All Activity

- Past hour

-

Lyons McCloskey sale keeps compliance muscle intact

Founding partner Bob Lyons will help ensure continuity. Frank Pallotta and Kathleen Koprowski will lead an advisory board for the auditing and consulting firm. View the full article

-

letters from Minneapolis

Some letters from Minneapolis: For the past several weeks, the Twin Cities, and the state of Minnesota overall, has been under siege by federal agents. My friends and coworkers are scared to leave their homes. Every day we see and hear about another innocent person being harassed, detained, and spirited away by plane and kept from their family, friends, pets, and lawyers. Neighbors exercising their constitutional rights are gassed and beaten. Victims emerge from detention centers with horrifying accounts. My friend was on the scene when Renee Good was murdered. In some of the coldest weather of my life, we stood outside for hours screaming for ICE to leave. People are not exaggerating with their comparisons to the gestapo. The streets crawl with them. And yet I’m at an employer that has kept largely quiet about it. We’re a nonprofit (though not the kind that provides a public service) headquartered in Minneapolis, and after the execution of Alex Pretti the C-suite sent another email that they don’t make position statements unless it has to do with our mission. My expectations of my org’s leaders were already in the toilet thanks to their previous poor decisions, but my coworkers, passionate people who took lower paying jobs at a nonprofit to do good in the world, are repeatedly infuriated by this. There are constant conversations about “what to do” and “how could they do this”? My personal solution is to not give a fig about this place and put my energy into activities outside of my job, but I won’t tell my coworkers to stop caring. How am I supposed to work when what little motivation I muster evaporates upon hearing the frustration of my coworkers? How can we take anything seriously for this org at all? I just need to get the bare minimum done so that I don’t find myself needing to stay late to finish whatever task and never think about my job after 4 pm hits. I even dropped out of a job candidacy because I just cannot handle interview prep with this actively happening. This feels so very different from Covid, or even George Floyd, where most people in government at least tried to deescalate things. Now the federal government is actively lying and making calculated decisions to attack us even more, and many of us that are in the midst of it have no idea how many people outside Minnesota truly get what’s going on. * * * * * I live in Minnesota. I don’t live inside Minneapolis/St. Paul but grew up there and I have many friends and immediate family there. As you can imagine, life is difficult right now. The news feels constant and unrelenting. I am doing what I can to support my community, but no one knows when the occupation will end and it feels like things are escalating. I worry about my community and my country, I have friends who have been targeted by ICE, and in the midst of this I have to carry on for my young children. I work for a large multinational corporation. We have a massive office here but I work from home permanently. My boss, my line of leaders, and everyone on my team lives elsewhere. And it feels impossible to work now, which is unfortunate because this is a busy time of year and I have many things to get done. Telling my coworkers that I’m under stress is hard because what is happening has been politicized, so I don’t know how it will be received or how people will respond. And everyone else seems to be going along just fine with their days, discussing projects and deadlines, while I stare at my screen, unable to form sentences. I have a therapist and I’m not in a mental health crisis, I’m just struggling to work while the world falls down around my community. I know the answer is “take time off’ but how do I explain this to my leaders, who are expecting me to deliver on high-profile projects? * * * * * I work in Minneapolis. Renee Good and Alex Pretti were murdered here. My employer has not acknowledged the murders. They have not acknowledged that the office’s collective mental health is in the gutter. There are wind chills of -35F today, with frostbite of exposed skin in 10 minutes or less, but we are still expected to go in to the office in person. We all are. I have been grabbed by ICE multiple times and demanded that I turn over my passport to them, as well as my work ID, trying to get to the office. They don’t care. They’re more afraid of speaking up than of something happening to any of us. We’re just dead weight to them. I don’t know what to do anymore about any of it. * * * * * I work full-time as an admin assistant for three different professionals. There is a central office I work out of that I commute to by bus, but the people I support are elsewhere (one in another city in the same state, two together in the same office out of state). I don’t currently have the ability to work from home. I also live in south Minneapolis, literally blocks from where Alex Pretti was recently killed. Needless to say, this is affecting me on multiple levels. On a logistical level, I’ve had to request PTO on short notice due to the ongoing volatile situation. On a cognitive and emotional level, I’ve been making mistakes at work due to stress. My job requires consistency, strong communication, and a high level of attention— all of which I have! Normally. I’m doing my best to keep work and emotions separate, but there’s some inevitable bleed and it’s showing up in ways that make me look careless. I’ve only had this position for six months, and although my three-month review was glowing and the professionals I support have had overwhelmingly positive feedback for me so far, I’m worried I don’t have enough of a track record established for what’s going on right now not to cause problems for me down the line. How transparent should I be about what’s going on? I’m sure the people I support have a general idea of the situation, and they know I live in Minneapolis, but I’m not sure they’re aware how literally and figuratively close to home all this is for me. If it was a personal issue, I wouldn’t hesitate to let them know in appropriately vague terms that I was dealing with temporary extenuating circumstances that I am doing my best to mitigate. As it is, though, I work in a somewhat conservative industry and I worry even introducing the topic runs the risk of being inappropriately “political” at work. But also, my city is under armed occupation and my neighbor was just shot in the street in broad daylight, so I am (understandably I think) extremely not okay! It is okay that you do not feel okay. We just watched our government brutally murder a man in the street. None of us should feel okay. None of this is okay. You don’t need to pretend that it is. You are allowed to be human. It is normal not to be your usual productive self right now. You, like many of the rest of us, are exhausted, distracted, overwhelmed, sickened, and scared. It is okay to scale back the expectations on yourself and your coworkers to just the minimum right now. If you need to spell it out for colleagues who aren’t in the area, do: “It’s really rough here right now. We’re right in the middle of everything that’s on the news.” … “People are being accosted on the streets going to and from work, and we’re terrified. No one here is at 100% right now.” … “People are being pulled out of their cars for driving down the wrong street. We’re working in what’s essentially a war zone, so some of this will need some extra time.” If you do have like-minded colleagues, think about banding together to demand that people in a position to do more — your company’s leadership — do more. There is safety in numbers, and there is power in numbers. Maybe that means calling out your leadership for staying quiet and expecting business as usual from you and your colleagues and not actively working to keep employees safer. It could mean asking them to do things like: • explicitly giving people permission to do what they need to feel safe, including working remotely or delaying travel • covering hotel rooms for people who can’t safely go home • providing more mental health days and breaks • pulling back on expectations while you’re under siege • sharing detailed instructions for scenarios involving ICE that might come up at or near work, including contact information for legal help And it could also mean calling on them to use their influence with higher levels of government to demand that ICE leave your city. We have more power than they want us to think. The post letters from Minneapolis appeared first on Ask a Manager. View the full article

-

Why Most Freelancers Fail at Money Management Within Six Months, According to Data

