Everything posted by ResidentialBusiness

-

My Favorite Amazon Deal of the Day: The Sonos Ace

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. You've probably heard of Sonos smart speakers and soundbars. They're one of the best in the market for audio quality and simple user experience. But unless you're in the weeds of tech audio, you probably missed their debut in the headphone space with the Sonos Ace, which was released last summer. You can get the Sonos Ace for $349 (originally $449), the lowest price they've been according to price tracking tools. Sonos Ace $349.00 at Amazon $449.00 Save $100.00 Get Deal Get Deal $349.00 at Amazon $449.00 Save $100.00 The Sonos Ace are soft, comfortable, and adaptable to different head sizes, thanks to their plastic design. You actually get buttons to control the headphones, which I personally consider a huge plus. The battery life is impressive, with about 30 hours with either the Active Noise Cancellation (ANC) or Aware Mode settings active or about 40 hours with both of those off. The Bluetooth multipoint connectivity means you can connect up to two devices at once and switch seamlessly between them. The headphones perform well, according to PCMag's "excellent" review. The sound is balanced with an EQ adjuster in the app, and the ANC and Aware Mode are top-tier, competing with the best headphones in the market. Unfortunately, the Sonos Ace aren't wifi-enabled, meaning you can't stream media into them like you can with Sonos speakers. However, you can connect to Sonos speakers through Bluetooth and listen to your media that way (if you own Sonos speakers). At their current price, the Sonos Ace are competitive with the best headphones for Apple users, the AirPods Max, and the best headphones for Android users, Sony's WH-1000XM5. If you care about transparency mode or have Sonos speakers are home, the Sonos Ace is your best choice. Otherwise, consider the AirPods Max or the WH-1000XM5. View the full article

-

How heavy metals get into baby food—and what California is doing to help parents

Parents across the U.S. should soon be able to determine how much lead, arsenic, cadmium, and mercury are in the food they feed their babies, thanks to a California law, the first of its kind, that took effect this year. As of January 1, 2025, every company that sells baby food products in California is required to test for these four heavy metals every month. That comes five years after a congressional report warned about the presence of dangerously high levels of lead and other heavy metals in baby food. Every baby food product packaged in jars, pouches, tubs, and boxes sold in California must carry a QR code on its label that consumers can scan to check the most recent heavy metal readings, although many are not yet complying. Because companies seldom package products for a single state, parents and caregivers across the country will be able to scan these QR codes or go online to the companies’ websites and see the results. I am a pharmacist researcher who has studied heavy metals in mineral supplements, dietary supplements, and baby food for several years. My research highlights how prevalent these toxic agents are in everyday products such as baby food. I believe the new California law offers a solid first step in giving people the ability to limit the intake of these substances. How do heavy metals get into foods? Soil naturally contains heavy metals. The earth formed as a hot molten mass. As it cooled, heavier elements settled into its center regions, called the mantle and core. Volcanic eruptions in certain areas have brought these heavy metals to the surface over time. The volcanic rock erodes to form heavy metal-laden soil, contaminating nearby water supplies. Another major source of soil contamination is the exhaust from fossil fuels, and in particular leaded gasoline. Some synthetic fertilizers contribute, too. Heavy metals in the soil can pass into foods via several routes. Plants that yield foods such as sweet potatoes and carrots, apples, cinnamon, rice, and plant-based protein powder are especially good at extracting them from contaminated soil. Sometimes the contamination happens after harvesting. For example, local water that contains heavy metals is often used to rinse debris and bugs off natural products, such as leaves used to make a widely used supplement called kratom. When the water evaporates, the heavy metals are retained on the surface. Sometimes drying products in the open air, such as cacao beans for dark chocolate, allows dust laden with heavy metals to stick to their surface. Producers can reduce heavy metal contamination in food in several ways, which range from modestly to very effectively. First, they can reserve more contaminated areas for growing crops that are less prone to taking in heavy metals from the soil, such as peppers, beans, squash, melons, and cucumbers, and conversely grow more susceptible crops in less-contaminated areas. They can also dry plants on uncontaminated soil and filter heavy metals out of water before washing produce. Producers are starting to use genetic engineering and crossbreeding to create susceptible plants that take up fewer heavy metals through their roots, but this approach is still in its early stages. Sweet potatoes and other root vegetables are especially susceptible to absorbing heavy metals from soil. [Photo: Hui Sang/Unsplash] How much is too much? Although there is no entirely safe level of chronic heavy metal ingestion, heavy metals are all around us and are impossible to avoid entirely. In January 2025, the U.S. Food and Drug Administration released its first-ever guidance for manufacturers that sets limits on the amount of lead that baby food can contain. But the FDA guidance does not require companies to adhere to the limits. In that guidance, the FDA suggested a limit of 10 parts per billion of lead for baby foods that contain fruits, vegetables, meats, or combinations of those items, with or without grains. Yogurts, custards, and puddings should have the same cutoff, according to the agency. Root vegetables and dry infant cereals, meanwhile, should contain less than 20 parts per billion of lead. The FDA regulations don’t apply to some products babies frequently consume, such as formula, teething crackers, and other snacks. The agency has not defined firm limits for the consumption of other heavy metals, but its campaign against heavy metals in baby food, called Closer to Zero, reflects that a lower dose is better. That campaign also laid out plans to propose limits for other heavy metals such as arsenic and mercury. Modestly exceeding the agency’s recommended dosage for lead or arsenic a few times a month is unlikely to have noticeable negative health effects. However, chronically ingesting too much lead or inorganic arsenic can negatively affect childhood health, including cognitive development, and can cause softening of bones. How California’s QR codes can help parents and other caregivers It’s unclear how many products consistently exceed these recommendations. A study by Consumer Reports in 2018 found that 33 of 50 products had concerning levels of at least one heavy metal. In 2023, researchers repeated testing on seven of the failing products and found that heavy metal levels were now lower in three, the same in one, and slightly higher in three. Because these tests assess products bought and tested at one specific time, they may not reflect the average heavy metal content in the same product over the entire year. These levels can vary over time if the manufacturer sources ingredients from different parts of the country or the world at different times of the year. That’s where California’s new law can help. The law requires manufacturers to gather and divulge real-time information on heavy metal contamination monthly. By scanning a QR code on a box of Gerber Teether Snacks or a jar of Beech Nut Naturals sweet potato puree, parents and caregivers can call up test results on a smartphone and learn how much lead, arsenic, cadmium, and mercury were found in those specific products manufactured recently. These test results can also be accessed by entering a product’s name or batch number on the manufacturer’s website. Slow rollout In an investigation by Consumer Reports and a child advocacy group called Unleaded Kids, only four companies out of 28 were fully in compliance with the California law as of early this year. Some noncompliant companies had developed no infrastructure, some had developed websites but no heavy metal information was logged in, and some had information but required consumers to enter batch numbers to access results, without the required QR codes on the product packaging. The law requires companies to provide this information for foods produced after Jan. 1, 2025, with no provisions for extensions, and the major producers agreed to comply not only for California residents but to provide the results nationwide. California enforces noncompliance by embargoing misbranded baby food products, issuing penalties, and suspending or revoking registrations and licenses. When companies’ testing and reporting systems are fully up and running, a quick scan at the grocery store will allow consumers to adapt their purchases to minimize infants’ exposures to heavy metals. Initially, parents and caregivers may find it overwhelming to decide between one chicken and rice product that is higher in lead but lower in arsenic than a competitor’s product, for example. However, they may also encounter instances where one baby food product clearly contains less of three heavy metals and only slightly more for the fourth heavy metal than a comparable product from a different manufacturer. That information can more clearly inform their choice. Regardless of the readings, health experts advise parents and caregivers not to eliminate all root vegetables, apples, and rice but instead to feed babies a wide variety of foods. C. Michael White is a distinguished professor of pharmacy practice at the University of Connecticut. This article is republished from The Conversation under a Creative Commons license. Read the original article. View the full article

