All Activity

- Past hour

-

open thread – February 13, 2026

It’s the Friday open thread! The comment section on this post is open for discussion with other readers on any work-related questions that you want to talk about (that includes school). If you want an answer from me, emailing me is still your best bet*, but this is a chance to take your questions to other readers. * If you submitted a question to me recently, please do not repost it here, as it may be in my queue to answer. The post open thread – February 13, 2026 appeared first on Ask a Manager. View the full article

-

A Roman board game has mystified researchers for years. AI discovered how to play

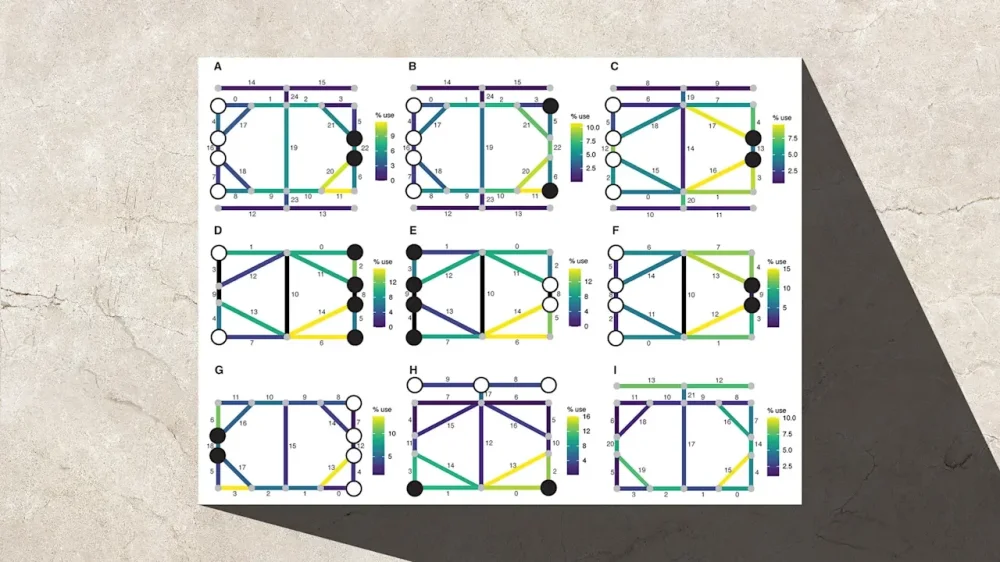

Somewhere around the turn of the 20th century, archaeologists in Heerlen, Netherlands, came across an odd-looking smooth white stone. They knew the territory was once the Roman settlement of Coriovallum, but had never seen anything like it and had no idea what it was for. For the better part of the next 100 years, it sat in a storage unit at the Thermenmuseum, a mystery taunting researchers. Then, six years ago, archaeologist Walter Crist spotted the stone while wandering the museum. Crist specializes in ancient board games and recognized it as one, though not one he had ever seen before. That sparked his curiosity. Now, with the help of artificial intelligence, he thinks he has figured it out—and even knows how to play. The stone isn’t much to look at. It’s an eight-inch piece of white Jurassic limestone. Lines etched into it form an oblong, diamond-like shape within a rectangle. But in a paper published Wednesday in the journal Antiquity, Crist and his team discuss what happened when they programmed two AI agents from the AI-driven play system Ludii to try to solve it. Playing Ludus Coriovalli The researchers had the AI play the game against itself thousands of times, testing more than 100 different sets of rules drawn from other known European games, both modern and ancient. They compared the AI’s moves with patterns of wear on the board, tracking which gameplay styles most closely matched the grooves on the stone. The board, it appeared, was used for a blocking game—a type of board game in which the goal is to prevent your opponent from moving. (Think of modern titles like Go or Blokus.) Blocking games were rare in ancient Europe and, before this, had only been dated to the Middle Ages. This discovery suggests they were played several centuries earlier. In the end, the AI and the team identified nine sets of rules consistent with the board’s wear. Crist and his team named the game Ludus Coriovalli, “the game from Coriovallum.” “By combining AI simulation with use-wear analysis to identify and model traces of game play, it is possible to not only identify potential game boards, but also to rebuild playable rulesets that may provide indications regarding the ways that people played games in the past,” the paper reads. So what were the rules? Here’s what researchers determined: One player controls four “dogs.” The other controls two “hares.” The dogs start on the four leftmost points; the hares start on the inner two points on the rightmost side. Players alternate turns moving a piece to an adjacent empty spot on the board. The dogs attempt to block the hares, while the hares try to remain unblocked for as long as possible. If the hares are blocked, players swap roles and play again. The player who lasts the longest as the hares wins. Got it? Good. Because this isn’t just a theoretical reconstruction. It’s a game you can actually play online now. Crist and his team uploaded a simulation of Ludus Coriovalli to Ludii, and it’s available to anyone who wants to give it a try. So why study the games ancient civilizations played? Beyond simple curiosity, Crist notes, they offer a clearer picture of everyday life in the past—and a connection to history that isn’t just dry numbers or broken pot shards. “The ability to identify play and games in archaeology strengthens the understanding of our ludic heritage, and makes ancient life more accessible to people in the present, as the act of playing a board game is fundamentally the same today as it was in past millennia,” he writes in the paper. View the full article

-

Cut your 2025 tax bill with these 4 smart moves

The One Big Beautiful Bill Act (OBBBA) made some long-awaited permanent changes to the tax code. It also introduced short-term tax breaks that come with strict limits and phaseouts, and many of them are only available through 2028 or 2029. Here are four ways to get the most out of the OBBBA’s temporary provisions as you file your 2025 taxes and plan ahead. Don’t dismiss itemizing your deductions The OBBBA temporarily boosts the state and local tax deduction cap, or SALT, from $10,000 to $40,000 (for married couples filing jointly and single filers). This higher cap applies from 2025 through 2029. Run the numbers: For 2025, the standard deduction is $31,500 for married couples and $15,750 for singles. If your total itemized deductions — including mortgage interest, charitable giving, and state and local taxes (up to the new $40,000 cap) — add up to more than your standard deduction, you should itemize. Watch your income: The new $40,000 SALT cap isn’t for everyone. It begins to phase out if your modified adjusted gross income is over $500,000 (for all filers). If your MAGI reaches $600,000, your SALT deduction reverts to the original $10,000 limit. Maximize the new targeted deductions—if you qualify The OBBBA introduced several temporary above-the-line deductions (available whether you itemize or not) to help middle-income workers. But they have very strict income and benefit limits. The qualified overtime pay deduction: Capped at $25,000 for married couples filing jointly and $12,500 for singles. Only the extra “half-time” portion of your time-and-a-half pay qualifies for the deduction. For a married couple, this benefit begins to disappear if your MAGI hits $300,000 and is entirely gone once your MAGI reaches $550,000. The qualified tips income deduction: Allows you to write off qualified tip income up to $25,000 per tax return, whether you file as married or single. The deduction is only available for tips that are formally reported on a Form W-2 or Form 1099. It phases out sharply for higher earners, starting at a MAGI of $300,000 for married couples and $150,000 for singles, and is fully eliminated at $550,000 and $400,000, respectively. The auto loan interest deduction: This temporary deduction allows you to write off up to $10,000 of interest paid on a loan for a new, personal-use vehicle with final assembly in the US. (Leases are excluded.) It starts to phase out at $200,000 for married couples and $100,000 for singles and is completely gone by $250,000 and $150,000. Seniors, time your 2026 Roth conversions carefully If you are 65 or older, the OBBBA offers a new, temporary deduction for seniors of up to $12,000 for married couples ($6,000 per eligible spouse) and $6,000 for single filers. This is a welcome tax break, but it’s fragile. Beware the MAGI trap: This deduction begins to disappear for married couples with a MAGI over $150,000 and for singles over $75,000. Model Roth conversions for 2026: If you are a senior who is close to the $150,000 MAGI limit, a Roth conversion done in 2026 could push your income over the threshold, causing you to lose this entire $12,000 deduction. Work with your adviser to model any planned 2026 conversions. Optimize income to qualify for the best breaks Many of the OBBBA’s most valuable temporary provisions are income-sensitive, particularly those new targeted deductions and the elevated SALT cap. Keep these rules in mind for 2025 filing and 2026 tax planning. For your 2025 return: You can still influence your 2025 MAGI by: Making 2025 HSA contributions (before the April 2026 tax deadline). Making 2025 deductible IRA contributions, if you’re eligible. Plan for 2026 income: If your 2026 income is likely to approach any phaseout thresholds (such as the $300,000 limit for tips/overtime or the $500,000 limit for the elevated SALT cap), consider strategies that help keep it within the qualifying range. Postponing the sale of highly appreciated stock to avoid realizing large capital gains in 2026. Delaying the exercise of nonqualified stock options if doing so would push you over a phaseout threshold. Maximizing 401(k) and health savings account contributions to reduce your 2026 MAGI. Holding off on large Roth conversions if they would increase your income above key limits. Don’t let the technical limitations and phaseouts catch you by surprise. With a little smart planning, you can lock in significant tax savings. This article was provided to The Associated Press by Morningstar. For more personal finance content, go to https://www.morningstar.com/personal-finance. Sheryl Rowling, CPA, is an editorial director, financial adviser for Morningstar. Related Links How to Name a Charity as Your IRA Beneficiary https://www.morningstar.com/personal-finance/how-name-charity-your-ira-beneficiary 6 Steps to Claiming Your Baby’s Free $1,000 From Uncle Sam https://www.morningstar.com/personal-finance/6-steps-claiming-your-babys-free-1000-uncle-sam 8 Tips to Stop Worrying About Running Out of Money in Retirement https://www.morningstar.com/personal-finance/8-tips-stop-worrying-about-running-out-money-retirement —Sheryl Rowling of Morningstar View the full article

