Everything posted by ResidentialBusiness

-

Trump says Fed chair contender Hassett should stay in White House job

US president says moving National Economic Council director to lead the central bank would be a ‘serious concern for me’View the full article

-

Why is everyone posting 2016? What to know about the nostalgic social media trend that’s dominating TikTok

By the time they get into their 20s, every generation seems to have nostalgia for one year from their teenage years. For people in my generation (Gen X), that year is usually cited as 1994—the final year before the internet really started taking hold. But if a recent trend on TikTok is anything to go by, the year Gen Z is most nostalgic for is 2016. Here’s what you need to know. ‘2026 is the new 2016’ In recent days, TikTok has been flooded with variations of the phrase “2026 is the new 2016.” Along with the phrase, TikTokers are posting throwback pictures to when they were younger, listening to songs popular a decade ago, and reminiscing about how the world just seemed like a more stable and safe place in 2016. It’s unclear exactly why or how this trend gained critical mass in the last few days, but at the start of any new year, it is natural to reflect on past years and compare how we and the world have changed over time. Nostalgia and the 10-year rule As a decade ago is both long enough to notice differences yet not so long ago that your memory becomes foggy of the time period, it’s little wonder why when we nostalgitize the past, we often choose a period that happened 10 years prior. As for why many may feel nostalgic for 2016, you just have to look at events so far in 2026. In America, we’re seeing increasing social upheaval and protests across the country, and once again, the U.S. is attacking other countries. Things feel chaotic, and that chaos makes us long for a time when things felt more stable. For many on TikTok, that time was apparently 2016. As noted by Yahoo Entertainment, for many TikTok users, 2016 felt “like the last year before the world shifted.” The leader of the free world was predictable and stable, housing prices were more affordable, and AI hadn’t yet put a big question mark over the future of people’s job security. It’s self-evident why those things are yearned for now. The world that was 2016 If your memory is a little foggy about what 2016 was actually like, here’s a little reminder. Google’s decade-old “Year in Search 2016” roundup showed what people across the world spent their year searching for, which reveals key events from the time. On the geopolitical front, the 2016 U.S. presidential election between Hillary Clinton and Donald The President was at the top of people’s minds. So were mass shootings in Orlando and Dallas, as well as fears over the Zika Virus outbreak. Culturally, people were obsessed with a new show called Stranger Things, as well as the shows Westworld, Luke Cage, Game of Thrones, and Black Mirror. The Rio Olympics and World Series were also on top of people’s minds. Deadpool, Captain America: Civil War, and Batman v. Superman got people into the theaters, and Celine Dion and Kesha were some of the musicians who generated the most interest. Meanwhile, 2016 was also the year that people were obsessed with Pokémon Go, and the top tech products of the year included the iPhone 7 and Google Pixel. View the full article

-

We asked Minnesota’s biggest companies about ICE. None of them responded

The sonic backdrop of the Twin Cities in 2026 is a cacophony. As thousands of ICE agents raid residential neighborhoods, schools, hospitals, and businesses, they’re trailed by the ambient noise of piercing sirens, whirring helicopters, and screeching whistles at all hours of the day, along with the occasional boom of flashbang grenades and the odd cry for help. Conspicuously silent in all the commotion, however, are major corporations that are headquartered in Minnesota. It’s a list that includes some of the most well-known consumer-facing brands in the country, including Target, Best Buy, and Land O’Lakes—all of which have an obvious direct stake in the communities that are currently being disrupted by this occupation. As of Friday morning, not one of them has released an official statement about what’s happening. After an ICE agent killed Renee Nicole Good last week and brought international attention to Minneapolis, escalating tensions have knocked residents out of their normal routines. A pervasive awareness has sunk in—violent ICE sweeps of residents or their neighbors can happen anywhere, and anyone might get caught up in them just for walking their dog at the wrong moment or not carrying proof of citizenship. One of the consequences is that small businesses are suffering—especially those owned by immigrants. Local restaurants are speaking up about the situation. Minneapolis’s Mothership Pizza, for instance, announced its owners are giving 10% of all dinner sales directly to team members affected by ICE, while Owamni by the Sioux Chef—which the New Yorker dubbed the “best new restaurant in the U.S.” in 2022—donated 10% of its proceeds last weekend to Good’s family. As for the Fortune 500 companies based in Minnesota, well, it’s anyone’s guess how those in their C-suites feel—or at least prefer to be seen as feeling—about what ICE is doing in the state. Fast Company reached out multiple times this week to General Mills, Target, Best Buy, Cargill, UnitedHealth Group, 3M, and Land O’Lakes for comment. None of them responded. What a difference five years—and a pivotal election—can make. The reckoning of the reckoning In the summer of 2020, another broad-daylight killing at the hands of a law enforcement officer—similarly captured on video—brought this city international attention. The murder of George Floyd by Minneapolis police sparked massive protests, and what some at the time prematurely called “a racial reckoning.” Even Donald The President, whom many seem to forget was president at the time, briefly acknowledged in a statement, “All Americans were rightly sickened and revolted by the brutal death of George Floyd,” before turning his ire forever toward the “angry mob” of protesters. Meanwhile, all of those major companies mentioned above were sufficiently moved to join the chorus of CEOs who had publicly weighed in on that moment. Depending on your perspective, they were either unburdening their consciences or paying lip service—your mileage may vary—but it’s notable that their ranks included Target’s then-CEO Brian Cornell, who declared in a statement, “We are a community in pain.” Graveyard of good intentions The intervening Biden years saw a swift and relentless rightwing backlash against anguished executives promising to do better. Tech CEO Vivek Ramaswamy, for instance, squeezed so much juice out of his staunch opposition to what he termed “woke capitalism” that he briefly became a long-shot 2024 presidential contender. Conservative media hubs like Fox News and The President-Lite figures like Governor Ron DeSantis of Florida strongly denounced corporate gestures toward social justice, including Target’s Pride merch and Disney’s LGBTQ advocacy. After a flurry of high-profile boycotts, the sprawling corporate conscience of 2020 looked more like a dream blinked away in the harsh light of day. Many companies had already begun retreating from DEI initiatives and inclusive messaging by 2024; partly for organic reasons, and partly as a result of MAGA influencers orchestrating social media attack campaigns. The election, however, changed everything. The Eye of Sauron is watching brands Conservatives hailed The President’s return to office as the final nail in the coffin of Woke. Mega-companies such as Meta Platforms and Amazon, formerly critical of The President, made a grand show of shredding their last remaining vestiges of DEI, seemingly part of a broader strategy to ingratiate themselves with the new president and his supporters—or, at least, to avoid their wrath. Nearly a year into The President 2.0, corporations now understand that speaking up about social issues might bring to bear the full force of the federal government in retaliation. Before Good was killed, for instance, a local Hilton affiliate declined to house ICE agents booked at the hotel. The Department of Homeland Security responded by posting on X that Hilton had launched a “coordinated campaign” against the agency, “siding with murderers and rapists to deliberately undermine and impede DHS law enforcement.” By the end of the day, the #BoycottHilton hashtag was all over X and the company’s shares were down by 2.5%. The hotel giant quickly clarified that the establishment responsible for canceling the reservations was independently owned, and that Hilton is in fact a welcoming oasis for any government agency conducting violent missions in any U.S. city. (More or less.) In another era, the company might have ended its ass-covering there. In this one, Hilton went scorched earth. It de-franchised the hotel, lest there be any confusion about whether the brand itself had been taking a stand against ICE, or even permitting a stand to be made on its property. No brand wants to be a target If it was unexpected how vehemently Hilton distanced itself from the possibility of having an opinion, other recent brand reactions to government overreach are much less surprising. Not a peep was heard from Jeff Bezos this week when the FBI raided the home of a reporter at the newspaper he owns. Nor is anyone holding their breath waiting for Mark Zuckerberg to speak out about ICE reportedly abducting workers from a Meta data center in Louisiana this week As for Minnesota businesses, the most conspicuously silent among them is Target. It’s perhaps the company most closely associated with the area, the one whose name adorns local baseball stadium and concert venue Target Field. And it’s the company most closely connected to the ICE raids, after agents snatched and injured two employees in the middle of a shift—both of whom turned out to be U.S. citizens, as caught on a disturbing video. But Target also might be the company with the most financially at stake. The retailer incurred persistent boycotts in 2025, after rolling back DEI initiatives amidst a changing political landscape. Its share price has only recently begun to recover—it’s up more than 10% in 2026. Still, the Twin Cities community wants action from the brand. Since the incident last week, residents have protested outside the store where the employees were abducted, demanding a response. A strong statement at least acknowledging that Minneapolis is, once again, “a community in pain,” might even help win back disappointed progressive shoppers. Then again, if Minnesota businesses continue to keep quiet about the ICE invasion, perhaps consumer demand within the state will become silent too. View the full article

