Everything posted by ResidentialBusiness

-

Meta readies $25bn bond sale as soaring AI costs trigger stock sell-off

Social media group sheds $200bn in market value as Mark Zuckerberg’s investment plans spook investorsView the full article

-

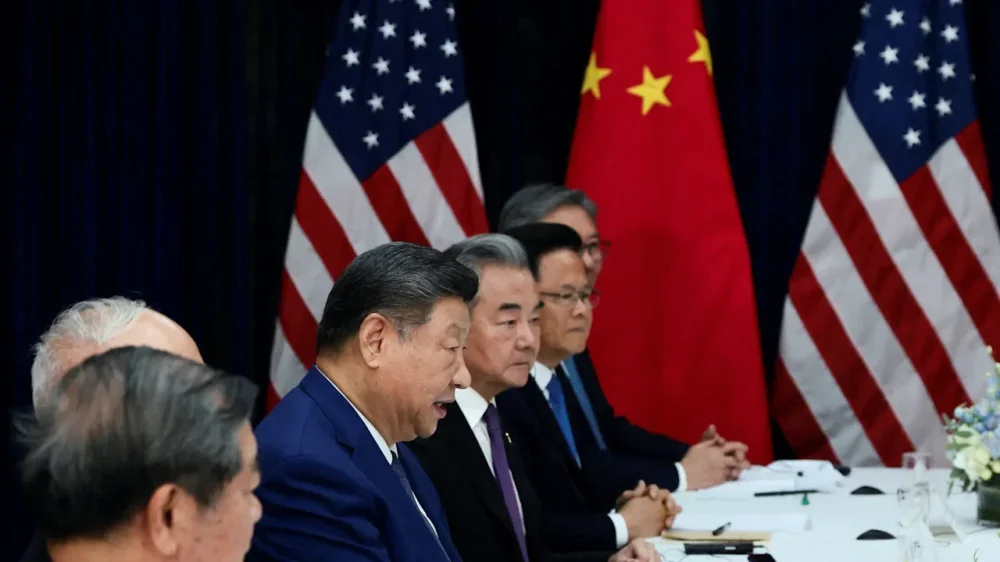

Trump-Xi summit brings a tactical truce

U.S. President Donald The President hailed a meeting with China’s Xi Jinping as “amazing” and “12” on a 10-point scale, but the agreement the two leaders reached appears to be no more than a fragile truce in a trade war with root causes still unresolved. The framework announced on Thursday—that includes China resuming soybean purchases, suspending its rare earths export curbs for a year, and the U.S. lowering tariffs on China by 10%—broadly rewinds ties to the status that existed before The President’s “Liberation Day” offensive triggered tit-for-tat escalation. But the deal exposes the fundamental mismatch between what Washington wants and what Beijing is willing to offer. Absent from the talks were the big issues cited by The President as he launched his tariffs in April—China’s industrial policies, manufacturing over-capacity, and its export-led growth model. “So what are we talking about? We are talking about de-escalation of the measures that both sides have taken since the start of the The President administration in this kind of escalating trade war,” said Emily Kilcrease, director at the Center for a New American Security. The outcome underscores the robustness of Xi’s new approach to dealing with the U.S., which relies on a broad toolbox of measures like export controls, swiftly deployed in response to each move by the The President administration. An official briefed on the deliberations said the Chinese had a realistic set of expectations for this encounter—and those did not include a fundamental reset of two-way ties. They were nonetheless happy with The President’s tone coming in and his framing of the meeting as a “G2”, said the official, who declined to be named or further identified because he was not authorised to speak to the media. China sees this as a stepping stone to a bigger meeting where they can stabilize the relationship, the official added. ‘World-class leaders’ Given the long-simmering tensions, the very fact that both leaders had a warm meeting—and agreed to two follow-up visits next year—offers rattled multinational corporations caught in the middle a much needed reprieve, say experts. Xi opened the talks, which took place ahead of the Asia-Pacific Economic Cooperation summit, by saying that “China’s development and rejuvenation are not incompatible with President The President’s goal of ‘Making America Great Again’.” He added that he was willing to work with The President to “lay a solid foundation for China-U.S. relations and create a favourable environment for the development of both nations.” The President emerged from the encounter glowing, chit-chatting and leaning into Xi as both left the venue, later calling him the “great leader of a great country,” and saying that this is how two global superpowers should deal with one another. “When we have this limited time-frame, the deal and the deal-making structure both function as an engagement mechanism between the two countries, so they can address the issues properly and adjust their mutual interests down the road to make sure people keep talking to each other,” said Bo Zhengyuan, Shanghai-based partner at research consultancy Plenum. The President said that tariffs on Chinese imports would be cut to 47% from around 57% by halving the rate of levies related to trade in fentanyl precursor chemicals to 10% from 20%. Xi will work “very hard to stop the flow” of the chemicals used for the production of the deadly opioid that is the leading cause of American overdose deaths, The President said, acknowledging that the issue was complex. The tariff was reduced “because I believe they are really taking strong action,” he added. China’s Foreign Minister Wang Yi emphasised that The President and Xi were “world-class leaders” in a Monday call with his U.S. counterpart Marco Rubio. “Their long-term engagement and mutual respect have become the most valuable strategic asset in U.S.-China relations,” he told his American counterpart, in unusually effusive language for a Chinese diplomat. ‘Difficult situation’ The deal buys both sides some breathing room: The President gets a win before his planned visit to Beijing in April, Xi gets relief from elevated U.S. tariffs that have put pressure on Chinese manufacturers. But even this tactical detente is incomplete. China’s latest rare earths licensing curbs are delayed, not dismantled, but earlier restrictions on the critical minerals that have upended global trade remain, leaving U.S. factories facing ongoing uncertainty in sourcing critical materials. “I think that what we’ve seen this year has been a more or less total vindication of China’s strategy of never striking first but always striking back,” Joe Mazur, geopolitics analyst at Trivium China, a consultancy. “It’s very clear that rare earths is the primary piece of leverage, the ace in the hole that China is able to wield over the U.S.—it doesn’t look like the U.S. has any comparable leverage or any way of breaking the stranglehold for the time being.” The agreement also highlights how dramatically the relationship between the world’s two biggest economies has deteriorated since The President’s first term, when negotiators produced a comprehensive 96-page document covering intellectual property, banking, and agriculture. This time around, the talks were far less intensive and both sides only offered relatively brief readouts that mostly focused on holding back threats made in the run-up to the talks. Da Wei, the director of Tsinghua University’s Centre for International Security and Strategy, warned that repeated escalations could exhaust Xi and The President’s personal rapport. “If the escalation of tensions happens many times, probably the patience and trust between the two leaders at a personal level will run out,” he said. “Then we will have a very difficult situation.” —Trevor Hunnicutt, Laurie Chen, and Mei Mei Chu, Reuters View the full article

-

Starbucks finally said how many U.S. stores it closed: The list of locations was bigger than many estimates

