Everything posted by ResidentialBusiness

-

In California, Gavin Newsom championed this innovative healthcare—now, under pressure from Trump, he wants to cut it

One of the great ironies of Gov. Gavin Newsom’s on-again, off-again push to make health care available to all Californians is that, to hear him tell it, it worked too well. That success—an unexpectedly high number of Californians who signed up to see a doctor under Newsom’s expansions of Medi-Cal—is now cited as one of the reasons Newsom wants to back away from the program he loudly championed—a cornerstone of his election and re-election campaigns. The proposed move to roll back Medi-Cal access, announced Wednesday as part of the governor’s revised 2025-26 state budget, will have profound repercussions for many of the estimated 1.6 million undocumented immigrants who use the safety net program. It left the director of one California immigrant rights group “outraged,” as he put it. Newsom’s explanation for the cuts is prosaic: The state is facing an additional $12 billion budget deficit, bringing the total to $39 billion, and the money has to come from somewhere. Modifying a program that benefits undocumented people is probably also politically expedient, although you won’t find Newsom acknowledging that. And there is the ongoing pressure from Washington, D.C., for states to quit providing health care to their undocumented populations. What it actually means for California is harder to gauge. The governor’s office says the proposed Medi-Cal changes will save $5.4 billion by fiscal year 2028-29. But budget figures can’t predict what happens when people who work and live in California get sick and can’t afford to receive care, nor how hospitals will handle a likely surge in emergency room visits by patients who put off health issues until they become severe—patients whom the hospitals by law cannot refuse, even if they have no ability to pay. * * * Newsom’s proposal will freeze Medi-Cal enrollment for undocumented adults (age 19 and older) beginning next year. It also would charge $100 a month to those already in the program, even though by definition Medi-Cal—the state’s version of Medicaid—is designed for those whose earnings are so close to the poverty level that any medical expense is likely to be too much. Given the state’s financial picture, some have argued that the Medi-Cal cuts could’ve been worse. Newsom’s office was quick to point out that no one’s coverage is being cut off, and there’s truth in that. But the key word in the conversation is “undocumented.” Under Newsom, the state dramatically expanded health coverage for undocumented residents, a program first begun under Gov. Jerry Brown to cover those under age 19. Newsom has used a series of moves to extend that Medi-Cal coverage to Californians of all ages regardless of their immigration status, and he has touted it as a fulfillment of his campaign promise of universal health care. In truth, Newsom originally campaigned for office as a strong advocate of single payer health care, a very different program. Under single payer, a lone (usually government-run) entity provides for and finances health care for all residents. That position won Newsom the support of powerful nurses’ unions and helped him get elected. But once in office, the governor, whose heavy political contributors have also included Blue Shield and the California Medical Association, quietly backed away from the issue. Newsom chose instead to try for a mix of public and private insurance—including the Medi-Cal expansion—so that almost all the state’s residents have some form of coverage, even if, as critics have consistently pointed out, the insurance is often too expensive for many Californians to actually use. The effect of the Medi-Cal expansions regardless of immigration status has been significant, and it shouldn’t be dismissed. It isn’t a perfect system; more than half a million undocumented Californians still earn too much to qualify for Medi-Cal yet don’t have employer-based coverage, rendering them effectively uninsured, according to research by the University of California, Berkeley, Labor Center. But by bringing so many of the state’s residents under the Medi-Cal umbrella, the program has offered care to people who live and work in the state. Undocumented workers paid $8.5 billion in state and local taxes in 2022, according to the Institute on Taxation and Economic Policy, and they’re the source of more than half a trillion dollars of products in California, either by direct, indirect, or induced production levels. Although no one can factor that output into a state budget, keeping these people and their families healthy and productive makes straight common sense. But that’s only if you factor out the politics. * * * Running in the background of this discussion is the obvious: Donald The President’s administration and the GOP-led Congress are threatening to penalize states that provide health care to undocumented immigrants. California could lose as much as $27 billion in federal funds between 2028 and 2034, according to the Center on Budget and Policy Priorities. And without question, the Medi-Cal expansion has cost more than expected. The Department of Health Care Services estimated that the state is paying $2.7 billion more than budgeted on Medi-Cal for undocumented immigrants, driven by “higher than anticipated enrollment and increased pharmacy costs.” (There has also been a significant uptick in overall Medi-Cal sign-ups, especially among older adults.) In other words, the expansion worked. California residents, including those who are undocumented, signed up for Medi-Cal. And now that the budget crunch is real, it’s immigrants whose coverage is deemed the most expendable. “We are outraged by the governor’s proposal to cut critical programs like Medi-Cal,” said Masih Fouladi, executive director of the California Immigrant Policy Center. “At a time when The President and House Republicans are pushing to slash health care access and safety net programs while extending tax cuts for the wealthy, California must lead by protecting, not weakening, support for vulnerable communities.” Wednesday was a step back in that regard. It certainly won’t be the last word. And what does not change is the most profound truth: The need for California’s immigrants to have access to basic health care didn’t go away. It’ll be there again tomorrow. This piece was originally published by Capital & Main, which reports from California on economic, political, and social issues. View the full article

