Everything posted by ResidentialBusiness

-

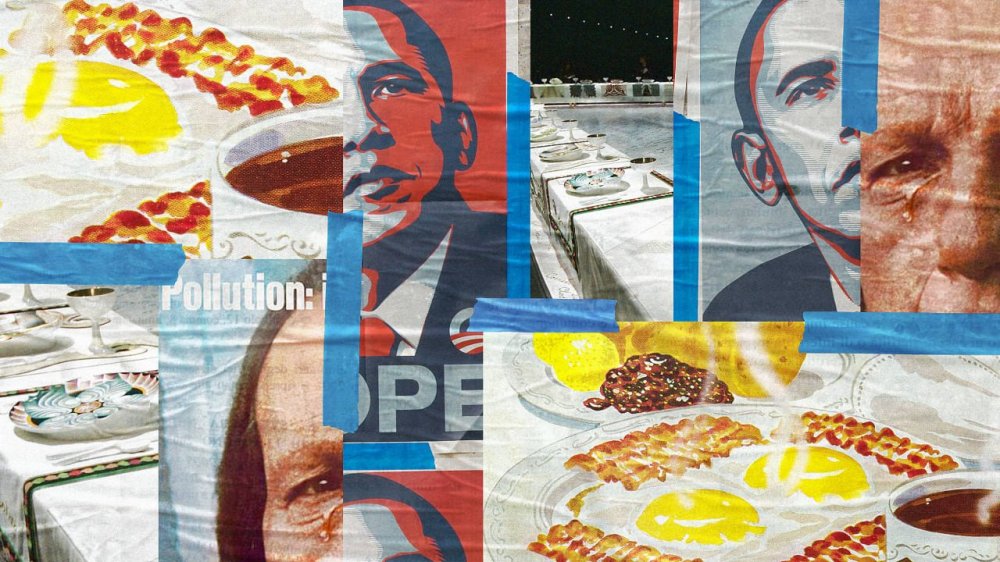

How to use ‘propagandart’ to sell your ideas

In the mid-1920s, most Americans ate light breakfasts. Edward Bernays, who would eventually be considered the father of public relations, was hired by a company that sold bacon to promote the idea that a “hearty” meal including bacon and eggs was more scientifically beneficial. Bernays conducted interviews and then carefully framed the results that led to a shift in public opinion. America’s iconic breakfast is now bacon and eggs. In the 1950s, the Keep America Beautiful campaign was launched by a coalition of corporations whose products were often littered (soda bottles, plastic packages, etc.). Their iconic moment was 1971’s commercial with actor Iron Eyes Cody as a Native American shedding a single tear about litter and pollution. Both of these campaigns were carefully crafted propaganda designed to focus on individual decisions and actions. They relied on imagery, symbolism, and emotion, not raw facts. And they weren’t designed to explicitly sell bacon or guilt. Public relations storytellers shaped public opinion like artists and nudged enough behavior change that the entire culture was impacted. Artful vision and the power to reframe Propaganda is an idea or allegation crafted not to inform neutrally, but to influence behavior and belief. Art is an object or image shaped with skill and imagination to evoke emotion and meaning. It’s useful to learn from people who create art and propaganda. In my work—planning transportation systems with a bias toward human flourishing—I often say I create “propagandart” to save the human race. prä-pə-ˈgan-därt (noun): ideas, allegations, and aesthetic objects produced with the conscious use of skill and creative imagination, spread deliberately to further one’s cause or to damage an opposing cause The people best equipped to influence behavior aren’t just marketers or policymakers—they’re propagandartists. The photographer who shapes what you notice. The muralist who reclaims public space. The meme creator who distills frustration into a punchline. Each is practicing a form of strategic persuasion. Each is shaping not just what we see, but how we feel about it. Whether you’re pitching a startup, selling a product, or reshaping a city, you’re competing with ads, reels, renderings, memes—all designed to influence perception before you’ve said a word. To win the room, you don’t need new tools nearly as much as you need to master an old one: the art of influence. Consider a fine art photographer and a meme lord. One crafts a single frame with obsessive care; the other floods the internet with viral punchlines. Both are propagandists—storytellers who deliberately shape how we see and feel. If I want to create walk-friendly, bicycle-friendly places that increase the smile density in my city, I’m only going to reach that goal through persuasive storytelling. Every photograph is a lie. Photography isn’t objective. Ansel Adams didn’t just capture Yosemite; he framed it to evoke awe. Gordon Parks didn’t just document injustice; he gave it emotional gravity. What’s left out of the frame is as important as what’s inside it. That’s the lesson: direct attention with intention. Don’t pitch the product. Show the life it makes possible. The relieved parent, the joyful commuter, the profitable small business, etc. Great art doesn’t just show—it sells a version of reality. Remix culture and the new public square For urbanism innovators, shaping imaginations is a vital part of the playbook. Launching a new cargo bike, pitching a housing policy, or designing a bus transfer hub requires persuasion. If you can’t shape public imagination, your product, policy, or vision will be dead on arrival, no matter how brilliant the data behind it. The Dinner Party Artists reframe the past, present, and future—sometimes in an effort to change culture in some way, sometimes just to be irreverent or entertaining. From Shepard Fairey’s “Hope” poster to Judy Chicago’s The Dinner Party, art can create appetites for ideas the mainstream hasn’t developed yet. A speculative rendering of a car-free downtown is an example of a prompt for belief. The High Line in New York began this way: a vision, illustrated and circulated, that turned an abandoned rail line into a civic treasure. Applying lessons learned from the art world doesn’t require training to become a great artist yourself. Memes are fast, cheap, and culturally potent. They’re the digital age’s most accessible form of propagandart and we all know they can sometimes look sloppy and haphazard. A meme doesn’t explain—it distills. The “Distracted Boyfriend” image reshaped debates about loyalty. Bernie Sanders in mittens became a viral fundraiser. Memes bypass logic, persuading with speed, irony, and emotional friction. For builders and changemakers, memes offer a strategy. Want to communicate the absurdity of legacy infrastructure or bloated software? A meme can do in seconds what a slide deck does in 30 minutes. Memes can help energize a movement or reframe a dull category. The trick is to stop thinking of them as fluff and start using them as signals. Organized persuasion We’ve been taught to fear the word “propaganda.” But propaganda, at its root, is organized persuasion. And in an environment of infinite messages, intentional persuasion is a competitive edge. Propagandart blends art’s emotional pull with strategy’s clarity. A viral video about your mission is propagandart. A campaign calling out industry greenwashing is propagandart. A cartoon satirizing the way zoning keeps Americans trapped in cars is propagandart. Decide what belief or point of view you’re trying to implant, or what behavior you’re trying to shift. Then use facts to create stories that move markets. From canvas to camera to meme, the artist’s role has never changed: shape what people see—and how they feel about it. This is true for shipping code, designing buildings, or launching a movement of kids biking to school. Your work and your legacy lives or dies by stories. With artistic tools in every pocket and public platforms a click away, we’re in a golden age of propagandart. If you want your idea to stick, it needs more than a data point—it needs to be seen, felt, and shared. Just ask the campaigners behind Barcelona’s “Superblocks.” Before reconfiguring traffic patterns or drafting ordinances, they shared speculative renderings of tree-lined streets, kids playing in former intersections, and cafes spilling into quiet roads once dominated by cars. Those images didn’t just illustrate the plan. They created public appetite for change—turning skepticism into support. The power of propagandart is shaping not just what people know, but what they want. Picture a better world. Frame the story. Share it. If you can shape how people feel, you can shape what they demand. View the full article