-

open thread – January 16, 2026

It’s the Friday open thread! The comment section on this post is open for discussion with other readers on any work-related questions that you want to talk about (that includes school). If you want an answer from me, emailing me is still your best bet*, but this is a chance to take your questions to other readers. * If you submitted a question to me recently, please do not repost it here, as it may be in my queue to answer. The post open thread – January 16, 2026 appeared first on Ask a Manager. View the full article

-

Homebuilder sentiment falls for first time in five months

Confidence among US homebuilders unexpectedly fell in January, as costly sales incentives outweighed a recent boost from lower mortgage rates and the president's housing proposals. View the full article

-

Competitor Keywords: How to Find & Win Rivals’ Best Terms

Find competitor keywords for SEO & PPC with Semrush. Step-by-step workflows plus free methods. View the full article

-

How Jerome Powell could stay at the Federal Reserve until 2028

The Justice Department’s investigation into Federal Reserve Chair Jerome Powell has brought heightened attention to a key drama that will play out at the central bank in the coming months: Will Powell leave the Fed when his term as chair ends, or will he take the unusual step of remaining a governor? Powell’s term as Fed chair finishes on May 15, but because of the central bank’s complex structure, he has a separate term as one of seven members of its governing board that lasts until January 31, 2028. Historically, nearly all Fed chairs have stepped down from the board when they are no longer chair. But Powell could be the first in nearly 50 years to stay on as a governor. Many Fed-watchers believe that the criminal investigation into Powell’s testimony about cost overruns for Fed building renovations was intended to intimidate him out of taking that step. If Powell stays on the board, it would deny the White House a chance to gain a majority, undercutting the The President administration’s efforts to seize greater control over what has for decades been an institution largely insulated from day-to-day politics. “I find it very difficult to see Powell leaving before midnight on Jan. 31, 2028,” said David Wilcox, a former top economist at the Fed and senior fellow at the Peterson Institute for International Economics. “This is a mortal threat to the governance structure of the Fed as we’ve known it for 90 years. And I think that Powell does take that threat exceedingly seriously, and therefore will believe that it is his solemn duty to continue to occupy his seat on the board of governors.” Powell, 72, was appointed as Fed chair by The President in 2018, and must step down from the position in May because his second four-year term is ending. He has declined several times to comment on his plans beyond that when asked by reporters. A spokesperson declined to comment for this story. The President has sought to push out Powell before his time is up, obsessively attacking him for not cutting rates as sharply as the president wants, particularly in light of ongoing concerns about high costs for groceries, utilities, and housing that have remained a salient political issue even as inflation has cooled. On Tuesday, The President highlighted that mortgage rates have declined in the past year. “If I had the help of the Fed, it would be easier,” he said. “But that jerk will be gone soon.” Or maybe not. Here is a look at the impacts of whether or not Powell stays on the board could have: What happens if Powell stays on the board The President said Tuesday that he hopes to name a new Fed chair in the next few weeks. But that could get held up by the criminal investigation of Powell. Several Republican senators, including at least two on the banking committee who would have to approve The President’s nominees to the Fed, have expressed skepticism that Powell committed crimes during his testimony last June regarding the Fed’s $2.5 billion renovation of two office buildings, a project that The President has criticized as excessive. That testimony is the subject of subpoenas sent to the Fed by U.S. attorney for the District of Columbia Jeanine Pirro. Sen. Thom Tillis, a North Carolina Republican, said he would not vote for any Fed nominees until the legal cloud around Powell is resolved. That would be enough to delay a nomination from getting out of the banking committee. If no new chair of the Fed’s board has been confirmed by May 15, then Powell could remain in that post until a replacement has been confirmed. As a result, the Fed might not cut interest rates anywhere near as quickly as The President wants. If Powell stays on as a governor even after he is no longer chair, The President could still name someone to lead the Fed but that would give him a total of three appointments on the board — including two from his first term — and short of a majority. So even if The President nominates a chair who seeks to do the president’s bidding regarding interest rates, that person “would have very little persuasive power with his colleagues,” said Wilcox, who is also director of research at Bloomberg Economics. Powell, along with other members of the Fed’s 19-member interest-rate setting committee, could outvote the new chair. That hasn’t happened since 1986. What happens if Powell leaves the board In that case, The President could nominate a fourth person to the board and gain a majority. He could even then add a fifth, if the Supreme Court allows his attempt to fire Governor Lisa Cook to proceed. The high court will hear her case on Wednesday. A majority on the board would enable the White House to make sweeping changes to the Fed. The President’s Treasury Secretary, Scott Bessent, has advocated numerous reforms to reduce the central bank’s influence in the economy and financial markets. The President’s majority on the Fed’s board could also remove some of the presidents of the 12 regional banks, who are members of the Fed’s rate-setting committee. The New York Fed president has a vote on the committee and four others vote on a rotating basis. Several of those bank presidents have expressed opposition to the deep rate cuts that The President has demanded. The board of governors could seek to have them fired if a chair wanted to do so. What past Fed chairs have done While nearly all Fed chairs have left the board of governors before their terms were up, there is some precedent for Powell to stay. In 1978, then-Chair Arthur Burns stayed on the board for about three weeks after his chairmanship ended. But in 1948, then-Fed chairman Marriner Eccles remained as a governor for three years after finishing as chair, in part because President Harry Truman asked him to remain. In 1951, however, he played a key role in undercutting the Truman administration in a dispute over interest rates, which led to the Fed-Treasury Accord that established the modern Fed as a largely independent institution. Eccles became a symbol of Fed independence, though some academics say that reputation is overstated. The Fed’s principal office building — currently under renovation and at the center of the criminal investigation of Powell — is named after him. Truman then appointed a Treasury official, William McChesney Martin, to the Fed chairmanship and assumed he would do his bidding. Yet Martin defied Truman and raised interest rates. Years later, Truman ran into Martin in New York City and called him a “traitor.” The Fed’s second office building in Washington is named after Martin. “So it’s a cautionary tale also for The President, thinking he’s going to get his own Fed chair in there,” said Lev Menand, a law professor at Columbia University who studies the Fed. “Martin didn’t do what Truman wanted.” —Christopher Rugaber, AP Economics Writer View the full article