It’s easy to assume that landing clients and building your portfolio are the hardest parts of freelancing. However, the numbers paint a different reality. More than half of new freelancers never make it past their first six months, not because of a lack of talent, but because their money management falls apart before the business can grow. Here’s what the data actually shows. According to Bonsai’s 2025 freelancer survey, over 60% of independent workers admit to starting without a budget or financial plan in place. Industry-wide reports back this up: most new freelancers do not separate business and personal finances early on, nor do they consistently track cash flow, resulting in missed expenses, lumpy savings, and confusion around taxes. If you believe that steady work and a few well-paid gigs will naturally lead to financial stability, it’s time to look closely at the facts. What really causes so many promising freelancers to hit a wall so quickly? And which changes, backed by hard numbers, actually make a difference? Most Freelancers Start Without a BudgetMost new freelancers start strong but skip the single step that keeps a business stable: setting a clear budget. Many simply pay bills as they come and hope that new projects will always cover new expenses. Take a freelancer who lands two big contracts in their first month, only to see both clients pay late the next month. With no savings or tracking habit in place, one surprise bill can throw everything off balance. Without a budget or separate business account, it is nearly impossible to spot a cash flow gap, plan for recurring expenses, or save for taxes. Cash Flow Problems Are CommonFreelancers cite inconsistent payments as a top problem. Genius’s 2025 freelance stats show that 47% of freelancers reported at least one late or missing client payment in their first six months. This pattern repeats more often than new freelancers realize, especially for those with only a handful of clients or long payment cycles. In reality, this makes it hard to forecast income or save for slow periods. This instability is the leading reason so many run out of runway, even when work is available. Personal and Business Funds Get MixedIf you pay for groceries and web hosting from the same card, it is tough to know what belongs where at tax time. Nearly half of respondents in The Freelancer Study 2025 said they still pay business expenses out of a personal account. This leads to messy records at tax time, frequent overspending, and missed opportunities for business deductions. Freelancers who separate their accounts are better at tracking spending, calculating profits, and finding ways to cut costs. Poor Saving and Spending HabitsIt is tempting to spend large payments as soon as they hit your account, treating each one as a sign you are “making it.” Picture a freelancer who buys a new laptop after a big project, only to face a dry spell the following month. With little set aside, they may have to borrow or use credit to keep the business afloat. Experienced freelancers flip the habit: each payment gets split, some for bills, some for taxes, and some stashed for quieter months. This is how financial stability takes hold. Undercharging and Unsustainable PricingData shows that many freelancers, especially those new to the space, charge too little for their services. The 2025 YunoJuno Freelancer Rates Report notes that average rates remain largely stagnant in many sectors, and just 28% of freelancers surveyed said they increased their fees within their first year. This may work for landing projects, but when expenses rise or larger opportunities come, the math no longer adds up. For example, undercharging by just $10 per hour over six months could mean hundreds lost, even as costs for tools and subscriptions keep climbing. Without scheduled rate reviews or clear pricing strategies, even busy freelancers see their earnings squeezed by rising costs and inflation. What the Data Says to Do InsteadIf the numbers illuminate the traps, they also point to solutions: Always create a budget first: The most successful freelancers use budget tools or simple spreadsheets from the start and adjust as their business grows.Separate your finances: Open a business checking account before your first invoice and process every client payment and business expense through it.Automate savings for taxes and emergencies: Set aside a fixed percentage of every payment as soon as it clears.Formalize contracts and payment terms: Use written agreements to clarify rates, deadlines, and late fees, reducing payment delays.Review and raise your rates regularly: Leading freelancers benchmark against industry averages and use data to justify annual price increases.Lean on data, not gut instinct: Use financial apps and regular monthly reviews to make spending, saving, and pricing decisions.The Takeaway: Systems and Data Beat Luck Every TimeThe statistics are clear. Most freelancers who fail in the first six months do so not because of a lack of skill or drive, but from avoidable money mistakes. The solution, backed by data, is to build simple routines for budgeting, saving, separating finances, and reviewing rates. Treat your freelance business like a true business from day one, and you dramatically improve your odds of not just surviving, but growing for the long haul. View the full article

-

Why Most Freelancers Fail at Money Management Within Six Months, According to Data

It’s easy to assume that landing clients and building your portfolio are the hardest parts of freelancing. However, the numbers paint a different reality. More than half of new freelancers never make it past their first six months, not because of a lack of talent, but because their money management falls apart before the business can grow. Here’s what the data actually shows. According to Bonsai’s 2025 freelancer survey, over 60% of independent workers admit to starting without a budget or financial plan in place. Industry-wide reports back this up: most new freelancers do not separate business and personal finances early on, nor do they consistently track cash flow, resulting in missed expenses, lumpy savings, and confusion around taxes. If you believe that steady work and a few well-paid gigs will naturally lead to financial stability, it’s time to look closely at the facts. What really causes so many promising freelancers to hit a wall so quickly? And which changes, backed by hard numbers, actually make a difference? Most Freelancers Start Without a BudgetMost new freelancers start strong but skip the single step that keeps a business stable: setting a clear budget. Many simply pay bills as they come and hope that new projects will always cover new expenses. Take a freelancer who lands two big contracts in their first month, only to see both clients pay late the next month. With no savings or tracking habit in place, one surprise bill can throw everything off balance. Without a budget or separate business account, it is nearly impossible to spot a cash flow gap, plan for recurring expenses, or save for taxes. Cash Flow Problems Are CommonFreelancers cite inconsistent payments as a top problem. Genius’s 2025 freelance stats show that 47% of freelancers reported at least one late or missing client payment in their first six months. This pattern repeats more often than new freelancers realize, especially for those with only a handful of clients or long payment cycles. In reality, this makes it hard to forecast income or save for slow periods. This instability is the leading reason so many run out of runway, even when work is available. Personal and Business Funds Get MixedIf you pay for groceries and web hosting from the same card, it is tough to know what belongs where at tax time. Nearly half of respondents in The Freelancer Study 2025 said they still pay business expenses out of a personal account. This leads to messy records at tax time, frequent overspending, and missed opportunities for business deductions. Freelancers who separate their accounts are better at tracking spending, calculating profits, and finding ways to cut costs. Poor Saving and Spending HabitsIt is tempting to spend large payments as soon as they hit your account, treating each one as a sign you are “making it.” Picture a freelancer who buys a new laptop after a big project, only to face a dry spell the following month. With little set aside, they may have to borrow or use credit to keep the business afloat. Experienced freelancers flip the habit: each payment gets split, some for bills, some for taxes, and some stashed for quieter months. This is how financial stability takes hold. Undercharging and Unsustainable PricingData shows that many freelancers, especially those new to the space, charge too little for their services. The 2025 YunoJuno Freelancer Rates Report notes that average rates remain largely stagnant in many sectors, and just 28% of freelancers surveyed said they increased their fees within their first year. This may work for landing projects, but when expenses rise or larger opportunities come, the math no longer adds up. For example, undercharging by just $10 per hour over six months could mean hundreds lost, even as costs for tools and subscriptions keep climbing. Without scheduled rate reviews or clear pricing strategies, even busy freelancers see their earnings squeezed by rising costs and inflation. What the Data Says to Do InsteadIf the numbers illuminate the traps, they also point to solutions: Always create a budget first: The most successful freelancers use budget tools or simple spreadsheets from the start and adjust as their business grows.Separate your finances: Open a business checking account before your first invoice and process every client payment and business expense through it.Automate savings for taxes and emergencies: Set aside a fixed percentage of every payment as soon as it clears.Formalize contracts and payment terms: Use written agreements to clarify rates, deadlines, and late fees, reducing payment delays.Review and raise your rates regularly: Leading freelancers benchmark against industry averages and use data to justify annual price increases.Lean on data, not gut instinct: Use financial apps and regular monthly reviews to make spending, saving, and pricing decisions.The Takeaway: Systems and Data Beat Luck Every TimeThe statistics are clear. Most freelancers who fail in the first six months do so not because of a lack of skill or drive, but from avoidable money mistakes. The solution, backed by data, is to build simple routines for budgeting, saving, separating finances, and reviewing rates. Treat your freelance business like a true business from day one, and you dramatically improve your odds of not just surviving, but growing for the long haul. View the full article

