Everything posted by ResidentialBusiness

-

Confronting the limits of monetary policy

The ability of interest rates to guide prices and the economy is diminishingView the full article

-

Housing market power shift: 15 states where buyers are winning back power

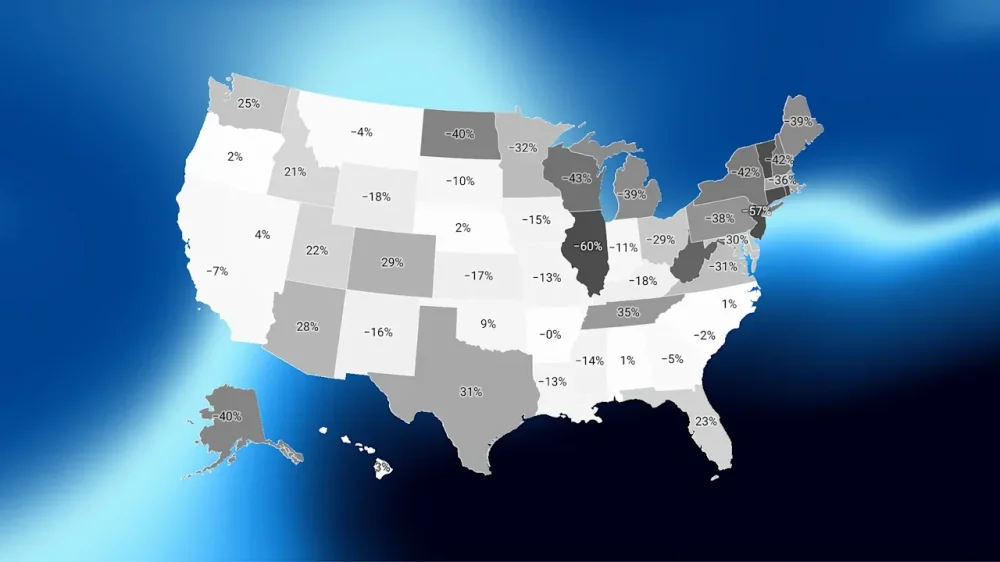

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. When assessing home price momentum, ResiClub believes it’s important to monitor active listings and months of supply. If active listings start to rapidly increase as homes remain on the market for longer periods, it may indicate pricing softness or weakness. Conversely, a rapid decline in active listings could suggest a market that is tightening or heating up. Since the national Pandemic Housing Boom fizzled out in 2022, the national power dynamic has slowly been shifting directionally from sellers to buyers. Of course, across the country that shift has varied significantly. Generally speaking, local housing markets where active inventory has jumped above pre-pandemic 2019 levels have experienced softer home price growth (or outright price declines) over the past 36 months. Conversely, local housing markets where active inventory remains far below pre-pandemic 2019 levels have, generally speaking, experienced more resilient home price growth over the past 36 months. Where is national active inventory headed? National active listings as tracked by Realtor.com are on the rise on a year-over-year basis (+17% between September 2024 and September 2025). This indicates that homebuyers have gained some leverage in many parts of the country over the past year. Some sellers markets have turned into balanced markets, and more balanced markets have turned into buyers markets. Nationally, we’re still below pre-pandemic 2019 inventory levels (-10% below September 2019) and some resale markets, in particular chunks of the Midwest and Northeast, still remain tight-ish. While national active inventory is still up year-over-year, the pace of growth has slowed in recent months—more than typical seasonality would suggest—as some sellers have thrown in the towel and delisted (more on that in another piece). These are the past September inventory/active listings totals, according to Realtor.com: September 2017 -> 1,308,607 📉 September 2018 -> 1,301,922 📉 September 2019 -> 1,224,868 📉 September 2020 -> 749,395 📉 September 2021 -> 578,070 📉 (overheating during the Pandemic Housing Boom) September 2022 -> 731,496 📈 September 2023 -> 702,430 📉 September 2024 -> 940,980 📈 September 2025 -> 1,100,407 📈 If we maintain the current year-over-year pace