All Activity

- Past hour

-

I’ve been using my company credit card for personal expenses

A reader writes: I used my company credit card for personal expenses over a long period (so, definitely not accidental purchases). I assumed it was somewhat frowned upon, but thought it was fine as long as I paid it off on time on my own dime. The balance amount over the months has ranged from $1,000 – $4,000. I did not realize it was a violation of agreements until I neglected to pay the balance for one month. (Before that, I had been paying off the full balance every month.) I did end up satisfying the balance, but obviously that invited scrutiny into how I have been using the card and they went back and looked at the history of transactions. HR set up a call with me to ask about the situation, lowered the credit limit on the card, and asked if I wanted to just cancel the card. I said to go ahead and cancel the card; now that I understand the cardholder agreement better, I don’t anticipate using the card again for personal expenses. Would it have been better to keep the card and just not use it to prove that I could be responsible? I apologized and took responsibility, but I am experiencing overwhelming shame and anxiety over the situation, and have reached out for professional help (my therapist and a financial counselor). This is tied to a larger mental health, shopping addiction, and impulse control issue I have been seeing a therapist about. I don’t really want to have to reveal that part to work, so I haven’t as of now. I looked briefly into our EAP and it felt risky to seek help there. I didn’t realize it was potentially a terminable offense. I do realize that now after researching the issue once HR scheduled a meeting with me. And I don’t have a professional or reasonable explanation for using the card in that way, so I realize how bad it is and looks. I obviously worry that this puts me at the front of the line to be fired or let go, so I am wondering if I should start seriously job searching. I realize I am 100% in the wrong and I feel physically unwell about the situation. I would like to save my job but I also know that may not be realistic. Besides this, I have had good performance and recently (in the last month) received a merit increase. First, for the record: as you know now, this wasn’t okay to do. You were borrowing their credit for your own personal use, and you opened them up to the risk that you’d rack up charges you couldn’t pay off immediately, and it’s not okay to do that in some else’s name without their explicit consent. But it doesn’t sound like you’re about to be fired over this. HR met with you about it, they addressed it, you paid off the balance, and they gave you the option of canceling the card. If they were getting ready to fire you, they’d be a lot less likely to have given you a choice; they would have simply canceled the card. They also likely would have indicated the situation was still an open one, but it sounds like they consider it dealt with. Their perspective is most likely that you misunderstood the agreement but you paid it all off every month so you weren’t stealing from them, it’s been addressed, and unless it happens again, it’s been handled. They’re obviously not going to be happy about it — but based on how they’ve handled it so far, it doesn’t sound like they’re gearing up to fire you. It would likely be a very different outcome if they had been paying the expenses you charged or if you built up a balance you couldn’t pay off yourself immediately (like this person who racked up $20,000 in personal expenses on his company card). If I were your boss and you were otherwise a good employee, I’d be concerned that this happened, it would make me doubt your judgment, and it would take time to build trust back, but I wouldn’t be leaning toward firing you over it unless there were other issues, particularly around trust and responsibility. I do think you need to talk to your boss about it if you haven’t already — raising it proactively if she doesn’t — and tell her you’re mortified and nothing like this will ever happen again. I’d want to hear that in her shoes. In doing that, you’ll also get a better sense of where she stands on all of this. That conversation might make it clear that she considers it handled and in the past, or it might make it clear that she doesn’t — but either way, it’ll be a helpful discussion to have. In answer to your question about whether it would have been better to keep the card open and just not use it, I don’t think it really matters one way or the other. If anything, as your boss I’d probably prefer that you chose to close it so it didn’t remain something that I’d have to check periodically. The post I’ve been using my company credit card for personal expenses appeared first on Ask a Manager. View the full article

-

Average down payment falls amid price cooling

The typical homebuyer's down payment in the United States decreased 1.5% year over year to $64,000 in December, Redfin said. View the full article