-

The Apple Watch Series 7 Is $250 Right Now

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. If you like the idea of running errands or going for a jog without lugging your phone around, the Apple Watch Series 7 (GPS + Cellular) is down to $249.99 on Woot. That’s a $500 discount on its original $749 price tag, but the deal is only live for two days or until it sells out. If you’re an Amazon Prime member, you get free standard shipping, while others will have to pay $6 (keep in mind that Woot won’t ship to Alaska, Hawaii, PO boxes, or APO addresses). Now, if you’re wondering why you should care about the cellular version over the regular GPS model, it's because it doesn’t need to be tethered to your iPhone to have a connection. You can take calls, reply to messages, stream Apple Music, and use Apple Pay without having your phone nearby. That’s especially useful if you like to run without your phone or leave it behind while at the gym. PCMag called the Series 7 the “Best Smartwatch of the Year 2021” and gave it an Editor's Choice award when it launched, thanks to its larger display (meaning bigger buttons, a full QWERTY keyboard for texting, and an easier-to-read interface) and fast charging capabilities, going from 0 to 80% in about 45 minutes (helpful if you use sleep tracking and don’t want to take it off for long). Of course, it's a couple of years old at this point (the Series 10 is the most recent generation), but the Series 7 is still a solid option if you don't care about having the absolutely newest tech available. The Series 7 also comes with an IP6X and WR50 rating, offering strong dust resistance for outdoor workouts and water resistance up to 50 meters (so you can wear it in the shower or take it poolside without worry). Additionally, this model comes with Apple’s limited one-year hardware warranty, which is a nice safety net. Like other Apple Watches, the Series 7 has a full set of health features including heart rate monitoring, ECG, blood oxygen tracking, always-on altimeter, and sleep tracking, among others. It also keeps an eye on your well-being, notifying you if it detects potentially harmful noise levels or irregular heart rhythms, plus fall detection—automatically dialing for help if you take a hard fall and don’t respond. That said, its battery life is around 18 hours, so you’ll need to charge it regularly, which isn’t great, but that’s the Apple Watch standard. If you want something that lasts multiple days, the Ultra models are better, but they cost a lot more. View the full article

-

SURVEY: Which Client Industries Will Grow This Year

Respondents tell us what they’re watching. Does it match what you’re seeing? By CPA Trendlines Research Go PRO for members-only access to more CPA Trendlines Research. View the full article

-

SURVEY: Which Client Industries Will Grow This Year

Respondents tell us what they’re watching. Does it match what you’re seeing? By CPA Trendlines Research Go PRO for members-only access to more CPA Trendlines Research. View the full article

-

Fed's Bowman calls for review of Dodd-Frank reforms

Federal Reserve Gov. Michelle Bowman — who is viewed as a leading contender to be the next Vice Chair for Supervision at the central bank — said changes to the post-financial crisis framework should be a focal point of the central bank's ongoing regulatory policy review. View the full article

