All Activity

- Past hour

-

Costar board blasted for $3B Homes.com loss

Shaw, which was part of last year's standstill agreement with Third Point, said it will support shareholder-driven change on Costar's board. View the full article

-

my coworker wants to fire a domestic violence survivor

A reader writes: Our company works in a building that houses multiple businesses. We share reception and security. Recently, there was a terrible incident where the ex-boyfriend of one of my employees, Sarah, got into the building by booking a job interview with a different company. He then made a beeline for our office instead, and made a huge scene shouting at Sarah, and even tried to hit her in front of all of us. Thankfully, security tackled him before he could hurt anyone, and he’s been arrested. We had a security meeting with reception and the other business managers in the building and have agreed to a shared appointment calendar and other precautions to prevent this from happening in the future. I’ve done my best to support Sarah with what she needs to feel safe here, and she seems to be doing well. The problem is Fred, the other manager in my office. About a week after this incident, I was giving him an update on the steps we were taking in case this man is released and causes further problems. Fred was clearly annoyed and asked me why I didn’t just “solve” the problem by firing Sarah. He went on to claim that Sarah was being unprofessional by “allowing her personal life in the office” and that we were going to a lot of trouble for “just one employee.” This is not the first time he’s said something insensitive about our employees, but this was by far the most egregious comment. I told him that Sarah had done nothing wrong, and that it was our job to provide a safe work environment. He rolled his eyes and visibly tuned out for the rest of the meeting. He hasn’t said anything else since that meeting. But I find it increasingly hard to work with him. I’ve been defaulting to email to communicate with him, even though his office is right next to mine, because I feel gross being in the same room with him. I especially feel icky when I see him chatting in a friendly way to Sarah, knowing what he thinks about the situation. It’s bad enough that I briefly considered looking for a new job, but that would mean Fred would temporarily be in charge of my reports. I’m worried he would actually fire Sarah if he could. How do I address this? I don’t feel like it would be appropriate for me to pull him aside and tell him what I think of his reaction, but I also feel like I’m dropping the ball by not the challenging what he said more directly. Is simply avoiding him as much as possible the most I can do here? I answer this question over at Inc. today, where I’m revisiting letters that have been buried in the archives here from years ago (and sometimes updating/expanding my answers to them). You can read it here. The post my coworker wants to fire a domestic violence survivor appeared first on Ask a Manager. View the full article

- Today

-

Tracking Jeffrey Epstein’s influence on the cutting edge of tech research

Jeffrey Epstein’s network of money and influence often intersected with scientific and academic communities. The disgraced financier spent years cultivating relationships with researchers at elite universities, frequently dangling the promise of funding. Some of the work he supported has had, and may still have, direct and indirect impacts on Silicon Valley’s most powerful technologies. Epstein was first convicted in 2008 on charges of soliciting a minor for prostitution, yet he continued to maintain a web of relationships across the worlds of technology and academia until he was indicted on federal sex-trafficking charges in 2019. The Department of Justice’s latest release of the “Epstein files” includes emails that reveal new names and details about those connections that had not previously been made public. Joscha Bach One striking example is Epstein’s patronage of German AI scientist and executive Joscha Bach. Known in academic and AI circles for his work on cognitive architectures, computational models that aim to replicate aspects of human cognition, Bach received extensive financial support from Epstein while completing postdoctoral work at MIT. According to emails reviewed by SFGate, Epstein covered Bach’s rent, flights, medical bills, and even private school tuition for his children in Menlo Park between 2013 and 2019. Bach is now the executive director of the California Institute for Machine Consciousness, a small, independent research organization focused on whether machines could ever become conscious. According to SFGate, Epstein met Bach through other AI and psychology researchers and began financing his work at the MIT Media Lab and the Harvard Program for Evolutionary Dynamics in 2013. The files show no indication of sexual impropriety on Bach’s part, and he has never been accused of such conduct. Bach told SFGate that MIT approved the funding and said many prominent scientists maintained relationships with Epstein. He added, “The prevailing view was that Epstein, having served his sentence, was complying with the law.” Antonio Damasio Epstein also corresponded with Antonio Damasio, the director of USC’s Brain and Creativity Institute. In 2013, Damasio asked Epstein to fund a new line of robotics and neuroscience research. Damasio, the Dornsife Chair in Neuroscience, and another USC researcher hoped to study the origins of emotion in the brain, and sought a nontraditional funding source so they could retain greater control over the direction of the work. Damasio presented the proposal to Epstein in February 2013 at Epstein’s New York City home, but Epstein ultimately declined to fund the research. Damasio told Annenberg Media that he did not know Epstein was a convicted sex offender at the time, and said he would never have contacted him had he known. “I was looking for a prestigious philanthropist, not a criminal,” Damasio said. Damasio’s primary field is neurobiology, though he also teaches psychology and philosophy, with a focus on the neural systems that underlie emotion, decision-making, memory, language, and consciousness. He is best known for an influential theory arguing that emotions and their biological foundations, not just reason, play a central role in decision-making, even when the decision-maker is not consciously aware of it. He also theorized that emotions provide the scaffolding for social cognition, shaping how people process, store, and apply information about others and social situations. Damasio argues that current AI models that power robots lack a sense of biological “vulnerability” that drives survival instincts and intelligence in living organisms. He theorises that training a robot to be “concerned” about its own preservation might help the robot solve problems more creatively. David Gelernter The DOJ document release also revealed that Epstein corresponded between 2009 and 2015 with Yale computer science professor David Gelernter, an early pioneer of concepts now associated with digital twins and metaverse-style overlays, which he calls “computed worlds.” Gelernter is the author of the book Mirror Worlds, which outlines much of that research. In 2001, Gelernter helped found a company called Mirror Worlds Software based on those ideas, but the venture failed to gain traction and shut down in 2004. In his correspondence with Epstein, Gelernter sought business advice rather than research funding, according to the New Haven Register. The files also revealed no evidence of wrongdoing by Gelernter. He has said he did not know Epstein was a convicted sex offender and was never aware of Epstein’s sex-trafficking operation. In 1993, Gelernter was severely injured by a mail bomb sent by the “Unabomber,” Ted Kaczynski, which destroyed four of his fingers and permanently damaged one of his eyes. He is also known for controversial views, including claims that liberal academia has a destructive influence on American society, that women, especially mothers, should not work outside the home, and for rejecting the scientific consensus that humans are driving climate change. Marvin Minsky The most direct link between Epstein and the AI world ran through MIT professor and pioneer Marvin Minsky, who died in 2016. Minsky helped establish artificial intelligence as a formal research discipline in the 1950s and later co-founded the field at MIT with John McCarthy, training generations of AI scientists. Epstein donated $100,000 to MIT to support Minsky’s research in 2002, before Epstein’s first criminal conviction. That gift was the first in a series of donations to MIT’s Media Lab that ultimately totaled $850,000 between 2002 and 2017. Minsky died in 2016. In 2019, court documents from a deposition by victim Virginia Giuffre were unsealed, revealing her allegation that Ghislaine Maxwell directed her to have sex with Minsky during a visit to Epstein’s compound. Minsky’s wife said the allegation was impossible because she was with him the entire time they were on the island. Minsky never faced charges, but the revelations placed his name at the center of a reckoning at MIT’s Media Lab over the influence of Epstein’s money on the lab’s work. A gray zone In many ways, Jeffrey Epstein operated in a gray zone created by shifting funding models for AI research. Long before the current AI boom, private industry had already overtaken the federal government as the primary backer of foundational AI work. In recent years, government funding has become increasingly tied to defense and intelligence priorities, leaving researchers in less immediately applicable fields with few viable grant options. At the same time, AI research has grown extraordinarily expensive, requiring elite talent and vast computing resources. As a result, universities and academic labs have become far more dependent on private philanthropy to sustain their work. Funding from wealthy donors often comes with fewer restrictions. It can arrive faster, offer greater flexibility, and require less public disclosure than government grants. This likely explains part of Epstein’s appeal to researchers. But the arrangement cuts both ways. Such donations also require little transparency from the donor, meaning beneficiaries may know very little about the source of their funding. Epstein’s case is extreme, but it highlights a broader risk: when public research funding is scarce and the costs of advanced AI are high, private money becomes more attractive, along with the ethical and reputational dangers it can carry. And the problem is not easing. Microsoft chief scientist Eric Horvitz warned that U.S. cuts to National Science Foundation research grants during the The President administration could undermine the country’s AI leadership, the Financial Times reported, noting that more than 1,600 NSF grants worth nearly $1 billion have been scrapped since 2025. View the full article