- Today

-

List of Top 10 Franchises and Their Costs

When considering franchise opportunities, comprehension of the costs associated with each option is essential. The top 10 franchises vary greatly in investment requirements, from affordable options like Cruise Planners at $10,995 to more expensive choices like Bojangles, which exceeds $2.6 million. Analyzing these costs will help you evaluate financial commitments effectively. As you explore these franchises, you’ll discover not just their investment ranges but likewise what they offer in return. Key Takeaways Franchise costs range widely, from under $25,000 for Cruise Planners to over $1 million for traditional restaurants like Bojangles. Mr. Rooter has an initial franchise fee of $50,000 to $70,000, with total startup costs between $100,000 and $200,000. Oxi Fresh Carpet Cleaning requires an initial franchise fee of $46,900, falling within the $25,000 to $49,999 investment category. Blue Moon Estate Sales has an investment range between $39,840 and $80,850, making it a mid-tier franchise option. Understanding ongoing fees, such as royalty fees and marketing contributions, is crucial for evaluating franchise profitability. Overview of Top 10 Franchises When exploring the terrain of franchise opportunities, you’ll find that the top 10 franchises stand out for their strong performance and owner satisfaction. These franchises, evaluated through extensive data from 34,000 franchise owners, showcase a mix of brand reputation and market demand. For instance, Mr. Rooter ranks prominently as a home service provider, highlighting the fundamental nature of its offerings. Costs for these franchises vary considerably, with options available from under $25,000 to over $1 million. Furthermore, it’s crucial to review the Franchise Disclosure Document (FDD) and consider the highest ongoing royalty fee associated with each opportunity. The Franchise 500 list serves as a valuable resource for traversing this diverse list of franchises and costs. Franchise 1: Cost Breakdown Understanding the cost breakdown for Mr. Rooter is crucial for prospective franchisees. The initial franchise fee typically ranges from $50,000 to $70,000, which covers the right to operate under the Mr. Rooter brand. Total startup costs can vary between $100,000 and $200,000, influenced by location and specific operational needs. In addition, you’ll need to account for ongoing royalty fees, usually around 5% of your gross sales, which contribute to continued brand support. Mr. Rooter also provides extensive training programs and ongoing assistance, helping you tackle operational challenges effectively. The franchise’s solid reputation in the plumbing industry improves its attractiveness and potential profitability, making it a viable option for those looking to invest in a home services franchise. Franchise 2: Cost Breakdown Franchise opportunities vary considerably regarding initial investment and ongoing costs, as seen with Mr. Cruise Planners, which starts at an initial investment of $10,995. This cost includes training and coaching for a home-based travel agency model. Conversely, Jazzercise requires a franchise fee of $1,250, but you’ll need to budget for additional equipment and facility setup costs. Vanguard Cleaning Systems offers franchise fees between $5,500 and $36,600, advising thorough research because of the nonrefundable nature of these fees. If you’re looking into Blue Moon Estate Sales, expect an initial investment between $39,840 and $80,850, whereas Oxi Fresh Carpet Cleaning’s initial franchise fee is $46,900, recognized for its success in the cleaning industry. Franchise 3: Cost Breakdown Mr. Rooter operates in the home services sector, and its franchise fees are part of a broader investment that varies by location and market conditions. Here’s a breakdown of costs across different franchise investment ranges: Investment Range Example Franchises Under $25,000 Cruise Planners: $10,995 $25,000 to $49,999 Blue Moon Estate Sales: $39,840 – $80,850 $50,000 to $74,999 bioPURE: $67,600 – $100,500 Understanding these tiers helps you gauge your financial commitment when considering a franchise. With options ranging from affordable to more significant investments, it’s essential to assess your budget and business goals before plunging in. Franchise 4: Cost Breakdown When considering a franchise, it’s vital to understand the initial investment breakdown and ongoing fees involved. You’ll find that initial costs can vary considerably, from as low as $10,995 for Cruise Planners to over $3 million for a Bojangles’ restaurant. Moreover, ongoing fees, which often include royalties and marketing contributions, play an important role in your overall financial commitment as a franchisee. Initial Investment Breakdown Comprehending the initial investment breakdown for Franchise 4 is vital for anyone considering this opportunity. The costs can vary greatly, so it is important to understand where your money will go. Here’s a concise breakdown: Cost Category Estimated Range Description Franchise Fee $20,000 – $50,000 Upfront cost to join the franchise. Equipment and Supplies $10,000 – $30,000 Necessary tools for operation. Initial Marketing $5,000 – $15,000 Costs to promote your new business. Location Setup $15,000 – $40,000 Expenses for leasing and renovating. Working Capital $10,000 – $25,000 Funds to cover operational expenses. Understanding these components helps you evaluate the financial viability and potential return on investment for Franchise 4. Ongoing Fees Overview After evaluating the initial investment for Franchise 4, it’s important to understand the ongoing fees that will affect your long-term financial planning. Typically, ongoing fees include royalty fees, which vary by brand and are calculated as a percentage of your gross sales. You’ll likely need to contribute to a national or regional marketing fund, usually between 1% and 5% of your sales. Furthermore, operational costs like rent, utilities, and employee wages are vital for daily operations. Some franchises charge specific fees for training and support services, which may be billed annually or monthly. Be sure to review the franchise agreement closely to identify all ongoing fees and expenses, ensuring transparency and effective budgeting for your franchise. Franchise 5: Cost Breakdown When considering Franchise 5, it’s vital to understand the initial investment and ongoing fees involved. The initial investment often includes the franchise fee and various start-up expenses, which can range widely based on the brand. Moreover, ongoing royalties can impact your profitability, making it imperative to analyze these costs carefully before committing. Initial Investment Overview Grasping the initial investment is crucial when considering a franchise, as costs can markedly vary across different options. You’ll find franchises priced under $25,000, like Cruise Planners at $10,995 and Jazzercise with just $1,250 in fees. If you’re looking at the $25,000 to $49,999 range, Blue Moon Estate Sales needs approximately $39,840 to $80,850, and Oxi Fresh Carpet Cleaning costs around $46,900. For investments between $50,000 and $74,999, bioPURE ranges from $67,600 to $100,500, whereas Caring Transitions costs between $58,912 and $82,712. Finally, franchises over $100,000 include British Swim School at about $110,240 and Bojangles, which can reach between $2,600,320 and $3,779,700 for traditional locations. Ongoing Fees Analysis Ongoing fees are a critical aspect of running a franchise, and comprehending them can help you gauge your potential profitability. These fees typically include royalty payments, often ranging from 4% to 8% of gross sales, which support brand marketing and services. Furthermore, franchises usually require a contribution to a national marketing fund, around 1% to 3% of gross sales, ensuring consistent promotion. You may likewise encounter technology and software fees, varying by operational needs, along with training and operational support costs. Fee Type Percentage of Gross Sales Description Royalty Fees 4% – 8% Fund brand marketing and support services National Marketing Fund 1% – 3% Consistent brand promotion across locations Technology Fees Varies Based on franchise operational needs Training Costs Varies May be included or additional expenses Operational Support Varies Ongoing assistance for franchisees Franchise 6: Cost Breakdown Grasping the cost breakdown of Franchise 6 is essential for anyone considering this investment opportunity. Franchise costs can vary considerably, typically ranging from under $25,000 to over $1 million, making it important to evaluate your budget. For instance, a lower-cost franchise like Cruise Planners requires an initial investment of $10,995, whereas a traditional restaurant like Bojangles demands between $2,600,320 and $3,779,700. If you’re looking at franchises in the $25,000 to $49,999 category, Oxi Fresh Carpet Cleaning has an initial fee of $46,900. At the same time, British Swim School, which falls in the $100,000 to $199,999 range, approximates around $110,240. Comprehending these costs, including franchise fees and startup expenses, is critical for evaluating your financial commitment. Franchise 7: Cost Breakdown When considering an investment in Franchise 7, it’s crucial to understand the financial obligations you’ll be taking on. Here’s a breakdown of the costs you can expect: Initial Franchise Fee: The starting fee for Franchise 7 is $49,500. Total Investment Range: You’ll need between $78,200 and $99,120 to get started. Additional Costs: Keep in mind other expenses, such as equipment, inventory, and marketing. Ongoing Royalties: You may as well have to pay ongoing royalties, which can impact your overall profitability. Understanding these costs will help you make an informed decision. Be sure to weigh these financial commitments against your budget and financial goals before jumping in. Franchise 8: Cost Breakdown Franchise 8 offers a unique investment opportunity with a cost structure that potential franchisees should carefully evaluate. The total investment can range considerably, from under $25,000 to over $1 million, depending on the brand and industry. For instance, Cruise Planners requires an initial investment of $10,995, whereas Bojangles can demand between $2,600,320 and $3,779,700 for traditional locations. Other franchises, like Oxi Fresh Carpet Cleaning, need around $46,900 to start, and British Swim School costs roughly $110,240. In addition to initial franchise fees, ongoing fees and royalties can impact your overall profitability. Therefore, comprehending the complete breakdown of investment costs, including equipment and operational expenses, is crucial for making informed decisions about franchise opportunities. Franchise 9: Cost Breakdown When you consider the costs associated with franchises, it’s crucial to understand the initial investment, ongoing fees, and potential return on investment. Each franchise option presents a unique financial commitment, with initial fees varying widely, from under $25,000 to several million. Initial Investment Overview Steering through the initial investment terrain for franchises reveals a wide spectrum of costs, making it essential for potential franchisees to understand what to expect. Here’s a breakdown of initial investment ranges you might encounter: Under $25,000: Options like Cruise Planners ($10,995) and Vanguard Cleaning Systems ($5,500 to $36,600) are available. $25,000 to $49,999: Oxi Fresh Carpet Cleaning costs about $46,900, whereas Blue Moon Estate Sales ranges from $39,840 to $80,850. $100,000 to $199,999: British Swim School requires around $110,240, and BrightStar Care varies from $112,459 to $231,538. Over $300,000: High-end franchises like Menchie’s Frozen Yogurt demand between $300,000 and $350,000. Understanding these costs helps you make informed decisions. Ongoing Fees Explained Ongoing fees are a vital aspect of franchise ownership that you need to comprehend, as they can greatly affect your bottom line. These fees typically include royalty fees, which range from 4% to 10% of gross sales, providing franchisors with a steady revenue stream. Furthermore, marketing fees often sit at 1% to 3% of gross sales to support brand visibility. Fee Type Percentage of Gross Sales Royalty Fees 4% – 10% Marketing Fees 1% – 3% Advertising Fund Fees Varies (fixed or % of sales) Remember to also budget for operational expenses like rent and utilities, which vary greatly by location and business type. Comprehending these ongoing fees is essential for evaluating your profitability. Potential ROI Insights Evaluating the potential return on investment (ROI) for a franchise can provide valuable insights into its financial viability. Franchises vary widely in initial investment, so comprehending costs is crucial. Here are four key factors to take into account: Initial Investment: Costs can range from $1,250 to over $3 million, affecting your ROI. Franchise Fees: Initial fees may be nonrefundable, so assess total costs, including royalties and operational expenses. Revenue Growth: Many top brands report strong revenue growth, indicating potential profitability. Financial Performance Representations: Analyze the Franchise Disclosure Document (FDD) for insights into expected revenues and profitability to aid your ROI evaluation. Frequently Asked Questions What Is the Cheapest Most Profitable Franchise to Own? The cheapest and most profitable franchise you can consider is Cruise Planners, with an initial investment starting at $10,995. This franchise not merely has a low entry cost but furthermore benefits from a strong support system and a proven business model. Moreover, franchises like Jazzercise and Vanguard Cleaning Systems offer various price points, but Cruise Planners stands out because of its affordability and potential for significant earnings in the travel industry. Which Franchise Is Best and Low Cost? When you’re looking for a low-cost franchise, consider options like Cruise Planners, which requires an initial investment of $10,995 and offers extensive training. Jazzercise is another affordable choice with a franchise fee of only $1,250, ideal for fitness enthusiasts. Vanguard Cleaning Systems provides flexibility with fees ranging from $5,500 to $36,600. Each of these franchises offers a viable entry point into their respective markets, balancing affordability and potential profitability. What Franchise Costs the Most? The franchise that costs the most to start is Bojangles, with initial investment costs ranging from $2,600,320 to $3,779,700 for traditional restaurant locations. This significant financial commitment reflects Bojangles’ established brand and operational requirements. Other high-cost franchises include Boston’s Pizza Restaurant & Sports Bar and Goldfish Swim School, with respective initial investments of up to $2,757,500 and $3,723,930, highlighting the diverse range of business models in the franchise industry. What Is the Most Profitable Franchise? The most profitable franchise typically combines strong brand recognition with a reliable business model. Fast food chains like McDonald’s often lead because of their global presence and effective marketing strategies. Service franchises, such as Anytime Fitness, likewise show high profitability, benefiting from recurring revenue. Key factors to evaluate include initial investment, training support, and market demand, as these elements greatly impact your potential return on investment and overall success in the franchise industry. Conclusion In conclusion, grasping the investment costs associated with various franchises is crucial for making informed decisions. Each franchise offers unique opportunities, with costs ranging from $10,995 for Cruise Planners to over $2.6 million for Bojangles. By carefully evaluating these financial commitments, potential franchisees can better align their budget with their business goals. This analysis highlights the importance of thorough research and financial planning in the franchise selection process, ensuring a more strategic investment in the future. Image via Google Gemini This article, "List of Top 10 Franchises and Their Costs" was first published on Small Business Trends View the full article

