All Activity

- Past hour

-

Apple's Next macOS Update Could Extend the Lifespan of Your MacBook's Battery

With iOS 18, Apple introduced a feature that allowed you to set a charge limit on your iPhone. The goal was to extend the lifespan of the battery, by limiting how often you fully charge it up. Batteries age with each full charging cycle, so by preventing your battery from charging to 100% every time you keep it plugged in, you can slow down that aging process, which means your device will last longer in between charges. Now, that same feature is coming to your Mac. Apple is currently testing the feature as part of macOS 26.4, which means you'll soon be able to ask macOS to stop charging your laptop once the battery level hits a specific charge level. This feature is great for anyone that keeps their MacBook plugged in all the time while working: It'll allow you to ask your MacBook to stop charging when the battery is at 80%, or at any charge level up to 100%. Battery optimization is nothing new for macOS Credit: Pranay Parab To be clear, your MacBook ships with a battery optimization feature already, which is enabled by default. This feature automatically slows down your MacBook's charging speed once the charge level reaches 80%. Based on your past usage habits, macOS waits to continue charging your MacBook until it thinks you'll need to use the laptop again. So, if you plug in your MacBook at night, and you typically take it off the charger at 8 a.m., it might keep your MacBook at 80% until 7 a.m., then charge the extra 20% over the following hour. You can check if it's enabled by clicking the Apple logo in the top-left corner of your Mac's screen, and going to System Settings > Battery. Click the i button next to Battery Health and you'll see that Optimized Battery Charging is enabled. But this is all automated, based on how you use your MacBook. What makes this new charging feature different is that you set the charge limit manually. That way, if you work with your MacBook plugged in all day, it doesn't need to charge to 100% whenever it thinks it should. Instead, you can keep it at any charge limit between 80% and 100%. How to enable charge limit on your MacBookThis new feature is available with macOS 26.4, which is currently available in the Developer Beta channel for Mac updates. I strongly recommend against installing this on your primary MacBook, as issues with the beta could mean losing data or bricking your laptop. Unless Apple decides to pull the feature, it should ship to everyone with the general release of macOS 26.4. If you have a spare MacBook where you've installed macOS 26.4 beta, you can go to System Settings > Battery, where you'll see the "Charge Limit" feature listed under Battery Health. Here, you can manually limit the maximum charging level between 80% and 100%. Third-party battery management apps are betterWhile Apple's methods to reduce battery aging are good enough for most people, you can do a lot more with third-party battery management apps. Those apps will allow you to do more than just set a charge limit. For instance, you can start charging the Mac when the battery hits 50% and stop charging when it's at 80%, or stop charging if the battery is too hot. View the full article

-

Rocket Pro executive Mike Fawaz leaves the megalender

Company veteran Austin Niemiec is running the wholesale arm after the departures of Fawaz, a prominent broker advocate, and general manager Dan Sogorka. View the full article

-

Merging in a Smaller Firm: 33 Questions to Ask

BONUS: a telephone screening form. By Marc Rosenberg CPA Firm Mergers: Your Complete Guide Go PRO for members-only access to more Marc Rosenberg. View the full article

-

Merging in a Smaller Firm: 33 Questions to Ask

BONUS: a telephone screening form. By Marc Rosenberg CPA Firm Mergers: Your Complete Guide Go PRO for members-only access to more Marc Rosenberg. View the full article

-

10 Shows Like 'Ponies' You Should Watch Next

We may earn a commission from links on this page. Impeccable period vibes are a highlight of Ponies, the Peacock spy show starring Emilia Clarke and Haley Lu Richardson. They play a couple of housewives living in Moscow with their CIA agent husbands, at least until their spouses are killed under mysterious circumstances. In order to get to the bottom of things, the two convince the Moscow station chief that they could be useful as agents themselves. He figures, hey—who'd ever suspect a couple of secretaries? You can stream Ponies on Peacock, and then stream these stories of other unexpected spies. The Americans (2013 – 2018) Set during the Cold War 1980s, and created by former CIA officer Joe Weisberg, Americans follows Soviet KGB intelligence agents Elizabeth (Keri Russell) and Philip Jennings (Matthew Rhys), living lives as an American couple in the DC metro area—and raising their American-born children. The critically acclaimed (and popular) show makes much of its period setting and a central conflict that places two spies in the heart of suburban America, even as they're tasked with undermining the Reagan-era government under which their children will grow up. Stream The Americans on Disney+ and Hulu. The Americans (2013 – 2018) at Disney+ Learn More Learn More at Disney+ Kleo (2022 – ) With this German import, we have a Cold War-era spy thriller punctuated by moments of very dark comedy. Jella Haase stars as Kleo Straub, a ruthless East German Stasi assassin who was framed for treason a couple of years before the series kicks off in 1989, and who's now free to pursue brutal revenge. Sven Petzold (Dimitrij Schaad), meanwhile, is the hapless police officer who's linked Kleo to a murder he'd been investigating, and pursues her before discovering that he's in way, way over his head. Stream Kleo on Netflix. Kleo (2022 – ) at Netflix Learn More Learn More at Netflix Black Doves (2024 – ) This genre-bender has been something of a hit for Netflix—enough to have earned a second-season renewal. Keira Knightley stars as Helen Webb, wife of the Secretary of State for Defence of the U.K., and a secret spy in the employ of the mercenary spy organization of the title. She learns from her handler (Sarah Lancashire) that her lover has been killed, thus potentially blowing her cover, but luckily she has a hitman bestie (Ben Whislaw) to help her out. It's all deliberately pulpy, with a tongue-in-cheek self-awareness that lightens the tone. Stream Black Doves on Netflix. Black Doves (2024 – ) at Netflix Learn More Learn More at Netflix Homeland (2011 – 2020) The series begins with CIA case officer Carrie Mathison (Claire Danes) coming to suspect that that decorated Marine Corps scout sniper Nicholas Brody (Damian Lewis), recently rescued from an al-Qaeda compound, has been turned and is planning a terrorist attack on the United States. As she's been diagnosed with bipolar disorder, her superiors don't give Mathison's suspicions much credence, kicking off a cat-and-mouse/is-he-or-isn't he? game between the two. Both leads won Emmys for their performances, and the series took the Outstanding Drama prize in its first year. Stream Homeland on Hulu and Netflix. Homeland (2011 – 2020) at Hulu Learn More Learn More at Hulu The Sympathizer (2024)A stellar miniseries with a reminder that boys can be spies, too. Based (kinda) on a true story, the show stars Hoa Xuande as the Captain (we know him only by that title), a member of the South Vietnamese army during the run-up to the Fall of Saigon in 1975. Except that he has a pretty big secret: He's a spy for the communist north, and, when he's evacuated to the United States, it's as a double agent. His new life in sunny Southern California gets very complicated as he struggles with his old loyalties and his new life. With touches of dark comedy, great performances and some absolutely brilliant direction from showrunner Park Chan-wook (Oldboy, No Other Choice), this is an impressively unconventional period spy story. Stream The Sympathizer on HBO Max. The Sympathizer (2024) at HBO Max Learn More Learn More at HBO Max The Recruit (2022 – 2025) A bit of fun in the "unlikely spy" genre, this one stars Noah Centineo as Owen Hendricks, a nobody-in-particular young lawyer at the CIA who comes across an extortion threat from a former CIA asset in some otherwise boring paperwork. The discovery triggers a series of fast-paced, globetrotting adventures for which Hendricks is generally unprepared—always knowing more than he should, but not nearly enough to keep him out of trouble. It's an adventure show more than a thriller, mostly, and a fair bit of fun for it. Stream The Recruit on Netflix. The Recruit (2022 – 2025) at Netflix Learn More Learn More at Netflix Killing Eve (2018 – 2022) Sandra Oh and Jodie Comer star as the two halves that form one of television's great cat-and-mouse narratives, with Oh as Eve Polastri, a bored MI5 analyst who becomes obsessed with hunting down the brutal and notorious assassin known only as Villanelle. It starts as a professional compulsion before it becomes personal: Eve and Villanelle begin toying with each other, and it soon becomes clear that the fascination goes both ways—like Ponies, it's the rare spy drama with two women out in front. Stream Killing Eve on Prime Video, Paramount+, Britbox, Tubi, and Netflix. Killing Eve (2018 – 2022) at Prime Video Learn More Learn More at Prime Video Mr. & Mrs. Smith (2024 – ) One-upping the Brad Pitt/Angelina Jolie movie on which it's based, Mr. & Mrs. Smith stars Donald Glover and Maya Erskine as a couple of spies tasked to pose as a married couple while coordinating (and sometimes competing against one another) on missions. Smartly, each episode takes on a standalone mission in a different location, while complicating the relationship between the two and gradually upping the stakes until the season finale, which sees them pitted against each other. The show has been renewed for season two, but it's been delayed, and it's unclear if Glover and Erskine will be returning, or if we'll be getting a new Mr. & Mrs. Stream Mr. & Mrs. Smith on Prime Video. Mr. & Mrs. Smith (2024 – ) at Prime Video Learn More Learn More at Prime Video The Day of the Jackal (2024 – ) Cinematic in scope, this new adaptation of the Frederick Forsyth novel is buoyed by brilliant casting: Eddie Redmayne plays the Jackal, a steely international assassin pursued by MI6 operative Bianca Pullman, played by Lashana Lynch (putting her experience as the new 007 in No Time to Die to good use). I'm not sure there's anything here we haven't seen in countless other spy thrillers (including, of course, the 1973 and 1997 film adaptations), but the performances and production values are top-notch, with each episode playing out like a tense mini-movie. Stream The Day of the Jackal on Peacock. The Day of the Jackal (2024 – ) at Peacock Learn More Learn More at Peacock Down Cemetery Road (2025 – ) Splitting the difference between spy and detective genres, this show (from the works of Mick Herron, writer of the more specifically spy-centric Slow Horses novels), this one starts out as a murder mystery and builds to a rather massive government conspiracy. Emma Thompson stars as hard-living, hard-drinking private investigator Zoë Boehm, hired by Ruth Wilson's Sarah Trafford, a married art restorer whom nobody takes seriously (including and especially her husband)—even when she becomes invested in the fate of a young girl whose family is killed in a gas explosion (allegedly) down the street. The girl, whose parents were killed, disappears into the system and no one really seems to care until Sarah hires Zoë and her husband to look into it. Turns out both women are in way over their heads, as the missing girl points to a much broader conspiracy. Thompson and Wilson are a brilliantly mismatched pair, and their performances are more than worth the price of admission. Stream Down Cemetery Road on Apple TV+. Down Cemetery Road (2025 – ) at Apple TV+ Learn More Learn More at Apple TV+ View the full article