-

Best LLC Structures for Tax Benefits

When establishing an LLC, comprehension of the tax structures available is essential for maximizing benefits. You can choose between pass-through taxation and S Corporation status, each offering unique advantages. For instance, single-member LLCs typically default to sole proprietorship taxation, whereas multi-member LLCs are usually treated as partnerships. These options can help you avoid double taxation. Nonetheless, determining the best structure for your needs involves more than just these basics. Considerations like self-employment taxes and specific state regulations can greatly impact your decision. Key Takeaways LLCs benefit from pass-through taxation, allowing profits and losses to be reported on personal tax returns, avoiding double taxation. Electing S Corporation status can reduce self-employment taxes, as only salaries are subject to these taxes. Single-member LLCs default to sole proprietorship taxation, while multi-member LLCs are taxed as partnerships, offering flexibility in tax classification. Deductible business expenses, including operational costs and start-up expenses, enhance cash flow and reduce taxable income. Consulting a tax professional helps customize tax strategies, ensuring optimal classification and compliance with state-specific franchise taxes. Understanding LLC Basics When you consider starting a business, comprehending the basics of a Limited Liability Company (LLC) is crucial. An LLC combines the liability protection of a corporation with the tax flexibility of a partnership, offering significant limited liability company tax benefits. For instance, single-member LLCs default to sole proprietorship taxation, whereas multi-member LLCs are taxed as partnerships, both benefiting from pass-through taxation. This means profits and losses appear on your personal tax returns, simplifying your tax filing. Furthermore, LLC tax classification allows you to elect S-corporation or C-corporation status, tailoring your tax strategies. You can likewise deduct business expenses, such as startup and operational costs, enhancing cash flow and reducing taxable income, showcasing the tax advantages of LLCs. The Benefits of Pass-through Taxation Pass-through taxation offers significant advantages for LLC owners, ensuring that business profits and losses are reported directly on your personal income tax returns. This approach helps you avoid double taxation, which C corporations face. As an LLC member, you can potentially lower your overall tax liability by offsetting business losses against your personal income, like wages or investment earnings. The IRS automatically classifies LLCs as pass-through entities except you choose C corporation taxation, giving you flexibility in planning. Simplifying tax compliance, you typically only need to file your personal tax return without a separate corporate one. Furthermore, by leveraging pass-through taxation, you can claim various deductions on business expenses, making it one of the best LLC structures for tax purposes. Choosing Your Tax Classification How do you determine the best tax classification for your LLC? Start by considering your business structure. Single-member LLCs typically default to sole proprietorship taxation, whereas multi-member LLCs default to partnership taxation. Both options benefit from pass-through taxation, which avoids double taxation. If you want to save on self-employment taxes, electing S Corporation status might be beneficial, as only salaries incur these taxes, not distributions. On the other hand, if your LLC generates high earnings, opting for C Corporation classification could provide advantages, given the corporate tax rate of 21% might be lower than individual rates for high-income earners. To make sure you choose the most advantageous classification, consult with a tax professional to evaluate your specific financial situation and tax liability. Deducting Business Expenses Comprehending the range of business expenses you can deduct is vital for maximizing your LLC’s tax benefits. LLCs can deduct various costs, including advertising, training, and travel, which considerably reduce taxable income. Furthermore, ongoing operational expenses like cell phone bills, internet services, and office rent improve your cash flow. Start-up costs incurred before the LLC begins operations can be deducted up to $5,000 in the first year, subject to phase-out limits. You can likewise write off legitimate business expenses on your personal tax returns, lowering your overall tax liability. Proper documentation and adherence to IRS guidelines are critical for maximizing deductions. Deductible Expense Description Advertising Costs related to promoting your LLC Training Expenses for employee education Travel Business-related travel costs Operational Expenses Regular bills like rent and utilities Start-up Costs Initial expenses before opening Comparing LLCs to Other Business Structures When considering the right business structure for your venture, it’s essential to understand how LLCs stack up against other options like sole proprietorships and corporations. LLCs offer limited liability protection, safeguarding your personal assets from business debts, unlike sole proprietorships and partnerships. They also benefit from pass-through taxation, which means you report profits and losses on your personal tax return, avoiding the double taxation faced by C corporations. Furthermore, LLCs allow for flexible tax classification, enabling customized strategies to fit your financial situation. Compared to corporations, LLCs have fewer administrative burdens and lower operational costs. Moreover, LLC owners can deduct business losses from personal income, providing tax advantages not available to sole proprietorships or partnerships. Tax Implications of S Corporation Election Electing S Corporation status for your LLC can markedly alter your tax terrain, primarily by allowing profits to bypass double taxation. Here are some key tax implications to examine: Profits pass directly to shareholders, taxed at individual rates. Shareholders can draw salaries and receive dividends, potentially lowering self-employment taxes. To qualify, your LLC must have no more than 100 shareholders and only one class of stock. You can utilize the Qualified Business Income (QBI) deduction, allowing up to a 20% deduction on pass-through income. The S Corporation election locks in for 60 months, so weigh the benefits and implications carefully before proceeding. Understanding these factors can help you make informed decisions about your LLC’s structure. Managing Self-Employment Taxes Managing self-employment taxes is essential for self-employment members, especially if you’re taxed as a sole proprietor or partner, since you’re liable for both the employer and employee portions of Social Security and Medicare taxes. By electing S-corporation status, you can reduce your self-employment tax burden by designating a portion of your income as salary, whereas the rest can be taken as distributions that aren’t subject to these taxes. It’s also significant to make estimated tax payments quarterly if you expect to owe $1,000 or more in self-employment taxes, helping you stay compliant with IRS regulations. Self-Employment Tax Implications Comprehending self-employment tax implications is crucial for LLC members, as they’re treated as self-employed and must pay self-employment taxes on their share of the business’s profits. This includes both the employer and employee portions of Social Security and Medicare taxes, currently totaling 15.3%. Here are some key points to take into account: Self-employment taxes apply to all net earnings from the LLC. Members must file estimated tax payments quarterly to avoid penalties. LLCs taxed as S-corporations can reduce self-employment tax liabilities by classifying income into salary and distributions. Members of LLCs taxed as partnerships face self-employment tax on all income. Consulting a tax professional is advisable to navigate these intricacies effectively. Tax Deduction Strategies When you own an LLC, taking advantage of tax deduction strategies can greatly mitigate your self-employment tax burden. If you’re taxed as a sole proprietor or partner, you face a self-employment tax rate of up to 15.3%. Nevertheless, electing S-corporation status allows you to classify part of your income as salary and the rest as distributions, reducing your self-employment tax impact. Furthermore, you can deduct the employer portion of self-employment taxes on your personal tax return, lowering your taxable income. Keeping detailed records of business expenses is essential, as these can likewise be deducted, further reducing your tax liability. To optimize your tax position, consult a tax professional for customized strategies regarding the timing of income and expenses. State-specific Franchise Tax Considerations Grasping state-specific franchise tax considerations is vital for LLC owners, as these taxes can greatly impact your business’s financial health. Franchise taxes differ markedly from state to state, so it’s important to understand the rules applicable to your LLC. Here are some key points to take into account: Texas imposes a franchise tax on LLCs with revenue over $1.23 million, with rates from 0.375% to 0.75%. Delaware charges no franchise tax for LLCs that don’t operate in the state, but has a $300 annual fee. California’s minimum franchise tax is $800, regardless of income, plus additional fees for those earning over $250,000. Research your state’s specific requirements. Guarantee compliance to optimize your tax strategy effectively. Leasing Personal Assets for Business Use Leasing personal assets to your LLC can offer significant tax benefits, such as deductible lease payments that reduce your taxable income. For example, if you lease your home office or equipment, the LLC can write off those expenses, whilst you gain additional income from the arrangement. Nevertheless, it’s essential to verify that the lease agreements are formalized and reflect fair market value to meet IRS requirements and avoid potential issues. Deductible Lease Payments Even though many business owners may not realize it, LLCs have the opportunity to lease personal assets from their members, which can create significant tax benefits. By doing this, your LLC can treat lease payments as deductible business expenses, reducing taxable income. Here are some key points to reflect on: You can lease your home office to the LLC, enabling you to claim rental expenses. Equipment, vehicles, and office space can likewise be leased. Confirm you have a formal Commercial Lease agreement in place to substantiate deductions. Document all lease payments carefully to comply with IRS guidelines. Verify that the assets are necessary for the business’s operation to qualify for deductions. These strategies can effectively improve your LLC’s financial efficiency. Asset Depreciation Benefits Using personal assets in your IRS can offer significant tax advantages, particularly through the process of asset depreciation. You can lease personal items, like a home office or equipment, allowing your IRS to deduct these leasing expenses. The IRS mandates that these assets must serve business purposes to qualify for depreciation, ensuring compliance. This arrangement not only generates income for you but likewise reduces your IRS’s taxable income through deductible expenses. To substantiate these claims, formal lease agreements are crucial. Here’s a quick overview: Aspect Details Leased Items Home office, equipment Tax Deductions Leasing expenses, depreciation Requirements Business use, formal lease agreements This strategy can improve your overall tax benefits effectively. Personal vs. Business Use How do you determine the appropriate balance between personal and business use when leasing assets to your LLC? It’s essential to formalize lease agreements in writing, guaranteeing compliance with IRS regulations. Consider these key points when leasing personal assets: Verify the leased asset is primarily for business use to qualify for tax deductions. Set a reasonable rental rate consistent with market values to avoid IRS scrutiny. Document the lease agreement to clarify terms and conditions. Keep detailed records of usage, separating personal and business use. Understand that income generated from leasing can provide additional cash flow during benefiting your LLC’s tax situation. Consulting a Tax Professional for Tailored Advice Have you considered the benefits of consulting a tax professional for your tax professional? A tax advisor can help you determine the best classification for tax purposes, aligning with your income and goals. They can provide insights on S-corporation status, potentially reducing self-employment taxes on distributions. Moreover, steering through deductible business expenses becomes easier with expert guidance, maximizing your write-offs. They can likewise evaluate state-specific franchise taxes, assisting you in choosing a registration state that minimizes your liabilities. Overall, customized advice helps you develop a bespoke strategy for your business needs. Benefit Description Tax Classification Determine the best classification for your LLC. S-Corporation Insights Explore potential tax savings on distributions. Deductible Expenses Maximize write-offs to minimize taxable income. Franchise Tax Evaluation Assess state-specific franchise taxes. Customized Tax Strategy Align tax strategy with your business goals. Frequently Asked Questions What Is the Best Tax Structure for LLC? The best tax structure for your LLC depends on various factors, including your business goals and income level. For single-member LLCs, being taxed as a sole proprietorship usually works well, whereas multi-member LLCs often benefit from partnership taxation. If you’re looking to reduce self-employment taxes, consider electing S Corporation status. Consulting a tax professional can help you assess the most advantageous option customized to your specific situation and future growth potential. What Is the Most Tax Efficient Way to Pay Yourself in an LLC? To pay yourself tax-efficiently in an LLC, consider a combination of salary and distributions. You’ll pay self-employment taxes only on your salary, whereas distributions aren’t subject to these taxes. If your LLC elects S Corporation status, you can further reduce your tax burden by classifying some income as distributions, taxed at a lower rate. Verify your salary is reasonable to comply with IRS regulations, and maintain proper documentation for all payments. Should My LLC Be an S or C Corp? When deciding whether your LLC should be an S Corporation or C Corporation, consider your business’s profit levels and growth potential. An S Corporation avoids double taxation, allowing profits to pass through to your personal tax return, which can save on self-employment taxes. Conversely, a C Corporation faces double taxation, taxing corporate income and dividends separately. If your LLC plans to attract investors, an S Corporation’s structure may likewise facilitate easier capital raising. Which Business Structure Has the Best Tax Benefits? When considering tax benefits, an LLC often stands out because of its pass-through taxation, meaning profits and losses appear on your personal tax return, avoiding double taxation. You can likewise elect to be taxed as an S Corporation, which may lower self-employment taxes by allowing part of your income to be treated as distributions. Furthermore, LLCs offer flexibility in tax treatment and allow deductions for various business expenses, enhancing your overall cash flow. Conclusion In summary, selecting the right LLC structure for tax benefits can greatly impact your overall financial health. By comprehending pass-through taxation, considering S Corporation status, and deducting legitimate business expenses, you can optimize your tax situation. Furthermore, managing self-employment taxes and being aware of state-specific fees are essential. Consulting a tax professional can provide customized advice, ensuring you choose the most advantageous structure based on your unique circumstances and goals. Making informed decisions now can lead to considerable savings later. Image via Google Gemini This article, "Best LLC Structures for Tax Benefits" was first published on Small Business Trends View the full article