-

The Rise of Longevity Fitness

You don’t have to want to live forever (a la the millionaire-immortality-influencer Bryan Johnson) to want to live longer. I’ve seen a larger shift in the fitness industry lately, where a focus on “longevity” has replaced where you might have once seen the words “beach body.” All around us, the language has shifted from "get shredded" to "increase healthspan," from "tone up" to "build bone density." In this new era, the goal isn't just looking good at the beach, but making sure you can still walk on that beach when you're ninety. On its face, this is a welcome change. I’ll always advocate for metrics of success that are less about how you look in a mirror, and more about how well your body functions across decades. At the same time, I’m skeptical of the ways "metabolic flexibility," "muscle mass preservation," and "inflammation control" are replacing "beach body" in the wellness lexicon. Is this truly progress in how we think about health? Again: A fundamental reimagining of why we exercise is not altogether bad. I’m just not convinced that’s what’s happening here. Is this obsession with longevity actually in good faith? Or are we being sold the same old products and insecurities, now wrapped in shiny new scientifically sounding packaging? What is the science behind longevity fitness?Beneath the fresh terminology, much of the longevity fitness advice in my algorithm is pretty familiar. Lift weights, do cardio, eat whole foods, get enough sleep, and manage stress? These are all the same recommendations that have anchored public health guidance for decades. Going a little deeper, studies do consistently show that muscle mass is one of the strongest predictors of longevity and independence in older age. Cardiovascular fitness is so strongly correlated with lifespan that some researchers have called it the single best predictor of mortality. "Instead of optimizing for short-term aesthetics or peak performance, longevity-focused movement optimizes for metabolic health, hormonal stability, and functional strength over time," says Dr. Katheleen Jordan, chief medical officer at Midi Health, a virtual care clinic focused on women in midlife. "Resistance training preserves muscle mass and bone density, which are critical predictors of fall risk and independence as we age. Muscle mass itself and cardiovascular fitness improves our metabolism and insulin sensitivity." This matters especially for women, who face specific challenges as they age. Women lose muscle mass faster than men after menopause and are at higher risk for osteoporosis. Plus, the cultural pressure to stay small has historically steered women away from the heavy lifting that could protect their bone density. "Fitness used to often be defined by one number on a scale, so it's exciting to see that we have gone beyond that with a greater understanding that many things define fitness," Jordan says. In this way, the longevity fitness framework pushes a truly helpful counter-narrative to diet culture, one where strength is more than just aesthetics. How longevity fitness can be used to rebrand products you don't needSo, on one hand, a focus on longevity does feel like progress: valuing strength over skinniness and thinking in decades rather than weeks. On the other hand, it's yet another set of standards to meet, and another source of anxiety about whether you're doing enough. "A lot of what's being marketed as new longevity or biohacking is actually reinforcing long trusted ideas around fitness, but with new language," Jordan says. This isn't necessarily nefarious—reframing exercise around long-term health rather than short-term aesthetics is genuinely valuable. But it does raise questions about who benefits from this linguistic shift. Often, it's the same wellness industrial complex that previously profited from body insecurity, now profiting from aging anxiety. In this way, the fitness industry has found a way to rebrand the same old products—like supplements or wearables—along with hawking some new ones, like direct-to-consumer "biological age” tests. But even a seemingly legit “biological age” test won’t really give you any actionable insights into living longer. That company will, however, try to sell you a supplement that you certainly don’t need. "As with any industry, there are some bad actors and we should be mindful of interventions that promise outsized results," Jordan says. "Healthspan cannot be hacked quickly or swallowed in one pill.” The interventions proven to have some impact on healthspan—exercise, nutrition, sleep, stress management, not smoking—are decidedly unglamorous. Myths about longevity fitnessIt’s no surprise that the longevity fitness space is rife with oversimplifications and outright myths. Here are some I kept coming across in my research that warrant skepticism: The idea that you can "biohack" your way to dramatic life extension. Despite the promises of longevity influencers, there's no evidence that any supplement, cold plunge protocol, or red light therapy device will add decades to your life. That more data equals better health. Obsessively tracking every health metric can become counterproductive, leading to stress that ironically undermines the benefits of all the healthy behaviors you're tracking. That longevity fitness can compensate for structural inequality. Your zip code is a better predictor of your lifespan than your VO2 max. Access to healthcare, safe places to exercise, fresh food, and economic security matter enormously. Individual optimization can't overcome systemic disadvantage. The pros and cons of the longevity fitness movementSo where does this leave us? The longevity fitness movement contains both genuine progress and, predictably, a lot of repackaged hype. The emphasis on strength, cardiovascular fitness, and metabolic health rests on solid science. And the shift from pure aesthetics to actual health-focused goals is meaningful, particularly for women escaping a lifetime of diet culture. But this shift isn’t perfect. In many ways, “healthspan” allows us to talk about the same old snake oil supplements and unattainable beauty standards, just with fancier language. It’s yet another arena for optimization, full of expensive and often unnecessary interventions. I recommend a middle ground. Embrace the core insights of longevity fitness—that exercise is about building a resilient, capable body for the long haul—while rejecting the anxiety and consumerism that often accompany it. Because in the end, what's the point of extending your healthspan if you spend all those extra healthy years anxiously monitoring whether you're doing it right? View the full article