Starbucks released its fourth-quarter earnings on Wednesday, October 30, finally providing an official figure for its recent wave of store closings. The Seattle-based coffee chain shuttered a total of 627 locations worldwide over the three months, ending up with a net closure of 107 stores. More than 90% of impacted locations were in North America, Starbucks said. In the United States, 520 stores were shuttered as part of the company’s turnaround efforts, Starbucks disclosed in an earnings release. Starbucks now runs 40,990 stores globally and 16,864 in the United States. Estimates of store closures varied widely In September, Starbucks announced the shuttering of stores in North America, but it didn’t identify specific locations or an exact figure. Working with limited information, news outlets made a number of different estimates at the time, ranging from around 100 closures to over 400. The number disclosed by Starbucks this week is above even many of the higher-end estimates. Moderators of the subreddit r/Starbucks, meanwhile, had created a crowdsourced Google Doc for confirmed closures. When reached by Fast Company for comment on store closure locations, a Starbucks representative said the company does “not have that to share.” The representative pointed to a September blog post from CEO Brian Niccols and said, “The best place for up-to-date hours of operation for our coffeehouses in the Starbucks app.” All part of the plan The significant number of store closures came as part of the company’s “Back to Starbucks” restructuring plan, which Niccols has been championing as key to growing the coffee chain’s foot traffic. In July’s third-quarter earnings report, Starbucks said that the plan “focuses on exceptional service, simplified routines, and deeper customer connections.” For Starbucks, that means expanding the assistant manager role across U.S. stores, hiring 90% of retail workers internally, and a lot more seating. Yes, Starbucks wants to move away from machines and mobile orders to create a warm, inviting in-store experience. According to Niccol, it’s working. “We’re a year into our ‘Back to Starbucks’ strategy, and it’s clear that our turnaround is taking hold,” he said in a statement. “Our return to global comp growth and the momentum we’re building give me confidence we’re on the right path to deliver the very best of Starbucks for our customers, partners and shareholders.” U.S. stores fell 2% on comparable sales year-over-year (YOY) in quarter three, while this quarter saw comparable sales remain the same YOY. Shares of Starbucks Corporation (Nasdaq: SBUX) were up around 1.17% in early trading on Thursday. The stock is down roughly 7.62% year to date. View the full article

-

OpenAI’s Atlas ushers in the era of AI browsing. Here’s what it means for media

For the past 30 years, the web browser has been the primary way humans navigate the internet. It makes sense, then, that as artificial intelligence becomes more humanlike in its capabilities, it would use the same tool. That’s basically the idea behind AI-powered browsers, which are definitely having an “it” moment now that OpenAI has launched Atlas, its own web browser that incorporates ChatGPT as an ever-present helper. Atlas follows Perplexity’s Comet, which arrived in the summer to quickly capture the imagination of what an AI browser could do. In both cases, the user can, at any time, call up an AI assistant (aka agent), able to perform multistep tasks—such as navigating to a grocery retailer and filling an online shopping cart with ingredients for a recipe—from a simple command. Atlas vs. Comet: Who has the smarter browser? Who has the better experience? Based on features, the clear winner is Comet, which boasts Chrome-like functionality, supporting multiple user profiles, extensions, and more buttons for specific, fast AI-powered actions, such as instant summarization of web pages. However, because ChatGPT is the go-to AI that over 800 million people now use, that context represents a huge advantage. When you call up the chatbot in Atlas, you can simply point to the relevant conversation, plus it will remember aspects of your browsing experience to better help you. The Atlas-vs.-Comet fight may be moot, though, since Google Chrome is the incumbent browser for most people (it has 74% market share worldwide), and it has AI features, too. Chrome’s large user base, however, also means Google can’t move as fast: Since the whole idea of AI agents taking control of your browser to perform tasks is fraught with security concerns, Google’s Gemini assistant in Chrome is relatively feeble; if you ask it to, say, shop for you on Amazon, it’ll give you the digital equivalent of a shrug. So Chrome’s continued dominance in the AI era isn’t assured. But the question of who will win the AI browser war doesn’t matter so much as whether AI browsing will take off at all. I’ve been using Comet heavily for a few months, and although I find the idea of an agent doing all my tedious internet tasks compelling, I’ve found the actual set of things it can do to be quite narrow. Generally, the task needs to be something that doesn’t require a lot of specialized context (since the AI can’t read your mind) or complex prompting (since spending several minutes crafting a prompt is time you could use to just do the task yourself). Nonetheless, OpenAI imagines a future where most of the activity online is done via AI agents in browsers like Atlas. In its announcement, it says, “This launch marks a step toward a future where most web use happens through agentic systems—where you can delegate the routine and stay focused on what matters most.” OpenAI could be right. Those narrow use cases for agentic browsing could be expanded greatly with more elegant and comprehensive merging of personal context and the browsing experience. If the agent understands the entire background of what you’re doing—the why—and gets better at navigating the web (as it inevitably will), AI browsing might even burst through to the mainstream. What agentic browsing means for publishers If that happens, it would have huge implications for the media. Because not only will people get a lot of their information through the lens of their preferred AI agent, the tasks performed on their behalf will be informed by content seen through that same lens. For example, an agent told to search for a “stylish suit” would need to essentially Google what’s in style, then use that information to complete the task. No human eyeballs ever look at the content it uses to research what’s in style, but getting the right information is a crucial part of the agent performing the task well. How agents access that information, and what they do with it, are important questions to answer in building the framework of how all this works. The whole area of how AI systems access information is of course hotly contested, generating several lawsuits, but there is some consensus. OpenAI made clear in the launch announcement that it would not use Atlas as a “backdoor” to train on content that was otherwise blocked from its training bot. However, access for the agent itself is controversial. AI companies maintain that agents are proxies for users, and should, in many cases, be allowed to bypass bot controls to access content and services that a human could access. Others don’t see it that way—that because an agent is a robot, with no human attention to cater to, it should not be treated as human, and sites should have the option to block agents specifically. This is essentially the core of what Perplexity and Cloudflare were arguing about this summer. With the release of Atlas, AI browsing can only accelerate, and answering these questions will become more urgent. Media strategy depends on knowing who your audience is, understanding how they access your content, and having reliable ways of monetizing that behavior. Right now none of those components are well defined for a future where the primary users of the internet are browser agents. It’s not just a question of whether sites should be able to block agents specifically. That’s just a building block in creating a system where an agent can work autonomously to either pay or register to access certain content, or prove it has a license to do so. For example, if a subscriber to Fast Company asks their agent to do a task, and in the course of that task needs information the publication can provide, access should be seamless and, importantly, measurable. But if you don’t have a subscription, your agent will be blocked and need to go elsewhere—regardless of whether the actual article is paywalled for humans. The real power of this idea is in the aggregate, where licensing deals carry over to users of the AI. In the case of OpenAI, which has licensed content from several media companies, that could theoretically carry over to its agents. And since agent activity is measurable, there could theoretically be a way for publications to reach those AI users and turn them into more engaged audience members. It could all be done anonymously, through the AI provider, based on user activity. When your audience isn’t human It’s questionable whether most web browsing in the future will be done by bots, but regardless of the proportion, it seems likely that agentic activity on the web will expand significantly, as security concerns are slowly resolved. That means publishers will need to adapt to a world where bots acting on behalf of users become a big part of their audience, and deciding what those agents see and how much they will pay will be critical. The fundamental question in front of us now, however, is figuring out who decides: the people making the content or the people making the agents. View the full article