-

Populism makes managing global economy harder, Andrew Bailey warns

Bank of England governor tells officials to challenge populist leaders ‘in deeds more than just words’View the full article

-

10 Different Franchises to Consider for Your Next Investment

When considering your next investment, it’s crucial to explore a variety of franchise opportunities that cater to different markets. From health and fitness franchises to home services and pet care, each sector presents unique advantages and steady demand. You might likewise find potential in education and tutoring or food and beverage franchises. Comprehending the strengths of these options can help you make an informed decision about where to invest your resources next. What will you choose? Key Takeaways Planet Fitness offers affordable gym memberships, emphasizing community engagement and brand loyalty in the growing fitness market. Molly Maid provides home cleaning services with low startup costs and consistent demand, making it an attractive franchise option. Dogtopia caters to the rising pet service market, offering dog daycare, grooming, and boarding, capitalizing on increased pet ownership. Tutor Doctor focuses on personalized tutoring and academic support, benefiting from the growing education and tutoring demand in various subjects. Allstate Insurance provides a flexible business model in the insurance sector with strong brand recognition, making it a reliable investment opportunity. Gyms & Fitness As the global fitness market is projected to grow from $216 billion in 2023 to $435 billion by 2028, investing in gyms and fitness franchises presents a compelling opportunity for potential franchisees. Membership-based revenue models create brand loyalty, ensuring stable income streams for owners. Established franchises simplify operations, allowing you to focus on member engagement and retention. You can explore different franchises, such as Planet Fitness and Anytime Fitness, which highlight success through affordability and community involvement. Furthermore, niche markets like boutique gyms and personal training studios cater to specific demographics, offering unique investment franchise examples. For those considering foreign franchising, the fitness industry presents varied possibilities, making it an attractive option for diverse investors seeking growth opportunities. Home Services In the home services sector, there’s a strong demand for crucial household services like plumbing and cleaning, which makes franchising an attractive option for investors. You’ll find that lower startup costs are a significant benefit, as these franchises typically don’t require a storefront, allowing for more manageable operations. With the industry’s resilience during economic fluctuations, pursuing a home services franchise can lead to a stable and potentially profitable investment. Essential Household Services Demand The demand for vital household services remains strong, reflecting consumers’ ongoing need for maintenance and repair in their homes. This sector consistently provides opportunities for investment owing to its resilience and diverse offerings. Here are four key aspects to reflect upon: Consistent Demand: Cleaning, landscaping, and handyman services are always needed, ensuring a steady stream of customers. Diverse Services: Franchises can offer various services, catering to a broad audience and meeting different consumer needs. Streamlined Operations: Many franchises operate with efficient systems, making management and scalability easier for you. Economic Resilience: Homeowners prioritize upkeep, even during economic downturns, safeguarding your potential revenue. Investing in household services can lead to a sustainable and profitable business venture. Low Startup Costs Benefits Investing in home services franchises offers distinct advantages, particularly regarding low startup costs that appeal to many aspiring entrepreneurs. Typically, these franchises require an initial investment ranging from $10,000 to $50,000, which makes them accessible for those with limited capital. Unlike traditional retail franchises, home services often don’t need a physical storefront, allowing for more flexible investment options. Many operate on a mobile basis, further reducing overhead expenses associated with a fixed location. The ongoing demand for critical household services guarantees steady revenue streams, enhancing financial viability. With average profit margins between 10% and 30%, you can achieve a sustainable business model, making low startup costs a significant benefit in the home services sector. Food & Beverage When you consider investing in food and beverage franchises, the diversity of menu options can be a significant advantage. Strong brand recognition plays an essential role in attracting customers, giving you a head start in a competitive market. With established franchises, you benefit from proven concepts that cater to various tastes and preferences, enhancing your chances for success. Diverse Menu Options Offering diverse menu options can greatly boost a food and beverage franchise’s appeal, as consumers increasingly seek variety in their dining experiences. By incorporating a range of choices, you can attract a broader customer base and improve repeat business. Here are four key benefits of offering diverse menu options: Increased Customer Attraction: A varied menu can draw in new customers looking for unique dining experiences. Repeat Business: Customers are likely to return for different menu items, particularly in coffee shops and QSRs. Market Resilience: Diverse offerings can help maintain sales during economic downturns, ensuring stability. Lower Competition: A unique menu sets you apart from competitors, boosting your franchise’s market position. Investing in variety can lead to long-term success in the food and beverage sector. Strong Brand Recognition Strong brand recognition plays a crucial role in the success of food and beverage franchises. Established names like McDonald’s and Starbucks benefit from loyal customers, leading to repeat business. The Quick-Service Restaurant (QSR) market is expected to reach $731.6 billion by 2030, showcasing the demand for well-known food franchises. Successful brands often implement extensive marketing strategies that improve visibility and build consumer trust, which contributes to their long-term success. Furthermore, these established franchises typically experience lower failure rates because of proven business models and strong support systems for franchisees. With strong brand recognition, many franchises enjoy higher profit margins, often around 65-70%, making them attractive investment opportunities for potential franchisees like you. Pet Services As pet ownership continues to rise, the demand for pet services has become increasingly important, presenting a promising investment opportunity for entrepreneurs. With around 67% of U.S. households owning pets, the market is thriving. Here are four key areas you might consider: Dog Grooming: Crucial for pet hygiene and maintenance, this service attracts regular clients. Pet Boarding: Pet owners need reliable places to leave their pets during traveling. Training: Professional training services can help pet owners manage behavior issues. Daycare: Busy pet parents often seek daycare options for socialization and care throughout the day. With annual consumer spending reaching approximately $124 billion and profit margins between 10% to 30%, investing in pet services can be lucrative. Education & Tutoring With parents increasingly prioritizing their children’s education, the education and tutoring franchise market has emerged as a viable investment opportunity. This sector thrives on the growing demand for academic tutoring and test preparation services, especially as families invest more in educational support. Many tutoring franchises emphasize STEM programs and personalized learning experiences, adapting to various learning styles, which makes them appealing to a broad audience. The industry remains resilient, consistently generating revenue even during economic fluctuations. Franchise opportunities often come with flexible business models, including both in-person and online tutoring options. As of 2023, the tutoring industry continues to expand, underscoring