Everything posted by ResidentialBusiness

-

Google may be cracking down on self-promotional ‘best of’ listicles

Google may finally be starting to address a popular SEO and AI visibility “tactic”: self-promotional “best of” listicles. That’s according to new research by Lily Ray, vice president, SEO strategy and research at Amsive. Across several SaaS brands hit hard in January, a pattern emerged. Many relied heavily on review-style content that ranked their own product as the No. 1 “best” in its category, often updated with the current year to trigger recency signals. What’s happening. After the December 2025 core update, Google search results showed increased volatility throughout January, according to Barry Schwartz. Google hasn’t announced or confirmed any updates this year, but the timing aligns with steep visibility losses at several well-known SaaS and B2B brands. According to Ray: In multiple cases, organic visibility dropped 30% to 50% within weeks. The losses were not domain-wide. They were concentrated in blog, guide, and tutorial subfolders. Those sections often contained dozens or hundreds of self-promotional listicles targeting “best” queries. In most cases, the publisher ranked itself first. Many of the articles were lightly refreshed with “2026” in the title, with little evidence of meaningful updates. “Presumably, these drops in Google organic results will also impact visibility across other LLMs that leverage Google’s search results, which extends beyond Google’s ecosystem of AI search products like Gemini and AI Mode [and AI Overviews], but is also likely to include ChatGPT,” Ray wrote. Why we care. Self-promotional listicles have been a shortcut for influencing rankings and AI-generated answers. If Google is now reevaluating how it treats this content, any strategies built around “best” queries are in danger of imploding. The gray area. Ranking yourself as the “best” without independent testing, clear methodology, or third-party validation has been considered (by most) to be a sketchy SEO tactic. It isn’t explicitly banned, but it definitely conflicts with Google’s guidance on reviews and trust. Google has repeatedly said that high-quality reviews should show first-hand experience, originality, and evidence of evaluation. Self-promotional listicles often fall short, especially when bias is not disclosed. Yes, but. Self-promotional listicles likely weren’t the only factor impacting organic visibility. Many affected sites also showed signs of rapid content scaling, automation, aggressive year-based refreshes, and other tactics tied to algorithmic risk. That said, the consistency of self-ranking “best” content among the hardest-hit sites suggests this signal could now carry more weight, especially when used at scale. What to watch. Whether self-promotional listicles earn citations and organic visibility. Google rarely applies changes evenly or instantly. If this volatility reflects updates to Google’s reviews system, the direction is clear. Content designed primarily to influence rankings, rather than to provide credible and independent evaluation, is becoming a liability. For brands chasing visibility in search and AI, the lesson is familiar: SEO shortcuts work until they don’t. The analysis. Is Google Finally Cracking Down on Self-Promotional Listicles? View the full article

-

Reform councillor steps down as head of Kent’s cost-cutting drive

Efficiencies chief had previously told FT no services were cut in apparent contradiction of party’s claim of vast wasteView the full article

-

This Norwegian skier is petitioning the IOC for change with a ‘Ski Fossil Free’ initiative ahead of the 2026 Olympics

Norwegian skier Nikolai Schirmer on Wednesday handed the International Olympic Committee a petition signed by more than 21,000 people and professional athletes who want to stop fossil fuel companies from sponsoring winter sports. Schirmer delivered the “Ski Fossil Free” petition to the IOC’s head of sustainability, Julie Duffus, at a hotel in the Italian city of Milan two days before the Milan Cortina Winter Olympics kick off. The petition asks the IOC and the International Ski and Snowboard Federation, FIS, to publish a report evaluating the appropriateness of fossil fuel marketing before next season. Schirmer, a filmmaker and two-time European Skier of the Year, spoke exclusively with The Associated Press outside the hotel, and said the IOC informed him that it would not allow media to witness their meeting. “It seems like the Olympics aren’t ready to be the positive force for change that they have the potential to be,” Schirmer told the AP afterward. “So I just hope this can be a little nudge in the right direction, but we will see.” Nikolai Schirmer Retreating winters spurred the skier to take action Schirmer is a freeride skier who documents his adventures exploring Europe’s steep terrains. While freeride skiing is not currently an Olympic event, he said he felt like he needed to bring attention to fossil fuel marketing. “The show goes on while the things you depend on to do your job — winter — is disappearing in front of your very eyes,” he said. “Not dealing with the climate crisis and not having skiing be a force for change just felt insane. We’re on the front lines.” Burning fossil fuels – coal, oil and gas – is the largest contributor to global climate change by far. As the Earth warms at a record rate, winters are shorter and milder and there is less snow globally, creating clear challenges for winter sports that depend on cold, snowy conditions. Researchers say the list of locales that could reliably host a Winter Games will shrink substantially in the coming years. Schirmer launched his petition drive in January. He surpassed his goal of 20,000 signatures in one month, and people continue to sign. It’s a first step, he argues, much like a campaign nearly 40 years ago that led to a ban of tobacco advertising at the Games. United Nations Secretary-General António Guterres has urged every country to ban advertising from fossil fuel companies. In his meeting on Wednesday, Schirmer said, the IOC’s head of sustainability pointed to the organization’s commitments to renewable energy. He said he feels that isn’t enough. The IOC told the AP in a statement that climate change is one of the most significant challenges facing sport and society. It didn’t say whether it will review fossil fuel marketing, as demanded by the petition. Olympic partners play an important role in supporting the Games, and they include those investing in clean energy, the statement said. FIS welcomes mobilization campaigns like this one, spokesperson Bruno Sassi said. He noted that He noted that no fossil fuel companies are partners of the FIS World Cup and FIS World Championships. Athletes say the petition is the start of a conversation Athlete-driven environmental group “Protect Our Winters” supported the petition drive. This is the first coordinated campaign about fossil fuel advertising centered around an Olympic Games, POW’s CEO Erin Sprague told the AP. American cross-country skier and Team USA member Gus Schumacher said he signed because it starts the conversation. “It’s short-sighted for teams and events to take money from these companies in exchange for helping them hold status as good, long-term energy producers,” he wrote in a text message. American cross-country skier Jack Berry said he’s hopeful this is an influential step toward a systemic shift away from the industry. Berry is seeking a spot on Team USA for the Paralympics in March. An Italian oil and gas company is sponsoring these Olympics Italy’s Eni, one of the world’s seven supermajor oil companies, is a “premium partner” of these Winter Games. Other oil and gas companies sponsor Olympic teams. Eni said it’s strongly committed to the energy transition, as evidenced by how it’s growing its lower carbon businesses, reducing emissions and aiming for carbon neutrality by 2050. And the company defended its role in the Winter Games. “Through the partnership with the biggest event hosted by Italy in the next 20 years, Eni wants to confirm its commitment to the future of the country and to a progressively more sustainable energy system through a fair transition path,” spokesperson Roberto Albini wrote in an e-mail. A January report found that promoting polluting companies at the Olympics will grow their businesses and lead to more greenhouse gas emissions that warm the planet and melt snow cover and glacier ice. Albini disputed the emissions calculations for Eni in the Olympics Torched report. Published by the New Weather Institute in collaboration with Scientists for Global Responsibility and Champions for Earth, the report also looks at the Games’ own emissions. “They have lots of sponsors that aren’t in these sectors,” said Stuart Parkinson, executive director at Scientists for Global Responsibility. “You can get the sponsorship money you’re after by focusing on those areas, much lower carbon areas. That reduces the carbon footprint.” McDermott reported from Cortina D’Ampezzo, Italy. AP Olympics: https://apnews.com/hub/milan-cortina-2026-winter-olympics The Associated Press’ climate and environmental coverage receives financial support from multiple private foundations. AP is solely responsible for all content. Find AP’s standards for working with philanthropies, a list of supporters and funded coverage areas at AP.org. —Jennifer McDermott and Fernanda Figueroa Associated Press View the full article

-

Chipotle has a 4-part plan to boost flat sales. Part 1 is ‘the most celebrated limited-time offer in history’