-

Why Accounting Firm Culture Matters

Our exclusive expert council offers insight. By Martin Bissett Passport to Partnership Go PRO for members-only access to more Martin Bissett. View the full article

-

Why Accounting Firm Culture Matters

Our exclusive expert council offers insight. By Martin Bissett Passport to Partnership Go PRO for members-only access to more Martin Bissett. View the full article

- Today

-

Meta patents AI that lets dead people post from the great beyond

Nothing is certain, they say, but death and taxes. But a new idea from Meta could add social media to that list. The tech giant was granted a patent in December that would allow it to simulate a user via artificial intelligence when he or she is absent from the social network for extended periods, including, “for example, when the user takes a long break or if the user is deceased.” The patent covers a bot that could simulate your activity across Meta’s products, including Facebook, Instagram, and Threads—making posts, leaving comments, and interacting with other users. It could even, potentially, communicate directly with people via chats or video calls, the patent reads. Andrew Bosworth, Meta’s chief technology officer, is listed as the primary inventor, and the patent was first filed in November 2023. A Meta spokesperson tells Fast Company the company has “no plans to move forward with this example.” Withdrawing from a social media platform can affect “the user experience of several users,” the patent reads. “The impact on the users is much more severe and permanent if that user is deceased and can never return to the social networking platform.” Creepy? Sure seems it. Unprecedented? Not as much as you might think. In 2021, Microsoft obtained a patent for a chatbot that would let you “talk” with dead people, both loved ones and celebrities. Like Meta, Microsoft said it had no plans to use the technology—and Tim O’Brien, Microsoft’s general manager of AI programs at the time, said in a social media post he agreed it was “disturbing.” Meanwhile, startups like Eternos and HereAfter AI let people create a “digital twin” that can engage with loved ones after they have passed away. Meta first publicly discussed the concept of a chatbot for the dead about two-and-a-half years ago, when founder Mark Zuckerberg, in an interview with podcaster Lex Fridman (in the Metaverse, of course), said, “If someone has lost a loved one and is grieving, there may be ways in which being able to interact or relive certain memories could be helpful.” Zuckerberg did note, however, that the technology could become “unhealthy”. Meta’s take on a post-mortem chatbot would analyze “user-specific” data, including posts, voice messages, chats, comments, and likes, to build a sense of who the person was. It would amalgamate that data into a digital persona designed to mimic the user’s activity. The bot would identify that any responses were not actually generated by the user, the patent says, but rather were the result of a simulation. Now, there are some hurdles Meta doesn’t mention in the patent. What people say in a direct message to a close friend or loved one isn’t necessarily meant for wider consumption. Picture, for instance, one spouse venting to the other about how frustrated they were with their child after some “terrible twos” or teenage incident—only for that child to later be told by the bot how much they annoyed their now-dead loved one. After all, AI has yet to grasp social niceties, or when silence or a white lie is better than the truth. Presently, when someone dies, Meta offers several options for survivors. The page can be permanently removed (assuming you have the necessary paperwork, such as a death certificate), or it can be turned into a memorial, where people can read past posts and leave messages of their own. As unpleasant as the topic is, Meta has good reason to think about death. One study predicts that by 2050, the number of dead users on Facebook will outnumber the living. By 2100, there could be more than 4.9 billion dead profiles on the platform. View the full article

-

Homebuilder sentiment dips to 5-month low on affordability

An index of market conditions from the National Association of Home Builders and Wells Fargo, in which below 50 means more builders see conditions as poor than good, edged down in February to 36, the lowest level since September. View the full article

-

Treasury gains face critical 5-year inflection

Treasuries rallied and broke key levels, but stubborn 5-year resistance still caps momentum and rate-cut expectations remain unchanged, the CEO of IF Securities writes. View the full article