-

Deep layoffs hit ‘The Washington Post,’ sparking sharp criticism for owner Jeff Bezos

The Washington Post informed its team on Wednesday morning that it was starting a round of mass layoffs, according to multiple media reports and a memo seen by Fast Company. Multiple sections are being shut down completely, while others are being shrunk significantly. The paper’s executive editor, Matt Murray, announced the cuts to the newsroom employees, saying that all sections would be impacted by the layoffs. He said the Post would be making a “strategic reset,” and is also cutting staff on the business side. The New York Times reported that approximately 30% of the Post’s employees are being laid off, including more than 300 of the around 800 journalists. News of the layoffs attracted a harsh rebuke from people in the media, including the Post‘s own former editor, who criticized the paper’s owner, Amazon founder Jeff Bezos. “This ranks among the darkest days in the history of one of the world’s greatest news organizations,” Marty Baron, executive editor of the Post from 2013 to 2021, said in a statement. “The Washington Post’s ambitions will be sharply diminished, its talented and brave staff will be further depleted, and the public will be denied the ground-level, fact-based reporting in our communities and around the world that is needed more than ever.” Reached for comment, a Washington Post spokesperson sent the following statement: “The Washington Post is taking a number of difficult but decisive actions today for our future, in what amounts to a significant restructuring across the company. These steps are designed to strengthen our footing and sharpen our focus on delivering the distinctive journalism that sets The Post apart and, most importantly, engages our customers.” Sports and other sections said to be gutted The sports section will reportedly be eliminated entirely, meaning that Washington’s paper of record will not provide day-to-day coverage for any of the city’s professional or college sports teams. Murray noted that some of the sports reporters will be moved to the features department to cover “the culture of sports.” This comes in the wake of controversy surrounding the Post’s plans for the Winter Olympics, which start this week. The Times reported on January 24 that the paper axed its plans to send a delegation to the Italy games just two weeks before the opening ceremony, but quickly reversed that decision, sending a team of four after the report came out. The Olympics aren’t the only major event looming on the sports calendar, as Super Bowl LX will be played in San Francisco this weekend, NCAA March Madness is just about a month away, and the FIFA World Cup, hosted in North America this year, kicks off in June. Meanwhile, the Post is reportedly cutting down its Metro desk, which covers Washington, D.C., and its surroundings, from over 40 journalists to well below half of that. The Post is drastically reducing its international coverage as well, although some international bureaus will stay operational Additionally, the paper is reportedly closing the books section and ending its daily Post Reports podcast. Weeks of speculation regarding the paper’s future The announcement comes after weeks of speculation within the newsroom. The Washington Post Guild made a statement last week, directly attacking Bezos, whose holding company, Nash Holdings, bought the paper for $250 million in 2013 and has owned it ever since. During Donald The President’s first term as president, the Post adopted the slogan “Democracy Dies in Darkness” and experienced a period of growth thanks to its aggressive coverage of the administration. In 2023, Bezos hired Will Lewis as publisher of the Post, and these layoffs are just the latest in a line of changes made since then. Notably, the paper did not endorse a candidate in the 2024 presidential election for the first time in 36 years. In response to the layoffs, the Washington Post Guild released another statement: “These layoffs are not inevitable,” its first paragraph reads. “A newsroom cannot be hollowed out without consequences for its credibility, its reach and its future.” This story has been updated with the Post‘s response to our inquiry. View the full article

-

Intuit Aims to Upskill One Million Future Accountants in Five Years

In a significant move poised to reshape the future of the accounting profession, Intuit has launched its innovative Career Pipeline Program, aiming to empower one million aspiring accountants over the next five years. This initiative responds not only to the growing demand for skilled professionals but also to the urgent challenges posed by automation and artificial intelligence (AI) in the industry. As businesses increasingly rely on digital solutions, accountants remain indispensable to organizational success. Intuit, the developer behind popular financial tools such as QuickBooks and TurboTax, understands the vital role that accounting professionals play in steering businesses towards prosperity. The company’s commitment to training the next generation comes amidst a stark talent shortage and misconceptions surrounding the profession, particularly among Gen Z, where 65% lack guidance on career paths in accounting. Simon Williams, Vice President of the Accountant Segment at Intuit, emphasized the need for this initiative. “The accounting community is an integral part of driving business success,” he noted. “Our commitment to upskill one million students is rooted in listening to our accounting partners, understanding the important role they play as advisors, and building a pipeline that helps their firms and their clients thrive.” The Career Pipeline Program aims to bridge the gap between current skills and what employers are seeking in the future. The curriculum will provide students with immersive learning experiences, mentorship opportunities, and industry-recognized certifications that modern firms value. According to analysts, equipping young professionals with digital and advisory skills that align with AI’s capabilities is not just beneficial—it’s essential for their career trajectories. To launch the program, Intuit will host the Career Lab: Skills for the New Era of Accounting, a virtual event scheduled for February 3 and 4, 2026. This event will gather industry experts to discuss trends, including AI’s impact on fintech and Client Advisory Services (CAS). It also aims to enlighten participants about the essential skills accounting firms need today. Participants will gain access to resources enabling them to obtain the ProAdvisor QuickBooks Certification, which is rapidly becoming a gold standard for recruitment in the accounting field. “At Intuit, we believe financial futures are strengthened when AI and human intelligence work together to expand opportunity and transform lives,” said Dave Zasada, Vice President of Education and Corporate Responsibility at Intuit. “By providing free, employer-recognized certifications and access to curriculum and resources that enhance the skills of young professionals, we’re building a robust CAS expert pipeline.” While the initiative provides a considerable opportunity for those entering the accounting profession, small business owners should be aware of potential challenges. With an influx of newly trained accountants entering the workforce, firms will need to differentiate themselves to attract these emerging talents. Moreover, as young professionals adapt to the evolving landscape, small business owners must ensure they provide meaningful roles that leverage these new skills, especially in navigating AI technology and its implications on service delivery. Furthermore, embracing AI tools may require established firms to adjust their traditional workflows. As automation continues to revolutionize jobs, ensuring a balance between human insight and technology will prove crucial. As businesses look to capitalize on these developments, they may need to invest in additional training to enable existing staff to work alongside new AI capabilities efficiently. The Career Pipeline Program aligns well with the growing emphasis on continuous learning within professional services. Small business owners stand to benefit significantly from this influx of well-prepared young accountants who not only possess updated skills but also bring fresh perspectives to traditional practices. As this initiative unfolds, small businesses are encouraged to engage with new talent by providing internships, mentorships, and opportunities for recent graduates. This proactive approach can help integrate the next generation of accountants into the workforce while fostering a more collaborative environment where innovation thrives. For more information about the Career Lab and the free certification resources available, visit Intuit’s dedicated webpage. To explore how Intuit aids accountants with its AI-native solutions, check out their Accountant Suite. The Career Pipeline Program represents a strategic effort by Intuit to ensure the accounting profession remains robust, relevant, and ready for the challenges of a digital future. With the right resources and guidance, small business owners can harness these changes to build stronger, more effective financial practices. The original press release can be found here. Image via Google Gemini This article, "Intuit Aims to Upskill One Million Future Accountants in Five Years" was first published on Small Business Trends View the full article