-

What is VUCA? How to manage in an increasingly unstable world

The headlines scream it daily: Markets are fluctuating wildly, AI is transforming entire industries overnight, supply chains are fracturing, and the workforce is reshuffling at unprecedented rates. According to the World Economic Forum, 78 million new job opportunities will emerge by 2030, but this comes amid massive workforce transformation, with 77% of employers planning upskilling initiatives while 41% anticipate reductions due to AI automation. All these moving parts are playing out against a global background of financial insecurity, war, climate change, and political disruption. The age of anxiety Welcome to the age of VUCA—volatility, uncertainty, complexity, and ambiguity—a concept adopted by the military to describe post-Cold War conditions but now perfectly capturing our business landscape. And here’s the brutal truth. We’re facing this unprecedented VUCA while collectively and perfectly depleted from the trauma of the past five years. A recent American Psychiatric Association survey reveals that 43% of U.S. adults feel more anxious than they did the previous year, with 70% particularly anxious about current events. Research from meQ also finds that depression and anxiety rates are more than four times higher for people who feel least prepared for change. This isn’t another challenging period to weather. Chaotic change isn’t a bug in the code we can just rewrite. It’s a fundamental feature of our era, requiring a complete reinvention of our relationship with change itself. Why the U in VUCA Hurts So Much Right Now In a word, trauma. The pandemic threw us into societal trauma at a level few of us had ever known. Unlike normal adversity, where mental health improves once the challenge passes, the pandemic created persistent mental health issues that have worsened even after the acute phases passed. When it comes to mental health, trauma has a long tail. The pandemic delivered a perfect storm of traumatic conditions: Chronic and unrelenting. Rather than a sharp, short crisis, it dragged on with no clear endpoint. Pervasive impact. It transformed every aspect of life simultaneously—work, relationships, health, finances. Global with no escape. You couldn’t get on a plane to avoid it. Beyond our control. Individual actions had minimal impact on the overall trajectory. Shifting goalposts. Vaccines were promised, then delayed; variants emerged; reopenings were followed by new lockdowns. Aversion to Uncertainty This roller coaster of false hope and disappointment forced us to experience unrelenting uncertainty, and even in good times, our brains hate uncertainty. In a 2016 University College London study, people experienced more stress and anxiety when facing a 50/50 chance of receiving an electric shock than when facing a 98% certainty of receiving that same shock. Uncertainty was more unbearable than guaranteed pain. This preference made evolutionary sense when stability increased the chance of survival. In today’s business environment, it’s a dangerous liability. The fight-flight-freeze responses that helped our ancestors survive short periods of uncertainty now paralyze us in boardrooms, strategy sessions, and daily decision-making. We are not yet equipped to handle the ongoing uncertainty of today’s nonstop change. The New Approach to Change I often describe our current relationship to change as abusive. Another disruption shakes us off course, and we think “this time will be different,” but it never is. The resulting uncertainty plagues us as much as before, because we haven’t changed our approach. Transforming our ingrained fear of uncertainty requires a process that rewrites our own relationship with change. We are then empowered to lead our teams and organizations through this era of VUCA without end. Step 1: Reject our old-fashioned beliefs about uncertainty and change We all have deep-seated beliefs about how the world should work. I call these Iceberg Beliefs because they’re enormous and largely lie beneath the surface of our awareness. They often define how we react to change. Classic beliefs about change and uncertainty might sound like: ● “If I keep my head down and work hard, certainty should be my reward.” ● “Uncertainty is unbearable and unfair.” ● “The more control I get, the better my life will be.” ● “Steady as she goes wins the race.” ● “Change is frightening. It should be resisted or ignored.” We have to discard these beliefs. For one, they’re not accurate. While hard work helps achieve our goals, it brings no guarantee of certainty or constancy. Second, they frame VUCA in a way that’s not useful. VUCA is happening to us all, and “fair” has nothing to do with it. These beliefs push us to waste our time and energy fighting for an illusion of certainty that will never come. We must reject these naive Icebergs and replace them with beliefs that reflect reality and point to a path ahead. Step 2: Reinvent and reimagine our beliefs about uncertainty and change Reinventing our relationship with change means rejecting old and tired thinking and constructing new belief systems. We can ease into this by first endorsing beliefs that get us more comfortable with change. ● “Not all uncertainty ends badly. There have been college applications, new jobs, and reorgs that turned out well.” ● “I’ve been through change before, and most of the terrible stuff I worried about at 3 a.m. every night didn’t actually happen.” ● “I am powerless to change change, but I alone have the power to change my relationship with it.” Next, we can finally turn the tables on this abusive relationship by edging toward embracing change. We’ll get there with beliefs like “there is no growth without change” and “every change brings opportunity.” We can also recognize that some of life’s most exhilarating moments—falling in love, becoming a parent, getting a promotion, starting a new venture—involve profound uncertainty and change. Part of this work must include recalibrating our sense of what is under our control and mapping our sphere of control daily. Trauma distorts our sense of what we can and cannot influence. For example, during the pandemic, I found myself obsessively worrying about my elderly parents’ health in Australia—something I had limited control over—while neglecting my children’s online education happening right in front of me. I was systematically failing to control what I could because I was exhausted trying to control what I couldn’t. Step 3: Lead your people through change With the threat of uncertainty neutralized and our beliefs about change and control starting to shift, we turn attention outward. How can we react to disruption more productively? And how can we successfully lead the people who count on us through VUCA? Practice a growth mindset These habits of mind help us see opportunities and stay focused through chaotic disruption. As leaders, we shift our teams’ response to change when we approach challenges with principles such as: ● Abandoning perfectionism. ● Accepting inevitable mistakes. ● Reframing mistakes as progress to value. ● Encouraging creativity without judgment. We can also educate our managers in this new approach to change, and help them learn to coach their teams to do the same. When this training happens at scale, our entire workforce is much more equipped to navigate and accelerate through organizational changes. Adjust work to the demands of VUCA We can’t lead like “business as usual” when VUCA rules. However, with our greater resilience in the face of change, we can skillfully shift workplace expectations and norms to reduce VUCA’s impact, thereby protecting growth and well-being as changes unfold. ● Reduce Volatile Processes. Slow processes down when possible. External forces put a ceiling on how much volatility you can control, but even small reductions help. The greatest athletes visualize the game in slow motion, while they respond in real time. Deal with one thing at a time rather than everything simultaneously. ● Reduce Uncertain Outcomes. While you can’t eliminate uncertainty, take actions today that narrow the field of possible outcomes. That’s why we try to exercise and eat healthfully. While never a guarantee that we’ll dodge illness, it renders that uncertainty small enough to set aside for now. ● Reduce Complex Problems. Break problems into smaller pieces. Think of untangling yarn—start with one strand, simplify it, then move to the next. Organizations like NASA excel at this approach, breaking seemingly impossible challenges into manageable components. ● Reduce Ambiguous Information with Clarity. The U in VUCA is future-directed, while the A—ambiguity—is happening now. During change, people will fill information gaps with their Icebergs and fears. In my research, organizations that fare better during VUCA have transparency of process and open information. It’s widely held in military circles that in a battle, communication is often the first thing to fail. By the time an organization is in VUCA, it’s too late to develop lines of communication. Work now, preemptively, to build strategies to keep your people informed. The payoff is clear. Research at meQ shows that most change-ready, resilient, and supported employees are significantly VUCA-proofed, with rates of depression, anxiety, and burnout slashed by around 75% when compared with their less change-ready peers. Taking the Power Back from Change The ultimate reality? Periods of stability will become increasingly rare. The concept that we just need to get through this “liminal time” before returning to normal is outdated. It’s the brief periods of stability that are now liminal—unusual spaces between the predominant times of change, turmoil, and flux. Those who can adapt internally rather than demanding external stability will be best positioned to thrive. The pursuit of stability is a fool’s errand, and what we’re chasing is fool’s gold. The only thing at stake is this: Our entire mental health, wellness, happiness, productivity, and performance. It’s time to take back the power in our relationship with change. View the full article