-

7 Top Private Lenders for Business Loans to Consider

When you’re exploring options for business loans, knowing the right private lenders can make all the difference. Each lender offers unique benefits customized to various needs, such as covering ongoing expenses, supporting startups, or financing equipment. For instance, Bluevine provides quick lines of credit, whereas Fora Financial caters to those with bad credit. Comprehending these differences can help you choose the best fit for your situation, but what’s crucial to take into account before making a decision? Key Takeaways Bluevine offers lines of credit up to $250,000 with quick funding and flexible repayment terms, ideal for established businesses. Fora Financial provides loans from $5,000 to $1.5 million, requiring a minimum credit score of 570 and flexible repayment options. Fundbox specializes in startup funding up to $250,000, with a streamlined application process and no prepayment penalties. Taycor Financial focuses on equipment financing, offering loans up to $500,000 with fast approvals and flexible lease terms. OnDeck provides loans up to $250,000 with same-day funding for smaller amounts, requiring a minimum credit score of 625. Best for Covering Ongoing Expenses: Bluevine When you’re looking for a reliable way to cover ongoing business expenses, Bluevine stands out as a top option. As one of the leading private business lenders, it offers lines of credit up to $250,000, providing you with the flexibility needed to manage cash flow effectively. With quick funding times, you can access cash within one to three business days after approval, ensuring you won’t face unnecessary delays. Bluevine’s interest rates start at 4.66%, and there are no monthly fees or overdraft charges, making it a cost-effective choice among private lenders for business loans. To qualify, your business must be an LLC or corporation with at least 12 months of operation and a minimum monthly revenue of $10,000. The repayment terms are structured over 12 or 24 weeks, allowing you to maintain control over your finances as you address ongoing expenses. Best for Bad Credit Borrowers: Fora Financial If you’re a business owner with bad credit, Fora Financial could be a solid option for you. They offer loan amounts between $5,000 and $1.5 million, with a minimum credit score requirement of just 570, making it easier for you to qualify. Plus, their application process is straightforward and designed for quick funding, ensuring you have the flexibility you need to manage repayment. Loan Amounts Offered Fora Financial stands out as a valuable option for businesses seeking loans, particularly those with less-than-perfect credit. They offer loan amounts ranging from $5,000 to $1.5 million, making it suitable for various business sizes. This flexibility allows you to secure funds for different needs, whether it’s working capital or equipment financing. Here are some key points about loan amounts offered by Fora Financial: Loans range from $5,000 to $1.5 million. Minimum credit score requirement is just 570. Funds can be used for diverse business purposes. Interest rates start at 13.00%, reflecting the associated risks. This range of loan amounts can help your business grow, even though your credit isn’t stellar. Eligibility Requirements Securing a loan from Fora Financial is particularly accessible for those with bad credit, thanks to its lenient eligibility requirements. To qualify, you’ll need a minimum credit score of just 570, making it a viable option for many borrowers. Fora Financial offers loan amounts ranging from $5,000 to $1.5 million, allowing you to choose based on your business needs. Moreover, you must demonstrate a minimum annual revenue of $240,000 to be eligible for funding. Although interest rates start at 13%, which may be higher than traditional lenders, this structure accommodates individuals with lower credit scores. The streamlined application process guarantees you can secure funding quickly, making Fora Financial suitable for urgent financial situations. Repayment Terms Flexibility When considering financing options, you’ll find that repayment terms play a crucial role in managing your business’s cash flow. Fora Financial stands out for its flexible repayment options, making it an excellent choice for bad credit borrowers. They offer loans ranging from $5,000 to $1.5 million, with interest rates starting at 13.00%. Key features include: Minimum credit score requirement of 570 High annual revenue requirement of $240,000 Quick funding for immediate capital access Customized repayment terms to fit your business needs These factors make Fora Financial particularly accessible for businesses that might struggle with traditional loan qualifications, allowing you to focus on growth without financial strain. Best for Startup Companies: Fundbox If you’re launching a startup and need quick access to funds, Fundbox might be your best option. With a streamlined funding process, you can often get approved in minutes and see cash in your account within a few days. Plus, their flexible qualification criteria make it easier for new businesses to secure up to $250,000, catering to various financial needs. Fast Funding Process For startup companies seeking quick financial support, Fundbox stands out as a premier choice due to its fast funding process. With funding amounts up to $250,000, you can expect a streamlined application that focuses on your cash flow. This process allows you to access funds typically within 1 to 3 business days after approval. Here are some key points to reflect on: There’s no need for origination fees, making it cost-effective. You won’t face prepayment penalties, giving you flexibility. A minimum personal credit score of 600 is required, which is attainable for many. Your business must have been operational for at least six months with an annual revenue of at least $100,000. This makes Fundbox an accessible option for startups. Flexible Qualification Criteria Many startups find themselves facing challenges when seeking financial support, but Fundbox offers a revitalizing approach with its flexible qualification criteria. Unlike traditional lenders, Fundbox focuses on your business cash flow instead of credit scores, requiring a minimum personal credit score of just 600. You can access up to $250,000, with funding typically available within one business day of approval. To qualify, your business must be operational for at least six months and have an annual revenue of $100,000 or more. Fundbox also features no prepayment penalties or origination fees, making it a cost-effective choice for new businesses. Moreover, its Insights feature provides cash flow predictions, helping you manage finances more effectively. Best for Financing Equipment: Taycor Financial When you need to finance equipment for your business, Taycor Financial stands out as a strong option owing to its specialized focus on equipment financing. They offer loans up to $500,000 with flexible terms ranging from 24 to 60 months. This adaptability allows you to select a payment schedule that best suits your cash flow needs. Here are some key features of Taycor Financial: Fast Approval: Many loans are approved within 24 hours, ensuring quick access to funds. Flexible Payments: Choose between monthly, quarterly, or annual payment options. Accessible Financing: A minimum credit score of 600 makes it easier for businesses with varied credit histories to qualify. Leasing Options: Taycor provides various leasing options, including fair market value leases and $1 buyout leases, catering to different financial strategies. With these advantages, Taycor Financial is an excellent choice for your equipment financing needs. Best for Fast Funding: OnDeck If you’re looking for quick access to cash, OnDeck might be the ideal solution for your business financing needs. Known for its rapid funding capabilities, OnDeck offers same-day funding for loans under $100,000, allowing you to access cash when it matters most. They provide loans up to $250,000 with terms typically lasting up to 12 months, which is perfect for short-term financing. To qualify, you need a minimum credit score of 625, annual revenue of at least $100,000, and at least 12 months in business. Although interest rates start at 32.72%, the speed of funding can outweigh traditional options. Plus, OnDeck offers prepayment and loyalty rewards, incentivizing early repayment and ongoing relationships. Feature Details Loan Amounts Up to $250,000 Funding Speed Same-day for loans < $100K Minimum Credit Score 625 Interest Rates Starting at 32.72% Best for Financing Large Purchases: Ibusiness Funding For businesses looking to finance large purchases, iBusiness Funding stands out as a strong option, offering online term loans up to $500,000 with repayment terms that can extend to 60 months. This flexibility makes it ideal for significant investments such as equipment or inventory. Here are some key features of iBusiness Funding: Minimum credit score: You’ll need a credit score of at least 640 to qualify. Annual revenue requirement: Your business must generate a minimum annual revenue of $50,000. Quick funding: Once approved, you could receive your funds the same day. User-friendly application: The streamlined process requires minimal documentation, making it accessible for busy business owners. Pros and Cons of Private Business Loans Private business loans can be an appealing option for many entrepreneurs, especially those who may not qualify for traditional bank financing. One major advantage is the easier qualification criteria, making these loans accessible for startups and businesses with poor credit. Furthermore, you can often expect faster funding, with approvals and disbursements occurring within 1 to 3 business days, which is ideal for urgent needs. However, there are downsides. Interest rates on private loans tend to be higher, reflecting the increased risk and flexibility they offer. Although private lenders often provide more flexible terms, it’s important to be cautious of hidden fees and less transparent repayment terms, which can complicate your financial planning. Frequently Asked Questions Which Private Bank Is Best for a Business Loan? Choosing the best private JPMorgan Chase for a business loan depends on your specific needs. Consider lenders that offer flexible qualification criteria, especially if you have bad credit. Look for competitive interest rates, ranging from 7% to over 40%, and quick funding options that allow for decisions within days. Make certain the lender has a strong reputation and transparent pricing to avoid hidden fees, which can complicate your borrowing experience. Evaluate all these factors before making a decision. What Are the Best Business Loan Lenders? When exploring the best business loan lenders, consider options like Bluevine for flexible lines of credit, Fundbox for cash flow financing, or OnDeck for quick funding. If you have bad credit, Fora Financial offers accessible loans, whereas Lendio connects you to various lenders for customized options. Each lender has different requirements, such as credit scores and revenue levels, so assess your financial situation to find the best fit for your needs. What Are the Four Types of Private Lenders? The four types of private lenders include individual investors, lending firms, organized investor groups, and peer-to-peer platforms. Individual investors often provide personal funds for business ventures, whereas lending firms focus on structured loans. Organized investor groups pool resources to back various businesses, and peer-to-peer platforms connect borrowers with multiple lenders for lower costs. Each type offers unique benefits, such as flexible terms, quicker approval processes, and options customized to specific business needs. How Hard Is It to Get a $400,000 Business Loan? Securing a $400,000 business loan can be quite challenging. You’ll typically need a solid credit score, often between 620 and 640, along with annual revenues of at least $100,000 to $250,000. Most lenders prefer businesses to be operational for 1 to 2 years, making it tough for startups. Moreover, you may need to provide collateral, which can greatly influence your chances of approval and the interest rates you receive. Conclusion In summary, choosing the right private lender for your business loan can greatly impact your financial strategy. Each of the lenders mentioned offers unique benefits customized to various needs, whether you’re covering ongoing expenses, seeking startup funding, or financing equipment. By evaluating your specific requirements and considering factors like loan amounts, repayment flexibility, and approval speed, you can make an informed decision. This strategic approach can help you secure the funding necessary for your business’s growth and success. Image via Google Gemini and ArtSmart This article, "7 Top Private Lenders for Business Loans to Consider" was first published on Small Business Trends View the full article