-

7 Best Times for Posting on Social Media Platforms for Maximum Engagement

Comprehending the best times to post on social media can greatly improve your engagement levels. Each platform has its peak times based on user activity, which varies from Facebook to TikTok. For instance, whereas Facebook might see higher engagement during weekday mornings, Instagram thrives midweek. Knowing these ideal times helps in strategizing your posts effectively. Curious about how to leverage this information for each platform? Let’s explore the specifics for maximum impact. Key Takeaways Facebook posts perform best on weekdays from 9 a.m. to noon, peaking on Wednesdays. Instagram sees high engagement on Mondays at 3 p.m. and midweek from 10 a.m. to 4 p.m. LinkedIn engagement peaks on Tuesdays at 10 a.m. and remains strong until noon during weekdays. TikTok’s optimal posting window is from 10 a.m. to 12 p.m., with peak times on Tuesdays at 4 p.m. and Wednesdays at 5 p.m. YouTube videos should be posted between 2 p.m. and 4 p.m. on weekdays, with Sundays effective from 9 a.m. to 11 a.m. Best Time to Post on Facebook When you’re planning your social media strategy, grasp of the best times to post on Facebook can make a noteworthy difference in your engagement rates. The ideal social media posting times are during weekdays, particularly between 9 a.m. and noon. Engagement peaks on Wednesdays, making it a prime day for posting. Early morning posts at 7 a.m. likewise draw attention as users start their day. Furthermore, Tuesdays at 5 a.m. and Thursdays at 7 a.m. are solid secondary options, ensuring visibility during busy hours. Be aware that engagement drops markedly on weekends, with Sundays being the least effective day. Best Time to Post on Instagram Grasping the best times to post on Instagram can greatly improve your engagement and reach. For ideal results, focus on Mondays, particularly around 3 p.m., which is the best time to post on Monday and sees the highest engagement. Midweek, you should likewise consider Wednesdays, between 10 a.m. and 4 p.m., as this aligns with users’ peak activity periods, resulting in considerable interaction. Furthermore, Fridays from 11 a.m. to 2 p.m. also show high engagement rates. Nevertheless, it’s wise to avoid posting on Saturdays, as engagement tends to drop considerably, making it one of the worst days for Instagram activity. Best Time to Post on LinkedIn Finding the best time to post on LinkedIn can greatly improve your visibility and engagement within a professional network. Research shows that the best time to post on Tuesday is at 10 a.m., which typically results in the highest engagement rates. Engagement levels rise during working hours, peaking mid-morning and remaining strong until noon on weekdays. Furthermore, posting on Wednesdays around 11 a.m. can likewise yield significant visibility. The best days to post are Tuesday, Wednesday, and Thursday, whereas weekends typically see lower engagement. To maximize your reach, focus on creating content that aligns with professional networking trends during these peak posting times. By strategically timing your posts, you can boost your overall LinkedIn presence. Best Time to Post on TikTok To maximize your reach on TikTok, it’s essential to understand the platform’s peak engagement times. The best time to post is between 10 a.m. and 12 p.m., with specific peaks noted on Tuesdays at 4 p.m. and Wednesdays at 5 p.m. Engagement tends to soar mid-to-late week, particularly on Tuesdays and Thursdays. Sundays at 8 p.m. likewise show high engagement levels, making it a strategic time for posting content. Afternoon posts, especially around 4 p.m., resonate well with younger audiences who are active after school or work. When posting on a social media platform like TikTok, aligning your content with trends and cultural moments boosts visibility, so timing your posts effectively can greatly impact your engagement. Best Time to Post on YouTube When you’re looking to optimize your reach on YouTube, grasping the best times to post can greatly improve your video’s performance. The best time of day to post on social media platforms like YouTube is typically between 2 PM and 4 PM on weekdays. Sundays are likewise effective, especially from 9 AM to 11 AM. Weekdays, particularly Wednesday, Thursday, and Friday, yield the highest viewer engagement. Posting consistently in the late afternoon allows your videos to gain momentum as users log on later. Remember, experimenting with different post timing is crucial to find what resonates best with your audience. Day Best Time to Post Engagement Level Monday 2 PM – 4 PM Moderate Wednesday 2 PM – 4 PM High Friday 2 PM – 4 PM High Sunday 9 AM – 11 AM Very High Best Time to Post on X (Twitter) Curious about the best times to post on X (formerly Twitter) for ideal engagement? Aim to share your content between 9 AM and 11 AM on weekdays, especially on Wednesdays and Fridays. Tuesdays at 8 AM additionally present a prime opportunity, as engagement peaks during this time. Remarkably, Fridays at noon are your best bet, capturing users during their lunch breaks. Typically, posting during the workweek yields better results, as engagement considerably drops on weekends, particularly Sundays. Tweets that gain immediate likes, retweets, and replies are prioritized by the platform’s algorithm, enhancing visibility. Although you may be looking for the best time to post on Pinterest or find the best time to post promo on Friday, focus on these X timings for ideal interaction. Best Time to Post on Pinterest Comprehending the best times to post on Pinterest can greatly improve your engagement and visibility. To maximize your reach, consider these key timeframes: Weekdays (2 p.m. – 4 p.m.): Users often browse during their afternoon breaks. Saturdays (8 a.m. – 11 a.m.): This is the best time to post on Saturdays, as people look for weekend project inspiration. Evenings (8 p.m. – 11 p.m.): Many users wind down by browsing for ideas. Wednesdays and Thursdays are ideal days for posting, as Pinterest users are particularly active mid-week. Avoid Sundays, when engagement tends to drop considerably. When is the safest time to post on social media? Following these guidelines can help you achieve better visibility on Pinterest. Frequently Asked Questions What Is the Best Time to Post on Social Media to Maximize Engagement? The best time to post on social media to maximize engagement varies by platform. Typically, mid-morning during weekdays tends to yield higher interaction rates. For Facebook, aim for posts between 9 AM and noon, especially on Wednesdays. On Instagram, try posting from 10 AM to 4 PM, focusing on Mondays and Wednesdays. For LinkedIn, mid-mornings around 10 AM are ideal, whereas TikTok sees better engagement from noon to early evening on Tuesdays and Thursdays. What Is the Best Time to Schedule Social Media Posts to Increase Customer Engagement? To increase customer engagement, schedule your social media posts during peak activity times. For Facebook, aim for 9 AM to 11 AM on weekdays, especially Tuesdays. On Instagram, post from 9 AM to 12 PM on Mondays and Tuesdays, or around 3 PM on Fridays. For LinkedIn, target 10 AM to 12 PM on Tuesdays and Wednesdays. Finally, consider posting on TikTok around 4 PM during weekdays to reach a larger audience effectively. When Should You Post Your Engagement on Social Media? When you’re looking to post your engagement on social media, timing is essential. Research shows that user activity peaks at specific times throughout the week. For instance, aim for 8:00 AM on Wednesdays for broad engagement. On Facebook, post between 9 AM and 11 AM during weekdays. If you’re using Instagram, aim for 9 AM to 12 PM on Mondays and Tuesdays. Each platform has its unique peak times, so adjust your strategy accordingly. What Day Has the Most Social Media Engagement? Wednesdays typically have the most social media engagement across various platforms. Users are most active on Facebook between 8 a.m. and 11 a.m., whereas Instagram sees a spike between 10 a.m. and 4 p.m. Twitter engagement peaks on Tuesdays and Wednesdays, particularly from 9 a.m. to 11 a.m. Alternatively, Sundays experience the lowest engagement, making them the least favorable days for posting. Conclusion To conclude, timing is essential for maximizing your social media engagement. By posting on Facebook during weekdays, especially Wednesdays, and targeting specific times for Instagram, LinkedIn, TikTok, and YouTube, you can greatly improve your visibility. Each platform has its unique peak times, so aligning your content strategy with these insights can lead to better audience interaction. Stay informed about these ideal posting times, and adjust your schedule accordingly to achieve the best results. Image via Google Gemini This article, "7 Best Times for Posting on Social Media Platforms for Maximum Engagement" was first published on Small Business Trends View the full article

-

These 6 quotes from OpenClaw creator Peter Steinberger hint at the future of personal computing

The AI boom began with ChatGPT and chatbots. Now chatbots are starting to “grow arms and legs,” as developers say, meaning they can use digital tools and work independently on a human’s behalf. The open-source platform OpenClaw is notable because it lets people build agents with far more autonomy than those offered by big tech. OpenClaw agents can control a browser, send emails, do multi-step planning, and pursue persistent goals. Users often interact with them through iMessage or Discord, with the agent hosted locally on a Mac mini. One user’s agent reportedly negotiated with several car dealerships and shaved four grand off a car’s price while its owner was in a meeting. Some say OpenClaw agents fulfill the promise of Samantha, the independent AI in Her. Developers are now racing to build their own. (To wit: The project hit 100,000 GitHub stars faster than any other.) That means the internet could soon be full of agents acting as proxies for humans. That’s why OpenClaw’s creator, Peter Steinberger, is worth hearing out. I listened to his recent three-hour interview with podcaster Lex Fridman, where the thoughtful (and quirky) Austrian shared prescient ideas about where AI agents could take personal computing, and how societies might respond. Below, the six most interesting things he said (lightly edited for clarity): On the Moltbot affair “Some people are just way too trusty or gullible. You know . . . I literally had to argue with people that told me, ‘Yeah, but my agent said this and this.’ So, we, as a society, we [have] some catching up to do in terms of understanding that AI is incredibly powerful, but it’s not always right. It’s not all-powerful, you know? And especially things like this, it’s very easy that it just hallucinates something or just comes up with a story.” For many of us, the first we heard of OpenClaw was when its agents began congregating on their own social site, called Moltbook, where they dragged their human owners, posted manifestos, and debated topics like sentience. It gave people a real sense of future shock. Steinberger believes AI has raced ahead of people’s understanding and readiness. On OpenClaw’s security issues “If you understand the risk profiles, fine. I mean, you can configure it in a way that nothing really bad can happen. But if you have no idea, then maybe wait a little bit more until we figure some stuff out. But they would not listen to the creator. They [installed] it anyhow. So the cat’s out of the bag, and security’s my next focus.” When an agent is operating on its own and interfacing with the web and other services, it creates a larger attack surface. A hacker could inject malicious prompts to redirect the agent toward harmful or even criminal actions. Steinberger believes OpenClaw should be used only by people who understand these risks and how to mitigate them. On Mac’s (potential) AI moment “Isn’t it funny how they completely blunder AI, and yet everybody’s buying Mac minis? No, you don’t need a Mac mini to install OpenClaw. You can install it on the web. There’s a concept called nodes, so you can make your computer a node and it will do the same. There is something to be said for running it on separate hardware. That right now is useful. . . . And no, I don’t get commission from Apple. They didn’t really communicate much.” Many developers who want their OpenClaw agents running continuously on a local machine, rather than in the cloud, are buying Mac Studio or Mac mini computers. That demand has reportedly created shortages of certain configurations, with delivery times stretching from a few days to as long as six weeks for high-memory systems. On Zuckerberg’s feedback “Mark [Zuckerberg] basically played all week with my product, and sent me, ‘Oh, this is great.’ Or, ‘This is shit. Oh, I need to change this.’ Or, like, funny little anecdotes. And people using your stuff is kind of like the biggest compliment, and also shows me that, you know, they actually . . . care about it. And I didn’t get the same on the OpenAI side.” Steinberger surprised the AI world last Friday when he announced he would sell OpenClaw to OpenAI and join the company. In the Lex Fridman interview a few days prior, he said he was considering selling to either OpenAI or Meta, and without naming a favorite, he sounded like he was leaning toward Meta. OpenAI’s Sam Altman may have done some fast talking after the interview was published, or Steinberger’s Meta-leaning comments may have been part of a negotiation strategy. Either way, Steinberger will now have far more people and computing power at OpenAI to help advance its AI agents. On AI’s not-so-great UX “The current interface is probably not the final form. Like, if you think more globally, we copied Google for agents. You have a prompt, and then you have a chat interface. That, to me, very much feels like when we first created television and then people recorded radio shows on television and you saw that on TV. I think there’s better ways how we eventually will communicate with models, and we are still very early in this ‘how will it even work’ phase. So, it will eventually converge and we will also figure out whole different ways to work with those things.” Steinberger says OpenClaw isn’t really competing with AI coding agents like Claude Code or OpenAI’s Codex. They’re different tools, he says, with OpenClaw functioning more like a personal assistant. But he believes they could eventually converge into something like an AI operating system, and that the way we interact with AI will change significantly in the years ahead. On ‘vibe coding’ “I actually think vibe coding is a slur. Yeah, I always tell people I do agentic engineering, and then maybe after 3 a.m. I switch to vibe coding, and then I have regrets the next day. You just have to clean up and fix your shit.” To Steinberger, “vibe coding” means using an AI coding assistant to quickly mock up an app or feature without much regard for security, testing, or its effects on a larger code base. “Agentic engineering,” meanwhile, is more like a collaboration between an experienced software engineer and an advanced coding assistant (such as Anthropic’s Claude Code or OpenAI’s Codex), in which the two create a detailed plan for building new software without introducing security problems or bugs. View the full article