Shares of Chipotle Mexican Grill are down over 6% in premarket trading following a relatively humdrum fourth-quarter earnings report. The report, released on Tuesday, February 3, showed a 2.5% decrease in comparable restaurant sales from quarter-three and a 1.7% drop year-over-year. However, it appears Chipotle has a plan to fix all that: more limited-time offerings. Yes, the company’s secret weapon of choice is to bump up its number of fresh menu options. This shift will include four limited-time offers throughout the year, Chipotle CEO Scott Boatwright said in an earnings call. He described the move as an increase in Chipotle’s “menu innovation cadence.” The limited-time offers (or LTOs) will start next week with the return of Chicken al Pastor, which Boatwright called “the most celebrated limited-time offer in history, with two times the requests on social media to bring it back compared to any other LTO.” Boatwright adds that Chipotle’s data shows a “core guest is more likely to choose a restaurant that has a new menu item.” Protein, rewards, and of course AI Chipotle has also recently rolled out its “high-protein line,” with Boatwright nodding to the increased use of weight-loss drugs. It includes a $3.50 taco with 15 grams of protein as an addition to an 80-gram double-protein bowl. There’s also a $3.80 high-protein cup “that is inspired by hacks that our guests rely on to boost their intake and offers a solution to those looking for smaller portions, which is a fast-growing trend with the adoption of GLP-1s,” Boatwright stated. Furthermore, the fast-casual chain is relaunching its rewards program and using AI to create more “personalized and impactful” experiences. Even with these steps, Chipotle predicts its comparable restaurant sales for 2026 will be flat. The company did report some wins for quarter-four. It reached $2.98 billion in revenue, beating Wall Street’s expected $2.96 billion, according to consensus estimates cited by CNBC. What happened to that Chipotle boycott? Quarter-one for 2026 has brought its own uncertainties to the fast-casual chain thanks to misinformation spreading online. Chipotle faced boycott calls in January after Bill Ackman, the billionaire CEO and founder of Pershing Square Capital Management, donated $10,000 to a GoFundMe campaign for Jonathan Ross, the ICE agent who shot and killed Renee Nicole Good as she turned her vehicle away from him. In 2016, Ackman bought a 9.9% stake in Chipotle, valued at about $1 billion, Newsweek reports. At the time, Pershing Square Capital was one of Chipotle’s top shareholders, but the company sold all of its shares as of November 2025. In response to the boycott, Chipotle took to social media to clarify that Ackman is no longer connected to the brand. Chipotle’s stock price (NYSE: CMG) was down more than 33% over 12 months when the market closed on Tuesday. View the full article

-

Your skincare products are full of fats and oils. This startup launched a clean beauty line with ancient chemistry

Your beauty and skincare products are full of fats and oils. They’re what makes that cream so moisturizing or that emollient so good at repairing your skin barrier. Often, those lipids come from palm oil or even animal fats, both of which are environmentally damaging to produce. But soon, the lipids in your personal care products could come from upcycled carbon, skipping the agriculture industry entirely. Savor, a tech company that makes fats and oils directly out of carbon, has already proven this technology through the launch of its butter, which began commercial production in 2025. Now, Savor is announcing a personal care and beauty division, bringing its plant- and animal-free fats beyond food to what it calls a “new era” of clean beauty. How Savor makes fats without plants or animals Savor turns the typical production of fats on its head. The usual formula to create fat starts with energy (from the sun or even grow lights), which grows plants, which can then be turned into oils—or be fed to livestock, which produce milk that becomes butter or fat that goes into skincare, such as beef tallow. Those processes require lots of land and have intense climate consequences. Both livestock farming and palm oil, which is used in a majority of beauty and personal care products, drive deforestation, leading to biodiversity loss, greenhouse gas emissions, and more. Savor, however, skips all those agricultural steps. Instead, the company turns energy—like captured carbon dioxide, methane, or green hydrogen—directly into fats through a thermochemical process. That carbon is combined with hydrogen, oxygen, and heat to create fatty acids, which can then be composed and rearranged into chains that mimic different fats, from butter to palm oil and cocoa butter. “Technically we’re making beautiful ingredients from thin air,” says Jennifer Halliday, an advisor across the biotechnology, beauty, and life sciences industries who is working with Savor. It’s a replica of ancient chemistry. Billions of years ago, hydrothermal vents at the bottom of the ocean created a chemical reaction that formed fatty acids out of hydrogen and carbon dioxide. Opportunities in the beauty industry Savor’s butter has already been adopted by chefs and restaurants, including Michelin-starred SingleThread, in Healdsburg, California, and Jane the Bakery, in San Francisco. It launched commercially in March 2025. Expanding from food to personal care makes sense for Savor, says Kathleen Alexander, cofounder and CEO of the startup, because the two industries overlap in terms of ingredients, environmental impact, and opportunity for change. “Two of the main pillars associated with our platform are sustainability and versatility, or tunability,” she says. “Those wind up being very important in food, and they’re very important in the beauty space as well.” By using its animal- and plant-free lipids, Savor says beauty companies could reduce their products’ emissions by more than 90%, compared to tropical oils like coconut or palm. “Palm and tropical oils wind up showing up a lot in the beauty sector, and those are products that we can really only grow in some of the most rich and biodiverse areas of the world.” Alexander adds. The agricultural industry at large takes up half of the world’s habitable land, and produces 25% to 30% of global greenhouse gas emissions. Savor skirts this entirely; the company says it requires 800 times less land to make its fats and oils than the agricultural industry. Currently, Savor has a 25,000-square-foot pilot facility outside of Chicago, with plans for a large-scale commercial plant by 2029. The startup, founded in 2022, has raised $33 million, according to PitchBook. Its Series A, funded in 2024, was led by food tech VC firm Synthesis Capital and Bill Gates’s Breakthrough Energy. Vegan tallow and more To launch its beauty and personal care division, Savor created three unique products. First, a Vegan Tallow, a colorless and odorless alternative to beef tallow, which has become a recent skin care craze. “We first made that for food customers, and we absolutely still have food customers that are interested in that,” Alexander says. “But the market pull in food for vegan tallow, it turns out, is a little bit lower than the pull we’re seeing in beauty and cosmetics.” Savor also created what it calls Climate Conscious Triglycerides, a palm-free emollient; and Mimetic, made to mimic the skin barrier’s structure to nourish and repair it. Don’t expect to see Savor-branded beauty products on store shelves, though. The startup created these three products to show what is possible, but ultimately, it’s a B2B company that will give its ingredients to brand formulations. Savor says it’s actively engaged with beauty brands, ingredient distributors, and personal care formulators to bring these materials to market, but can’t yet share names. And there’s lots of room for interest to grow, it adds, as brands adapt to regulatory pressure around their supply chains. Traditional feedstocks from plants and animals are also subject to increasing volatility, because of climate change’s effects on crops, geopolitics, traceability concerns, and general price swings. “We’ve actually just had a change in the GHG Protocol Standard to require corporations to start including land use in their accounting, which is just huge,” Alexander says as an example. “That is one of the biggest advantages from an environmental perspective of our platform, that we require less land to make our fats and oils.” Humans have always had an inherently extractive relationship with the planet, she adds. It’s how our food chain works; it’s how we make all sorts of products. “What we’re doing at Savor is rethinking, what if humans could make molecules ourselves?” she says. “What would it mean to really exist on this planet in a way where we can actually not necessarily have to have to make use of other creatures in order to nourish ourselves.” View the full article

-

Information Retrieval Part 2: How To Get Into Model Training Data

Navigate the complexities of information retrieval and find out how to get into model training data for AI success. The post Information Retrieval Part 2: How To Get Into Model Training Data appeared first on Search Engine Journal. View the full article