-

Why the Apple TV App Is Better on Android Than iPhone

After five long years, Apple TV has made it to Android phones and tablets, bringing a polished and Apple-like interface to every Android device out there. You can finally binge-watch Severance on your Samsung smartphone (as you very much should), and if you're like me, you might actually prefer it there than on iPhone. The Apple TV app for Android, it turns out, is a stripped down version of the TV app from iPhone and iPad, not including content from partner streaming services or the ability to buy or rent movies. But it's this stripped down approach that actually makes the Android app better than the iPhone counterpart, at least in my opinion. In the language of Dieter Rams, "good design is as little design as possible". When you open the Apple TV app on Android, the Apple TV+ tab is the default option, showing your Apple TV+ queue and top TV shows and movies right up top. The only other content option is Apple's MLS sports streaming add-on, which gets its own distinct tab, too. On the iPhone and iPad, meanwhile, the TV app is actually much bigger than just Apple TV+. It carries subscription add-ons for different services like Disney+, Prime Video, Starz, Hulu, Peacock, and more. Plus, you can also use the app to rent or buy movies. This means that when you open the Apple TV app, you might be greeted by a banner for a new movie you've been wanting to see, thinking it's been added to Apple TV+ for free. However, clicking in will greet you with a big buy button, instead. Because Apple TV's interface is incredibly simple and there's no sections dividing up services (save for Apple's own), that can get confusing fast. Credit: Khamosh Pathak Compare that to Android, where the Apple TV app still carries the same design language, same polished interface, and the same minimal media player, but just feels better to use because there are no distractions and no hoops to jump through. On the iPhone or iPad app, I've come to dread the extra step of navigating to the dedicated Apple TV+ tab before I look for streaming content. On Android, that's already the default. Android also has a dedicated Downloads tab, while on the iOS and iPadOS app, you first have to switch to the Library tab to see your Downloads. Everything takes an extra step on the iPhone app. I sincerely hope that Apple is inspired by this feedback and works on making the iPhone app simpler, but given the nature of the product and all the things that the app does, it might be better to make the Apple TV+ app a separate entity by itself, kind of like the Apple TV app on Android. The Apple TV app on Android comes with a one-week free trial for Apple TV+, and then it's the same $9.99/month subscription as elsewhere. While the app is quite feature-rich, it does lack the Cast feature, so you can't just stream content to a TV via your Android smartphone. Aside from that, though, everything I need is here, including my watch list, offline downloads and picture-in-picture. View the full article

-

Housing affordability is so squeezed that office-to-apartment conversions just spiked 484%

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. Pandemic era adoption of work-from-home and hybrid work models has left many office spaces unused, triggering a surge in expired leases and vacant office buildings. Simultaneously, the residential housing market remains resilient, with the number of active homes for sale in January 2025 sitting 25% below the levels recorded in January 2019. It’d only make sense that many of these offices over time get converted into condos and apartments, right? To gain a comprehensive understanding of the current office-to-apartment conversions landscape, ResiClub turned to RentCafe, an arm of property management software giant Yardi Systems. Entering 2021, there were 12,100 office-to-apartment units in the U.S. conversion pipeline. Fast-forward to 2025, and that figure is now 70,700—an increase of 484% in just four years. “This significant increase highlights the evolving nature of America’s cities that are driven by shifts in living preferences and changes in work habits,” wrote RentCafe in its latest report. “As office spaces are reimagined to meet the demand for housing, it’s clear that adaptive reuse is playing a key role in reshaping urban landscapes.” According to RentCafe, the office-to-apartment unit pipeline (70,700) makes up 42% of the 169,000 units currently being converted from commercial properties into apartment units. It’s followed by hotel-to-apartment (22%), factory-to-apartment (11%), and warehouse-to-apartment (6%). The biggest chunk of this 70,700 office-to-apartment unit pipeline can be found in New York (8,310 units). Not too far behind is Washington, D.C. (6,533 units), Los Angeles (4,388 units), Chicago (3,606 units), and Dallas (2,752 units). From a big-picture perspective, the 70,700 office-to-residential conversion pipeline might not be as significant as it appears at first glance. Look no further than the project at 219 E. 42nd Street in Midtown Manhattan, near Grand Central Terminal. The former Pfizer headquarters will be transformed from a 10-story office building into a 29-story luxury multifamily development, bringing 1,600 housing units to market in 2027. This single conversion will be the biggest in New York City’s history and makes up 19% of New York City’s conversion pipeline and 2.3% of the U.S. conversion pipeline. The 291,000-square-foot office building will be about 540,000 square feet after the additional 19 stories are added to the structure. For perspective, there are about 95 million square feet of office real estate available for lease in New York City alone. Of the 55,339 office-to-apartments in some phase of development in January 2024, only 3,709 were completed by December, leaving 51,630 units that carried over into 2025, according to RentCafe’s report. Why aren’t there more office-to-apartment conversions right now? Commercial buildings may not be designed or constructed with residential living in mind. Converting office spaces into comfortable and functional apartments may require significant structural changes, such as adding windows or ventilation, or modifying floor plans. While office-to-apartment conversions can often be done faster, they often cost more than just building a new building. Big Picture: While the conversion of office spaces into residential units is gaining momentum, it still remains a small segment of the residential housing market. View the full article