-

New Survey: 82% of Freelancers Say Healthcare Access Influences How They Vote

Towards the end of 2025, we circulated a survey to our members, asking how they as freelancers will be affected by the expiration of the Affordable Care Act enhanced subsidies. Of the over 600 respondents, 58% said that they purchase their healthcare plan through the state marketplace. Seventy-seven percent of freelancers said that without the ACA enhanced subsidies, they would lose coverage, downgrade their plans, or need to cut back on essential spending, like housing, groceries, and transportation. Freelancers are overwhelmingly in support of the Affordable Care Act subsidies, with 91% of respondents saying they want to see the ACA subsidies extended. Whether or not freelancers are personally enrolled in state marketplace plans, they heartily support other freelancers’ ability to easily access affordable healthcare. In fact, 82% of freelancers said that access to healthcare is an issue that affects how they vote — a key touchpoint to consider ahead of the June 2026 midterm elections. As the freelance workforce grows, both the government and market must catch up to their needs. Freelance workers put in the same amount of work as any full-time employee; they deserve the same benefits, be it healthcare, sick time, personal leave, and more. Portable benefits present a potential path forward. Although 70% of respondents were unfamiliar at this time with portable benefits, upon explanation, 41% believed portable benefits could improve their lives. See below for more takeaways from the survey. Freelancers make our economy work; we deserve a healthcare system that works for us in turn. View the full article

-

New Survey: 82% of Freelancers Say Healthcare Access Influences How They Vote

Towards the end of 2025, we circulated a survey to our members, asking how they as freelancers will be affected by the expiration of the Affordable Care Act enhanced subsidies. Of the over 600 respondents, 58% said that they purchase their healthcare plan through the state marketplace. Seventy-seven percent of freelancers said that without the ACA enhanced subsidies, they would lose coverage, downgrade their plans, or need to cut back on essential spending, like housing, groceries, and transportation. Freelancers are overwhelmingly in support of the Affordable Care Act subsidies, with 91% of respondents saying they want to see the ACA subsidies extended. Whether or not freelancers are personally enrolled in state marketplace plans, they heartily support other freelancers’ ability to easily access affordable healthcare. In fact, 82% of freelancers said that access to healthcare is an issue that affects how they vote — a key touchpoint to consider ahead of the June 2026 midterm elections. As the freelance workforce grows, both the government and market must catch up to their needs. Freelance workers put in the same amount of work as any full-time employee; they deserve the same benefits, be it healthcare, sick time, personal leave, and more. Portable benefits present a potential path forward. Although 70% of respondents were unfamiliar at this time with portable benefits, upon explanation, 41% believed portable benefits could improve their lives. See below for more takeaways from the survey. Freelancers make our economy work; we deserve a healthcare system that works for us in turn. View the full article

-

Treasuries tread water as gold and dollar break away

Treasury yields are stuck, but gold and the dollar are flashing unusual signals that could push rates after the FOMC, according to the CEO of IF Securities. View the full article

- Today

-

How the Minneapolis shooting of Alex Pretti is impacting gun rights politics for Trump

Prominent Republicans and gun rights advocates helped elicit a White House turnabout this week after bristling over the administration’s characterization of Alex Pretti, the second person killed this month by a federal officer in Minneapolis, as responsible for his own death because he lawfully possessed a weapon. The death produced no clear shifts in U.S. gun politics or policies, even as President Donald The President shuffles the lieutenants in charge of his militarized immigration crackdown. But important voices in The President’s coalition have called for a thorough investigation of Pretti’s death while also criticizing inconsistencies in some Republicans’ Second Amendment stances. If the dynamic persists, it could give Republicans problems as The President heads into a midterm election year with voters already growing skeptical of his overall immigration approach. The concern is acute enough that The President’s top spokeswoman sought Monday to reassert his brand as a staunch gun rights supporter. “The president supports the Second Amendment rights of law-abiding American citizens, absolutely,” White House press secretary Karoline Leavitt told reporters. Leavitt qualified that “when you are bearing arms and confronted by law enforcement, you are raising … the risk of force being used against you.” Videos contradict early statements from administration That still marked a retreat from the administration’s previous messages about the shooting of Pretti. It came the same day the president dispatched border czar Tom Homan to Minnesota, seemingly elevating him over Homeland Security Secretary Kristi Noem and Border Patrol chief Greg Bovino, who had been in charge in Minneapolis. Within hours of Pretti’s death on Saturday, Bovino suggested Pretti “wanted to … massacre law enforcement,” and Noem said Pretti was “brandishing” a weapon and acted “violently” toward officers. “I don’t know of any peaceful protester that shows up with a gun and ammunition rather than a sign,” Noem said. White House deputy chief of staff Stephen Miller, an architect of The President’s mass deportation effort, went further on X, declaring Pretti “an assassin.” Bystander videos contradicted each claim, instead showing Pretti holding a cellphone and helping a woman who had been pepper sprayed by a federal officer. Within seconds, Pretti was sprayed, too, and taken to the ground by multiple officers. No video disclosed thus far has shown him unholstering his concealed weapon -– which he had a Minnesota permit to carry. It appeared that one officer took Pretti’s gun and walked away with it just before shots began. As multiple videos went viral online and on television, Vice President JD Vance reposted Miller’s assessment, while The President shared an alleged photo of “the gunman’s gun, loaded (with two additional full magazines!).” Swift reactions from gun rights advocates The National Rifle Association, which has backed The President three times, released a statement that began by casting blame on Minnesota Democrats it accused of stoking protests. But the group lashed out after a federal prosecutor in California said on X that, “If you approach law enforcement with a gun, there is a high likelihood they will be legally justified in shooting you.” That analysis, the NRA said, is “dangerous and wrong.” FBI Director Kash Patel magnified the blowback Sunday on Fox News’ “Sunday Morning Futures With Maria Bartiromo.” No one, Patel said, can “bring a firearm, loaded, with multiple magazines to any sort of protest that you want. It’s that simple.” Erich Pratt, vice president of Gun Owners of America, was incredulous. “I have attended protest rallies while armed, and no one got injured,” he said on CNN. Conservative officials around the country made the same connection between the First and Second amendments. “Showing up at a protest is very American. Showing up with a weapon is very American,” state Rep. Jeremy Faison, who leads the GOP caucus in Tennessee, said on X. The President’s first-term vice president, Mike Pence, called for “full and transparent investigation of this officer involved shooting.” A different response from the past Liberals, conservatives and nonpartisan experts noted how the administration’s response differed from past conservative positions involving protests and weapons. Multiple The President supporters were found to have weapons during the Jan. 6, 2021, attack on the U.S. Capitol. The President issued blanket pardons to all of them. Republicans were critical in 2020 when Mark and Patricia McCloskey had to pay fines after pointing guns at protesters who marched through their St. Louis neighborhood after the police killing of George Floyd in Minneapolis. And then there’s Kyle Rittenhouse, a counter-protester acquitted after fatally shooting two men and injuring another in Kenosha, Wisconsin, during the post-Floyd protests. “You remember Kyle Rittenhouse and how he was made a hero on the right,” Trey Gowdy, a Republican former congressman and attorney for The President during one of his first-term impeachments. “Alex Pretti’s firearm was being lawfully carried. … He never brandished it.” Adam Winkler, a UCLA law professor who has studied the history of the gun debate, said the fallout “shows how tribal we’ve become.” Republicans spent years talking about the Second Amendment as a means to fight government tyranny, he said. “The moment someone who’s thought to be from the left, they abandon that principled stance,” Winkler said. Meanwhile, Democrats who have criticized open and concealed carry laws for years, Winkler added, are not amplifying that position after Pretti’s death. Uncertain effects in an election year The blowback against the administration from core The President supporters comes as Republicans are trying to protect their threadbare majority in the U.S. House and face several competitive Senate races. Perhaps reflecting the stakes, GOP staff and campaign aides were reticent Monday to talk about the issue at all. The House Republican campaign chairman, Rep. Richard Hudson of North Carolina, is sponsoring the GOP’s most significant gun legislation of this congressional term, a proposal to make state concealed-carry permits reciprocal across all states. The bill cleared the House Judiciary Committee last fall. Asked Monday whether Pretti’s death and the Minneapolis protests might affect debate, an aide to Speaker Mike Johnson did not offer any update on the bill’s prospects. Gun rights advocates have notched many legislative victories in Republican-controlled statehouses in recent decades, from rolling back gun-free zones around schools and churches to expanding gun possession rights in schools, on university campuses and in other public spaces. William Sack, legal director of the Second Amendment Foundation, said he was surprised and disappointed by the administration’s initial statements following the Pretti shooting. The President’s vacillating, he said, is “very likely to cost them dearly with the core of a constituency they count on.” Associated Press writer Kimberlee Kruesi in Providence, Rhode Island, contributed to this report. —Bill Barrow and Nicholas Riccardi, Associated Press View the full article