-

This Feature Lets You Autofill Your Credit Card on Any Site or App on iPhone

A useful feature baked into iOS 26 is the ability to autofill credit cards stored in Apple Wallet across apps and browsers. If you don't use a password manager (which you absolutely should), AutoFill via Apple Wallet saves you the trouble of having to manually enter your credit card information every time you want to make a purchase on your phone. Even if you have a password manager, though, not all plans allow payment card storage and autofilling, and the feature can be clunky on those that do. As 9to5Mac points out, AutoFill for credit cards was already available in Safari and is now supported systemwide, managed through Apple Wallet. How to set up and use AutoFill in Apple WalletFirst, you'll need to add your payment cards to Apple Wallet's autofill list (which is separate from your general wallet). Tap the three dots in the upper-right corner and select AutoFill. Tap Add Card to input card details manually or use the camera scan feature. The security code is optional, meaning you can add and store it in Apple Wallet AutoFill or enter it for each transaction. To autofill saved credit cards, simply tap any form field to bring up the Paste/AutoFill option. Select AutoFill > Credit Card, authenticate with Face ID or Touch ID, and tap the card you want to enter. You'll have to repeat the process for each field, as Apple Wallet won't autofill the whole form at once. View the full article

-

What higher ed data shows about SEO visibility and AI search

AI search hasn’t killed SEO. Now you have to win twice: the ranking and the citation. Google searches for almost anything today, and there’s a good chance you’ll see an AI Overview before the organic results, sometimes even before the ads. That summary frames the query, shortlists sources, and shapes which brands get considered. AI Overviews now appear for about 21% of all keywords, according to Ahrefs. And 99.9% are triggered by informational intent. Search rankings still matter. But AI summaries increasingly determine who wins early consideration. Here’s what we’re seeing: brands aren’t losing visibility because they dropped from position three to seven. They’re losing it because they were never cited in the AI answer at all. This article draws on research conducted by Search Influence and the online and professional education association UPCEA, which examined how people use AI-assisted search and how organizations are adapting. (Disclosure: I am the CEO at Search Influence) Key takeaways AI citations are becoming a trust signal: Being cited by AI influences credibility and early consideration – before users ever compare sources directly. AI visibility is cumulative: AI systems pull from your website, YouTube, LinkedIn, and third-party publishers to assemble answers. Your URL isn’t the only thing that matters. Authority doesn’t guarantee inclusion: Even established brands get sidelined when their content doesn’t match how users ask questions. Most organizations know AI search matters but lack a plan: The gap isn’t awareness – it’s ownership, prioritization, and repeatable process. Content structure affects whether you get cited: Pages built for retrieval, comparison, and decision-making outperform narrative or brand-led content. Examining both sides of the search equation To understand what’s happening, we need to look at two sides of the same equation – how people are searching today and how organizations are responding (or aren’t). “AI Search in Higher Education: How Prospects Search in 2025” surveyed 760 prospective adult learners in March 2025. It examined: Where online discovery happens. How AI tools are used alongside traditional search. Which sources people trust during early research. While the study focused on professional and continuing education, these behaviors mirror what we’re seeing across industries: more AI-assisted discovery, earlier opinion formation, and trust signals shifting. A separate snap poll of 30 UPCEA member institutions in October 2025 looked at the other side: AI search strategy adoption. Barriers slowing progress. How visibility in AI-generated results gets tracked. Together, these datasets show a widening gap between how people search and how organizations have adapted. So what does the data actually tell us? The search patterns worth paying attention to The research highlights several search behaviors that consistently influence how people discover and evaluate options today. AI tools and AI summaries are influencing trust early The data makes one thing clear: AI-driven search has moved from the margins into the mainstream. 50% of prospective students use AI tools at least weekly. 79% read Google’s AI Overviews when they appear. 1 in 3 trust AI tools as a source for program research. 56% are more likely to trust a brand cited by AI. Trust is forming earlier now, often before users compare sources directly. If you’ve been putting off your AI search strategy because “people don’t trust AI,” the data says otherwise. AI citations are becoming a credibility signal – a trust shortcut before deeper research begins. Search behavior is diversified Search doesn’t happen in one place or follow one clean path anymore. 84% of prospective students use traditional search engines during research. 61% use YouTube. 50% use AI tools. These behaviors aren’t sequential. Users move between surfaces, carrying context with them. What they see in an AI summary influences how they read a search result. A YouTube video can establish trust before a website ever earns a click. This is where many strategies fall out of sync. Teams optimize one channel at a time – usually their website – and treat everything else as optional. But AI search engines pull from everywhere your brand has a presence: Your website. Your YouTube channel. Your LinkedIn content. Third-party and publisher sites. Your AI credibility is cumulative. It’s built anywhere your brand shows up, not just where you own the URL. Search engines and brand-owned websites still matter The rise of AI search doesn’t mean the end of traditional search. It raises the bar for it. Even as AI summaries reshape early trust, people still rely heavily on first-party sources and organic results when they evaluate options: 63% rely on brand-owned websites during research. 77% trust university-owned websites more than other sources. 82% are more likely to consider options that appear on the first page of search results. AI engines prioritize content that search engines can already crawl, interpret, and trust. If your core content isn’t clearly structured, accessible, and eligible to rank in traditional search, it’s far less likely to be pulled into AI-generated answers. Dig deeper: Your website still matters in the age of AI Get the newsletter search marketers rely on. See terms. Organizational readiness lags behind Most organizations recognize that AI search is reshaping discovery. Far fewer have translated that awareness into coordinated action. AI search strategy adoption remains uneven Most institutions sit somewhere between curiosity and commitment: 60% are in the early stages of exploring AI search. 30% have a formal AI search strategy in place. 10% haven’t started or believe AI search will have limited impact. The majority of teams know something important is happening. But ownership, process, and prioritization remain unresolved. What’s slowing progress When asked what’s holding them back, institutions cited execution constraints: 70% report limited bandwidth or competing priorities. 37% report a lack of in-house expertise or training. 27% report unclear ROI, leadership buy-in, or uncertainty around how AI search works. For many organizations, AI search has entered the roadmap conversation. It just hasn’t earned consistent operational focus yet. (Sound familiar?) Dig deeper: Why most SEO failures are organizational, not technical What teams say they’re prioritizing When teams do take action, their priorities cluster around two themes: 59% focus on the accuracy of AI-generated information about their offerings. 48% focus on improving visibility and competitive positioning. Those goals are linked. Clear, structured information makes it easier for AI systems to represent a brand. Visibility follows clarity. When that clarity is missing, AI fills in the blanks using third-party sources and competitor content. Tracking AI visibility remains inconsistent AI visibility tracking varies widely: 57% know their institution appears in AI-generated answers. 27% have seen their brand referenced occasionally but don’t actively monitor it. 13% are unsure whether they appear in AI-generated responses at all. Among teams that do track AI visibility: 64% use dedicated tools or formal tracking methods. 29% rely on informal checks or don’t track consistently. This creates a familiar blind spot. Teams feel the impact of AI search anecdotally but lack consistent visibility into where, how, and why their brand appears. Dig deeper: How to track visibility across AI platforms Why higher ed is a useful lens Universities bring everything search engines are supposed to reward: High domain authority. Deep, long-standing content libraries. Strong brand recognition. Yet in AI-generated answers, those advantages often don’t translate. When AI systems generate answers, they cite content that already matches the way users ask questions. That often means: Comparisons. “Top tools,” “top programs,” or “top options” lists. Third-party explainers written about brands. Those formats are dominated by aggregators and publishers – not the institutions themselves. AI doesn’t look for the biggest brand. It looks for the best answer. Higher education shows what happens when brands rely on authority alone and why every industry needs to rethink how it publishes. So what do you do about it? 1. Get your foundations in order before chasing AI visibility The most common question right now: “How do we show up in AI results?” In many cases, I think the honest answer is to fix what’s already broken. AI systems rely on the same signals that traditional search does: crawlability, structure, clarity. If your pages are blocked, poorly organized, or weighed down by technical debt, they won’t surface cleanly anywhere. We’ve seen teams invest energy in AI conversations while core pages still struggle with: Indexing issues. Bloated or unclear page structures. Content written for storytelling, not retrieval. Start with your traditional SEO foundation. AI systems can only work with what’s structurally sound. Dig deeper: AI search is growing, but SEO fundamentals still drive most traffic 2. Optimize content for retrieval, not just reading AI search engines favor content that can be lifted cleanly and reused without interpretation. The job of content shifts from “telling a complete story” to “delivering clear, extractable answers.” Many brand pages technically contain the right information, but it’s buried in long-form prose or brand language that requires context to understand. Content that performs well in AI answers tends to: Lead with direct answers, not setup. Use headings that map to search intent. Separate ideas into self-contained sections. Avoid forcing readers (or machines) to infer meaning. This isn’t about shortening content. It’s about sharpening it. When intent is obvious, AI knows exactly what to pull and when to cite you. 3. Compete on format, not just authority If AI keeps citing comparisons, lists, and explainers – and it does – brands probably need to own those formats themselves. AI systems pull from content that already reflects how people evaluate options. When those pages don’t exist on your site, AI cites the aggregators and publishers instead. To compete, brands need to publish: Comparison pages that reflect real decision criteria. “Best for X” content tied to specific use cases. Standalone explainers that help buyers choose. Put simply: publish what AI actually wants to cite. Dig deeper: How to create answer-first content that AI models actually cite 4. Prioritize third-party platforms Your website shouldn’t be doing all the work. AI answers routinely pull from a mix of sources: YouTube videos. LinkedIn posts. Instagram content. Reddit threads (when relevant). Brand content published on third-party platforms. In some cases, being cited from a third-party platform matters more than where your site ranks. We’ve seen AI Overviews where a brand’s YouTube video is cited alongside their webpage and third-party sources – all shaping the same answer. That blended source set is becoming the norm. If your content strategy only prioritizes on-site publishing, you’re narrowing your chances of earning AI visibility. Dig deeper: YouTube is no longer optional for SEO in the age of AI Overviews Where things stand AI search is moving faster than most SEO strategies are built to respond. Discovery is happening earlier. Trust is being assigned sooner. Visibility is being decided before rankings ever come into play. The question isn’t whether AI search will matter to your industry. It’s whether you’ll be cited, overlooked, or summarized by someone else. The brands that adapt now – not later – will be the ones that win. View the full article