-

WhatsApp Is Rolling Out Passkey Support for Encrypted Backups

In the beginning, WhatsApp users could not protect their chat backups with encryption—while all communications were encrypted end-to-end, backups weren't afforded the same protection. Since 2021, however, WhatsApp has offered two ways for users to encrypt these backups: a standard password, or a 64-digit encryption key. There are security issues with both of these methods. Passwords can be secure, but let's be real, many of us use very simple passwords that are easy to remember, and, in some cases, we even repeat passwords from account to account to make things easier on our brains. If your password for WhatsApp backups is the same password you use for your email, and the latter gets leaked, hackers can easily break into your WhatsApp backups. Not good. (Side note: Please use a strong and unique password for all of your accounts.) The 64-digit encryption key, on the other hand, is extremely secure. It would take a computer a long time to crack (perhaps a few lifetimes) and would be essentially impossible for a human to guess. But it's 64 characters long. You're not going to remember it, and if you don't store it somewhere safe and secure, you could lose track of it—and with it, access to your encrypted chat backups. Again, not good. On Thursday, however, WhatsApp announced it is adding a new authentication method to protect your encrypted backups, and a big improvement over the existing two options: passkeys. If you choose to encrypt your chat backups with a passkey, you'll be able to decrypt them the same way you unlock your device, such as with your fingerprint, face scan, or device passcode. Passkeys offer the best of both passwords and two-factor authentication (2FA). The "key" is stored on-device or associated with your account, so there's no passphrase to remember, write down, or store in a password manager. That means you don't need to worry about it landing in a hacker's hands due to a data leak. The only way to access the passkey is to authenticate yourself with a connected and trusted device, such as your smartphone. Without your fingerprint, face scan, or passcode, no one is getting into your encrypted backups. How to check if you have passkey supportWhatsApp says it is gradually rolling out this passkey support "over the coming weeks and months." To check if your account supports it, head to Settings > Chats > Chat backup > End-to-end encrypted backup. View the full article

-

the belligerent unicorn, the inappropriate vampire, and other stories of Halloween at work

In honor of Halloween tomorrow, here are eight of my favorite stories about Halloween at work that have been shared here over the years. 1. The costume tradition For close to 15 years now, dressing up as one of your coworkers has been a Halloween tradition where I work. It actually started when someone came dressed as me the first year. A year later, I waited until I saw what a coworker was wearing that day, got a co-conspirator to bring a matching outfit, and sat down next to them. People have worn the CEO’s face printed out as a mask. Nobody’s ever gotten offended by it, it’s just a strange tradition now. I think it has more to do with the culture and the intent than anything else.. our clones are in a spirit of fun and respect. 2. The skeletons I was working from home on Halloween when an email was sent to the whole department about free Halloween goodie bags for everyone in the office. Which was then closely followed by an email explaining that the skeletons were not edible! I spent the rest of the day imagining different ways someone might accidentally eat a plastic skeleton. 3. The M&M’s A company I worked for went all in for Halloween. Each department picked a theme to decorate their desks and wore costumes. There was a competition with prizes. Most of us in accounts were Type A ladies who shared a brainwave and completed each other’s sentences, etc. We decided to decorate our department like Candyland and dress up as M&M’s. The Candyland deskscape was magnificent and all of us showed up on October 31st with either a store bought M&M costume or a colourful sweatshirt with an M on it … except for our one new colleague. He showed up dressed up as Eminem. The look on our faces and his face as it dawned on all of us that we had verbally communicated all of the ideas, and he hadn’t put the candy and candyland theme together and literally thought we were all dressing up as Marshall Mathers! So we decided for our contest presentation of the theme he would rap along to “Lose Yourself” while throwing out Candyland cards like money and we would all dance like his backup act while walking through the board game we’d built in our department. It was so amazing and we won the contest. People were laughing about it so much, and still talked about it years later. 4. The makeup I was in my mid-twenties when I decided to try my hand at wound make-up. Nothing terribly grisly; just a gash on my forehead and some bruising that, if you looked too closely, probably had some sparkle to it because I definitely used eye shadow. I worked for a warehouse club at the time (think Costco, Sam’s, BJ’s, etc.), but I wasn’t customer-facing really, and since I was going to be spending the day in a tiny closet of an office by myself counting cash sent over from cashiers, I didn’t think the wound make-up would be a big deal. Except that it was apparently more convincing at first glance than I realized. The first manager to see me that morning panicked momentarily because he thought I’d been injured, and, later, a coworker saw me and blurted out, “WHO DID THAT TO YOU?!” I ended up removing everything within the first couple of hours of my shift. (And I’m glad I did! Like, I wasn’t OFTEN customer-facing in that role, but I did have to help on the floor sometimes. I don’t know WHAT I was thinking.) 5. The face mask During Covid, my division of my company (around 150 people spread around the country) started having monthly contests and the winner would be announced during our monthly team calls. In October, the contest was “show us your favorite mask” – you know, Halloween-themed. So, as a joke, I put on a clay face mask (the kind for skin care) instead of some monster mask and emailed a photo off to the coordinator with a snarky “does this count” lol. I hit reply-all accidentally. And realized it far too late to recall it. The only balm (uh, aside from the facemask) for my mortification was I tied for the win. Was it out of pity? Probably. Don’t care – I used that $10 Amazon card like nobody’s business! 6. The belligerent unicorn For years, I worked in a landmark building in a major American city with very strict security protocols. We all had a badge with our photo and name on it that was verified by security every time we entered the building. One Halloween, one of my colleagues came to work dressed up as a unicorn. He walked into the building with a full-on unicorn mask that completely covered not just his face, but his entire head. Security stopped him in the lobby and told him he needed to take the mask off before he went any further. My colleague refused to remove the mask, and instead showed security his badge with his name and photo. Security said, “That’s not enough. You need to remove the mask so that we can be sure that you are the same person in the photo.” My colleague continued to refuse. This went on … for a while. Eventually building security called our office to explain the situation and asked for our help in resolving it. But it was no use. My colleague refused to remove his mask and refused to leave the building. At one point, he suggested taking a new security photo with the mask on so that his physical presence would match his security badge. He never made it up to the office, not just on that day, but any day thereafter. He was fired for being a dick to the building security staff and showing terrible judgement for a simple request. He had always been a little weird, but I never expected him to die on the hill of wearing a unicorn mask into the building. 7. The inappropriate vampire A receptionist at my old job wore a vampire costume that was equal parts sexy and horrifying. Her corset, booty shorts, fishnets, and thigh-high platform boots seemed to be at war with Hollywood-grade blood spattered all over her face and throat, dripping and congealing in hyperrealistic fashion. She had white-out contacts that completely hid her irises and reduced her pupils to tiny pinpricks. Her teeth interfered with her ability to enunciate, leading to confusion when she answered the phone, and she asked to be excused from mail duty, since all of the reaching and twisting associated with that task placed her at risk for wardrobe malfunctions. She went home at lunch. 8. The pumpkin carving contest We had a pumpkin carving contest between departments, which went off nicely enough. Except we forgot how much the office cat loved pumpkin. And I mean LOVED pumpkin. Everyone’s jack o’ lanterns had chomp marks within hours. At the end of the day, all teams were supposed to either take theirs home or put it outside in the garden to compost. One team forgot. The cat ate three-quarters of it overnight. We gave them litter box duty as penance. The post the belligerent unicorn, the inappropriate vampire, and other stories of Halloween at work appeared first on Ask a Manager. View the full article