of inventory growth (+159,427 homes for sale), we’d have 1,259,834 active inventory come September 2026. Below is the year-over-year percentage change by state: While active housing inventory is rising in most markets on a year-over-year basis, some markets still remain tight-ish (although it’s loosening in those places, too). As ResiClub has been documenting, both active resale and new homes for sale remain the most limited across huge swaths of the Midwest and Northeast. That’s where home sellers this spring had, relatively speaking, more power. In contrast, active housing inventory for sale has neared or surpassed pre-pandemic 2019 levels in many parts of the Sunbelt and Mountain West, including metro area housing markets such as Punta Gorda and Austin. Many of these areas saw major price surges during the Pandemic Housing Boom, with home prices getting stretched compared to local incomes. As pandemic-driven domestic migration slowed and mortgage rates rose, markets like Tampa and Austin faced challenges, relying on local income levels to support frothy home prices. This softening trend was accelerated further by an abundance of new home supply in the Sunbelt. Builders are often willing to lower prices or offer affordability incentives (if they have the margins to do so) to maintain sales in a shifted market, which also has a cooling effect on the resale market: Some buyers, who would have previously considered existing homes, are now opting for new homes with more favorable deals. That puts additional upward pressure on resale inventory. At the end of September 2025, 15 states were above pre-pandemic 2019 active inventory levels: Alabama, Arizona, Colorado, Florida, Hawaii, Idaho, Nebraska, Nevada, North Carolina, Oklahoma, Oregon, Tennessee, Texas, Utah, and Washington. (The District of Columbia—which we left out of this analysis—is also back above pre-pandemic 2019 active inventory levels. Softness in D.C. proper predates the current administration’s job cuts.) Big picture: Over the past few years, we’ve observed a softening across many housing markets as strained affordability tempers the fervor of a market that was unsustainably hot during the Pandemic Housing Boom. While home prices are falling some in pockets of the Sunbelt, a big chunk of Northeast and Midwest markets still eked out a little price appreciation this spring. Nationally aggregated home prices have been pretty close to flat in 2025. Click Below is another version of the table above—but this one includes every month since January 2017. (Click the link to see an interactive version.) View the full article