-

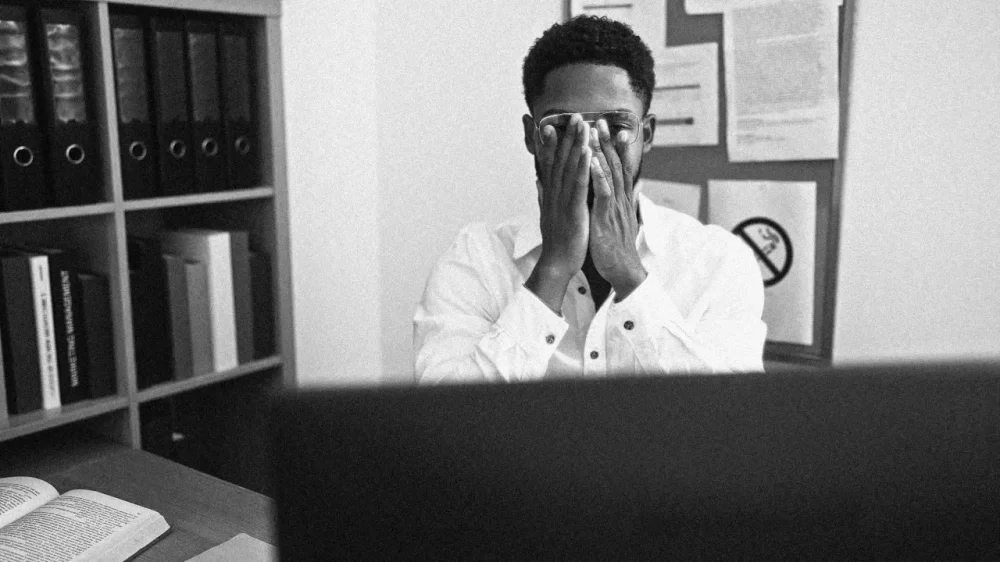

Why work is making us miserable—and what needs to change

How do you feel about your work? Do its daily demands leave you burned out and drained of energy? Do you find yourself reducing how much effort you make to engage in some “quiet” or “soft” quitting? Or maybe you dream of taking a more decisive step and joining the “great resignation.” The prevalence—and popularity—of these responses suggest that there has been quite a change in many people’s attitudes to the way they earn a living. Some think that this change stems from a post-COVID evaluation of work-life balance. Others say it’s an individual form of industrial action. However, these explanations keep the spotlight firmly on workers rather than the work itself. Perhaps the truth lies in a fundamental deterioration in people’s relationship with their work and maybe the work needs to shoulder some of the responsibility. Our experience of working, and its impact on our lives, is about more than what goes on within the office or school or hospital or factory that pays our wages. Even something as simple (yet important) as the number of hours someone works might be the result of a complex combination of national law, professional expectations, and an organization’s resources. This is where something known as the “psychosocial work environment” comes in—an approach (especially popular in Scandinavia) that examines the various structures, conditions, and experiences that affect an employee’s psychological and emotional well-being. Research in this field suggests that there are three conditions vital to the modern work experience: autonomy, boundary management, and “precarity.” Autonomy is about how much control and influence you have when it comes to doing your job and is key to how most employees feel about their work. Low levels of autonomy can leave people feeling overwhelmed and powerless. But high levels can also be detrimental, leading to excessive levels of individual responsibility and overwhelming hours. Ideally, you should have enough autonomy to feel a sense of flexibility and self-determination—but not so much that you feel you need to always be available and constantly on the clock. Setting boundaries Boundary management is the ability to manage the physical and mental boundaries between work and nonwork lives. Achieving a suitable work-life balance has become even more important in a world of hybrid working. But in jobs with high levels of autonomy and responsibility, boundaries can become blurred and unpredictable. Phones ping with work-related notifications, and leisure becomes work at the swipe of a screen. All of this can lead to feelings of anxiety and exhaustion. The goal here is to set clear boundaries that bring predictability and clarity around work time and demands. This provides flexibility that is empowering rather than exploitative. Finally, “precarity” refers to a lack of stability and security in life. It refers specifically to a harmful state of uncertainty that is typically associated with job insecurity (zero-hour contracts, for example). This uncertainty and insecurity can dominate daily work time (and free time), leading to feelings of stress and anxiety. It can also have a negative impact on personal finances and career plans. Income and contract security can help here, although people working in insecure jobs often have little power when it comes to persuading their employers to make the necessary changes. But addressing the deteriorating relationship between employees and their work means confronting certain core conditions. Reflecting on the psychosocial elements of employment can help to identify the gap between expectation and actual experience. Before experiencing burnout or resorting to quitting (in any of its forms), this approach encourages employees and employers to reflect on two key questions. How does work make you feel? And what are the things that cause those feelings? Research on psychosocial work environments provides some guidance. It suggests that workers are more likely to thrive when they have autonomy that feels like control rather than abandonment, and flexibility and clarity that allows for a good work-life balance. They also need security that offers certainty in the present—and confidence in the future. John-Paul Byrne is a lecturer at RCSI University of Medicine and Health Sciences. This article is republished from The Conversation under a Creative Commons license. Read the original article. View the full article

-

boss tells me to solve everything myself, how much contact should I have with my teenager’s manager, and more