-

Super Bowl 2026 advertisers are paying record-breaking prices to feature these brands and celebrities

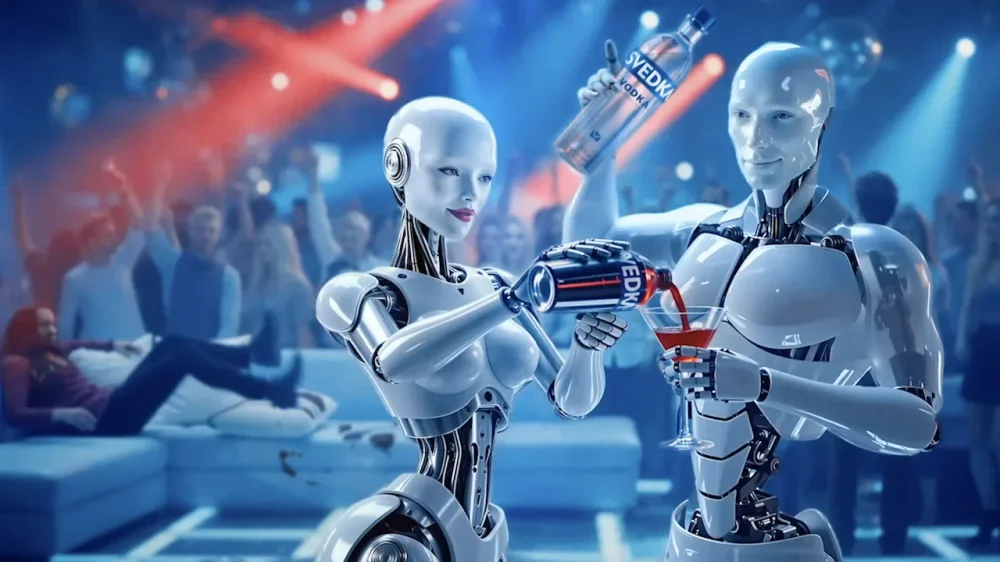

As Super Bowl Sunday approaches, the battle off the field for advertisers to win over 120 million-plus viewers will be just as heated as the rivalry between the New England Patriots and Seattle Seahawks. Dozens of advertisers are pulling out all the stops for Super Bowl 60, airing Sunday on NBC. They’re hoping that audiences tuning in will remember their brand names as they stuff their ads with celebrities ranging from Kendall Jenner (Fanatics Sportsbook) to George Clooney (Grubhub), tried-and-true ad icons like the Budweiser Clydesdales, and nostalgia for well-known movie properties such as “Jurassic Park” (Comcast Xfinity). Each year Super Bowl ads offer a snapshot of the American mood — as well as which industries are flush with cash that particular year: from the “Dot-Com Bowl” of 2000 to the “Crypto Bowl” of 2022. This year’s trends include health and telehealth companies advertising weight loss drugs and medical tests, tech companies showing off their latest gadgets and apps and advertisers showcasing AI in their ads. Villanova University marketing professor Charles Taylor said because of the heavy headlines in the news lately — from the immigration enforcement surge in Minnesota to conflicts abroad — he expects a advertisers to stick to a light and silly tone. “Because of the Super Bowl’s status as a pop culture event with a fun party atmosphere, the vast majority of brands will avoid any dark or divisive tone and instead allow consumers to escape from thinking about these troubled times,” he said. Record-breaking prices Advertisers flock to the Super Bowl each year because so many people watch the big game. In 2025, a record 127.7 million U.S. viewers watched the game across television and streaming platforms. Demand is higher than ever, since live sporting events are one of the few remaining places in the fractured media landscape where advertisers can reach a large audience. NBC sold out of ad space in September. Space sold for an average of $8 million per 30-second unit, but a handful of spots sold for $10 million-plus, a record, said Peter Lazarus, executive vice president, sports & Olympics, advertising and partnerships for NBCUniversal. He said he was calling February, with the Super Bowl, Olympics and the NBA All-Star Game, “legendary February.” Lazarus said 40% of advertisers bought across all of NBC’s major sports properties, and 70% of Super Bowl advertisers bought the Olympics as well. Celebrities galore Featuring celebrities is a tried-and-true way advertisers can get goodwill from viewers. This year, Fanatics Sportsbook enlists Kendall Jenner to talk about the “Kardashian Kurse,” in which bad things happen to basketball players she dates. George Clooney appears in a Grubhub add to promote a deal that the delivery app offers to “Eat the Fees” on orders of $50 or more. Several ads feature more than one celebrity or sports star. Michelob Ultra shows Kurt Russell training actor Lewis Pullman, as Olympic snowboarder Chloe Kim and hockey player T.J. Oshie watch on a ski slope. Xfinity reunites Sam Neill, Laura Dern and Jeff Goldblum in a tongue-and-cheek reimagining of “Jurassic Park” that shows an Xfinity tech bringing power back to the island so nothing goes awry. And Uber Eats enlists Matthew McConaughey for the second year in a row to convince celebrities — this year it is Bradley Cooper and Parker Posey — that football is a conspiracy to make people hungry so they order food. AI takes the stage For the second year in a row, AI is making waves in Super Bowl ads. Oakley Meta touts their AI-enabled glasses in two action-packed spots showing Spike Lee, Marshawn Lynch and others using the glasses to film video and answer questions. Wix Harmony debuted an ad that features its web design software that uses AI tools. Wix is also airing an add for Base44, an AI app builder. And OpenAI will advertise during the game with a yet-to-be revealed ad. Svedka Vodka enlisted Silverside AI, an AI studio, to help create their ad, which features their robot mascot FemBot along with a male counterpart, BroBot. They took that approach because of Svedka’s positioning as the “vodka of the future,” said Sara Saunders, chief marketing officer at Sazerac, which bought the Svedka brand in 2025. “We reimagined the robot via AI,” Saunders said. “It took us many, many months to rebuild her, to give her functionality, to give her that human spirit that we wanted to show up on behalf of the brand.” Health and telehealth Health and telehealth providers are everywhere during Super Bowl 60. Two pharma companies are advertising tests: Novartis touts a blood test to screen for prostate cancer with the tagline “Relax your tight end,” featuring football tight ends relaxing. Boehringer Ingelheim’s ad stars Octavia Spencer and Sofia Vergara, who encourage people to screen for kidney disease. Liquid I.V., which makes an electrolyte drink mix, has teased an ad about staying hydrated. Telehealth firm Ro is using Serena Williams in their ad for GLP-1 weigh loss drugs. Novo Nordisk, which makes Wegovy and Ozempic, has teased that it will have a spot as well. Hims & Hers — another company that offers GLP-1 weight loss drugs — has an ad that says the company gives people better access to health care that usually only rich people get. “You could call this the GLP-1 Super Bowl,” said Tim Calkins, a clinical professor of marketing at Northwestern University. “Often you don’t see a lot from pharmaceutical companies on the Super Bowl, but this year we’re going to see quite a few showing up.” Tried-and-true themes Some advertisers are sticking to the tried and true. Budweiser’s heartwarming ad shows a Clydesdale foal growing up with a bald eagle to the tune of Lynyrd Skynyrd’s “Free Bird.” The ad celebrates Budweiser’s 150th anniversary. And Pepsi tries to reignite the Cola wars with their ad showing polar bears — Coca-Cola’s famous mascots — picking Pepsi Zero Sugar over Coke Zero in a blind taste test. The ad ends with the bears being caught on a “kiss cam.” Surprises While the majority of Super Bowl advertisers release their ad early to try to capitalize on buzz, some hold back until game day to reveal their ad. Pepsi-owned soft drink Poppi teased that pop star Charli XCX and actress Rachel Sennott will star in their ad. Ben Affleck is back in an ad for Dunkin’ Donuts. A teaser spot showed him with ’90s sitcom legends Jennifer Aniston and Matt LeBlanc of “Friends” and Jason Alexander from “Seinfeld.” And there are fewer car advertisers this year, but Cadillac is hinting that it will show off its new Formula 1 car in an ad. —Mae Anderson, AP Business Writer View the full article