-

Badenoch promises US-style crackdown on migrants

Tory leader pledges to deport 150,000 people a year who do not have right to remain in UKView the full article

-

States are rethinking student cellphone use, but digital devices are still essential in classrooms

Across the U.S., more schools are implementing policies restricting cellphones as concerns about digital distraction, mental health, and academic performance rise. The scale of the issue is significant. According to a 2023 report from Common Sense Media, 97% of students between the ages of 11 and 17 use their cellphones at least once during the school day. These students spend a median of 43 minutes online each day during school hours. Social media, YouTube, and gaming were the students’ top cellphone uses. Schools have already begun taking action. Data from the National Center for Education Statistics published in 2025 shows that 77% of public schools ban cellphones during classes. Some 38% of schools have cellphone policies that restrict use outside of class as well—including during free periods, between classes, or during extracurricular activities. Policymakers in different states and educators in school districts across the country are putting into place a variety of solutions. Some rely on partial restrictions, while others enforce complete bans. Many are still searching for the balance between technology access and minimizing distraction. What is clear, however, is that cellphones have become one of the central issues shaping today’s classroom environment. The role of technology in the classroom As researchers and professors who study the integration of technology for teaching and learning—and who are also parents of school-age children—we firmly believe that digital technologies are no longer optional add-ons. They have become indispensable in modern classrooms, acting as versatile instruments for instruction, collaboration, and student engagement. Take, for example, the ongoing shift from traditional paper textbooks to digital ones. This transformation has broadened access and created new opportunities for interactive, personalized learning. Abundant evidence demonstrates the positive effects of technology in supporting students’ engagement in class and their academic performance. Students’ access to digital devices has improved significantly as schools across the United States continue investing in technology infrastructure. A 2023 report from the National Center for Education Statisitics indicates that 94% to 95% of public schools now provide devices to students who need them, although disparities exist between states. A growing number of districts are adopting 1:1 initiatives, ensuring that every student has access to a personal device such as a laptop or tablet. These initiatives accelerated after the COVID-19 pandemic made clear the need for reliable access to learning technologies in schools for all students. They highlight the central role technology now plays in shaping everyday classroom instruction. These technologies hold great educational potential. Yet, when not integrated thoughtfully and regulated effectively, they can inadvertently reduce focus and undermine learning. Our recent systematic review on digital distraction in classrooms, which synthesized 26 empirical studies, finds three main drivers of distraction among students: Technology-related factors included constant social networking, texting, and cellphone addiction. These accounted for over half of the reported distractions. Personal needs, such as entertainment, made up more than one-third. Instructional environment, including classroom instruction that isn’t engaging, poor classroom management, and difficult course content, accounted for the rest. To address these challenges, the authors of the papers we reviewed suggested strategies such as teaching students how to control their own behavior and focus, silencing notifications, issuing clear device policies, or banning devices. The studies in our review also drew a clear distinction between school-provided and personally owned mobile devices. Devices provided by schools are typically equipped for instructional purposes, enhanced with stronger security and designed to restrict distracting uses. Personal devices are far less regulated and more prone to off-task use. As schools increasingly provide devices designed for learning, the role of personal cellphones in classrooms becomes harder to justify as they present more risks of distraction than educational benefits. Laws and policies regarding cellphone use Several states in the U.S. have passed laws banning or restricting cellphone use in schools, with some notable differences. States vary in how they define wireless communication devices. In Michigan, Senate Bill 234, passed in May 2025, describes a wireless communication device as an “electronic device capable of, but not limited to, text messaging, voice communication, entertainment, navigation, accessing the internet, or producing email.” While most of the states have several technology types listed under wireless communication devices, a Colorado bill passed in May 2025 clearly identified that laptops and tablets did not fall under the list of restricted wireless communication devices. Most state laws don’t specify whether the bans apply to both personally owned devices and school-owned devices. One exception is the bill Missouri passed in July 2025, which clearly specifies its ban refers only to personal devices. North Carolina made exceptions in a bill approved in July 2025, allowing students to use wireless communication devices for instructional purposes. Other exceptions in the North Carolina bill include an emergency, when students’ individual education programs call for it, and a documented medical condition. In their bills, most states provide recommendations for school districts to create cellphone use policy for their students. To take one typical example, the policy for Wake County in North Carolina, one of the state’s largest school districts, specifically refers to personal wireless communication devices. For elementary and middle school students, they must be silenced and put away between morning and afternoon bells, either in a backpack or locker. For high school students, teachers may allow them to be used for lessons, but they must otherwise be silenced and put away during instructional time. They can be used on school buses with low volume and headphones. Kui Xie is the dean of the College of Education and Human Development at the University of Missouri-Columbia. Florence Martin is a professor of learning, design, and technology at North Carolina State University. This article is republished from The Conversation under a Creative Commons license. Read the original article. View the full article