It’s four answers to four questions. Here we go… 1. Am I obligated to use my personal network for my job? I work for a nonprofit in a general admin role that involves some development as well (we’re very small, so it’s kind of all-hands-on-deck). From the start, I have been urged by the executive director (my direct boss) to send our fundraising appeals to my own friends and family, and he’s very pointedly asked me about any wealthy people/possible donors I might know. I mostly managed to wiggle out of that one by making it clear that I don’t have any wealthy friends. However, as we move into our big fundraising season I’m being asked to use my personal network to procure things like prizes for auctions/raffles. I have (decidedly non-wealthy) friends who own small businesses in the area, and my boss has asked me to approach them for in-kind donations, etc. Here’s the thing: I have been actively looking to leave this job for months. I’m about two seconds away from rage-quitting without a safety net, and currently just attempting to hold on until I can get another job lined up. I have a lot of problems with this organization, including my incredibly micromanaging, pushy boss and a larger creeping worry about the way our money is spent. I have no interest in (what I see as) exploiting my friends to support a nonprofit I do not believe in. My job description does contain some development work, but it’s mostly the administrative side of fundraising — logging gifts, sending acknowledgments, running reports. It does not list gift solicitation as one of my responsibilities. I am not a schmoozer; I’m a behind-the-scenes spreadsheet-maker, and I would not have accepted this job if making these asks was listed as one of the core job components. I am sure that more of these requests will be coming in as we enter our busy season, and I’m unsure how to say “no” when my boss asks me to dog my friends for auction prizes. Am I really expected to mine my personal network in this way? For what it’s worth, I’ve worked at a variety of nonprofits, sometimes as part of a development team, and have never been so aggressively pushed to use my personal connections for the benefit of the organization. I’d love your take on what I could say to my boss to make this clear without making the (hopefully short!) remainder of my time here more miserable than it is. If it comes down to it, I’m prepared to just say “no,” even if there are repercussions. I have written off this boss as a possible future reference because he has very little professional decorum and I think he’d reflect badly on me, even if the reference he gave was overall positive. People find him very off-putting and he has a tendency to ramble and talk constantly about how hard he works. So I’m extremely prepared to burn this bridge, was just wondering if there’s any way I can set this boundary without doing so. It’s not unusual for staff in nonprofits, especially small ones, to be encouraged to fundraise among their own networks (including for things like auction donations), but it should be left to your judgment about who to approach and how to do it, including whether to do it at all. And you’re not obligated to do it if you prefer not to. As for how to handle it, do you want the easiest way or the stand-on-principle way? Because while you’re proposing the stand-on-principle way (saying no), the easier way to just say you’ve asked and they can’t help (without actually asking them). Your boss isn’t entitled to a full and honest accounting of what you’ve tried in response to an inappropriate request like this; you can simply use your own judgment, decide your friends would say no, and report that they said no. If you want, feel free to add in, “They seemed uncomfortable that I asked, and I think it would harm the relationship to request anything else.” Additional advice here: my job wants me to hit up everyone I know for money and other help 2. Stakeholder going beyond bounds of their scope in feedback Let’s say I work as a project manager in teapot design and production. I send designs to a handful of stakeholders for input and approval based on their subject matter expertise. Most people know to speak to their area of expertise and know that I’m not asking them for their personal opinion on the designs themselves. One stakeholder is only supposed to weigh in on whether her area’s social media team would be interested in engaging with the designs on platforms when they’re finalized and ready to start marketing. I do not need this person’s opinions on the designs themselves. This does not stop this person from asking me if the curve of the handle can be deeper because it’s ugly as is, or if we can add more filigree to the lid border, or things of that nature — basically applying her personal taste to the actual designs when that’s not her role on this project, or any project we consult with her on. It doesn’t help that it takes her several days beyond when I ask to have comments back by, so this is not the only issue I encounter with her. I’m not especially close to or familiar with this stakeholder, but I do want someone, whether that’s me or another party, to level-set with her on exactly what feedback I’m asking for in the review phase. I was put in touch with her because of the account manager, and I wonder if Accounts might be the better party to manage expectations with her. For what it’s worth, the account manager and I are very aligned on what feedback we need from this person. Any advice on how to do this warmly, but directly? I want to be collaborative and maintain a good relationship with her since I can’t just go to a different person, but I don’t need a dozen stakeholders turning into creative directors when that function is covered elsewhere and that’s not the feedback I need from them. The next time you send her something for review, be very, very explicit about what input you are and are not asking for. For example: “I’m seeking your input on ABC, but not on the design itself (things like the lids and handle are being handled elsewhere).” It’s possible that simply spelling it out clearly will solve the problem, but if after that she again sends you feedback outside the scope of what you need, you should reply, “I’m incorporating your input on ABC, but we aren’t looking for feedback on the design at this point (and have different stakeholders charged with that). I want to make sure you know that so you don’t spend time on design feedback in the future.” If it still happens after that, give her a call or talk in person the next time you have something to send her. Say basically the same thing, and frame it as, “I don’t want you to spend time on input we can’t use, so I want to explain exactly what we are and aren’t looking for.” If that fails, you could involve the account manager, but with most people this would be something you could solve with the approach above. 3. My manager tells me to solve everything myself, even when I need her help I’m seeking a sanity check on a situation with my manager and my current role. I have spent most of my time supporting a single department. For years, I’ve been told that no senior positions would be offered, so I never expected any upward mobility. However, recently, my boss posted a senior position for the department without notifying anyone internally or offering it to someone within the team, and instead hired someone externally. When I reviewed my goals for the year, I asked my boss what steps I needed to take to get promoted. She said I should come to her with the plan for my own promotion. This is a recurring pattern: every time I bring up a roadblock or an issue, she tells me that I should be coming to her with a solution, even though I only approach her once I’ve exhausted all my available options. For example, when I needed another person for a project, her response was that she didn’t have anyone available, and I should either be creative with my time or propose another solution. I’m finding this (and many other things) to be really frustrating. It seems like she’s not offering much support or direction for our goals. She sat in a meeting with a new executive about metrics and then told us to come up with metrics without sharing any of the information she got from the meeting. I’m wondering if this is a new kind of management style — possibly the opposite of servant leadership. I don’t mind taking initiative, but at some point, it feels like I’m being asked to solve problems that should involve more collaboration or guidance from her. Am I missing something here? Is this just how modern management works now, or is there something off about this approach? This isn’t a new management style; it’s just plain old bad management, which has been around as long as there have been managers. She just sucks at her job and is trying to outsource it to you, despite you not having the tools or authority to do the things she’s asking you to do. “Come up with a plan for your own promotion” could mean “think about what skills you need to build to move from X to Y and propose work you can to do build those skills” … but given everything else you described about your boss, combined with the fact that she’s told you for years there would never be a path to promotion (if I’m interpreting that correctly), I’m skeptical that that’s what it meant. You could certainly try approaching it that way anyway and see what happens, but this really should be a conversation between the two of you where she offers feedback on what it would take to move to the next level and you collaboratively discuss what a path there could look like. She just sounds like she sucks as a manager, unfortunately. Related: my boss won’t give me any direction — but then says my work is wrong 4. How much communication should I have with my teenager’s manager? My 16-year-old will be starting her first job soon, and I wanted your take on what is an appropriate level of communication between her manager and me. For example, should I introduce myself to them? Should I ever contact them to be sure my daughter has informed them of any scheduling conflicts? When I was a teen worker, I kind of viewed my manager like I did my teachers or a coach; an adult who was in charge of me, but I could be wrong here, and that’s why I’m seeking your advice. You shouldn’t have any contact with your teenager’s manager unless it’s an emergency and you’re calling to explain she’s too sick to call out herself. You do not need to introduce yourself to them (you of course can if you happen to meet them one day, but you shouldn’t go out of your way to do it otherwise), and you definitely shouldn’t contact them to make sure your daughter told them about her schedule; the latter is for her to handle on her own. You do have a role, though! It’s to coach her from behind the scenes. You can teach her how to communicate with her employer, as long as she is the one doing the communication. Learning to do that (and probably stumbling her way through some of it) is part of the advantage of having a job in high school. (Money is the other advantage, obviously, but learning to deal with her managers on her own is a big advantage to working, too.) The post boss tells me to solve everything myself, how much contact should I have with my teenager’s manager, and more appeared first on Ask a Manager. View the full article

-

UK water watchdog woos investors with ‘guaranteed revenues’ of PFI deals

About £50bn is needed to back projects to improve Britain’s crumbling water infrastructure View the full article

-

How Ukraine lost hundreds of millions on arms deals gone wrong

Desperate to source munitions, Kyiv paid foreign brokers for weapons and shells that were sometimes unusable or never arrived View the full article

-

A US recession doesn’t seem so likely any more

The President has shown a willingness to pivot in the face of adverse market reactionView the full article

-

How Trump made me a hundred grand

There is nothing like irrational mayhem for opportunistic investingView the full article

-

UK ministers consider cutting tax-free cash Isa allowance

City groups think such a move will attract money into equity funds and domestic sharesView the full article

-

Nvidia plans Shanghai research centre in new commitment to China

US chipmaker considers expanding its presence in the country even as sales are hit by Washington’s export controlsView the full article

-

AI chatbots do battle over human memories

Tech groups have released upgrades to store a larger amount of user information and personalise responsesView the full article

-

Japan to hold out for better trade deal with US

Prime Minister Shigeru Ishiba’s unpopular government fears concessions could prompt electoral backlashView the full article

-

Canva Launches Canva Sheets, Merging Data, Design, and AI for a New Era of Spreadsheets