-

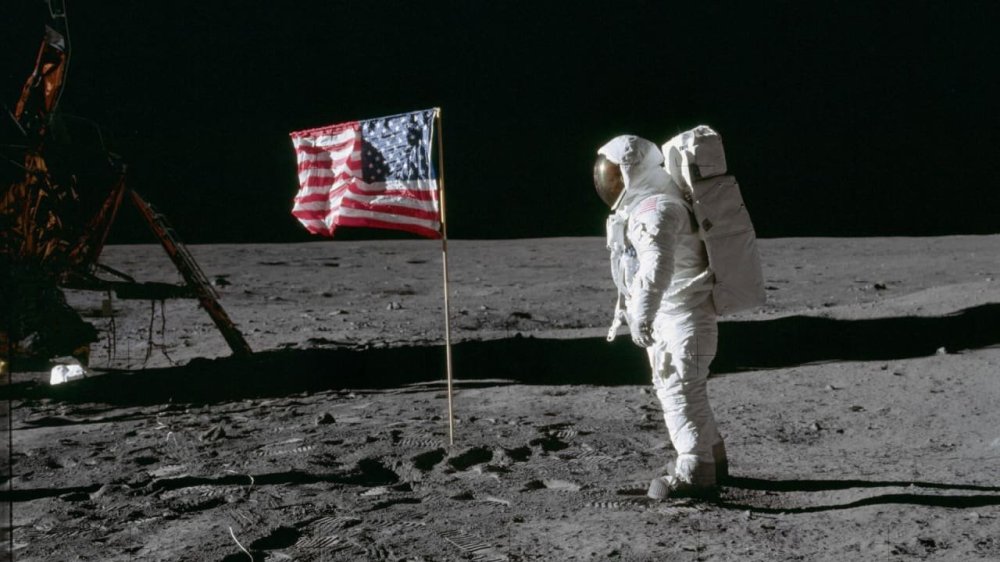

The Wilderness Letter is a reminder that nature shaped America’s identity

As summer approaches, millions of Americans begin planning or taking trips to state and national parks, seeking to explore the wide range of outdoor recreational opportunities across the nation. A lot of them will head toward the nation’s wilderness areas—110 million acres, mostly in the West, that are protected by the strictest federal conservation rules. When Congress passed the Wilderness Act in 1964, it described wilderness areas as places that evoked mystery and wonder, “where the earth and its community of life are untrammeled by man, where man himself is a visitor who does not remain.” These are wild landscapes that present nature in its rawest form. The law requires the federal government to protect these areas “for the permanent good of the whole people.” Wilderness areas are found in national parks, conservation land overseen by the U.S. Bureau of Land Management, national forests and U.S. Fish and Wildlife refuges. In early May 2025, the U.S. House of Representatives began to consider allowing the sale of federal lands in six counties in Nevada and Utah, five of which contain wilderness areas. Ostensibly, these sales are to promote affordable housing, but the reality is that the proposal, introduced by U.S. Rep. Mark Amodei, a Nevada Republican, is a departure from the standard process of federal land exchanges that accommodate development in some places but protect wilderness in others. Regardless of whether Americans visit their public lands or know when they have crossed a wilderness boundary, as environmental historians we believe that everyone still benefits from the existence and protection of these precious places. This belief is an idea eloquently articulated and popularized 65 years ago by the noted Western writer Wallace Stegner. His eloquence helped launch the modern environmental movement and gave power to the idea that the nation’s public lands are a fundamental part of the United States’ national identity and a cornerstone of American freedom. Humble origins In 1958, Congress established the Outdoor Recreation Resources Review Commission to examine outdoor recreation in the U.S. in order to determine not only what Americans wanted from the outdoors, but to consider how those needs and desires might change decades into the future. One of the commission’s members was David E. Pesonen, who worked at the Wildland Research Center at the University of California at Berkeley. He was asked to examine wilderness and its relationship to outdoor recreation. Pesonen later became a notable environmental lawyer and leader of the Sierra Club. But at the time, Pesonen had no idea what to say about wilderness. However, he knew someone who did. Pesonen had been impressed by the wild landscapes of the American West in Stegner’s 1954 history “Beyond the Hundredth Meridian: John Wesley Powell and the Second Opening of the West.” So he wrote to Stegner, who at the time was at Stanford University, asking for help in articulating the wilderness idea. Stegner’s response, which he said later was written in a single afternoon, was an off-the-cuff riff on why he cared about preserving wildlands. This letter became known as the Wilderness Letter and marked a turning point in American political and conservation history. Pesonen shared the letter with the rest of the commission, which also shared it with newly installed Secretary of the Interior Stewart Udall. Udall found its prose to be so profound, he read it at the seventh Wilderness Conference in 1961 in San Francisco, a speech broadcast by KCBS, the local FM radio station. The Sierra Club published the letter in the record of the conference’s proceedings later that year. But it was not until its publication in The Washington Post on June 17, 1962, that the letter reached a national audience and captured the imagination of generations of Americans. Wallace StegnerPageMaryMultimedia Archives, Special Collections, J. Willard Marriott Library, University of Utah An eloquent appeal In the letter, Stegner connected the idea of wilderness to a fundamental part of American identity. He called wilderness “something that has helped form our character and that has certainly shaped our history as a people . . . the challenge against which our character as a people was formed . . . (and) the thing that has helped to make an American different from and, until we forget it in the roar of our industrial cities, more fortunate than other men.” Without wild places, he argued, the U.S. would be just like every other overindustrialized place in the world. In the letter, Stegner expressed little concern with how wilderness might support outdoor recreation on public lands. He didn’t care whether wilderness areas had once featured roads, trails, homesteads or even natural resource extraction. What he cared about was Americans’ freedom to protect and enjoy these places. Stegner recognized that the freedom to protect, to restrain ourselves from consuming, was just as important as the freedom to consume. Perhaps most importantly, he wrote, wilderness was “an intangible and spiritual resource,” a place that gave the nation “our hope and our excitement,” landscapes that were “good for our spiritual health even if we never once in ten years set foot in it.” Without it, Stegner lamented, “never again will Americans be free in their own country from the noise, the exhausts, the stinks of human and automotive waste.” To him, the nation’s natural cathedrals and the vaulted ceiling of the pure blue sky are Americans’ sacred spaces as much as the structures in which they worship on the weekends. Stegner penned the letter during a national debate about the value of preserving wild places in the face of future development. “Something will have gone out of us as a people,” he wrote, “if we ever let the remaining wilderness be destroyed.” If not protected, Stegner believed these wildlands that had helped shape American identity would fall to what he viewed as the same exploitative forces of unrestrained capitalism that had industrialized the nation for the past century. Every generation since has an obligation to protect these wild places. Stegner’s Wilderness Letter became a rallying cry to pass the Wilderness Act. The closing sentences of the letter are Stegner’s best: “We simply need that wild country available to us, even if we never do more than drive to its edge and look in. For it can be a means of reassuring ourselves of our sanity as creatures, a part of the geography of hope.” This phrase, “the geography of hope,” is Stegner’s most famous line. It has become shorthand for what wilderness means: the wildlands that defined American character on the Western frontier, the wild spaces that Americans have had the freedom to protect, and the natural places that give Americans hope for the future of this planet. National Park Service/E. Letterman America’s ‘best idea’ Stegner returned to themes outlined in the Wilderness Letter again two decades later in his essay “The Best Idea We Ever Had: An Overview,” published in Wilderness magazine in spring 1983. Writing in response to the Reagan administration’s efforts to reduce protection of the National Park System, Stegner declared that the parks were “Absolutely American, absolutely democratic.” He said they reflect us as a nation, at our best rather than our worst, and without them, millions of Americans’ lives, his included, would have been poorer. Public lands are more than just wilderness or national parks. They are places for work and play. They provide natural resources, wildlife habitat, clean air, clean water and recreational opportunities to small towns and sprawling metro areas alike. They are, as Stegner said, cures for cynicism and places of shared hope. Stegner’s words still resonate as Americans head for their public lands and enjoy the beauty of the wild places protected by wilderness legislation this summer. With visitor numbers increasing annually and agency budgets at historic lows, we believe it is useful to remember how precious these places are for all Americans. And we agree with Stegner that wilderness, public lands writ large, are more valuable to Americans’ collective identity and expression of freedom than they are as real estate that can be sold or commodities that can be extracted. Leisl Carr Childers is an associate professor of history at Colorado State University. Michael Childers is an associate professor of history at Colorado State University. This article is republished from The Conversation under a Creative Commons license. Read the original article. View the full article