the importance of quality education for community development and student success. Senior Care The senior care market is quickly growing, with projections estimating its value at $70.1 billion by 2025 and a potential to double in just eight years. This growth highlights a strong demand for diverse service offerings, particularly in-home care, which is expected to reach $441.5 billion by 2025. As an investor, you can tap into this recession-resistant industry, benefiting from steady profit margins as well as making a positive impact in your community. Growing Market Demand Given the significant growth potential in the senior care market, investors should take note of the promising statistics that highlight this sector’s value. Here are some key points to reflect on: The senior care market is projected to be valued at $70.1 billion by 2025, doubling by 2033. In-home senior care alone is expected to reach $441.5 billion by 2025 and climb to $1.09 trillion by 2035. This industry is recession-resistant, requiring fewer liquid assets compared to food businesses. Senior care franchises offer strong profit margins and recurring demand, making them a lucrative investment option. With the aging population continuing to grow, the demand for senior care services is set to rise, ensuring a stable and profitable investment environment. Diverse Service Offerings As you explore the senior care market, you’ll find a variety of service offerings designed to meet the unique needs of aging individuals. This sector is expected to grow considerably, with in-home care projected to reach $441.5 billion by 2025. Franchises typically provide strong profit margins and recurring demand, making them an attractive investment. Service Type Description Market Potential In-home Care Personalized care at home $441.5 billion by 2025 Assisted Living Community living with support Growing demand Adult Day Care Supervised daytime care Broadening services Memory Care Specialized dementia care Increasing need Palliative Care Comfort-focused support Crucial services Engaging in this industry not merely offers financial returns but also enables you to make a meaningful community impact. Retail & E-Commerce In today’s market, many entrepreneurs are turning to retail and e-commerce franchises as viable investment opportunities. These franchises effectively blend in-store and online shopping, catering to diverse customer preferences and maximizing reach. Here are some advantages to contemplate: Brand Recognition: Established retail franchises come with strong branding, reducing risk for new franchisees. Consumer Trust: Loyalty to well-known brands can lead to repeat business, crucial for profitability. Flexible Business Models: The rapid e-commerce growth encourages franchises to adapt to changing market demands. Streamlined Operations: Franchisees benefit from proven strategies, enhancing the likelihood of success. Investing in retail and e-commerce franchises can provide a stable foundation for your entrepreneurial expedition as you tap into a growing market. Automotive Services As retail and e-commerce franchises offer exciting opportunities, the automotive services sector presents its own unique advantages for investors. This industry generates steady demand because of regular vehicle maintenance needs, creating reliable revenue streams. Franchises such as oil change centers and detailing services often cultivate a loyal customer base, ensuring repeat business. With average profit margins ranging from 10% to 20%, depending on the service, the potential for profitability is significant. In addition, the U.S. automotive repair market is projected to reach approximately $74 billion by 2025, highlighting growth potential. Many automotive franchises likewise provide thorough training and support, enabling new owners to manage operations effectively, even without extensive prior industry experience. Travel & Hospitality The travel and hospitality sector offers an appealing investment opportunity for franchise owners looking to tap into a thriving market. With the U.S. travel agency market projected to reach $42.7 billion in 2023 and a growth rate of 3.9% anticipated, now’s a great time to contemplate entering this field. Here are some key points to reflect on: Profit margins for travel agencies typically range from 10% to 15%. Many travel agency franchises have low startup costs, averaging around $50,000. The business can often run from home, reducing overhead costs. Over 43,315 travel agency businesses currently operate in the U.S., providing ample opportunities for new franchisees. Investing in travel and hospitality could be a rewarding venture for you. Business & Marketing Services Franchising in business and marketing services presents a lucrative opportunity, especially with the U.S. digital marketing industry valued at an impressive $460 billion. This sector offers low startup costs and often allows for home-based operations, making it accessible for aspiring entrepreneurs. With high profit margins possible, you can benefit from the growing demand for businesses to improve their online presence and marketing strategies. Franchise offerings may include digital marketing, consulting, and business coaching, appealing to a diverse range of clients seeking growth and innovation. As companies increasingly shift from traditional to digital marketing platforms, investing in franchises within this space can help you capitalize on trends, ensuring sustainable revenue streams and scalability for your business. Frequently Asked Questions Which Franchise Gives the Best Return on Investment? Determining which franchise offers the best return on investment (ROI) depends on various factors, including industry growth and profit margins. Fitness franchises, like Planet Fitness, show promising potential owing to rising membership trends. Quick-service restaurants likewise present solid returns, benefiting from high demand. Cleaning services and senior care franchises are increasingly lucrative, offering low initial costs and resilient market demand. Digital marketing franchises provide significant growth with reduced overhead, making them attractive investment options. What Is the 7 Day Rule for Franchise? The 7 Day Rule for franchises requires franchisors to provide you with the Franchise Disclosure Document (FDD) at least 14 days before you sign any agreement or make a payment. This rule aims to give you ample time to review crucial information, including financial performance and existing franchisee experiences. What Is the Cheapest Most Profitable Franchise to Own? The cheapest, most profitable franchise to own often includes cleaning services, which have low startup costs and tap into a booming market projected to reach $617 billion by 2030. Vending machine franchises likewise offer low investment and minimal staffing, creating opportunities for passive income. Furthermore, pet service franchises, like grooming or boarding, require low initial costs and benefit from increasing consumer spending on pets, making them a strong choice for profitability. How to Decide Which Franchise to Buy? To decide which franchise to buy, start by evaluating your interests and skills to guarantee they align with the franchise’s industry. Next, research franchises with strong brand recognition and proven business models. Analyze financial requirements, including initial investment and ongoing fees, to confirm they fit your budget. Review the support and training offered by the franchisor and consult the Franchise Disclosure Document (FDD) as you connect with current owners for insights. Conclusion In conclusion, exploring diverse franchise opportunities can help you make informed investment decisions. Whether you’re drawn to gyms and fitness, home services, or pet care, each sector offers unique benefits and steady demand. Education, food and beverage, and automotive services as well present viable options. By considering these franchises, you can align your investment strategy with market trends and consumer needs. In the end, choosing the right franchise can lead to sustainable growth and a rewarding business experience. Image via Google Gemini This article, "10 Different Franchises to Consider for Your Next Investment" was first published on Small Business Trends View the full article