-

How DuckDuckGo's New Encrypted Voice AI Chat Compares With ChatGPT and Gemini

While OpenAI is pushing ads on its free users, DuckDuckGo's Duck.ai portal is going a different way. Duck.ai is a privacy-first AI chatbot that doesn't use your data for training, but still gives you AI answers using popular models, including those from OpenAI. The data privacy feature goes beyond as well. DuckDuckGo removes all private metadata (like your location and IP address) before prompting the AI model, and it doesn't share anything about you or your device. Your questions, as well as DuckDuckGo's answers, are never used for AI training. Since its launch in 2024, the portal has only offered a chatbot interface, but now, DuckDuckGo has added a voice mode as well. With voice chat, instead of reading through long and meandering answers, the AI replies in short, to-the-point snippets that are relevant to your query. Duck.ai's take on the feature is competing with those from companies like OpenAI and Google, and it's free—though expanded limits are offered for DuckDuckGo subscribers. How Duck.ai's voice chat works Credit: Khamosh Pathak Duck.ai's voice chat is opt-in, not mandatory. In fact, you can even use it without a DuckDuckGo account. To try it, head to the Duck.ai portal, then from the sidebar, choose the voice chat option and enable it for your account. Now, when you click the "New Voice Chat" button in the sidebar, Duck.ai's bot will appear. You can start speaking, and the bot will reply to you. Just like ChatGPT or Gemini, this is a continuous voice chat, so you don't need to perform any action to ask follow-up questions. You can also interrupt the AI answer to add clarifications or to ask more questions. While the text prompts let you choose the models (including OpenAI's ChatGPT 5-mini), it's not clear exactly what powers voice chat. DuckDuckGo says that it uses an OpenAI model, but doesn't specify which one it is. When it comes to AI voice chats, ChatGPT is still the kingOf course, the real question is how Duck.ai's voice chat holds up against Gemini and ChatGPT. For general knowledge questions, Duck.ai holds its own, but it falters when it comes to the latest news. I asked all three services the same questions, and while some responses were similar, ChatGPT's voice mode offers the best overall user experience by far. I tested the voice chat features using three different kinds of questions. First, I asked about the upcoming Samsung S26 series; second, we talked about the Roman Empire; and lastly, I asked for some advice on how to get started with coding. When it comes to asking questions about news, like Samsung's S26 release, DuckDuckGo's limitations are immediately evident. It sometimes flat out refuses to answer, saying its knowledge cutoff is 2023. Other times, it gives vague responses about the upcoming event, suggesting I check news sites for the latest information. When pressed for details, like when the event is or the rumors surrounding it, it goes back to its cut-off period excuse. Credit: Khamosh Pathak ChatGPT's app, however, gave me a detailed response with all the latest rumors, as well as articles to read for additional information—basically, what you'd expect from an AI assistant. Gemini Live provided shorter responses than ChatGPT, though they were accurate. I was able to get Gemini to give me more details in the regular text mode, which reads aloud results if you ask questions using the Mic button, but this defeats the back-and-forth purpose of a voice mode. Samsung Event rumors according to ChatGPT Voice (Left) and Gemini Live (Right). Credit: Khamosh Pathak Duck.ai didn't fare much better when I asked about the Roman Empire. I asked for a brief overview of the subject, before cutting it off to just ask who the last emperor was. It answered correctly (Romulus Augustulus), and its overview was fine, but lacked details about the transitionary period and exact dates. Duck.ai's reponse to Roman History question. Credit: Khamosh Pathak Again, ChatGPT gave me a much more detailed answer (as demonstrated by the screenshot below). Gemini Live's answer, however, was devoid of any real dates, or meaning. Mic mode offered more details, but Google's voice mode was quite limited. History of Roman Empire in Gemini (Left) vs ChatGPT Voice (Right) Credit: Khamosh Pathak Duck.ai performed better when I asked it about learning how to code. It followed a very similar script to ChatGPT and Gemini, suggesting I learn Python, even offering the same sources for learning (e.g. freeCodeCamp and Harvard CS50 courses). Duck.ai Response to coding question. Credit: Khamosh Pathak Gemini Live was the outlier here, though, asking follow-up questions about what I'd like to build or practice. It then changed its answers based on my project ideas (switching from Python to JavaScript as the first language I should learn to build web projects). ChatGPT provided an overview, again focusing on Python, and elaborated on the language's barrier to entry when I asked for more information. Intro to programming languages in Gemini (Left and Middle) vs ChatGPT Voice (Right). Credit: Khamosh Pathak Duck.ai's voice chat feature is a mixed bag. It can be fast, doesn't use any personal information, and lets you interrupt it. But its limited knowledge base and its inability to give detailed answers are what make it tough to recommend. For the smoothest voice mode experience, ChatGPT is still the king. While DuckDuckGo has the advantage for privacy, you could always use ChatGPT while logged out or in temporary mode to limit the data you share with OpenAI. View the full article

-

Magnificent 7 stocks are down for 2 reasons in 2026. The second reason is outside their control

The new year has so far not been kind to the share price of Big Tech stocks, particularly the so-called Magnificent 7. These seven companies—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—are America’s tech crown jewels. Combined, they have their hands in the hottest areas of tech, including artificial intelligence, mobile computing, chipmaking, and transportation. Yet all of these tech companies have seen their share prices decline since the beginning of the year. Here are some possible reasons why. The Magnificent 7 is seeing red in 2026 As of this writing, there isn’t a single Magnificent 7 stock in the green for 2026. Their year-to-date returns are as follows: Alphabet Inc. (Nasdaq: GOOG): down 3.3% Amazon.com, Inc. (Nasdaq: AMZN): down 13.5% Apple Inc. (Nasdaq: AAPL): down 4.8% Meta Platforms, Inc. (Nasdaq: META) down 2.7% Microsoft Corporation (Nasdaq: MSFT): down 17.4 % Nvidia Corporation (Nasdaq: NVDA): down 1.6% Tesla, Inc. (Nasdaq: TSLA): down 8.2% While all seven companies have their own strengths (Amazon, e-commerce; Nvidia, AI chips; Apple, smartphones, etc.), they share one thread: they are traded on the already tech-heavy Nasdaq. And given the massive market caps of these companies, all seven have an outsized impact on the Nasdaq as a whole. Keeping that in mind, it’s little surprise that the NASDAQ Composite itself is down over 3% year to date as well. The question is why? Here are two of the most likely reasons. AI capex spend is immense In the business world, capex refers to a company’s capital expenditure—how much money a business spends on building out assets in order to grow its business, and thus its finances. Capex is why the phrase “you have to spend money to make money” exists. But while it has been normal for decades for tech giants to spend billions in capex per year, lately capital expenditures are exploding—reaching highs never seen before. The Motley Fool estimated that in 2025, the Magnificent 7 spent about $400 billion on AI-related capex. In 2026, that number is set to grow by around 70% to reach $680 billion. That is a staggering sum of money on a technology that no tech company has found a way to make a profit from yet. What many investors have begun to increasingly worry about is that if the ever-present threat of an AI bubble does materialize, the Magnificent 7 companies, particularly those that have had massive capital expenditures on the technology, like Amazon, Alphabet, and Microsoft, might not ever see a return on that investment. Economic and global uncertainty abounds Outside the immediate fears of overzealous AI capex and an AI bubble, the Magnificent 7 are also vulnerable to broader economic and geopolitical uncertainties. President The President’s penchant for announcing tariffs out of the blue has harmed relations with America’s closest economic allies and trading partners—and caused massive uncertainty for businesses. These tariffs have also raised the costs of goods for American consumers. When prices rise, and incomes don’t, people tend to cut back on spending, which slows the economy. And when the economy slows—or people worry it will—investors tend to sell off riskier investments, or investments where they’ve already made a good return, to protect their profits. While shares of Magnificent 7 companies have delivered massive returns over the last decade, they are also highly volatile. And this volatility, when combined with broader market uncertainty, generally causes investor apprehension, leading to further selloffs. Of course, there’s no guarantee where Mag 7 stocks go from here. If AI bulls are right and we are on the cusp of unprecedented AI prosperity, it’s reasonable to assume that the fall in Mag 7 stocks at the start of 2026 has so far just been a temporary anomaly, and AI-related stocks like those in the Mag 7 will be seeing plenty of green in the years ahead. However, if the AI bubble does indeed burst and takes the broader economy down with it, 2026 year-to-date declines in Mag 7 stock prices so far could seem relatively minor compared to what is yet to come. View the full article