-

What is a ‘snowplow manager?’ How to deal with this type of toxic boss

Does your manager hate to delegate tasks? It might sound like a good thing—after all, that means less work for you. But, just like having a micromanaging boss is no fun, having a manager who takes on much of your work can create a work environment that is both stifling and unproductive. We asked three experts about what causes some bosses to act this way and how to encourage your supervisor to step aside and allow you to do your job. What is a ‘snowplow manager’? A “snowplow manager” is a supervisor who takes on excessive work themselves rather than delegating to their team, says Frank Weishaupt, CEO of videoconferencing tech company Owl Labs. His team recently came up with the term, says Weishaupt, after noticing this trend in management, which “resembles snowplow parenting, where a parent removes as many challenges from their child’s life as possible.” Signs that your manager is snowplowing can include micromanagement, not letting you lead projects or calls, excluding you from meetings with senior leadership, and stepping in to do work they had previously assigned to you, says Jennifer Dulski, CEO and founder of software company Rising Team. Another telltale sign your boss is snowplowing is that they rarely delegate meaningful tasks to you. “Instead, they hand off smaller, administrative work to your team while they handle bigger, more significant projects themselves,” says Weishaupt. Rather than empower workers with self-reliance, snowplow managers often request constant updates and check-ins, showing their lack of trust in their team. He says they will use phrases like “I’ll just handle this,” or “It’s faster if I do it.” Why some managers act this way According to Owl Labs’s 2024 State of Hybrid Work Report, the trend of “snowplow managers” likely stems from managers’ worries about their own job requirements and expectations. “The study revealed that managers’ stress levels are 55% higher than non-managers,” says Weishaupt. Respondents said they were concerned about their teams’ productivity and employee engagement—particularly among workers who are hybrid or entirely remote. Good managers help remove obstacles for their teams, but removing any and all adversity reports may encounter will hinder their team’s development and success. “When managers hog the work, they strip away learning moments,” says Annie Rosencrans, people and culture director at HiBob. ”You lose the chance to problem-solve, build resilience, and grow your skills. The short-term relief isn’t worth the long-term setback to your career.” So, what’s causing managers to behave this way? For some, their own reputation is a top priority. “Some may be concerned that poor results will reflect badly on them, especially in high-pressure situations where the manager’s supervisor expects a lot from them,” says Weishaupt. Other managers may not trust their team to complete tasks to their standards. And, finally, they may believe that it’s just easier to complete a task themselves. “Efficiency can also be a misleading motivator as some managers convince themselves it’s faster to handle a task themselves than explain how it should be done,” says Weishaupt. The impact of potential layoffs Fear of downsizing can play a role in driving snowplow managers, experts say. “As layoffs increasingly become a looming threat, managers can feel intense pressure to demonstrate results to protect both their team and their own position,” says Weishaupt. “At organizations that emphasize short-term results over long-term team development, snowplow management can become a survival strategy to hold on to your position.” Those in middle management may be experiencing particular worries. “Many recent rounds of layoffs at large companies like Amazon have specifically targeted middle managers, so people at that level may rightfully be worried about their jobs,” says Dulski. “Those middle-management layoffs also leave the remaining managers with more scope, which compounds the problem of them feeling overwhelmed and worried about their team’s performance.” At times like this, she says managers may overcompensate by stepping in to “snowplow” for their teams by helping in areas the team should be able to do on their own. “Ultimately that does not always lead to better team performance, and long-term it kneecaps the ability for the team to deliver without help,” says Dulski. How to deal with a snowplow manager If you realize that your manager is acting this way, there are strategies you can try. Rosencrans recommends thanking your boss for their guidance but then suggests pivoting to express an interest in more latitude at work. Consider saying something like: “I’d love to take more ownership of this project. Would you be open to that?” Or, “I noticed that some of the tasks I’ve been assigned are quite limited in scope. I’m keen to develop my skills further. Could we discuss ways I could take on more responsibility or contribute to higher-level work?” Another strategy could be to offer to give your boss a well-needed break. Dulski suggests saying something like this to a “snowplowing” supervisor: “I know you have a lot on your plate, and I want to find ways to support you more. I’d love to take the lead on [specific task or project] to be helpful. It would also be a great learning opportunity for me. I’d be happy to run with it, check in for your input, and keep you updated along the way. I’m ready to jump in if that would be helpful.” What to do if there’s pushback If your manager resists giving you more responsibility, don’t give up. Instead, try and reframe the conversation. “Ask what specific skills or milestones they’d need to see before entrusting you with more complex tasks,” suggests Rosencrans. “This shifts the dynamic from rejection to development, giving you clear goals to work toward. In the meantime, keep a record of your contributions and successes to build a case for your growth.” You can also seek opportunities outside your direct manager’s scope—join cross-functional projects, find a mentor in another department, or take advantage of internal training, she says. If, after multiple attempts, your development is still blocked, consider having a respectful conversation with HR. “Focus on your desire to grow and contribute more, rather than criticizing your manager,” cautions Rosencrans. “The goal is to advocate for your potential in a way that opens doors rather than escalates tension.” View the full article