-

Funding Your Franchise – A Step-by-Step Guide to Get Funding

Funding your franchise is an essential step in ensuring your business’s success. You’ll need to assess your total investment, including franchise fees and operational costs. There are various financing options available, from SBA loans to personal funding sources. Comprehending these avenues can greatly impact your ability to secure the necessary capital. In the following sections, we’ll break down each option and guide you through the application and approval processes. Key Takeaways Assess your total startup costs, including franchise fees and operational expenses, to determine your funding needs. Explore various funding options like SBA loans, traditional bank loans, and personal savings for financing your franchise. Prepare a comprehensive loan package with a solid business plan and financial projections to enhance your approval chances. Maintain a strong credit score and organize required documentation, such as financial statements, to demonstrate creditworthiness to lenders. Consult with a financial advisor or franchise expert to develop an effective funding strategy tailored to your specific situation. Understanding Franchise Financing When you’re considering investing in a franchise, awareness of franchise financing is vital to guarantee you’re making informed decisions. Franchise financing typically includes initial franchise fees, which range from $20,000 to over $100,000, depending on the brand. Well-known franchises, like McDonald’s, can demand substantial upfront investments, sometimes exceeding $2 million. Grasping these costs is fundamental for effective financial planning. Personal funds usually cover 10% to 30% of total expenses, demonstrating your commitment to lenders and enhancing your chances of approval. There are various financing options available, including franchise loans and SBA loans for franchise, which offer favorable terms and can provide up to $5 million. Knowing how to get a franchise loan can greatly impact your franchise funding success. Importance of Funding Your Franchise Securing sufficient funding for your franchise is vital, as it directly impacts your ability to operate effectively and achieve long-term success. Without adequate resources, covering initial franchise fees, equipment costs, and ongoing operational expenses can become challenging. Working capital for small businesses is important, as it helps manage expenses until your franchise generates positive cash flow. You might consider a personal loan for business or explore various franchise financing options, such as how to get a 1 million dollar business loan or a 3 million loan, depending on your needs. Engaging a knowledgeable business advisor can be invaluable in developing a funding strategy that aligns with your financial requirements and helps mitigate risks associated with personal funding. Personal Funding Options When considering personal funding options for your franchise, personal savings often serve as your main source of capital, with many entrepreneurs using a portion of their own finances to showcase commitment to potential lenders. You might likewise think about liquidating assets like 401(k) accounts to gather necessary funds, but be aware of the risks involved, including tax penalties if not handled correctly. Though self-funding gives you control over your investment decisions, it likewise means you’re taking on significant financial risk if your franchise doesn’t succeed. Utilizing Personal Savings Utilizing personal savings can be a strategic choice for funding your franchise, as it allows you to maintain direct control over your investment without the burden of debt. Many franchise owners rely on personal savings to cover 10% to 30% of their franchise costs, demonstrating commitment to lenders when seeking additional financing. Self-funding means you won’t incur interest payments or fees associated with loans, which can greatly aid cash flow management during the startup phase. Nevertheless, relying solely on personal funds poses financial risks, including the potential for substantial loss if the franchise doesn’t succeed. It’s crucial to weigh these risks carefully as you consider using personal savings for your franchise ownership endeavor. Liquidating Assets Effectively Liquidating assets can be an effective strategy for funding your franchise, providing you with immediate cash flow to cover initial costs. By carefully evaluating market conditions, you can maximize your returns from liquidating personal assets like stocks or real estate. Here are three key strategies to keep in mind: Utilize 401(k) Funds: Use the Rollover for Business Startups (ROBS) mechanism to access your retirement savings without penalties. Tap into Personal Savings: Contributing 10% to 30% of your total franchise costs demonstrates your commitment to potential lenders. Engage a Financial Advisor: They can help you navigate the intricacies of liquidating assets, optimizing funding while minimizing tax implications and financial losses. Risks of Self-Funding Self-funding your franchise can seem like a straightforward solution, especially after considering the benefits of liquidating assets. Nevertheless, it comes with significant risks that you should be aware of. Utilizing personal savings or assets can jeopardize your financial security and limit your funds for emergencies. Here’s a quick overview: Pros Cons Direct control High financial risk Demonstrates commitment Limits additional financing Quick access to funds Risk of losing personal assets While self-funding shows commitment to lenders, it may likewise hinder your ability to secure further financing. Financial advisors typically recommend balancing personal investments with external funding options to mitigate these risks effectively. Always assess your financial situation before proceeding. Exploring Franchise Financing Options When considering franchise financing options, it’s essential to understand the various avenues available to fund your investment. You may explore multiple sources that can cater to your specific needs: SBA Loans: These loans can provide up to $5 million for franchise-related expenses with favorable terms and government backing. Conventional Bank Loans: These often require a solid credit history and a detailed business plan, but they can offer lower interest rates for qualified applicants. Rollovers as Business Startups (ROBS): This option allows you to use your retirement funds for your franchise investment without early withdrawal penalties. Additionally, personal funds typically cover 10% to 30% of total costs, demonstrating commitment to franchise financing lenders and aiding in securing business loans for franchise startup. SBA Loans: A Popular Starting Point SBA loans serve as a popular starting point for many franchisees due to their favorable terms and accessibility. These loans are particularly customized for small business owners, offering lower down payments and longer repayment terms, making them an excellent choice for franchise financing. With competitive interest rates, SBA loans can cover initial investment costs and acquire crucial fixed assets necessary for launching your franchise. The SBA 7(a) loan program allows financing up to $5 million, with repayment terms of up to 10 years for equipment and 25 years for real estate. To qualify, you must be included in the SBA Franchise Directory, ensuring you pursue recognized and vetted business opportunities, enhancing your chances for success. Traditional Bank Loans When considering traditional bank loans for your franchise, you’ll need to meet specific eligibility criteria and navigate a detailed application process. Strong credit scores, a solid business plan, and collateral are key factors that lenders look for to secure funding. Comprehending these requirements is essential for streamlining your path to financing, so let’s break down what you need to know. Eligibility Criteria Overview Securing a traditional bank loan for your franchise involves meeting specific eligibility criteria that lenders require to mitigate their risk. Comprehending these requirements is vital for franchise financing. Here are three key factors to take into account: Credit Score: A strong credit score, typically above 680, is fundamental for qualifying for a business loan. Collateral: Many lenders require collateral, like real estate or personal assets, to secure the loan. Financial Documentation: You’ll need to provide documents needed for a business loan, including income statements and tax returns from the past two years. Research banks that offer specialized commercial loans for franchises to improve your chances of securing business loans for franchise startup. This preparation can notably streamline how to get a business loan. Application Process Steps Once you understand the eligibility criteria for obtaining a traditional bank loan, it’s time to focus on the application process. Start by preparing a thorough loan package that includes a detailed business plan, financial projections, and personal assets to demonstrate your repayment capability. A strong credit score, typically 700 or higher, is essential for securing favorable terms, as banks closely review your credit history. Be prepared to submit financial statements and collateral documentation during the application. Approval timelines can vary, often taking weeks to months, so plan accordingly and maintain open communication with your lender. Research specialized commercial financing options for franchise startup loans to identify the best fit for your financing franchise opportunities, especially if you’re considering a million dollar loan or how to get a loan with an LLC. Franchises That Offer In-House Financing Many franchise opportunities come with the added advantage of in-house financing, which can greatly streamline the funding process for aspiring franchisees. Franchises that offer financing directly simplify the capital access, allowing you to focus on launching your business. Here are three key benefits of in-house financing options: Tailored Programs: Many franchises provide financing solutions designed for your specific needs, making it easier to secure funds. Reduced Paperwork: In-house financing typically involves less documentation compared to traditional small business loans for franchise. Favorable Terms: Using in-house financing can result in better terms than a business loan for franchise startup. 