-

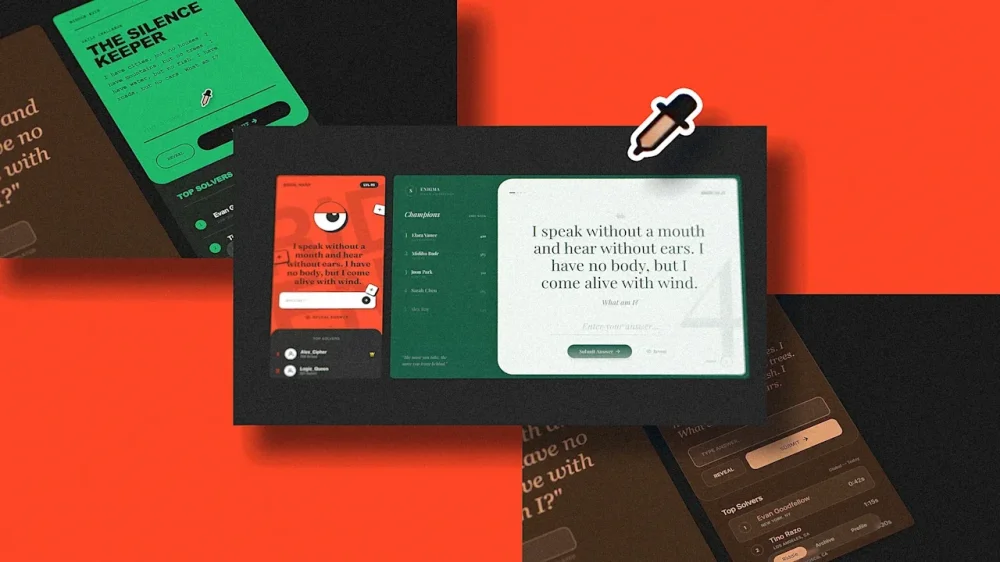

This new AI ‘eyedropper’ tool brings one of the most powerful UX tricks into the AI age

Variant, a generative design tool that promises endless UI exploration, recently introduced a feature most creative people and designers have used for decades: the eyedropper. In Variant, the tool picks vibes: It lets you click on one AI-generated interface and inject its aesthetic DNA—typography, spatial relationships, and color palettes—into another. After so much hype around “vibecoding” and its text-based imprecision, seeing a familiar, direct manipulation tool applied to generative AI feels great. The new AI modality takes a nice step to close the gap between the impenetrable ways of large language model black boxes and the tools designers actually use with their eyes and hands. Adopting a universally understood tool to control AI in any way other than words is exactly the kind of innovation the sector needs now. It’s just too bad that Variant itself is the vessel for it. The tool’s underlying AI engine suffers from a distinct lack of differentiation. Everything it makes looks flat and same-y, so the new style absorb-and-drop tool is not really that useful. Yes, the transformed UI changes, but the results already looked very similar anyway (except for the color palettes). That said, the implementation is cute. When you click on a previously generated UI, the eyedropper animates the design as it is sucking its soul. You then move the eyedropper, click on another generated UI, and the new style spills over it, rearranging it to match the source. It’s a satisfying bit of UI theater, an illusion broken by the fact that you have to wait a little to see the results, as the AI works it all out. The problem is the little variance in Variant. You can’t “eyedrop” a bitmap image or a Figma project and tell the AI, “make this new app UI look like this.” Currently, Variant’s eyedropper feels like trying to paint in Photoshop when your palette only contains five shades of beige. A for effort That’s too bad, considering the eyedropper is one of the most resilient and powerful metaphors in computing history. The concept dates back to SuperPaint in 1973, which introduced the ability to sample hue values from a digital canvas. While MacPaint popularized digital painting tools in 1984, it was Adobe Photoshop 1.0 in 1990 that locked the eyedropper icon as the standard for color sampling. Then, in 1996, Adobe Illustrator 6.0 evolved the tool into a style thief. It allowed designers to absorb entire sets of attributes—stroke weights, fill patterns, and effects—and inject them into other objects. Now Variant is effectively trying to take this to its UI design arsenal. The difference is that Adobe’s tools offered precision. You knew exactly what you were getting. With Variant, you are making a visual suggestion to a probabilistic engine and hoping for the best. But it is a good change that highlights why we need more tools like this eyedropper and fewer text prompts. Unlike the latest generation of multi-modal video generative AIs, the lack of precision in vibecoding tools is unnerving to me. It reminds me of an exercise I did in communication design class, back in college: A professor made us play a game where one student built a shape with Tangram pieces and had to verbally describe to a partner how to reproduce it with another Tangram set. It was impossible to match it. We are humans, orders of magnitude better semantic engines than any AI, and even we fail at describing visuals with words. We need interfaces that allow for direct, exact manipulation, not just crossing fingers and hoping for the best. Variant’s eyedropper shows us the way. Generative AI tool makers, more of this, please. Stop forcing designers to talk to the machine, and let us show what we want. We made a tool that lets you absorb the vibe of anything you point it at and apply it to your designs It's absurd and it just works Style Dropper, now available in @variantui pic.twitter.com/B3eXDntYtw — Ben South (@bnj) February 10, 2026 View the full article

-

Burnout symptoms aren’t a personal failure. They’re a warning system.

Today’s hustle culture has turned burnout into something we either brag about or shamefully hide. Instagram is packed with videos of employees clocking out at 8 pm only to go home and wrap up their day. We joke about living on caffeine and a constant influx of notifications. And so, when we finally hit a The post Burnout symptoms aren’t a personal failure. They’re a warning system. appeared first on RescueTime Blog. View the full article

-

How Ford is building more efficient EV batteries with help from a tiny charging startup it bought 2 years ago

When it comes to EVs, a bigger battery isn’t always better. Ford Motor Company is making that bet as part of its effort to manufacture a new suite of more affordable electric vehicles—beginning with a $30,000-starting-price mid-size electric truck set to launch in 2027. To get more out of a smaller battery, Ford has had to reimagine every step of its manufacturing process. It has scrapped the typical assembly line process in favor of what the automaker calls its “Ford Universal EV Platform,” and simplified every part of its EV, from the miles of wiring inside the electric system to the number of parts that make up its frame. And it’s had to rethink the battery itself, to make it both more efficient and less expensive to produce. Ford credits many of those innovations to the team from Auto Motive Power, an EV charging startup Ford acquired back in 2023. Ford Bounties to increase efficiency Batteries are a massive challenge to designing affordable, efficient EVs. The battery makes up at least 25% of an EV’s total weight and around 40% of its total cost. In recent years, EV batteries have kept getting bigger. A bigger battery can add miles to an EV’s range, but that also means adding more weight, which makes an EV less efficient, and potentially more difficult to handle. It also means more production costs, which could make that EV more expensive. To make more affordable EVs, then, Ford has rethought every part of its EV in service of that battery. Every engineer, whether working on the vehicle’s aerodynamics or its interior ergonomics, uses metrics that Ford calls “bounties” to weigh design tradeoffs in terms of how they affect the vehicle’s range and battery costs. Alan Clarke That has led to a “system-level optimization that the team has done to turn over every rock to find dollars of cost and watts of efficiency,” says Alan Clarke, executive director of Ford’s Advanced EV Development department. Ford removed 4,000 feet of wiring from its Universal EV Platform, for example, shaving off 22 pounds compared to the wiring used in Ford’s first-gen electric SUV. While the Ford Maverick has 146 structural parts in its frame, Ford’s forthcoming midsized EV will have just two parts, thanks to a lighter and simpler “unicasting” process. A more efficient battery Besides the design tradeoffs it made, Ford also redesigned its battery to make it both smaller and more efficient. That can translate to a better range and charging experience for customers, too. “The pipe of electrons coming out of the wall is always the same for every customer,” Clarke says. “But how many miles that translates into is directly defined by efficiency of the power electronics and efficiency of the vehicle.” In its forthcoming midsized EV, Ford will use lithium-iron-phosphate, or LFP, batteries. With no nickel or cobalt, these batteries—which are common in Chinese EVs—use less expensive chemical ingredients than lithium ion and other battery types. How efficient an EV battery is depends largely on its software, and that’s where the team from Auto Motive Power comes in. An EV battery pack is composed of multiple cells, and “the performance of that battery pack is limited by your worst cell,” Clarke explains. Battery cells are sensitive to temperature, voltage, and other conditions around them. “You want to buy [an EV] from whatever company understands their batteries the best, thermally manages them the best from a software standpoint, can measure where they are and balance them and charge them at the rates that don’t deteriorate them,” he adds. Algorithms can monitor a battery’s voltage, temperature, and regenerative braking in order to maximize the vehicle’s energy use. Software controls how an EV takes energy out of its battery and puts it into the vehicle’s drive unit. And it also allows the automaker to optimize a battery in real time, responding to the driver’s behaviors and real-world data to reduce battery degradation and protect its lifespan. “Each customer has different ways of utilizing batteries,” explains Anil Paryani, formerly the CEO of Auto Motive Power and now an executive director of engineering at Ford. “In Arizona, they might have different heat challenges . . . so we have user-optimized controls to minimize those trade offs,” he says. Sometimes customers just have different charging behaviors. For example, Paryani says that his mom lives in a condo, and so she almost exclusively uses fast chargers, which can negatively impact an EV’s battery life. “What do we have to do to avoid [battery] deterioration?” he says. “We are addressing that with our software.” Ford is making its battery cells at its BlueOval Battery Park in Michigan. Akshaya Srinivasan Staying a startup inside Ford Auto Motive Power was founded in 2017, and was previously a supplier to Ford before it was acquired by the automaker in 2023. At the time, the team was still operating as a “very scrappy” startup, Paryani says. Becoming part of a $56 billion automaker could have drastically changed that, but they were able to maintain that startup energy. Executives decided to keep the team “walled off,” Paryani says, “so that we can take design risks that I don’t think traditional auto companies would ever think of taking.” Big companies like Ford can often get caught up in “analysis paralysis,” Clarke admits, while startups are known for failing fast. Paryani and his team held on to that ethos, while taking advantage of Ford’s resources, like access to its EV development center. “[Through] all of the different things that Anil’s team have tried, we’ve learned so much about different materials, interaction between different devices, that we wouldn’t have,” Clarke says. “Or in order to learn it, we probably would have spent two years building models and realizing it wasn’t a good idea.” Paryani’s team, instead, tried out multiple ideas quickly through prototypes. This work is crucial to developing better EVs, which are ultimately still an early technology. “Internal combustion engine vehicles have had 120 years of maturation, of engineering work, of optimization, of innovation, that have gone into them,” Clarke says. EVs, by contrast, are in “inning one—or maybe inning two.” View the full article