-

Explore the Benefits of Investing in a Steak Shack Franchise Today

Key Takeaways Proven Business Model: The Steak Shack franchise adopts a successful business model that minimizes risk for new franchise owners, providing a solid framework for running a restaurant. Extensive Training and Support: Franchisees benefit from comprehensive training and ongoing support, including operational guidance and marketing strategies to ensure consistent success. Varied Investment Options: The franchise offers flexible investment models, with the traditional option requiring a higher initial investment, while the Franchise Partnership model allows for a lower entry point with profit-sharing benefits. Diverse Menu Offerings: The menu features high-quality steakburgers and customizable options, appealing to a wide customer base and enhancing customer satisfaction through personalization. Strong Brand Identity: With over 89 years of history, Steak Shack’s established brand reputation attracts customers and facilitates local marketing efforts, reinforcing franchisee success. Community Engagement Focus: Franchisees are encouraged to engage with their local communities, enhancing brand loyalty and establishing a strong customer base through personalized service and involvement. If you’ve ever dreamed of owning a business that serves delicious food and brings people together, the Steak Shack franchise might be your golden ticket. This popular eatery combines mouthwatering steaks with a casual atmosphere, making it a favorite among meat lovers everywhere. With a proven business model and strong brand recognition, stepping into the world of franchising could be your chance to turn that dream into reality. Investing in a Steak Shack franchise means more than just serving great food; it’s about joining a community of passionate entrepreneurs. You’ll benefit from comprehensive training and ongoing support, helping you navigate the challenges of running a successful restaurant. Let’s dive into what makes the Steak Shack franchise an enticing opportunity for aspiring business owners like you. Overview of Steak Shack Franchise Steak Shack franchise offers a unique blend of high-quality steaks and a casual dining atmosphere. You can connect with a dedicated customer base, as this franchise attracts meat lovers who appreciate both taste and quality. Investing in a Steak Shack franchise presents distinct advantages. This franchise operates on a proven business model that minimizes risk, which is crucial for small business owners. Strong brand recognition sets you apart in the competitive food industry, attracting new customers and retaining loyal ones. Franchisees receive comprehensive support and training, enabling you to manage daily operations efficiently. This support includes marketing strategies, operational guidance, and ongoing assistance, which helps you navigate the complexities of running a small business. Overall, a Steak Shack franchise positions you for success in the food service market, capitalizing on the continued demand for high-quality dining experiences. Franchise Opportunities Steak Shack provides various franchise opportunities for aspiring small business owners, featuring both traditional and partnership models that cater to different financial situations and operational experiences. Initial Investment The Franchise Partnership model requires a total investment of approximately $10,000. This option allows you to earn 50% of net profits after a six-month training period, ideal for individuals focused on daily operations rather than additional business ownership. Traditional franchising, on the other hand, requires a more substantial investment, ranging from $1.34 million to $2.34 million for most new store openings, with non-traditional locations start at about $316,000. For traditional franchises, financial prerequisites include a franchise fee of $25,000, a liquid capital requirement exceeding $400,000, and a net worth greater than $1 million excluding your primary residence. Franchise Fee Structure Franchise Partnership fees stand at $10,000, granting you access to 50% of net profits post-training. The traditional franchise fee is about $25,000, complemented by substantial capital requirements for launching new stores. Additionally, veteran discounts may offer a 15% reduction on the initial franchise fee. Ongoing royalties generally comprise a percentage of gross receipts, with typical fees noted at 5.0% or 1.0%, depending on your specific agreement. Steak Shack focuses on empowering franchisees through a supportive culture, extensive training, and a strong brand legacy, making it an attractive prospect for those exploring small business ventures. Menu Offerings Steak Shack presents a diverse menu that showcases high-quality steakburgers and homemade milkshakes, appealing to a broad range of customers. Signature Dishes Steak Shack’s signature dishes include favorites like the Original Double ‘n Cheese Steakburger, known for its rich flavors and juicy patties. Other notable items are the Western BBQ ‘N Bacon Steakburger and the Butter Steakburger, both offering unique taste experiences. Menu also features the popular Chili 5-Way, chicken fingers, and creative milkshake options, ensuring something for everyone. Customization Options Customization plays a vital role in the Steak Shack experience. You can select from single, double, or triple patty options for steakburgers. Many items on the menu allow you to add cheese, bacon, BBQ sauce, jalapeños, and more, catering to individual preferences. With a focus on protein variety—beef, grilled, or crispy chicken—and sides like fries topped with bacon and cheese, you can create a meal that suits any palate. This emphasis on customization enhances customer satisfaction, reinforcing the business’s appeal. Marketing and Promotion Steak Shack employs effective marketing strategies that resonate with small business owners seeking to establish a strong brand presence. The focus remains on creating a loyal customer base through quality offerings and community engagement. Brand Identity Steak Shack positions itself as a classic American brand with over 89 years of history, appealing to consumers looking for quality and nostalgia. This established reputation provides small business owners with a solid foundation, making it easier to attract customers. By modernizing its image with updated technologies and prototypes, the brand maintains its heritage while appealing to a contemporary audience. Local Marketing Strategies Franchisees significantly impact local marketing efforts, emphasizing community involvement and superior customer service. You’ll find that a Franchise Partnership model, requiring minimal investment, allows you to engage directly with your community. With the potential to earn 50% of net profits, franchisees are motivated to succeed locally. Innovative formats like self-service options enhance productivity, ensuring your small business remains competitive. These strategies work together to create a dynamic local presence and stimulate customer loyalty. Training and Support Steak Shack provides extensive training and support, essential for small business owners to thrive in the competitive food industry. The comprehensive training offers the knowledge and confidence necessary for effective restaurant management. Initial Training Programs Steak Shack’s initial training program spans several weeks, tailored for franchise partners. This program covers critical aspects of operations, from opening procedures to maintaining service quality. You’ll receive hands-on instruction in areas like food preparation, customer service, and business management, ensuring a smooth transition into ownership. Ongoing Support Ongoing support includes several key elements: Operations Support: You’ll benefit from guidance provided by a Manager of Field Operations, who assists with daily operations and restaurant openings. Operating Standards System: This established system helps maintain high operational standards across all locations, benefiting your small business by ensuring consistency and quality. Manager-in-Training and Management Development Programs: These programs are designed to enhance your management skills and promote operational excellence, essential for sustaining a profitable venture. Continuous Consultation: Ongoing consultation services are available, helping you tackle operational challenges and ensuring compliance with Steak Shack’s rigorous standards. This structured support system enhances your chances of success in the competitive landscape of small business ownership. Conclusion Investing in a Steak Shack franchise offers a unique opportunity to join a brand that combines quality food with a strong community focus. With comprehensive support and training you’ll be equipped to navigate the challenges of the food industry. The diverse menu and customizable options ensure you can cater to a wide range of customers while building a loyal following. Whether you choose a traditional or partnership model you can feel confident in a business that has stood the test of time. Steak Shack’s commitment to quality and customer satisfaction creates an appealing environment for both franchisees and patrons. If you’re ready to take the plunge into the world of food entrepreneurship Steak Shack could be your path to success. Frequently Asked Questions What is Steak Shack? Steak Shack is a franchise that offers delicious steakburgers and a casual dining atmosphere, making it a popular choice for meat lovers. With a focus on high-quality ingredients and customization, it provides a unique dining experience. What are the benefits of a Steak Shack franchise? Franchisees enjoy a proven business model that reduces risk, strong brand recognition to attract customers, and comprehensive support in marketing, operations, and training, ensuring efficient day-to-day management. How much does it cost to start a Steak Shack franchise? A traditional Steak Shack franchise requires an investment ranging from $1.34 million to $2.34 million. Alternatively, the Franchise Partnership model needs about $10,000 upfront, allowing franchisees to earn 50% of net profits after training. What financial prerequisites are required for traditional franchising? For a traditional Steak Shack franchise, you need a $25,000 franchise fee, over $400,000 in liquid capital, and a net worth exceeding $1 million, excluding your primary residence. What menu items does Steak Shack offer? Steak Shack features a diverse menu that includes high-quality steakburgers, homemade milkshakes, and signature dishes like the Original Double ‘n Cheese Steakburger and the Western BBQ ‘N Bacon Steakburger, catering to various customer preferences. How does Steak Shack support its franchisees? Steak Shack provides extensive training and ongoing support, including operational guidance, customer service training, and marketing strategies, helping franchisees effectively manage their businesses and address challenges. What marketing strategies does Steak Shack use? Steak Shack focuses on building a loyal customer base through quality products and community engagement. Franchisees are encouraged to participate in local marketing efforts to enhance brand visibility. How long is the training program for new franchisees? The initial training for Steak Shack franchisees typically lasts several weeks and covers crucial areas such as food preparation, customer service, and business management. What is unique about the Steak Shack brand? Steak Shack is positioned as a classic American icon with over 89 years of history, appealing to customers seeking quality and nostalgia while also modernizing its image for a contemporary audience. Can I customize my Steak Shack order? Yes, customers can customize their Steak Shack orders, choosing from different patty sizes and a variety of toppings, enhancing their overall dining experience and satisfaction. Image Via Envato Image Via Envato This article, "Explore the Benefits of Investing in a Steak Shack Franchise Today" was first published on Small Business Trends View the full article