-

Salesforce Ventures Accelerates AI Investments, Backing 35 Innovators

Salesforce Ventures, a subsidiary of the tech giant Salesforce, is making significant strides in the rapidly evolving realm of artificial intelligence (AI) with its AI fund, now totaling over $850 million in deployed investments. Small business owners should pay close attention to these developments, as the investment in AI is poised to redefine the competitive landscape and create numerous opportunities for innovation. This move follows Salesforce’s impressive expansion of its AI fund to $1 billion last year and positions its portfolio in line with leading innovators in the AI sector. With investments in 35 AI-first companies, including names like Anthropic and Cohere, Salesforce Ventures has built a collective valuation of over $270 billion within its portfolio. This reflects a robust commitment to discovering and backing companies that are not only pioneering technologies but also shaping the future of enterprise operations. Paul Drews, Managing Partner at Salesforce Ventures, observed, “After 15 years of investing in enterprise technology, we’ve seen how monumental platform shifts create new market leaders. We believe AI is the most profound platform shift of our time.” His insights emphasize a vital takeaway: AI is no longer just a tool for large corporations; it’s transforming industries that small businesses inhabit. For small business owners, this development represents a unique opportunity. The ongoing focus from Salesforce Ventures on securing trustworthy AI enables startups and smaller firms to tap into cutting-edge technology, which could allow them to streamline operations, enhance customer experiences, and unlock new revenue streams. Moreover, Salesforce Ventures has demonstrated a founder-first approach, committing to teams beyond just financial backing. By offering valuable market insights and a powerful global network, they provide a framework that small businesses can leverage as they embrace innovative technologies. Krishna Rao, CFO of Anthropic, shared this sentiment, stating, “Salesforce Ventures has been an important partner…They have provided valuable customer insights and helped Anthropic scale faster.” The latest push towards integrating AI into mainstream enterprise operations signals a shift from mere experimentation to practical applications. Leaders in AI are now focusing on creating solutions that address real-world challenges, particularly in automating processes and improving efficiency. This trend could offer small business owners numerous possibilities—from chatbot services that enhance customer service to AI-driven analytics that inform marketing strategies. However, small business owners should also be aware of potential challenges as they navigate this new landscape. While integrating AI can lead to significant efficiencies, the upfront costs and complexity of these technologies might pose barriers. Finding the right tools that match their specific needs and budget could require careful consideration. Additionally, as AI becomes a fixture in business operations, the demand for skilled employees who can manage and optimize these technologies may rise, potentially leading to labor shortages in the tech-savvy job market. Salesforce Ventures is not only investing in existing players but is also actively seeking emerging companies in the field. This relentless search underscores the message that for small businesses, staying ahead of trends—be it in automation or AI—could be the key to sustainable growth. John Somorjai, President of Salesforce Ventures, asserted, “Enterprises are moving beyond experimentation to full-scale production with AI…The companies that will win aren’t just building better models; they’re building more resilient businesses around transformative AI capabilities.” For small business owners looking to capitalize on these trends, engaging with the evolving AI ecosystem could be transformative. From leveraging existing AI tools to considering partnerships with innovative startups, there is a landscape rich with options for those willing to adapt. Salesforce Ventures aims to be a long-term partner for those navigating the AI revolution, lending both financial support and market insights. For businesses keen on understanding how to integrate AI effectively, tapping into resources like Salesforce’s global network could prove invaluable. As this new era unfolds, small business owners must remain vigilant and proactive. Embracing AI not only offers a path to operational resilience but also positions businesses to be competitive players in a dynamic market being reshaped by technology. For more information on this initiative, you can read the original press release. Image via Envanto This article, "Salesforce Ventures Accelerates AI Investments, Backing 35 Innovators" was first published on Small Business Trends View the full article

-

Salesforce Ventures Accelerates AI Investments, Backing 35 Innovators

Salesforce Ventures, a subsidiary of the tech giant Salesforce, is making significant strides in the rapidly evolving realm of artificial intelligence (AI) with its AI fund, now totaling over $850 million in deployed investments. Small business owners should pay close attention to these developments, as the investment in AI is poised to redefine the competitive landscape and create numerous opportunities for innovation. This move follows Salesforce’s impressive expansion of its AI fund to $1 billion last year and positions its portfolio in line with leading innovators in the AI sector. With investments in 35 AI-first companies, including names like Anthropic and Cohere, Salesforce Ventures has built a collective valuation of over $270 billion within its portfolio. This reflects a robust commitment to discovering and backing companies that are not only pioneering technologies but also shaping the future of enterprise operations. Paul Drews, Managing Partner at Salesforce Ventures, observed, “After 15 years of investing in enterprise technology, we’ve seen how monumental platform shifts create new market leaders. We believe AI is the most profound platform shift of our time.” His insights emphasize a vital takeaway: AI is no longer just a tool for large corporations; it’s transforming industries that small businesses inhabit. For small business owners, this development represents a unique opportunity. The ongoing focus from Salesforce Ventures on securing trustworthy AI enables startups and smaller firms to tap into cutting-edge technology, which could allow them to streamline operations, enhance customer experiences, and unlock new revenue streams. Moreover, Salesforce Ventures has demonstrated a founder-first approach, committing to teams beyond just financial backing. By offering valuable market insights and a powerful global network, they provide a framework that small businesses can leverage as they embrace innovative technologies. Krishna Rao, CFO of Anthropic, shared this sentiment, stating, “Salesforce Ventures has been an important partner…They have provided valuable customer insights and helped Anthropic scale faster.” The latest push towards integrating AI into mainstream enterprise operations signals a shift from mere experimentation to practical applications. Leaders in AI are now focusing on creating solutions that address real-world challenges, particularly in automating processes and improving efficiency. This trend could offer small business owners numerous possibilities—from chatbot services that enhance customer service to AI-driven analytics that inform marketing strategies. However, small business owners should also be aware of potential challenges as they navigate this new landscape. While integrating AI can lead to significant efficiencies, the upfront costs and complexity of these technologies might pose barriers. Finding the right tools that match their specific needs and budget could require careful consideration. Additionally, as AI becomes a fixture in business operations, the demand for skilled employees who can manage and optimize these technologies may rise, potentially leading to labor shortages in the tech-savvy job market. Salesforce Ventures is not only investing in existing players but is also actively seeking emerging companies in the field. This relentless search underscores the message that for small businesses, staying ahead of trends—be it in automation or AI—could be the key to sustainable growth. John Somorjai, President of Salesforce Ventures, asserted, “Enterprises are moving beyond experimentation to full-scale production with AI…The companies that will win aren’t just building better models; they’re building more resilient businesses around transformative AI capabilities.” For small business owners looking to capitalize on these trends, engaging with the evolving AI ecosystem could be transformative. From leveraging existing AI tools to considering partnerships with innovative startups, there is a landscape rich with options for those willing to adapt. Salesforce Ventures aims to be a long-term partner for those navigating the AI revolution, lending both financial support and market insights. For businesses keen on understanding how to integrate AI effectively, tapping into resources like Salesforce’s global network could prove invaluable. As this new era unfolds, small business owners must remain vigilant and proactive. Embracing AI not only offers a path to operational resilience but also positions businesses to be competitive players in a dynamic market being reshaped by technology. For more information on this initiative, you can read the original press release. Image via Envanto This article, "Salesforce Ventures Accelerates AI Investments, Backing 35 Innovators" was first published on Small Business Trends View the full article