-

Best LLC Structures for Tax Benefits

When establishing an LLC, comprehension of the tax structures available is essential for maximizing benefits. You can choose between pass-through taxation and S Corporation status, each offering unique advantages. For instance, single-member LLCs typically default to sole proprietorship taxation, whereas multi-member LLCs are usually treated as partnerships. These options can help you avoid double taxation. Nonetheless, determining the best structure for your needs involves more than just these basics. Considerations like self-employment taxes and specific state regulations can greatly impact your decision. Key Takeaways LLCs benefit from pass-through taxation, allowing profits and losses to be reported on personal tax returns, avoiding double taxation. Electing S Corporation status can reduce self-employment taxes, as only salaries are subject to these taxes. Single-member LLCs default to sole proprietorship taxation, while multi-member LLCs are taxed as partnerships, offering flexibility in tax classification. Deductible business expenses, including operational costs and start-up expenses, enhance cash flow and reduce taxable income. Consulting a tax professional helps customize tax strategies, ensuring optimal classification and compliance with state-specific franchise taxes. Understanding LLC Basics When you consider starting a business, comprehending the basics of a Limited Liability Company (LLC) is crucial. An LLC combines the liability protection of a corporation with the tax flexibility of a partnership, offering significant limited liability company tax benefits. For instance, single-member LLCs default to sole proprietorship taxation, whereas multi-member LLCs are taxed as partnerships, both benefiting from pass-through taxation. This means profits and losses appear on your personal tax returns, simplifying your tax filing. Furthermore, LLC tax classification allows you to elect S-corporation or C-corporation status, tailoring your tax strategies. You can likewise deduct business expenses, such as startup and operational costs, enhancing cash flow and reducing taxable income, showcasing the tax advantages of LLCs. The Benefits of Pass-through Taxation Pass-through taxation offers significant advantages for LLC owners, ensuring that business profits and losses are reported directly on your personal income tax returns. This approach helps you avoid double taxation, which C corporations face. As an LLC member, you can potentially lower your overall tax liability by offsetting business losses against your personal income, like wages or investment earnings. The IRS automatically classifies LLCs as pass-through entities except you choose C corporation taxation, giving you flexibility in planning. Simplifying tax compliance, you typically only need to file your personal tax return without a separate corporate one. Furthermore, by leveraging pass-through taxation, you can claim various deductions on business expenses, making it one of the best LLC structures for tax purposes. Choosing Your Tax Classification How do you determine the best tax classification for your LLC? Start by considering your business structure. Single-member LLCs typically default to sole proprietorship taxation, whereas multi-member LLCs default to partnership taxation. Both options benefit from pass-through taxation, which avoids double taxation. If you want to save on self-employment taxes, electing S Corporation status might be beneficial, as only salaries incur these taxes, not distributions. On the other hand, if your LLC generates high earnings, opting for C Corporation classification could provide advantages, given the corporate tax rate of 21% might be lower than individual rates for high-income earners. To make sure you choose the most advantageous classification, consult with a tax professional to evaluate your specific financial situation and tax liability. Deducting Business Expenses Comprehending the range of business expenses you can deduct is vital for maximizing your LLC’s tax benefits. LLCs can deduct various costs, including advertising, training, and travel, which considerably reduce taxable income. Furthermore, ongoing operational expenses like cell phone bills, internet services, and office rent improve your cash flow. Start-up costs incurred before the LLC begins operations can be deducted up to $5,000 in the first year, subject to phase-out limits. You can likewise write off legitimate business expenses on your personal tax returns, lowering your overall tax liability. Proper documentation and adherence to IRS guidelines are critical for maximizing deductions. Deductible Expense Description Advertising Costs related to promoting your LLC Training Expenses for employee education Travel Business-related travel costs Operational Expenses Regular bills like rent and utilities Start-up Costs Initial expenses before opening Comparing LLCs to Other Business Structures When considering the right business structure for your venture, it’s essential to understand how LLCs stack up against other options like sole proprietorships and corporations. LLCs offer limited liability protection, safeguarding your personal assets from business debts, unlike sole proprietorships and partnerships. They also benefit from pass-through taxation, which means you report profits and losses on your personal tax return, avoiding the double taxation faced by C corporations. Furthermore, LLCs allow for flexible tax classification, enabling customized strategies to fit your financial situation. Compared to corporations, LLCs have fewer administrative burdens and lower operational costs. Moreover, LLC owners can deduct business losses from personal income, providing tax advantages not available to sole proprietorships or partnerships. Tax Implications of S Corporation Election Electing S Corporation status for your LLC can markedly alter your tax terrain, primarily by allowing profits to bypass double taxation. Here are some key tax implications to examine: Profits pass directly to shareholders, taxed at individual rates. Shareholders can draw salaries and receive dividends, potentially lowering self-employment taxes. To qualify, your LLC must have no more than 100 shareholders and only one class of stock. You can utilize the Qualified Business Income (QBI) deduction, allowing up to a 20% deduction on pass-through income. The S Corporation election locks in for 60 months, so weigh the benefits and implications carefully before proceeding. Understanding these factors can help you make informed decisions about your LLC’s structure. Managing Self-Employment Taxes Managing self-employment taxes is essential for self-employment members, especially if you’re taxed as a sole proprietor or partner, since you’re liable for both the employer and employee portions of Social Security and Medicare taxes. By electing S-corporation status, you can reduce your self-employment tax burden by designating a portion of your income as salary, whereas the rest can be taken as distributions that aren’t subject to these taxes. It’s also significant to make estimated tax payments quarterly if you expect to owe $1,000 or more in self-employment taxes, helping you stay compliant with IRS regulations. Self-Employment Tax Implications Comprehending self-employment tax implications is crucial for LLC members, as they’re treated as self-employed and must pay self-employment taxes on their share of the business’s profits. This includes both the employer and employee portions of Social Security and Medicare taxes, currently totaling 15.3%. Here are some key points to take into account: Self-employment taxes apply to all net earnings from the LLC. Members must file estimated tax payments quarterly to avoid penalties. LLCs taxed as S-corporations can reduce self-employment tax liabilities by classifying income into salary and distributions. Members of LLCs taxed as partnerships face self-employment tax on all income. Consulting a tax professional is advisable to navigate these intricacies effectively. Tax Deduction Strategies When you own an LLC, taking advantage of tax deduction strategies can greatly mitigate your self-employment tax burden. If you’re