-

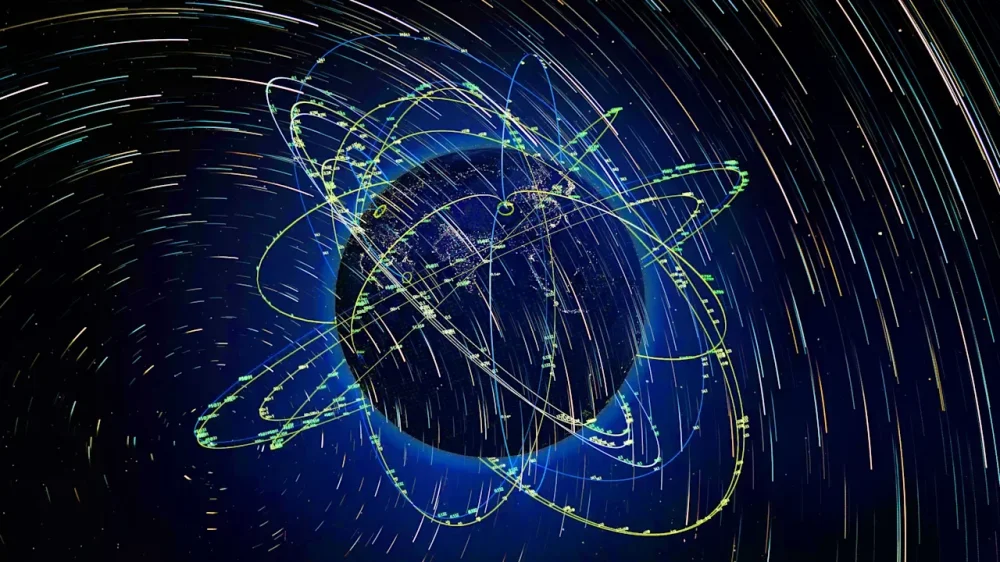

Elon Musk wants to put 1 million satellites in orbit. Can Earth handle it?

Low Earth orbit is already getting crowded. Around 14,500 active satellites are circling Earth, and roughly two-thirds of them are run by SpaceX. Now, in filings connected to Elon Musk’s plan to fold SpaceX and his AI firm xAI together ahead of an IPO, the company has asked the Federal Communications Commission (FCC) for permission to launch up to one million more. The figure is so large it would dwarf the number of satellites currently in orbit. In fact, it is more than every object ever sent into space by every nation combined. So why is Musk planning it, and what would it mean for the rest of us? In a public update posted on the SpaceX website as part of the merger process between SpaceX and xAI, Musk wrote that “Launching a constellation of a million satellites that operate as orbital data centers is a first step towards becoming a Kardashev II-level civilization.” The Kardashev scale is a measure of technological development first outlined in the 1960s by Soviet astronomer Nikolai Kardashev, who died in 2019. While the scale of the proposal may have impressed Kardashev, many experts are far more skeptical. A million new satellites would represent roughly a 67-fold increase over today’s orbital population. “Proposals on the scale being discussed—up to one million satellites—represent a step change that deserves the same level of scrutiny we would apply to any other major global infrastructure project,” says Ruskin Hartley, CEO of DarkSky International, a nonprofit focused on preserving night skies and mitigating the impacts of light pollution. Satellite deployment at such a scale would have huge knock-on effects. “The consequences extend well beyond astronomy,” Hartley says. “They include cumulative impacts on the night sky, increased atmospheric pollution from satellite launches and re-entries, and a sharply elevated risk of orbital congestion and collision cascades that could impair access to low Earth orbit for all nations.” When satellites burn up, they release metals such as aluminum into the upper atmosphere, a process scientists and the U.K. Space Agency warn is still poorly understood but likely accelerating as megaconstellations grow. There is also the question of safety. Space is already crowded with satellites that power communications, enable GPS navigation, and support countless services we rely on every day. Adding vastly more objects increases the chances of close approaches, which, if not monitored and avoided, can result in collisions and cascading debris. “SpaceX will say they can do that stationkeeping successfully, but it doesn’t take many failures to have you end up in a bad situation,” says Jonathan McDowell, an astronomer and space sustainability analyst based in London and Boston and formerly at the Center for Astrophysics. “The SpaceX satellites will be in the higher part of low Earth orbit where it will take a long time for failed satellites to re-enter.” Hartley, for his part, argues that these risks demand far more scrutiny. “Decisions made now will shape the near-Earth environment for generations,” he says. Not everyone believes the million-satellite figure is even realistic. “As to the question of if it’s practical, I would think not,” says Caleb Henry, director of research at Quilty Space. “Filing for 1 million satellites is probably a way for SpaceX to push the envelope before accepting whatever fraction regulators deem acceptable.” That tactic may already be working. The FCC initially rejected a 2022 SpaceX proposal to launch 30,000 satellites, before later approving it in 25% tranches. “The commission authorized another 7,500 satellites this January, for a total approval of 15,000 satellites from that filing,” says Henry. SpaceX is also asking the FCC to waive standard deployment milestones, and says the economics of the plan depend on Starship becoming fully reusable, a goal it has not yet reached. In that sense, the million-satellite request is not a signal of imminent growth, but a bid to stake out spectrum and orbital real estate for a future that Musk is already trying to define. View the full article