401(k) Rollovers or ROBS Using a Rollover for Business Startups (ROBS) can be a smart way to fund your franchise without tapping into your savings or facing early withdrawal penalties. ROBS allows you to use your 401(k) or IRA funds as a retirement plan investment, helping cover franchise fees and other start-up costs. Here’s a quick overview of ROBS: Aspect Details Initial Investment Access to significant capital Business Type Required Must create a C corporation Necessary Consultation Consult a financial professional Equipment and Asset-Based Loans When considering funding for your franchise, equipment and asset-based loans can be a practical choice. These secured loans use the value of your equipment, vehicles, or real estate as collateral, often allowing you to finance up to 100% of the equipment cost. It’s essential to evaluate your startup costs and ongoing expenses carefully, as these loans can help manage your cash flow with predictable monthly payments and potential tax benefits. Definition and Types Equipment and asset-based loans serve as a crucial financial resource for franchise owners seeking to acquire necessary tools and facilities without overwhelming upfront costs. These secured loans use your business equipment, vehicles, or real estate as collateral, making it easier to secure funding at lower interest rates. Here are three key aspects to evaluate: Financing Amount: It typically hinges on the collateral’s value, ensuring lenders have security in case of default. Fixed-Rate Financing: This allows you to predict expenses and manage cash flow effectively. Startup Cost Review: Thoroughly assess your startup costs and ongoing expenses to align financing with your business needs. Understanding equipment financing for startup business and exploring franchise finance options can guide you in how to get a business loan effectively. Benefits of Secured Financing Secured financing offers several benefits that can greatly improve your franchise’s financial stability and growth potential. By using collateral, such as equipment or real estate, you can lower interest rates and increase your chances of loan approval. Equipment loans allow you to finance specific machinery, often with terms matching the equipment’s useful life, which improves your financial planning. Asset-based loans provide flexibility, enabling you to leverage existing assets for additional capital to cover growth or operational expenses. With secured financing, you typically enjoy predictable monthly payments, which aid in cash flow management for franchise owners. Overall, these financing options can considerably reduce upfront costs, making vital equipment and assets more accessible for your business. Evaluating Startup Costs Grasping startup costs is crucial for any franchise owner looking to establish a successful business. Evaluating these costs can help you secure the right financing, such as equipment loans for startup businesses. Here’s what to contemplate: Identify Equipment Needs: Determine what equipment is necessary for your franchise and its associated costs. Explore Financing Options: Research various franchise startup loans and the best small business equipment financing available, focusing on fixed-rate options. Assess Working Capital: Verify you have enough working capital for new business expenses, like marketing and operations, during adherence to business loan guidelines. Alternative Lenders and Financing When you’re exploring funding options for your franchise, alternative lenders can offer a practical solution, especially if you don’t meet the requirements set by traditional banks. These lenders provide fast financing solutions with quicker access to funds, often requiring less documentation than conventional loans. Specialized alternative lending Kiva companies can cater to unique business needs, offering immediate funding options for startups and franchises facing urgent expenses. Nevertheless, it’s essential to compare multiple offers, as interest rates and terms can vary considerably. Although alternative financing can be a lifeline for quick cash, you should be aware of potentially higher interest rates compared to traditional banking options. Always read the fine print to fully understand the associated costs. Friends, Family, and Private Investors Funding a franchise often extends beyond traditional lending sources, and tapping into your personal network can be a practical approach. Friends and family can provide funding with more flexible terms, whereas private investors can improve your resources. To make the most of these relationships, consider the following: Communicate Your Business Plan: Clearly outline your vision and financial projections to build trust. Formalize Agreements: Treat loans or investments as business transactions to protect both parties and maintain relationships. Engage in Open Discussions: Talk about expectations and potential returns to guarantee alignment of interests. Building partnerships with private investors can ease financial burdens and set a solid foundation for your franchise’s long-term success. Loan Application Process When you start the loan application process, you’ll need to gather specific documentation to demonstrate your business’s potential. This includes preparing detailed financial statements and comprehending how your creditworthiness will be evaluated by lenders. Required Documentation Overview Securing a loan for your franchise requires careful preparation and organization of required documentation. This documentation is vital in providing lenders with a clear comprehension of your franchise operations. Here are three fundamental items to include: Financial Statements: Prepare balance sheets and income statements to illustrate your business’s current financial health. Business Plan: A well-researched business plan, along with financial projections, showcases your franchise’s potential for profitability and growth. Personal Assets: Document your personal assets to demonstrate your financial stability and commitment to the franchise investment. Additionally, expect a thorough credit check, as lenders will assess your creditworthiness before approving your loan. Organizing these documents effectively can greatly improve your chances of securing funding. Financial Statement Preparation Preparing financial statements is a critical step in the loan application process, as lenders rely heavily on these documents to assess your business’s financial viability. To meet business loan requirements, include a balance sheet, income statement, and cash flow statement, which together provide a thorough view of your financial health. Make certain these financial statements reflect at least three years of historical data and incorporate projections for the next three to five years. Don’t forget to include personal financial statements detailing your assets, liabilities, and income to further showcase your stability. Utilize accounting software or consult a professional accountant to make sure your statements comply with widely accepted accounting principles (GAAP) and are error-free, enhancing your chances of loan approval. Creditworthiness Evaluation Process After you’ve prepared your financial statements, the next step in the loan application process involves evaluating your creditworthiness. Lenders assess your financial health and repayment ability based on several key factors. Grasping these can help you figure out how to get a million dollar business loan. Credit Score: A thorough credit check reveals your credit score, which is essential for approval. Personal Assets: Demonstrating your personal assets strengthens your application and shows financial stability. Well-Structured Business Plan: Including a detailed plan with financial projections improves your chances. Approval Process Guiding the approval process for franchise financing can be challenging, especially since it varies considerably by lender and the type of loan you’re pursuing. You’ll need to prepare a thorough loan package that includes detailed documentation like your credit history, financial statements, and business projections. Lenders use this information to evaluate your creditworthiness and ability to repay the loan. Grasping the specific lender requirements and criteria is essential to navigate the approval process successfully. The timeframe for approval can range from a few days to several weeks, depending on the complexity of your application. A well-prepared loan package can notably increase your chances of securing the financing needed to launch your franchise. Seeking Guidance for Franchise Financing Steering through the intricacies of franchise financing can be overwhelming, especially after you’ve tackled the approval process with lenders. To navigate this complex environment effectively, consider these steps: Engage a financial advisor specializing in franchise funding to improve your comprehension of financing solutions that fit your needs. Consult a franchise consultant who can provide expert guidance on franchise financing options and help you prepare an all-encompassing business plan and loan package financing. Seek insights from seasoned franchise owners to learn financing strategies that worked for them, helping you avoid potential pitfalls. Using resources like Neighborly can likewise connect you with qualified lenders franchise, ensuring you find customized financing solutions that align with your specific situation. Frequently Asked Questions What Is the 7 Day Rule for Franchise? The 7 Day Rule for franchising mandates that franchisors must provide you with a Franchise Disclosure Document (FDD) at least seven days before you sign any agreements or pay fees. This rule guarantees you have adequate time to review important details about fees, obligations, and the franchisor’s financial performance. It’s designed to promote transparency and protect you from hasty decisions, helping you make an informed choice before committing to a franchise. Why Is It Only $10,000 to Open a Chick-Fil-A? The initial fee to open a Chick-fil-A franchise is only $10,000 since the company retains ownership of the restaurant and covers the majority of startup costs, including real estate and equipment. This model allows for lower financial barriers, encouraging committed franchisees to manage their locations actively. Even though total investments range from $200,000 to $2 million, Chick-fil-A provides extensive training and support, contributing to the franchise’s overall success and profitability. What Are the 4 P’s of Franchising? The 4 P’s of franchising are Product, Price, Place, and Promotion. First, you need to guarantee your product meets customer needs during aligning with your brand. Next, set competitive pricing that reflects your offerings’ value. Then, choose the right location, focusing on accessibility and visibility for your target market. Finally, implement effective promotional strategies to create brand awareness, utilizing any marketing resources provided by your franchisor to attract customers effectively. Can You Get a Loan of $50,000 for a Startup Business? Yes, you can secure a loan of $50,000 for a startup business through various financing options. Consider applying for an SBA loan, which often provides favorable terms for new entrepreneurs. Traditional bank loans are another option but may require strong credit, a solid business plan, and collateral. On the other hand, explore alternative lenders for quicker access to funds. Additionally, some franchises offer in-house financing, simplifying the process further for new owners. Conclusion In conclusion, securing funding for your franchise involves a clear comprehension of your financial needs and available options. By evaluating personal funding sources, exploring loans like SBA options, and preparing a solid business plan, you can effectively navigate the financing terrain. Connecting with friends, family, and private investors may likewise provide valuable support. Finally, seeking professional guidance can further improve your chances of obtaining the necessary capital to launch and sustain your franchise successfully. Image via Google Gemini This article, "Funding Your Franchise – A Step-by-Step Guide to Get Funding" was first published on Small Business Trends View the full article