-

You control hidden markets at work—it’s time to start acting like it

Your inbox is brimming with new emails, and you need to decide which to reply to quickly and which to ignore. You try to schedule something for next week, but your calendar is already packed with recurring meetings. So many employees have asked for a particular day off—or requested a particular shift schedule—that you can’t grant all their requests. You post a job listing for a single position and get 250 applications. These situations arise constantly in our work lives, and their analogues come up in our personal lives. But despite their frequency, we often struggle with how to handle them. We barrel through our inbox and move things around on our calendar. We follow (perhaps unwritten) rules to determine which employees get requests filled and which do not. Sometimes we decide it’s too much to figure out ourselves and outsource the whole endeavor to AI. The common theme of the examples above is what economists call excess demand, which arises when more people want something than we can serve. Economists have a go-to solution for excess demand: rising prices. When prices go up, fewer people find that it is worthwhile, or even feasible, to pay for the thing, so they stop asking for it. But there are times when price doesn’t exist—for example, it would be inappropriate to charge people for a job interview. In these scenarios, we don’t use prices, but we still decide who gets what. We respond to emails and take meetings. We decide who gets the day off and who gets the best shift schedule. We interview candidates and eventually hire someone. Instead of prices changing, a “hidden market” arises to resolve the excess demand. These hidden markets are under our control. We set the rules to decide who gets what, and we can optimize them. To do so, we must think carefully about what we want our hidden markets to achieve: a set of goals that I call the three E’s: efficiency, equity, and ease. Effective hidden markets are efficient, meaning that they do not waste resources and they give resources to the people who value them most. You want to use your precious inbox time to respond to the emails that will generate the most value for recipients. You want to give the day off to an employee who really values it (say prioritizing a once-in-a-lifetime event, like a child’s graduation, over something that could happen another day, like a beach trip with friends). You want the job to go to the candidate who is the best fit for the firm. Effective hidden markets are equitable, meaning that they treat people fairly. It would be unfair if one employee always got their preferred schedule while an equally deserving employee was always given something less desirable. Effective hidden markets are also easy to participate in. A hidden market would not be easy if getting what you want required an ordeal, like sending a dozen follow-up emails to get a reply or doing personal favors for a manager to get a preferred day off. This three-E framework can help you improve—and even optimize—the hidden markets you control. When I open my inbox, I think a lot about whether I am using my time efficiently. Doing so requires triaging anything that isn’t important. Among my important emails, I first look to see if anything requires my immediate attention. When in doubt, I use a last-in, first-out rule for triage, meaning I prioritize emails that came in later to ones that came in earlier. I do this because people who emailed me most recently might still be working on whatever project they had just pinged me about. If so, a snappy reply might be more valuable to them than to someone who emailed me last night. When I look at my calendar, I ask whether I am being equitable in how I allocate my time. This has caused me to question my recurring meetings, which repeat on the same day and time (e.g., each Thursday at 10 a.m.). Recurring meetings impose a first-in-time, first-in-right rule that gives perpetual access to a scarce resource based on the order in which it was originally claimed. A recurring meeting set up a year ago gets priority (for Thursday at 10 a.m.) over anything that comes later. But a new project might be just as worthy—or even more worthy—of my time than the projects whose meetings are clogging my calendar. It is unfair (and possibly also inefficient) to give it the dregs. Rules for staff scheduling might be based on seniority or worker tenure. In workplaces with regular turnover—where a person who sticks around long enough will eventually go from getting to pick last to getting to pick first—such rules might be fair. But if the same set of workers get their first choices for decades while workers who started a few years later are consistently out of luck, this is no longer equitable. To combat this, many workplaces use first-come, first-served rules to let workers claim vacation days or preferred shifts. While first-come, first-served is familiar and ubiquitous, it is not necessarily easy for market participants. Employees might have to make requests before they know what schedule would be ideal and, if there is a race to sign up, employees must be vigilant about asking immediately once requests start being accepted. But a thoughtful market designer can make these systems easier and more equitable by building in memory, so workers who did not get their first choice this year get priority next year and perhaps by building in a fair lottery (rather than choosing based on whose email request arrived a few seconds earlier). In these situations—and in many others—we are market designers who must resolve excess demand by allocating scarce resources to the many people who want them. Considering the three-Es can help us generate allocations that are efficient, equitable, and easy for market participants. If we do it right, we can achieve a fourth E: elevating us as market designers, so we are as happy as possible with the outcomes. View the full article

-

Argentina’s wily currency traders drain Javier Milei’s dollars

Labyrinthine restrictions and chronic instability spawn strategies to profit from foreign exchange policiesView the full article

-

What if working from home was a legal right?

An Australian state is planning a new hybrid work law despite an angry business outcryView the full article

-

OpenAI and Jony Ive grapple with technical issues on secretive AI device

ChatGPT maker is working with former Apple design boss to launch a palm-sized personal assistant next yearView the full article

-

Monzo plots new push for US banking licence

UK neobank hopes fresh application will be approved amid The President’s push for deregulationView the full article

-

Impact of Trump tariffs is beginning to show in US consumer prices

Trade levies are starting to drive up costs for goods from cans of soup to car partsView the full article

-

EU pushes new AI strategy to reduce tech reliance on US and China

Brussels to unveil plan targeting digital sovereignty as it warns technology can be ‘weaponised’ by geopolitical rivals View the full article

-

The rise of America’s hard left

Economic populists offer an alternative to the authoritarian right, but they have to balance the righteous with the practicalView the full article

-

Crypto skulduggery isn’t a bug, it’s the whole point

Exploiting regulatory loopholes is the name of the gameView the full article

-

Labour markets stuck in a ‘low-hire, low-fire’ cycle

Employers and employees grow cautious as AI and trade war threaten disruptionView the full article

-

US and investors gambling on unproven nuclear technology, warn experts

Small reactors could prove too costly to be viable despite $9bn investment in power for AI boom View the full article

-

What Is the Role of Training and Development in Human Resource Management?