-

Messenger Apps Are Compressing Your Files, but There's a Workaround

In the old days, we'd post our photos and videos on social media for the world to see. Right now, it's far more common to send these pictures and clips to friends and family through private chat groups—but what you might not have realized is that they get pretty heavily compressed along the way. There are many reasons for this: It means the files get sent faster, for example, and that the companies behind these messenger apps don't have to spend quite so much on cloud storage (imagine millions of images being sent by millions of users, all the time). However, the recipients of these photos and videos are missing out, and getting copies that are of a much lower quality. A lot of the time, you can't really tell the difference on a small phone screen, which is why apps can get away with it. But if you're looking at something on a computer screen or trying to print something out to get a permanent physical copy, the compression quickly becomes apparent. It's something most messenger apps do—but there is a workaround if you want your photos and videos shared at full resolution. How much do messenger apps compress your files? Look out for the HD button when sharing on Instagram. Credit: Lifehacker Messenger apps are rather coy when it comes to revealing just how much compression they apply: Search the web and you'll hit Reddit threads and support forums rather than actual official documents. Apple admits iMessage applies compression "when necessary", and Google acknowledges files "may have a lower resolution" when sent through Google Chat, but it's all rather vague. To try and get a bit more clarity, I ran a quick test myself, with a 12MP, 4,000 x 3,000 pixel, 3.4MB image taken on a Pixel. Bearing in mind that compression levels will vary depending on what you're sending, and this was just a test with a single image, here's how the file was changed after it got sent through various DMs: Facebook Messenger: 2,048 x 1,536 pixels, 392KB Google Chat: 1,600 x 1,200 pixels, 324KB Google Messenger: 4,000 x 3,000 pixels, 3.4MB. iMessage: 4,000 x 3,000 pixels, 3.2MB Instagram: 1,000 x 750 pixels, 138KB WhatsApp: 2,000 x 1,500 pixels, 390KB You can see there's a lot of compression going on here, but Google Messages and iMessage are the clear winners when it comes to retaining original quality (at least with images)—a good advert for both Apple's proprietary messaging system and for RCS. It's also worth delving into the settings for each app. In Instagram, for example, there's a HD button next to the photo and video picker: When I selected this, Instagram shrank my original photo down to 2,000 x 1,500 pixels, with a file size of 421KB. In its help section, Instagram says it automatically adjusts image compression based on current network conditions, which is something else to think about—you might want to do all your photo and video sharing over wifi (which is what I did here). How to send files in their original quality through messenger apps It only takes a couple of taps to get iCloud links in Apple Photos. Credit: Lifehacker You can make sure your photos and videos get to your friends and family in their glorious, original quality, but you lose a bit of convenience along the way. Essentially, you need to pick a cloud storage service where your images and videos will be stored in full resolution, and then share links to these files—rather than sharing the files themselves. It's not quite the same immediate experience if you're sending around baby pictures or party pictures: Your recipients will just see a rather dull-looking link instead of thumbnails right inside their apps (though in some cases, there might be a small preview attached). If quality is what matters most to you, this is the way to go when it comes to sharing photos and videos. You're free to use your cloud storage provider of choice, but if there is one made by the same company behind your favorite messaging app, it makes sense to combine them together. In Google Photos on Android, for example, you can tap on a photo to view it, then choose Share and Share again to find the Create link feature: You can then share this link with any contact in any app. For Apple Photos on the iPhone, you can get a link to a photo once you've opened it up by tapping the share button (lower left), then Copy iCloud Link. Again, you can paste this anywhere you like, and it's not much more difficult to share entire folders of pictures rather than individual images. There is an extra advantage to sharing photos and videos this way, in that you can revoke sharing permissions any time you like: New people can be added and other people can be removed from albums showing your toddler growing up for example. It's not as fast and easy as direct file sharing, but you do get a bit more control (and higher resolutions). View the full article

-

How Anthropic achieved AI coding breakthroughs — and rattled business

New AI-powered tools reduce time and cost of software development, threatening industries from law to advertisingView the full article

-

Trump administration to unveil grand plan for countering China’s control on critical minerals

President Donald The President’s administration is expected to unveil its grandest plan yet to rebuild supply chains of critical minerals needed for everything from jet engines to smartphones, likely through purchase agreements with partners on top of creating a $12 billion U.S. strategic reserve to help counter China’s dominance. Vice President JD Vance is set to deliver a keynote address Wednesday at a meeting that Secretary of State Marco Rubio is hosting with officials from several dozen European, Asian and African nations. The U.S. is expected to sign deals on supply chain logistics, though details have not been revealed. Rubio met Tuesday with foreign ministers from South Korea and India to discuss critical minerals mining and processing. The meeting and expected agreements will come just two days after The President announced Project Vault, or a stockpile of critical minerals to be funded with a $10 billion loan from the U.S. Export-Import Bank and nearly $1.67 billion in private capital. The President’s Republican administration is making such bold moves after China, which controls 70% of the world’s rare earths mining and 90% of the processing, choked off the flow of the elements in response to The President’s tariff war. The two superpowers are in a one-year truce after The President and Chinese President Xi Jinping met in October and agreed to pull back on high tariffs and stepped-up rare earth restrictions. But China’s limits remain tighter than they were before The President took office. “We don’t want to ever go through what we went through a year ago,” The President said on Monday when announcing Project Vault. Countering China’s dominance on critical minerals Other countries might join with the The President administration in buying up critical minerals and taking other steps to spur industry development because the trade war revealed how vulnerable Western countries are to China, said Pini Althaus, who founded Oklahoma rare earth miner USA Rare Earth in 2019. “They’re looking at setting up sort of a buyers’ club, if you will,” said Althaus, who now is working to develop new mines in Kazakhstan and Uzbekistan as CEO of Cove Capital. “The key producers and key consumers of critical minerals will sort of get together and work on pricing structures, floor pricing and other things.” The government last week also made its fourth direct investment in an American critical minerals producer when it extended $1.6 billion to USA Rare Earth in exchange for stock and a repayment agreement. Seeking government funding these days is like meeting with private equity investors because officials are scrutinizing companies to ensure anyone they invest in can deliver, Althaus said. And the government is demanding terms designed to generate a return for taxpayers as loans are repaid and stock prices increase, he said. The stockpile strategy Meanwhile, the U.S. Export-Import Bank’s board this week approved the $10 billion loan — the largest in its history — to help finance the setup of the U.S. Strategic Critical Minerals Reserve. It is tasked with ensuring access to critical minerals and related products for manufacturers, including battery maker Clarios, energy equipment manufacturer GE Vernova, digital storage company Western Digital and aerospace giant Boeing, according to the policy bank. Bank President and Chairman John Jovanovic told CNBC that the project creates a public-private partnership formula that “is uniquely suited and puts America’s best foot forward.” “What it does is it creates a scenario where there are no free riders. Everybody pitches in to solve this huge problem,” he said. Manufacturers, which benefit the most from the reserve, are making a long-term financial commitment, Jovanovic said, while the government loan spurs private investments. The stockpile strategy may help spark a “more organic” pricing model that excludes China, which has used its dominance to flood the market with lower-priced products to squeeze out competitors, said Wade Senti, president of the U.S. permanent magnet company AML. The The President administration also has injected public money directly into the sector. The Pentagon has shelled out nearly $5 billion over the past year to help ensure its access to the materials after the trade war laid bare just how beholden the U.S. is to China. Efforts get some bipartisan support A bipartisan group of lawmakers last month proposed creating a new agency with $2.5 billion to spur production of rare earths and the other critical minerals. The lawmakers applauded the steps by the The President administration. “It’s a clear sign that there is bipartisan support for securing a robust domestic supply of critical minerals that both reduces our reliance on China and stabilizes the market,” Sens. Jeanne Shaheen, D-N.H., and Todd Young, R-Ind., said in a joint statement Tuesday. Building up a stockpile will help American companies weather future rare earth supply disruptions, but that will likely be a long-term effort because the materials are still scarce right now with China’s restrictions, said David Abraham, a rare earths expert who has followed the industry for decades and wrote the book “The Elements of Power.” The The President administration has focused on reinvigorating critical minerals production, but Abraham said it’s also important to encourage development of manufacturing that will use them. He noted that The President’s decisions to cut incentives for electric vehicles and wind turbines have undercut demand for these elements in America. —Didi Tang, Josh Funk and Matthew Lee, Associated Press View the full article