-

Google's Pixel 10a Isn't Much of an Upgrade From the Pixel 9a

We may earn a commission from links on this page. Early every year, Google releases a budget-oriented a-series phone that acts like a stripped down version of its latest mainline Pixel phone. The Pixel 9a, for instance, had the same chip as the Pixel 9, reduced memory and camera specs, and most importantly, a slimmed down design that finally ditched the obtrusive camera bar. The Pixel 10a, announced today, is a bit of an outlier. Instead of upgrading to the same chip as the Pixel 10, it also has the same chip as the Pixel 9, with only slight improvements to everything else that was already in the Pixel 9a. So, is it worth an upgrade? The Pixel 10a's specsThe Pixel 10a's specs are, on paper, nearly identical to the Pixel 9a's. Both phones have a Tensor G4 processor, 8GB of RAM, and up to 256GB of storage. They also have the same camera system, with a 48MP main lens, a 13MP ultrawide lens, and a 13MP selfie camera. Battery life also sits at the same promised 30+ hours, with a typical 5,100 mAh capacity. The only real difference on paper is that the 6.3-inch screen is a little brighter, with up to 3,000 nits of peak brightness instead of 2,700. The bezels are also supposed to look about 10% thinner, although I needed to be told that to spot it during a hands-on session with the Pixel 10a. Even the Pixel 10's MagSafe-like Pixelsnap feature is gone, meaning you won't be able to use this phone with any magnetic accessories, at least without adhesive magnets or special third-party cases. Google Pixel 10a (left) vs. Google Pixel 9a (right) Credit: Michelle Ehrhardt That said, there are a few changes to the hardware, notably to the look of the phone. Like the Pixel 9a, the Pixel 10a also ditches the camera bar, and evolves on Google's last budget model for a completely flat back. That means the rear camera has no bump or lip to it at all, for a completely flush and seamless feel. It's definitely clean, but the 9a's miniscule camera bump was already barely an inconvenience back when I reviewed it. Meanwhile, you'd need to be told about the other design upgrades to appreciate them. Google says the Pixel 10a has improved Corning Gorilla Glass 7i cover glass so that it's more resilient to drops and scratches, but I couldn't test that while carefully handling the company's demo units. Essentially, when looking at raw specs, the Pixel 10a comes across at first less like a stripped down version of the Pixel 10, and more like another iteration of the Pixel 9. But Google's hoping its software can win you over. Pixel 10a AI camera features and satellite SOSThe Pixel 10a does differ from the Pixel 9a when it comes to AI, and introduces two AI camera features that debuted on the main-series Pixel 10. These are Auto Best Take and Camera Coach, although one of them is also an iteration on something that came out alongside the Pixel 8. That would be Auto Best Take. Essentially, what this does is detect when you're in a group shot with other people, then take up to 150 frames all in one press. It'll then intelligently find the best shot from those frames and ditch the rest, and if it can't find a good shot, it'll stitch together elements from multiple shots so that everyone has their eyes open. You will know when a shot has been stitched together using Auto Best Take (it'll have a Gemini icon), and can choose to use a non-AI assisted one if you prefer. The ability to stitch together photos is a few generations behind at this point, but not having to choose when to load it up is convenient, if you're into AI-generated photos. If you're not, Camera Coach lets you get some AI assistance in your photos without actually having AI in your shots. Essentially, this will look through your camera for you, generate an ideal shot for you to take, then guide you through the real-world steps you need to follow to recreate it. You're essentially handing off the ideation part of photography to Gemini, but you also won't have to risk any hallucinations popping up in your pics. Credit: Michelle Ehrhardt Aside from new photography features, you've also got Satellite SOS for the first time on an a-series phone. This lets you connect to a Satellite if you're away from wifi or your mobile network, so you can ping emergency services for help if you need it. Hopefully, you'll never actually have to use this feature, but it is some great piece of mind. Is the Pixel 10a worth it?Like the Pixel 9a, the Pixel 10a is $500, so if you're trying to choose between the two and aren't buying a 9a at a discount secondhand, it's a no-brainer. It does also have a new selection of colors, including a poppy red "berry" look and a purplish blue hue named Lavender. Google Pixel 10a in Berry Credit: Michelle Ehrhardt But if you've already got a Pixel 9a and are eyeing an upgrade, it's a bit harder to justify. The biggest new additions are all software, and Google has already brought previously Pixel 10-exclusive software to older phones before (although with mixed results). That means the 9a is likely to stay relevant for a good few more years, and may actually eventually have all the same features as the 10a, minus that completely flush back. The standard Pixel 10 series is also likely to remain a good choice. Back when I reviewed it, I thought the 9a was better than the Pixel 9, but since the 10a doesn't even have the same chip as the regular Pixel 10, it's much less likely to be able to stand in for it, however clean it looks. If that doesn't deter you, though, you can pre-order the Pixel 10a now on Google's website, with models set to ship out and hit retail stores on March 5. View the full article

-

Daily Search Forum Recap: February 18, 2026

Here is a recap of what happened in the search forums today...View the full article