-

Chinese trading firm Zhongcai nets $500mn from silver rout

Well-timed short bets make group led by Bian Ximing a big winner after recent precious metals sell-offView the full article

-

5 Must-Have Store Coupons for Big Savings

If you’re looking to save money during shopping, knowing the right store coupons can make a significant difference. Coupons from stores like Target, Walmart, and CVS can reduce your expenses effectively. Each offers unique benefits, from cash rewards to price matching. By strategically combining these coupons, you can maximize your savings during sales. Comprehending how these programs work will improve your shopping experience, ensuring you get the best deals possible. Let’s explore how each of these can benefit you. Key Takeaways Urban Decay Coupons: Get discounts on popular beauty products like eyeshadow palettes and lip products, starting at just $7.65 on Amazon. The North Face Discounts: Save up to 40% on jackets and 30% on backpacks, perfect for outdoor apparel enthusiasts during Black Friday. Atari Console Offer: Grab the Atari 7800+ for $49.99, featuring a classic game library, ideal for retro gaming fans and collectors. Winn-Dixie Digital Coupons: Use user-friendly digital coupons for immediate discounts at checkout, and earn points through their Rewards program. Store Loyalty Programs: Sign up for loyalty programs to access exclusive coupons and maximize savings during seasonal sales and promotions. Top Black Friday Urban Decay Deals on Amazon: Prices Start at Just $7.65 As you prepare for Black Friday shopping, you’ll find that Urban Decay offers an enticing range of makeup products on Amazon, with prices starting at just $7.65. This sale includes popular items like eyeshadow palettes and lip products, which are perfect for both personal use and gifting. The limited-time discounts encourage you to make quick purchases, ensuring you don’t miss out on these great deals. Urban Decay’s diverse product range caters to various beauty needs, making it easy to stock up on necessities or explore new items. To maximize your savings, consider using printable coupons available online, which can further reduce your total. These exclusive Black Friday deals from a well-known brand provide a fantastic opportunity to invest in high-quality makeup without breaking the bank. With these options at your fingertips, you’re well-equipped to take advantage of this year’s Black Friday event. The North Face Black Friday Deals on Amazon With the holiday season approaching, it’s an excellent opportunity to explore the Black Friday deals from The North Face on Amazon. You can find impressive discounts on a variety of outdoor apparel, making it the perfect time to stock up on winter gear. Whether you’re looking for jackets, backpacks, or accessories, there’s something for everyone. Item Type Discounted Price Coupon Availability Jackets Up to 40% off Available for coupons printing Backpacks Up to 30% off Available for coupons printing Accessories Up to 25% off Available for coupons printing These deals cater to both men and women, ensuring you can find quality gear for your outdoor adventures. Limited-time offers during Black Friday encourage quick purchases, so don’t miss the chance to save considerably during holiday shopping for friends and family. Official Atari 7800+ Console and Controller, Now $49.99 on Amazon If you’re looking to immerse yourself in retro gaming, the Official Atari 7800+ Console and Controller, priced at $49.99 on Amazon, is a great place to start. This console comes pre-loaded with a classic game library, giving you instant access to nostalgic gaming experiences. You’ll find that the package includes a controller, allowing you to engage in gameplay right out of the box without needing any additional purchases. The Atari 7800+ appeals not just to collectors but also to gamers who appreciate a blend of vintage charm and modern convenience. With the growing interest in retro gaming culture, this console serves as the perfect gift option for gamers. Plus, don’t forget to check for home store coupons that may apply to your purchase, enhancing your savings even further. Enjoy the thrill of retro gaming as you keep your budget in check with this fantastic deal on Amazon. Save With Winn-Dixie Digital Coupons After enjoying some retro gaming with the Atari 7800+, you might be looking for ways to save on your next grocery run. Winn-Dixie offers a fantastic way to cut costs with their digital coupons. You can easily activate these coupons online, ensuring immediate discounts at checkout. By signing in to your account, you’ll find a user-friendly interface to manage your savings. Here’s how to make the most of Winn-Dixie digital coupons: Clip and view all your coupons in the app. Check featured offers for active discounts. Earn points through the Winn-Dixie Rewards program. Receive notifications for expired or redeemed coupons. Access exclusive “just for you” offers customized to your shopping habits. Utilizing these digital coupons can streamline your shopping experience, making savings more accessible. Just log in, clip your coupons, and enjoy the benefits during your next visit! Additional Tips for Maximizing Your Savings To maximize your savings during shopping, it’s essential to adopt a strategic approach that combines various methods. Start by signing up for store loyalty programs to access exclusive in store coupons and promotions. Digital coupon apps like Coupon24 can simplify your experience, allowing you to browse and redeem without printing. Keep an eye on limited-time offers and seasonal sales, especially during major events like Black Friday, for substantial discounts. Combining manufacturer coupons with store-specific promotions can lead to impressive savings. Regularly check for online and in-store promotions at your favorite retailers, as they frequently update their offers. Strategy Benefits Join loyalty programs Access exclusive coupons Use digital coupon apps Streamlined shopping experience Watch for seasonal sales Higher discounts on popular items Combine coupons Maximize savings potential Check for updates Stay informed about new offers Frequently Asked Questions Is Extreme Couponing Illegal Now? Extreme couponing isn’t illegal, but it can breach store policies if you misuse coupons, like using expired ones. Retailers often set limits on how many coupons you can use per transaction, which you need to follow. Some states have laws regulating coupon use, but no federal laws particularly target extreme couponing. Although it’s legal, you should be mindful of how you conduct your couponing to avoid negative perceptions from cashiers and other shoppers. What’s the Best Store to Coupon At? When considering the best store to coupon at, it depends on your shopping needs. Walmart offers a variety of digital and printable coupons, ideal for grocery and household items. CVS has a strong rewards program, enhancing savings with ExtraBucks. Kroger allows coupon stacking with sales, maximizing your grocery budget. Target’s Cartwheel program combines discounts with manufacturer coupons, whereas Publix features “BOGO” deals, perfect for frequent purchases. Evaluate these options based on your preferences. What Is the GIMME10 Code? The GIMME10 code is a promotional coupon that provides a $10 discount on your purchase, but certain conditions must be met. Typically, it applies to orders exceeding a specified minimum amount. To use it, you’ll need to enter the code at checkout on participating retail websites or apps. Keep in mind that the code may have an expiration date, so make sure to use it within the allowed timeframe to benefit from the savings. What Is the Trick to Extreme Couponing? The trick to extreme couponing lies in preparation and organization. You should start by collecting various coupon types and using apps to track them efficiently. Planning your shopping trips around weekly sales can greatly improve your savings. Keep a close eye on expiration dates and store policies to maximize your coupons’ effectiveness. Building rapport with store employees can likewise provide insights into additional savings opportunities, making your couponing experience smoother and more rewarding. Conclusion In summary, leveraging these five must-have store coupons can greatly improve your shopping experience and savings. By utilizing Target’s Cartwheel, Walmart’s Savings Catcher, Kohl’s Cash, CVS ExtraBucks, and Ulta Beauty’s loyalty program, you’re well-equipped to maximize discounts. Furthermore, consider exploring specific Black Friday deals and digital coupons for further savings opportunities. By combining these strategies, you can effectively reduce your overall spending, ensuring that you get the most value during your shopping endeavors. Image via Google Gemini This article, "5 Must-Have Store Coupons for Big Savings" was first published on Small Business Trends View the full article