-

10 Different Franchises to Consider for Your Next Investment

When considering your next investment, it’s crucial to explore a variety of franchise opportunities that cater to different markets. From health and fitness franchises to home services and pet care, each sector presents unique advantages and steady demand. You might likewise find potential in education and tutoring or food and beverage franchises. Comprehending the strengths of these options can help you make an informed decision about where to invest your resources next. What will you choose? Key Takeaways Planet Fitness offers affordable gym memberships, emphasizing community engagement and brand loyalty in the growing fitness market. Molly Maid provides home cleaning services with low startup costs and consistent demand, making it an attractive franchise option. Dogtopia caters to the rising pet service market, offering dog daycare, grooming, and boarding, capitalizing on increased pet ownership. Tutor Doctor focuses on personalized tutoring and academic support, benefiting from the growing education and tutoring demand in various subjects. Allstate Insurance provides a flexible business model in the insurance sector with strong brand recognition, making it a reliable investment opportunity. Gyms & Fitness As the global fitness market is projected to grow from $216 billion in 2023 to $435 billion by 2028, investing in gyms and fitness franchises presents a compelling opportunity for potential franchisees. Membership-based revenue models create brand loyalty, ensuring stable income streams for owners. Established franchises simplify operations, allowing you to focus on member engagement and retention. You can explore different franchises, such as Planet Fitness and Anytime Fitness, which highlight success through affordability and community involvement. Furthermore, niche markets like boutique gyms and personal training studios cater to specific demographics, offering unique investment franchise examples. For those considering foreign franchising, the fitness industry presents varied possibilities, making it an attractive option for diverse investors seeking growth opportunities. Home Services In the home services sector, there’s a strong demand for crucial household services like plumbing and cleaning, which makes franchising an attractive option for investors. You’ll find that lower startup costs are a significant benefit, as these franchises typically don’t require a storefront, allowing for more manageable operations. With the industry’s resilience during economic fluctuations, pursuing a home services franchise can lead to a stable and potentially profitable investment. Essential Household Services Demand The demand for vital household services remains strong, reflecting consumers’ ongoing need for maintenance and repair in their homes. This sector consistently provides opportunities for investment owing to its resilience and diverse offerings. Here are four key aspects to reflect upon: Consistent Demand: Cleaning, landscaping, and handyman services are always needed, ensuring a steady stream of customers. Diverse Services: Franchises can offer various services, catering to a broad audience and meeting different consumer needs. Streamlined Operations: Many franchises operate with efficient systems, making management and scalability easier for you. Economic Resilience: Homeowners prioritize upkeep, even during economic downturns, safeguarding your potential revenue. Investing in household services can lead to a sustainable and profitable business venture. Low Startup Costs Benefits Investing in home services franchises offers distinct advantages, particularly regarding low startup costs that appeal to many aspiring entrepreneurs. Typically, these franchises require an initial investment ranging from $10,000 to $50,000, which makes them accessible for those with limited capital. Unlike traditional retail franchises, home services often don’t need a physical storefront, allowing for more flexible investment options. Many operate on a mobile basis, further reducing overhead expenses associated with a fixed location. The ongoing demand for critical household services guarantees steady revenue streams, enhancing financial viability. With average profit margins between 10% and 30%, you can achieve a sustainable business model, making low startup costs a significant benefit in the home services sector. Food & Beverage When you consider investing in food and beverage franchises, the diversity of menu options can be a significant advantage. Strong brand recognition plays an essential role in attracting customers, giving you a head start in a competitive market. With established franchises, you benefit from proven concepts that cater to various tastes and preferences, enhancing your chances for success. Diverse Menu Options Offering diverse menu options can greatly boost a food and beverage franchise’s appeal, as consumers increasingly seek variety in their dining experiences. By incorporating a range of choices, you can attract a broader customer base and improve repeat business. Here are four key benefits of offering diverse menu options: Increased Customer Attraction: A varied menu can draw in new customers looking for unique dining experiences. Repeat Business: Customers are likely to return for different menu items, particularly in coffee shops and QSRs. Market Resilience: Diverse offerings can help maintain sales during economic downturns, ensuring stability. Lower Competition: A unique menu sets you apart from competitors, boosting your franchise’s market position. Investing in variety can lead to long-term success in the food and beverage sector. Strong Brand Recognition Strong brand recognition plays a crucial role in the success of food and beverage franchises. Established names like McDonald’s and Starbucks benefit from loyal customers, leading to repeat business. The Quick-Service Restaurant (QSR) market is expected to reach $731.6 billion by 2030, showcasing the demand for well-known food franchises. Successful brands often implement extensive marketing strategies that improve visibility and build consumer trust, which contributes to their long-term success. Furthermore, these established franchises typically experience lower failure rates because of proven business models and strong support systems for franchisees. With strong brand recognition, many franchises enjoy higher profit margins, often around 65-70%, making them attractive investment opportunities for potential franchisees like you. Pet Services As pet ownership continues to rise, the demand for pet services has become increasingly important, presenting a promising investment opportunity for entrepreneurs. With around 67% of U.S. households owning pets, the market is thriving. Here are four key areas you might consider: Dog Grooming: Crucial for pet hygiene and maintenance, this service attracts regular clients. Pet Boarding: Pet owners need reliable places to leave their pets during traveling. Training: Professional training services can help pet owners manage behavior issues. Daycare: Busy pet parents often seek daycare options for socialization and care throughout the day. With annual consumer spending reaching approximately $124 billion and profit margins between 10% to 30%, investing in pet services can be lucrative. Education & Tutoring With parents increasingly prioritizing their children’s education, the education and tutoring franchise market has emerged as a viable investment opportunity. This sector thrives on the growing demand for academic tutoring and test preparation services, especially as families invest more in educational support. Many tutoring franchises emphasize STEM programs and personalized learning experiences, adapting to various learning styles, which makes them appealing to a broad audience. The industry remains resilient, consistently generating revenue even during economic fluctuations. Franchise opportunities often come with flexible business models, including both in-person and online tutoring options. As of 2023, the tutoring industry continues to expand, underscoring the importance of quality education for community development and student success. Senior Care The senior care market is quickly growing, with projections estimating its value at $70.1 billion by 2025 and a potential to double in just eight years. This growth highlights a strong demand for diverse service offerings, particularly in-home care, which is expected to reach $441.5 billion by 2025. As an investor, you can tap into this recession-resistant industry, benefiting from steady profit margins as well as making a positive impact in your community. Growing Market Demand Given the significant growth potential in the senior care market, investors should take note of the promising statistics that highlight this sector’s value. Here are some key points to reflect on: The senior care market is projected to be valued at $70.1 billion by 2025, doubling by 2033. In-home senior care alone is expected to reach $441.5 billion by 2025 and climb to $1.09 trillion by 2035. This industry is recession-resistant, requiring fewer liquid assets compared to food businesses. Senior care franchises offer strong profit margins and recurring demand, making them a lucrative investment option. With the aging population continuing to grow, the demand for senior care services is set to rise, ensuring a stable and profitable investment environment. Diverse Service Offerings As you explore the senior care market, you’ll find a variety of service offerings designed to meet the unique needs of aging individuals. This sector is expected to grow considerably, with in-home care projected to reach $441.5 billion by 2025. Franchises typically provide strong profit margins and recurring demand, making them an attractive investment. Service Type Description Market Potential In-home Care Personalized care at home $441.5 billion by 2025 Assisted Living Community living with support Growing demand Adult Day Care Supervised daytime care Broadening services Memory Care Specialized dementia care Increasing need Palliative Care Comfort-focused support Crucial services Engaging in this industry not merely offers financial returns but also enables you to make a meaningful community impact. Retail & E-Commerce In today’s market, many entrepreneurs are turning to retail and e-commerce franchises as viable investment opportunities. These franchises effectively blend in-store and online shopping, catering to diverse customer preferences and maximizing reach. Here are some advantages to contemplate: Brand Recognition: Established retail franchises come with strong branding, reducing risk for new franchisees. Consumer Trust: Loyalty to well-known brands can lead to repeat business, crucial for profitability. Flexible Business Models: The rapid e-commerce growth encourages franchises to adapt to changing market demands. Streamlined Operations: Franchisees benefit from proven strategies, enhancing the likelihood of success. Investing in retail and e-commerce franchises can provide a stable foundation for your entrepreneurial expedition as you tap into a growing market. Automotive Services As retail and e-commerce franchises offer exciting opportunities, the automotive services sector presents its own unique advantages for investors. This industry generates steady demand because of regular vehicle maintenance needs, creating reliable revenue streams. Franchises such as oil change centers and detailing services often cultivate a loyal customer base, ensuring repeat business. With average profit margins ranging from 10% to 20%, depending on the service, the potential for profitability is significant. In addition, the U.S. automotive repair market is projected to reach approximately $74 billion by 2025, highlighting growth potential. Many automotive franchises likewise provide thorough training and support, enabling new owners to manage operations effectively, even without extensive prior industry experience. Travel & Hospitality The travel and hospitality sector offers an appealing investment opportunity for franchise owners looking to tap into a thriving market. With the U.S. travel agency market projected to reach $42.7 billion in 2023 and a growth rate of 3.9% anticipated, now’s a great time to contemplate entering this field. Here are some key points to reflect on: Profit margins for travel agencies typically range from 10% to 15%. Many travel agency franchises have low startup costs, averaging around $50,000. The business can often run from home, reducing overhead costs. Over 43,315 travel agency businesses currently operate in the U.S., providing ample opportunities for new franchisees. Investing in travel and hospitality could be a rewarding venture for you. Business & Marketing Services Franchising in business and marketing services presents a lucrative opportunity, especially with the U.S. digital marketing industry valued at an impressive $460 billion. This sector offers low startup costs and often allows for home-based operations, making it accessible for aspiring entrepreneurs. With high profit margins possible, you can benefit from the growing demand for businesses to improve their online presence and marketing strategies. Franchise offerings may include digital marketing, consulting, and business coaching, appealing to a diverse range of clients seeking growth and innovation. As companies increasingly shift from traditional to digital marketing platforms, investing in franchises within this space can help you capitalize on trends, ensuring sustainable revenue streams and scalability for your business. Frequently Asked Questions Which Franchise Gives the Best Return on Investment? Determining which franchise offers the best return on investment (ROI) depends on various factors, including industry growth and profit margins. Fitness franchises, like Planet Fitness, show promising potential owing to rising membership trends. Quick-service restaurants likewise present solid returns, benefiting from high demand. Cleaning services and senior care franchises are increasingly lucrative, offering low initial costs and resilient market demand. Digital marketing franchises provide significant growth with reduced overhead, making them attractive investment options. What Is the 7 Day Rule for Franchise? The 7 Day Rule for franchises requires franchisors to provide you with the Franchise Disclosure Document (FDD) at least 14 days before you sign any agreement or make a payment. This rule aims to give you ample time to review crucial information, including financial performance and existing franchisee experiences. What Is the Cheapest Most Profitable Franchise to Own? The cheapest, most profitable franchise to own often includes cleaning services, which have low startup costs and tap into a booming market projected to reach $617 billion by 2030. Vending machine franchises likewise offer low investment and minimal staffing, creating opportunities for passive income. Furthermore, pet service franchises, like grooming or boarding, require low initial costs and benefit from increasing consumer spending on pets, making them a strong choice for profitability. How to Decide Which Franchise to Buy? To decide which franchise to buy, start by evaluating your interests and skills to guarantee they align with the franchise’s industry. Next, research franchises with strong brand recognition and proven business models. Analyze financial requirements, including initial investment and ongoing fees, to confirm they fit your budget. Review the support and training offered by the franchisor and consult the Franchise Disclosure Document (FDD) as you connect with current owners for insights. Conclusion In conclusion, exploring diverse franchise opportunities can help you make informed investment decisions. Whether you’re drawn to gyms and fitness, home services, or pet care, each sector offers unique benefits and steady demand. Education, food and beverage, and automotive services as well present viable options. By considering these franchises, you can align your investment strategy with market trends and consumer needs. In the end, choosing the right franchise can lead to sustainable growth and a rewarding business experience. Image via Google Gemini This article, "10 Different Franchises to Consider for Your Next Investment" was first published on Small Business Trends View the full article