-

10 Small Business Jobs Near Me You Can Apply For Today

If you’re on the lookout for small business jobs nearby, there are several options worth considering. Positions like a mid-level CPA, part-time office admin, or small business banker can provide solid career paths. You might likewise explore roles such as a business loan broker or client service manager. Each role has specific requirements and responsibilities that can suit various skill sets. Comprehending these opportunities can help you make an informed decision about your next career move. Key Takeaways Explore mid-level CPA roles for small business accounting and tax services, offering competitive salaries and responsibilities in financial analysis and bookkeeping. Consider part-time office admin positions requiring QuickBooks proficiency and online marketing skills, with flexible scheduling and hourly pay between $20 – $25. Look into small business banker roles focused on relationship building with local entrepreneurs, emphasizing customer service and sales experience for career advancement. Apply for business loan broker positions that assess client financial needs, offering entry-level salaries starting around $40,000 with potential for higher earnings through commissions. Seek remote opportunities like assistant director for small business national partners, focusing on strategy execution and relationship building with competitive mid-level compensation. Mid-Level CPA (Small Business Accounting & Tax Services) If you’re considering a career as a Mid-Level CPA in small business accounting and tax services, you might find the position at Clear Crossway Solutions in Houston, TX, particularly appealing. This role offers a competitive salary ranging from $45K to $55K per year, making it an attractive option among small business jobs near me. As a Mid-Level CPA, you’ll prepare and review various tax returns, including Forms 1040, 1120, 1120S, and 1065, during managing bookkeeping and general ledger oversight for assigned clients. You’ll be expected to conduct financial analysis for small businesses, requiring a solid comprehension of financial management and accounting principles. Adaptability and problem-solving skills are essential in this dynamic work environment. Familiarity with accounting software and digital marketing platforms not only improves your prospects but additionally streamlines financial operations, making this position an excellent fit for those interested in jobs in business. Part-Time Office Admin — QuickBooks & Online Marketing REQUIRED For those looking to expand their career options in the small business sector, the Part-Time Office Admin position at Scoop Le Poop in Houston, TX, presents a compelling opportunity. This role requires proficiency in QuickBooks and online marketing to effectively support business operations. Here are some key aspects to evaluate: Pay Range: The position offers $20 – $25 per hour, depending on experience. Skills: Strong customer service and retention skills are a must, along with a self-directed management style. Multitasking: You’ll need to adapt quickly in a fast-paced environment, handling multiple tasks efficiently. Flexible Hours: This role allows for flexible scheduling, making it ideal for those seeking part-time work as they apply their administrative and marketing expertise. If you meet these requirements, this position could be a great fit for your professional growth. Small Business Banker Bellaire The Small Business Banker position at Comerica in Bellaire, TX, plays a crucial role in nurturing relationships with local entrepreneurs as they address their unique financial needs. This role focuses on driving net customer growth by servicing small business relationships, which requires strong financial acumen. You’ll be responsible for delivering customized banking solutions that meet the specific needs of each small business. To excel, applicants typically need a background in customer service, sales, or business banking, along with effective communication skills to build rapport with clients. Engaging with local entrepreneurs is important, as you’ll help them navigate financial challenges and achieve their business goals. Additionally, this position offers opportunities for career advancement within Comerica, a company dedicated to supporting small business growth and community development. If you’re passionate about helping businesses thrive, this role could be an excellent fit for you. Assistant Director, Small Business National Partners As you explore the role of Assistant Director, Small Business National Partners at The Hartford, you’ll find a position designed for those who excel in executing small business strategies and nurturing partnership initiatives. This remote role requires a blend of skills vital for success, including: Business Development: You’ll need to identify and cultivate relationships with small business partners. Communication: Strong verbal and written skills are fundamental for effective collaboration and negotiation. Strategic Planning: You’ll analyze market trends to drive growth and improve partnerships. Small Business Operations: A solid comprehension of small business dynamics will guide your initiatives. Candidates should demonstrate experience in managing partnerships and delivering results. The position offers competitive compensation, aligning with industry standards for mid-level management roles in small business services. If you’re looking to make an impact in this field, this role could be the perfect opportunity for you. Small Business Client Service Manager I In a dynamic business environment, a Small Business Client Service Manager I plays a vital role in ensuring that small business clients receive the support they need to thrive. This position, available remotely at Gallagher in Houston, TX, focuses on delivering exceptional customer service within the small business division. Strong communication skills are important, as you’ll help clients navigate their needs effectively. Ideally, you should have a background in customer service, particularly with experience in small business operations or financial management. Business Bankruptcy Lawyer Supporting small businesses goes beyond client service; it often involves maneuvering through financial challenges, especially when those businesses face bankruptcy. If you’re considering a career as a Business Bankruptcy Lawyer, you’ll play a vital role in helping small business owners reorganize their debts under Chapter 11 sub-chapter V. Here are key aspects of the position: Salary Range: Expect a competitive salary between $85K – $135K annually. Expertise: You’ll need a solid comprehension of bankruptcy law to navigate complex financial situations. Client Interaction: Work closely with clients to develop customized debt relief strategies, negotiating with creditors when necessary. Skills Required: Strong communication and analytical skills are fundamental for presenting legal arguments and advising clients effectively. This role is especially in demand during economic downturns, making it a potentially lucrative career for those specializing in small business financial matters. Customer Service Representative Customer Service Representatives play a vital role in small businesses, acting as the primary point of contact for clients and addressing their inquiries and concerns. Typically, these positions offer salaries ranging from $15.75 to $20.75 per hour, depending on the company and location. Strong communication skills are important, as you’ll assist clients with inquiries, complaints, and service-related issues. Adaptability and problem-solving abilities are also highlighted, since you’ll often need to handle diverse customer needs and concerns. Familiarity with point-of-sale systems and customer relationship management software can improve your effectiveness in this role. Furthermore, opportunities for advancement exist within customer service, potentially leading to management, training, or specialized support roles, especially in a small business environment. If you enjoy engaging with people and solving problems, a position as a Customer Service Representative may be a great fit for you. Small Business Sales Account Executive – South Texas As a Small Business Sales Account Executive in South Texas, you’ll focus on driving sales and cultivating relationships with small to medium-sized enterprises throughout the region. This role requires strong business acumen and problem-solving skills, along with a solid comprehension of financial management. Here are key aspects of the position: Sales Focus: You’ll actively pursue new clients and upsell existing