Canva unveiled Canva Sheets on May 14 at its Canva Create: Uncharted event, introducing a new generation of AI-powered data tools designed to make working with data simple, fast, and visual. The release marks Canva’s expansion into the world of spreadsheets, bringing together analytics, design, and automation within a unified platform. According to the announcement, Canva Sheets reimagines the traditional spreadsheet by combining structured data capabilities with Canva’s design-first approach. Users can now transform raw numbers into engaging visuals, reports, and marketing content without leaving the Canva ecosystem. A Visual-First Spreadsheet Experience Canva’s goal is to move beyond traditional rows and columns by making data communication clearer, more compelling, and more accessible. “Spreadsheets have been designed for analysis, not for storytelling,” the company stated. Canva Sheets aims to change that with tools that prioritize visual communication, allowing users to create interactive, presentation-ready content from raw data. The platform includes integrated features like Magic Formulas, Magic Insights, and Magic Charts. These AI-powered tools enable users to analyze data, uncover key trends, and instantly convert results into charts or visual narratives. Magic Charts suggests optimal chart formats based on the dataset and includes interactive filters and animations such as Match & Move to enhance storytelling. AI Tools Streamline Workflows With the integration of Magic Studio, users can scale content creation directly from spreadsheets. The announcement highlights how teams can generate personalized, on-brand materials—such as social media posts, emails, and campaign assets—based on spreadsheet data, all within a few clicks. “Powered by Canva AI, what once took hours now takes seconds,” the company stated. Features include bulk editing, cross-platform resizing, multilingual translation into 100+ languages, and campaign adaptation for multiple markets. Enhanced Data Synchronization To help teams stay aligned, Canva Sheets includes Data Connectors that integrate with third-party tools like Google Analytics and HubSpot. This allows users to connect live data sources to their Sheets and automatically update charts and visuals in real time. Canva noted, “When the data changes, so do your designs – no need for manual rebuilds or pasted screenshots.” This feature is particularly aimed at recurring tasks such as stakeholder updates, campaign dashboards, and monthly reporting, simplifying what has traditionally been a labor-intensive process. Image: Canva This article, "Canva Launches Canva Sheets, Merging Data, Design, and AI for a New Era of Spreadsheets" was first published on Small Business Trends View the full article

-

Canva Launches Canva Sheets, Merging Data, Design, and AI for a New Era of Spreadsheets

Canva unveiled Canva Sheets on May 14 at its Canva Create: Uncharted event, introducing a new generation of AI-powered data tools designed to make working with data simple, fast, and visual. The release marks Canva’s expansion into the world of spreadsheets, bringing together analytics, design, and automation within a unified platform. According to the announcement, Canva Sheets reimagines the traditional spreadsheet by combining structured data capabilities with Canva’s design-first approach. Users can now transform raw numbers into engaging visuals, reports, and marketing content without leaving the Canva ecosystem. A Visual-First Spreadsheet Experience Canva’s goal is to move beyond traditional rows and columns by making data communication clearer, more compelling, and more accessible. “Spreadsheets have been designed for analysis, not for storytelling,” the company stated. Canva Sheets aims to change that with tools that prioritize visual communication, allowing users to create interactive, presentation-ready content from raw data. The platform includes integrated features like Magic Formulas, Magic Insights, and Magic Charts. These AI-powered tools enable users to analyze data, uncover key trends, and instantly convert results into charts or visual narratives. Magic Charts suggests optimal chart formats based on the dataset and includes interactive filters and animations such as Match & Move to enhance storytelling. AI Tools Streamline Workflows With the integration of Magic Studio, users can scale content creation directly from spreadsheets. The announcement highlights how teams can generate personalized, on-brand materials—such as social media posts, emails, and campaign assets—based on spreadsheet data, all within a few clicks. “Powered by Canva AI, what once took hours now takes seconds,” the company stated. Features include bulk editing, cross-platform resizing, multilingual translation into 100+ languages, and campaign adaptation for multiple markets. Enhanced Data Synchronization To help teams stay aligned, Canva Sheets includes Data Connectors that integrate with third-party tools like Google Analytics and HubSpot. This allows users to connect live data sources to their Sheets and automatically update charts and visuals in real time. Canva noted, “When the data changes, so do your designs – no need for manual rebuilds or pasted screenshots.” This feature is particularly aimed at recurring tasks such as stakeholder updates, campaign dashboards, and monthly reporting, simplifying what has traditionally been a labor-intensive process. Image: Canva This article, "Canva Launches Canva Sheets, Merging Data, Design, and AI for a New Era of Spreadsheets" was first published on Small Business Trends View the full article

-

Shopify Launches Commerce Integration with Roblox

Shopify has announced the launch of a new commerce integration with Roblox, giving eligible Shopify merchants the ability to sell physical products directly within Roblox’s immersive gaming platform. The integration is now live and marks Shopify’s debut as Roblox’s first official commerce partner. According to the announcement, brands using Shopify can now create in-game commerce experiences to engage with Roblox’s extensive user base, which reached over 97 million daily active users. “Brands can now create immersive commerce experiences right inside Roblox to reach an engaged audience of 97+ million daily active users,” Shopify stated. Expanding Commerce Into Immersive Spaces Shopify framed the partnership as a strategic effort to advance its mission of enabling commerce everywhere. “This partnership brings together two companies on a mission of furthering entrepreneurship and making commerce everywhere a reality—even in immersive spaces,” the company stated. As part of the integration, Shopify will pilot its Checkout product within the Roblox platform, with a full launch expected in early 2025. This will enable developers, creators, and Shopify-connected brands to sell physical items to Roblox users without requiring them to leave the game environment. Opportunities for Creators and Brands Shopify highlighted the potential this integration holds for Roblox creators, describing it as a “brand new avenue to entrepreneurship.” The company emphasized that creators and brands will be able to tap into a global audience of nearly 80 million daily active Roblox users, based on Q2 2024 data. “Commerce happens everywhere—from physical stores, to online, to immersive spaces,” the company said. “One of the most relevant places for digitally-savvy Gen Z consumers in the world right now is Roblox, where millions of creators pursue entrepreneurship through immersive content creation.” Shaping the Future of Immersive Commerce Shopify positioned this partnership as part of its broader vision to support entrepreneurs across evolving digital spaces. “This is another example of how Shopify is shaping the future of immersive commerce and shopping,” the company stated. “When entrepreneurs have more spaces to connect with fans, they have more opportunities to succeed. That is what we power at Shopify.” The integration offers new opportunities for entrepreneurs to monetize their audiences and grow their businesses in an increasingly virtual world. With Shopify’s Checkout functionality embedded within Roblox games, the company aims to streamline the path from engagement to purchase in immersive environments. “See you soon on Roblox,” Shopify concluded in its announcement. This article, "Shopify Launches Commerce Integration with Roblox" was first published on Small Business Trends View the full article

-

Shopify Launches Commerce Integration with Roblox

Shopify has announced the launch of a new commerce integration with Roblox, giving eligible Shopify merchants the ability to sell physical products directly within Roblox’s immersive gaming platform. The integration is now live and marks Shopify’s debut as Roblox’s first official commerce partner. According to the announcement, brands using Shopify can now create in-game commerce experiences to engage with Roblox’s extensive user base, which reached over 97 million daily active users. “Brands can now create immersive commerce experiences right inside Roblox to reach an engaged audience of 97+ million daily active users,” Shopify stated. Expanding Commerce Into Immersive Spaces Shopify framed the partnership as a strategic effort to advance its mission of enabling commerce everywhere. “This partnership brings together two companies on a mission of furthering entrepreneurship and making commerce everywhere a reality—even in immersive spaces,” the company stated. As part of the integration, Shopify will pilot its Checkout product within the Roblox platform, with a full launch expected in early 2025. This will enable developers, creators, and Shopify-connected brands to sell physical items to Roblox users without requiring them to leave the game environment. Opportunities for Creators and Brands Shopify highlighted the potential this integration holds for Roblox creators, describing it as a “brand new avenue to entrepreneurship.” The company emphasized that creators and brands will be able to tap into a global audience of nearly 80 million daily active Roblox users, based on Q2 2024 data. “Commerce happens everywhere—from physical stores, to online, to immersive spaces,” the company said. “One of the most relevant places for digitally-savvy Gen Z consumers in the world right now is Roblox, where millions of creators pursue entrepreneurship through immersive content creation.” Shaping the Future of Immersive Commerce Shopify positioned this partnership as part of its broader vision to support entrepreneurs across evolving digital spaces. “This is another example of how Shopify is shaping the future of immersive commerce and shopping,” the company stated. “When entrepreneurs have more spaces to connect with fans, they have more opportunities to succeed. That is what we power at Shopify.” The integration offers new opportunities for entrepreneurs to monetize their audiences and grow their businesses in an increasingly virtual world. With Shopify’s Checkout functionality embedded within Roblox games, the company aims to streamline the path from engagement to purchase in immersive environments. “See you soon on Roblox,” Shopify concluded in its announcement. This article, "Shopify Launches Commerce Integration with Roblox" was first published on Small Business Trends View the full article