-

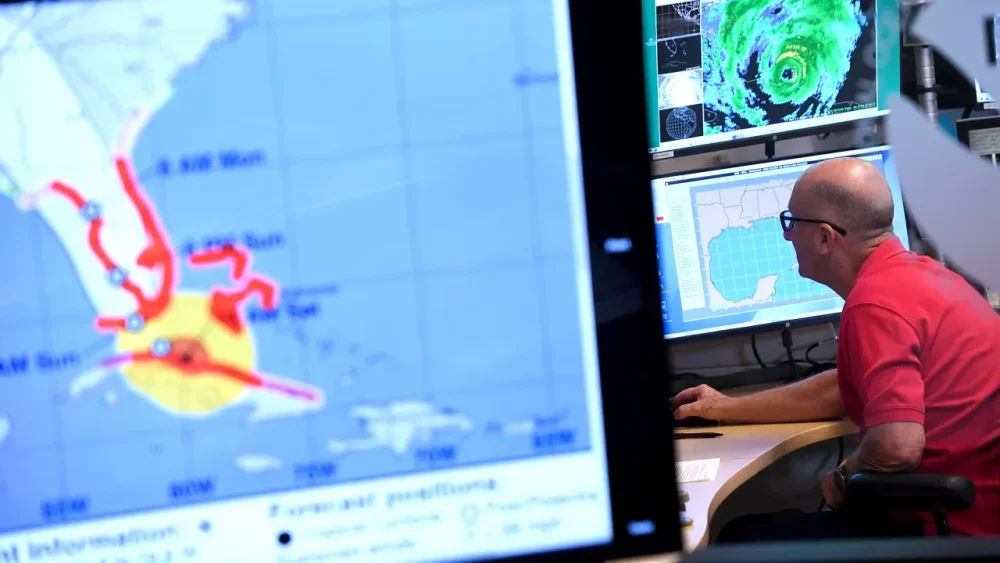

Weather forecasts depend on the NOAA. Could private companies ever replace it?

When a hurricane or tornado starts to form, your local weather forecasters can quickly pull up maps tracking its movement and showing where it’s headed. But have you ever wondered where they get all that information? The forecasts can seem effortless, but behind the scenes, a vast network of satellites, airplanes, radar, computer models and weather analysts are providing access to the latest data—and warnings when necessary. This data comes from analysts at the National Oceanic and Atmospheric Administration, known as NOAA, and its National Weather Service. Atmospheric scientists Christine Wiedinmyer and Kari Bowen, who is a former National Weather Service forecaster, explained NOAA’s central role in most U.S. weather forecasts. When people see a weather report on TV, what went on at NOAA to make that forecast possible? A lot of the weather information Americans rely on starts with real-time data collected by NOAA satellites, airplanes, weather balloons, radar, and maritime buoys, as well as weather stations around the world. All of that information goes into the agency’s computers, which process the data to begin defining what’s going on in different parts of the atmosphere. NOAA forecasters use computer models that simulate physics and the behavior of the atmosphere, along with their own experience and local knowledge, to start to paint a picture of the weather—what’s coming in a few minutes or hours or days. They also use that data to project seasonal conditions out over weeks or months. NOAA’s data comes from many sources to provide a more complete picture of developing climate and weather conditions. Communities and economies rely on that constantly updated information. [Chart: NOAA] When severe weather is on the way, the agency issues the official alerts you’ll see in the news and on your phone. All of this analysis happens before the information reaches private weather apps and TV stations. No matter who you are, you can freely access that data and the analyses. In fact, a large number of private companies use NOAA data to create fancy maps and other weather products that they sell. It would be extremely difficult to do all of that without NOAA. The agency operates a fleet of 18 satellites that are packed with instruments dedicated to observing weather phenomena essential to predicting the weather, from how hot the land surface is to the water content of the atmosphere. Some are geostationary satellites which sit high above different parts of the U.S. measuring weather conditions 24/7. Others orbit the planet. Many of these are operated as part of partnerships with NASA or the Air Force. Some private companies are starting to invest in satellites, but it would take an enormous amount of money to replicate the range of instrumentation and coverage that NOAA has in place. Satellites only last so long and take time to build, so NOAA is continually planning for the future, and using its technical expertise to develop new instruments and computer algorithms to interpret the data. NOAA’s low earth orbiting satellites circle the planet from pole to pole and across the equator 14 times a day to provide a full picture of the year twice a day. The agency also has geostationary satellites that provide continuous coverage over the U.S. [Chart: NOAA] Maritime buoys are another measuring system that would be difficult to replicate. Over 1,300 buoys across oceans around the world measure water temperature, wind, and wave height—all of which are essential for coastal warnings, as well as long-term forecasts. Weather observation has been around a long time. President Ulysses S. Grant created the first national weather service in the War Department in 1870. It became a civilian service in 1880 under the Department of Agriculture and is now in the Commerce Department. The information its scientists and technologists produce is essential for safety and also benefits people and industries in a lot of ways. Could a private company create forecasts on its own without NOAA data? It would be difficult for one company to provide comprehensive weather data in a reliable way that is also accessible to the entire public. Some companies might be able to launch their own satellite, but one satellite only gives you part of the picture. NOAA’s weather observation network has been around for a long time and collects data from points all over the U.S. and the oceans. Without that robust data, computer models and the broad network of forecasters and developers, forecasting also becomes less reliable. Analyzing that data is also complex. You’re not going to be able to take satellite data, run a model on a standard laptop and suddenly have a forecast. And there’s a question of whether a private company would want to take on the legal risk of being responsible for the nation’s forecasts and severe weather warnings. NOAA is taxpayer-funded, so it is a public good—its services provide safety and security for everyone, not just those who can pay for it. If weather data was only available at a price, one town might be able to afford the weather information necessary to protect its residents, while a smaller town or a rural area across the state might not. If you’re in a tornado-prone area or coastal zone, that information can be the difference between life or death. Is climate data and research into the changing climate important for forecasts? The Earth’s systems—its land, water, and the atmosphere—are changing, and we have to be able to assess how those changes will impact weather tomorrow, in two weeks and far into the future. Rising global temperatures affect weather patterns. Dryness can fuel wildfires. Forecasts have to take the changing climate into account to be accurate, no matter who is creating the forecast. Drought is an example. The dryness of the Earth controls how much water gets exchanged with the atmosphere to form clouds and rainfall. To have an accurate weather prediction, we need to know how dry things are at the surface and how that has changed over time. That requires long-term climate information. NOAA doesn’t do all of this by itself—who else is involved? NOAA partners with private sector, academia, nonprofits, and many others around the world to ensure that everyone has the best information to produce the most robust weather forecasts. Private weather companies and media also play important roles in getting those forecasts and alerts out more widely to the public. A lot of businesses rely on accuracy from NOAA’s weather data and forecasts: aviation, energy companies, insurance, even modern tractors’ precision farming equipment. The agency’s long-range forecasts are essential for managing state reservoirs to ensure enough water is saved and to avoid flooding. The government agency can be held accountable in a way private businesses are not because it answers to Congress. So, the data is trustworthy, accessible and developed with the goal to protect public safety and property for everyone. Could the same be said if only for-profit companies were producing that data? Christine Wiedinmyer is an associate director for science at CIRES at the University of Colorado Boulder. Kari Bowen is an atmospheric scientist and program manager at CIRES at the University of Colorado Boulder. This article is republished from The Conversation under a Creative Commons license. Read the original article. View the full article

-

how do I apply for a job internally without my boss knowing?