-

What People Are Getting Wrong This Week: 'It Can Be Too Cold to Snow,' and Other Winter Myths

With the monumental winter storm recently covering most of the nation, now seems a good time to look at some cold and winter weather myths and misinformation. You might be freezing, but there's no excuse for being freezing and ignorant. Myth: A blizzard is a heavy snowstormTechnically, for a storm to be a blizzard, it must have these things: wind speeds of over 35 mph and low visibility (under 1/4 mile) for at least three hours. So you could have blizzard from blowing snow, even if no snow is falling, and you could get a ton of accumulation without it technically ever being a blizzard. (Whether it's a snowstorm or a blizzard likely won't matter to you if you're trapped in it, however.) Myth: It can be too cold to snowThere's some nuance to this one. Extremely cold air contains very little moisture, but it has to be very cold. According to Matt Peroutka, a meteorologist at the National Weather Service, "Once the air temperature at ground level drops below about -10 degrees Fahrenheit, (-20 degrees Celsius), snowfall becomes unlikely in most places." But there could still be something like snow. "There actually is no such thing as too low a temperature for some sort of ice crystal to form and for such crystals to settle out and land on the surface," explains Fred W. Decker of the Oregon Climate Service at Oregon State University, in an interview with Scientific American. "Such a deposit of ice needles is not usually considered 'snow,' however; in the Arctic, for instance, we might refer instead to an ice fog." Myth: You lose most of your body heat through your headI dug deeply into this myth here, but the bottom line is, not wearing a hat accounts for around seven to 10 percent of bodily heat loss because your head accounts for about seven to 10 percent of your body. On the other hand, how cold you feel is subjective, and not wearing a hat in cold weather will probably make you feel colder, even if you're not actually losing most of your body heat. Bottom line: Wear a hat to feel warm in cold weather, or don't wear a hat to prove you're not losing too much heat. Myth: Alcohol keeps you warm in cold weatherIn an emergency situation, drinking brandy from the cask around a rescue St. Bernard's neck is a bad idea. Alcohol makes you feel warm by dilating blood vessels, but it actually lowers your body temperature by drawing heat away from your core, which increases your risk of hypothermia. But, much like "losing heat through your head" myth, drinking alcohol often makes people feel warmer, so if you're safe on your porch and you want a hot toddy, it will seem to "warm you up." Speaking of... Myth: Drinking hot liquids warms you faster than drinking cold liquidsIt's probably impossible to drink enough of a hot liquid to raise the temperature of your body’s core. On the other hand (and for the third entry in a row) it might make you feel warmer to drink something warm, and often that's what you really want, even if it isn't literally making you warmer. So if you're safe on your porch and you want a hot tea to feel cozy, go for it. Traditional winter signs that don’t actually predict anythingThere might be a lot we can learn from folk traditions, but man, they get a lot of things wrong too. The following are some folklore sayings about winter that seem dubious: Thick corn husks, onion skins, and apple skins means a cold winter: The thickness of the outside of vegetables reflect the condition under which they were grown; they don't predict the future. Squirrels with very bushy tails means a cold winter: Like the vegetables, the thickness of a squirrel's tail is generally determined by how healthy and fed it was leading up to winter. More nuts in summer means beefier squirrels. You can predict winter severity by looking at a caterpillar tail: They say the wider the rusty brown sections on a wooly caterpillar, the milder the coming winter will be. The more black there is, the more severe the winter. The problem is, you'd have to look at a lot of caterpillars to even check if this is true, because some would have wider brown stripes and some wouldn't. According to University of Massachusetts entomology Mike Peters in the Farmer's Almanac, “There’s evidence that the number of brown hairs has to do with the age of the caterpillar—in other words, how late it got going in the spring. The [band] does say something about a heavy winter or an early spring. The only thing is … it’s telling you about the previous year.” Weird myth: This winter storm was manmade and designed to freeze a gigantic sea serpentThe weirder corners of the internet are spreading the theory that the Biblical beast Leviathan has awakened, and the winter storm was created by us to freeze it in its tracks. Their evidence is satellite photos which seem to show a gigantic serpent shape in the Atlantic Ocean. As much as I'd welcome a Biblical sea monster rising from the ocean to seek retribution—all hail Leviathan!—it's unlikely to exist. I'm 99.9% certain (still have some hope) these were natural geological formations seen on Google Earth being mistaken for a sea monster as a result of pareidolia, the human tendency to see patterns in random data. Also: We can't control winter storms any more than we can control hurricanes, even if we were about to be eaten by a sea monster. View the full article