Training and development are crucial components of Human Resource Management, as they directly improve employee skills and knowledge. This process involves identifying training needs, designing effective programs, and measuring their impact on performance. By focusing on these areas, organizations can improve productivity and cultivate employee engagement. Comprehending how these elements work together is fundamental for achieving business goals. So, what specific strategies can organizations implement to guarantee their training programs are successful? Key Takeaways Training and development enhance employee skills and knowledge, leading to improved performance and productivity within the organization. HR identifies training needs through assessments and performance evaluations to tailor programs effectively. Structured training programs foster employee retention and job satisfaction, reducing turnover rates. Continuous learning initiatives align employee skills with organizational goals and adapt to industry changes. Successful training initiatives drive business performance and promote a culture of collaboration and growth among employees. Understanding Training and Development in HRM Training and development in human resource management (HRM) is a critical process that focuses on enhancing employee skills and knowledge to boost overall performance. The training and development function of an HR department includes evaluating employee needs, designing customized programs, and monitoring outcomes. Training definition in human resource management refers to a systematic approach aimed at improving productivity, service quality, and employee retention. Various types of training, such as orientation, job-specific, promotional, and refresher training, equip employees with fundamental skills to meet organizational goals. Effective training and development in human resource management additionally involves using diverse delivery methods and evaluating the effectiveness of programs to guarantee they positively impact employee performance and contribute to organizational success. Historical Context of Training and Development Though many people mightn’t realize it, the historical context of training and development in human resource management (HRM) dates back to the early 1900s, when companies began establishing schools particularly aimed at worker training. The concept gained significant traction during World War II, driven by the urgent need for skilled workers to support military efforts and industrial growth. As society evolved, so did training practices, reflecting technological advancements and the increasing complexity of business operations. Following the post-war economic expansion in the mid-20th century, companies placed greater emphasis on employee training to boost productivity and maintain a competitive advantage. Over time, training and development shifted from basic skills instruction to thorough strategies that promote employee growth and align with organizational objectives. Significance of Training and Development in Organizations Training and development are crucial for enhancing employee skills and boosting organizational efficiency. When you invest in these initiatives, your workforce becomes more competent, leading to increased productivity and reduced operational costs. Enhancing Employee Skills When organizations prioritize employee skill improvement through training and development, they often experience significant productivity gains. On average, companies that invest in these programs see a 24% increase in productivity. Continuous training leads to higher job satisfaction, with employees 34% more likely to feel content in their roles, contributing to improved retention rates. By focusing on employee development, organizations can reduce turnover by up to 30%, which helps lower recruitment and training costs. In addition, customized training programs can boost performance by an impressive 50%. Companies that emphasize skill improvement through training are likewise 21% more likely to outperform competitors in profitability, showcasing the direct impact of effective training and development initiatives on organizational success. Boosting Organizational Efficiency Organizations recognize that investing in training and development greatly boosts overall efficiency. Research shows that these programs can lead to a 24% increase in employee productivity, which considerably improves operations. When companies allocate funds for employee training, they often see a return of $4.53 for every dollar spent, proving the financial advantages of workforce skill improvement. Moreover, organizations with strong training initiatives experience a 34% reduction in employee turnover, resulting in a more stable workforce. A commitment to continuous learning can increase employee engagement by 37%, directly impacting performance. Improved training programs likewise streamline processes, allowing employees to perform tasks more accurately and reduce errors, ultimately driving overall organizational efficiency. Key Functions of HR in Employee Training In your role, comprehending how HR identifies training needs is essential for effective employee development. By conducting performance evaluations and gathering feedback, HR pinpoints skill gaps that inform the design of targeted training programs. These programs not just align with organizational goals but likewise equip employees with the necessary skills to boost productivity and job satisfaction. Identifying Training Needs Identifying training needs is a vital step in enhancing employee skills and, as a result, overall organizational performance. You can assess current employee skills through interviews, performance data reviews, and surveys, which help uncover areas needing improvement. By conducting a training needs analysis, you compare existing competencies with desired outcomes, establishing specific training goals. HR plays an important role in developing a training plan that outlines objectives, target audience, methodologies, and timelines based on these identified gaps. Continuous evaluation of training effectiveness is fundamental, as you gather feedback from performance metrics and employee surveys. Customized training sessions that address individual gaps lead to a more skilled workforce, in the end, boosting organizational performance and productivity. Designing Training Programs Designing effective training programs is critical for enhancing employee skills and aligning them with organizational objectives. HR plays a significant role in evaluating training needs, identifying gaps between current skills and required competencies through interviews and performance data reviews. Tailoring content and delivery methods to different learning styles guarantees that training is relevant and impactful. Creating clear objectives for training sessions is likewise fundamental, as it keeps the content engaging and interactive, facilitating better retention of knowledge. Continuous evaluation of training outcomes allows HR to monitor employee progress and adjust programs based on feedback and performance metrics. Finally, HR professionals act as facilitators, providing resources and support for smooth implementation and nurturing a culture of continuous learning. Processes Involved in Training and Development Comprehending the processes involved