This post was written by Alison Green and published on Ask a Manager. A reader writes: I have many questions about applying to internal jobs, something I have never done. At my current company, a new role came up that is a dream job for me. But it is also a reach, as it would be a bit of a career change. Knowing this job might open up, I’ve been making efforts to get to know the hiring manager, and I think we have a good relationship. But how do I actually navigate applying? I know it’s best practice not to tell your manager when you are job hunting, but what about when the job you’re applying for is an internal one? My manager is fair and a nice person, but I still don’t want them to know I’m looking to move on. Would it be beneficial for me to reach out to the hiring manager before the job is posted, or should I wait and apply through the usual process once the posting is live? I’m inclined to contact them first, as we have a solid, though relatively new, rapport. If I tell the hiring manager discreetly about my interest in the job, can I ask them to keep my interest under wraps? Or is that weird and not done? I’ve expressed a lot of interest in their work, so I don’t think it will be a massive surprise that I want to apply. I believe I have a better chance at a stretch job at a company where I already work and have a strong reputation, compared to applying for a stretch job externally. However, is it worth the risk of upsetting my current manager or damaging my reputation here for an internal opportunity? If I want to apply for a job that’s a reach, would it be less risky to do it outside my company? My preference is to get this internal job, but if I don’t, I’ll be applying outside the company eventually, although I’m in no huge rush. I think the smart thing to do would be to start my external job hunt at the same time as internally applying, so if my manager is upset or my reputation is dinged, I’ll hopefully have other options. Honestly, I’m feeling super overwhelmed just thinking about a full-on job hunt with everything else going on in my life! But do I just need to buckle down and go for it? You can read my answer to this letter at New York Magazine today. Head over there to read it. View the full article

-

Philippines ‘deeply disturbed’ by incident over shoal disputed by China

Manila’s foreign secretary says he is reassured by US commitment to alliance amid tensions with BeijingView the full article