-

Congress Urged to Pass Credit Card Competition Act to Aid Small Businesses

In an era where small businesses strive to optimize every dollar spent, a new piece of legislation could significantly impact their bottom line. The National Federation of Independent Business (NFIB) recently urged Congress to pass the Credit Card Competition Act, a bill aimed at reforming credit card processing and alleviating the financial burdens associated with high swipe fees. The NFIB, the leading advocacy group for small businesses in the U.S., emphasizes that these fees have escalated disproportionately, now ranking among the most significant monthly expenses for many small business owners. This legislation, reintroduced by Senators Roger Marshall (R-Kansas) and Dick Durbin (D-Illinois), seeks to foster competition in the credit card processing market. It aims to provide small business owners the flexibility to choose between multiple credit card networks, a right that 92% of NFIB members firmly support. Brad Close, President of NFIB, commented on the impetus behind the bill. “Introducing much-needed competition into the credit card processing market will force networks to compete for their customers, just as small businesses compete for customers every day,” he explained. “Small business owners pay exorbitant fees just to be able to accept credit cards from their customers, and those costs have skyrocketed. It’s time for Washington to advance the Credit Card Competition Act so small business owners can invest in their own employees and communities instead of Wall Street’s bottom line.” The current landscape for credit card fees has left small businesses feeling the financial pinch. Swipe fees, known as interchange fees, can eat into profits, especially for businesses operating with tight margins. The proposed act would allow small business owners the flexibility to utilize different networks, potentially leading to lower fees. This shift might offer significant relief by allowing them to reinvest in their operations, from hiring additional staff to enhancing customer experience. However, while the benefits appear promising, small business owners will want to remain vigilant. Transitioning to new processing networks could introduce complexities regarding compatibility with existing systems and customer preferences. Not all networks offer the same services or ease of use, and businesses would need to evaluate which networks best align with their financial and operational needs. Moreover, the passage of this legislation could disrupt the current balance in the credit card industry, leading to shifts in practices among larger banks and networks. Small business owners might encounter a learning curve as they navigate these changes. It would be essential for them to stay informed about the evolving landscape and be proactive in seeking out the best options. The bipartisan support for the Credit Card Competition Act reflects a growing recognition of the challenges small businesses face. President The President echoed similar sentiments, labeling swipe fees as “out of control.” His early support adds an influential voice to the campaign for reform. For small business owners, staying abreast of this legislative development can provide much-needed insight into financially optimizing their operations. As the NFIB continues its push for the Credit Card Competition Act, small businesses should begin preparing strategies to take advantage of potential cost savings. Understanding these dynamics and preparing for the potential implications of new credit card processing options could give small business owners not only an edge in managing operational costs but also a greater sense of empowerment in a market traditionally dominated by large corporations. For more details on this initiative and to keep track of its progress, small business owners can refer to the NFIB’s website for ongoing updates. The Credit Card Competition Act could ultimately be a game-changer, allowing small businesses to reclaim some financial control and focus on what truly matters: fostering growth and innovation within their communities. For further information, you can read the original press release here. Image via Google Gemini This article, "Congress Urged to Pass Credit Card Competition Act to Aid Small Businesses" was first published on Small Business Trends View the full article

