Everything posted by ResidentialBusiness

-

Streamlining team workflows: The power of shared time tracking for project success

Time is our most valuable resource, but it’s also often the most mismanaged. When you’re juggling the efforts of multiple people working on the same project, the struggle of time management becomes amplified. You don’t necessarily want to monitor an employee’s every move, but you do need to know where they are in their work The post Streamlining team workflows: The power of shared time tracking for project success appeared first on RescueTime Blog. View the full article

-

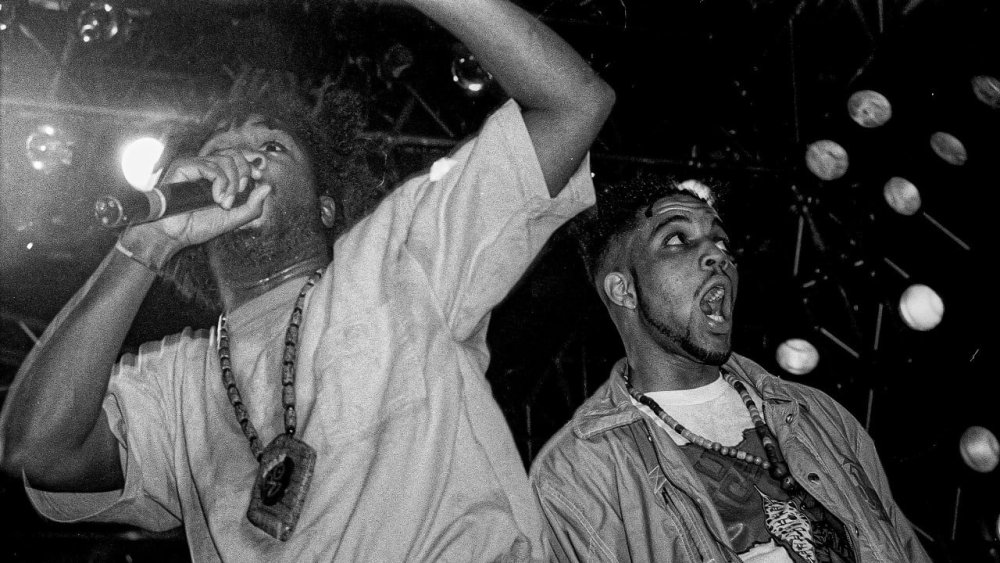

Hip-hop and house revolutionized music and culture. Here’s what they have in common

There was a time when artists representing two of America’s biggest homegrown musical genres wouldn’t get a look in at the Grammys. Hip-hop and house both have their origins in the 1970s and early 1980s—in fact, they recently celebrated a 50th and 40th birthday, respectively. But it was only in 1989 that an award category for “best rap performance” started recognizing hip-hop’s contribution to U.S. music, and house had to wait another decade, with the introduction of “best dance/electronic recording” in 1998. At this year’s awards, taking place on February 2, hip-hop and house artists will be among the most talked about. House duo Justice and Kendrick Lamar, a hip-hop superstar who incorporates elements of house himself, are among those looking to pick up an award. Meanwhile, a nomination for a collaboration between DJ Kaytranada and rapper Childish Gambino shows how artists from both genres continue to feed off each other. And while both genres are now celebrated for their separate contributions to the music landscape, as a scholar of African American culture and music, I am interested in their commonality: Both are distinctly Black American art forms that originated on the streets and dance floors of U.S. cities, developing a devoted underground following before being accepted by—and transforming—the mainstream. The pulse of the 1970s The roots of hip-hop and house music both lie in the seismic shifts of the late 1970s, a period of sociopolitical unrest and electronic experimentation that redefined the possibilities of sound. For hip-hop, this was expressed through the turntable manipulation pioneered by DJ Kool Herc in 1973, when he extended and looped breakbeats to energize crowds. House music’s innovators turned to the drum machine to create the genre’s foundational four-on-the-floor dance rhythm. That rhythm, foreshadowed by Eddy Grant’s 1977 production of “Time Warp” by the Coachouse Rhythm Section, would go on to shape house music’s distinct pulse. The track showed how electronic instruments such as the synthesizer and drum machine could recast traditional rhythmic patterns into something entirely new. This dance vibe—in which a base drum provides a steady four-four beat—became the heartbeat of house music, creating an enduring structure for DJs to layer bass lines, percussion, and melodies. In a similar way, Kool Herc’s breakbeat manipulation provided the scaffolding for MCs and dancers in hip-hop’s formative years. Marginalized communities in urban centers like Chicago and New York were at the forefront of these innovations. Despite experiencing grinding poverty and discrimination, it was Black and Latino youth—armed with turntables, drum machines, and samplers—who made these groundbreaking advances in music. For hip-hop, this meant manipulating breakbeats from songs like Kraftwerk’s “Trans-Europe Express” and “Numbers” to energize B-boys and B-girls; for house, it meant extending disco’s rhythmic pulse into an ecstatic, inclusive dance floor. Both genres exemplified—and continue to exemplify—the ingenuity of predominantly Black and Hispanic communities who turned limited resources into cultural revolutions. From this shared origin of technological experimentation, cultural resilience and creative ingenuity, hip-hop and house music grew into distinct yet globally influential movements. The message and the MIDI By the early 1980s, both genres had found their feet. Hip-hop emerged as a powerful voice for storytelling, resistance and identity. Building on the foundations laid down by DJ Kool Herc, artists like Afrika Bambaataa emphasized hip-hop’s cultural and communal aspects. Meanwhile, Grandmaster Flash elevated the genre’s technical artistry with innovations like cutting and scratching. By 1984, hip-hop had evolved from its grassroots beginnings in the Bronx into a cultural movement on the cusp of mainstream recognition. Run-DMC’s self-titled debut album released that year introduced a harder, stripped-down sound that departed from disco-influenced beats. Their music, paired with the trio’s Adidas tracksuits and gold chains, established an aesthetic that resonated far beyond New York City. Music videos on MTV gave hip-hop a new medium for storytelling, while films like Beat Street and Breakin’ showcased the features and tenets of hip-hop culture: DJing, rapping, graffiti, breaking and knowledge of self – cementing its cultural presence, and presenting it to a world outside the U.S. But at its core, hip-hop remained a voice for the voiceless that sought to address systemic inequities through storytelling. Tracks like Grandmaster Flash and the Furious Five’s “The Message” vividly depicted the reality of living in poor, urban communities, while Public Enemy’s “Fight the Power” and Tupac Shakur’s “Keep Ya Head Up” became anthems for social justice. Together these artists positioned hip-hop as a platform for resistance and empowerment. Becoming a cultural force Unlike hip-hop’s lyrical storytelling, house music focused on the physicality of rhythm and the collective experience of the dance floor. And as hip-hop moved away from disco, house leaned into it. Italy’s “father of disco,” Giorgio Moroder, showed the way with his pioneering use of synthesizers in Donna Summer’s “I Feel Love.” Over in New York, Larry Levan’s DJ sets at Paradise Garage demonstrated how electronic instruments could create immersive, emotionally charged experiences as a club that centered crowd participation through dance and not lyrics. By 1984, Chicago DJs Frankie Knuckles and Ron Hardy were repurposing disco tracks with drum machines like the Roland TR-808 and 909 to create hypnotic beats. Knuckles, known as the “Godfather of House,” transformed his sets at the Warehouse club into euphoric experiences, giving the genre its name in the process. House music thrived on inclusivity, served as a safe space for Black and Latino members of the LGBTQ+ communities at a time when hip-hop was severely unwelcoming of gay men. Tracks like Jesse Saunders’s “On & On” and Marshall Jefferson’s “Move Your Body” celebrated freedom, love, and unity, encapsulating its liberatory spirit, as rap music and hip-hop culture embarked on its mainstream journey with songs like Run DMC’s “Sucker M.C.s (Krush Groove)” and Salt-N-Pepa debuted their album Hot, Cool, & Vicious. As with hip-hop, by the the mid-1980s house music had become a cultural force, spreading from Chicago to Detroit to New York and, eventually, to the U.K.’s rave scene. Its emphasis on repetition, rhythm, and electronic instrumentation solidified its global appeal, uniting people across identities and geographies. Mainstays in modern music Despite their differences, moments of crossover highlight their shared DNA. From the late 1980s, tracks like “Yo Yo Get Funky” by Fast Eddie and “I’ll House You” by the Jungle Brothers merged house beats with hip-hop’s lyrical flow. Artists like Kaytranada and Doechii continue to blend the two genres today, staying true to the genres’ legacies while pushing their boundaries. And technology continues to drive both genres. Platforms like SoundCloud have democratized music production, allowing emerging artists to build on the decades of innovations that preceded them. Collaborations, such as Disclosure and Charli XCX’s “She’s Gone, Dance On,” highlight their adaptability and enduring appeal. Whether through hip-hop’s lyrical narratives or house’s rhythmic euphoria, these genres continue to inspire, challenge and transcend. As the 2025 Grammy Awards celebrate today’s leading house and hip-hop artists and their contemporary achievements, it is clear that the legacies of these two genres are mainstays in the kaleidoscope of American popular music and culture, having come a long way from back-to-school park jams and underground dance parties. Joycelyn Wilson is an assistant professor of ethnographic and cultural studies at the Georgia Institute of Technology. This article is republished from The Conversation under a Creative Commons license. Read the original article. View the full article