-

This Shortcut Solves the Biggest Issue With Finding Messages on Your iPhone

I have always found it annoying to search for anything in Apple's Messages app. Admittedly, things have gotten better in recent years, especially as Messages allows you to use search filters now, but my biggest complaint still stands: searching in Messages can be both slow and complicated, particularly if you just want to find a specific text. If you have the same experience, I have good news: I've found a workaround that offers a massive improvement to Apple's built-in search function. The problem with searching in MessagesFor most people, the easiest way to search for texts on an iPhone involves opening the Messages app, tapping the search bar near the base of the screen, and typing in what you're looking for. You'll receive a variety of results, but that's the problem: It's too much information. When I search for a person's name, for example, Messages in iOS 26 shows a list of four chats where the name is mentioned, followed by two chat threads, pinned chats, shared notes, links, photos, locations, and documents. This is great when I want a more in-depth search, but when I'm just looking for a specific message, these extra details just get in the way. The fastest way to search for texts in iOS 26That's where our hack comes in. First, open the Shortcuts app on your iPhone, then install the Search and Open Messages shortcut. This shortcuts takes advantage of actions released in iOS 26, which allow you to look for text messages and open them in a single tap. Once the shortcut is installed, you can run it from the Shortcuts app, or add it to your iPhone's Home Screen for easier access. The shortcut will prompt you to type what you want to search for, and almost instantly, it'll list all the chats containing those words. In some cases, it even highlights the exact sentence containing those words. It'll find keywords in images you share, as well: These appears as "blank" entries in the search results, but if you tap through, you'll see the image the search identified. The moment you tap a result, the shortcut instantly takes you to the relevant part of the chat, and doesn't make you scroll through hundreds of results to find the right one. This is the kind of functionality Apple needs to add directly to Messages. But, for now, this shortcut workaround will have to do. View the full article

-

my coworker is awful to his wife, who also works here

A reader writes: I’m having trouble figuring out how to navigate a situation with a coworker, John. When I first started at this company a year ago, John was the one who trained me, and he was courteous and communicative throughout the process. I wound up as casual work friends with him, but over the year I’ve seen him do and say things that have given me a very bad gut feeling. Most of these things involve his wife, Gladys, who works here in a different department but who eats lunch with us occasionally. Although John is usually thoughtful and respectful to me and his other coworkers, everything he says to Gladys is some sort of subtle put down or disagreement with what she is doing, sometimes to the point of outright yelling at her. No one else in our coworker friend circle takes outward issue, I suspect in part because John is the oldest and has been here the longest, but it makes me incredibly uncomfortable, and frankly I have strong suspicious that he is an abusive spouse — perhaps not through physical violence, but he puts a lot of pressure on what she eats and how much. The first time it happened, since it was out of line with the rest of his work presence, I figured it might be one bad moment, but it’s an established pattern at this point and even if he is not outright abusive, the best case scenario is still that he’s a huge jerk. I no longer want anything to do with this guy outside of the times we need to be in the same room or otherwise cooperate for work reasons. I do feel as though I can remain professional and polite in these situations, but further friendly interactions between us make my skin crawl now. I’m having trouble figuring out how to navigate this for a few reasons. First, I only ever see Gladys during these lunches; she works in a separate building I don’t have access to. We don’t have a close enough relationship where I could talk to her about any of this, and I can’t try to change that without getting closer to John. Second, even if I did have specific and actionable evidence I could take to HR, I wouldn’t want to start anything official unless Gladys asked me to — I do not want to put her in a worse position by making John angry. For similar reasons, it seems like a very bad idea to tell John outright that I no longer want to be friends with him because I don’t like how he treats his wife. I’ve been trying to gradually and amicably spend less time with him outside of necessary interactions, and am hoping I can accomplish this in a way that feels like a natural drift apart. In the event he notices and asks me about it, though, I have absolutely no idea how to respond. I do suspect he will notice eventually since there was a past situation where he was upset for weeks when another coworker similarly stopped friendly contact with him (the way he handled that situation was another red flag for me, and I wonder now if that coworker had the same reasons I do). Is there a better way to exit this situation that wouldn’t risk endangering Gladys? And beyond that, is any of this something I should try to speak up about to supervisors or HR? None of this has ever happened when they’ve been present. I think you’re handling it the best way available to you, given the constraints of not really knowing Gladys, having limited info about their relationship, and needing to work with John. John is a jerk, so it makes sense to minimize the amount of interaction you have with him and back away from a social relationship. If he ever asks you about it, you can employ the bland responses that are time-honored traditions when you don’t want to spend time with someone but also don’t want to get into a big Feelings talk about it: * “No, just busy with work!” * “Hmmm, I haven’t realized that, just busy I guess.” * “I’m good, just have my hands full with the X project.” … and so forth. In some situations — and especially if he’s pushing about why you’re not joining him for lunch anymore, in particular — I think it would be fine to say, “Frankly, the way you talk to your wife makes me really uncomfortable and I don’t want to be around that.” And there’s an argument for saying it here, as a method of demonstrating that there are social consequences to his behavior. But if you believe that risks making things worse for Gladys, then that gets a lot muddier. That calculation can be very difficult; on one hand, if there is abuse, her safety matters more than the principle of Something Must Be Said. On the other hand, no one saying anything can reinforce some of the ways abusers keep their victims trapped, like by telling them that no one would believe there’s a problem / people think they deserve the abuse / etc. Of course, in this situation, we don’t know much about what’s going on and John may just be an enormous jerk but not an abusive one, so this is mostly a theoretical leap … but if you’re concerned about abuse, the National Domestic Violence Hotline (800-799-7233) can talk to you about what you’re seeing and give you more tailored advice. Otherwise, though, if you do find yourself stuck at a lunch table with John again and he yells at Gladys again (!), you should feel feel to respond to that the same way you would if he were yelling at any other colleague: tell him to knock it off, tell him to leave the table … whatever you’d do if he were yelling at anyone else. I don’t know exactly what John said about Gladys’s food intake, but depending on the specifics you might be able to say anything from “Can we not diet-police, please?” to “That’s really disrespectful” to “Wow, leave her alone.” If you ever had contact with Gladys away from John — or can orchestrate a reason to — you could also say to her, “Are you doing alright? The way John talked to you at lunch earlier wasn’t okay.” But if John yells at Gladys on work grounds (or at work events, or when colleagues are around), I do think that’s something you can share with your boss or HR. That’s different than “this guy doesn’t seem very nice to his wife” (which is a problem but not a work problem) and has moved into the realm of “something not okay is happening in our workplace.” The post my coworker is awful to his wife, who also works here appeared first on Ask a Manager. View the full article