-

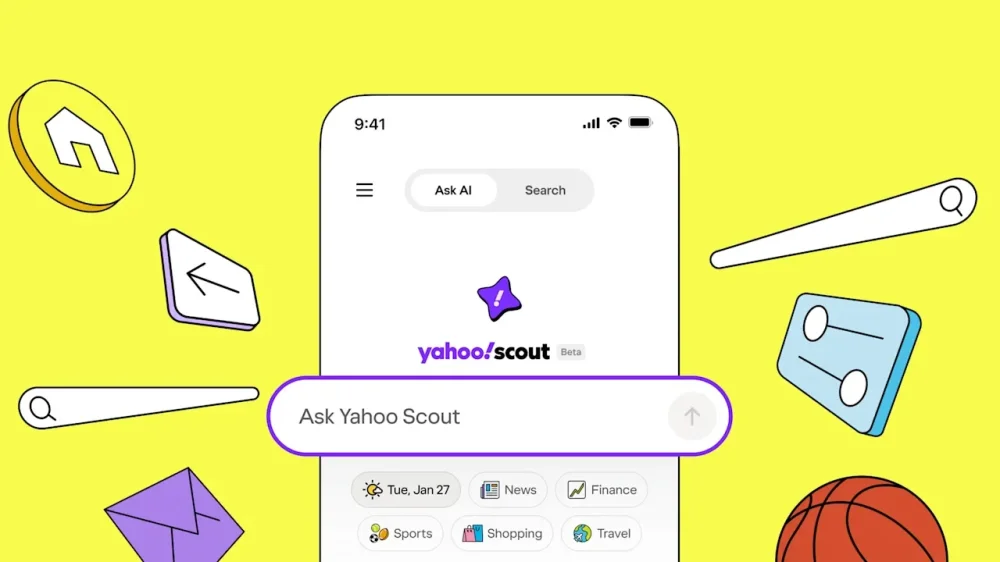

Yahoo! Scout – Yahoo’s return to search and web discovery

Yahoo has launched its first version of its AI-based answer engine named Yahoo! Scout. Yahoo! Scout is available at scout.yahoo.com and is also embedded through Yahoo’s massive network of sites; Yahoo News, Finance, Mail and of course, Yahoo Search. Think of it as a Yahoo-branded AI companion for Yahoo users, that is there to help you along the way within those specific properties. What is Yahoo Scout. Yahoo Scout is Yahoo’s take at an AI search engine and companion, much like Google’s AI Mode or OpenAI’s ChatGPT, but with a flare from Yahoo. Yahoo told me that they wanted Yahoo Scout to have personality, to make it fun and engaging for users to interact with and allow all consumers of all ages to easily use and understand. When you first visit Yahoo Scout, you are greeted with a fun home page, with a search box, a fun slogan and an animated icon above it, making it feel friendly and warm to use. There are also suggested searches below the search box, including ways to filter those suggestions based on topics such as news, finance, sports, shopping and travel. On the left are your previous queries, so you can go back in time and pick up from where you left off. Here is a screenshot of the home page – this one has a cowboy hat, but you can find a crystal ball, gold medal, walking cartoon brain, and much more. Yahoo Scout’s advantage. The Yahoo Search team gave me early access to play around with Yahoo Scout and while the interface is familiar to some of its competitors, the Yahoo-only elements do stand out as unique to Yahoo. Yahoo’s advantage over many other companies doing AI in Search is that it already has a massive user base across Yahoo Mail, News, Finance and even search. Yahoo has over 500 million user profiles, and stores data such as queries, usage, intent, and more. It also has over one billion entities in its knowledge graph, and 18 trillion consumer events and signals across all those properties. Yahoo can use this to make a more personal AI-search experience. It can also categorize queries better than most because of this data. Note, Yahoo is the second largest email company and third largest search engine, the company told me. Yahoo Scout can incorporate its rich content from its properties directly into the responses, including the best of Yahoo such as Yahoo Finance widgets, detailed financial information, tables and citations. Weather results, news results and much more. “Search is fundamentally changing, and our team has been inspired to use our decades of experience and extremely rare assets to create something uniquely useful for Yahoo’s hundreds of millions of monthly users,” said Jim Lanzone, CEO of Yahoo. “This beta launch is just the starting point. From search to our industry-leading verticals, Yahoo Scout will help our users accomplish their goals online faster and better than ever before.” Sending traffic to you, the publisher. Jim Lanzone, the CEO of Yahoo, told me that Scout is very much close to heart with Yahoo’s original mission of being the trusted guide to the internet. And thus from the ground up in building Yahoo Scout, Yahoo incorporated ways to honor the relationship with the open web by driving traffic downstream, to the content creators. Yahoo Scout responses have big and wide blue highlights over its textual responses, that when overlayed by your mouse cursor, can be clicked on to go to the source of that response. Each response also has a “featured source” that is bright and easy to see and click on. Yahoo uses tables, imagery and other methods to highlight content, plus it promotes relevant news articles and sources throughout the answers. Jim Lanzone told me that the first iterations of AI engines did not do nearly enough to send traffic downstream, to where the content of those answers were coming from. Yahoo wanted to set an example on how to try to do this right. There isn’t enough revenue out there for every publisher to make licensing deals with AI companies and the way, historically, the relationship worked, and worked well, was to send traffic to those sources. Here is an example of how Yahoo Scout has links to sources – hovering over that blue highlight, shows the source and you can click on it to navigate there. The purple highlight, “Read more” featured source section also aims to drive traffic downstream: CTR expectations. I asked Yahoo, what is the expected click-through rate from Yahoo Scout to publishers. The truth is, they did not know. They hope to learn a lot when it goes public and iterate to continue to improve clicks downstream, they told me. This is its first release of Yahoo Scout and real user data should be telling. What they expect is that query length with be longer in Yahoo Scout than Yahoo Search, ad loads will be lighter and they are all hoping there will be a much higher CTR than the industry average. Yahoo promised me that they will build a way to let publishers see impressions and click data at some point in the future. Maybe a Yahoo Webmaster Tools without the crawling and indexing data, since that is still powered by Microsoft Bing. Yahoo Scout in every Yahoo property. You will be able to find Yahoo Scout through all of the Yahoo properties: Yahoo Search will incorporate AI summaries powered by Yahoo Scout Yahoo News will give you key highlights from articles and even incorporate the daily digest audio summary Yahoo Finance will incorporate a new Analyze button also powered by Yahoo Scout Yahoo Mail will also summarize your emails with AI and even extract actionable items, like adding items to your calendar. Examples of Yahoo Scout in action. Here are some examples of Yahoo Scout, it is not perfect, but for a 6 month project, I have to say I am impressed. I asked Yahoo Scout with some help on how SEO works and it gave a nice response (of course, SEO is complex and not everyone would agree with this response). There are citations throughout the summary: I asked it to give me some sources of sites to use to find content on the topic as a follow up to that query. Clearly there are many missed opportunities here to link out more, whcih I shared with Yahoo and they agreed. I asked Yahoo Scout how can I navigate to these sources mentioned above and it did give me links at that point: Here is a screenshot of another citation, when you hover your mouse cursor over it: Here are some other searches I tried including: Entertainment: As you can see, it incorporates news articles, with larger graphics in very clickable card formats. Finance: For finance-related queries, Yahoo brings in Yahoo Finance. I was not able to generate stock charts, although in a demo I was given, I was shown that live. So maybe it was being worked on during my tests: Weather: I was testing this Sunday morning, as the big snow storm was touching down in New York: I was able to get a Yahoo Weather chart: With tips on how to stay warm: Sports: The Super Bowl is coming up and I was hoping to get some predictions: As a Jets fan all my life, I wanted to know if the Jets will have any chance at winning the Super Bowl in the next 10 years – I guess not likely. But I am happy to see that chart embedded in the answer: Shopping: And then Yahoo gave me some advice on how to dress during this weather: Ads and commissions. Yahoo Scout will have ads at the bottom of some of the responses. Plus, the commerce-related queries will be monetized through affiliate commissions, which is a common revenue method across the web. Yahoo told me the ads are still powered by Microsoft Advertising, but Yahoo controls how those ads appear within these interfaces. These ads will be charged on a CPC basis, not an impression basis, as some other AI engines announced. Here is a screenshot of a Progressive Insurance ad for questions about car insurance. Here is a screenshot of product results that are labeled, “Yahoo may earn commission from these links.” How Yahoo Scout came about. For about three years now, Yahoo has been hinting about making a return to the search game. In 2009, Yahoo made a deal with Microsoft to have Microsoft power Yahoo Search and that was the end of Yahoo building its own search technology. Literally, Yahoo has outsources Search since then and has not done its own search technology until now, with Yahoo Scout. That is until now. About six month ago, Yahoo acquired Eric Feng’s company to lead up consumer search at Yahoo. Eric Feng is known for co-founding an online video platform startup called Mojiti, which was acquired by Hulu in 2007, in which Eric became the founding CTO and head of product at Hulu. But before that, he worked at Microsoft in the Research labs, working on solving problems with Search. “Yahoo’s deep knowledge base, 30 years in the making, allows us to deliver guidance that our users can trust and easily understand, and will become even more personalized over the coming months,” said Eric Feng, Senior Vice President and General Manager of Yahoo Research Group, the creators of Yahoo Scout. “Yahoo Scout now powers a new generation of intelligence experiences across Yahoo, seamlessly integrated into the products people use every day.” Jim Lanzone, the CEO of Yahoo, who in his own right has a long history in search, as the CEO of Ask.com for many years, told me that Eric Feng has been instrumental in building out Yahoo Scout in the past 6 months. And there is so much more to come, this is just the first public release and you can expect many more interations and improvements to Yahoo Scout in the near future. Anthropic. Yahoo Scout is not built on its own LLM, Yahoo partnered with Anthropic to use Claude as Yahoo Scout’s primary foundational AI model. Anthropic is one of the top artificial intelligence companies in the market. It has arguably the best AI for coders and coding frameworks named Claude. Anthropic was founded in 2021 by former members of OpenAI, including siblings Daniela Amodei and Dario Amodei, who serve as president and CEO, respectively. In September 2023, Amazon announced an investment of up to $4 billion. Google committed $2 billion the next month. As of November 2025, Anthropic has an estimated value of $350 billion. While the foundational AI models use Anthropic, Yahoo has customized it and incorporates Yahoo’s proprietary data to make it unique and useful. Doing these searches on Anthropic will not give you anywhere close to the same experience as you would get on Yahoo Scout. “When you’re serving hundreds of millions of users, you need AI that can do more than retrieve information – it has to reason, synthesize, and explain. Yahoo is building toward a more personalized, trustworthy kind of search, and Claude’s ability to deliver that quality of guidance at scale is at the heart of Yahoo Scout,” said Ami Vora, Head of Product at Anthropic. Microsoft Bing. Plus, Microsoft Bing data is also incorporated into Yahoo Scout. The underlining search index is from Bing, but the responses, ranking, and experience is all Yahoo. “Yahoo Scout also builds on Yahoo’s long-standing relationship with Microsoft by leveraging Microsoft Bing’s grounding API. By combining this API with Yahoo’s trusted data and content ecosystem, Yahoo Scout ensures that answers are informed by authoritative sources from across the open web, Yahoo wrote. Plus, Yahoo is also joining Microsoft’s Publisher Content Marketplace pilot. Microsoft’s Publisher Content Marketplace can help support revenue for publishers, the company said. Yahoo wrote this is, “reflecting a shared commitment to expanding publisher reach, connecting original work with new audiences, and supporting sustainable revenue opportunities for publishers.” Hallucinations. I asked about hallucinations and Yahoo told me they put in a lot of guardrails to prevent hallucinations as much as possible. The Yahoo entity graph, the news content, and other Yahoo-specific data are used to ground the responses so that communications should be minimal and less than some other AI engines. In fact, they believe the hallucination rate would be “very low” compared to other AI engines. Agents. Many AI-engines are releasing agentic experiences, AI-agents, to complete tasks for you. Google, OpenAI and Microsoft are investing big time into this. Yahoo Scout has added some elements of this including inside of Yahoo Mail to add calendar events, smart compose features and more. Yahoo promises a lot more to come on this front. Why we care. It is such an exciting time for search these days and to see Yahoo enter the space, especially for someone like me who has been in search for over 20 years, it is just so nice to see. Seeing industry legends, such as Jim Lanzone, Eric Feng and Brian Provost take up search with AI is making search fun again and I very much look forward to seeing what else Yahoo has up its sleeves. The Yahoo Scout answer engine is available today in beta for U.S. users at Scout.Yahoo.com and in the Yahoo Search app on iOS and Android. For more about Yahoo Scout, see this help document. View the full article

-

Daily Search Forum Recap: January 27, 2026

Here is a recap of what happened in the search forums today...View the full article

-

TikTok's New Terms of Service Has Raised Alarm Bells