-

US demands Panama reduce Chinese influence over canal or face action

US Secretary of State Marco Rubio says Central American nation is violating canal treaty’s neutrality clause View the full article

-

EU opens door to UK and Norway for defence ‘coalition of the willing’

Keir Starmer to join Nato and European leaders at summit on boosting securityView the full article

-

‘Enough is enough’: Trump tariffs inspire economic patriotism in Canada

US president’s aggressive actions have kick-started a ‘Buy Canadian’ campaign across the borderView the full article

-

Future of US aid agency in doubt after website goes dark and officials put on leave

President and ally Elon Musk have launched an assault on the Agency for International DevelopmentView the full article

-

Musk vows to cancel grants after gaining access to US Treasury payment system

System disperses trillions of dollars in US government spending each year, including social securityView the full article

-

Trump faces tariff backlash from business as trade war sparks inflation fear

Experts warn aggressive levies against US allies will hurt consumers and roil supply chainsView the full article

-

Four Ways to Provide Wealth Management in Your Accounting Practice

Plus specifics on revenue potential. By Rob Santos The Holistic Guide to Wealth Management Go PRO for members-only access to more Rory Henry. View the full article

-

Four Ways to Provide Wealth Management in Your Accounting Practice

Plus specifics on revenue potential. By Rob Santos The Holistic Guide to Wealth Management Go PRO for members-only access to more Rory Henry. View the full article

-

The absurdity of Donald Trump’s trade war

Tariffs on Canada, Mexico and China will harm America’s own economy and diplomatic powerView the full article

-

The Top Ten Problems the IRS Still Needs to Fix

Despite improvements, substantial issues remain. By CPA Trendlines Research Go PRO for members-only access to more CPA Trendlines Research. View the full article

-

The Top Ten Problems the IRS Still Needs to Fix

Despite improvements, substantial issues remain. By CPA Trendlines Research Go PRO for members-only access to more CPA Trendlines Research. View the full article

-

How to Make Business Cards on Canva

Canva is great for any business seeking an integrated tool that makes it easy to create business cards. But when it comes to making business cards, what is Canva capable of? In this article, we’ll show you step-by-step how individuals and small teams can make professional-looking business cards using Canva. Can You Use Canva to Create Business Cards? Individuals and small teams can utilize Canva to design business cards at no cost. You can choose from a variety of pre-made templates or start a design from scratch. Why You Should Create a Canva Business Card Creating business cards with Canva is a great way to make sure they’re professional and stylish. Here are five reasons why: Branding. You can create a unique design that reflects your brand. Templates. Canva offers a wide range of templates, so you can find the perfect one for your business. Easy to personalize. You can easily add your logo and contact information. Easy to use. Canva’s drag-and-drop interface makes it easy to design your business card. Easy to order. After designing your business card, you can easily order some using Canva Print. How to Create Your Own Business Cards on Canva Let’s talk about how to create your digital business card in Canva, which you can also print for offline use. To create and download designs: 1. Signup or Login After signing up for a Canva account or logging into an existing one, hover over “Templates” and click on “Business Cards.” 2. Select a Template After finding a template you like, click on it, then click “Customize this template.” 3. Add or Remove Images To remove images, click the image and hit delete or backspace on your keyboard. To add images like a logo or other graphics for your brand, use the “Photos” and “Elements” sections. You can also upload images for your business cards in “Uploads.” 4. Modify the Background To change the background of your design, click on “Background” to the left and select a new one. 5. Modify Text and Fonts To change the text, including your contact information and company name, just click on the text. Next, click the font box and choose from a variety of available font styles. 6. Download Your Business Card Design Download your design by clicking “Share” at the top right of your screen, then “Download.” Modify the download settings to your liking, then click the “Download” button. How to Print Business Cards from Canva Canva is undoubtedly the best place to buy business cards. Now, let’s go over how to print your business cards from Canva. Click “Print Business Cards.” Located at the top right of your screen, next to “Share.” Set your print options. Choose “Single-sided” or “Double-sided,” pages to print, paper type, finish, and the number of business cards to print. Remove gaps. See any gaps around the edges of your design? Then stretch your background as shown in Canva. Danger zone. If you see text or images on the red border, move them so they’re not cut off on your business cards. Download proof. Download a PDF proof of your business card design to check for mistakes. Shipping details. Set the shipping speed, then enter your name and address. Confirm and pay. Confirm your order details, then click “Place Order.” How to Print Multiple Business Cards from Canva Below, we will show you how to print multiple business cards from Canva when you have more than two pages. Click on the “Print Business Cards” button. This button is to the left of the “Share” button. Print options. Set all of the options to your liking. Notice the price is doubled since you’ll be printing two different business cards. Get rid of gaps. Follow Canva’s on-screen instructions to remove any gaps around the edges of your design. Avoid the danger zone. Remove any images or text from the red danger zone. Check for errors. Download the PDF proof of your design to check for any errors. Set shipping options. Choose between “Economy,” “Standard,” and “Express Shipping.” Pay for your order. When you’re positive your order details are correct, click “Place Order.” Best Canva Business Card Templates Here are five of the best professionally designed business card template designs on Canva: Restaurant Template This business card design is great for restaurant owners. Yoga Instructor Business Cards This template is perfect for Yoga instructors. Green Lush Leaves Landscaping Business Card Here’s a simple yet elegant design for landscapers. Lawyer Business Card This template design is a good option for law firms. Chef Catering Restaurant Business Card Here’s a design that bakers or caterers would love. Canva Business Card Tips Below are five tips for creating amazing Canva business cards that will stand out from the competition: Use high-quality images. Use only high-resolution images so your cards look sharp and professional. Keep it simple. Stick to the essentials like your name, title, name of your company, and contact information. Incorporate branding elements. Include your company’s logo, color scheme, and other branding features to ensure your business card is easily recognizable. Get creative. Being creative could be as simple as experimenting with different sans serif fonts which is the best font for business cards. Use high-quality paper for printing. Ensure that your cards are printed on high-quality paper to achieve a professional appearance and texture. How long does it take to make a business card in Canva? Creating a business card on Canva is straightforward, thanks to their templates and various tools, and can be completed in just a few minutes. How do you make business cards vertical on Canva? Vertical business cards are distinct from traditional ones, and creating them on Canva is a straightforward process. Follow these steps: After logging in, hover over “Templates” and click on “Business Cards.” Click on “Portrait” in the left margin under the “Format” section. Select your vertical design and click “Customize this template.” Modify your images and text to match your brand. Download your design when you’re done by clicking on “Share,” then “Download,” and finally on the “Download” button. How do you make a business card front and back in Canva? To create a business card in Canva that has a front and back is simple. Let’s briefly go over the steps: Login, then hover over “Templates” clicking on “Business Cards” afterward. Choose the template you’d like to work with and click on “Customize this template.” If the template only has one page, you’ll need to add a second page. The first page will be the front of your business card, and the second page will be the back. Make sure your images and text are consistent with your brand. When you’re finished designing your business card, click “Share,” then “Download,” and “Download” again to save your design to your computer. What size are business cards in Canva? Canva business cards are sized 3.5×2 inches which is close to the size of a bank card. This makes them easy to put in your wallet. Image: Envato Elements This article, "How to Make Business Cards on Canva" was first published on Small Business Trends View the full article