taxed as a sole proprietor or partner, you face a self-employment tax rate of up to 15.3%. Nevertheless, electing S-corporation status allows you to classify part of your income as salary and the rest as distributions, reducing your self-employment tax impact. Furthermore, you can deduct the employer portion of self-employment taxes on your personal tax return, lowering your taxable income. Keeping detailed records of business expenses is essential, as these can likewise be deducted, further reducing your tax liability. To optimize your tax position, consult a tax professional for customized strategies regarding the timing of income and expenses. State-specific Franchise Tax Considerations Grasping state-specific franchise tax considerations is vital for LLC owners, as these taxes can greatly impact your business’s financial health. Franchise taxes differ markedly from state to state, so it’s important to understand the rules applicable to your LLC. Here are some key points to take into account: Texas imposes a franchise tax on LLCs with revenue over $1.23 million, with rates from 0.375% to 0.75%. Delaware charges no franchise tax for LLCs that don’t operate in the state, but has a $300 annual fee. California’s minimum franchise tax is $800, regardless of income, plus additional fees for those earning over $250,000. Research your state’s specific requirements. Guarantee compliance to optimize your tax strategy effectively. Leasing Personal Assets for Business Use Leasing personal assets to your LLC can offer significant tax benefits, such as deductible lease payments that reduce your taxable income. For example, if you lease your home office or equipment, the LLC can write off those expenses, whilst you gain additional income from the arrangement. Nevertheless, it’s essential to verify that the lease agreements are formalized and reflect fair market value to meet IRS requirements and avoid potential issues. Deductible Lease Payments Even though many business owners may not realize it, LLCs have the opportunity to lease personal assets from their members, which can create significant tax benefits. By doing this, your LLC can treat lease payments as deductible business expenses, reducing taxable income. Here are some key points to reflect on: You can lease your home office to the LLC, enabling you to claim rental expenses. Equipment, vehicles, and office space can likewise be leased. Confirm you have a formal Commercial Lease agreement in place to substantiate deductions. Document all lease payments carefully to comply with IRS guidelines. Verify that the assets are necessary for the business’s operation to qualify for deductions. These strategies can effectively improve your LLC’s financial efficiency. Asset Depreciation Benefits Using personal assets in your IRS can offer significant tax advantages, particularly through the process of asset depreciation. You can lease personal items, like a home office or equipment, allowing your IRS to deduct these leasing expenses. The IRS mandates that these assets must serve business purposes to qualify for depreciation, ensuring compliance. This arrangement not only generates income for you but likewise reduces your IRS’s taxable income through deductible expenses. To substantiate these claims, formal lease agreements are crucial. Here’s a quick overview: Aspect Details Leased Items Home office, equipment Tax Deductions Leasing expenses, depreciation Requirements Business use, formal lease agreements This strategy can improve your overall tax benefits effectively. Personal vs. Business Use How do you determine the appropriate balance between personal and business use when leasing assets to your LLC? It’s essential to formalize lease agreements in writing, guaranteeing compliance with IRS regulations. Consider these key points when leasing personal assets: Verify the leased asset is primarily for business use to qualify for tax deductions. Set a reasonable rental rate consistent with market values to avoid IRS scrutiny. Document the lease agreement to clarify terms and conditions. Keep detailed records of usage, separating personal and business use. Understand that income generated from leasing can provide additional cash flow during benefiting your LLC’s tax situation. Consulting a Tax Professional for Tailored Advice Have you considered the benefits of consulting a tax professional for your tax professional? A tax advisor can help you determine the best classification for tax purposes, aligning with your income and goals. They can provide insights on S-corporation status, potentially reducing self-employment taxes on distributions. Moreover, steering through deductible business expenses becomes easier with expert guidance, maximizing your write-offs. They can likewise evaluate state-specific franchise taxes, assisting you in choosing a registration state that minimizes your liabilities. Overall, customized advice helps you develop a bespoke strategy for your business needs. Benefit Description Tax Classification Determine the best classification for your LLC. S-Corporation Insights Explore potential tax savings on distributions. Deductible Expenses Maximize write-offs to minimize taxable income. Franchise Tax Evaluation Assess state-specific franchise taxes. Customized Tax Strategy Align tax strategy with your business goals. Frequently Asked Questions What Is the Best Tax Structure for LLC? The best tax structure for your LLC depends on various factors, including your business goals and income level. For single-member LLCs, being taxed as a sole proprietorship usually works well, whereas multi-member LLCs often benefit from partnership taxation. If you’re looking to reduce self-employment taxes, consider electing S Corporation status. Consulting a tax professional can help you assess the most advantageous option customized to your specific situation and future growth potential. What Is the Most Tax Efficient Way to Pay Yourself in an LLC? To pay yourself tax-efficiently in an LLC, consider a combination of salary and distributions. You’ll pay self-employment taxes only on your salary, whereas distributions aren’t subject to these taxes. If your LLC elects S Corporation status, you can further reduce your tax burden by classifying some income as distributions, taxed at a lower rate. Verify your salary is reasonable to comply with IRS regulations, and maintain proper documentation for all payments. Should My LLC Be an S or C Corp? When deciding whether your LLC should be an S Corporation or C Corporation, consider your business’s profit levels and growth potential. An S Corporation avoids double taxation, allowing profits to pass through to your personal tax return, which can save on self-employment taxes. Conversely, a C Corporation faces double taxation, taxing corporate income and dividends separately. If your LLC plans to attract investors, an S Corporation’s structure may likewise facilitate easier capital raising. Which Business Structure Has the Best Tax Benefits? When considering tax benefits, an LLC often stands out because of its pass-through taxation, meaning profits and losses appear on your personal tax return, avoiding double taxation. You can likewise elect to be taxed as an S Corporation, which may lower self-employment taxes by allowing part of your income to be treated as distributions. Furthermore, LLCs offer flexibility in tax treatment and allow deductions for various business expenses, enhancing your overall cash flow. Conclusion In summary, selecting the right LLC structure for tax benefits can greatly impact your overall financial health. By comprehending pass-through taxation, considering S Corporation status, and deducting legitimate business expenses, you can optimize your tax situation. Furthermore, managing self-employment taxes and being aware of state-specific fees are essential. Consulting a tax professional can provide customized advice, ensuring you choose the most advantageous structure based on your unique circumstances and goals. Making informed decisions now can lead to considerable savings later. Image via Google Gemini This article, "Best LLC Structures for Tax Benefits" was first published on Small Business Trends View the full article