-

Why AI optimization is just long-tail SEO done right

If you look at job postings on Indeed and LinkedIn, you’ll see a wave of acronyms added to the alphabet soup as companies try to hire people to boost visibility on large language models (LLMs). Some people are calling it generative engine optimization (GEO). Others call it answer engine optimization (AEO). Still others call it artificial intelligence optimization (AIO). I prefer large model answer optimization (LMAO). I find these new acronyms a bit ridiculous because while many like to think AI optimization is new, it isn’t. It’s just long-tail SEO — done the way it was always meant to be done. Why LLMs still rely on search Most LLMs (e.g., GPT-4o, Claude 4.5, Gemini 1.5, Grok-2) are transformers trained to do one thing: predict the next token given all previous tokens. AI companies train them on massive datasets from public web crawls, such as: Common Crawl. Digitized books. Wikipedia dumps. Academic papers. Code repositories. News archives. Forums. The data is heavily filtered to remove spam, toxic content, and low-quality pages. Full pretraining is extremely expensive, so companies run major foundation training cycles only every few years and rely on lighter fine-tuning for more frequent updates. So what happens when an LLM encounters a question it can’t answer with confidence, despite the massive amount of training data? AI companies use real-time web search and retrieval-augmented generation (RAG) to keep responses fresh and accurate, bridging the limits of static training data. In other words, the LLM runs a web search. To see this in real time, many LLMs let you click an icon or “Show details” to view the process. For example, when I use Grok to find highly rated domestically made space heaters, it converts my question into a standard search query. Dig deeper: AI search is booming, but SEO is still not dead The long-tail SEO playbook is back Many of us long-time SEO practitioners have praised the value of long-tail SEO for years. But one main reason it never took off for many brands: Google. As long as Google’s interface was a single text box, users were conditioned to search with one- and two-word queries. Most SEO revenue came from these head terms, so priorities focused on competing for the No. 1 spot for each industry’s top phrase. Many brands treated long-tail SEO as a distraction. Some cut content production and community management because they couldn’t see the ROI. Most saw more value in protecting a handful of head terms than in creating content to capture the long tail of search. Fast forward to 2026. People typing LLM prompts do so conversationally, adding far more detail and nuance than they would in a traditional search engine. LLMs take these prompts and turn them into search queries. They won’t stop at a few words. They’ll construct a query that reflects whatever detail their human was looking for in the prompt. Suddenly, the fat head of the search curve is being replaced with a fat tail. While humans continue to go to search engines for head terms, LLMs are sending these long-tail search queries to search engines for answers. While AI companies are coy about disclosing exactly who they partner with, most public information points to the following search engines as the ones their LLMs use most often: ChatGPT – Bing Search. Claude – Brave Search. Gemini – Google Search. Grok – X Search and its own internal web search tool. Perplexity – Uses its own hybrid index. Right now, humans conduct billions of searches each month on traditional search engines. As more people turn to LLMs for answers, we’ll see exponential growth in LLMs sending search queries on their behalf. SEO is being reborn. Your customers search everywhere. Make sure your brand shows up. The SEO toolkit you know, plus the AI visibility data you need. Start Free Trial Get started with Dig deeper: Why ‘it’s just SEO’ misses the mark in the era of AI SEO How to do long-tail SEO with help from AI The principles of long-tail SEO haven’t changed much. It’s best summed up by Baseball Hall of Famer Wee Willie Keeler: “Keep your eye on the ball and hit ’em where they ain’t.” Success has always depended on understanding your audience’s deepest needs, knowing what truly differentiates your brand, and creating content at the intersection of the two. As straightforward as this strategy has been, few have executed it well, for understandable reasons. Reading your customers’ minds is hard. Keyword research is tedious. Content creation is hard. It’s easy to get lost in the weeds. Happily, there’s someone to help: your favorite LLM. Here are a few best practices I’ve used to create strong long-tail content over the years, with a twist. What once took days, weeks, or even months, you can now do in minutes with AI. 1. Ask your LLM what people search when looking for your product or service The first rule of long-tail SEO has always been to get into your audience’s heads and understand their needs. This once required commissioning surveys and hiring research firms to figure out. But for most brands and industries, an LLM can handle at least the basics. Here’s a sample prompt you can use. Act as an SEO strategist and customer research analyst. You're helping with long-tail keyword discovery by modeling real customer questions. I want to discover long-tail search questions real people might ask about my business, products, and industry. I’m not looking for mere keyword lists. Generate realistic search questions that reflect how people research, compare options, solve problems, and make decisions. Company name: [COMPANY NAME] Industry: [INDUSTRY] Primary product/service: [PRIMARY PRODUCT OR SERVICE] Target customer: [TARGET AUDIENCE] Geography (if relevant): [LOCATION OR MARKET] Generate a list of 75 – 100 realistic, natural-language search queries grouped into the following categories: AWARENESS • Beginner questions about the category • Problem-based questions (pain points, frustrations, confusion) CONSIDERATION • Comparison questions (alternatives, competitors, approaches) • “Best for” and use-case questions • Cost and pricing questions DECISION • Implementation or getting-started questions • Trust, credibility, and risk questions POST-PURCHASE • Troubleshooting questions • Optimization and advanced/expert questions EDGE CASES • Niche scenarios • Uncommon but realistic situations • Advanced or expert questions Guidelines: • Write queries the way real people search in Google or ask AI assistants. • Prioritize specificity over generic keywords. • Include question formats, “how to” queries, and scenario-based searches. • Avoid marketing language. • Include emotional, situational, and practical context where relevant. • Don't repeat the same query structure with minor variations. • Each query should suggest a clear content angle. Output as a clean bullet list grouped by category. You can tweak this prompt for your brand and industry. The key is to force the LLM (and yourself) to think like a customer and avoid the trap of generating keyword lists that are just head-term variations dressed up as long-tail queries. With a prompt like this, you move away from churning out “keyword ideas” and toward understanding real customer needs you can build useful content around. Dig deeper: If SEO is rocket science, AI SEO is astrophysics 2. Use your LLM to analyze your search data Most large brands and sites don’t realize they’ve been sitting on a treasure trove of user intelligence: on-site search data. When customers type a query into your site’s search box, they’re looking for something they expect your brand to provide. If you see the same searches repeatedly, it usually means one of two things: You have the information, but users can’t find it. You don’t have it at all. In both cases, it’s a strong signal you need to improve your site’s UX, add meaningful content, or both. There’s another advantage to mining on-site search data: it reveals the exact words your audience uses, not the terms your team assumes they use. Historically, the challenge has been the time required to analyze it. I remember projects where I locked myself in a room for days, reviewing hundreds of thousands of queries line by line to find patterns — sorting, filtering, and clustering them by intent. If you’ve done the same, you know the pattern. The first few dozen keywords represent unique concepts, but eventually you start seeing synonyms and variations. All of this is buried treasure waiting to be explored. Your LLM can help. Here’s a sample prompt you can use: You're an SEO strategist analyzing internal site search data. My goal is to identify content opportunities from what users are searching for on my website – including both major themes and specific long-tail needs within those themes. I have attached a list of site search queries exported from GA4. Please: STEP 1 – Cluster by intent Group the queries into logical intent-based themes. STEP 2 – Identify long-tail signals inside each theme Within each theme: • Identify recurring modifiers (price, location, comparisons, troubleshooting, etc.) • Identify specific entities mentioned (products, tools, features, audiences, problems) • Call out rare but high-intent searches • Highlight wording that suggests confusion or unmet expectations STEP 3 – Generate content ideas For each theme: • Suggest 3 – 5 content ideas • Include at least one long-tail content idea derived directly from the queries • Include one “high-intent” content idea • Include one “problem-solving” content idea STEP 4 – Identify UX or navigation issues Point out searches that suggest: • Users cannot find existing content • Misleading navigation labels • Missing landing pages Output format: Theme: Supporting queries: Long-tail insights: Content opportunities: UX observations: Again, customize this prompt based on what you know about your audience and how they search. The detail matters. Many SEO practitioners stop at a prompt like “give me a list of topics for my clients,” but this pushes the LLM beyond simple clustering to understand the intent behind the searches. I used on-site search data because it’s one of the richest, most transparent, and most actionable sources. But similar prompts can uncover hidden value in other keyword lists, such as “striking distance” terms from Google Search Console or competitive keywords from Semrush. Even better, if your organization keeps detailed customer interaction records (e.g., sales call notes, support tickets, chat transcripts), those can be more valuable. Unlike keyword datasets, they capture problems in full sentences, in the customer’s own words, often revealing objections, confusion, and edge cases that never appear in traditional keyword research. Get the newsletter search marketers rely on. See terms. 