-

5 Must-Have Store Coupons for Big Savings

If you’re looking to save money during shopping, knowing the right store coupons can make a significant difference. Coupons from stores like Target, Walmart, and CVS can reduce your expenses effectively. Each offers unique benefits, from cash rewards to price matching. By strategically combining these coupons, you can maximize your savings during sales. Comprehending how these programs work will improve your shopping experience, ensuring you get the best deals possible. Let’s explore how each of these can benefit you. Key Takeaways Urban Decay Coupons: Get discounts on popular beauty products like eyeshadow palettes and lip products, starting at just $7.65 on Amazon. The North Face Discounts: Save up to 40% on jackets and 30% on backpacks, perfect for outdoor apparel enthusiasts during Black Friday. Atari Console Offer: Grab the Atari 7800+ for $49.99, featuring a classic game library, ideal for retro gaming fans and collectors. Winn-Dixie Digital Coupons: Use user-friendly digital coupons for immediate discounts at checkout, and earn points through their Rewards program. Store Loyalty Programs: Sign up for loyalty programs to access exclusive coupons and maximize savings during seasonal sales and promotions. Top Black Friday Urban Decay Deals on Amazon: Prices Start at Just $7.65 As you prepare for Black Friday shopping, you’ll find that Urban Decay offers an enticing range of makeup products on Amazon, with prices starting at just $7.65. This sale includes popular items like eyeshadow palettes and lip products, which are perfect for both personal use and gifting. The limited-time discounts encourage you to make quick purchases, ensuring you don’t miss out on these great deals. Urban Decay’s diverse product range caters to various beauty needs, making it easy to stock up on necessities or explore new items. To maximize your savings, consider using printable coupons available online, which can further reduce your total. These exclusive Black Friday deals from a well-known brand provide a fantastic opportunity to invest in high-quality makeup without breaking the bank. With these options at your fingertips, you’re well-equipped to take advantage of this year’s Black Friday event. The North Face Black Friday Deals on Amazon With the holiday season approaching, it’s an excellent opportunity to explore the Black Friday deals from The North Face on Amazon. You can find impressive discounts on a variety of outdoor apparel, making it the perfect time to stock up on winter gear. Whether you’re looking for jackets, backpacks, or accessories, there’s something for everyone. Item Type Discounted Price Coupon Availability Jackets Up to 40% off Available for coupons printing Backpacks Up to 30% off Available for coupons printing Accessories Up to 25% off Available for coupons printing These deals cater to both men and women, ensuring you can find quality gear for your outdoor adventures. Limited-time offers during Black Friday encourage quick purchases, so don’t miss the chance to save considerably during holiday shopping for friends and family. Official Atari 7800+ Console and Controller, Now $49.99 on Amazon If you’re looking to immerse yourself in retro gaming, the Official Atari 7800+ Console and Controller, priced at $49.99 on Amazon, is a great place to start. This console comes pre-loaded with a classic game library, giving you instant access to nostalgic gaming experiences. You’ll find that the package includes a controller, allowing you to engage in gameplay right out of the box without needing any additional purchases. The Atari 7800+ appeals not just to collectors but also to gamers who appreciate a blend of vintage charm and modern convenience. With the growing interest in retro gaming culture, this console serves as the perfect gift option for gamers. Plus, don’t forget to check for home store coupons that may apply to your purchase, enhancing your savings even further. Enjoy the thrill of retro gaming as you keep your budget in check with this fantastic deal on Amazon. Save With Winn-Dixie Digital Coupons After enjoying some retro gaming with the Atari 7800+, you might be looking for ways to save on your next grocery run. Winn-Dixie offers a fantastic way to cut costs with their digital coupons. You can easily activate these coupons online, ensuring immediate discounts at checkout. By signing in to your account, you’ll find a user-friendly interface to manage your savings. Here’s how to make the most of Winn-Dixie digital coupons: Clip and view all your coupons in the app. Check featured offers for active discounts. Earn points through the Winn-Dixie Rewards program. Receive notifications for expired or redeemed coupons. Access exclusive “just for you” offers customized to your shopping habits. Utilizing these digital coupons can streamline your shopping experience, making savings more accessible. Just log in, clip your coupons, and enjoy the benefits during your next visit! Additional Tips for Maximizing Your Savings To maximize your savings during shopping, it’s essential to adopt a strategic approach that combines various methods. Start by signing up for store loyalty programs to access exclusive in store coupons and promotions. Digital coupon apps like Coupon24 can simplify your experience, allowing you to browse and redeem without printing. Keep an eye on limited-time offers and seasonal sales, especially during major events like Black Friday, for substantial discounts. Combining manufacturer coupons with store-specific promotions can lead to impressive savings. Regularly check for online and in-store promotions at your favorite retailers, as they frequently update their offers. Strategy Benefits Join loyalty programs Access exclusive coupons Use digital coupon apps Streamlined shopping experience Watch for seasonal sales Higher discounts on popular items Combine coupons Maximize savings potential Check for updates Stay informed about new offers Frequently Asked Questions Is Extreme Couponing Illegal Now? Extreme couponing isn’t illegal, but it can breach store policies if you misuse coupons, like using expired ones. Retailers often set limits on how many coupons you can use per transaction, which you need to follow. Some states have laws regulating coupon use, but no federal laws particularly target extreme couponing. Although it’s legal, you should be mindful of how you conduct your couponing to avoid negative perceptions from cashiers and other shoppers. What’s the Best Store to Coupon At? When considering the best store to coupon at, it depends on your shopping needs. Walmart offers a variety of digital and printable coupons, ideal for grocery and household items. CVS has a strong rewards program, enhancing savings with ExtraBucks. Kroger allows coupon stacking with sales, maximizing your grocery budget. Target’s Cartwheel program combines discounts with manufacturer coupons, whereas Publix features “BOGO” deals, perfect for frequent purchases. Evaluate these options based on your preferences. What Is the GIMME10 Code? The GIMME10 code is a promotional coupon that provides a $10 discount on your purchase, but certain conditions must be met. Typically, it applies to orders exceeding a specified minimum amount. To use it, you’ll need to enter the code at checkout on participating retail websites or apps. Keep in mind that the code may have an expiration date, so make sure to use it within the allowed timeframe to benefit from the savings. What Is the Trick to Extreme Couponing? The trick to extreme couponing lies in preparation and organization. You should start by collecting various coupon types and using apps to track them efficiently. Planning your shopping trips around weekly sales can greatly improve your savings. Keep a close eye on expiration dates and store policies to maximize your coupons’ effectiveness. Building rapport with store employees can likewise provide insights into additional savings opportunities, making your couponing experience smoother and more rewarding. Conclusion In summary, leveraging these five must-have store coupons can greatly improve your shopping experience and savings. By utilizing Target’s Cartwheel, Walmart’s Savings Catcher, Kohl’s Cash, CVS ExtraBucks, and Ulta Beauty’s loyalty program, you’re well-equipped to maximize discounts. Furthermore, consider exploring specific Black Friday deals and digital coupons for further savings opportunities. By combining these strategies, you can effectively reduce your overall spending, ensuring that you get the most value during your shopping endeavors. Image via Google Gemini This article, "5 Must-Have Store Coupons for Big Savings" was first published on Small Business Trends View the full article