- Today

-

This Rugged Action Camera Is Nearly $90 Off During an Early Presidents Day Sale

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. The Insta360 Ace Pro 2 isn’t trying to win you over with just flashy specs, though it has plenty of those. It’s currently on sale (see more President’s Day sale here) for $489.99 on Amazon (down from $579.99), which also happens to be its lowest tracked price to date, according to price trackers. Insta360 Ace Pro 2 Flash Print Bundle $489.99 at Amazon $579.99 Save $90.00 Get Deal Get Deal $489.99 at Amazon $579.99 Save $90.00 This particular bundle includes some solid extras: two batteries, a flip screen hood, a leather case, a grip kit, and even a pocket printer to turn your favorite captures into prints. What you’re really getting, though, is a rugged, compact camera that delivers impressive 4K video, stable footage, and solid low-light performance—all in a body that’s waterproof, durable, and lightweight enough to clip onto your shirt or bike. While Insta360 advertises 8K recording at 30fps, most people will likely stick to its excellent 4K modes, which go up to 120fps for smooth slow motion. It also offers a log profile (I-Log) for anyone who wants to color grade their footage later. The 2.5-inch flip-up screen is a standout—bigger than what you get on front-facing GoPro or DJI screens—making framing easier whether you're filming yourself or setting up a shot. The flip mechanism can be a bit clunky if you're constantly switching angles, but it doubles as a mount or even a POV bite grip in a pinch. Unlike its rivals, it doesn’t have built-in storage, so a microSD card (up to 1TB supported, sold separately) is a must-have from day one. In daily use, the Ace Pro 2 delivers. The footage is sharp, the stabilization keeps things steady, and the built-in mics offer better-than-expected audio. There’s Bluetooth, Wi-Fi, USB-C 3.0, and solid app integration for both iOS and Android, making edits and uploads quick. Battery life is solid, and the included extras in this Flash Print Bundle add good value. It’s not leagues ahead of the GoPro Hero 13 or DJI Osmo Action 5 Pro, but it brings enough to the table—like the larger flip screen, smart mounting system, and polished app experience—to make it worth considering. If you’re in the market for a flagship action cam and prefer editing clean 4K footage over fiddling with massive 8K files, this is a smart pickup at its current price. Our Best Editor-Vetted Presidents' Day Deals Right Now Apple AirPods 4 Active Noise Cancelling Wireless Earbuds — $139.99 (List Price $179.00) Apple Watch Series 11 [GPS 46mm] Smartwatch with Jet Black Aluminum Case with Black Sport Band - M/L. Sleep Score, Fitness Tracker, Health Monitoring, Always-On Display, Water Resistant — $329.00 (List Price $429.00) Apple iPad 11" 128GB A16 WiFi Tablet (Blue, 2025) — $299.00 (List Price $349.00) Bose QuietComfort Noise Cancelling Wireless Headphones — $229.00 (List Price $349.00) Dell 16 DC16255 (AMD Ryzen 7 250, 512GB SSD, 16GB RAM, 2K Display) — $649.99 (List Price $869.99) HP Omen 35L (Intel Core Ultra 9 285K, RTX 5080, 2TB SSD, 64GB RAM) — (List Price $3,099.99 With Code "PRESDAYPC100") HP OmniBook X Flip Ngai 16-Inch (AMD Ryzen AI 7 350, Radeon 860M, 512GB SSD, 16GB RAM, 2K Display) — (List Price $649.99 With Code "PRESDAYPC50") Deals are selected by our commerce team View the full article