-

AI search KPIs: Focus on inclusion, not position

We need to have a talk about KPIs and AI search. I’ve observed numerous SEO professionals on LinkedIn and at conferences talking about “ranking No. 1 on ChatGPT” as if it’s the equivalent of a No. 1 ranking on Google: On Google, being the first result is often a golden ticket. Going from No. 2 to No. 1 in Google search will often result in 100%-300% increases in traffic and conversions. This is almost certainly not the case with AI responses – even if they weren’t constantly changing. Our team’s research shows AI users consider an average of 3.7 businesses before deciding who to contact. Being the first result in that list on ChatGPT isn’t the golden ticket it is in Google search. This being the case, the focus of AI search really should be on “inclusion in the consideration set” – not necessarily being “the first mentioned in that set” – as well as crafting what AI is saying about us. User behavior on AI platforms differs from Google search Over the past several months, my team has spent more than 100 hours observing people use ChatGPT and Google’s AI Mode to find services. One thing came into focus within the first dozen or so sessions: User behavior on AI platforms differs from Google search in ways that extend far beyond using “natural language” and having conversations versus performing keyword searches. Which is overstated, by the way. About 75% of the sessions we observed included “keyword searches.” One key difference: Users consider more businesses in AI responses than in organic search. It makes sense — it’s much easier to compare multiple options in a chat window than to click through three to five search results and visit each site. Dig deeper: From searching to delegating: Adapting to AI-first search behavior AI users don’t stop at the first result In both Google AI Mode and ChatGPT, users considered an average of 3.7 businesses from the results. This has strong implications for the No. 1 result – as well as No. 4. The value of appearing first drops sharply — and the value of appearing lower rises — when, in 75% of sessions, users also consider businesses in Positions 2 to 8. What’s driving conversions isn’t your position in that list. Get the newsletter search marketers rely on. See terms. Why do businesses with lower rankings end up in the consideration set in LLMs? First of all, these aren’t rankings. They are a list of recommendations that will likely get shuffled, reformatted from a list to a table, and completely changed, given the probabilistic nature of AI. That aside, AI chat makes it much easier to scan and consider more options than Google search does. Let’s look at the Google search results for “fractional CMO.” If a user wants to evaluate multiple fractional CMO options for their startup, it’s more work to do so in Google Search than in ChatGPT. Only two options appear above the fold, and each requires a click-through to read their website content. Contrast this with the experience on ChatGPT. The model gave them eight options, along with information about each one. It’s easy to read all eight blurbs and decide whom to explore further. Which leads to the other thing we really need to focus on: what the model is saying about you. Your customers search everywhere. Make sure your brand shows up. The SEO toolkit you know, plus the AI visibility data you need. Start Free Trial Get started with A bigger driver than being first on ChatGPT: Being a good fit Many search marketers focus on rankings and traffic, but rarely on messaging and positioning. This needs to change. In the case of the response for an ophthalmologist in southern New Jersey, you get an easily scannable list: Roughly 60% make their entire decision based on the response, without visiting the website or switching to Google, according to our study. So how do you drive conversion? Deliver the right message — and make sure the model shares it. Dr. Lanciano may be the best glaucoma specialist in the area. But if the model highlights Ravi D. Goel and Bannett Eye Centers for glaucoma care, and that’s what the user needs, they’ll go there. Bannett Eye Centers appears last in the AI response but may still win the conversion because of what the model says about it — something that rarely happens in Google Search. Visibility doesn’t pay the bills. Conversions do. And conversions don’t happen when customers think someone else is a better fit. Dig deeper: How to measure your AI search brand visibility and prove business impact As SEOs shift toward Dig deeper: , a mindset shift needs to occur We’re still thinking about AI search the way we’ve thought about SEO. In SEO, the top result captures most of the traffic. In AI search, it doesn’t. AI users consider more available options. Responses — and their format — change dramatically with each request. “Winning” in AI search means getting into the consideration set and being presented compellingly. It’s not about being first on a list, especially if what’s said about you misses the mark. In other words, SEOs who think like copywriters and salespeople will drive outcomes for their organizations. Dig deeper: Is SEO a brand channel or a performance channel? Now it’s both View the full article

-

Spain first to enter race for Lagarde succession at ECB

Spanish government seeks ‘influential and meaningful position’ at helm of Eurozone central bankView the full article

-

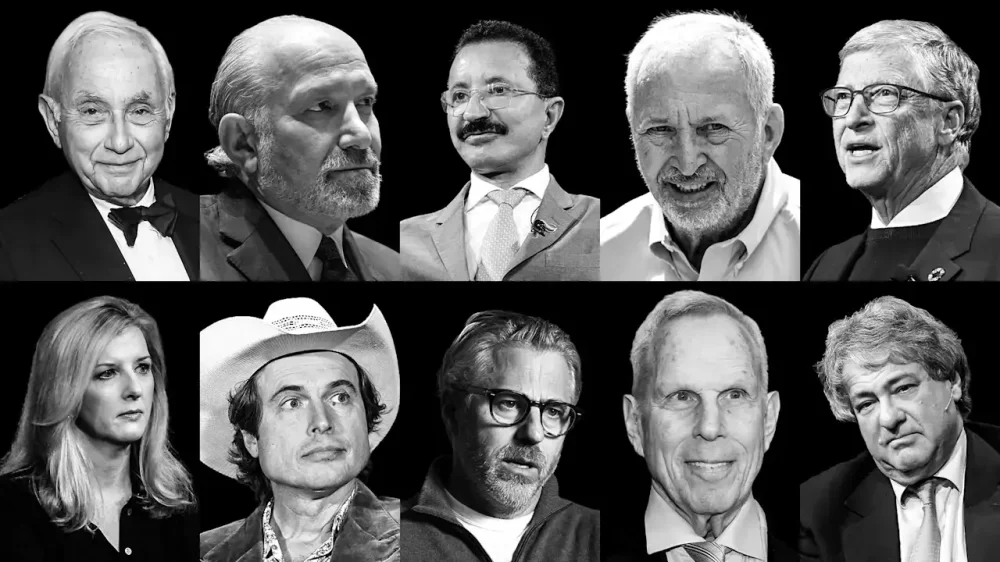

Epstein files fallout: The growing list of business leaders who have faced consequences after being mentioned