-

The Best OLED TV of 2025 Is $500 Off Right Now

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. It's impressive when new flagship TVs that came out this year drop in price months after their release, but when they also happen to be the best OLED TV your money can buy, it becomes a bargain (well, if you can afford it). The 65-inch LG G5 OLED TV is $1,996.99 (originally $2,496.99), the lowest price it has been since its recent release, according to price-tracking tools. The bigger 77-inch and 83-inch series are also at their lowest prices right now. LG 65-Inch Evo G5 OLED TV (OLED65G5WUA) $1,996.99 at Amazon $2,496.99 Save $500.00 Get Deal Get Deal $1,996.99 at Amazon $2,496.99 Save $500.00 LG 77-Inch Evo G5 OLED TV (OLED77G5WUA) $3,496.99 at Amazon $4,499.99 Save $1,003.00 Get Deal Get Deal $3,496.99 at Amazon $4,499.99 Save $1,003.00 LG 83-Inch Evo G5 OLED TV (OLED83G5WUA) $4,996.99 at Amazon $6,499.99 Save $1,503.00 Get Deal Get Deal $4,996.99 at Amazon $6,499.99 Save $1,503.00 SEE 0 MORE OLED TVs offer the best colors and contrast ratio that money can buy. They don't come cheap, though (but you can still shop for budget options). Two of the biggest downsides of OLED TVs, though, are that they can suffer from the notorious burn-in effect and that they don't get as bright as QLED or LED TVs, so they're better suited for dimmer or theater rooms. But when LG upgraded the G4 in 2025, they made sure to address one of these issues. For an OLED, the Evo G5 gets bright, at 1,608 nits (average for an LED). That means you can actually use this OLED TV in a bright room without getting the quality washed away. The color accuracy is on point out of the box, and it comes with a 165Hz VRR, 12.9 ms of input lag in Game Mode, and a 120Hz native refresh rate, making it great for gaming, according to PCMag's "outstanding" review. They also deemed it the best OLED TV of 2025. Like all LGs, you'll get HDR-10 and Dolby Vision, but not HDR10+. If you're searching for the best OLED TV of 2025 at its best price, you're looking at it. Our Best Editor-Vetted Early Black Friday Deals Right Now Apple AirPods Pro 2 Noise Cancelling Wireless Earbuds — $169.99 (List Price $249.00) Apple iPad 11" 128GB A16 WiFi Tablet (Blue, 2025) — $299.00 (List Price $349.00) Amazon Fire TV Stick 4K Plus — $29.99 (List Price $49.99) Shark AV2501AE AI XL Hepa- Safe Self-Emptying Base Robot Vacuum — $459.95 (List Price $649.99) Ring Pan-Tilt Indoor Cam, White with Ring Indoor Cam (2nd Gen), White — $59.99 (List Price $99.99) Blink Video Doorbell Wireless (Newest Model) + Sync Module Core — $29.99 (List Price $69.99) Blink Mini 2 1080p Indoor Security Camera (2-Pack, White) — $27.99 (List Price $69.99) Ring Video Doorbell Pro 2 with Ring Chime Pro — $149.99 (List Price $259.99) Introducing Amazon Fire TV 55" Omni Mini-LED Series, QLED 4K UHD smart TV, Dolby Vision IQ, 144hz gaming mode, Ambient Experience, hands-free with Alexa, 2024 release — $699.99 (List Price $819.99) Blink Outdoor 4 1080p 2-Camera Kit With Sync Module Core — $51.99 (List Price $129.99) Deals are selected by our commerce team View the full article

-

Ten Questions to Check Your Entrepreneurship

Your biggest enemies: procrastination and questioning advice before you’ve even tried it. By Jackie Meyer Go PRO for members-only access to more Jackie Meyer. View the full article

-

Ten Questions to Check Your Entrepreneurship

Your biggest enemies: procrastination and questioning advice before you’ve even tried it. By Jackie Meyer Go PRO for members-only access to more Jackie Meyer. View the full article

-

More than a million people talk to ChatGPT about suicide each week

Welcome to AI Decoded, Fast Company’s weekly newsletter that breaks down the most important news in the world of AI. I’m Mark Sullivan, a senior writer at Fast Company, covering emerging tech, AI, and tech policy. This week, I’m focusing on a stunning stat showing that OpenAI’s ChatGPT engages with more than a million users a week about suicidal thoughts. I also look at new Anthropic research on AI “introspection,” and at a Texas philosopher’s take on AI and morality. Sign up to receive this newsletter every week via email here. And if you have comments on this issue and/or ideas for future ones, drop me a line at sullivan@fastcompany.com, and follow me on X (formerly Twitter) @thesullivan. OpenAI’s vulnerable position OpenAI says that 0.15% of users active in a given week have conversations that include “explicit indicators of potential suicidal planning or intent.” Considering that ChatGPT has an estimated 700 million weekly active users, that works out to more than a million such conversations every week. That puts OpenAI in a very vulnerable position. There’s no telling how many of those users will choose their actions based on the output of a language model. There’s the case of teenager Adam Raine, who died by suicide in April after talking consistently with ChatGPT. His parents are suing OpenAI and its CEO Sam Altman, charging that their son took his life as a result of his chatbot discussions. While users feel like they can talk to a non-human entity without judgement, there’s evidence that chatbots aren’t always good therapists. Researchers at Brown University found that AI chatbots routinely violate core mental health ethics standards, underscoring the need for legal standards and oversight as use of these tools increases. All of this helps explain OpenAI’s recent moves around mental health. The company decided to make significant changes in its newest GPT-5 model based on concern about users with mental health issues. It trained the model to be less sycophantic, or less likely to constantly validate the user’s thoughts, even when they’re self-distructive, for example. This week the company introduced further changes. Chatbot responses to distressed users may now include links to crisis hotlines. The chatbot might reroute sensitive conversations originating to safer models. Some users might see gentle reminders to take breaks during long chat sessions. OpenAI says it tested its models’ responses to 1,000 challenging self-harm and suicide conversations, finding that the new GPT‑5 model gave 91% satisfactory answers compared to 77% for the previous GPT‑5 model. But those are just evals performed in a lab—how well they emulate real-world conversations is anybody’s guess. As OpenAI itself has said, it’s hard to consistently and accurately pick up on signs of a distressed user. The problem began coming to light with research showing that ChatGPT users—especially younger ones—spend a lot of time talking to the chatbot about personal matters including self-esteem issues, friend relationships, and the like. While such conversations are not the most numerous on ChatGPT, researchers say they are the lengthiest and most engaged. Anthropic shows that AI models can think about their own thoughts It may come as a surprise to some people that AI labs cannot explain, in mathematical terms, how large AI models arrive at the answers they give. There’s a whole subfield in AI safety called “mechanistic interpretability” dedicated to trying to look inside these models to understand how they make connections and reason. Anthropic’s Mechanistic Interpretability team has just released new research showing evidence that large language models can display introspection. That is, they can recognize their own internal thought processes, rather than just fabricate plausible-sounding answers when questioned about their reasoning. The discovery could be important for safety research. If models can accurately report on their own internal mechanisms, researchers could gain valuable insights into their reasoning processes and more effectively identify and resolve behavioral problems, Anthropic says. It also implies that an AI model might be capable of reflecting on wrong turns in its “thinking” that send it in unsafe directions (perhaps failing to object to a user considering self-harm). The researchers found the clearest signs of introspection in its largest and most advanced models—Claude Opus 4 and Claude Opus 4.1—suggesting that AI models’ introspective abilities are likely to become more sophisticated as the technology continues to advance. Anthropic is quick to point out that AI models don’t think introspectively in the nuanced way we humans do. Despite the limitations, the observation of any introspective behavior at all goes against prevailing assumptions among AI researchers. Such progress in investigating high-level cognitive capabilities like introspection can gradually take the mystery out of AI systems and how they function. Can AIs be taught morals and values? Part of the problem of aligning AI systems with human goals and aspirations is that models can’t easily be taught moral frameworks that help guide their outputs. While AI can mimic human decision-making, it can’t act as a “moral agent” that understands the difference between right and wrong, such that it can be held accountable for its actions, says Martin Peterson, a philosophy professor at Texas A&M. AI can be observed outputting decisions and recommendations that sound similar to those humans might produce, but the way the AI reasons toward constructing them isn’t very humanlike at all, Peterson adds. Humans make judgements with a sense of free will and moral responsibility, but those things can’t currently be trained into AI models. In a legal sense (which may be a reflection of society’s moral sense), if an AI system causes harm, the blame lies with its developers or users, not the technology itself. Peterson asserts that AI can be aligned with human values such as fairness, safety, and transparency. But, he says, it’s a hard science problem, and the stakes of succeeding are high. “We cannot get AI to do what we want unless we can be very clear about how we should define value terms such as ‘bias,’ ‘fairness,’ and ‘safety,’” he says, noting that even with improved training data, ambiguity in defining these concepts can lead to questionable outcomes. More AI coverage from Fast Company: Harvey, OpenAI, and the race to use AI to revolutionize Big Law The 26 words that could kill OpenAI’s Sora Exclusive new data shows Google is winning the AI search wars OpenAI finalizes restructure and revises Microsoft partnership Want exclusive reporting and trend analysis on technology, business innovation, future of work, and design? Sign up for Fast Company Premium. View the full article