accounts, aiming to meet sales targets. Relationship Building: Establishing trust with clients is crucial for grasping their unique business needs. Commission Structure: Your earnings can substantially increase through performance-based incentives, rewarding your hard work. Career Advancement: Opportunities often arise for those who network effectively and demonstrate consistent sales performance, leading to roles in management. With excellent communication skills, you’ll effectively engage clients and drive your success in this competitive field. Part-Time Real Estate Photographer (No Experience Needed) If you’re looking for a flexible job that allows you to express your creativity, consider becoming a part-time real estate photographer. This role requires no previous experience, making it a great entry point for anyone interested in photography as it offers the chance to develop your skills. You’ll be able to work around your schedule, travel to different locations, and earn competitive pay, making it a solid option in today’s gig economy. Flexible Work Hours Finding a job with flexible work hours can greatly improve your work-life balance, especially in a position like the Part-Time Real Estate Photographer role at Real Estate Photographer Pro in Houston, TX. This opportunity is perfect if you’re looking to enter the photography field without prior experience. Here are some key benefits of this position: Flexible Scheduling: You can plan shoots around your availability. No Experience Required: It’s accessible for anyone interested in photography. Creative Expression: Capture stunning images that help market properties. Commission-Based Earnings: Your income can grow based on how many properties you photograph. This role allows you to blend your passion for photography with the real estate market during maintaining a manageable schedule. Creative Skill Development Creative skill development plays a significant role in the path of a Part-Time Real Estate Photographer, especially when you have no prior experience. This position at Real Estate Photographer Pro in Houston, TX, offers you a chance to learn photography during flexible hours. You’ll focus on capturing high-quality images that highlight properties, which is critical for attracting potential buyers. As you take on this role, you’ll build a portfolio that showcases your progress and creativity, fundamental for advancing in the photography field. Moreover, working in real estate photography allows you to gain insights into the market, network with agents and homeowners, and potentially open doors for future job opportunities. This experience can be invaluable for your career. Business Loan Broker, Houston If you’re considering a career as a Business Loan Broker in Houston, you’ll play an essential role in connecting small and medium-sized businesses with the capital they need to thrive. This position demands strong financial management skills and a thorough comprehension of the lending process, as you’ll help clients navigate loan applications and secure favorable terms. With potential earnings based on commissions and the flexibility to work remotely, this job can be an appealing option for those balancing professional and personal responsibilities. Responsibilities and Duties As a Business Loan Broker in Houston, you play a vital role in supporting small and medium-sized enterprises by helping them secure the financing they need to grow and succeed. Your responsibilities include: Evaluating clients’ financial needs and matching them with suitable loan products. Conducting thorough assessments of credit histories and financial statements to determine loan eligibility. Building and maintaining relationships with lending institutions to access competitive loan terms. Guiding clients through the application process, ensuring all documentation is submitted accurately and swiftly. You’ll need effective communication skills to explain complex loan options clearly. Your role is essential in helping clients navigate the often complicated world of business financing, enabling them to make informed decisions for their enterprises. Required Skills and Qualifications To succeed as a Business Loan Broker in Houston, you’ll need a specific set of skills and qualifications that cater to the demands of this competitive field. Strong financial acumen is vital, along with a solid comprehension of lending processes, to help small and medium-sized enterprises secure capital. Familiarity with accounting software and digital marketing tools can further boost your effectiveness in managing client portfolios and outreach efforts. Excellent interpersonal and communication skills are key for building relationships with clients and lenders, ensuring successful negotiations. Prior experience in finance, sales, or customer service is often preferred, as it equips you to navigate complex loan agreements. Moreover, knowledge of local market trends and economic factors can improve your ability to provide customized financial solutions. Potential Salary Range The potential salary range for a Business Loan Broker in Houston reflects the varying levels of experience and performance in this dynamic field. Typically, you can expect: Entry-level positions starting around $40,000 annually. Average salaries usually range from $50,000 to $100,000 per year, depending on your skills and success. Seasoned brokers can earn upwards of $120,000, especially with strong client relationships. Commissions are a key factor, often boosting income remarkably based on the volume of loans processed. With the growing demand for financing among small and medium-sized businesses, job security is promising. Many brokers likewise benefit from flexible work arrangements, allowing them to manage multiple clients effectively, further enhancing their earning potential. Frequently Asked Questions What Jobs Pay $400 an Hour? Jobs that pay $400 an hour are typically found in specialized sectors. You might consider roles like surgeons or anesthesiologists in healthcare, top-tier attorneys in complex litigation, or C-level executives in large corporations. Furthermore, highly skilled consultants in technology or finance often charge similar rates for their expertise. Freelancers in high-demand fields, such as cybersecurity or artificial intelligence, may likewise command these hourly rates based on their unique skills and client needs. How Can I Make $2000 a Week Working From Home? To make $2000 a week from home, focus on high-paying freelance or remote roles. Consider consulting, specialized sales, or multiple part-time gigs like virtual assistance or online tutoring. Commission-based sales in fields like real estate can likewise boost your income if you have strong networking skills. Utilizing platforms like Upwork or Fiverr allows you to leverage your expertise in various freelance projects, helping you reach your weekly earnings goal effectively. What Jobs Pay $1,000 an Hour? Jobs that pay $1,000 an hour are rare and usually require significant qualifications. Professionals like specialized surgeons, corporate attorneys, or elite consultants typically earn these rates because of their expertise and experience. Some freelance roles, such as expert witnesses or high-level financial advisors, can likewise command such fees. Nevertheless, most jobs in various sectors offer much lower wages, often between $15 and $50 per hour, highlighting the exclusivity of high-paying positions. What Jobs Make $500 an Hour? Jobs that make $500 an hour are typically found in specialized fields like medicine, law, or high-level consulting. For instance, certain surgeons or top law firm partners can command these rates because of their extensive training and experience. Moreover, freelancers or consultants in these areas often set high hourly rates for their expertise. As lucrative as they are, these positions are highly competitive and not common, representing a small fraction of the overall job market. Conclusion To summarize, there are several small business job opportunities available that cater to various skills and interests. Whether you’re interested in accounting, administration, banking, or creative roles, you can find positions that match your qualifications. By applying to these roles, you can contribute to local businesses as you advance your career. Take the time to explore these options and submit your applications today to secure a position that aligns with your professional goals and expertise. Image via Google Gemini and ArtSmart This article, "10 Small Business Jobs Near Me You Can Apply For Today" was first published on Small Business Trends View the full article