-

Explore the Benefits of Investing in a Steak Shack Franchise Today

Key Takeaways Proven Business Model: The Steak Shack franchise adopts a successful business model that minimizes risk for new franchise owners, providing a solid framework for running a restaurant. Extensive Training and Support: Franchisees benefit from comprehensive training and ongoing support, including operational guidance and marketing strategies to ensure consistent success. Varied Investment Options: The franchise offers flexible investment models, with the traditional option requiring a higher initial investment, while the Franchise Partnership model allows for a lower entry point with profit-sharing benefits. Diverse Menu Offerings: The menu features high-quality steakburgers and customizable options, appealing to a wide customer base and enhancing customer satisfaction through personalization. Strong Brand Identity: With over 89 years of history, Steak Shack’s established brand reputation attracts customers and facilitates local marketing efforts, reinforcing franchisee success. Community Engagement Focus: Franchisees are encouraged to engage with their local communities, enhancing brand loyalty and establishing a strong customer base through personalized service and involvement. If you’ve ever dreamed of owning a business that serves delicious food and brings people together, the Steak Shack franchise might be your golden ticket. This popular eatery combines mouthwatering steaks with a casual atmosphere, making it a favorite among meat lovers everywhere. With a proven business model and strong brand recognition, stepping into the world of franchising could be your chance to turn that dream into reality. Investing in a Steak Shack franchise means more than just serving great food; it’s about joining a community of passionate entrepreneurs. You’ll benefit from comprehensive training and ongoing support, helping you navigate the challenges of running a successful restaurant. Let’s dive into what makes the Steak Shack franchise an enticing opportunity for aspiring business owners like you. Overview of Steak Shack Franchise Steak Shack franchise offers a unique blend of high-quality steaks and a casual dining atmosphere. You can connect with a dedicated customer base, as this franchise attracts meat lovers who appreciate both taste and quality. Investing in a Steak Shack franchise presents distinct advantages. This franchise operates on a proven business model that minimizes risk, which is crucial for small business owners. Strong brand recognition sets you apart in the competitive food industry, attracting new customers and retaining loyal ones. Franchisees receive comprehensive support and training, enabling you to manage daily operations efficiently. This support includes marketing strategies, operational guidance, and ongoing assistance, which helps you navigate the complexities of running a small business. Overall, a Steak Shack franchise positions you for success in the food service market, capitalizing on the continued demand for high-quality dining experiences. Franchise Opportunities Steak Shack provides various franchise opportunities for aspiring small business owners, featuring both traditional and partnership models that cater to different financial situations and operational experiences. Initial Investment The Franchise Partnership model requires a total investment of approximately $10,000. This option allows you to earn 50% of net profits after a six-month training period, ideal for individuals focused on daily operations rather than additional business ownership. Traditional franchising, on the other hand, requires a more substantial investment, ranging from $1.34 million to $2.34 million for most new store openings, with non-traditional locations start at about $316,000. For traditional franchises, financial prerequisites include a franchise fee of $25,000, a liquid capital requirement exceeding $400,000, and a net worth greater than $1 million excluding your primary residence. Franchise Fee Structure Franchise Partnership fees stand at $10,000, granting you access to 50% of net profits post-training. The traditional franchise fee is about $25,000, complemented by substantial capital requirements for launching new stores. Additionally, veteran discounts may offer a 15% reduction on the initial franchise fee. Ongoing royalties generally comprise a percentage of gross receipts, with typical fees noted at 5.0% or 1.0%, depending on your specific agreement. Steak Shack focuses on empowering franchisees through a supportive culture, extensive training, and a strong brand legacy, making it an attractive prospect for those exploring small business ventures. Menu Offerings Steak Shack presents a diverse menu that showcases high-quality steakburgers and homemade milkshakes, appealing to a broad range of customers. Signature Dishes Steak Shack’s signature dishes include favorites like the Original Double ‘n Cheese Steakburger, known for its rich flavors and juicy patties. Other notable items are the Western BBQ ‘N Bacon Steakburger and the Butter Steakburger, both offering unique taste experiences. Menu also features the popular Chili 5-Way, chicken fingers, and creative milkshake options, ensuring something for everyone. Customization Options Customization plays a vital role in the Steak Shack experience. You can select from single, double, or triple patty options for steakburgers. Many items on the menu allow you to add cheese, bacon, BBQ sauce, jalapeños, and more, catering to individual preferences. With a focus on protein variety—beef, grilled, or crispy chicken—and sides like fries topped with bacon and cheese, you can create a meal that suits any palate. This emphasis on customization enhances customer satisfaction, reinforcing the business’s appeal. Marketing and Promotion Steak Shack employs effective marketing strategies that resonate with small business owners seeking to establish a strong brand presence. The focus remains on creating a loyal customer base through quality offerings and community engagement. Brand Identity Steak Shack positions itself as a classic American brand with over 89 years of history, appealing to consumers looking for quality and nostalgia. This established reputation provides small business owners with a solid foundation, making it easier to attract customers. By modernizing its image with updated technologies and prototypes, the brand maintains its heritage while appealing to a contemporary audience. Local Marketing Strategies Franchisees significantly impact local marketing efforts, emphasizing community involvement and superior customer service. You’ll find that a Franchise Partnership model, requiring minimal investment, allows you to engage directly with your community. With the potential to earn 50% of net profits, franchisees are motivated to succeed locally. Innovative formats like self-service options enhance productivity, ensuring your small business remains competitive. These strategies work together to create a dynamic local presence and stimulate customer loyalty. Training and Support Steak Shack provides extensive training and support, essential for small business owners to thrive in the competitive food industry. The comprehensive training offers the knowledge and confidence necessary for effective restaurant management. Initial Training Programs Steak Shack’s initial training program spans several weeks, tailored for franchise partners. This program covers critical aspects of operations, from opening procedures to maintaining service quality. You’ll receive hands-on instruction in areas like food preparation, customer service, and business management, ensuring a smooth transition into ownership. Ongoing Support Ongoing support includes several key elements: Operations Support: You’ll benefit from guidance provided by a Manager of Field Operations, who assists with daily operations and restaurant openings. Operating Standards System: This established system helps maintain high operational standards across all locations, benefiting your small business by ensuring consistency and quality. Manager-in-Training and Management Development Programs: These programs are designed to enhance your management skills and promote operational excellence, essential for sustaining a profitable venture. Continuous Consultation: Ongoing consultation services are available, helping you tackle operational challenges and ensuring compliance with Steak Shack’s rigorous standards. This structured support system enhances your chances of success in the competitive landscape of small business ownership. Conclusion Investing in a Steak Shack franchise offers a unique opportunity to join a brand that combines quality food with a strong community focus. With comprehensive support and training you’ll be equipped to navigate the challenges of the food industry. The diverse menu and customizable options ensure you can cater to a wide range of customers while building a loyal following. Whether you choose a traditional or partnership model you can feel confident in a business that has stood the test of time. Steak Shack’s commitment to quality and customer satisfaction creates an appealing environment for both franchisees and patrons. If you’re ready to take the plunge into the world of food entrepreneurship Steak Shack could be your path to success. Frequently Asked Questions What is Steak Shack? Steak Shack is a franchise that offers delicious steakburgers and a casual dining atmosphere, making it a popular choice for meat lovers. With a focus on high-quality ingredients and customization, it provides a unique dining experience. What are the benefits of a Steak Shack franchise? Franchisees enjoy a proven business model that reduces risk, strong brand recognition to attract customers, and comprehensive support in marketing, operations, and training, ensuring efficient day-to-day management. How much does it cost to start a Steak Shack franchise? A traditional Steak Shack franchise requires an investment ranging from $1.34 million to $2.34 million. Alternatively, the Franchise Partnership model needs about $10,000 upfront, allowing franchisees to earn 50% of net profits after training. What financial prerequisites are required for traditional franchising? For a traditional Steak Shack franchise, you need a $25,000 franchise fee, over $400,000 in liquid capital, and a net worth exceeding $1 million, excluding your primary residence. What menu items does Steak Shack offer? Steak Shack features a diverse menu that includes high-quality steakburgers, homemade milkshakes, and signature dishes like the Original Double ‘n Cheese Steakburger and the Western BBQ ‘N Bacon Steakburger, catering to various customer preferences. How does Steak Shack support its franchisees? Steak Shack provides extensive training and ongoing support, including operational guidance, customer service training, and marketing strategies, helping franchisees effectively manage their businesses and address challenges. What marketing strategies does Steak Shack use? Steak Shack focuses on building a loyal customer base through quality products and community engagement. Franchisees are encouraged to participate in local marketing efforts to enhance brand visibility. How long is the training program for new franchisees? The initial training for Steak Shack franchisees typically lasts several weeks and covers crucial areas such as food preparation, customer service, and business management. What is unique about the Steak Shack brand? Steak Shack is positioned as a classic American icon with over 89 years of history, appealing to customers seeking quality and nostalgia while also modernizing its image for a contemporary audience. Can I customize my Steak Shack order? Yes, customers can customize their Steak Shack orders, choosing from different patty sizes and a variety of toppings, enhancing their overall dining experience and satisfaction. Image Via Envato Image Via Envato This article, "Explore the Benefits of Investing in a Steak Shack Franchise Today" was first published on Small Business Trends View the full article