-

5 Essential Tips for Streamlining Payroll and HR Management

Streamlining payroll and HR management is vital for efficiency and accuracy. By embracing automation, you can reduce errors and guarantee timely payments. Compliance with labor laws is fundamental, as is simplifying payroll processes through direct deposit and self-service portals. Investing in integrated technology eliminates duplicate entries, whereas promoting transparency helps employees understand policies. Discover how these strategies can transform your payroll practices and make your HR operations more effective. Key Takeaways Embrace automation to reduce manual errors and shift HR focus to strategic initiatives, enhancing overall employee satisfaction. Ensure compliance with labor laws by keeping accurate records and conducting regular audits to avoid financial penalties. Simplify payroll processes by automating calculations and implementing direct deposit to ensure timely and secure payments. Invest in integrated technology to streamline data entry, improve accuracy, and provide real-time updates on payroll compliance. Foster transparency by providing employees access to payroll information and maintaining clear communication about policies and processes. Embrace Automation for Efficiency In today’s fast-paced business environment, embracing automation in payroll and HR management can lead to noteworthy improvements in efficiency. Automating payroll processes minimizes manual errors, guaranteeing accurate calculations of wages and tax deductions. This accuracy can save you considerable costs in penalties and corrections. By implementing automated systems for payroll and HR tasks, your HR team can shift focus from administrative duties to strategic initiatives, enhancing overall employee satisfaction. Utilizing self-service portals empowers employees to access and manage their payroll information, reducing the administrative burden on HR staff. Integration of automated payroll systems with time-tracking tools guarantees a seamless data flow, drastically cutting down on manual data entry time. Additionally, automation keeps you informed about changing tax regulations and labor laws, greatly minimizing the risk of costly audits. By embracing these technologies, you’ll streamline payroll in human resource management and optimize your organization’s overall performance. Ensure Compliance With Labor Laws Comprehension and guaranteeing compliance with labor laws is essential for any business, especially since violations can result in significant financial penalties. Staying informed about federal, state, and local labor laws helps you avoid fines that can range from hundreds to thousands of dollars. The Fair Labor Standards Act (FLSA) mandates that you maintain accurate records of employee hours worked and wages earned, with these records needing to be kept for up to three years. Regular audits of payroll records can help identify discrepancies and guarantee adherence to tax regulations, with the IRS recommending that payroll tax records be retained for at least four years. Utilizing compliance tracking software can streamline the monitoring of changing labor laws and reduce the risk of human error in payroll processing. Furthermore, providing training and resources to managers on state-specific compliance regulations cultivates a culture of accountability and guarantees timely and accurate employee payments. Simplify Payroll Processes Maintaining compliance with labor laws is just one aspect of effective payroll management; simplifying payroll processes can greatly improve operational efficiency. You can start by automating payroll calculations and tax filings with dedicated payroll software. This reduces manual errors and guarantees timely, accurate payments. Implementing direct deposit for employees likewise streamlines payment processes, minimizing the risks associated with lost or stolen checks. Regularly reviewing and simplifying payroll policies helps eliminate complexity, making it easier for employees to understand their compensation and benefits. Consider utilizing employee self-service portals, which empower staff to manage their payroll information independently. This not only eases administrative burdens on HR but additionally improves employee satisfaction. Finally, conducting periodic audits of payroll records and processes identifies inefficiencies and helps guarantee compliance with tax and labor laws. By focusing on these strategies, you can create a more efficient and transparent payroll environment. Invest in Integrated Technology Investing in integrated technology can considerably improve your HR and payroll management processes, as it streamlines operations and reduces the risk of errors. By using integrated solutions, you eliminate the need for duplicate data entry, saving time and minimizing mistakes. Cloud-based platforms guarantee real-time updates for payroll compliance, automatically adjusting for tax rate changes and multi-state regulations, which helps you avoid costly penalties. Furthermore, automation features augment efficiency by auto-populating employee data and syncing time entries directly into payroll, surpassing the benefits of merely digitizing paperwork. Integrated technology likewise provides fundamental reporting capabilities, offering real-time insights into labor costs, turnover rates, and hiring pipelines, which are imperative for strategic decision-making. Finally, a multi-functional HR tech stack built for integration creates a seamless user experience for employees, positively impacting retention rates and overall satisfaction. Investing in this technology is significant for streamlined HR and payroll management. Foster Transparency With Employees Nurturing transparency with employees regarding payroll processes is essential for building trust and morale within your organization. When employees understand how payroll works, it minimizes misunderstandings that can harm morale. Here are some effective ways to encourage transparency: Provide access to payroll processing information, including detailed explanations of deductions and classifications. Include payroll policies and classifications in the employee handbook, so staff can reference them as needed. Maintain an FAQ section for common payroll-related inquiries, empowering employees to seek answers independently. Frequently Asked Questions What Are the 7 C’s of Human Resource Management? The 7 C’s of Human Resource Management are Competence, Cost-effectiveness, Communication, Compliance, Culture, Commitment, and Consistency. Competence focuses on hiring skilled employees to boost performance. Cost-effectiveness guarantees you manage HR expenses during maximizing productivity. Communication involves maintaining transparency and addressing concerns. Compliance safeguards against legal issues. Culture promotes a positive environment that aligns with values. Commitment encourages employee loyalty, and Consistency guarantees fair practices across the organization, enhancing overall effectiveness. How Do You Streamline HR Processes? To streamline HR processes, implement cloud-based systems that centralize employee records, reducing duplicate entries. Automate payroll by syncing time entries to minimize errors and save time. Encourage employee autonomy through self-service portals, allowing staff to manage HR tasks directly. Regularly gather feedback to identify inefficiencies in payroll, and utilize analytics tools to gain insights into labor costs and turnover. These steps can improve efficiency as well as ensuring accurate and timely HR management. What Are the 7 Core HR Processes? The seven core HR processes are recruitment and staffing, employee onboarding, performance management, payroll and benefits administration, employee relations, training and development, and compliance with labor laws. Each process plays a critical role in guaranteeing efficient workforce management. Recruitment identifies the right candidates, onboarding integrates them into the culture, whereas performance management aligns goals. Payroll guarantees timely compensation, employee relations promote a positive work environment, and training improves skills, all during compliance with regulations. How to Manage Payroll Efficiently? To manage payroll efficiently, implement automated payroll software to handle calculations and tax filings, which can greatly reduce errors. Establish direct deposit for timely payments and improve employee satisfaction. Regularly review payroll expenses against budget forecasts, as they can account for a considerable portion of overall costs. Maintain accurate records of employee hours and wages, and train your staff on compliance to guarantee timely, accurate payments as well as minimizing potential errors. Conclusion In summary, streamlining payroll and HR management is crucial for improving efficiency and accuracy. By embracing automation, ensuring compliance with labor laws, simplifying payroll processes, investing in integrated technology, and promoting transparency with employees, you can create a more effective system. Regularly auditing your practices will help identify areas for improvement. Implementing these strategies not just minimizes errors but likewise empowers employees, eventually leading to a smoother and more reliable payroll experience for everyone involved. Image via Google Gemini This article, "5 Essential Tips for Streamlining Payroll and HR Management" was first published on Small Business Trends View the full article