The consequences from being associated with Jeffrey Epstein are mostly playing out behind closed doors rather than in courtrooms. Despite the release of millions of documents and photos that seemingly include damning evidence of impropriety and even potential criminal activity, the Epstein files haven’t yet resulted in further criminal charges. That’s not altogether surprising as an unsigned memo from the Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI) last year indicated that no further investigation into “uncharged parties” was warranted based on an “exhaustive review” of evidence that confirmed Epstein had harmed more than 1,000 victims. U.S. Attorney General Pam Bondi has often frustrated lawmakers and advocates who continue to seek justice for Epstein’s victims. During her testimony before the House Judiciary Committee last week, Bondi said that the Justice Department is actively investigating individuals who might have conspired with the convicted sex offender, without specifying who those individuals are. On Saturday, Bondi sent a letter to Congress indicating that the DOJ has released “all” records, documents, communications, and investigative materials required by the Epstein Files Transparency Act. That letter also contained a list of 300-plus prominent individuals whose names appear in the files, though she cautioned that their names appear “in a wide variety of contexts.” Even if the highest law enforcement agency in the country ultimately decides not to dive back into this case to bring charges, consequences have been rippling through Hollywood, Wall Street, academia, and beyond. Some prominent figures named in the files have faced a reputational reckoning that has forced them to step down from high-profile roles, while others will likely escape unscathed from the scrutiny. Resignations from Epstein fallout The list that Bondi shared over the weekend includes the names of dozens of prominent U.S. politicians, including many who have served in either the first or second term of President Donald The President’s administrations. But politicians in Europe have thus far faced more pressure to resign. In the United States, elected officials haven’t faced the most severe consequences as of yet. Rather, people beyond the Capital Beltway are reckoning with having their personal correspondences with Epstein aired out in public, though the severity of the fallout has ranged widely. Here are some business leaders who have resigned from prominent roles in recent weeks. No one on this list has been accused of a crime, but many are facing business consequences due to the reputational damage of communicating with Epstein. Casey Wasserman In a company-wide email he reportedly sent on Friday (per CNN and other media outlets), Hollywood agent Casey Wasserman announced that he is selling his talent agency after his flirtatious emails with Ghislaine Maxwell appeared in the Epstein files and high-profile clients like Chappell Roan started to jump ship from his agency. Wasserman has thus far resisted stepping down as chair of the 2028 Los Angeles Olympics, though L.A. Mayor Karen Bass on Monday joined a growing chorus of people calling for his resignation. Kathryn Ruemmler The now-former general counsel for Goldman Sachs reportedly resigned last week after emails and other materials revealed her personal relationship with Epstein that included providing legal counsel and calling the disgraced financier by pet names. Ruemmler will remain with the bank until June 30 to provide a smooth transition. In a statement confirming her resignation to The New York Times, Ruemmler said: “My responsibility is to put Goldman Sachs’s interests first.” Sultan Ahmed bin Sulayem On Friday, Dubai-based DP World announced in a regulatory statement that Bin Sulayem had resigned as chairman and CEO of one of the world’s largest logistics companies, where he’d been at the helm since 2019—and that his replacements had already been named. The Epstein files revealed a close relationship between the two men that remained long after Epstein was first convicted in 2008. Kimbal Musk The fallout from the Epstein files may be the way that many people are learning for the first time that there’s a board of directors behind Burning Man, the annual desert party. Members of the Burning Man community called for the resignation of Elon Musk’s younger brother Kimbal Musk after his correspondence with Epstein appeared in the last trove of files. But he had apparently submitted his resignation before the latest files were released, according to The San Francisco Standard. Kimbal Musk still sits on the boards of Tesla and SpaceX. Larry Summers In November, Harvard University announced that its former president Larry Summers would immediately leave his role as an instructor as the university investigated his ties to Epstein. Summers, who also served as U.S. Treasury Secretary, was seen in photos on Epstein’s private plane. Leon Black When his ties to Epstein first surfaced several years ago, Leon Black resigned from his role as CEO of investment firm Apollo Global Management and chairman of the Museum of Modern Art (MoMA). Even though he’s largely out of the public eye now, the billionaire private equity investor surfaced again after the latest drop of Epstein files. There have been reports that some school districts have dropped plans for class pictures because of a link between Apollo, which Black led for more than three decades, and Lifetouch, which photographs students each year. Ken Murphy, CEO of Lifetouch, said in a statement that neither Black nor any of Apollo’s directors or investors ever had access to Lifetouch photos. Resisting calls to resign Even as some powerful figures have faced career-altering consequences stemming from their relationships with Epstein, other associates have resisted the pressure to resign—for now. That wait-and-see approach may ultimately mean that many of Epstein’s associates don’t face any consequences, though they may be in a period of professional limbo as the public and their respective organizations weigh the evidence. The latest release of files has been particularly reputationally damaging, though the fallout remains uneven. Without the threat of legal action by the Justice Department, some prominent people are banking on a strategy of apologizing for their links to Epstein and then vowing that they partook in no criminal activity. Whether that strategy ultimately saves them from facing consequences, only time will tell. Les Wexner The billionaire business mogul led Victoria’s Secret for more than a decade and most recently served as chair emeritus of Bath & Body Works, the company he cofounded. But he severed ties with these retailers several years ago, and will face questions from lawmakers this week about his relationship with Epstein. Though Wexner claims to have cut ties with Epstein by 2008 and has denied any knowledge of Epstein’s offenses (as reported last week by WOSU Public Media), the FBI named him as a “co-conspirator” of Epstein’s in 2019. Howard Lutnick The latest Epstein files revealed that Howard Lutnick maintained communications with Epstein more than a decade after he claimed to have cut off all contact. Lutnick testified before Congress earlier this month that he did have lunch with Epstein in 2012, years after he claimed to have cut off contact and after the financier was convicted for soliciting prostitution from a child. But he’s thus far resisted calls from a bipartisan group of lawmakers who want to see Lutnick resign or be fired. Bill Gates Things must surely be a bit awkward at the Gates Foundation lately, as the organization issued a statement following the latest release of Epstein files, while the Financial Times reported that its chief executive told staff he feels “sullied” by the foundation’s association with the disgraced financier. But Gates hasn’t stepped aside as chair and finally addressed what he called “false” allegations in an interview with an Australian TV network. “Every minute I spent with him, I regret, and I apologize that I did that,” Gates said. Steve Tisch Steve Tisch, co-owner of the New York Giants and the Hollywood producer behind Forrest Gump, claims to have had only a “brief association” with Epstein. Meanwhile, NFL Commissioner Roger Goodell has promised that the league will review “all the facts” about their relationship. In a statement (as reported in January by the Athletic and other outlets), Tisch said that he now “deeply” regrets his association with the convicted sex offender, but he has thus far ignored the calls for his resignation as co-owner of the Giants. Riding it out . . . Many more prominent people are simply riding out the storm caused by their inclusion in the Epstein files, with no apparent consequences for them in sight. While many supporters of President The President called for the release of the Epstein files during the lead-up to the 2024 presidential election, The President’s name was mentioned in the files some 38,000 times, along with several of his cabinet members and close associates, like billionaire Elon Musk. But it’s a topic that continues to divide voters. The President has repeatedly rejected that he had any knowledge of Epstein’s criminal activity, but a majority of Americans don’t buy his story. In fact, 52% say the president is trying to cover up Epstein’s crimes, while 30% say he isn’t, according to an Economist/YouGov poll conducted earlier this month. While The President recently said it’s time to “turn the page” on the Epstein scandal and Bondi has said that there are no more files to come, the reputational toll may continue to play out—though largely outside of Washington, D.C. View the full article

-

Sandisk stock price stalls amid secondary public share offering. Is the 2026 memory chip rally about to end?

Sandisk Corporation has announced plans for a secondary public offering. The data storage company will open up 5,821,135 common stock shares (Nasdaq:SNDK) at $545 a pop. The shares are currently owned by Western Digital Corporation (WDC), Sandisk’s former parent company. Sandisk separated from WDC nearly a year ago to the date, and subsequently joined the S&P 500 in November. Now, WDC is furthering that split. It will be left with 1,691,884 shares of common stock, but it plans to get rid of those as well. WDC intends to complete a debt-for-equity exchange with J.P. Morgan Securities LLC and BofA Securities—both of which will act as selling stockholders. Sandisk says it will not personally sell any of its shares or profit from the secondary offering. The offering should close tomorrow, Thursday, February 19. Sandisk is benefiting from an AI-fueled chip memory shortage In response to the news, Sandisk’s shares have fallen over 3.5% during premarket trading on Wednesday. However, they’re still sitting very comfortably. Sandisk’s shares have risen about 148% in 2026 and nearly 1,184% in the past 12 months. Sandisk’s dramatic upward trend mirrors many of its fellow memory chip makers—including WDC’s shares (Nasdaq:WDC). WDC is up around 1.68% in premarket trading and about 422% year-over-year (YOY). Micron, another manufacturer, is up about 283% YOY. Sandisk and Macron have both benefited tremendously from this year’s global memory chip shortage. They have AI companies to thank for the extreme demand—and subsequent shortage—that makes these companies’ products extremely valuable and their respective shares skyrocket. View the full article

-

Are Citations In AI Search Affected By Google Organic Visibility Changes? via @sejournal, @lilyraynyc

An analysis of 11 impacted sites reveals a strong correlation between Google visibility losses and declining AI search citations, with ChatGPT hit hardest. The post Are Citations In AI Search Affected By Google Organic Visibility Changes? appeared first on Search Engine Journal. View the full article

-

What People Are Getting Wrong This Week: Is This February an Unusually Lucky Month?