-

Essential Guide on How to Obtain a Franchise Successfully

Key Takeaways Franchising Overview: Franchising offers an opportunity to operate a business under an established brand, benefiting from proven business models and support from franchisors. Benefits of Franchise Ownership: Key advantages include financial stability, brand recognition, and access to training and marketing assistance, which enhance the likelihood of success. Researching Franchise Opportunities: Conduct thorough research to identify interests, analyze market demand, and utilize online resources for discovering suitable franchises. Financial Assessment: Understand the initial costs, liquid capital requirements, and net worth qualifications needed to secure a franchise successfully. Franchise Disclosure Document (FDD): Scrutinize the FDD to understand financial performance and obligations, ensuring that you’re well-informed before making a commitment. Avoid Common Pitfalls: Steer clear of inadequate research, insufficient legal reviews, poor financial planning, and neglecting feedback from current franchisees to make more informed franchise decisions. Thinking about diving into the world of franchising? It’s a smart choice for many aspiring entrepreneurs. A franchise offers the chance to run your own business while benefiting from an established brand and proven business model. But navigating the process of obtaining a franchise can feel overwhelming if you don’t know where to start. In this guide, you’ll learn the essential steps to secure your franchise, from researching potential opportunities to understanding the legal requirements. With the right approach and preparation, you can transform your dream of business ownership into reality. Let’s explore how to make your franchise journey a successful one. Understanding Franchising Franchising represents a strategic route for small business owners seeking to expand their operations or start a new venture. It involves a relationship between the franchisor, who owns the brand, and the franchisee, who purchases the right to operate under that brand. Franchising offers several advantages for small businesses. You gain the benefit of an established brand reputation, which can drive customer trust and loyalty. You’ll also use a proven business model, reducing the risks associated with starting an independent venture. When exploring franchising, consider the following key aspects: Brand Recognition: Joining a recognized franchise can enhance your visibility in the market, attracting more customers. Training and Support: Many franchisors provide comprehensive training programs and ongoing support to ensure your success. Marketing Assistance: Franchisors often handle national marketing campaigns, allowing you to focus on day-to-day operations while benefiting from larger promotional efforts. Understanding these elements of franchising helps you make informed decisions about pursuing this business model. Benefits of Owning a Franchise Owning a franchise offers numerous advantages, particularly for small business entrepreneurs. You’ll find that these benefits can significantly improve your chances of success in the competitive marketplace. Financial Security Franchises often provide a stable financial foundation due to their established brand success. Many successful franchises report consistent revenue streams, reducing the risk of financial failure. As a franchisee, you tap into a proven business model with a track record of profitability, which can lead to quicker return on investment. Moreover, initial costs are often lower than starting an independent business from scratch, granting you more financial flexibility. Brand Recognition Leveraging an established brand name can substantially enhance your customer appeal. Customers frequently trust well-known brands, which can translate into higher foot traffic and sales for your small business. Using the franchisor’s branding and reputation, you can attract customers more effectively than if you were to start a business without these advantages. This brand recognition creates immediate credibility and provides a competitive edge in your local market, facilitating your business growth. Steps to Obtain a Franchise Obtaining a franchise involves several key steps that enable you to move forward confidently in your small business journey. Follow these steps to simplify the process. Researching Franchise Opportunities Identify Interests: Determine which franchise type aligns with your skills and passions. Focus on sectors where you can excel. Market Research: Analyze market demand and assess competition. Investigating local market needs helps identify thriving franchise opportunities. Online Resources: Utilize online directories and platforms, such as FranchiseDirect or the Franchise Global website, to discover available franchises that fit your criteria. Assessing Financial Requirements Initial Costs: Calculate total investment requirements, including initial fees and recurring expenses. Understanding these figures aids in budgeting effectively. Liquid Capital: Prepare to allocate 25-30% of the total investment in cash. This liquid capital eases entry into franchise ownership. Net Worth Requirements: Assess net worth to meet franchisor qualifications. Franchisors often require net worth to include cash, investments, and real estate equity. Evaluating Franchise Disclosure Documents FDD Overview: The Franchise Disclosure Document (FDD) details essential financial information, legal agreements, and obligations. Acquainting yourself with the FDD fosters informed decision-making. Item 19: Examine Item 19, which discloses financial performance data. This critical analysis helps you understand potential revenue and profitability tied to the franchise. Meeting with Franchisors Initial Contact: Reach out to franchisors to express interest and inquire about their recruitment processes. This step sets the groundwork for a potential partnership. Discovery Day: Attend a discovery day to explore the franchise’s culture and operations. Engaging directly with franchisors allows you to ask questions and gain insights. Application Process: Once satisfied with your research and interactions, proceed with the application process. Completing this step signifies your commitment to becoming a franchisee. Common Mistakes to Avoid Inadequate Research: Avoid skipping thorough research on the franchisor’s reputation and financial stability. Understanding the franchise’s market position and previous franchisee experiences enhances your decision-making process. Insufficient Legal Review: Don’t overlook the need for a franchise attorney. Engage a qualified professional to review and negotiate legal documents, ensuring compliance and clarity in agreements. Poor Financial Planning: Avoid underestimating the total investment required. Accurately quantify initial fees, equipment costs, and ongoing expenses to secure stable financial footing for your small business. Neglecting Franchisee Feedback: Speak with existing franchisees to gain insights into their experiences and challenges. Gathering firsthand accounts provides valuable context for your potential investment and helps set realistic expectations. Conclusion Embarking on the journey to obtain a franchise can be both exciting and challenging. By following the steps outlined in this article, you’re setting yourself up for success in the franchising world. Remember to thoroughly research your options and assess your financial readiness. Engaging with franchisors and existing franchisees will provide valuable insights that can guide your decisions. With the right preparation and a clear understanding of the process, you can turn your aspirations into a thriving business. Embrace the opportunities that franchising offers and take the first step towards achieving your entrepreneurial dreams. Frequently Asked Questions What is franchising? Franchising is a business model where an individual (franchisee) operates a business under the established brand and system of a larger company (franchisor). This setup allows franchisees to benefit from a proven business model, brand recognition, and support from the franchisor. What are the benefits of owning a franchise? Owning a franchise offers several benefits, including brand recognition, comprehensive training, and ongoing support from the franchisor. Additionally, franchises often provide financial stability, quicker returns on investment, and an established customer base, which can lead to consistent revenue. How do I research franchise opportunities? Start by identifying your interests and conducting market research to find franchises that align with your goals. Utilize online resources such as franchise directories and company websites. It’s also useful to attend franchise expos and talk to current franchisees for insights. What are the financial requirements for a franchise? Financial requirements vary by franchise but typically include initial startup costs, liquid capital, and net worth qualifications. Ensure you assess your financial situation thoroughly and factor in all potential expenses, including ongoing fees and additional operating costs. What is a Franchise Disclosure Document (FDD)? The Franchise Disclosure Document (FDD) is a legal document that provides information about the franchise offer. It includes details on fees, obligations, financial performance, and the franchisor’s background. Reviewing the FDD is crucial for understanding your responsibilities and potential returns. What mistakes should I avoid while franchising? Common mistakes include failing to research the franchisor’s reputation and financial stability, neglecting to consult a franchise attorney for legal guidance, and poor financial planning. It’s essential to grasp the total investment costs and seek feedback from existing franchisees to make informed decisions. Image Via Envato This article, "Essential Guide on How to Obtain a Franchise Successfully" was first published on Small Business Trends View the full article