-

5 Essential Tips for Streamlining Payroll and HR Management

Streamlining payroll and HR management is vital for efficiency and accuracy. By embracing automation, you can reduce errors and guarantee timely payments. Compliance with labor laws is fundamental, as is simplifying payroll processes through direct deposit and self-service portals. Investing in integrated technology eliminates duplicate entries, whereas promoting transparency helps employees understand policies. Discover how these strategies can transform your payroll practices and make your HR operations more effective. Key Takeaways Embrace automation to reduce manual errors and shift HR focus to strategic initiatives, enhancing overall employee satisfaction. Ensure compliance with labor laws by keeping accurate records and conducting regular audits to avoid financial penalties. Simplify payroll processes by automating calculations and implementing direct deposit to ensure timely and secure payments. Invest in integrated technology to streamline data entry, improve accuracy, and provide real-time updates on payroll compliance. Foster transparency by providing employees access to payroll information and maintaining clear communication about policies and processes. Embrace Automation for Efficiency In today’s fast-paced business environment, embracing automation in payroll and HR management can lead to noteworthy improvements in efficiency. Automating payroll processes minimizes manual errors, guaranteeing accurate calculations of wages and tax deductions. This accuracy can save you considerable costs in penalties and corrections. By implementing automated systems for payroll and HR tasks, your HR team can shift focus from administrative duties to strategic initiatives, enhancing overall employee satisfaction. Utilizing self-service portals empowers employees to access and manage their payroll information, reducing the administrative burden on HR staff. Integration of automated payroll systems with time-tracking tools guarantees a seamless data flow, drastically cutting down on manual data entry time. Additionally, automation keeps you informed about changing tax regulations and labor laws, greatly minimizing the risk of costly audits. By embracing these technologies, you’ll streamline payroll in human resource management and optimize your organization’s overall performance. Ensure Compliance With Labor Laws Comprehension and guaranteeing compliance with labor laws is essential for any business, especially since violations can result in significant financial penalties. Staying informed about federal, state, and local labor laws helps you avoid fines that can range from hundreds to thousands of dollars. The Fair Labor Standards Act (FLSA) mandates that you maintain accurate records of employee hours worked and wages earned, with these records needing to be kept for up to three years. Regular audits of payroll records can help identify discrepancies and guarantee adherence to tax regulations, with the IRS recommending that payroll tax records be retained for at least four years. Utilizing compliance tracking software can streamline the monitoring of changing labor laws and reduce the risk of human error in payroll processing. Furthermore, providing training and resources to managers on state-specific compliance regulations cultivates a culture of accountability and guarantees timely and accurate employee payments. Simplify Payroll Processes Maintaining compliance with labor laws is just one aspect of effective payroll management; simplifying payroll processes can greatly improve operational efficiency. You can start by automating payroll calculations and tax filings with dedicated payroll software. This reduces manual errors and guarantees timely, accurate payments. Implementing direct deposit for employees likewise streamlines payment processes, minimizing the risks associated with lost or stolen checks. Regularly reviewing and simplifying payroll policies helps eliminate complexity, making it easier for employees to understand their compensation and benefits. Consider utilizing employee self-service portals, which empower staff to manage their payroll information independently. This not only eases administrative burdens on HR but additionally improves employee satisfaction. Finally, conducting periodic audits of payroll records and processes identifies inefficiencies and helps guarantee compliance with tax and labor laws. By focusing on these strategies, you can create a more efficient and transparent payroll environment. Invest in Integrated Technology Investing in integrated technology can considerably improve your HR and payroll management processes, as it streamlines operations and reduces the risk of errors. By using integrated solutions, you eliminate the need for duplicate data entry, saving time and minimizing mistakes. Cloud-based platforms guarantee real-time updates for payroll compliance, automatically adjusting for tax rate changes and multi-state regulations, which helps you avoid costly penalties. Furthermore, automation features augment efficiency by auto-populating employee data and syncing time entries directly into payroll, surpassing the benefits of merely digitizing paperwork. Integrated technology likewise provides fundamental reporting capabilities, offering real-time insights into labor costs, turnover rates, and hiring pipelines, which are imperative for strategic decision-making. Finally, a multi-functional HR tech stack built for integration creates a seamless user experience for employees, positively impacting retention rates and overall satisfaction. Investing in this technology is significant for streamlined HR and payroll management. Foster Transparency With Employees Nurturing transparency with employees regarding payroll processes is essential for building trust and morale within your organization. When employees understand how payroll works, it minimizes misunderstandings that can harm morale. Here are some effective ways to encourage transparency: Provide access to payroll processing information, including detailed explanations of deductions and classifications. Include payroll policies and classifications in the employee handbook, so staff can reference them as needed. Maintain an FAQ section for common payroll-related inquiries, empowering employees to seek answers independently. Frequently Asked Questions What Are the 7 C’s of Human Resource Management? The 7 C’s of Human Resource Management are Competence, Cost-effectiveness, Communication, Compliance, Culture, Commitment, and Consistency. Competence focuses on hiring skilled employees to boost performance. Cost-effectiveness guarantees you manage HR expenses during maximizing productivity. Communication involves maintaining transparency and addressing concerns. Compliance safeguards against legal issues. Culture promotes a positive environment that aligns with values. Commitment encourages employee loyalty, and Consistency guarantees fair practices across the organization, enhancing overall effectiveness. How Do You Streamline HR Processes? To streamline HR processes, implement cloud-based systems that centralize employee records, reducing duplicate entries. Automate payroll by syncing time entries to minimize errors and save time. Encourage employee autonomy through self-service portals, allowing staff to manage HR tasks directly. Regularly gather feedback to identify inefficiencies in payroll, and utilize analytics tools to gain insights into labor costs and turnover. These steps can improve efficiency as well as ensuring accurate and timely HR management. What Are the 7 Core HR Processes? The seven core HR processes are recruitment and staffing, employee onboarding, performance management, payroll and benefits administration, employee relations, training and development, and compliance with labor laws. Each process plays a critical role in guaranteeing efficient workforce management. Recruitment identifies the right candidates, onboarding integrates them into the culture, whereas performance management aligns goals. Payroll guarantees timely compensation, employee relations promote a positive work environment, and training improves skills, all during compliance with regulations. How to Manage Payroll Efficiently? To manage payroll efficiently, implement automated payroll software to handle calculations and tax filings, which can greatly reduce errors. Establish direct deposit for timely payments and improve employee satisfaction. Regularly review payroll expenses against budget forecasts, as they can account for a considerable portion of overall costs. Maintain accurate records of employee hours and wages, and train your staff on compliance to guarantee timely, accurate payments as well as minimizing potential errors. Conclusion In summary, streamlining payroll and HR management is crucial for improving efficiency and accuracy. By embracing automation, ensuring compliance with labor laws, simplifying payroll processes, investing in integrated technology, and promoting transparency with employees, you can create a more effective system. Regularly auditing your practices will help identify areas for improvement. Implementing these strategies not just minimizes errors but likewise empowers employees, eventually leading to a smoother and more reliable payroll experience for everyone involved. Image via Google Gemini This article, "5 Essential Tips for Streamlining Payroll and HR Management" was first published on Small Business Trends View the full article