-

To transform Iran, the west needs patience not over-reach

Playing a long game paid off with the Soviet Union and a similar trajectory of regime collapse could come in TehranView the full article

-

How to Protect Your Credit Cards From 'Web Skimming' Scams

You have probably heard of skimming, a type of fraud in which criminals install physical devices capable of capturing your payment card details on ATMs, gas pumps, and point-of-sale terminals. If you enter your debit or credit card into one of these fake card readers, your data is stored for later download or transmitted wirelessly in real time to a device controlled by scammers, who will use the information to steal from your accounts. Unfortunately, online shoppers aren't immune from this scheme. Web skimming is a type of cyberattack that uses malicious code to steal card data during checkout, and researchers have identified an ongoing campaign targeting major payment providers and, by extension, consumers. Online credit card skimmingWeb skimming attacks, broadly referred to as "Magecart" campaigns, are initiated when malicious JavaScript is injected into e-commerce websites and payment portals. When a checkout page loads, the skimmer replaces it with a spoofed form that collects card numbers, expiry dates, card verification codes, and billing or shipping addresses—everything threat actors need to turn around and use your card for fraudulent purchases. The fake payment forms use legitimate-looking branding and styling to minimize suspicion. Once payment details are transmitted to the attacker, the user gets an error message and is redirected to the real checkout page, a flow designed to make you believe that you've simply entered your information incorrectly. Web skimmers are typically designed to avoid detection and may even self-destruct, making them difficult to identify even for site admins. They also utilize bulletproof hosting, which shields cyber actors from takedown requests and law enforcement action. How to protect your payment cardUnfortunately, consumers can't do much about the presence of web skimmers, but they can play defense against them. Red flags of an online shopping scam are also red flags for skimming—for example, deals and discounts that are too good to be true are indicators of a possible fraudulent vendor or malicious site, where you may be more likely to have your card details stolen. Shopping with reputable vendors will reduce (though not entirely eliminate) the risk. You should also be vigilant about any unusual steps during checkout, such as redirects or error messages, and abandon any suspicious transactions. If you suspect that your payment details may have been stolen, keep an eye on your bank and credit card statements for unauthorized activity, and enable transaction alerts for real-time updates. Remember that credit cards offer more security protections than debit cards. You could also use virtual cards for online purchases, which allows you to keep your actual card details private and protect you from further fraud. (Note, however, that virtual cards have some drawbacks. For example, you may lose some protections offered by your primary card provider and have a tougher time obtaining refunds.) View the full article

-

Remodeling businesses cite favorable prospects to start 2026

NAHB's remodeling index finished at its highest mark in a year, with the current industry outlook standing in stark contrast to homebuilder sentiment. View the full article

-

Gas Prices Hit 5-Year Low, Averaging $2.81 as Demand Drops

As the new year unfolds, small business owners will likely see both challenges and opportunities with the latest gas price developments. The national average for regular gasoline has dropped to an inviting $2.81 per gallon—the lowest level observed since March 2021. This significant decrease could offer a welcome respite for businesses that rely on transportation and logistics. Gas prices fell from $2.833 the week prior and sharply dropped from $2.952 just a month ago. This change in the fuel market is linked to a steady crude oil supply and lower demand, particularly as OPEC+ maintains its current production levels. “The global oil supply is strong,” says a representative from AAA, suggesting stability in fuel costs for the foreseeable future. Key Takeaways: Current national average for gasoline: $2.819 per gallon. A notable decline from $3.069 one year ago. Crude oil price stability: WTI settled at $55.99 per barrel. Small business owners should note that the decreased costs at the pump can play a pivotal role in their operational budgets. Those in logistics, transportation, or delivery services may find that fuel savings can positively influence their profit margins. Restaurants and retailers with delivery options can also benefit, potentially passing savings on to customers while maintaining their competitive edge. While the national average for gasoline prices appears favorable, it’s essential to consider consumer behavior. According to recent data from the Energy Information Administration (EIA), gasoline demand has dipped from 8.56 million barrels per day to 8.17 million. This reduction may signal shifting consumer habits, prompting businesses to adapt accordingly. “Businesses should remain agile. While lower gas prices may encourage more travel and spending, they should also be prepared for potential fluctuations,” warns an industry analyst. The consistent supply of gasoline coupled with decreasing consumer demand may indicate a shift in market dynamics that could prompt future price adjustments. Electric vehicle (EV) charging rates remain consistent, averaging 38 cents per kilowatt hour at public stations. While the transition to electric has gained traction, it’s important for small business owners to keep an eye on local infrastructures. Understanding regional pricing variations can assist business owners in strategizing EV-related investments, possibly influencing customer behaviors as the popularity of electric vehicles grows. Gasoline price differences across states further illustrate regional advantages for small business owners. For example, Oklahoma boasts a low average of $2.25 per gallon, while California faces much higher costs at around $4.23. These variances can directly impact operational expenses for businesses that operate across state lines, making it crucial to plan accordingly. Potential challenges come into play as well. If gas prices remain low, businesses that depend on a robust logistics framework might feel pressure to incentivize service through pricing strategies that balance delivering value for customers while protecting margins. Additionally, an uncertain global oil market, influenced by geopolitical factors such as Venezuela’s role, could spark volatility in prices, making it essential for small enterprises to maintain flexible budgeting strategies. As small businesses navigate these changes, it’s advisable to utilize tools like the AAA TripTik Travel planner, a resource that allows drivers to find current gas and electric charging prices along their routes, ensuring informed decisions about travel costs. For small businesses, the current gas price landscape offers a chance to optimize operations and possibly enhance customer outreach via promotional pricing. However, the need for vigilance regarding international oil markets and evolving consumer behavior remains paramount. Staying informed about fuel pricing can enable business owners to leverage opportunities and address challenges effectively. To explore the specifics of this report further, visit the original post at AAA Gas Prices. Image via Google Gemini This article, "Gas Prices Hit 5-Year Low, Averaging $2.81 as Demand Drops" was first published on Small Business Trends View the full article