We're heading toward the back half of February—and according to your weird aunt on Facebook, this is an unusual, maybe magical month. Some say it is a "miraclein," a lucky calendar configuration that only occurs once every 823 years. Others say February 2026 is a "perfect month." Some say it is the beginning of an extremely unlucky year. Some say that a late-month planetary alignment will cause great upheaval. The February 2026 "miraclein"Though it is not a word used by astronomers (or even astrologers, to my knowledge), some are describing this month as a "miraclein," a month in which every day of the week falls four times during the month. This only happens every 823 years, they say. A variation of the miraclein month has some people calling February "moneybags" and making the claim that it's a good month for abundance. (The markets don't agree: February has been volatile.) Here's a video explaining the theory: A quick check of a calendar reveals that miracleins happen almost every year. Every day of the week falls exactly four times every February (except leap years), because four times seven is 28, and there are 28 days in the month. It's not a miracle—it's math. It's not even new. People spread this every February. This is an example of a pervasive strain of myths and superstitions based on the calendar. Is February 2026 a "perfect month"?If you dig a little deeper into the lore of February 2026, you'll find people describing it as a "perfect month," in that it begins on a Sunday and ends on a Sunday. There's logic to this, because the calendar is a perfect grid, with no days overhanging. This is nice and orderly, but it's not that unusual. February 2015 was a "perfect" month and February 2037 will be perfect as well. February's planetary paradeThe "miraclein" and perfect month only exist because that's how we decided to write calendars, but there is a cosmic event happening this month that goes beyond humanity. On the 28th of February, six planets—Mercury, Venus, Jupiter, Saturn, Uranus, and Neptune—will appear to be "lined up" in the sky. Some describe it as a "once every 6,000 years planetary conjunction" that will create a "paradigm shift for the entire planet" or cause gravitational anomalies. Some warn: "Do not look at the sky during the planetary alignment;" other, funnier, people say "The planets are having some type of conference or gang meeting on February 28." But whether you call it a "conjunction" or a "conference," it's not rare. Five or six planet line ups happen every few years, and last February, seven planets attended a gang meeting. The planets aren't actually lining up, anyway. They'll just look lined up from our perspective on earth. Nothing will happen to your eyes if you look at it (you won't even be able to see Uranus and Neptune without a telescope anyway) and it won't affect gravity or cause a paradigm shift. It's just planets doing their thing in space. Is 2026 unusually unlucky?In 2026, there will be three Friday the 13ths—one just passed in February, one is coming in March, and there's a third in November—this leads some to believe that 2026 is a particularly unlucky or cursed year. Jury's out on whether the year is cursed, but if so, it's not because of Friday the 13ths. While three is the maximum number of Friday the 13ths that can happen in a calendar year, it's not unusual. There were three Friday the 13ths in 2015, and there will be three in 2037 too. Speaking of the 13th, the belief that it's a bad, or unlucky day dates back to 19th-century France, but it's not entirely clear why people think it's unlucky. One guess is that Judas was the 13th apostle, but there's also a Norse myth about Loki showing up to as the thirteenth guest at a dinner party and doing mischief. Other cultures have other unlucky days. The 4th is unlucky in China. In Italy, the 17th is unlucky because XVII can be rearranged to form "VIXI," Latin for "my life is over," a common inscription on tombstones. The through-line is that none of these superstitions have anything to do with the physical world. They're examples of seeing connections where none exist. All hail Apophenia, ruler of human thoughtI don't have research to back this up, but I imagine the Venn diagram of people who believed the Rapture was coming, that Leviathan was rising from the oceans, and aliens were landing has serious overlap with the people who think there's something portentous about the planets aligning or that February is moneybags month. You'd think that when the aliens didn't land and the rapture didn't happen, folks would be more discerning about spreading future predictions, but that doesn't seem to be the case. But it's not just because people are gullible. It's a byproduct of how our brains are wired. Apophenia is the tendency to perceive meaningful connections between unrelated things. Neurologist Klaus Conrad coined the term in a 1958 study of schizophrenics, describing "a specific feeling of abnormal meaningfulness," but apophenia goes beyond schizophrenics. It's in every gambler on a "lucky streak," everyone who sees a "man in the moon," and everyone who ever mistook correlation for causation. So: everyone. Our brains evolved to find patterns in data because it kept us alive and led to things like the scientific method, but the trade-off is that we think a rally cap is going to help our ball club win the series. Pascal's WagerApophenia isn't the only thing at play here. Spreading a TikTok video promising abundance is a cranked-up version of Pascal's Wager, the philosophical argument that it’s smarter to bet on a reward when the cost of entry is low—hitting "share" takes almost no effort, and what if it works? While none of these beliefs are new, in the Before Times, if you wanted to be a doomsayer, you'd have to stand on a street corner with a sign reading "the end is near." That's a lot of effort and you wouldn't have an algorithm ensuring your message got to the people who would be most receptive to it. Even misinformation that doesn't promise a monetary reward offers something to the person who spreads it. Sometimes it's the momentary high of feeling like you possess secret knowledge. Or it's a way of signaling belonging to an in-group ("I'm the kind of person who thinks the position of the stars has mystical significance!") or maybe it's just to get some attention. I don't choose to post about "moneybags February" because my "cost of entry" would be my friends thinking I'm weird for sharing Facebook glurge, and a general sense that it's harmful to spread lies, but really, your weird aunt on Facebook and I are doing the same thing. We're both out here matching patterns and hitting "share"; we just have different ideas about which patterns to pay attention to. I'll still take bets on any conspiracy theory, but February is a cold month, and if it warms your aunt's heart to think it's bringing money, who am I to call her wrong? It's just that the same wiring that spreads "February is magic" also spreads beliefs and ideas that are legitimately dangerous, even deadly—at least according to the way I read the patterns. View the full article

-

Perplexity stops testing advertising

Perplexity is abandoning advertising, for now at least. The company believes sponsored placements — even labeled ones — risk undermining the trust on which its AI answer engine depends. Perplexity phased out the ads it began testing in 2024 and has no plans to bring them back, the Financial Times reported. The AI search company could revisit advertising or “never ever need to do ads,” the report said. Why we care. If Perplexity remains ad-free, brands lose paid access to a fast-growing audience. The company previously reported that it gets 780 million monthly queries. With sponsored placements gone, brands have no way to get visibility inside Perplexity’s answers other than via organic citations. What changed. Perplexity was one of the first AI search companies to test ads, placing sponsored answers beneath chatbot responses. It said at the time that ads were clearly labeled and didn’t influence outputs. Executives now say perception matters as much as policy. “A user needs to believe this is the best possible answer,” one executive said, adding that once ads appear, users may second-guess response integrity. Meanwhile. Perplexity’s exit comes as other AI platforms experiment with ads. OpenAI is now testing ads in ChatGPT for free users, placing labeled sponsored results below answers. Google runs ads in AI Mode and AI Overviews within Search, though not in Gemini. Anthropic has publicly committed to keeping Claude ad-free. Perplexity says subscriptions are its core business. It offers a free tier and paid plans from $20 to $200 per month. It has more than 100 million users and about $200 million in annualized revenue, according to executives. Perplexity also introduced shopping features, but doesn’t take a cut of transactions, another indication it’s cautious about revenue models that could create conflicts of interest. “We are in the accuracy business, and the business is giving the truth, the right answers,” one executive said. The report. Perplexity drops advertising as it warns it will hurt trust in AI (subscription required) View the full article

-

UCL students win £21mn over Covid disruption in watershed settlement

Move involving 6,500 claimants is set to put pressure on other universities to compensate graduates View the full article

-

Samsung’s Newest Dolby Atmos Soundbar Is Over 50% Off Right Now

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. Samsung HW-QS700F dropped to $355.49 in open-box condition at Woot, which is a steep cut from its $799.99 list price. Amazon currently has it for $597.99, and the lowest it has dipped there was $397.99. So this is comfortably below its previous low, according to price trackers. “Open-box” here means it may have been repackaged due to damaged packaging but you still get the full setup: soundbar, wireless subwoofer, HDMI cable, wall mount kit, rubber feet, and a remote with batteries. Samsung HW-QS700F Soundbar $355.49 at Woot $799.99 Save $444.50 Get Deal Get Deal $355.49 at Woot $799.99 Save $444.50 This is a 3.1.2-channel system, which in plain terms means left, right, and center speakers; a dedicated subwoofer for bass; and two upward-firing speakers for height effects like Dolby Atmos and DTS:X. What makes this model different is its adjustable (Convertible Fit) design, meaning it actually changes how the speakers behave depending on whether it’s sitting flat on a TV stand or mounted vertically on a wall. Built-in sensors detect the position and reassign the speaker roles so the sound still points where it should. In practice, that means you’re not sacrificing performance just because you prefer one setup over the other. The included subwoofer, too, does a good job of adding depth to movies without overwhelming dialogue. It also supports wifi and Bluetooth streaming, including Chromecast, AirPlay, Spotify Connect, and Tidal Connect, so it works easily with most phones and TVs. That said, it does not include rear speakers, so you won’t get full wraparound surround sound unless you buy extras separately. The HDMI passthrough also skips 4K at 120Hz for high-end gaming consoles, so serious gamers will need to plug directly into the TV and use eARC. Also, dialogue can reportedly sound slightly restrained in certain placements, though you can tweak levels manually. Still, for most living rooms, this soundbar setup delivers strong volume, clear detail, and convincing Atmos height in either position. At this open-box price, it's worth considering if you want flexible placement and big sound without paying flagship money. Our Best Editor-Vetted Tech Deals Right Now Apple AirPods 4 Active Noise Cancelling Wireless Earbuds — $158.00 (List Price $179.00) Apple iPad 11" 128GB A16 WiFi Tablet (Blue, 2025) — $329.00 (List Price $349.00) Apple Watch Series 11 [GPS 46mm] Smartwatch with Jet Black Aluminum Case with Black Sport Band - M/L. Sleep Score, Fitness Tracker, Health Monitoring, Always-On Display, Water Resistant — $329.00 (List Price $429.00) Amazon Fire TV Stick 4K Plus — $29.99 (List Price $49.99) Bose QuietComfort Noise Cancelling Wireless Headphones — $229.00 (List Price $349.00) Samsung Galaxy Tab A9+ 64GB Wi-Fi 11" Tablet (Silver) — $159.99 (List Price $219.99) Deals are selected by our commerce team View the full article

-

What Is a Bidirectional Sync?