-

How to Make Business Cards on Canva

Canva is great for any business seeking an integrated tool that makes it easy to create business cards. But when it comes to making business cards, what is Canva capable of? In this article, we’ll show you step-by-step how individuals and small teams can make professional-looking business cards using Canva. Can You Use Canva to Create Business Cards? Individuals and small teams can utilize Canva to design business cards at no cost. You can choose from a variety of pre-made templates or start a design from scratch. Why You Should Create a Canva Business Card Creating business cards with Canva is a great way to make sure they’re professional and stylish. Here are five reasons why: Branding. You can create a unique design that reflects your brand. Templates. Canva offers a wide range of templates, so you can find the perfect one for your business. Easy to personalize. You can easily add your logo and contact information. Easy to use. Canva’s drag-and-drop interface makes it easy to design your business card. Easy to order. After designing your business card, you can easily order some using Canva Print. How to Create Your Own Business Cards on Canva Let’s talk about how to create your digital business card in Canva, which you can also print for offline use. To create and download designs: 1. Signup or Login After signing up for a Canva account or logging into an existing one, hover over “Templates” and click on “Business Cards.” 2. Select a Template After finding a template you like, click on it, then click “Customize this template.” 3. Add or Remove Images To remove images, click the image and hit delete or backspace on your keyboard. To add images like a logo or other graphics for your brand, use the “Photos” and “Elements” sections. You can also upload images for your business cards in “Uploads.” 4. Modify the Background To change the background of your design, click on “Background” to the left and select a new one. 5. Modify Text and Fonts To change the text, including your contact information and company name, just click on the text. Next, click the font box and choose from a variety of available font styles. 6. Download Your Business Card Design Download your design by clicking “Share” at the top right of your screen, then “Download.” Modify the download settings to your liking, then click the “Download” button. How to Print Business Cards from Canva Canva is undoubtedly the best place to buy business cards. Now, let’s go over how to print your business cards from Canva. Click “Print Business Cards.” Located at the top right of your screen, next to “Share.” Set your print options. Choose “Single-sided” or “Double-sided,” pages to print, paper type, finish, and the number of business cards to print. Remove gaps. See any gaps around the edges of your design? Then stretch your background as shown in Canva. Danger zone. If you see text or images on the red border, move them so they’re not cut off on your business cards. Download proof. Download a PDF proof of your business card design to check for mistakes. Shipping details. Set the shipping speed, then enter your name and address. Confirm and pay. Confirm your order details, then click “Place Order.” How to Print Multiple Business Cards from Canva Below, we will show you how to print multiple business cards from Canva when you have more than two pages. Click on the “Print Business Cards” button. This button is to the left of the “Share” button. Print options. Set all of the options to your liking. Notice the price is doubled since you’ll be printing two different business cards. Get rid of gaps. Follow Canva’s on-screen instructions to remove any gaps around the edges of your design. Avoid the danger zone. Remove any images or text from the red danger zone. Check for errors. Download the PDF proof of your design to check for any errors. Set shipping options. Choose between “Economy,” “Standard,” and “Express Shipping.” Pay for your order. When you’re positive your order details are correct, click “Place Order.” Best Canva Business Card Templates Here are five of the best professionally designed business card template designs on Canva: Restaurant Template This business card design is great for restaurant owners. Yoga Instructor Business Cards This template is perfect for Yoga instructors. Green Lush Leaves Landscaping Business Card Here’s a simple yet elegant design for landscapers. Lawyer Business Card This template design is a good option for law firms. Chef Catering Restaurant Business Card Here’s a design that bakers or caterers would love. Canva Business Card Tips Below are five tips for creating amazing Canva business cards that will stand out from the competition: Use high-quality images. Use only high-resolution images so your cards look sharp and professional. Keep it simple. Stick to the essentials like your name, title, name of your company, and contact information. Incorporate branding elements. Include your company’s logo, color scheme, and other branding features to ensure your business card is easily recognizable. Get creative. Being creative could be as simple as experimenting with different sans serif fonts which is the best font for business cards. Use high-quality paper for printing. Ensure that your cards are printed on high-quality paper to achieve a professional appearance and texture. How long does it take to make a business card in Canva? Creating a business card on Canva is straightforward, thanks to their templates and various tools, and can be completed in just a few minutes. How do you make business cards vertical on Canva? Vertical business cards are distinct from traditional ones, and creating them on Canva is a straightforward process. Follow these steps: After logging in, hover over “Templates” and click on “Business Cards.” Click on “Portrait” in the left margin under the “Format” section. Select your vertical design and click “Customize this template.” Modify your images and text to match your brand. Download your design when you’re done by clicking on “Share,” then “Download,” and finally on the “Download” button. How do you make a business card front and back in Canva? To create a business card in Canva that has a front and back is simple. Let’s briefly go over the steps: Login, then hover over “Templates” clicking on “Business Cards” afterward. Choose the template you’d like to work with and click on “Customize this template.” If the template only has one page, you’ll need to add a second page. The first page will be the front of your business card, and the second page will be the back. Make sure your images and text are consistent with your brand. When you’re finished designing your business card, click “Share,” then “Download,” and “Download” again to save your design to your computer. What size are business cards in Canva? Canva business cards are sized 3.5×2 inches which is close to the size of a bank card. This makes them easy to put in your wallet. Image: Envato Elements This article, "How to Make Business Cards on Canva" was first published on Small Business Trends View the full article

-

Oil demand to remain at current levels until at least 2040, Vitol says

Commodity trader’s forecast indicates energy transition will be slower than anticipatedView the full article

-

EU to ‘respond firmly’ if Trump imposes tariffs

Bloc warns of ‘unnecessary economic disruption’ after US president hits China, Canada and Mexico with trade measuresView the full article