in training and development is essential for maximizing employee potential and aligning skills with organizational goals. The training process typically includes several key steps: Assessment of Needs: Identify gaps between current skills and required competencies. Motivation: Encourage engagement among both trainers and trainees to improve learning experiences. Program Design: Tailor training programs to meet specific employee needs using various methods, such as e-learning and workshops. Delivery and Evaluation: Utilize diverse formats like lectures and role-playing as well as continuously evaluating training effectiveness to make necessary adjustments. Types of Training Programs Offered Training programs play a crucial role in enhancing employee capabilities and ensuring that they meet organizational expectations. There are several types of training programs offered. Orientation training helps new employees acclimate to the company culture and understand their roles, promoting a smooth shift. Job training focuses on enhancing existing skills, allowing employees to perform their duties more effectively. For those aiming for promotions, promotional training prepares them for higher positions by equipping them with necessary skills and knowledge. Refresher training keeps employees updated on the latest practices relevant to their roles, which is critical in a swiftly evolving industry. Companies like Amazon and AT&T provide customized programs, such as Machine Learning University and AT&T University, to address specific employee development needs. Examples of Successful Training and Development Initiatives Organizations recognize the importance of effective training programs, and many have implemented successful initiatives that not just improve employee skills but also drive overall performance. Here are a few notable examples: Amazon: Upskilled over 300,000 employees through initiatives like Machine Learning University and various apprenticeships. AT&T: Promotes continuous education with AT&T University, offering personalized training to improve employee skills and career growth. Google: The “g2g” program encourages employees to teach one another, nurturing a collaborative learning environment. Starbucks: Invests in thorough training for partners, covering barista skills and leadership development, which boosts retention rates. These initiatives highlight how organizations can effectively improve employee capabilities as they enhance overall business performance. Identifying and Assessing Training Needs Identifying training needs is vital for ensuring that your workforce is equipped with the skills necessary to meet organizational goals. You can assess current employee skills against required competencies through interviews, surveys, and performance data reviews. This helps pinpoint areas for improvement. Conducting a training needs analysis enables you to understand specific skills and knowledge gaps within your workforce, forming the foundation for targeted training programs. Continuous evaluation of these needs is important, as it allows you to adapt initiatives based on changing industry standards and employee feedback. Moreover, gathering insights from employee surveys improves engagement by tailoring methods to individual learning preferences. Establishing clear goals during the assessment process aligns training efforts with organizational objectives, promoting a culture of continuous learning. Trends Shaping the Future of Training and Development As workforce dynamics evolve, new trends are emerging in the domain of training and development that reflect the changing needs of employees and organizations. Here are some key trends to evaluate: Remote and hybrid work environments are driving the adoption of e-learning platforms, offering flexible training opportunities. Personalized learning experiences, energized by AI, allow organizations to tailor training to individual employee preferences. Continuous learning is essential, as 41% of employees value career growth opportunities highly, prompting companies to invest more in development. There’s an increasing focus on soft skills training, with 92% of talent professionals recognizing its importance alongside technical skills. These trends highlight the necessity for organizations to adapt their training strategies to remain competitive and meet employee expectations. Frequently Asked Questions What Is the Primary Goal of Training and Development in HR Management? The primary goal of training and development in HR management is to improve employee performance. You’re equipped with necessary skills and knowledge to meet job requirements effectively. This process aligns your capabilities with organizational objectives, ensuring you contribute to the company’s success. Furthermore, it focuses on upskilling, which increases productivity and reduces errors. In the end, cultivating a culture of continuous learning helps both you and the organization adapt to evolving market demands and technological advancements. How to Do Training and Development in HR? To implement effective training and development in HR, start by evaluating current employee skills and identifying gaps. Use interviews, questionnaires, and performance data for thorough evaluations. Next, design customized training programs that incorporate various teaching methods like lectures and e-learning. Monitor the training process by collecting feedback to measure effectiveness. Regularly update training materials to guarantee relevance, and maintain open communication for addressing employees’ training needs and supporting career advancement. Why Is Training Such an Important Role of the HR Department? Training is essential for the HR department as it directly impacts employee retention and engagement. When you provide employees with opportunities to grow, they feel valued and are more likely to stay. Effective training improves productivity and guarantees employees develop the necessary skills to adapt to changes in the industry. What Is the Function of HR Training and Development Programs Focus On? HR training and development programs focus on enhancing your skills and knowledge to improve job performance. They assess your training needs through performance data reviews and employee surveys, tailoring sessions to address specific gaps. By offering opportunities for career growth, these programs increase your job satisfaction and retention. Effective training boosts company productivity by enhancing efficiency and reducing errors, nurturing a culture of continuous learning that keeps you engaged and adaptable to changes. Conclusion In conclusion, training and development are crucial components of Human Resource Management that improve employee skills, boost productivity, and promote organizational growth. By effectively evaluating needs and implementing customized training programs, HR professionals guarantee that employees remain engaged and capable of meeting market demands. As the business environment evolves, staying committed to continuous training will not just improve service quality but will additionally strengthen employee retention, eventually contributing to the organization’s long-term success. Image Via Envato This article, "What Is the Role of Training and Development in Human Resource Management?" was first published on Small Business Trends View the full article