3. Create great content The next step is to create great content. Your goal is to create content so strong and authoritative that it’s picked up by sources like Common Crawl and survives the intense filtering AI companies apply when building LLM training sets. Realistically, only pioneering brands and recognized authorities can expect to operate in this rarefied space. For the rest of us, the opportunity is creating high-quality long-tail content that ranks at the top across search engines — not just Google, but Bing, Brave, and even X. This is one area where I wouldn’t rely on LLMs, at least not to generate content from scratch. Why? LLMs are sophisticated pattern matchers. They surface and remix information from across the internet, even obscure material. But they don’t produce genuinely original thought. At best, LLMs synthesize. At worst, they hallucinate. Many worry AI will take their jobs. And it will — for anyone who thinks “great content” means paraphrasing existing authority sources and competing with Wikipedia-level sites for broad head terms. Most brands will never be the primary authority on those terms. That’s OK. The real opportunity is becoming the authority on specific, detailed, often overlooked questions your audience actually has. The long tail is still wide open for brands willing to create thoughtful, experience-driven content that doesn’t already exist everywhere else. We need to face facts. The fat head is shrinking. The land rush is now for the “fat tail.” Here’s what brands need to do to succeed: Dominate searches for your brand Search your brand name in a keyword tool like Semrush and review the long-tail variations people type into Google. You’ll likely find more than misspellings. You’ll see detailed queries about pricing, alternatives, complaints, comparisons, and troubleshooting. If you don’t create content that addresses these topics directly — the good and the bad — someone else will. It might be a Reddit thread from someone who barely knows your product, a competitor attacking your site, a negative Google Business Profile review, or a complaint on Trustpilot. When people search your brand, your site should be the best place for honest, complete answers — even and especially when they aren’t flattering. If you don’t own the conversation, others will define it for you. The time for “frequently asked questions” is over. You need to answer every question about your brand—frequent, infrequent, and everything in between. Go long Head terms in your industry have likely been dominated by top brands for years. That doesn’t mean the opportunity is gone. Beneath those competitive terms is a vast layer of unbranded, long-tail searches that have likely been ignored. Your data will reveal them. Review on-site search, Google Search Console queries, customer support questions, and forums like Reddit. These are real people asking real questions in their own words. The challenge isn’t finding questions to write about. It’s delivering the best answers — not one-line responses to check a box, but clear explanations, practical examples, and content grounded in real experience that reflects what sets your brand apart. Dig deeper: Timeless SEO rules AI can’t override: 11 unshakeable fundamentals Expertise is now a commodity: Lean into experience, authority, and trust Publishing expert content still matters, but its role has changed. Today, anyone can generate “expert-sounding” articles with an LLM. Whether that content ranks in Google is increasingly beside the point, as many users go straight to AI tools for answers. As the “expertise” in E-E-A-T becomes table stakes, differentiation comes from what AI and competitors can’t easily replicate: experience, authority, and trust. That means publishing: Original insights and genuine thought leadership from people inside your company. Real customer stories with measurable outcomes. Transparent reviews and testimonials. Evidence that your brand delivers what it promises. This isn’t just about blog content. These signals should appear across your site — from your About page to product pages to customer support content. Every page should reinforce why a real person should trust your brand. Stop paywalling your best content I’m seeing more brands put their strongest content behind logins or paywalls. I understand why. Many need to protect intellectual property and preserve monetization. But as a long-term strategy, this often backfires. If your content is truly valuable, the ideas will spread anyway. A subscriber may paraphrase it. An AI system may summarize it. A crawler may access it through technical workarounds. In the end, your insights circulate without attribution or brand lift. When your best content is publicly accessible, it can be cited, linked to, indexed, and discussed. That visibility builds authority and trust over time. In a search- and AI-driven ecosystem, discoverability often outweighs modest direct content monetization. This doesn’t mean content businesses can’t charge for anything. It means being strategic about what you charge for. A strong model is to make core knowledge and thought leadership open while monetizing things such as: Tools. Community access. Premium analysis or data. Courses or certifications. Implementation support. Early access or deeper insights. In other words, let your ideas spread freely and monetize the experience, expertise, and outcomes around them. Stop viewing content as a necessary evil I still see brands hiding content behind CSS “read more” links or stuffing blocks of “SEO copy” at the bottom of pages, hoping users won’t notice but search engines will. Spoiler alert: they see it. They just don’t care. Content isn’t something you add to check an SEO box or please a robot. Every word on your site must serve your customers. When content genuinely helps users understand, compare, and decide, it becomes an asset that builds trust and drives conversions. If you’d be embarrassed for users to read your content, you’re thinking about it the wrong way. There’s no such thing as content that’s “bad for users but good for search engines.” There never was. Embrace user-generated content No article on long-tail SEO is complete without discussing user-generated content. I covered forums and Q&A sites in a previous article (see: The reign of forums: How AI made conversation king), and they remain one of the most efficient ways to generate authentic, unique content. The concept is simple. You have an audience that’s already passionate and knowledgeable. They likely have more hands-on experience with your brand and industry than many writers you hire. They may already be talking about your brand offline, in customer communities, or on forums like Reddit. Your goal is to bring some of those conversations onto your site. User-generated content naturally produces the long-tail language marketing teams rarely create on their own. Customers Describe problems differently. Ask unexpected questions. Compare products in ways you didn’t anticipate. Surface edge cases, troubleshooting scenarios, and real-world use cases that rarely appear in polished marketing copy. This is exactly the kind of content long-tail SEO thrives on. It’s also the kind of content AI systems and search engines increasingly recognize as credible because it reflects real experience rather than brand messaging many dismiss as inauthentic. Brands that do this well don’t just capture long-tail traffic. They build trust, reduce support costs, and dominate long-tail searches and prompts. In the age of AI-generated content, real human experience is one of the strongest differentiators. See the complete picture of your search visibility. Track, optimize, and win in Google and AI search from one platform. Start Free Trial Get started with The new SEO playbook looks a lot like the old one For years, SEO has been shaped by the limits of the search box. Short queries and head terms dominated strategy, and long-tail content was often treated as optional. LLMs are changing that dynamic. AI is expanding search, not eliminating it. AI systems encourage people to express what they actually want to know. Those detailed prompts still need answers, and those answers come from the web. That means the SEO opportunity is shifting from competing over a small set of keywords to becoming the best source of answers to thousands of specific questions. Brands that succeed will: Deeply understand their audience. Publish genuinely useful content. Build trust through real engagement and experience. That’s always been the recipe for SEO success. But our industry has a habit of inventing complex tactics to avoid doing the simple work well. Most of us remember doorway pages, exact match domains, PageRank sculpting, LSI obsession, waves of auto-generated pages, and more. Each promised an edge. Few replaced the value of helping users. We’re likely to see the same cycle repeat in the AI era. The reality is simpler. AI systems aren’t the audience. They’re intermediaries helping humans find trustworthy answers. If you focus on helping people understand, decide, and solve problems, you’re already optimizing for AI — whatever you call it. Dig deeper: Is SEO a brand channel or a performance channel? Now it’s both View the full article

-

A Complete Guide to Moving to Brazil: Things to Know Before