-

The Top Invoicing Software for Small Businesses

If you’re a small business owner, it’s no secret how important invoicing is in keeping your cash flow flowing. However, knowing which invoicing software to use can be tricky as the market is flooded with options. Luckily, we’ve researched for you and put together an up-to-date list of the best invoicing software for small business owners. Let’s take a look at the best invoicing software options available that can help simplify your billing process and promote effective financial management for your business. What Is Invoicing Software? Invoicing software is a software program that helps businesses keep track of their invoices and payments. It can help businesses create, send, and track invoices and keep tabs on when payments are due and received. Invoicing software can also help businesses manage their finances by tracking spending and creating reports. Some invoicing software programs also integrate with other financial software, such as accounting software or payment processors, making it easier for businesses to track all their financial data in one place. READ MORE: How Small Businesses Can Invoice and Collect More Efficiently Top Invoicing Software for Small Businesses: Our Methodology Choosing the right invoicing software is a crucial step for small businesses, impacting how you manage your transactions, cash flow, and customer relationships. The perfect tool should simplify your work, ensure you’re organized, and help you get paid promptly. In selecting the top invoicing software suitable for businesses and freelancers, we’ve considered a variety of factors. Each criterion is rated on a scale from 10 (most critical) to 1 (least critical), to ensure that our recommendations cater to the needs of efficient billing and financial management. Ease of Use and User Interface: Importance 10/10 Intuitive design for easy navigation and use. Simple process for creating and sending invoices. Clear and accessible layout for tracking payments and expenses. Customization and Flexibility: Importance 9/10 Options to customize invoice templates and branding. Flexibility to handle different billing scenarios and tax settings. Capability to accommodate various currencies and languages. Integration Capabilities: Importance 8/10 Seamless integration with accounting software and payment gateways. Compatibility with other business tools (CRM, project management, etc.). Ability to synchronize data across platforms. Automation and Efficiency Features: Importance 8/10 Automated invoicing and recurring billing features. Reminders and alerts for overdue payments. Efficiency tools like bulk invoicing and expense tracking. Security and Data Protection: Importance 7/10 Robust security measures to protect financial data. Compliance with financial regulations and data privacy laws. Reliable backup and data recovery options. Reporting and Analytics: Importance 6/10 Comprehensive reporting features for financial insights. Real-time analytics on cash flow and business performance. Customizable reports for accounting and tax purposes. Customer Support and Resources: Importance 5/10 Access to responsive customer support. Availability of help resources, tutorials, and guides. Community forums or user groups for additional support. Pricing and Value for Money: Importance 5/10 Transparent and competitive pricing structures. Scalable plans are suitable for different business sizes. Free trials or demos to evaluate software features. Through this thorough examination, we identify invoicing software options that encompass not just the technical requirements but also contribute to a smoother, more efficient financial workflow for small business owners. Top Invoicing Software Solutions Before digging too deeply into the list, here is a quick reference table that lets you quickly compare the top invoice software options: SoftwareKey FeaturesPricing Zoho InvoiceCraft professional invoices, bill in multiple currencies, automate payment remindersFree Quickbooks OnlineCreate and track invoices on the go, integrate with popular third-party appsStarts at $15 per month Square InvoicesSend digital invoices and estimates, enable pay later optionForever-free plan, $20 monthly plan BrightpearlTailored for retail businesses, handles proforma and actual invoicesFlexible pricing based on business needs PaySimpleIntegrates invoicing with payments, ideal for service-based businessesStarts at $69.95 per month FreshBooksCloud-based accounting software, automated invoicing, online payment acceptanceStarts at $16.50 per month WaveBudget-friendly invoicing software, customized invoices, automated billingFree InvoiceSimpleIntuitive invoicing app, easy invoicing for small businesses and freelancersFree Sage IntacctIdeal for merchants with complex invoicing flow, real-time payment status visibilityPricing based on selected features XeroCustomizable online invoices, automatic reminders, accept instant paymentsStarts at $25 per month XeroCustomizable online invoices, automatic reminders, and instant online payments.Starts at $25 per month Invoice2goCreate invoices on the spot, send via various channels, and customizable invoice templates.Starter plan at $5.99 per month ChargeBeeAutomates recurring billing, supports multiple currencies and subscription models, real-time analytics for performance.Free plan available HarvestEfficient time-based invoicing, automatic invoicing, integrated payments, and client management.Free-forever plan, $12 per user/month Invoice NinjaFree invoicing tool, quote and invoice creation, tracking payments, and setting up recurring invoices.Free plan available InvoiceraTotal invoice and billing management, customization options, and control of multiple businesses through a single account.Starter plan available for free HiveageSimplified invoicing, payment and cash management, easy tax calculation, and discounts.Free plan available BillBooksIntelligent invoicing platform, assisted scheduling, automatic payment reminders, and mobile-optimized invoicing app.Starting at $7.95 per month ZipBooksInvoicing and automation of the billing process, unlimited invoices and payment tracking.Free invoicing tool Bill.comManaging accounts payable and accounts receivable, track payments, request money, and schedule payments.Starting at $45 per user/month SliQ InvoicingSimple and powerful invoicing program, unlimited invoices and quotes, easy setup and usage.£6 (or $7.3) monthly plan Here are the top invoicing software programs to pick the best invoicing solution for your business: Zoho Invoice Zoho Invoice is a free online invoicing software program for small businesses. It enables you to craft professional invoices, bill in the currency you want, and automate payment reminders. With Zoho Invoice, you can even automate recurring invoices. It simplifies billing so you can focus better on your business. The Zoho Invoice tool is available for free. Quickbooks Online QuickBooks Online makes it easy to create and track invoices on the go. SMB owners can store HSN/SAC codes, generate invoices, and automatically calculate payable taxes. QuickBooks Online ensures breezy invoicing and payment clearance. It also integrates well with hundreds of popular third-party apps. The base plan of QuickBooks Online costs $15 per month. Higher plans with features such as expense tracking, analytics, and inventory management are also available. Square Invoices Square Invoices is an easy-to-use tool for sending digital invoices and estimates. It enables businesses to create invoices, track payments and monitor analytics from one place. Square Invoices even allows businesses to enable the pay later option. It’s an ideal tool for managing your transactions while maintaining customer relationships. Square Invoices has a forever-free plan with all invoicing features. It also has a $20 monthly plan with more finance management utilities. Brightpearl Brightpearl is a software package tailored to the invoicing needs of retail businesses. It offers various features to handle and process proforma and actual invoices. Brightpearl has flexible pricing and invoicing features to manage cash flow efficiently. You can even keep track of part payments and bank deposits and have a bird’s eye view of each payment status. Brightpearl tailors its pricing to business needs. READ MORE: How to Create an Invoice That Gets Paid PaySimple PaySimple integrates invoicing with payments to simplify small business operations. It’s beneficial for service-based businesses that need to handle payments from multiple points of sale. PaySimple makes the workflow manageable with its online invoicing and easy processing of online payments. Pricing for PaySimple starts at $69.95 per month. FreshBooks FreshBooks is a cloud-based accounting software designed with small businesses in mind. It puts invoicing on autopilot. The professional automated invoicing of FreshBooks enables the quick creation of clean and customizable invoices. You can also accept payments online, track their status, and send reminders for late payments. FreshBooks’ pricing starts at $16.50 per month for unlimited billable clients. Higher plans with better tracking, analytics, and reports are also available. Wave Wave is a budget-friendly invoicing software solution for small businesses. It takes care of all the invoicing and payment needs. The information is synced with the customer’s info. Wave app helps in creating customized invoices and automating the billing process. You can even set up recurring invoices and automate payment processing for repeat customers. Wave invoicing app is free for invoicing. InvoiceSimple InvoiceSimple is an easy-to-use invoicing app for business owners. It touts itself as the simplest way for small businesses and freelancers to invoice customers. Invoice Simple makes invoicing straightforward for businesspeople. It allows invoicing via mobile and laptop to help you stay organized throughout. You can try Invoice Simple for free. Sage Intacct Sage Intacct is ideal for merchants with a complex invoicing flow who need granular control over the process. This powerful tool provides complete control and customization over invoicing with real-time visibility of payment status. A subscription to Sage Intacct includes access to a community of industry peers. Business owners can interact with them and get support and industry updates. The pricing of Sage Intacct’s plans depends on the features you select for your business. Xero Xero online invoicing is another intuitive tool for small businesses. It enables you to customize your online invoices, set automatic reminders, and invoice directly from the app. You can choose from custom, ready-made, or pre-set invoices without leaving the app. With Xero, you can also accept instant payments online. It makes it easy for customers to pay you. Pricing plans for Xero start at $25 per month, with higher plans for comprehensive accounting tools. READ MORE: 12 Printable Invoice Template Options More Invoicing Software Options for Small Business Here are some more billing and invoicing software for small businesses: Invoice2go Invoice2go is an easy-to-use, mobile-friendly invoicing tool to create invoices on the spot. It enables business owners to send invoices via email, messenger, and even text. For new businesses, Invoice2go is a time-saver. You can customize the business logo, fonts, and colors and create an invoice immediately. Invoice2go has a range of plans, with the Starter plan at $5.99 per month. ChargeBee ChargeBee is a widely used invoicing software for small businesses in the SaaS and subscription industry. It automates recurring billing, eliminating the need for manual invoice processing. ChargeBee supports various currencies and subscription models, allowing you to manage a global customer base. Additionally, you can access real-time analytics to monitor your invoicing performance effectively. ChargeBee has a free plan, offering essential invoicing and subscription management features. Higher plans are also available. Harvest Harvest is an online invoicing and billing software tool that automates time-based invoicing efficiently. It’s the most suitable for businesses providing services. Harvest allows for automatic invoicing, integrated payments, and client management, all in one place. Depending on availability, you can bill clients