-

Understanding Deal Falling Through: Causes, Impacts, and Recovery Strategies

Key Takeaways Recognize Common Causes: Understand that deals can fall through due to incomplete documentation, financial issues, misalignment of interests, market conditions, and legal challenges. Impact on Stakeholders: Falling deals can affect various stakeholders, including entrepreneurs, employees, investors, customers, and partners, emphasizing the importance of communication and transparency. Learn from Case Studies: Review real-world examples of failed deals to identify lessons in financial accuracy, comprehensive inspections, and the necessity of clear titles. Preventative Strategies: Implement effective communication and thorough due diligence to reduce the likelihood of deals collapsing, ensuring all parties are aligned and informed. Next Steps After a Failure: After a deal falls through, focus on assessing what went wrong, communicating openly, maintaining momentum, and re-evaluating your business model for future improvement. Invest in Adaptability: Strengthen your financial management, legal structure, and marketing strategy while preparing for future negotiations to enhance your business’s resilience and success. Every deal has its ups and downs, but when a deal falls through, it can feel like a gut punch. Whether you’re navigating real estate, business partnerships, or personal transactions, understanding the reasons behind these setbacks can save you time, money, and frustration. You’re not alone in facing this challenge. Many experience the disappointment of a deal collapsing at the last minute. Recognizing the warning signs and knowing how to respond can empower you to bounce back stronger and make better decisions in the future. Let’s dive into what causes deals to fall apart and how you can mitigate these risks. Understanding Deal Falling Through Deals can collapse for a variety of reasons, impacting small business operations and growth strategies. Understanding these setbacks helps you prepare for future transactions and navigate them more effectively. Common Causes Incomplete Documentation: Missing legal documents, such as contracts or permits, can halt a deal. Ensure you maintain thorough records and understand required paperwork. Financial Issues: Insufficient funding often leads to failed transactions. Knowing your budget and exploring funding options, like loans or angel investors, is crucial. Misalignment of Interests: Conflicting goals can derail partnerships. Clear communication about expectations and objectives promotes a shared vision, reducing the risk of misalignment. Market Conditions: Economic downturns or shifting consumer preferences can affect deals. Regular market research helps you adapt and stay informed about potential impacts on your transactions. Legal Challenges: Issues regarding intellectual property, such as trademarks or patents, may obstruct progress. Seek legal advice to navigate complications and ensure compliance with regulations. Impact on Stakeholders Entrepreneurs: Falling deals can hinder growth and disrupt plans. You may need to revise your business plan or approach to ensure future success. Employees: Uncertainty from disrupted deals can affect team morale. Clear communication about challenges helps maintain trust and focus on ongoing goals. Investors: Investors may reconsider their support if deals consistently fall through. Keeping open lines of communication and demonstrating adaptability builds confidence. Customers: Deal failures may impact product availability or service offerings. Keep your target audience informed to maintain their trust and loyalty during transitions. Partners: Failed deals strain relationships. Building strong collaborations through transparent discussions allows for more resilient partnerships in the future. Case Studies of Deal Falling Through Understanding the reasons behind deals falling through can help you prepare for future transactions in your small business. You’ll encounter various circumstances that may derail a deal, and reviewing notable examples can provide valuable insights. Notable Examples Financing Issues A small business owner faced a setback when the lender declined their loan due to a sudden drop in credit score. The loan, crucial for funding operations, fell through as the lender discovered discrepancies in the business’s financial statements during the underwriting process. This situation illustrates that ensuring accurate financial reporting is essential to secure funding. Inspection Findings A local entrepreneur’s retail space deal collapsed after a property inspection revealed severe structural damage. The seller’s reluctance to address the necessary repairs led the entrepreneur to walk away, knowing the costs would exceed the budget. This incident highlights the importance of thorough market research and property assessments before finalizing agreements. Title Problems A partnership intended to buy a restaurant encountered title issues. Undisclosed liens and disputes over property boundaries came to light, causing significant complications. The business partners had to abandon the deal as a clear title is crucial for securing funding and maintaining business stability. This example underscores the necessity of seeking legal advice and conducting diligent title searches during real estate transactions. Lessons Learned Financial Accuracy Prioritize transparency in your financial statements. Accurate documentation fosters trust and can prevent last-minute financing issues. Comprehensive Inspections Always conduct property inspections before commitments. Identifying potential problems early on saves time and money in the long run. Clear Titles Ensure all title matters are resolved before proceeding. Engage legal experts to navigate potential obstacles and maintain smooth transactions. By learning from these notable examples and lessons, you can navigate your small business transactions more effectively, mitigate risks, and position your enterprise for success. Strategies to Prevent Deals from Falling Through Effective strategies can significantly reduce the chances of deals falling through. Focus on the following key areas: Effective Communication Effective communication plays a vital role in preventing deal failures. Align your conversations with buyer priorities, especially in small business environments. Focus sales discussions on the buyer’s key business issues rather than just your product features. Build a coaching cadence within your team to structure these conversations. Integrate active listening techniques to ensure you understand the buyer’s pain points. Maintain regular check-ins throughout the negotiation process to address concerns promptly and adjust strategies as needed. Thorough Due Diligence Thorough due diligence is essential for successful transactions. Conduct comprehensive market research to understand competitive landscapes and buyer expectations. Ensure financial documentation is accurate and readily available, minimizing discrepancies that could derail a deal. Review all terms of agreements, including legal structures like LLCs or partnerships, to confirm compliance with regulations. Schedule inspections if necessary to eliminate any surprises related to property or product quality. Document all findings and share them transparently with stakeholders, establishing trust and accountability throughout the negotiation. When a Deal Falls Through: Next Steps When a deal falls through, immediate action is crucial for recovering and moving forward. Focus on both short-term actions and long-term considerations to strengthen your position. Short-Term Actions Do Not Blame Yourself Excessively Don’t linger in regret. Recognize that deals collapse frequently, often due to conditions beyond your control. Acknowledging this keeps you mentally prepared for future opportunities. Assess What Went Wrong Examine the transaction’s factors that contributed to its failure. Identify issues such as financial discrepancies, unrealistic pricing expectations, or misalignment between interests. This analysis helps refine your business plan for future dealings. Maintain Momentum Keep your network active. Attend industry events, participate in business mixers, and engage with other small business owners. Networking can lead to new partnerships, potential funding options, or alternative sales opportunities. Communicate Openly Contact all affected stakeholders, from team members to potential clients. Keeping lines of communication open fosters trust and shows resilience. This transparency can strengthen relationships for future negotiations. Long-Term Considerations Re-evaluate Your Business Model After a deal falls through, adjust your business model where necessary. Consider market research to identify areas for improvement, ensuring your offerings align with your target audience’s needs. Enhance Your Legal Structure Review your legal setup and consider options like an LLC or corporation for better protection against deal-related risks. A solid legal structure safeguards your interests and adds professionalism to future ventures. Invest in Professional Development Seek mentorship or advice from business coaches. Engaging with successful entrepreneurs can provide insights that enhance your approach and decision-making in future deals, potentially leading to a stronger growth strategy. Strengthen Financial Management Implement effective accounting and budgeting practices. Accurate financial tracking ensures clarity and aids in recognizing funding options or partnerships that can support a new venture. Build Your Brand and Marketing Strategy Focus on developing a robust digital marketing and branding strategy. An effective online presence, supported by SEO and content marketing, can enhance customer acquisition and boost sales opportunities in the long run. Prepare for Future Negotiations Be proactive in negotiation skills development by practicing pitches and developing clear presentations. A well-prepared approach can make a significant difference in future transactions, increasing the likelihood of success. By taking these steps, you can turn setbacks into learning experiences that bolster your business’s resilience and readiness for subsequent opportunities. Conclusion Experiencing a deal fall through can be disheartening but it doesn’t have to define your journey. By understanding the reasons behind these setbacks you can turn disappointment into a valuable learning experience. Embrace the lessons learned and use them to refine your approach in future negotiations. Staying proactive and adaptable is key. Focus on clear communication and thorough preparation to build trust with your stakeholders. Remember that resilience and a willingness to learn will not only help you recover from failed deals but also position you for greater success in the long run. Keep pushing forward and seize the opportunities that await you. Frequently Asked Questions What causes deals to fall through? Deals can fall through for various reasons, including incomplete documentation, financial issues, misalignment of interests, adverse market conditions, and legal challenges. Recognizing these factors helps you prepare for future transactions. How can I prevent my deal from collapsing? To prevent deals from collapsing, prioritize effective communication and thorough due diligence. Align discussions with buyer priorities, conduct comprehensive market research, and share relevant findings transparently to foster trust among stakeholders. What should I do if a deal falls through? If a deal falls through, avoid excessive self-blame. Assess what went wrong, maintain networking momentum, and communicate openly with stakeholders. This helps in learning from setbacks and preparing for future opportunities. What is the emotional impact of a failed deal? A failed deal can lead to disappointment and frustration for stakeholders, including entrepreneurs, employees, and investors. Understanding that these emotions are common can help individuals cope better and build resilience. How can I improve my negotiation skills after a setback? To improve negotiation skills, focus on learning from past experiences. Re-evaluate your business model, invest in professional development, and strengthen your financial management. This proactive approach prepares you for future negotiations. Image Via Envato This article, "Understanding Deal Falling Through: Causes, Impacts, and Recovery Strategies" was first published on Small Business Trends View the full article