-

Gas Prices Hit 5-Year Low, Averaging $2.81 as Demand Drops

As the new year unfolds, small business owners will likely see both challenges and opportunities with the latest gas price developments. The national average for regular gasoline has dropped to an inviting $2.81 per gallon—the lowest level observed since March 2021. This significant decrease could offer a welcome respite for businesses that rely on transportation and logistics. Gas prices fell from $2.833 the week prior and sharply dropped from $2.952 just a month ago. This change in the fuel market is linked to a steady crude oil supply and lower demand, particularly as OPEC+ maintains its current production levels. “The global oil supply is strong,” says a representative from AAA, suggesting stability in fuel costs for the foreseeable future. Key Takeaways: Current national average for gasoline: $2.819 per gallon. A notable decline from $3.069 one year ago. Crude oil price stability: WTI settled at $55.99 per barrel. Small business owners should note that the decreased costs at the pump can play a pivotal role in their operational budgets. Those in logistics, transportation, or delivery services may find that fuel savings can positively influence their profit margins. Restaurants and retailers with delivery options can also benefit, potentially passing savings on to customers while maintaining their competitive edge. While the national average for gasoline prices appears favorable, it’s essential to consider consumer behavior. According to recent data from the Energy Information Administration (EIA), gasoline demand has dipped from 8.56 million barrels per day to 8.17 million. This reduction may signal shifting consumer habits, prompting businesses to adapt accordingly. “Businesses should remain agile. While lower gas prices may encourage more travel and spending, they should also be prepared for potential fluctuations,” warns an industry analyst. The consistent supply of gasoline coupled with decreasing consumer demand may indicate a shift in market dynamics that could prompt future price adjustments. Electric vehicle (EV) charging rates remain consistent, averaging 38 cents per kilowatt hour at public stations. While the transition to electric has gained traction, it’s important for small business owners to keep an eye on local infrastructures. Understanding regional pricing variations can assist business owners in strategizing EV-related investments, possibly influencing customer behaviors as the popularity of electric vehicles grows. Gasoline price differences across states further illustrate regional advantages for small business owners. For example, Oklahoma boasts a low average of $2.25 per gallon, while California faces much higher costs at around $4.23. These variances can directly impact operational expenses for businesses that operate across state lines, making it crucial to plan accordingly. Potential challenges come into play as well. If gas prices remain low, businesses that depend on a robust logistics framework might feel pressure to incentivize service through pricing strategies that balance delivering value for customers while protecting margins. Additionally, an uncertain global oil market, influenced by geopolitical factors such as Venezuela’s role, could spark volatility in prices, making it essential for small enterprises to maintain flexible budgeting strategies. As small businesses navigate these changes, it’s advisable to utilize tools like the AAA TripTik Travel planner, a resource that allows drivers to find current gas and electric charging prices along their routes, ensuring informed decisions about travel costs. For small businesses, the current gas price landscape offers a chance to optimize operations and possibly enhance customer outreach via promotional pricing. However, the need for vigilance regarding international oil markets and evolving consumer behavior remains paramount. Staying informed about fuel pricing can enable business owners to leverage opportunities and address challenges effectively. To explore the specifics of this report further, visit the original post at AAA Gas Prices. Image via Google Gemini This article, "Gas Prices Hit 5-Year Low, Averaging $2.81 as Demand Drops" was first published on Small Business Trends View the full article

-

Jan Lewis: Workforce Development Is the Next CPA Imperative | Gear Up For Growth

Training and growth will determine the profession’s future. Gear Up for Growth With Jean Caragher For CPA Trendlines Go PRO for members-only access to more Jean Marie Caragher. View the full article

-

Jan Lewis: Workforce Development Is the Next CPA Imperative | Gear Up For Growth

Training and growth will determine the profession’s future. Gear Up for Growth With Jean Caragher For CPA Trendlines Go PRO for members-only access to more Jean Marie Caragher. View the full article

-

Daily Search Forum Recap: January 16, 2026

Here is a recap of what happened in the search forums today...View the full article

-

Android 16 Makes Split Screen Easier on Smaller Screens

Stock Android added the concept of App Pairs back in Android 15. You choose two apps to use in split screen mode, add a shortcut to the paired apps to the home screen, and it's now trivially easy to trigger split screen multitasking (instead of having to perform multiple tap and drag gestures). It sounds neat, but I never really used it, because on my small Pixel 9a, using apps in 50:50 split-screen mode is hardly user-friendly. There's just not enough room on the screen for each app to take up half of it and still be usable. But that changed with Android 16, thanks to a small update to how split screen works. In Android 16, the split screen ratios for app pairs are much more flexible. You can have two apps in 70:30, or even 90:10. And once you get used to the idea of 90:10 split screen multitasking, things really start to flow. For example, I have an app pair for my Chrome and Gemini apps. Chrome for browsing, and Gemini for research. Credit: Khamosh Pathak Chrome is usually my maximized app, taking up 90% of my screen space, while Gemini is docked at the bottom, minimized. But with one tap, Gemini comes to the front and Chrome takes a back seat. And I can keep switching between the two just as easily. This is much faster than using Android's multitasking menu. How to set up App Pairs with 90:10 split screen multitaskingTo set up an App Pair and try this out for yourself, you'll first need to create a split screen pair. Open the two apps that you want to pair, and then go to the multitasking view (swipe up from the Home bar and hold for a second). Tap the name of the first app you want to open and choose the Split screen option. Then choose another app to pair it with. You'll now enter a 50:50 split screen view. Grab the handle in between the two apps and drag it all the way up or all the way down to trigger the 90:10 split. Alternatively, you can also set up a 70:30 split by leaving some extra space on your second app. Credit: Khamosh Pathak Now, go back to the multitasking view, tap on one of the app names, and choose the Save app pair option. Credit: Khamosh Pathak After that, you'll find the app pair as a shortcut on your home screen. Tap on it to launch your pre-configured app combo. And yes, it does remember your last used split screen ratio, saving you some valuable setup time. View the full article

-

SEO Pulse: UCP Debate, Trends Gets Gemini, Health AIO Concerns via @sejournal, @MattGSouthern