automatically or assign work to your team. Harvest has a free-forever plan for one user. It has a $12 per user per month plan for multiple users and projects. Invoice Ninja Invoice Ninja is a free-to-use invoicing tool. It enables business owners to quote, invoice, and take payments for free. It also helps track billable time, auto-invoicing, and setting up recurring invoices. The facility to take advance deposits and partial payments further eases the troubles. You can even set up a client-side invoice & payment portal with Invoice Ninja. Invoice Ninja has a free plan along with higher plans for more features. READ MORE: How Zoho Invoice Will Help Your Business – for FREE Invoicera Invoicera is a total invoice and billing management system. It supports all types of businesses, from small businesses to enterprises. Invoicera easily integrates with existing business management tools to be customized as per the business. And it allows one person to control multiple businesses through a single account. Invoicera’s Starter plan is offered for free but comes with limited features. Upgrading to higher plans provides access to more advanced functionalities. Hiveage Hiveage is a cloud-based invoicing tool for small businesses. It doesn’t burden you with a host of accounting features. With Hiveage, you can manage payments and cash with ease. Its simplified interface makes it easy to bill clients and keep track of revenue. You can easily enter regular tax amounts, discounts, and shipping charges. Hiveage starts with a free plan. Upgraded plans are also available, giving access to many more features. BillBooks Billbooks is an online invoicing platform built specifically for small businesses. It’s an intelligent tool that speeds up invoicing. It offers assisted scheduling and automatic payment reminders for different time zones to ensure more efficient payments. Billbooks is a mobile-optimized invoicing app that simplifies invoicing and payments. The pricing for Billbooks has been designed keeping small businesses in mind. The base price is $7.95 per month. ZipBooks Zipbooks is a vital invoicing software for small businesses that helps streamline and automate the billing process. It supports unlimited invoices and payment tracking. Zipbooks offers numerous useful features, including the ability to create estimates and manage customer payments all in one location. Additionally, it provides tools for time-tracking and automated billing. Zipbooks is a free invoicing tool with more features available on higher plans. Bill.com Bill.com is an online invoicing tool to save time and money. It lets business owners manage accounts payable as well as accounts receivable. You can efficiently keep track of payments, request money and schedule payments. Its two-way sync with accounting software makes invoicing easier. So, managing financial transactions is a breezy experience with Bill.com. The starting plan of Bill.com is priced at $45 per user per month. SliQ Invoicing SliQ Invoicing is a simple yet powerful invoicing program for small businesses. It lets business owners create invoices, payment reminders, and record payments. It’s simple to set up and use. And you can send unlimited invoices and quotes. SliQ Invoicing also helps handle invoices for multiple businesses with one admin panel. SliQ Invoicing has a £6 (or $7.3) monthly plan. You can upgrade to a higher plan to onboard more team members. Why You Should Consider Using Invoicing Software for Small Business Here are key reasons why you should use invoicing software in your business: Invoice software often includes features that save time, such as the ability to create and send invoices quickly, automatic invoice numbering, and the option to save frequently used phrases or paragraphs. With invoicing software, you can also track payments and expenses. This information can be helpful when preparing tax returns or other financial documents. Online invoicing lets you see when online payments are made and received, which can help you keep tabs on your cash flow and budget. A well-designed invoice that is easy to read will give a good impression to your customers. Last but not least, most invoicing software allows you to understand your business better. This is because analytics provided by those software applications can help you understand which products sell fast and which ones move slower. READ MORE: The Manual Dilemma: 4 Ways To Streamline Invoicing Maximizing Efficiency with Invoicing Software for Small Businesses Enhanced Features of Invoicing Software Automation and Time Management: Invoicing software automates many of the mundane tasks associated with billing, such as data entry, calculations, and invoice tracking. This automation significantly reduces the time spent on invoicing, allowing small business owners to focus on other critical aspects of their business. Improved Accuracy and Professionalism: The use of invoicing software minimizes errors that can occur with manual invoicing. It ensures accuracy in calculations and consistency in the presentation of invoices, enhancing the professional image of the business. Real-Time Financial Overview: Invoicing software provides a real-time view of the business’s financial health. It tracks outstanding invoices, payments received, and overall cash flow, offering valuable insights for informed decision-making. Seamless Integration with Other Systems: Numerous invoicing software for small business solutions easily connect with various business systems, including accounting software, CRM tools, and payment gateways. This integration enhances the flow of financial data, making financial management more straightforward. Customization and Branding: Invoicing software often allows for the customization of invoice templates. Businesses can add their logos, brand colors, and personalized messages, aligning the invoices with their brand identity and enhancing the overall customer experience. Navigating the Challenges of Invoicing Software Cost Considerations: While many invoicing software options offer free basic plans, more advanced features might come at a cost. Small businesses need to evaluate the cost-benefit ratio to determine if the additional features are worth the investment. Adaptation and Training: Integrating new software into existing business processes may require training for staff. Businesses must consider the time and resources needed for effective adaptation to the new system. Dependence on Technology: Reliance on invoicing software means being susceptible to technical issues or service downtimes. Small businesses should have contingency plans in place to address any potential disruptions. Data Security and Privacy: With financial data being stored and managed digitally, ensuring data security and privacy becomes paramount. It’s essential to choose software that offers robust security features to protect sensitive information. Making the Most of Invoicing Software Leveraging Data for Strategic Insights: Invoicing software for small businesses offers valuable data that can be analyzed to gain insights. By understanding payment patterns, client behavior, and sales trends, businesses can make informed strategic decisions to foster growth. Enhancing Customer Relations: Prompt and accurate invoicing, coupled with professional presentation, contributes to a positive customer experience. This can lead to improved customer satisfaction and retention. Streamlining Tax Preparation: The comprehensive financial records maintained by invoicing software simplify the process of tax preparation. Accurate and organized financial data can make tax reporting more efficient and accurate. Invoicing software offers a multitude of benefits for small businesses, from improving efficiency and accuracy to providing strategic business insights. However, it’s crucial to consider the potential challenges and ensure that the chosen software aligns with the business’s specific needs and capabilities. With the right approach, invoicing software can be a powerful tool in the arsenal of a small business, contributing significantly to its operational efficiency and financial health. What Is the Best Free Invoicing Software for Small Businesses? When it comes to finding the best free invoicing software for small businesses, Zoho Invoice emerges as the top choice. With its user-friendly interface and robust features, Zoho Invoice provides small business owners with a comprehensive solution for managing invoices effectively. From creating professional-looking invoices to tracking payments and generating insightful reports, Zoho Invoice offers a seamless invoicing experience. If you’re looking for more options in the realm of free billing software, Wave, FreshBooks, and Invoicera are worthy contenders. Wave stands out for its simplicity and versatility, offering invoicing, accounting, and receipt scanning features. On the other hand, FreshBooks combines user-friendly invoicing tools with advanced accounting capabilities, making it suitable for small businesses with more complex financial needs. Invoicera provides a range of invoicing features along with expense management and time-tracking functionalities, making it a well-rounded choice for small business owners. Whether you choose Zoho Invoice, Wave, FreshBooks, or Invoicera, these free invoicing software options empower small business owners to streamline their billing processes, save time, and ensure prompt payment collection. Take advantage of the features and capabilities offered by these software solutions to enhance your invoicing efficiency and maintain a healthy cash flow for your business. What Is the Best Way to Create Invoices for Your Business? By choosing the appropriate invoicing software for small businesses, you can experience numerous benefits that extend beyond just utilizing free customizable invoice templates. Here are some advantages of selecting the right invoicing software: Efficient Invoice Creation: With the right invoicing software, you can quickly and easily create professional invoices. These software solutions offer intuitive interfaces and pre-designed invoice templates that can be customized to suit your branding and specific needs. This saves you time and ensures that your invoices are accurate, consistent, and visually appealing. Seamless Estimate Generation: Invoicing software often includes the functionality to create estimates or quotes for your clients. This enables you to provide detailed cost breakdowns and project timelines to potential customers, helping you secure more business. The ability to convert estimates into invoices with a few clicks streamlines your workflow and eliminates manual data entry. Overdue Invoice Tracking: Keeping track of overdue invoices is crucial for maintaining a healthy cash flow. Premium invoicing software allows you to set up automated reminders and notifications for overdue payments. This helps you stay on top of outstanding invoices, send reminders to clients, and take necessary actions to collect payments promptly. Invoice Customization: The right invoicing software offers extensive customization options, allowing you to tailor your invoices to reflect your brand identity. You can add your logo, choose colors that align with your brand, and include personalized messages or terms and conditions. This level of customization helps create a professional image for your business and reinforces your brand identity. Time-Saving Automation: Premium invoicing software often includes automation features that can significantly reduce manual tasks. These features may include recurring invoice generation, automated payment reminders, and integration with payment gateways for seamless online payment processing. By automating repetitive tasks, you can save time and focus on other aspects of running your small business. In short, utilizing the features and capabilities offered by the right invoicing software will streamline your invoicing processes, enhance professionalism, improve cash flow management, and save valuable time. Consider investing in a premium invoicing software solution that aligns with your business needs and empowers you to create and manage invoices more efficiently. Image: Depositphotos This article, "The Top Invoicing Software for Small Businesses" was first published on Small Business Trends View the full article