-

Essential Guide on How to Obtain a Franchise Successfully

Key Takeaways Franchising Overview: Franchising offers an opportunity to operate a business under an established brand, benefiting from proven business models and support from franchisors. Benefits of Franchise Ownership: Key advantages include financial stability, brand recognition, and access to training and marketing assistance, which enhance the likelihood of success. Researching Franchise Opportunities: Conduct thorough research to identify interests, analyze market demand, and utilize online resources for discovering suitable franchises. Financial Assessment: Understand the initial costs, liquid capital requirements, and net worth qualifications needed to secure a franchise successfully. Franchise Disclosure Document (FDD): Scrutinize the FDD to understand financial performance and obligations, ensuring that you’re well-informed before making a commitment. Avoid Common Pitfalls: Steer clear of inadequate research, insufficient legal reviews, poor financial planning, and neglecting feedback from current franchisees to make more informed franchise decisions. Thinking about diving into the world of franchising? It’s a smart choice for many aspiring entrepreneurs. A franchise offers the chance to run your own business while benefiting from an established brand and proven business model. But navigating the process of obtaining a franchise can feel overwhelming if you don’t know where to start. In this guide, you’ll learn the essential steps to secure your franchise, from researching potential opportunities to understanding the legal requirements. With the right approach and preparation, you can transform your dream of business ownership into reality. Let’s explore how to make your franchise journey a successful one. Understanding Franchising Franchising represents a strategic route for small business owners seeking to expand their operations or start a new venture. It involves a relationship between the franchisor, who owns the brand, and the franchisee, who purchases the right to operate under that brand. Franchising offers several advantages for small businesses. You gain the benefit of an established brand reputation, which can drive customer trust and loyalty. You’ll also use a proven business model, reducing the risks associated with starting an independent venture. When exploring franchising, consider the following key aspects: Brand Recognition: Joining a recognized franchise can enhance your visibility in the market, attracting more customers. Training and Support: Many franchisors provide comprehensive training programs and ongoing support to ensure your success. Marketing Assistance: Franchisors often handle national marketing campaigns, allowing you to focus on day-to-day operations while benefiting from larger promotional efforts. Understanding these elements of franchising helps you make informed decisions about pursuing this business model. Benefits of Owning a Franchise Owning a franchise offers numerous advantages, particularly for small business entrepreneurs. You’ll find that these benefits can significantly improve your chances of success in the competitive marketplace. Financial Security Franchises often provide a stable financial foundation due to their established brand success. Many successful franchises report consistent revenue streams, reducing the risk of financial failure. As a franchisee, you tap into a proven business model with a track record of profitability, which can lead to quicker return on investment. Moreover, initial costs are often lower than starting an independent business from scratch, granting you more financial flexibility. Brand Recognition Leveraging an established brand name can substantially enhance your customer appeal. Customers frequently trust well-known brands, which can translate into higher foot traffic and sales for your small business. Using the franchisor’s branding and reputation, you can attract customers more effectively than if you were to start a business without these advantages. This brand recognition creates immediate credibility and provides a competitive edge in your local market, facilitating your business growth. Steps to Obtain a Franchise Obtaining a franchise involves several key steps that enable you to move forward confidently in your small business journey. Follow these steps to simplify the process. Researching Franchise Opportunities Identify Interests: Determine which franchise type aligns with your skills and passions. Focus on sectors where you can excel. Market Research: Analyze market demand and assess competition. Investigating local market needs helps identify thriving franchise opportunities. Online Resources: Utilize online directories and platforms, such as FranchiseDirect or the Franchise Global website, to discover available franchises that fit your criteria. Assessing Financial Requirements Initial Costs: Calculate total investment requirements, including initial fees and recurring expenses. Understanding these figures aids in budgeting effectively. Liquid Capital: Prepare to allocate 25-30% of the total investment in cash. This liquid capital eases entry into franchise ownership. Net Worth Requirements: Assess net worth to meet franchisor qualifications. Franchisors often require net worth to include cash, investments, and real estate equity. Evaluating Franchise Disclosure Documents FDD Overview: The Franchise Disclosure Document (FDD) details essential financial information, legal agreements, and obligations. Acquainting yourself with the FDD fosters informed decision-making. Item 19: Examine Item 19, which discloses financial performance data. This critical analysis helps you understand potential revenue and profitability tied to the franchise. Meeting with Franchisors Initial Contact: Reach out to franchisors to express interest and inquire about their recruitment processes. This step sets the groundwork for a potential partnership. Discovery Day: Attend a discovery day to explore the franchise’s culture and operations. Engaging directly with franchisors allows you to ask questions and gain insights. Application Process: Once satisfied with your research and interactions, proceed with the application process. Completing this step signifies your commitment to becoming a franchisee. Common Mistakes to Avoid Inadequate Research: Avoid skipping thorough research on the franchisor’s reputation and financial stability. Understanding the franchise’s market position and previous franchisee experiences enhances your decision-making process. Insufficient Legal Review: Don’t overlook the need for a franchise attorney. Engage a qualified professional to review and negotiate legal documents, ensuring compliance and clarity in agreements. Poor Financial Planning: Avoid underestimating the total investment required. Accurately quantify initial fees, equipment costs, and ongoing expenses to secure stable financial footing for your small business. Neglecting Franchisee Feedback: Speak with existing franchisees to gain insights into their experiences and challenges. Gathering firsthand accounts provides valuable context for your potential investment and helps set realistic expectations. Conclusion Embarking on the journey to obtain a franchise can be both exciting and challenging. By following the steps outlined in this article, you’re setting yourself up for success in the franchising world. Remember to thoroughly research your options and assess your financial readiness. Engaging with franchisors and existing franchisees will provide valuable insights that can guide your decisions. With the right preparation and a clear understanding of the process, you can turn your aspirations into a thriving business. Embrace the opportunities that franchising offers and take the first step towards achieving your entrepreneurial dreams. Frequently Asked Questions What is franchising? Franchising is a business model where an individual (franchisee) operates a business under the established brand and system of a larger company (franchisor). This setup allows franchisees to benefit from a proven business model, brand recognition, and support from the franchisor. What are the benefits of owning a franchise? Owning a franchise offers several benefits, including brand recognition, comprehensive training, and ongoing support from the franchisor. Additionally, franchises often provide financial stability, quicker returns on investment, and an established customer base, which can lead to consistent revenue. How do I research franchise opportunities? Start by identifying your interests and conducting market research to find franchises that align with your goals. Utilize online resources such as franchise directories and company websites. It’s also useful to attend franchise expos and talk to current franchisees for insights. What are the financial requirements for a franchise? Financial requirements vary by franchise but typically include initial startup costs, liquid capital, and net worth qualifications. Ensure you assess your financial situation thoroughly and factor in all potential expenses, including ongoing fees and additional operating costs. What is a Franchise Disclosure Document (FDD)? The Franchise Disclosure Document (FDD) is a legal document that provides information about the franchise offer. It includes details on fees, obligations, financial performance, and the franchisor’s background. Reviewing the FDD is crucial for understanding your responsibilities and potential returns. What mistakes should I avoid while franchising? Common mistakes include failing to research the franchisor’s reputation and financial stability, neglecting to consult a franchise attorney for legal guidance, and poor financial planning. It’s essential to grasp the total investment costs and seek feedback from existing franchisees to make informed decisions. Image Via Envato This article, "Essential Guide on How to Obtain a Franchise Successfully" was first published on Small Business Trends View the full article

-

Discover the Benefits of Self Storage Programs for Your Needs