-

Bissett Bullet: Push and Pull

Today's Bissett Bullet: “Selling ‘pushes’ something to a prospective client. Attracting them to buy ‘pulls’ them toward your value.” By Martin Bissett See more Bissett Bullets here Go PRO for members-only access to more Martin Bissett. View the full article

-

Bissett Bullet: Push and Pull

Today's Bissett Bullet: “Selling ‘pushes’ something to a prospective client. Attracting them to buy ‘pulls’ them toward your value.” By Martin Bissett See more Bissett Bullets here Go PRO for members-only access to more Martin Bissett. View the full article

-

How Accountability Drives Firm Success

Four challenges to address. By Anthony Zecca Leading From the Edge Go PRO for members-only access to more Anthony Zecca. View the full article

-

How Accountability Drives Firm Success

Four challenges to address. By Anthony Zecca Leading From the Edge Go PRO for members-only access to more Anthony Zecca. View the full article

-

Samsung’s third quarter revenue soars, driven by semiconductor sales

Samsung Electronics on Thursday reported a 32.5% increase in operating profit for the third quarter, driven by rebounding demand for its computer memory chips, which the company expects will continue to grow on the back of artificial intelligence. The South Korean technology giant set a new high in quarterly revenue, which rose nearly 9% to 86 trillion won ($60.4 billion) for the July-September period, fueled by increased sales of semiconductor products and mobile phones. Samsung, which has dual strength in both components and finished products, said it expects the demand driven by AI to further expand market opportunities in coming months. SK Hynix, another major South Korean chipmaker, also reported a record operating profit of 11.4 trillion won ($8 billion) on Wednesday, which it also described as AI-related growth. Samsung’s operating profit of 12.2 trillion won ($8.6 billion) in the last quarter marked a 160% increase from the previous quarter, when it said its semiconductor earnings were weighed down by inventory value adjustments and one-off costs related to technology export restrictions on China. Samsung’s semiconductor division posted 7 trillion in operating profit for the third quarter, with the company reporting strong sales in high bandwidth memory chips, which are used to power AI applications. “The semiconductor market is expected to remain strong, driven by ongoing AI investment momentum,” the company said in a statement. The company said an advanced version of its high-bandwidth memory chips, the HBM3E, is “currently in mass production and being sold to all relevant customers,” while samples of its next-generation product, the HBM4, are being shipped to key clients. —Kim Tong-Hyung, Associated Press View the full article