-

Google lists Googlebot file limits for crawling

Google has updated two of its help documents to explain the limits of Googlebot when it crawls. Specifically, how much Googlebot can consume by filetype and format. The limits. The limits, some of which were documented already and are not new, include: 15MB for web pages: Google wrote, “By default, Google’s crawlers and fetchers only crawl the first 15MB of a file.” 64MB for PDF files: Google wrote, “When crawling for Google Search, Googlebot crawls the first 2MB of a supported file type, and the first 64MB of a PDF file.” 2MB for supported files types: Google wrote, “When crawling for Google Search, Googlebot crawls the first 2MB of a supported file type, and the first 64MB of a PDF file.” Note, these limits are pretty large and the vast majority of websites do not need to be concerned with these limits. Full text. Here is what Google posted fully in its help documents: “By default, Google’s crawlers and fetchers only crawl the first 15MB of a file. Any content beyond this limit is ignored. Individual projects may set different limits for their crawlers and fetchers, and also for different file types. For example, a Google crawler may set a larger file size limit for a PDF than for HTML.” “When crawling for Google Search, Googlebot crawls the first 2MB of a supported file type, and the first 64MB of a PDF file. From a rendering perspective, each resource referenced in the HTML (such as CSS and JavaScript) is fetched separately, and each resource fetch is bound by the same file size limit that applies to other files (except PDF files). Once the cutoff limit is reached, Googlebot stops the fetch and only sends the already downloaded part of the file for indexing consideration. The file size limit is applied on the uncompressed data. Other Google crawlers, for example Googlebot Video and Googlebot Image, may have different limits.” Why we care. It is important to know of these limits but again, most sites will likely never even come close to these limits. That being said these are the document limits of Googlebot’s crawling. View the full article

-

The PPC Skills That Won’t Be Replaced By Automation

Top PPC specialists create outsized impact by combining paid media expertise with business strategy, profit modeling, and cross-channel insight. The post The PPC Skills That Won’t Be Replaced By Automation appeared first on Search Engine Journal. View the full article

-

Britain can’t ignore Europe and China at the same time

Tory criticism of Sir Keir Starmer’s foreign policy shows the party is unseriousView the full article

-

Why Google’s Performance Max advice often fails new advertisers

One of the biggest reasons new advertisers end up in underperforming Performance Max campaigns is simple: they followed Google’s advice. Google Ads reps are often well-meaning and, in many cases, genuinely helpful at a surface level. But it’s critical for advertisers – especially new ones – to understand who those reps work for, how they’re incentivized, and what their recommendations are actually optimized for. Before defaulting to Google’s newest recommendation, it’s worth taking a step back to understand why the “shiny new toy” isn’t always the right move – and how advertisers can better advocate for strategies that serve their business, not just the platform. Google reps are not strategic consultants Google Ads reps play a specific role, and that role is frequently misunderstood. They do not: Manage your account long term. Know your margins, cash flow, or true break-even ROAS. Understand your internal goals, inventory constraints, or seasonality. Get penalized when your ads lose money. Their responsibility is not to build a sustainable acquisition strategy for your business. Instead, their primary objectives are to: Increase platform and feature adoption. Drive spend into newer campaign types. Push automation, broad targeting, and machine learning. That distinction matters. Performance Max is Google’s flagship campaign type. It uses more inventory, more placements, and more automation across the entire Google ecosystem. From Google’s perspective, it’s efficient, scalable, and profitable. From a new advertiser’s perspective, however, it’s often premature and misaligned with early-stage needs. Dig deeper: Dealing with Google Ads frustrations: Poor support, suspensions, rising costs Performance Max benefits Google before it benefits you Performance Max often benefits Google before it benefits the advertiser. Because it automatically spends across Search, Shopping, Display, YouTube, Discover, and Gmail, Google is given near-total discretion over where your budget is allocated. In exchange, advertisers receive limited visibility into what’s actually driving results. For Google, this model is ideal. It monetizes more surfaces, accelerates adoption of automated bidding and targeting, and increases overall ad spend across the board. For advertisers – particularly those with new or low-data accounts – the reality looks different. New accounts often end up paying for upper-funnel impressions before meaningful conversion data is available. Budgets are diluted across lower-intent placements, CPCs can spike unpredictably, and when performance declines, there’s very little insight into what to fix or optimize. You’re often left guessing whether the issue is creative, targeting, bidding, tracking, or placement. This misalignment is exactly why Google reps so often recommend Performance Max even when an account lacks the data foundation required for it to succeed. ‘Best practice’ doesn’t mean best strategy for your business What Google defines as “best practice” does not automatically translate into the best strategy for your business. Google reps operate from generalized, platform-wide guidance rather than a custom account strategy. Their recommendations are typically driven by aggregated averages, internal adoption goals, and the products Google is actively promoting next – not by the unique realities of your business. They are not built around your specific business model, your customer acquisition cost tolerance, your testing and learning roadmap, or your need for early clarity and control. As a result, strategies that may work well at scale for mature, data-rich accounts often fail to deliver the same results for new or growing advertisers. What’s optimal for Google at scale isn’t always optimal for an advertiser who is still validating demand, pricing, and profitability. Dig deeper: Google Ads best practices: The good, the bad and the balancing act Smart advertisers earn automation – they don’t start with it Smart advertisers understand that automation is something you earn, not something you start with. Even today, Google Shopping Ads remain one of the most effective tools for new ad accounts because they are controlled, intent-driven, and rooted in real purchase behavior. Shopping campaigns rely far less on historical conversion volume and far more on product feed relevance, pricing, and search intent. That makes them uniquely well-suited for advertisers who are still learning what works, what converts, and what deserves more budget. To understand how this difference plays out in practice, consider what happened to a small chocolatier that came to me after implementing Performance Max based on guidance from their dedicated Google Ads rep. Get the newsletter search marketers rely on. See terms. A real-world example: When Performance Max goes wrong The challenge was straightforward: The retailer’s Google Ads account was new, and Performance Max was positioned as the golden ticket to quickly building nationwide demand. The result was disastrous. Over $3,000 was spent with a return of just one purchase. Traffic to the website and YouTube channel remained low despite the spend. CPCs climbed as high as $50 per click. ROAS was effectively nonexistent. To make matters worse, conversion tracking had not been set up correctly, causing Google to report inflated and inaccurate sales numbers that didn’t align with Shopify at all. Understandably, the retailer lost confidence – not just in Performance Max, but in paid advertising as a whole. Before walking away entirely, they reached out to me. Recognizing that this was a new account with no reliable data, I immediately reverse-engineered the setup into a standard Google Shopping campaign. We properly connected Google Ads and Google Merchant Center to Shopify to ensure clean, accurate tracking. From there, the campaign was segmented by product groups, allowing for intentional bidding and clearer performance signals. Within two weeks, real sales started coming through. By the end of the month, the brand had acquired 56 new customers at a $53 cost per lead, with an average order value ranging from $115 to $200. More importantly, the account now had clean data, clear winners, and a foundation that could actually support automation in the future. Dig deeper: The truth about Google Ads recommendations (and auto-apply) Why Shopping ads still work – and still matter By starting with Shopping campaigns, advertisers can validate products, pricing, and conversion tracking while building clean, reliable data at the product and SKU level. This early-stage performance proves demand, highlights top-performing items, and trains Google’s algorithm with meaningful purchase behavior. Shopping Ads also offer a higher level of control and transparency than Performance Max. Advertisers can segment by product category, brand, margin, or performance tier, apply negative keywords, and intentionally allocate budget to what’s actually profitable. When something underperforms, it’s clear why – and when something works, it’s easy to scale. This level of insight is invaluable early on, when every dollar spent should be contributing to learning, not just impressions. The case for a hybrid approach Standard Shopping consistently outperforms Performance Max for accounts that require granular control over product groups and bidding – especially when margins vary significantly across SKUs and precise budget allocation matters. It allows advertisers to double down on proven winners with exact targeting, intentional bids, and full visibility into performance. That said, once a Shopping campaign has been running long enough to establish clear performance patterns, a hybrid approach can be extremely effective. Performance Max can play a complementary role for discovery, particularly for advertisers managing broad product catalogs or limited optimization bandwidth. Used selectively, it can help test new products, reach new audiences, and expand beyond existing demand – without sacrificing the stability of core revenue drivers. While Performance Max reduces transparency and control, pairing it with Standard Shopping for established performers creates a balanced strategy that prioritizes profitability while still allowing room for scalable growth. Dig deeper: 7 ways to segment Performance Max and Shopping campaigns Control first, scale second Google reps are trained to recommend what benefits the platform first, not what’s safest or most efficient for a new advertiser learning their market. While Performance Max can be powerful, it only works well when it’s fueled by strong, reliable data – something most new accounts simply don’t have yet. Advertisers who prioritize predictable performance, cleaner insights, and sustainable growth are better served by starting with Google Shopping Ads, where intent is high, control is stronger, and optimization is transparent. By using Shopping campaigns to validate products, understand true acquisition costs, and build confidence in what actually converts, businesses create a solid foundation for automation. From there, Performance Max can be layered in deliberately and profitably – used as a tool to scale proven success rather than a shortcut that drains budget. That approach isn’t anti-Google. It’s disciplined, strategic advertising designed to protect spend and drive long-term results. View the full article