-

Understanding Deal Falling Through: Causes, Impacts, and Recovery Strategies

Key Takeaways Recognize Common Causes: Understand that deals can fall through due to incomplete documentation, financial issues, misalignment of interests, market conditions, and legal challenges. Impact on Stakeholders: Falling deals can affect various stakeholders, including entrepreneurs, employees, investors, customers, and partners, emphasizing the importance of communication and transparency. Learn from Case Studies: Review real-world examples of failed deals to identify lessons in financial accuracy, comprehensive inspections, and the necessity of clear titles. Preventative Strategies: Implement effective communication and thorough due diligence to reduce the likelihood of deals collapsing, ensuring all parties are aligned and informed. Next Steps After a Failure: After a deal falls through, focus on assessing what went wrong, communicating openly, maintaining momentum, and re-evaluating your business model for future improvement. Invest in Adaptability: Strengthen your financial management, legal structure, and marketing strategy while preparing for future negotiations to enhance your business’s resilience and success. Every deal has its ups and downs, but when a deal falls through, it can feel like a gut punch. Whether you’re navigating real estate, business partnerships, or personal transactions, understanding the reasons behind these setbacks can save you time, money, and frustration. You’re not alone in facing this challenge. Many experience the disappointment of a deal collapsing at the last minute. Recognizing the warning signs and knowing how to respond can empower you to bounce back stronger and make better decisions in the future. Let’s dive into what causes deals to fall apart and how you can mitigate these risks. Understanding Deal Falling Through Deals can collapse for a variety of reasons, impacting small business operations and growth strategies. Understanding these setbacks helps you prepare for future transactions and navigate them more effectively. Common Causes Incomplete Documentation: Missing legal documents, such as contracts or permits, can halt a deal. Ensure you maintain thorough records and understand required paperwork. Financial Issues: Insufficient funding often leads to failed transactions. Knowing your budget and exploring funding options, like loans or angel investors, is crucial. Misalignment of Interests: Conflicting goals can derail partnerships. Clear communication about expectations and objectives promotes a shared vision, reducing the risk of misalignment. Market Conditions: Economic downturns or shifting consumer preferences can affect deals. Regular market research helps you adapt and stay informed about potential impacts on your transactions. Legal Challenges: Issues regarding intellectual property, such as trademarks or patents, may obstruct progress. Seek legal advice to navigate complications and ensure compliance with regulations. Impact on Stakeholders Entrepreneurs: Falling deals can hinder growth and disrupt plans. You may need to revise your business plan or approach to ensure future success. Employees: Uncertainty from disrupted deals can affect team morale. Clear communication about challenges helps maintain trust and focus on ongoing goals. Investors: Investors may reconsider their support if deals consistently fall through. Keeping open lines of communication and demonstrating adaptability builds confidence. Customers: Deal failures may impact product availability or service offerings. Keep your target audience informed to maintain their trust and loyalty during transitions. Partners: Failed deals strain relationships. Building strong collaborations through transparent discussions allows for more resilient partnerships in the future. Case Studies of Deal Falling Through Understanding the reasons behind deals falling through can help you prepare for future transactions in your small business. You’ll encounter various circumstances that may derail a deal, and reviewing notable examples can provide valuable insights. Notable Examples Financing Issues A small business owner faced a setback when the lender declined their loan due to a sudden drop in credit score. The loan, crucial for funding operations, fell through as the lender discovered discrepancies in the business’s financial statements during the underwriting process. This situation illustrates that ensuring accurate financial reporting is essential to secure funding. Inspection Findings A local entrepreneur’s retail space deal collapsed after a property inspection revealed severe structural damage. The seller’s reluctance to address the necessary repairs led the entrepreneur to walk away, knowing the costs would exceed the budget. This incident highlights the importance of thorough market research and property assessments before finalizing agreements. Title Problems A partnership intended to buy a restaurant encountered title issues. Undisclosed liens and disputes over property boundaries came to light, causing significant complications. The business partners had to abandon the deal as a clear title is crucial for securing funding and maintaining business stability. This example underscores the necessity of seeking legal advice and conducting diligent title searches during real estate transactions. Lessons Learned Financial Accuracy Prioritize transparency in your financial statements. Accurate documentation fosters trust and can prevent last-minute financing issues. Comprehensive Inspections Always conduct property inspections before commitments. Identifying potential problems early on saves time and money in the long run. Clear Titles Ensure all title matters are resolved before proceeding. Engage legal experts to navigate potential obstacles and maintain smooth transactions. By learning from these notable examples and lessons, you can navigate your small business transactions more effectively, mitigate risks, and position your enterprise for success. Strategies to Prevent Deals from Falling Through Effective strategies can significantly reduce the chances of deals falling through. Focus on the following key areas: Effective Communication Effective communication plays a vital role in preventing deal failures. Align your conversations with buyer priorities, especially in small business environments. Focus sales discussions on the buyer’s key business issues rather than just your product features. Build a coaching cadence within your team to structure these conversations. Integrate active listening techniques to ensure you understand the buyer’s pain points. Maintain regular check-ins throughout the negotiation process to address concerns promptly and adjust strategies as needed. Thorough Due Diligence Thorough due diligence is essential for successful transactions. Conduct comprehensive market research to understand competitive landscapes and buyer expectations. Ensure financial documentation is accurate and readily available, minimizing discrepancies that could derail a deal. Review all terms of agreements, including legal structures like LLCs or partnerships, to confirm compliance with regulations. Schedule inspections if necessary to eliminate any surprises related to property or product quality. Document all findings and share them transparently with stakeholders, establishing trust and accountability throughout the negotiation. When a Deal Falls Through: Next Steps When a deal falls through, immediate action is crucial for recovering and moving forward. Focus on both short-term actions and long-term considerations to strengthen your position. Short-Term Actions Do Not Blame Yourself Excessively Don’t linger in regret. Recognize that deals collapse frequently, often due to conditions beyond your control. Acknowledging this keeps you mentally prepared for future opportunities. Assess What Went Wrong Examine the transaction’s factors that contributed to its failure. Identify issues such as financial discrepancies, unrealistic pricing expectations, or misalignment between interests. This analysis helps refine your business plan for future dealings. Maintain Momentum Keep your network active. Attend industry events, participate in business mixers, and engage with other small business owners. Networking can lead to new partnerships, potential funding options, or alternative sales opportunities. Communicate Openly Contact all affected stakeholders, from team members to potential clients. Keeping lines of communication open fosters trust and shows resilience. This transparency can strengthen relationships for future negotiations. Long-Term Considerations Re-evaluate Your Business Model After a deal falls through, adjust your business model where necessary. Consider market research to identify areas for improvement, ensuring your offerings align with your target audience’s needs. Enhance Your Legal Structure Review your legal setup and consider options like an LLC or corporation for better protection against deal-related risks. A solid legal structure safeguards your interests and adds professionalism to future ventures. Invest in Professional Development Seek mentorship or advice from business coaches. Engaging with successful entrepreneurs can provide insights that enhance your approach and decision-making in future deals, potentially leading to a stronger growth strategy. Strengthen Financial Management Implement effective accounting and budgeting practices. Accurate financial tracking ensures clarity and aids in recognizing funding options or partnerships that can support a new venture. Build Your Brand and Marketing Strategy Focus on developing a robust digital marketing and branding strategy. An effective online presence, supported by SEO and content marketing, can enhance customer acquisition and boost sales opportunities in the long run. Prepare for Future Negotiations Be proactive in negotiation skills development by practicing pitches and developing clear presentations. A well-prepared approach can make a significant difference in future transactions, increasing the likelihood of success. By taking these steps, you can turn setbacks into learning experiences that bolster your business’s resilience and readiness for subsequent opportunities. Conclusion Experiencing a deal fall through can be disheartening but it doesn’t have to define your journey. By understanding the reasons behind these setbacks you can turn disappointment into a valuable learning experience. Embrace the lessons learned and use them to refine your approach in future negotiations. Staying proactive and adaptable is key. Focus on clear communication and thorough preparation to build trust with your stakeholders. Remember that resilience and a willingness to learn will not only help you recover from failed deals but also position you for greater success in the long run. Keep pushing forward and seize the opportunities that await you. Frequently Asked Questions What causes deals to fall through? Deals can fall through for various reasons, including incomplete documentation, financial issues, misalignment of interests, adverse market conditions, and legal challenges. Recognizing these factors helps you prepare for future transactions. How can I prevent my deal from collapsing? To prevent deals from collapsing, prioritize effective communication and thorough due diligence. Align discussions with buyer priorities, conduct comprehensive market research, and share relevant findings transparently to foster trust among stakeholders. What should I do if a deal falls through? If a deal falls through, avoid excessive self-blame. Assess what went wrong, maintain networking momentum, and communicate openly with stakeholders. This helps in learning from setbacks and preparing for future opportunities. What is the emotional impact of a failed deal? A failed deal can lead to disappointment and frustration for stakeholders, including entrepreneurs, employees, and investors. Understanding that these emotions are common can help individuals cope better and build resilience. How can I improve my negotiation skills after a setback? To improve negotiation skills, focus on learning from past experiences. Re-evaluate your business model, invest in professional development, and strengthen your financial management. This proactive approach prepares you for future negotiations. Image Via Envato This article, "Understanding Deal Falling Through: Causes, Impacts, and Recovery Strategies" was first published on Small Business Trends View the full article