-

You Can 'Remap' Your PC's Copilot Key to Do Something Actually Useful

If you bought a Windows computer in the past couple years, there's a good chance that it a "Copilot" key where the right ctrl key used to be. But what if you actually used the right ctrl key? Or what if you prefer Claude or ChatGPT to Copilot? Whatever your reason for not loving the Copilot key, don't worry—you can change it. Here's how to do so in the Windows settings or, if necessary, using Microsoft Powertoys. How to change the Copilot key in settingsOpen the Settings application and head to the Personalization section. You should find a Customize Copilot key option here, assuming you're using a recent-ish version of Windows 11. Click the drop-down menu and you'll have three options: Copilot, Search, and Custom. You can change the button to Search if you'd rather use the key to bring up the Windows search tool instead of Copilot. Alternatively, you can use the Custom option to launch any application on your computer instead of Copilot. This could be a useful way to open the Claude or ChatGPT desktop apps instead of Copilot. Or, if you're not a big AI fan, you could just have it open your browser. This is a limited number of options, granted, but it's easy and doesn't require any sort of tools. It's your simplest option. How to change the Copilot key using Microsoft PowertoysYou may have noticed that the options in Settings don't let you remap the Copilot key to the ctrl key, or any other key—all you can do is launch an application. For that, you're going to need to install Powertoys, the secret Microsoft app that improves Windows. After installing, go to the Keyboard Manager section. The simplest thing to do, which may or may not work on your computer, is to click Remap keys. You should be able to press your Copilot key to remap it (it will show up as F23, which we'll get to). Now you can choose what you want the key to serve as. This could be ctrl, if you like, or it could be any other key. Click OK, and you should be done. Credit: Justin Pot There's a chance this won't work for you. Why? Because the Copilot key works a little differently depending on what kind of laptop you have. Buckle up: This gets complicated in a very Microsoft-y way. On many computers, the Copilot key functions as an F23 key. This is a workaround, of sorts, allowing Microsoft to add a key without changing the operating system very much. Most modern keyboards only have one row of function keys—around 12 in total. Keyboards in the 80's and 90's sometimes had two rows of keys—around 24 in total. Windows, to this day, still supports all 24 keys, even though basically no one has that many function keys. Microsoft took advantage of this—on many laptops the Copilot key functions as an F23 key. But this is Windows, so of course it's more complicated than that. On some laptops, pressing the Copilot key triggers a keyboard shortcut: Windows-Shift-F23. This means you can't use the Remap keys function in Powertoys to remap the Copilot key, because the Copilot key already triggers a keyboard shortcut. What you can do is use the Remap a shortcut option. Use this, then press the Copilot key as your selection. You should see the keyboard shortcut Windows-Shift-F23 show up. Now choose what you want to remap your Copilot key to. This works, with a caveat: You really can't use it to bring back your ctrl key, as users have noted on Github. The issue is that you can't remap a keyboard shortcut to a modifier key, just to a single keypress. It's not clear what could fix this, and I suspect users of such laptops are just stuck. Which is all to say that you might not be able to get your control key back, but least you can remap the key to do something else. View the full article

-

Trump’s border tsar announces withdrawal of 700 federal agents from Minneapolis

Drawdown comes as backlash against enforcement tactics forces president to soften approach to immigration crackdownView the full article

-

Google Ads adds a second set of eyes for high-risk account changes

Google Ads has quietly rolled out multi-party approval, a security feature that requires a second administrator to approve certain high-risk account actions. These include adding or removing users and changing user roles. Why we care. As ad accounts grow larger — and more valuable — access control has become a bigger risk. A single unauthorized, malicious or accidental account change can disrupt campaigns, access, and billing in minutes. Multi-party approval reduces that risk by requiring a second admin sign-off on high-impact actions, adding protection without changing day-to-day campaign management. For agencies and large teams especially, it helps prevent costly mistakes and improves overall account security. How it works. When an admin initiates a sensitive change, Google Ads automatically creates an approval request. Other eligible admins receive an in-product notification, and one of them must approve or deny the request within 20 days. If no action is taken, the request expires and the change is blocked. Status tracking. Each request is clearly labeled as Complete, Denied, or Expired, making it easier for teams to monitor what’s been approved — and what didn’t make it through. Where to find it. Admins can view and manage approval requests from the Access and security section within the Admin menu. The bigger picture. The update reflects growing concern around account security, especially for agencies and large advertisers managing multiple users, partners, and permissions. With advertisers recently reporting costly hacks, this would be a very welcome update. Bottom line. Multi-party approval adds friction — but the good kind. It gives advertisers more control over who can make critical changes and helps protect Google Ads accounts from unauthorized access. View the full article

-

The Top 10 Movies Streaming This Month

We may earn a commission from links on this page. January has a reputation for being a dumping ground at movie theaters, but that's certainly not the case when it comes to streaming, as the apps begin to load up on the prior year's critical and commercial hits—and 2026 came in like a champion, with the list of the top movies streaming including banger after banger, from One Battle After Another, to Sinners, to F1. January's streaming winners are heavy on social commentary. One Battle After Another plays it straight in its bracingly contemporary story of anti-fascist revolutionaries and immigration raids, while Sinners, Bugonia, and 28 Years Later use sci-fi and horror tropes to comment on our current political divides. If that all sounds too heavy, the list is rounded out by escapist fair like F1 and The Rip. Also of note: The popularity of The Running Man and The Long Walk indicate that movie-goers are hungry for adaptations of dystopian Stephen King novels written under the pen-name Richard Bachman and foregrounding near-future authoritarian societies in which deadly ambulation-based contests are popular. I wonder what that's about? Here's the full list of the top 10 most-streamed movies of January 2026 across all major streaming services, as compiled by JustWatch. One Battle After Another (2025) Topping the charts this month is Paul Thomas Anderson's nuanced, intelligent thriller about resistance and race in a fascistic, anti-immigration United States. (No, it's not a documentary.) Featuring fantastic performances from heavyweights like Leonardo DiCaprio, Sean Penn, Benicio Del Toro, and Regina Hall, One Battle After Another is that rare movie that's equal parts thoughtful and exciting. It was recently nominated for 13 Oscars. Stream one Battle After Another on HBO Max. One Battle After Another (2025) at HBO Max Learn More Learn More at HBO Max Bugonia (2025) It's always nice when a weirdo movie is widely watched, and Bugonia was that movie in January 2026. Jesse Plemons and Aidan Delbis play a couple of societal dregs who kidnap a high-powered pharmaceutical executive (Emma Stone) because they think she's an alien. Directed by Yorgos Lanthimos, who helmed 2023's excellent Poor Things, the Best Picture Oscar nominee is a must-watch, even if you're only a little weird. (And if you want more weirdness, it's based on an even odder South Korean film called Save the Green Planet.) Stream Bugonia on Peacock. Bugonia (2025) at Peacock Learn More Learn More at Peacock Sinners (2025) This one-of-kind flick mashes up so many styles, it's practically its own genre. A historical-horror-ensemble romance-drama-comedy-musical exploring race and historical prejudice in the United States, Sinners tells its story through both song and vampire violence. It is absolutely to-notch in every cinematic way, which is probably why it earned a record 16 Oscar nominations. Stream Sinners on HBO Max and Prime Video. Sinners (2025) at HBO Max Learn More Learn More at HBO Max The Running Man (2025) Based on a 1982 novel by Stephen King (writing as Richard Bachman) and directed by Edgar Wright, The Running Man is a dystopian near-future sci-fi action flick in which the most popular show on TV is a deadly reality competition with contestants who must survive 30 days while being hunted by professional assassins. I hate to admit that I would totally watch that show, and you should totally watch this movie. Stream The Running Man on MGM+ and Paramount+. The Running Man (2025) at MGM+ Learn More Learn More at MGM+ The Rip (2026) If you're in the mood for a throwback action-thriller, check out The Rip, from director Joe Carnahan. It tells the story of a Miami tactical narcotics team that discovers $20 million of dirty money in a stash house. Nobody in the squad is a "clean cop" when there's that much money in play, and soon, everything goes predictably haywire in unpredictable ways. Starring movie pals Matt Damon and Ben Affleck, The Rip is a non-stop ride. Stream The Rip on Netflix. The Rip (2025) at Netflix Learn More Learn More at Netflix Train Dreams (2025) If you want maximum Americana drama, but not in a cheesy way, check out Train Dreams. Set in the early 1900s, it tells the story of Robert Grainier (Joel Edgerton), a logger and railroad builder whose quiet life is upended by a devastating tragedy. Train Dreams is a thoughtful, poetic movie about the passing of an era. It's also a Best Picture nominee this year. Stream Train Dreams on Netflix. Train Dreams (2025) at Netflix Learn More Learn More at Netflix Wake Up Dead Man: A Knives Out Mystery (2025) The third Knives Out mystery stars Daniel Craig as Benoit Blanc, the last of the gentleman's sleuths, who is this time investigating the murder of a priest. A stylish, twisty, brain-testing whodunnit with an all-star cast that includes Josh O'Connor, Glenn Close, Josh Brolin, Mila Kunis, and Jeremy Renner, Wake Up Dead Man is proof that a classic murder mystery can still keep the most seasoned armchair detectives guessing. Stream Wake Up Dead Man: A Knives Out Mystery on Netflix. Wake Up Dead Man: A Knives Out Mystery (2025) at Netflix Learn More Learn More at Netflix The Long Walk (2025) The second film in this month's top 10 based on a novel by Stephen King but written under the pseudonym Richard Bachman, The Long Walk shares only surface similarities with The Running Man in its story of a group of young men living in a dystopian future society who are forced to compete in a deadly contest that requires them to keep walking until only one of them is left standing (and alive). It's an ensemble character study closer to They Shoot Horses, Don't They than it is to over-the-top action sci-fi of The Running Man. (They'd make a great double-feature, though.) Stream The Long Walk on Starz or rent it from Prime Video. The Long Walk (2025) at Prime Video Learn More Learn More at Prime Video 28 Years Later (2025) Zombies spoil if you leave 'em out to long, and these dead boys have been marinating for nearly 30 years. Danny Boyle and Alex Garland's 28 Years Later ditches much of the fast-paced chaos of modern zombie flicks for an atmospheric, haunting exploration of the community of humans still alive in a long-dead England. It’s a somber movie about the post-apocalypse that makes you wonder if the zombies have it better off. Stream 28 Years Later on Netflix or rent it from Prime Video. 28 Years Later (2025) at Prime Video Learn More Learn More at Prime Video F1 (2025) I'm happy that this list of bleak zombie narratives, carefully paced mysteries, and thinly veiled cultural critique ends with a movie about cars driving very, very fast. (Sometimes you just need a palate cleanser.) Starring Brad Pitt as race car driver striving for one last stab at glory, the Best Picture-nominated F1 was shot at actual F1 Grand Prix events and perfectly captures the danger, drama, and pure adrenaline of the sport. It's a great film to show off your new TV and soundbar. Stream F1: The Movie on Apple TV+. F1: The Movie (2025) at Apple TV+ Learn More Learn More at Apple TV+ View the full article