-

Ring Just Ended Its Controversial Partnership With Flock Safety

Ring isn't having the week it probably thought it would have. The Amazon-owned company aired an ad on Super Bowl Sunday for "Search Party," its new feature that turns a neighborhood's collective Ring cameras into one network, with the goal of locating lost dogs. Viewers, however, saw this as a major privacy violation—it doesn't take much to imagine using this type of surveillance tech to locate people, not pets. The backlash wasn't just isolated to the ad, however. The controversy reignited criticisms of the company's partnership with Flock Safety, a security company that sells security cameras that track vehicles, notably for license plate recognition. But the partnership with Ring wasn't about tracking vehicles: Instead, Flock Safety's role was to make it easier for law enforcement agencies that use Flock Safety software to request Ring camera footage from users. Agencies could put in a request to an area where a crime supposedly took place, and Ring users would be notified about the request. They didn't have to agree to share footage, however. Law enforcement could already request footage from Ring users, through the platform's existing "Community Requests" feature. But this partnership would let agencies make these requests directly through Flock Safety's software. If a user submitted footage following a request, Ring said that data would be "securely packaged" by Flock Safety and share to the agency through FlockOS or Flock Nova. Ring cancels its partnership with Flock SafetyThat partnership is officially over. On Friday, Ring published a blog post announcing the end of its relationship with Flock Safety. The company said, after a review, the integration "would require significantly more time and resources than anticipated." As such, both parties have agree to cancel the partnership. Importantly, Ring says that since the integration never actually launched, no user footage was ever sent to Flock Safety—despite the company announcing the partnership four months ago. Social media influencers had spread the false claim that Flock Safety was seeding Ring footage directly to law enforcement agencies, such as ICE. While those claims are inaccurate, they were likely fueled by reporting from 404 Media that ICE has been able to access Flock Safety's data in its investigations. Had Ring's partnership with Flock Safety gone ahead, there would be legitimate cause to believe that agencies like ICE could tap into the footage Ring users had shared—even if those users were under the impression they were only sharing footage with local agencies to solve specific cases. While privacy advocates will likely celebrate this news, the cancelled partnership has no effect on Community Requests. Law enforcement agencies will still be able to request footage from Ring users, and those users will still have a say in whether or not they send that footage. Ring sees the feature as an objective good, allowing users to voluntarily share footage that could help law enforcement solve important cases. In its announcement on Friday, Ring cited the December 2025 Brown University shooting, in which seven users shared 168 video clips with law enforcement. According to Ring, one of those videos assisted police in identifying the suspect's car, which, in turn, solved the case. View the full article

-

PayPal Announces Strong Q4 and Full-Year Results for 2025

In a significant announcement, PayPal Holdings, Inc. revealed its fourth-quarter and full-year results for 2025, highlighting a robust growth trajectory that may catch the eye of small business owners. With over 25 years of experience in revolutionizing commerce, PayPal continues to empower entrepreneurs across various markets, enhancing their ability to thrive in an increasingly competitive global economy. The financial results, disclosed on February 3, 2026, reflect PayPal’s innovative approach to making transactions seamless, secure, and personalized. This iteration of their financial performance emphasizes their commitment to providing tools and solutions tailored for businesses of all sizes. Key Takeaways: Growth Metrics: PayPal reported substantial growth in transaction volumes, indicating increased consumer and merchant engagement. Marketplace Expansion: With operations in approximately 200 markets, PayPal is making it easier for small businesses to reach a global audience. Enhanced Services: Continued advancements in product offerings, including more options for digital wallets and streamlined payment processes. “PayPal empowers consumers and businesses to join and thrive in the global economy,” said a company spokesperson, underscoring their mission to facilitate transaction simplicity for all users. For small business owners, the implications of these metrics are crucial. As more people shift towards online shopping, having a reliable payment platform is indispensable. PayPal provides a familiar and often preferred payment method for consumers, which can increase sales conversion rates for several small businesses. In practical terms, small businesses can leverage PayPal’s features, such as one-click payments and comprehensive dispute resolution services, to enhance customer experience and safeguard transactions. Additionally, with the continued rise of e-commerce, integrating PayPal into online stores can provide a competitive edge, allowing for faster checkout processes that can significantly decrease cart abandonment rates. Moreover, the latest performance results may lead to new opportunities for promotional campaigns that can drive further traffic and engagement. PayPal often runs initiatives that can benefit small businesses, such as payment processing discounts or access to exclusive marketing resources. However, small business owners should also consider potential challenges associated with using PayPal. Transaction fees, although competitive, can add up, especially for businesses with lower profit margins. Additionally, reliance on a third-party payment processor means that any service disruptions could directly impact revenue flow. As with any financial platform, customer support and dispute resolution remain critical. Small businesses should familiarize themselves with these processes to address any issues efficiently. Furthermore, given the rapidly changing landscape of digital payments, staying updated on PayPal’s latest features and enhancements will be essential to fully leverage the platform’s capabilities. Overall, PayPal’s continued innovation and expansion present small business owners with unique opportunities to enhance their offerings and engage with a broader customer base. For more details on their quarterly results and the evolving landscape of digital payment solutions, you can view the full press release on PayPal’s investor relations website here. Image via Google Gemini This article, "PayPal Announces Strong Q4 and Full-Year Results for 2025" was first published on Small Business Trends View the full article

-

PayPal Announces Strong Q4 and Full-Year Results for 2025

In a significant announcement, PayPal Holdings, Inc. revealed its fourth-quarter and full-year results for 2025, highlighting a robust growth trajectory that may catch the eye of small business owners. With over 25 years of experience in revolutionizing commerce, PayPal continues to empower entrepreneurs across various markets, enhancing their ability to thrive in an increasingly competitive global economy. The financial results, disclosed on February 3, 2026, reflect PayPal’s innovative approach to making transactions seamless, secure, and personalized. This iteration of their financial performance emphasizes their commitment to providing tools and solutions tailored for businesses of all sizes. Key Takeaways: Growth Metrics: PayPal reported substantial growth in transaction volumes, indicating increased consumer and merchant engagement. Marketplace Expansion: With operations in approximately 200 markets, PayPal is making it easier for small businesses to reach a global audience. Enhanced Services: Continued advancements in product offerings, including more options for digital wallets and streamlined payment processes. “PayPal empowers consumers and businesses to join and thrive in the global economy,” said a company spokesperson, underscoring their mission to facilitate transaction simplicity for all users. For small business owners, the implications of these metrics are crucial. As more people shift towards online shopping, having a reliable payment platform is indispensable. PayPal provides a familiar and often preferred payment method for consumers, which can increase sales conversion rates for several small businesses. In practical terms, small businesses can leverage PayPal’s features, such as one-click payments and comprehensive dispute resolution services, to enhance customer experience and safeguard transactions. Additionally, with the continued rise of e-commerce, integrating PayPal into online stores can provide a competitive edge, allowing for faster checkout processes that can significantly decrease cart abandonment rates. Moreover, the latest performance results may lead to new opportunities for promotional campaigns that can drive further traffic and engagement. PayPal often runs initiatives that can benefit small businesses, such as payment processing discounts or access to exclusive marketing resources. However, small business owners should also consider potential challenges associated with using PayPal. Transaction fees, although competitive, can add up, especially for businesses with lower profit margins. Additionally, reliance on a third-party payment processor means that any service disruptions could directly impact revenue flow. As with any financial platform, customer support and dispute resolution remain critical. Small businesses should familiarize themselves with these processes to address any issues efficiently. Furthermore, given the rapidly changing landscape of digital payments, staying updated on PayPal’s latest features and enhancements will be essential to fully leverage the platform’s capabilities. Overall, PayPal’s continued innovation and expansion present small business owners with unique opportunities to enhance their offerings and engage with a broader customer base. For more details on their quarterly results and the evolving landscape of digital payment solutions, you can view the full press release on PayPal’s investor relations website here. Image via Google Gemini This article, "PayPal Announces Strong Q4 and Full-Year Results for 2025" was first published on Small Business Trends View the full article

-

CPI relief sends 5-year yield toward breakout

The 5-year yield swung sharply after conflicting BLS jobs and CPI data, with softer inflation boosting rate-cut hopes, according to the CEO of IF Securities. View the full article

-

This Premium Sony Soundbar Is More Than 50% Off During an Early Presidents Day Sale