-

Essential eBay Apps for Successful Sellers

eBay is a popular online marketplace where sellers can showcase their products to a wide audience. To enhance their selling experience and increase efficiency, many sellers rely on a range of useful apps. This article first looks at 30 essential eBay apps that can help sellers achieve success by streamlining tasks and maximizing their selling potential. Additionally, it provides insights on benefits and what to look for in an eBay app, why you should use listing software to increase sales on an eBay store, useful FAQs and more. Read on to find out how these apps can transform your eBay business, ensuring you select the right tools for your specific needs. The Best eBay Apps for Sellers Below, you will find the best eBay apps designed to improve your selling experience and increase your success on the platform. These apps provide various features and functionalities that help streamline your operations and optimize your sales potential. eBay Login App The eBay app offers convenience and exclusive features for buyers and sellers. Users can receive real-time alerts from their eBay account, use image search, and securely store payment preferences in this easy-to-use app. Sellers can easily create, edit, and monitor listings, with the ability to sync across devices, including mobile. eBay Mastercard App The eBay Mastercard is from Synchrony Bank, so you’ll have to download their mobile app to access customer support, easily view your accounts, and enjoy convenient features like balance widgets and secure logins. eBay Profit Calculator App The free eBay Profit Calculator app helps sellers calculate their total profit after eBay fees, managed payment, promoted ads, and PayPal fees. It’s available on the web and for Android and is regularly updated. eBay Seller Hub eBay Seller Hub is a one-stop platform for sellers to streamline their business. It offers easy-to-use tools for listing creation, order management, sales insights, competitive analysis, and marketing. It’s free to use with advanced features for increased efficiency. Inkfrog Inkfrog is a management tool designed for eBay and Amazon businesses. It provides features such as inventory synchronization, quick eBay listings, professional templates, and a range of pricing plans. The tool has received favorable reviews from millions of shoppers and sellers. Terapeak Terapeak is a set of eBay research tools exclusive to sellers. Terapeak Product Research helps optimize listings with market data and trends, while Terapeak Sourcing Insights identifies high-demand categories and trends. Both tools are accessible through the Research tab in Seller Hub. Title Builder Title Builder is a powerful eBay title generator that’s free to use and helps sellers optimize their listings. It provides keyword suggestions, item images with similar keywords, spell check, eBay-suggested categories, and more. Auctiva Auctiva simplifies multi-channel selling with centralized inventory management, automatic product importing, and bulk listing. It offers image hosting, mobile app support, and reporting. Different pricing plans are available. JoeLister JoeLister is a tool for cross-listing Amazon inventory on eBay and Shopify. It populates listings, syncs quantities and prices, handles fulfillment, and offers plans starting at $29/month. A two-week free trial is available. Vendio Vendio is a company that provides e-commerce solutions to help small businesses manage and sell their products online. Their services include inventory management, order processing, and online store creation. Sellbrite Sellbrite is now free for small businesses to sell their products on major online marketplaces. It offers easy listing, inventory management, order fulfillment, and shipping. Plans start at $19/month. Feedback Boost Feedback Boost helps over 5000 eBay sellers increase feedback scores by up to 50%. It automates feedback reminders, improves communication, and offers features like order tracking and automatic feedback. Pricing is $9.99/month with unlimited transactions. Checkaflip CheckAFlip assists eBay sellers in pricing items accurately. After being acquired by KragerLabs, it provides an easy-to-use interface and valuable data for sellers. Users can compare listings and discover average prices. ChannelAdvisor ChannelAdvisor helps businesses expand to new sales channels, optimize their presence, and streamline operations. They offer integrations to global marketplaces, drop-ship solutions, retail media advertising, web store amplification, fulfillment services, and managed services. Auto DS Auto DS is a powerful eBay dropshipping tool that offers features such as product discovery, price tracking, and automated order management. It allows for manual dropshipping without the need for an API, making it suitable for both beginners and experienced users. Kyozou Kyozou is eBay-certified software with features for efficient eBay selling. It includes auto listing, bulk editing, scheduled listings, eBay Motors integration, inventory management, multichannel listing, order and shipping management, and a web store platform. ShelfTrend ShelfTrend offers eBay sellers data analytics reports for improved sales. It provides insights into inventory, sales, competitor activity, and market trends. Developed by former eBay employees, ShelfTrend supports online sellers in driving e-commerce growth. ZIK Analytics ZIK Analytics offers eBay sellers powerful tools for product research. Find profitable items, analyze competitors, and rank your products higher. Benefit from market insights, category research, and title building. Repricer Repricer.com updates prices in real time across multiple channels like Amazon, eBay, and Walmart. It offers integrations with various marketplaces, inventory systems, and automation tools to help businesses increase sales and profits. Start a free trial now. KeywordTool.io KeywordTool.io is a reliable keyword research tool specifically designed for eBay. It gathers actual search queries from eBay apps and the website, assisting sellers in identifying the most effective keywords for their product listings. The premium version provides additional keywords and search volume data to enhance optimization. Mark Sight Mark Sight provides eBay research and analytics tools for online sellers. Access completed listings, eBay statistics surrounding keywords, price trends, and sell-through data. Tested and praised by thousands of users. Ideal for eBay and Amazon sellers seeking popular product ideas. GoDataFeed GoDataFeed is an e-commerce platform that markets products on multiple channels. It simplifies data formatting, improves ad targeting, and alerts users of feed errors. It offers advanced feed management, connects to popular marketplaces, and has many positive reviews. Algopix Algopix offers comprehensive eBay and Amazon product research tools, helping sellers manage their placement and shipping. It also provides data insights for market analysis, competitor research, fee analysis, sales history, price management, and bulk research. Podorder Podorder is a print-on-demand platform for businesses. It offers tools for product management, order fulfillment, automation, and branding across multiple channels. Trusted by over 100k sellers, it provides solutions tailored to print-on-demand businesses on various platforms. LitCommerce LitCommerce enables businesses to connect with millions of eBay users, offering global reach, diverse product categories, seller tools, auction format, seller protection, and a multichannel solution for increased sales. 