-

The Top Invoicing Software for Small Businesses

If you’re a small business owner, it’s no secret how important invoicing is in keeping your cash flow flowing. However, knowing which invoicing software to use can be tricky as the market is flooded with options. Luckily, we’ve researched for you and put together an up-to-date list of the best invoicing software for small business owners. Let’s take a look at the best invoicing software options available that can help simplify your billing process and promote effective financial management for your business. What Is Invoicing Software? Invoicing software is a software program that helps businesses keep track of their invoices and payments. It can help businesses create, send, and track invoices and keep tabs on when payments are due and received. Invoicing software can also help businesses manage their finances by tracking spending and creating reports. Some invoicing software programs also integrate with other financial software, such as accounting software or payment processors, making it easier for businesses to track all their financial data in one place. READ MORE: How Small Businesses Can Invoice and Collect More Efficiently Top Invoicing Software for Small Businesses: Our Methodology Choosing the right invoicing software is a crucial step for small businesses, impacting how you manage your transactions, cash flow, and customer relationships. The perfect tool should simplify your work, ensure you’re organized, and help you get paid promptly. In selecting the top invoicing software suitable for businesses and freelancers, we’ve considered a variety of factors. Each criterion is rated on a scale from 10 (most critical) to 1 (least critical), to ensure that our recommendations cater to the needs of efficient billing and financial management. Ease of Use and User Interface: Importance 10/10 Intuitive design for easy navigation and use. Simple process for creating and sending invoices. Clear and accessible layout for tracking payments and expenses. Customization and Flexibility: Importance 9/10 Options to customize invoice templates and branding. Flexibility to handle different billing scenarios and tax settings. Capability to accommodate various currencies and languages. Integration Capabilities: Importance 8/10 Seamless integration with accounting software and payment gateways. Compatibility with other business tools (CRM, project management, etc.). Ability to synchronize data across platforms. Automation and Efficiency Features: Importance 8/10 Automated invoicing and recurring billing features. Reminders and alerts for overdue payments. Efficiency tools like bulk invoicing and expense tracking. Security and Data Protection: Importance 7/10 Robust security measures to protect financial data. Compliance with financial regulations and data privacy laws. Reliable backup and data recovery options. Reporting and Analytics: Importance 6/10 Comprehensive reporting features for financial insights. Real-time analytics on cash flow and business performance. Customizable reports for accounting and tax purposes. Customer Support and Resources: Importance 5/10 Access to responsive customer support. Availability of help resources, tutorials, and guides. Community forums or user groups for additional support. Pricing and Value for Money: Importance 5/10 Transparent and competitive pricing structures. Scalable plans are suitable for different business sizes. Free trials or demos to evaluate software features. Through this thorough examination, we identify invoicing software options that encompass not just the technical requirements but also contribute to a smoother, more efficient financial workflow for small business owners. Top Invoicing Software Solutions Before digging too deeply into the list, here is a quick reference table that lets you quickly compare the top invoice software options: SoftwareKey FeaturesPricing Zoho InvoiceCraft professional invoices, bill in multiple currencies, automate payment remindersFree Quickbooks OnlineCreate and track invoices on the go, integrate with popular third-party appsStarts at $15 per month Square InvoicesSend digital invoices and estimates, enable pay later optionForever-free plan, $20 monthly plan BrightpearlTailored for retail businesses, handles proforma and actual invoicesFlexible pricing based on business needs PaySimpleIntegrates invoicing with payments, ideal for service-based businessesStarts at $69.95 per month FreshBooksCloud-based accounting software, automated invoicing, online payment acceptanceStarts at $16.50 per month WaveBudget-friendly invoicing software, customized invoices, automated billingFree InvoiceSimpleIntuitive invoicing app, easy invoicing for small businesses and freelancersFree Sage IntacctIdeal for merchants with complex invoicing flow, real-time payment status visibilityPricing based on selected features XeroCustomizable online invoices, automatic reminders, accept instant paymentsStarts at $25 per month XeroCustomizable online invoices, automatic reminders, and instant online payments.Starts at $25 per month Invoice2goCreate invoices on the spot, send via various channels, and customizable invoice templates.Starter plan at $5.99 per month ChargeBeeAutomates recurring billing, supports multiple currencies and subscription models, real-time analytics for performance.Free plan available HarvestEfficient time-based invoicing, automatic invoicing, integrated payments, and client management.Free-forever plan, $12 per user/month Invoice NinjaFree invoicing tool, quote and invoice creation, tracking payments, and setting up recurring invoices.Free plan available InvoiceraTotal invoice and billing management, customization options, and control of multiple businesses through a single account.Starter plan available for free HiveageSimplified invoicing, payment and cash management, easy tax calculation, and discounts.Free plan available BillBooksIntelligent invoicing platform, assisted scheduling, automatic payment reminders, and mobile-optimized invoicing app.Starting at $7.95 per month ZipBooksInvoicing and automation of the billing process, unlimited invoices and payment tracking.Free invoicing tool Bill.comManaging accounts payable and accounts receivable, track payments, request money, and schedule payments.Starting at $45 per user/month SliQ InvoicingSimple and powerful invoicing program, unlimited invoices and quotes, easy setup and usage.£6 (or $7.3) monthly plan Here are the top invoicing software programs to pick the best invoicing solution for your business: Zoho Invoice Zoho Invoice is a free online invoicing software program for small businesses. It enables you to craft professional invoices, bill in the currency you want, and automate payment reminders. With Zoho Invoice, you can even automate recurring invoices. It simplifies billing so you can focus better on your business. The Zoho Invoice tool is available for free. Quickbooks Online QuickBooks Online makes it easy to create and track invoices on the go. SMB owners can store HSN/SAC codes, generate invoices, and automatically calculate payable taxes. QuickBooks Online ensures breezy invoicing and payment clearance. It also integrates well with hundreds of popular third-party apps. The base plan of QuickBooks Online costs $15 per month. Higher plans with features such as expense tracking, analytics, and inventory management are also available. Square Invoices Square Invoices is an easy-to-use tool for sending digital invoices and estimates. It enables businesses to create invoices, track payments and monitor analytics from one place. Square Invoices even allows businesses to enable the pay later option. It’s an ideal tool for managing your transactions while maintaining customer relationships. Square Invoices has a forever-free plan with all invoicing features. It also has a $20 monthly plan with more finance management utilities. Brightpearl Brightpearl is a software package tailored to the invoicing needs of retail businesses. It offers various features to handle and process proforma and actual invoices. Brightpearl has flexible pricing and invoicing features to manage cash flow efficiently. You can even keep track of part payments and bank deposits and have a bird’s eye view