan that breaks down the dynamics of the NFL’s decision to partner with Bad Bunny for the Super Bowl halftime show and what takeaways leaders can glean about their own organizations. View the full article

-

Construction Milestones: Milestone Schedule Example