-

Tax dodging by rich could be ‘much greater than thought’, says UK audit office

Watchdog issues warning after tax authority succeeds in raising more tax from wealthy than previously estimatedView the full article

-

Storage Unit ROI: Key Factors for Maximizing Returns

Key Takeaways Strong Returns: Storage units typically yield annual returns between 8% and 12%, often outperforming other real estate investments due to lower operational costs and capital requirements. Key Metrics: Understanding and calculating important ROI metrics, such as cash-on-cash return and capitalization rate, is essential for assessing the profitability of your storage facility investment. Impact of Location: The location of your storage facility plays a significant role in profitability, with urban areas generally attracting higher occupancy rates and rental income. Operational Efficiency: Managing operational expenses effectively, including maintenance and utilities, directly influences profit margins. Streamlined operations can help maximize profits. Market Demand and Competition: Evaluating local market demand and competition can inform pricing strategies, ensuring your facility remains competitive while optimizing rental income. Additional Revenue Streams: Incorporating ancillary services, such as moving supplies and truck rentals, can enhance overall customer experience and significantly boost income potential from your storage investment. Investing in storage units can be a smart move for generating significant returns. With average annual returns ranging from 8 to 12 percent, self-storage facilities often outperform other real estate investments due to their lower operating costs and capital expenditures. As demand for storage solutions continues to rise, understanding the return on investment (ROI) becomes crucial for maximizing your profits. Calculating ROI in the self-storage sector involves assessing metrics like cash-on-cash returns and capitalization rates. These figures help you gauge the potential profitability of your investment while accounting for factors like debt service, taxes, and ongoing maintenance costs. Whether you’re a seasoned investor or just starting out, grasping the intricacies of storage unit ROI can pave the way for a rewarding venture in this thriving industry. Understanding Storage Unit ROI Understanding storage unit ROI is crucial for maximizing annual income when owning storage units. The return on investment varies based on several factors including location, market conditions, and operational efficiency. Generally, average annual returns range from 8 to 12 percent. This performance often exceeds other real estate investments due to lower operational costs and capital expenditures. To effectively assess how profitable self-storage units are, utilize two key metrics: cash-on-cash return and capitalization rate. Cash-on-cash ROI calculates the rate of return on cash invested each year. It presents a straightforward percentage that reflects your annual income from the storage unit. The capitalization rate, on the other hand, indicates the potential return based on net operating income (NOI) relative to the property’s value. For example, if you invest $1 million in a storage facility and generate an NOI of $100,000, this signifies a 10 percent cap rate. You’ll recoup the initial investment in ten years, provided other factors remain constant. Knowing these metrics enables you to determine if storage facilities are a good investment. Evaluating additional costs is essential for assessing profitability. Factors like debt servicing, property taxes, and maintenance expenses directly impact your bottom line. Ignoring these costs can lead to misleading calculations, affecting your overall storage facility profit margin. Once you grasp the essential elements of storage unit income, you can make informed decisions. Researching local market conditions and competitor pricing aids in establishing optimal rental rates. Understanding pricing strategies ensures a healthy profit margin while maximizing occupancy rates. By successfully implementing these strategies, you enhance your understanding of how much you can make owning a storage facility, increasing your chances of self-storage profits. Factors Influencing Storage Unit ROI Understanding the factors influencing storage unit ROI is essential for maximizing your annual income from owning storage units. Several key elements play a vital role in determining profitability in this sector. Location and Market Demand Location significantly impacts the profitability of your storage facility. Facilities situated near high-density urban areas tend to attract more customers, leading to higher occupancy rates and increased rental income. Therefore, positioning your storage units close to residential or commercial centers enhances demand. Additionally, market demand influenced by local economic conditions—such as low unemployment and population growth—can drive up requests for storage services. In areas with limited competition, your facility can capture a larger market share, further improving your storage unit income. Facility Features and Management Investing in security features and amenities can differentiate your storage units from competitors, increasing appeal to potential renters. Features like 24/7 CCTV, gated access, climate control, and convenient drive-up access attract a wider customer base and allow you to command higher rents. Moreover, efficient management practices can lead to lower operating costs and increased self-storage profits. Focusing on operational efficiency reduces expenses while maintaining quality service, ultimately enhancing your overall profit margin. Pricing Strategies and Revenue Generation Implementing effective pricing strategies directly impacts your storage facility’s financial health. Consider dynamic pricing, which adjusts rental rates based on demand and seasonal trends. This approach optimizes revenue potential. Additionally, offering diversified services, such as moving supplies or truck rentals, can create additional revenue streams. Utilizing sales promotions and rent discounts during slow seasons can also attract new customers. By managing rental rates and effectively generating revenue, you can maximize the profitability of your storage units and ensure your business remains competitive in the market. Comparing Storage Unit ROI to Other Investments Storage units offer compelling returns compared to many traditional investment options. The average annual ROI for self-storage facilities can reach up to 11%, with historical performance as high as 16.9% from 2009 to 2018. These returns often outpace other sectors of commercial real estate like retail and office spaces, which can vary significantly in profitability. Focusing on specific investment types allows for clearer comparisons: Investment Type Average Annual ROI Self-Storage Up to 11%, 16.9% (2009-2018) Stocks (S&P 500) Around 7-10% Real Estate (General) Varies widely by sector Lower operating costs and less complexity in management contribute to the attractive ROI of storage facilities. Self-storage units typically incur lower capital expenditures than residential or commercial properties, translating to higher profit margins. However, profits can vary based on factors like location and market demand. Self-storage can benefit from market stability and scalability. High demand for storage solutions leads to consistent rental income, making them a good investment option. Considering the recurring revenue