3DSellers 3DSellers is an all-in-one eBay selling manager software trusted by thousands. It offers a free 7-day trial, including ebay listing tools, multichannel order management, customer service helpdesk, and automation features. Solid Commerce Solid Commerce offers multi-channel eCommerce solutions to expand, streamline, and automate business operations. Trusted by 10,000+ brands, it integrates with various marketplaces and offers comprehensive business visibility. Xpress Lister Xpress Lister is an advanced eBay listing tool recommended by experts. It offers faster and easier listing management, auto-categorization, mobile-optimized templates, and bulk editing features. It ensures active content compliance and supports multi-variant listings. Try it for free; no credit card is required. App NameKey Features eBay Login AppReal-time alerts, image search, secure payment preference storage, easy listing creation and editing eBay Mastercard AppCustomer support, easy account access, balance widgets, secure logins eBay Profit Calculator AppCalculate total profit after various fees, regularly updated eBay Seller HubStreamlined selling platform, listing creation, order management, sales insights, competitive analysis, marketing tools InkfrogInventory synchronization, fast eBay listing, professional templates, multiple pricing plans TerapeakOptimizes listings with market data and trends, identifies high-demand categories AfterShipProactive tracking, returns automation, shipping protection, carrier integration Title BuilderPowerful title generator, keyword suggestions, item images with similar keywords, spell check, eBay suggested categories AuctivaCentralized inventory management, automatic product importing, bulk listing, image hosting, mobile app support, reporting JoeListerCross-listing tool for Amazon inventory on eBay and Shopify, handles fulfillment VendioInventory management, order processing, online store creation SellbriteEasy listing, inventory management, order fulfillment, shipping Feedback BoostAutomates feedback reminders, improves communication, offers order tracking CheckaflipPricing tool, average price finding, listing comparison ChannelAdvisorChannel expansion, optimization, and streamlining services, drop-ship solutions, advertising Auto DSAdvanced eBay dropshipping tool, product finding, price monitoring, automated orders KyozouAuto listing, bulk editing, scheduled listings, eBay Motors integration, inventory management ShelfTrendProvides data analytics reports for inventory, sales, competitor activity, and market trends ZIK AnalyticsProduct research, competitor analysis, product ranking, market insights Repricer.comReal-time price updates across multiple channels, marketplace integrations KeywordTool.ioKeyword research, extracts search queries from eBay, search volume data Mark SighteBay research and analytics tools, price trends, sell-through data GoDataFeedMarkets products on multiple channels, data formatting, ad targeting, feed error alerts AlgopixComprehensive product research tools, market analysis, competitor research, fee analysis PodorderProduct management, order fulfillment, automation, branding tools for print-on-demand businesses LitCommerceGlobal reach, diverse product categories, seller tools, auction format, seller protection 3DSellerseBay selling manager software, listing tools, multichannel order management, customer service helpdesk Solid CommerceMulti-channel eCommerce solutions, marketplace integrations, business visibility Xpress ListerAdvanced listing tool, auto-categorization, mobile-optimized templates, bulk editing PrintfulEnables eBay store setup, print-on-demand product selling, automatic fulfillment Understanding eBay Apps eBay apps are essential tools for sellers, streamlining operations and boosting success. Discover what these apps are and why sellers need them to thrive. What is an eBay App? eBay apps are software applications designed to enhance the selling experience on eBay. They offer various features and functionalities that facilitate listing management, order processing, inventory tracking, and buyer communication. Whether you’re just learning how to start an eBay store or are a seasoned pro, these apps can simplify tasks and improve overall efficiency. Why Do eBay Sellers Need Apps? eBay sellers face multiple challenges, such as managing listings, handling orders, and staying competitive. eBay apps can help users navigate these challenges. Here are some specific reasons why sellers should utilize eBay apps: Streamlined Listing Management: eBay apps provide tools that simplify and expedite the process of listing items for sale. This includes features like bulk listing, scheduled listings, and easy editing of listing details, all of which can save you significant time and effort. Improved Inventory Control: Keeping track of your stock can be challenging, especially if you’re selling a large number of different items. eBay apps can provide real-time inventory updates, send alerts when stock is running low, and help prevent overselling. Automated Shipping: Some eBay apps offer shipping automation features that can help streamline order fulfillment. This includes automatically printing shipping labels, updating tracking information, and integrating with various shipping carriers. Effective Customer Communication: Timely and effective communication with customers is crucial for any online seller. eBay apps can assist with this by providing features for automated messaging, dispute resolution, and tracking customer interactions. Analytics and Reporting: eBay apps often include robust analytics and reporting features, which can provide valuable insights into your sales, customer behavior, and market trends. These insights can inform your business decisions and help improve your selling strategies. Increased Competitiveness: Many eBay apps provide market research and competitive analysis tools. These can help you understand what other sellers in your category are doing and adjust your own strategies to stay competitive. Time Efficiency: By automating and streamlining various aspects of your eBay business, these apps can save you significant time. This frees you up to focus on other important aspects of your business, like sourcing new products or expanding to new markets. Scalability: As your business grows, managing it manually can become increasingly difficult. eBay apps can scale your business, handling a greater volume of sales and inventory as needed. Multi-Platform Integration: If you’re selling on multiple platforms, some eBay apps can integrate all of your operations into a single interface. This can greatly simplify your tasks and make managing your business much easier. Improved Seller Ratings: By helping to ensure timely shipping and effective communication with buyers, eBay apps can help improve your seller ratings. Higher ratings can increase buyer trust and lead to more sales. The Benefits of Using Apps for an eBay Seller Discover how utilizing apps can significantly benefit eBay sellers by improving inventory management, streamlining order processes, automating eBay listings, and much more. Inventory Management Efficient inventory management is crucial for eBay sellers. With the help of apps, sellers can easily track and organize their inventory, ensuring accurate stock levels, reducing errors, and preventing overselling. Apps also enable swift adjustments to inventory in response to sales trends or stock changes. Order Management Handling orders can be time-consuming and complex. eBay apps simplify this process by providing tools to manage orders efficiently, including order tracking, automated notifications, and streamlined shipping workflows. This efficiency results in faster order processing and improved buyer satisfaction. Automated eBay Listings Creating and managing eBay listings can take time and effort. Apps offer features like bulk listing creation, templates, and automation, enabling sellers to quickly list products, save time, and maintain consistency in their listings. Enhanced listing quality and visibility lead to increased sales. Cross-Platform Selling Expand your reach beyond eBay by using eBay apps that facilitate cross-platform selling. These apps enable sellers to list their products across various e-commerce platforms, thereby reaching a wider audience and enhancing sales potential. The seamless integration with other platforms boosts your online presence. Manage Multiple Listings Selling a large number of products requires effective management. eBay apps provide tools to efficiently handle multiple listings, including bulk editing, revising, and relisting capabilities, making tracking and updating product information easier. Simplifies operations for sellers with extensive inventories. Improved Customer Service for your eBay Business Customer service is essential for eBay sellers. Apps offer features such as automated responses, message templates, and order status updates, enabling sellers to provide timely and personalized customer support and enhancing the overall buying experience. Promotes stronger buyer relationships and repeat business. Sales Data Analysis Apps provide valuable insights into sales data, allowing sellers to analyze trends, identify popular products, and make informed business decisions. These data-driven insights help optimize pricing strategies and identify growth opportunities. Enables strategic planning based on real-time data. Shipping and Fulfillment, Including Tracking Information Efficient shipping and fulfillment are critical for customer satisfaction. eBay apps offer integration with shipping carriers, streamlining shipping processes, generating