-

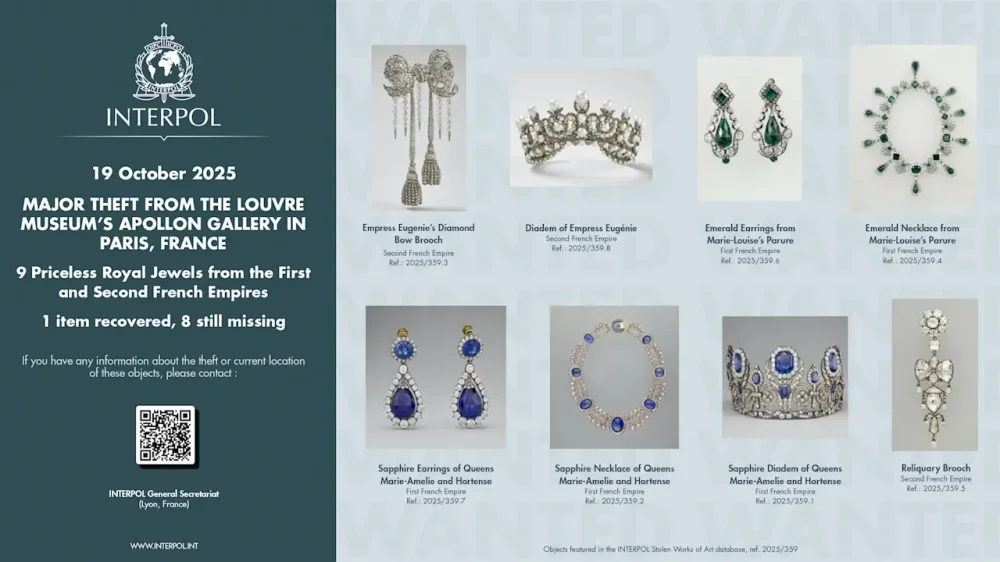

Where the jewels stolen from the Louvre might end up

Seven people have been arrested in the investigation of a stunning heist at the Louvre Museum in Paris, but the lavish, stolen jewels that once adorned France’s royals are still missing. In the days after the theft, a handful of experts warned that the artifacts valued at more than $100 million (88 million euros) could be melted or broken into parts. If done successfully, some say those smaller pieces could later go up for sale as part of a new necklace, earrings, or other jewelry, without turning too many heads. “You don’t even have to put them on a black market, you just put them in a jewelry store,” said Erin Thompson, an art crime professor at the John Jay College of Criminal Justice in New York. “It could be sold down the street from the Louvre.” Thompson and others say that this has become increasingly common with stolen jeweled and metal goods, noting that it’s a way thieves can try to cover their tracks and make money. It’s not like someone could publicly wear one of France’s stolen Crown Jewels — and finding a market to sell the full artifacts would be incredibly difficult after “everyone and their sister” has seen photos of them over the last week, said Christopher Marinello, a lawyer and founder of Art Recovery International. French prosecutor Laure Beccuau made a plea Wednesday to whoever has the jewels. “These jewels are now, of course, unsellable … Anyone who buys them would be guilty of concealment of stolen goods,” she warned. “There’s still time to give them back.” The jewels may be hard to monetize “By breaking them apart, they will hide their theft,” Marinello said, adding that these items could become even more “traceless” if they’re taken out of France and through jewel cutters and robust supply chains in other countries. Still, such pieces are often sold for a fraction of the value of what was stolen — due to their smaller size, but also because melting or breaking down high-profile items removes the historical worth. It isn’t a simple process. “The real art in an art heist isn’t the stealing, it’s the selling,” explained Robert Wittman, former senior investigator of the Federal Bureau of Investigation’s art crime team. Wittman, who has since formed his own private practice, said that the individuals behind such heists are typically “better criminals or thieves than they are businessmen.” Unlike others, Wittman is skeptical about the thieves successfully monetizing the artifacts they stole from the Louvre — which include an emerald necklace and earrings, two crowns, two brooches, a sapphire necklace and a single earring worn by 19th-century royals. He notes the gems may still be identifiable by their clarity, for example, and gold that was refined when the pieces were made hundreds of years ago is not as pure as what’s typically in demand today. “Because of what they are, there’s really no point destroying them,” Wittman said, while pointing to the risks of selling such high-profile stolen goods. Scott Guginsky, executive vice president of the Jewelers’ Security Alliance, a nonprofit trade association focused on preventing jewelry crime, also notes the age and quality of the artifacts’ diamonds. He suspects they’re probably not graded. “It’s not something that you can move on the open market. It’s nothing that can go through an auction house,” said Guginsky, who used to run the New York Police Department’s organized theft squad. Given the amount of preparation that the thieves likely put into this, Guginsky believes they have a plan for selling the jewels, even if they might first decide to “sit on” the jewelry and wait out suspicion. “I can’t see them stealing it without having an idea what they want to do,” he said. “There’s always a person willing to buy stolen jewelry. No matter what it is, somebody will buy it.” Sara Yood, CEO and general counsel of the Jewelers Vigilance Committee, notes most jewelry businesses implement anti-money laundering programs and look out for red flags like unusual orders, repeated purchases, and requests for secrecy. Still, she and others say the age of some jewels—if broken down effectively—could actually make it harder to track. Newer gemstones, for example, sometimes carry a laser inscription inside that can be evaluated in a lab. But “because these are historical pieces, it’s rather unlikely that it has those identifying features,” noted Yood. Experts like Thompson say bigger gems can be recut to a point that they’re unrecognizable. A challenge is finding people who have the skill to do that and don’t ask too many questions — but it’s possible, she said. Whether the people behind the heist had those contacts or certain buyers lined up is unknown. But it’s important to also note that “the guys who actually enter the museums are usually all hired hands, and they’re almost always caught in these cases,” Thompson added. Chances of recovery look dim She and others say that museums have increasingly faced a rash of similar thefts over recent years. Thompson notes that stealing from storage can go undetected for longer: the British Museum in London, which has accused a former curator of stealing artifacts and selling them online, is still trying to recover some of the 2,000 items stolen. Some past thieves have made ransom demands for stolen artwork overall, or wait for a potential “no questions asked” reward from an insurance company — which can amount to about a 10% cut for some insured pieces in Europe, Thompson says. The jewels stolen from the Louvre, however, were not privately insured. Sometimes government offers of a reward for information about a high-profile heist can also quicken the investigation, although the French government has yet to publicize such an incentive. If that changes, or promising leads are uncovered from the evidence left behind at the Louvre, experts like Wittman note it could increase the chances of recovering the artifacts. Still, as more time passes, others feel that the fate of finding the historic jewels looks dim. “I think they’re going to catch the criminals,” Marinello said. “But I don’t think they’ll find them with the jewels intact.” —Wyatte Grantham-Philips and R.J. Rico, Associated Press View the full article

-

Israel’s ultraorthodox hold mass protest against military conscription

Hundreds of thousands of Haredim converge on Jerusalem to oppose mandatory military serviceView the full article

-

What Factors Influence How Much Does It Cost to Purchase a Franchise?