-

ICE quietly scrambled for vaccine support after losing access through the VA

In procurement documents quietly published last month, Immigration and Customs revealed that the Veterans Affairs administration abruptly cut off its access to vaccines that the agency has historically provided to the people it detains. It was one of a series of medical support services that were suddenly halted, and comes amid long-standing and growing concerns about the health care provided at ICE facilities. ICE subsequently pursued an “emergency” procurement to access vaccines in another way, according to the contracting documents released by the government. The Department of Homeland Security, in which ICE is housed, claims there was no gap in the vaccine service provided by the agency. Still, the document is a small window into the state of ICE operations as the agency continues to ramp up immigration enforcement efforts. ICE had for decades secured what calls “seasonal and routine” vaccines from the VA Financial Services Center, which provides support to both the veterans agency and other federal departments. Earlier government documents, previously reported by Popular Information, show that the VA suddenly cut off services for the ICE Health Corps back in October, which created subsequent issues for both medical claims processing and the pharmacy benefits management for people detained at ICE facilities. Now, another set of documents show that disintegration of the collaboration between the VA and ICE even extended to vaccines and created what the document, as an “absolute emergency.” ICE reveals relatively little about the extent to which it actually provides vaccines to detainees, and the agency did not comment on which particular vaccines it actually provides. The agency did distribute tens of thousands of COVID-19 vaccine doses during the height of the pandemic, but further information isn’t available. There are already serious concerns about the quality and extent of health services provided to ICE detainees. The transmission of illnesses—including the flu and Hep A—are well documented at ICE facilities, and the risk of an outbreak has grown as ICE has sought to round up and detain more people, overcrowding detention centers. ICE recently paused movement at one detention facility in Texas because of a measles outbreak, and the agency is facing several class action lawsuits over the state of detainees’ health care. “Over the years, there have been many documented outbreaks of measles, mumps, influenza, chickenpox, and other infectious diseases in detained migrants in ICE detention centers,” Nathan Lo, a Stanford professor who studies infectious diseases, tells Fast Company. “Many of these outbreaks are quite unusual which underscore that it’s these conditions that predispose to these outbreaks.” Adults are often not even offered vaccines, Lo adds. ICE claimed in the documents, which were posted publicly in January, that the VA “abruptly and instantly terminated” the agreement in October, leaving the DHS component with no mechanism to provide vaccines to undocumented people. “It is an absolute emergency for ICE to immediately procure vaccine support because lack of this support will delay critical and life-saving vaccines,” the procurement justification said. DHS tells Fast Company that there was never a gap in services because they were able to secure a new vendor. ICE did not answer a series of questions about its vaccine provision, including which vaccines the agency offers detainees, or provide further details about its reliance on the VA. When Fast Company asked the Veterans Affairs Department about the situation, the agency’s press secretary Peter Kasperowicz only said that under the new administration, the “VA does not provide any services or support to illegal immigrants. We are solely focused on providing the best possible care and benefits to the Veterans, families, caregivers and survivors we serve.” Under the The President administration, ICE has aimed to deport a record number of people, which has exacerbated existing and serious concerns about the health and safety of detention centers and extremely limited oversight. More than 32 people died in ICE custody last year, making 2025 the deadliest year for the agency in decades, The Guardian reported. “ICE has systematically neglected—and actively harmed—the health and well-being of the people it detains for as long as the agency has existed, just like all the U.S. government agencies throughout history that have caged and deported people,” says Ana Linares, a paralegal focused on mental health care at legal access at the California Collaborative for Immigrant Justice, one of the groups leading lawsuits against ICE. “The only solution that centers real health and safety is to end ICE detention and allow people to pursue their immigration processes in freedom with the support and care of family and community.” The VA did not provide any more details over its decision to cut off vaccine support to ICE, but it’s possible the agency made the decision in the wake of Executive Order 14218, which the The President Administration announced in February and dubbed the “Ending Taxpayer Subsidization of Open Borders.” The order directed agencies to analyze taxpayer-funded funds that went to “unqualified” aliens and take any appropriate actions to end those programs. In response to the order, several other agencies, including the Department of Education and the Department of Labor, began reviews of their programs. As detailed by Popular Information, the VA had previously faced right-wing backlash for providing this service to ICE, but it’s not clear if that backlash was related to the VA’s decision. When asked for comment, the Department of Homeland Security said it was a long-standing practice for the agency to provide medical care to people in ICE custody, including various medical and mental health screenings and health assessments. “As we transitioned contracts, there were no gaps in medical care—including access to necessary vaccines, which are being provided. Illegal aliens in ICE custody still have access to vaccines like they always have,” Tricia McLaughlin, the assistant secretary for the agency, told Fast Company. View the full article

-

AI can now fake the videos we trust most. How to tell the difference—and how newsrooms can respond