model, facility owners often enjoy strong cash flow, increasing average annual income owning storage units. Assessing profitability is essential, and metrics like cash-on-cash return and capitalization rates help in evaluating performance. Factors such as facility management, tenant demand, and operational efficiency significantly influence how profitable self-storage units can be. Location plays a vital role in determining how much you can make owning a storage facility. Facilities in urban areas tend to achieve higher occupancy rates and rental prices. Implementing effective pricing strategies can further maximize revenue and enhance your storage unit income potential. Overall, understanding these dynamics highlights why many investors ask, “Are self-storage units a good investment?” The evidence strongly supports that well-managed, strategically located storage facilities are profitable ventures that can yield substantial self-storage profits. Challenges Affecting ROI in Storage Units Understanding the challenges impacting storage unit ROI is essential for small business owners looking to maximize their annual income owning storage units. Various obstacles can affect profitability, particularly operational expenses and market competition. Operational Expenses and Maintenance Operational expenses significantly impact the profit margin for storage facilities. Costs such as property maintenance, utilities, insurance, and property taxes typically account for 30-40% of gross rental income. Efficient management of these expenses is crucial. Implementing streamlined processes and utilizing management software can optimize operations, ultimately enhancing self-storage profits. Paying attention to regular maintenance helps prevent costly repairs and ensures a positive experience for tenants. The combination of controlled operational costs and ongoing maintenance leads to improved self-storage profit margins. Market Competition and Economic Factors Market competition poses another challenge that can influence your bottom line. Areas with numerous competing storage facilities may experience lower occupancy rates, impacting your rental income. Thorough market research is vital to understanding local demand and competitive pricing strategies. Economic factors, such as job growth and population trends, also play a role. If a location lacks steady growth, it can diminish profitability. Offering additional services beyond basic storage, such as security features or climate-controlled units, can differentiate your facility and draw more customers. By addressing competition and market dynamics effectively, you can enhance the performance of your storage facility and improve the likelihood that it remains a profitable investment. Maximizing ROI in the Storage Unit Business Maximizing ROI in the storage unit business involves strategic approaches that enhance visibility and optimize pricing for increased income. Understanding these components plays a critical role in determining whether self-storage units are a good investment. Strategic Marketing and Visibility Increase your storage unit income by implementing a robust marketing strategy. Focus on establishing an online presence through search engine optimization (SEO) and active social media engagement. This approach helps attract potential clients searching for storage solutions. Utilize local advertising tactics to reach nearby residents, as local demographics substantially influence customer acquisition. Encouraging customer reviews and testimonials boosts your facility’s reputation. Positive feedback from satisfied customers reinforces your credibility and can sway potential renters’ decisions. Additionally, participating in community events and partnerships with local businesses raises awareness and visibility. When people consider your storage facility, strong visibility translates directly into increased occupancy rates, which ultimately enhances profitability. Optimizing Pricing and Diversification To maximize annual income owning storage units, carefully analyze local market rates. Continuously monitor competitor pricing to ensure your rates remain attractive yet profitable. Implement dynamic pricing strategies that adjust based on demand fluctuations, allowing you to capitalize on peak times. Striking a balance between competitive pricing and maintaining profitability is crucial for sustaining a healthy profit margin. Diversifying your services provides additional revenue streams. Consider offering moving supplies, truck rentals, and insurance options. These ancillary services create a comprehensive storage solution, enhancing the overall customer experience and positioning your facility as a one-stop-shop for storage needs. When evaluating whether storage facilities are profitable, it’s essential to recognize that these additional offerings can significantly contribute to overall financial success. By focusing on strategic marketing efforts and optimizing your pricing model, you can effectively navigate the storage unit business landscape and increase your ROI. The cumulative effect of these strategies leads to a more lucrative operation, ensuring your investment in self-storage translates into substantial profits. Conclusion Investing in self-storage units can be a smart move for your portfolio. With the right strategies in place you can maximize your returns and enjoy a stable income stream. By focusing on location market demand and effective management you’ll position your facility for success. Understanding and calculating your ROI is crucial for making informed decisions. Keep an eye on operational costs and market competition to protect your profit margins. With a well-thought-out approach you can tap into the growing demand for storage solutions and secure a profitable investment for years to come. Embrace the opportunities within the self-storage market and watch your investment thrive. Frequently Asked Questions What are the returns on self-storage? Self-storage investments typically yield attractive returns, often averaging between 8% to 12% annually. Some facilities have historically achieved returns as high as 16.9%. Low operating costs and steady demand contribute to these appealing returns. Do storage units cash flow? Yes, storage units can generate positive cash flow, which is crucial for maintaining financial health. The income from rentals should exceed operational expenses, ensuring that investors optimize their cash flow for sustainability and profitability. Are storage units recession-proof? While no investment is entirely recession-proof, self-storage tends to perform better during economic downturns. People often downsize or store belongings, maintaining demand for storage solutions even in challenging economic times. Are storage units good for passive income? Yes, self-storage units offer a reliable source of passive income due to consistent demand and lower management complexities. Investors can benefit from steady rental income with minimal day-to-day involvement compared to other real estate investments. Is a storage unit a good investment? Absolutely, self-storage units are often viewed as a solid investment. They provide high earning potential and lower costs compared to residential or other commercial properties, making them a popular choice among investors seeking strong ROI. This article, "Storage Unit ROI: Key Factors for Maximizing Returns" was first published on Small Business Trends View the full article

-

Storage Unit ROI: Key Factors for Maximizing Returns