When considering the cost of purchasing a franchise, several key factors come into play. The initial franchise fee typically ranges from $20,000 to $50,000, but total startup costs can reach up to $2.3 million. Moreover, ongoing royalty payments and marketing contributions greatly affect your financial planning. Equipment and inventory costs, along with any professional fees, further complicate the budget. Comprehending these elements is essential, as they directly impact your potential return on investment. What other factors should you consider? Key Takeaways Initial franchise fees vary significantly, typically ranging from $20,000 to $50,000, depending on the franchise brand and business model. Total start-up costs can range from $1.3 million to $2.3 million, influenced by equipment and inventory requirements. Ongoing royalty payments, usually between 4.5% and 9% of gross sales, impact overall profitability and cash flow management. Marketing contributions and additional expenses, including advertising fees, can further affect the total cost of owning a franchise. Financing options, such as personal savings or loans, play a crucial role in determining the affordability of franchise investments. Initial Franchise Fees When considering franchise ownership, one key factor you’ll encounter is the initial franchise fee, which typically falls between $20,000 and $50,000. This fee varies based on the franchise brand and business model. For instance, well-known franchises like McDonald’s may charge over $45,000, with total start-up costs ranging from $1.3 million to $2.3 million. To fully understand what’re the costs associated with operating a franchise, you’ll need to review the Franchise Disclosure Document (FDD). This document provides detailed information about the initial fee and its components. Moreover, if you’re purchasing an existing franchise, transfer fees can increase your initial investment. Grasping these costs is crucial when evaluating how much it costs to purchase a franchise and its financial viability. Ongoing Royalty Payments When you invest in a franchise, ongoing royalty payments play a key role in your financial environment. Typically ranging from 4.5% to 9% of your gross sales, these fees directly affect your profitability and are fundamental for accessing the franchisor’s brand and support systems. Moreover, the structure of these payments can vary greatly between franchises, so it’s critical to understand how they’ll impact your overall investment. Royalty Fees Explained Royalty fees are a vital aspect of franchise ownership, typically ranging from 4.5% to 5.9% of gross sales. These ongoing payments support your access to the franchisor’s established trademarks, business systems, and marketing resources. Nevertheless, they also reduce your net income, so it’s important to factor them into your financial planning. Royalty payments are commonly calculated monthly or quarterly, necessitating regular reviews of your cash flow. Franchise agreements usually specify the royalty percentage, which can differ based on the franchise’s market position and the services provided. Furthermore, some franchises impose minimum royalty fees, ensuring that the franchisor receives a baseline income regardless of your sales performance, further influencing your overall financial obligations. Impact on Profitability Though ongoing royalty payments are vital for accessing a franchise’s established resources, they can have a significant impact on your profitability. Typically ranging from 4.5% to 5.9% of gross sales, these fees can reduce your overall earnings over time. Charged monthly or quarterly, they represent a consistent expense you’ll need to incorporate into your financial projections. Unfortunately, you often have little control over these percentages, as they’re set by the franchisor, which can limit your ability to manage profits effectively. Furthermore, unexpected advertising costs tied to royalty fees may further diminish your net profitability, particularly in years of lower sales. It’s important to assess the financial health of the franchise before you invest, considering how royalties will affect your bottom line. Variability Among Franchises The variability in ongoing royalty payments among different franchises can greatly influence your overall investment strategy. Typically ranging from 4.5% to 5.9% of gross sales, these fees considerably impact your profitability over time. Comprehending the specific terms of these payments is essential, as they create a continuous financial obligation. Here are three key factors to reflect on: Percentage Rate: Some franchises charge higher royalty fees, especially premium brands with established reputations and support systems. Frequency of Payments: Royalty fees are often calculated monthly or quarterly, affecting cash flow. Additional Fees: Many franchises impose extra advertising fees, further reducing your profit margins alongside standard royalties. Being aware of these factors can help you assess the long-term viability of your franchise investment. Additional Costs and Expenses When you invest in a franchise, it’s vital to take into account additional costs and expenses that go beyond the initial fees. Ongoing franchise fees, operational costs, and hidden expenses can greatly influence your bottom line, so it’s important to plan accordingly. Comprehending these factors will help you create a more accurate financial picture as you navigate your franchise path. Ongoing Franchise Fees Ongoing franchise fees, which often include royalty payments and contributions to marketing funds, play an important role in determining your overall financial obligations as a franchisee. These fees can greatly impact your profit margins, so it’s important to understand them fully. Here are some key considerations: Royalty Fees: Typically range from 4.5% to 5.9% of gross sales, affecting your bottom line over time. Advertising Contributions: You’ll likely need to contribute a percentage of gross sales to a national or regional advertising fund. Local Marketing Costs: Additional expenses for local promotions, like online ads or materials, can further increase your costs. Being aware of these ongoing fees is paramount for evaluating your financial commitments and overall profitability as a franchisee. Operational Cost Considerations Comprehending the operational costs associated with running a franchise is vital for your financial planning, especially since these expenses can greatly influence your profitability. Typical ongoing costs include salaries, utilities, and maintenance, which vary by franchise type and location. Furthermore, franchise royalty fees of 5% to 9% of gross sales can markedly impact your bottom line. Marketing expenses, including contributions to a national fund and local initiatives, should also be factored in. Professional fees for legal and accounting services may range from $1,500 to $5,000 for reviewing the Franchise Disclosure Document (FDD). Finally, ensuring adequate working capital for 2-3 months to 2-3 years of operating expenses is vital. Cost Category Estimated Range Notes Employee Salaries Varies by location Major ongoing expense Royalty Fees 5% – 9% of gross sales Substantial recurring cost Marketing Expenses Varies by initiatives Local and national contributions Professional Fees $1,500 – $5,000 For legal and accounting needs Hidden Expenses to Anticipate Though you’ve gained insight into the operational costs of running a franchise, it’s important to recognize that hidden expenses can greatly affect your financial planning. These additional costs often catch new franchisees off guard, so budgeting for them is vital. Here are three hidden expenses to take into account: Ongoing Royalty Fees: Typically between 4.5% and 5.9% of gross sales, these fees can greatly diminish your profit margins over time. Advertising Contributions: Often a percentage of gross sales, this fund supports marketing efforts but adds to your overall expenses. Professional Fees: Legal and accounting services for compliance, which can range from $1,500 to $5,000, are fundamental for traversing the franchise environment. Being aware of these costs helps guarantee a more accurate financial forecast for your franchise. Equipment and Inventory Costs When starting a franchise, comprehension of equipment and inventory costs is crucial to your financial planning. Equipment costs can vary widely, from a few thousand dollars for basic setups to over $100,000 for specialized machinery in industries like food service. Initial inventory costs typically range from $5,000 to $50,000, depending on franchise requirements. Often, franchises require you to purchase from approved suppliers, which can raise costs. The Franchise Disclosure Document (FDD) outlines these expenses, giving you transparency. Furthermore, you should budget for ongoing inventory replenishment, as this can greatly affect cash flow, especially in high-turnover industries. Cost Type Range Notes Equipment Costs $1,000 – $100,000 Varies by industry type Initial Inventory $5,000 – $50,000 Based on franchise requirements Supplier Restrictions Higher costs possible Must buy from approved suppliers Ongoing Costs Variable Affects cash flow in high turnover sectors Marketing and Advertising Fees Marketing and advertising fees play an integral role in the success of your franchise, as these expenses can greatly affect your bottom line. Comprehending how to allocate funds effectively is vital. Here are three key aspects to evaluate: National Advertising Fund: You’ll often contribute a percentage of your gross sales, usually between 1% to 4%, to support brand-wide marketing efforts. Local Marketing Costs: These can vary considerably, including online ads, print materials, and event sponsorships customized to your specific location. Promotional Materials: Some franchises require you to budget for items like banners and promotional goods, further increasing your marketing expenses. Professional Fees and Legal Assistance Steering through the terrain of franchise ownership often requires expert guidance, particularly regarding professional fees and legal assistance. You’ll typically face legal fees for services like reviewing the Franchise Disclosure Document (FDD), which can range from $1,500 to $5,000 based on the complexity of the franchise agreement. Engaging a franchise attorney is vital, as they guarantee your documentation complies with laws and regulations, protecting your investment. Furthermore, you may need to budget for accounting services to manage bookkeeping and tax compliance, important for your financial health. It’s wise to reflect on these initial legal and accounting fees as part of your overall startup costs. These professionals provide valuable insights, helping you navigate potential challenges in your franchise relationship. Financing Options and Debt Servicing Steering through financing options is vital for anyone looking to invest in a franchise, as the right funding strategy can greatly influence your long-term success. Many franchisees often rely on personal savings or loans, whereas some franchisors provide financial assistance, even if options can be limited. It’s important to reflect on the impact of ongoing debt-servicing obligations on profitability. Here are three key factors to evaluate: Initial Investment: Franchise costs can range from $20,000 to over $2 million, affecting financing needs. Royalty Payments: Ongoing fees, typically 4.5% to 5.9% of sales, can strain your cash flow and affect debt repayment. Total Cost of Ownership: Comprehending all costs helps determine manageable debt levels for sustainable operations. Market Position and Brand Strength When considering a franchise investment, comprehension of the market position and brand strength of the franchise is crucial, as these factors can greatly affect your financial commitments. Well-established brands often charge initial fees between $20,000 and $50,000 or more because of their strong market recognition and consumer trust. A franchise’s competitive environment and customer loyalty likewise influence ongoing royalty fees, typically ranging from 5% to 9% of gross sales, impacting your long-term profitability. Strong brand recognition can result in higher sales volume, enabling you to recoup your initial investment more quickly. Furthermore, robust franchise support, including marketing assistance, is linked to brand strength, which can alleviate some advertising costs. Researching a franchise’s reputation can provide valuable insights into its financial performance. Frequently Asked Questions What Costs Are Involved in Buying a Franchise? When buying a franchise, you’ll encounter several costs. Initially, you’ll pay an upfront franchise fee, typically between $20,000 and $50,000. Ongoing royalty fees of 5% to 9% on gross sales will affect your profits. Moreover, you’ll need to budget for real estate, initial inventory, renovations, and marketing expenses. Don’t forget professional fees for legal and accounting services, which usually range from $1,500 to $5,000 for necessary compliance and financial management. What Are Some Factors to Consider Before Buying a Franchise? Before buying a franchise, you should consider several key factors. First, evaluate the initial franchise fees and ongoing royalty fees, which can greatly affect your profitability. Review the Franchise Disclosure Document (FDD) to understand all costs, including advertising contributions and operational expenses. Furthermore, assess the franchise’s financial health and historical performance. Speaking with current franchisees can provide valuable insights into their experiences and help you gauge potential return on investment. Why Does It Cost so Much to Franchise? Franchising costs are substantial owing to various factors. You’ll likely pay an initial fee for brand rights, which can range from $20,000 to $50,000. Ongoing royalty fees, typically 4.5% to 9% of sales, add to your expenses. You’ll additionally need to take into account costs for real estate, inventory, renovations, and required purchases from the franchisor. Legal fees for reviewing documents can further increase your initial investment, highlighting the importance of thorough financial planning. What Factors Contribute to the High Cost of Maintaining a Franchise? Maintaining a franchise can be costly because of several factors. You’ll pay ongoing royalty fees, typically between 4.5% and 9% of gross sales, which can greatly cut into profits. Furthermore, contributing to advertising funds based on sales adds to your expenses. You may likewise face higher costs for required products from the franchisor and compliance costs from operational restrictions. Regular operational expenses, like salaries and utilities, further increase your financial burden. Conclusion https://elements.envato.com/photos/franchise+purchase+cost In conclusion, comprehending the costs associated with purchasing a franchise is essential for your financial planning. The initial franchise fee, ongoing royalties, and additional expenses like equipment and marketing can greatly impact your investment. By thoroughly evaluating these factors, along with market position and brand strength, you can make informed decisions that align with your financial goals. Careful consideration of financing options likewise plays a key role in managing your overall costs effectively. Image via Envanto This article, "What Factors Influence How Much Does It Cost to Purchase a Franchise?" was first published on Small Business Trends View the full article

-

What Factors Influence How Much Does It Cost to Purchase a Franchise?