-

Google Search Ranking Volatility Heats Up Big Time Starting On February 2nd

I was hoping, well, not really, that Google would calm down a bit since we had such a volatile January. But the Google Search results volatility is still very volatile, and the shuffling in those results is still shaking up. View the full article

-

Microsoft Publisher Content Marketplace - Pay For AI To License Content

Microsoft announced the expansion of the Microsoft Publisher Content Marketplace. This marketplace is designed to give publishers a new revenue stream, provides AI systems with scaled access to premium content, and deliver better responses for consumers. In short, it will pay for using your content in its AI.View the full article

-

Bahama Breeze is closing all locations, but Olive Garden parent will convert some restaurants. See the full list

Olive Garden parent company Darden Restaurants has announced that it will shut down its Bahama Breeze restaurant chain for good. But in an unusual move, some current Bahama Breeze locations will live on as a different brand, while the remaining stores will close. Here’s what you need to know. What’s happened? On Tuesday, Darden Restaurants revealed the fate of one of its restaurant chains. The restaurant group, which is based in Orlando, Florida, owns LongHorn Steakhouse, Olive Garden, and Ruth’s Chris Steak House, and others. In a news release, it announced the closure and conversion of all of its Bahama Breeze restaurants. That Darden is jettisoning Bahama Breeze is no surprise. Last May, the company closed 15 Bahama Breeze locations and, in June, it announced that the brand’s 28 remaining locations were no longer “a strategic priority” for the company. At the time, CEO Ricardo Cadenas said the company would be “considering strategic alternatives for Bahama Breeze, including a potential sale of the brand or converting restaurants to other Darden brands.” Jump forward to yesterday, and Darden did indeed confirm the final fate of Bahama Breeze. A buyer for Bahama Breeze never materialized, so instead, the company has revealed that it will simply shut down the brand. Yet not all 28 locations are actually closing. Instead, half will shutter their doors for good, while the other half will continue running until they can be converted into locations of other restaurant chains Darden owns. These Bahama Breeze locations will close The following 14 Bahama Breeze locations will be closing for good. According to Darden, the closures should be completed by April 5, 2026. Those permanently closing locations include stores in 9 states: Delaware 500 Center Blvd., Newark, DE Georgia 3590 Breckenridge Blvd., Duluth, GA Florida 12395 SW 88th St., Miami, FL 10205 Rivercoast Drive, Jacksonville, FL 1251 West Osceola Pkwy., Kissimmee, FL 11000 Pines Blvd., Pembroke Pines, FL 1540 Rinehart Road, Sanford, FL Michigan 19600 Haggerty Road, Livonia, MI New Jersey 2000 Route 38, Cherry Hill, NJ North Carolina 3309 Wake Forest Drive, Raleigh, NC Pennsylvania 320 Goddard Blvd., King of Prussia, PA 6100 Robinson Center Drive, Pittsburgh, PA Virginia 2714 Potomac Mills Circle, Woodbridge, VA Washington 15700 Southcenter Pkwy., Tukwila, WA These Bahama Breeze locations will be converted As for the remaining 14 Bahama Breeze locations, they will be converted into other Darden-owned restaurants. Darden did not disclose which brands the stores will transition into. “The company believes the conversion locations are great sites that will benefit several of the brands in its portfolio,” Darden said in a statement. The 14 transitioning Bahama Breeze locations are expected to continue operating until their temporary closures are needed for the conversion. Those converting locations include stores in five states: Florida 499 E Altamonte Drive, Altamonte Springs, FL 805 Brandon Town Center Drive, Brandon, FL 14701 S Tamiami Trail, Ft. Myers, FL 8160 Irlo Bronson Memorial Hwy., Kissimmee, FL 25830 Sierra Center Blvd., Lutz, FL 5620 W. Oak Ridge Road, Orlando, FL 8849 International Drive, Orlando, FL 8735 Vineland Ave., Orlando, FL 1200 N Alafaya Drive, Orlando, FL 3045 N Rocky Point Drive East, Tampa, FL Georgia 755 Earnest W Barrett Pkwy NW, Kennesaw, GA North Carolina 570 Cross Creek Mall, Fayetteville, NC South Carolina 7811 Rivers Ave., Charleston, SC Virginia 4554 Virginia Beach Blvd., Virginia Beach, VA How is Darden Restaurants stock reacting? It seems investors have taken the news of Bahama Breeze’s demise in stride, most likely because Darden had previously announced that it was seeking to divest itself of the chain. Yesterday, shares of Darden Restaurants Inc. (NYSE: DRI) closed up about 2.2% to $205.49. As of this writing, in premarket trading, DRI shares are down slightly by about 0.4%. So far this year, the company’s stock price has risen more than 11%. That is nearly triple the return of the broader New York Stock Exchange during the same period. However, shares are currently down from their all-time high of around $228 in June of last year. Darden’s brands, like many restaurant chains, are facing tough times as inflationary pressures increase costs and make diners more choosy about where they spend their discretionary dollars. Darden is far from the only company closing restaurants in 2026. In January alone, FAT Brands disclosed that it would close a number of restaurants (including some Smokey Bones, Johnny Rockets, and Yalla Mediterranean locations) as it seeks Chapter 11 bankruptcy protection. Meanwhile, Noodles & Company said it would close between 30 and 35 locations, and Salad and Go announced it would close more than 32 locations. View the full article

-

Google Hit Self-Promotional Listicles In Recent Unconfirmed Updates?

Google may have hit those self-promotional and self-serving listicle articles in one of the more recent unconfirmed Google search ranking updates. Lily Ray dug into a pattern she spotted with these types of pieces of content, mostly in the SaaS space, being hit hard with the January Google updates.View the full article

-

Google On Serving Markdown Pages To LLM Crawlers

Google's John Mueller responded to a question on the pros and cons of serving raw markdown pages to LLM crawlers and bots. John didn't say much but he did list a number of concerns and things you should be on top of, if you do go down that avenue. View the full article

-

Google Ad Network Invalid Clicks Report: Fraud vs Accidental

Mike Ryan posted data on the percentage of invalid clicks on the Google Ad Network, broken down by fraudulent clicks or likely accidental clicks. It shows the Google Display Network has the most invalid clicks, but search partners have the most fraudulent invalid clicks.View the full article

-

Padma Lakshmi on what America has lost—and what it must rebuild