This week’s SEO Pulse highlights the implications of Google handling more of the journey, from discovery to checkout, inside its own ecosystem. The post SEO Pulse: UCP Debate, Trends Gets Gemini, Health AIO Concerns appeared first on Search Engine Journal. View the full article

-

Spotify just announced another price hike. Here’s what’s really driving it

Everything from coffee to a used car is more expensive these days, and now your music streaming service is too. Spotify announced this week that it will raise prices for U.S. subscribers – again. Spotify Premium plans will jump up to $12.99 from $11.99 starting with the next billing date. The streamer last increased prices for U.S. users in 2024 after a decade-plus run of charging $9.99 for ad-free listening on its premium individual streaming plan. The main individual plan isn’t the only Spotify subscription getting a price hike. Discounted student plans are getting bumped up to $6.99 from $5.99, the Duo two-person plan will go to $18.99 from $16.99 and the streamer’s Family plans will hop to $21.99 from $19.99. Users outside the U.S. in Estonia and Latvia will also see prices go up next month. Spotify offered little in the way of explanation for the pricing changes. “Occasional updates to pricing across our markets reflect the value that Spotify delivers, enabling us to continue offering the best possible experience and benefit artists,” the company wrote in a blog post announcing the new pricing scheme. The early 2026 pricing changes are the third time Spotify has raised prices for U.S. listeners since launching in the country in 2011. Two of those price hikes were back to back $1 increases, one in 2023 and one in 2024. In 2024, Spotify explained that the service would “occasionally” update its pricing in order to “continue to invest in and innovate on our product features and bring users the best experience” – language echoed in its short statement on the latest price increase. Why is Spotify raising prices? Spotify isn’t explaining much about the decision to tack another dollar onto its core premium subscription service, but the company is in a very different place now compared to when it was duking it out with Pandora in the dark ages of music streaming more than a decade ago. Now, the Swedish company is the global dominant force in streaming audio, boasting north of 713 million users and 281 million paid subscribers worldwide – up from 252 million in 2024. Apple Music and Amazon Music are the next closest competitors, but Spotify sits pretty with a much bigger share of the market. As a household name at this point – a level of brand recognition boosted even further by its genius flourish of marketing, Spotify Wrapped – Spotify will be increasingly hard-pressed to reach new subscribers in super mature markets like the U.S. Like other public companies, Spotify is beholden to a set of shareholders who want to see line go up – and it’s sort of that simple. The company needs to squeeze more money out of its entrenched, very popular subscription service, all while likely approaching a saturation point in markets like the U.S. Changes afoot for the Swedish streamer Last November, the Financial Times reported that another price jump was on the way for Spotify subscribers in the U.S. “Questions around the timing of the potential US pricing step-ups… have taken a toll on sentiment,” Deutsche Bank analysts observed late last year. Analysts at JPMorgan estimated that another $1 price hike in Spotify’s U.S. market would net the company an additional $500 million in revenue. Another big factor: Spotify’s Founder and CEO Daniel Ek announced last September that he would step down from his role after steering the company through two decades of explosive growth. Entering 2026 without its longtime leader, Spotify wants to signal to investors that stability and sustainability are the name of the game. In Spotify’s November earnings report, Ek emphasized that Spotify’s business is “healthy” and focused on growing its profit and revenue. “It all comes back to user fundamentals and that’s where we are: 700 million users who keep coming back, engagement at all-time highs,” Ek said. “We’re building Spotify for the long-term.” After this week’s price increase, Wall Street will likely agree. But in an age of mounting inflation stress, yet another price hike may not go down easy for Spotify’s already financially exhausted U.S. users. View the full article

-

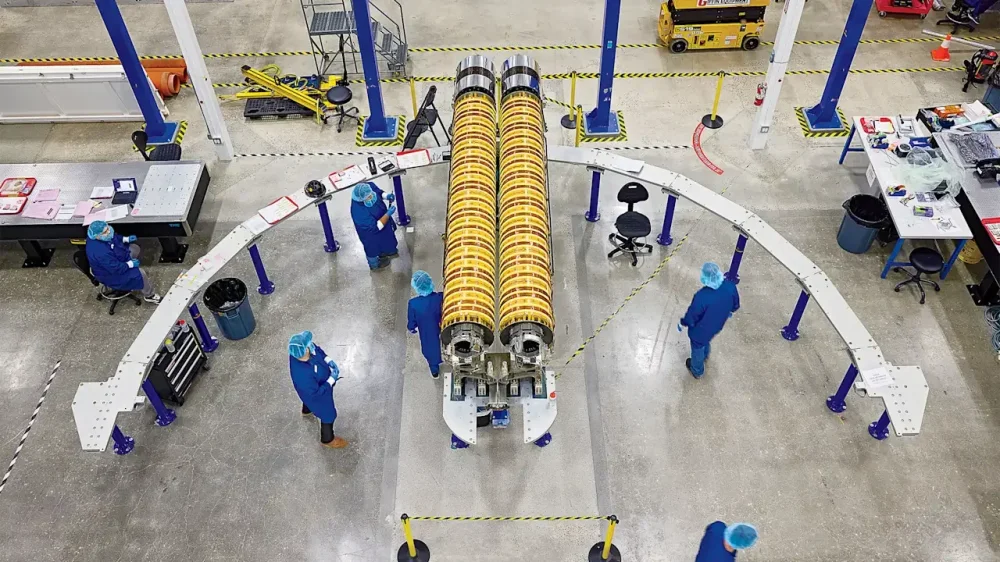

The power that’ll fuel NASA’s Gateway Lunar Space Station

In two years, there could be a space station orbiting the moon. NASA’s Gateway Lunar Space Station, set to launch as early as 2027, will support the Artemis IV and V moon missions and, eventually, be a jumping-off point for missions to Mars. And maybe, one day, a colony. But before any of that can happen, the Gateway will need a power source—a powerful one, at that. The challenge is getting that energy supply into orbit the way anything reaches space: in the nose cone of a rocket. Gateway’s power will come from a pair of blankets of photovoltaic cells, known as Roll-Out Solar Arrays (ROSAs). Each is roughly the size of a football end zone, and together they’ll provide 60 kilowatts for 24 hours a day—enough energy to power roughly 50 American homes. But to minimize their profile on the trip out of Earth’s atmosphere, the arrays will be launched in a rolled-up state, a pair of sci-fi rugs bound for lunar orbit. The Gateway’s ROSAs are built by space company Redwire, using tech initially developed by its subsidiary Deployable Space Solutions. “When the arrays get to the Gateway, they’ll be attached [to the station] and then roll out,” says Mike Gold, a NASA veteran and Redwire’s president of civil and international space business. The unrolling process doesn’t require an electric motor: A flexible boom simply guides the arrays as they unspool. After successfully testing the panels’ roll-out capabilities in July, Redwire is handing them off for prelaunch testing to space tech company Lanteris (formerly Maxar), which is building the Gateway’s power and propulsion element. Though the arrays for the Gateway are the largest and most powerful ROSAs that Redwire has built, the company’s tech is all over space. Six smaller ROSAs have already deployed on the International Space Station, with two more set to be launched and installed in 2026. Smaller versions of Redwire’s arrays will power the new Space Inspire telecom satellites from aerospace company Thales Alenia Space (launching in 2026). Redwire is also working on two ROSA wings for Axiom Space’s planned module for the International Space Station, slated to launch in late 2027. “We like to say we are second only to the sun when it comes to providing power in space,” Gold says. View the full article

-

What People Are Getting Wrong This Week: Is Gravity Ending?