of each payment status. Brightpearl tailors its pricing to business needs. READ MORE: How to Create an Invoice That Gets Paid PaySimple PaySimple integrates invoicing with payments to simplify small business operations. It’s beneficial for service-based businesses that need to handle payments from multiple points of sale. PaySimple makes the workflow manageable with its online invoicing and easy processing of online payments. Pricing for PaySimple starts at $69.95 per month. FreshBooks FreshBooks is a cloud-based accounting software designed with small businesses in mind. It puts invoicing on autopilot. The professional automated invoicing of FreshBooks enables the quick creation of clean and customizable invoices. You can also accept payments online, track their status, and send reminders for late payments. FreshBooks’ pricing starts at $16.50 per month for unlimited billable clients. Higher plans with better tracking, analytics, and reports are also available. Wave Wave is a budget-friendly invoicing software solution for small businesses. It takes care of all the invoicing and payment needs. The information is synced with the customer’s info. Wave app helps in creating customized invoices and automating the billing process. You can even set up recurring invoices and automate payment processing for repeat customers. Wave invoicing app is free for invoicing. InvoiceSimple InvoiceSimple is an easy-to-use invoicing app for business owners. It touts itself as the simplest way for small businesses and freelancers to invoice customers. Invoice Simple makes invoicing straightforward for businesspeople. It allows invoicing via mobile and laptop to help you stay organized throughout. You can try Invoice Simple for free. Sage Intacct Sage Intacct is ideal for merchants with a complex invoicing flow who need granular control over the process. This powerful tool provides complete control and customization over invoicing with real-time visibility of payment status. A subscription to Sage Intacct includes access to a community of industry peers. Business owners can interact with them and get support and industry updates. The pricing of Sage Intacct’s plans depends on the features you select for your business. Xero Xero online invoicing is another intuitive tool for small businesses. It enables you to customize your online invoices, set automatic reminders, and invoice directly from the app. You can choose from custom, ready-made, or pre-set invoices without leaving the app. With Xero, you can also accept instant payments online. It makes it easy for customers to pay you. Pricing plans for Xero start at $25 per month, with higher plans for comprehensive accounting tools. READ MORE: 12 Printable Invoice Template Options More Invoicing Software Options for Small Business Here are some more billing and invoicing software for small businesses: Invoice2go Invoice2go is an easy-to-use, mobile-friendly invoicing tool to create invoices on the spot. It enables business owners to send invoices via email, messenger, and even text. For new businesses, Invoice2go is a time-saver. You can customize the business logo, fonts, and colors and create an invoice immediately. Invoice2go has a range of plans, with the Starter plan at $5.99 per month. ChargeBee ChargeBee is a widely used invoicing software for small businesses in the SaaS and subscription industry. It automates recurring billing, eliminating the need for manual invoice processing. ChargeBee supports various currencies and subscription models, allowing you to manage a global customer base. Additionally, you can access real-time analytics to monitor your invoicing performance effectively. ChargeBee has a free plan, offering essential invoicing and subscription management features. Higher plans are also available. Harvest Harvest is an online invoicing and billing software tool that automates time-based invoicing efficiently. It’s the most suitable for businesses providing services. Harvest allows for automatic invoicing, integrated payments, and client management, all in one place. Depending on availability, you can bill clients automatically or assign work to your team. Harvest has a free-forever plan for one user. It has a $12 per user per month plan for multiple users and projects. Invoice Ninja Invoice Ninja is a free-to-use invoicing tool. It enables business owners to quote, invoice, and take payments for free. It also helps track billable time, auto-invoicing, and setting up recurring invoices. The facility to take advance deposits and partial payments further eases the troubles. You can even set up a client-side invoice & payment portal with Invoice Ninja. Invoice Ninja has a free plan along with higher plans for more features. READ MORE: How Zoho Invoice Will Help Your Business – for FREE Invoicera Invoicera is a total invoice and billing management system. It supports all types of businesses, from small businesses to enterprises. Invoicera easily integrates with existing business management tools to be customized as per the business. And it allows one person to control multiple businesses through a single account. Invoicera’s Starter plan is offered for free but comes with limited features. Upgrading to higher plans provides access to more advanced functionalities. Hiveage Hiveage is a cloud-based invoicing tool for small businesses. It doesn’t burden you with a host of accounting features. With Hiveage, you can manage payments and cash with ease. Its simplified interface makes it easy to bill clients and keep track of revenue. You can easily enter regular tax amounts, discounts, and shipping charges. Hiveage starts with a free plan. Upgraded plans are also available, giving access to many more features. BillBooks Billbooks is an online invoicing platform built specifically for small businesses. It’s an intelligent tool that speeds up invoicing. It offers assisted scheduling and automatic payment reminders for different time zones to ensure more efficient payments. Billbooks is a mobile-optimized invoicing app that simplifies invoicing and payments. The pricing for Billbooks has been designed keeping small businesses in mind. The base price is $7.95 per month. ZipBooks Zipbooks is a vital invoicing software for small businesses that helps streamline and automate the billing process. It supports unlimited invoices and payment tracking. Zipbooks offers numerous useful features, including the ability to create estimates and manage customer payments all in one location. Additionally, it provides tools for time-tracking and automated billing. Zipbooks is a free invoicing tool with more features available on higher plans. Bill.com Bill.com is an online invoicing tool to save time and money. It lets business owners manage accounts payable as well as accounts receivable. You can efficiently keep track of payments, request money and schedule payments. Its two-way sync with accounting software makes invoicing easier. So, managing financial transactions is a breezy experience with Bill.com. The starting plan of Bill.com is priced at $45 per user per month. SliQ Invoicing SliQ Invoicing is a simple yet powerful invoicing program for small businesses. It lets business owners create invoices, payment reminders, and record payments. It’s simple to set up and use. And you can send unlimited invoices and quotes. SliQ Invoicing also helps handle invoices for multiple businesses with one admin panel. SliQ Invoicing has a £6 (or $7.3) monthly plan. You can upgrade to a higher plan to onboard more team members. Why You Should Consider Using Invoicing Software for Small Business Here are key reasons why you should use invoicing software in your business: Invoice software often includes features that save time, such as the ability to create and send invoices quickly, automatic invoice numbering, and the option to save frequently used phrases or paragraphs. With invoicing software, you can also track payments and expenses. This information can be helpful when preparing tax returns or other financial documents. Online invoicing lets you see when online payments are made and received, which can help you keep tabs on your cash flow and budget. A well-designed invoice that is easy to read will give a good impression to your