shipping labels, and providing tracking information, ensuring smooth order fulfillment. Reduces delivery times and enhances buyer trust. Marketing and SEO for Your eBay Business Promoting your eBay business and improving visibility is easier with apps offering marketing and SEO features. These tools assist in optimizing product listings with relevant keywords, increasing search rankings, and attracting more potential buyers. What to Look for in an eBay App When selecting an eBay app to manage your eBay selling activities, you need to consider a variety of factors that will align with your needs as a seller. Here’s an expanded guide on the key aspects you should pay attention to: Sales Volume Capability: Take into account the scale of your business and the volume of sales you manage. Certain eBay apps are specifically designed to accommodate high-volume sellers, whereas others cater to smaller businesses. Listing Management: Look for features that enable you to manage your listings easily. This may include tools for bulk editing, product description templates, automatic repricing, and scheduled listings. Inventory Management: If you sell many products, having a system in place to manage your inventory can save you a lot of time and headaches. This may include features for tracking inventory levels, alerting when stocks are low, and managing product variations. Order Management: The app should offer comprehensive order management tools. These include automated invoicing, shipment tracking, order fulfillment status, and integration with major shipping carriers. Integration with Other Platforms: If you sell on other platforms as well as eBay, you’ll want an app that can manage all of these from a single interface. This can simplify your tasks and save you a lot of time. Seller Protection Features: Look for an app that offers robust security features to help protect you from eBay scams and fraud. This could include enhanced communication tools, dispute resolution assistance, and proactive alerts about suspicious activity. Reporting and Analytics: A good eBay app should provide you with insights about your sales, customer behavior, and other important metrics. This information can be invaluable in helping you make informed decisions about your business. Customer Relationship Management (CRM): Some eBay apps include CRM features, which allow you to track customer interactions, send marketing messages, and provide superior customer service. Ease of Use: The interface of the app should be user-friendly and intuitive, enabling you to accomplish tasks quickly and efficiently. Pricing Structure: Consider the app’s cost and whether it provides good value for money. This will depend on the number and quality of the features offered and how well they meet your specific needs. Customer Support: Look for an app with a reputation for providing excellent customer support. You want to be sure that if you encounter any issues or have questions, you’ll be able to get the help you need promptly. These factors should help you select an eBay app that enhances the management of your eBay business, making it easier and more profitable. Using Listing Software to Increase Sales on an eBay Store Using listing software for your eBay store can significantly boost your sales. These apps offer features like bulk listing creation, templates, and optimization tools that help attract more buyers, improve visibility, and enhance the overall presentation of your products. Furthermore, advanced analytics provided by these tools can give you insights into which listings perform well, allowing for data-driven decisions to refine your strategy. Automated pricing adjustments ensure your listings remain competitive in real-time, adapting to market changes and competitor pricing. Lastly, the ability to schedule listings for peak buying times means your products are more likely to be seen by potential customers, increasing the chances of making a sale. Our Methodology to Choose the Best eBay Apps When recommending eBay apps suitable for small business owners, we’ve evaluated various factors to ensure our selections meet the unique needs of businesses operating on this platform. Each criterion is rated on a scale from 10 (most important) to 1 (least important). Ease of Use and User Interface: Importance 10/10 Intuitive and user-friendly interface. Simple navigation and ease of performing key tasks. Clear and helpful onboarding process. Listing and Inventory Management: Importance 9/10 Efficient tools for creating and managing listings. Capabilities for bulk listing and editing. Integration with inventory management systems. Pricing and Fee Management: Importance 8/10 Tools for tracking and managing eBay fees. Features for price optimization and competitive analysis. Ability to handle different pricing models. Order Processing and Fulfillment: Importance 8/10 Streamlined order processing workflows. Integration with shipping and fulfillment services. Features for managing and tracking shipments. Customer Service and Communication: Importance 7/10 Tools for efficient customer communication. Automation of common customer inquiries and responses. Management of feedback and reviews. Analytics and Reporting: Importance 7/10 Comprehensive analytics on sales, trends, and performance. Customizable reports for business insights. Data export options for further analysis. Mobile Accessibility and Performance: Importance 6/10 Functionality and performance on mobile devices. Accessibility of key features via mobile apps. Synchronization between desktop and mobile platforms. Security and Compliance: Importance 5/10 Measures for ensuring data security and privacy. Compliance with eBay’s policies and guidelines. Regular updates and maintenance for security. By focusing on these key areas, we’ve honed in on what truly impacts an eBay seller’s experience and success. This targeted approach avoids overwhelm and allows for informed decision-making that aligns with your business’s specific demands on eBay. Elevating Your eBay Business: The Takeaways As you can see, eBay apps offer numerous advantages that can help sellers manage their businesses more effectively, stay competitive, and achieve greater success on the platform. The specific benefits you experience will depend on which app you choose and how well it aligns with your business needs. Integrating the right apps into your workflow can transform your operations, making them more streamlined and responsive to market demands. Additionally, leveraging these tools can unlock new opportunities for growth, helping you to explore untapped markets and customer segments with greater ease. FAQs: eBay Apps Is There a Free App Available for Selling on eBay? Yes, eBay provides a free app allowing sellers to manage their business directly from their mobile devices. This app offers essential features for listing items, managing orders, tracking sales, and communicating with buyers, making it a convenient and cost-effective option for sellers. How does listing software help eBay sellers on multiple sales channels? Listing software empowers eBay sellers to extend their reach beyond the eBay platform. These tools enable sellers to create and manage listings across multiple sales channels at the same time, streamlining the listing management process and saving both time and effort. How Can eBay Apps Help to track inventory? eBay apps provide inventory tracking features that enable sellers to keep an eye on stock levels, receive alerts for low inventory, and monitor product availability. These tools facilitate precise inventory management, helping to prevent overselling and assisting sellers in staying organized. What role do auto-relist rules in listing software play in eBay inventory management? Auto-relist rules in listing software automate the process of relisting items that have expired without being sold. This feature saves time for sellers by automatically relisting items based on predefined rules, ensuring continuous visibility and maximizing sales opportunities. How can eBay apps streamline tracking inventory and listings for high-volume sellers? For high-volume sellers, managing inventory and listings can be challenging. eBay apps streamline this process by offering advanced inventory management features, bulk listing capabilities, and tools for efficient tracking, enabling high-volume sellers to stay organized and handle large quantities of listings effectively. Image: Envato This article, "Essential eBay Apps for Successful Sellers" was first published on Small Business Trends View the full article

-

Essential eBay Apps for Successful Sellers