customers. Last but not least, most invoicing software allows you to understand your business better. This is because analytics provided by those software applications can help you understand which products sell fast and which ones move slower. READ MORE: The Manual Dilemma: 4 Ways To Streamline Invoicing Maximizing Efficiency with Invoicing Software for Small Businesses Enhanced Features of Invoicing Software Automation and Time Management: Invoicing software automates many of the mundane tasks associated with billing, such as data entry, calculations, and invoice tracking. This automation significantly reduces the time spent on invoicing, allowing small business owners to focus on other critical aspects of their business. Improved Accuracy and Professionalism: The use of invoicing software minimizes errors that can occur with manual invoicing. It ensures accuracy in calculations and consistency in the presentation of invoices, enhancing the professional image of the business. Real-Time Financial Overview: Invoicing software provides a real-time view of the business’s financial health. It tracks outstanding invoices, payments received, and overall cash flow, offering valuable insights for informed decision-making. Seamless Integration with Other Systems: Numerous invoicing software for small business solutions easily connect with various business systems, including accounting software, CRM tools, and payment gateways. This integration enhances the flow of financial data, making financial management more straightforward. Customization and Branding: Invoicing software often allows for the customization of invoice templates. Businesses can add their logos, brand colors, and personalized messages, aligning the invoices with their brand identity and enhancing the overall customer experience. Navigating the Challenges of Invoicing Software Cost Considerations: While many invoicing software options offer free basic plans, more advanced features might come at a cost. Small businesses need to evaluate the cost-benefit ratio to determine if the additional features are worth the investment. Adaptation and Training: Integrating new software into existing business processes may require training for staff. Businesses must consider the time and resources needed for effective adaptation to the new system. Dependence on Technology: Reliance on invoicing software means being susceptible to technical issues or service downtimes. Small businesses should have contingency plans in place to address any potential disruptions. Data Security and Privacy: With financial data being stored and managed digitally, ensuring data security and privacy becomes paramount. It’s essential to choose software that offers robust security features to protect sensitive information. Making the Most of Invoicing Software Leveraging Data for Strategic Insights: Invoicing software for small businesses offers valuable data that can be analyzed to gain insights. By understanding payment patterns, client behavior, and sales trends, businesses can make informed strategic decisions to foster growth. Enhancing Customer Relations: Prompt and accurate invoicing, coupled with professional presentation, contributes to a positive customer experience. This can lead to improved customer satisfaction and retention. Streamlining Tax Preparation: The comprehensive financial records maintained by invoicing software simplify the process of tax preparation. Accurate and organized financial data can make tax reporting more efficient and accurate. Invoicing software offers a multitude of benefits for small businesses, from improving efficiency and accuracy to providing strategic business insights. However, it’s crucial to consider the potential challenges and ensure that the chosen software aligns with the business’s specific needs and capabilities. With the right approach, invoicing software can be a powerful tool in the arsenal of a small business, contributing significantly to its operational efficiency and financial health. What Is the Best Free Invoicing Software for Small Businesses? When it comes to finding the best free invoicing software for small businesses, Zoho Invoice emerges as the top choice. With its user-friendly interface and robust features, Zoho Invoice provides small business owners with a comprehensive solution for managing invoices effectively. From creating professional-looking invoices to tracking payments and generating insightful reports, Zoho Invoice offers a seamless invoicing experience. If you’re looking for more options in the realm of free billing software, Wave, FreshBooks, and Invoicera are worthy contenders. Wave stands out for its simplicity and versatility, offering invoicing, accounting, and receipt scanning features. On the other hand, FreshBooks combines user-friendly invoicing tools with advanced accounting capabilities, making it suitable for small businesses with more complex financial needs. Invoicera provides a range of invoicing features along with expense management and time-tracking functionalities, making it a well-rounded choice for small business owners. Whether you choose Zoho Invoice, Wave, FreshBooks, or Invoicera, these free invoicing software options empower small business owners to streamline their billing processes, save time, and ensure prompt payment collection. Take advantage of the features and capabilities offered by these software solutions to enhance your invoicing efficiency and maintain a healthy cash flow for your business. What Is the Best Way to Create Invoices for Your Business? By choosing the appropriate invoicing software for small businesses, you can experience numerous benefits that extend beyond just utilizing free customizable invoice templates. Here are some advantages of selecting the right invoicing software: Efficient Invoice Creation: With the right invoicing software, you can quickly and easily create professional invoices. These software solutions offer intuitive interfaces and pre-designed invoice templates that can be customized to suit your branding and specific needs. This saves you time and ensures that your invoices are accurate, consistent, and visually appealing. Seamless Estimate Generation: Invoicing software often includes the functionality to create estimates or quotes for your clients. This enables you to provide detailed cost breakdowns and project timelines to potential customers, helping you secure more business. The ability to convert estimates into invoices with a few clicks streamlines your workflow and eliminates manual data entry. Overdue Invoice Tracking: Keeping track of overdue invoices is crucial for maintaining a healthy cash flow. Premium invoicing software allows you to set up automated reminders and notifications for overdue payments. This helps you stay on top of outstanding invoices, send reminders to clients, and take necessary actions to collect payments promptly. Invoice Customization: The right invoicing software offers extensive customization options, allowing you to tailor your invoices to reflect your brand identity. You can add your logo, choose colors that align with your brand, and include personalized messages or terms and conditions. This level of customization helps create a professional image for your business and reinforces your brand identity. Time-Saving Automation: Premium invoicing software often includes automation features that can significantly reduce manual tasks. These features may include recurring invoice generation, automated payment reminders, and integration with payment gateways for seamless online payment processing. By automating repetitive tasks, you can save time and focus on other aspects of running your small business. In short, utilizing the features and capabilities offered by the right invoicing software will streamline your invoicing processes, enhance professionalism, improve cash flow management, and save valuable time. Consider investing in a premium invoicing software solution that aligns with your business needs and empowers you to create and manage invoices more efficiently. Image: Depositphotos This article, "The Top Invoicing Software for Small Businesses" was first published on Small Business Trends View the full article

-

The Best Business Ideas for Teens