-

What Is the Role of Training and Development in Human Resource Management?

Training and development are crucial components of Human Resource Management, as they directly improve employee skills and knowledge. This process involves identifying training needs, designing effective programs, and measuring their impact on performance. By focusing on these areas, organizations can improve productivity and cultivate employee engagement. Comprehending how these elements work together is fundamental for achieving business goals. So, what specific strategies can organizations implement to guarantee their training programs are successful? Key Takeaways Training and development enhance employee skills and knowledge, leading to improved performance and productivity within the organization. HR identifies training needs through assessments and performance evaluations to tailor programs effectively. Structured training programs foster employee retention and job satisfaction, reducing turnover rates. Continuous learning initiatives align employee skills with organizational goals and adapt to industry changes. Successful training initiatives drive business performance and promote a culture of collaboration and growth among employees. Understanding Training and Development in HRM Training and development in human resource management (HRM) is a critical process that focuses on enhancing employee skills and knowledge to boost overall performance. The training and development function of an HR department includes evaluating employee needs, designing customized programs, and monitoring outcomes. Training definition in human resource management refers to a systematic approach aimed at improving productivity, service quality, and employee retention. Various types of training, such as orientation, job-specific, promotional, and refresher training, equip employees with fundamental skills to meet organizational goals. Effective training and development in human resource management additionally involves using diverse delivery methods and evaluating the effectiveness of programs to guarantee they positively impact employee performance and contribute to organizational success. Historical Context of Training and Development Though many people mightn’t realize it, the historical context of training and development in human resource management (HRM) dates back to the early 1900s, when companies began establishing schools particularly aimed at worker training. The concept gained significant traction during World War II, driven by the urgent need for skilled workers to support military efforts and industrial growth. As society evolved, so did training practices, reflecting technological advancements and the increasing complexity of business operations. Following the post-war economic expansion in the mid-20th century, companies placed greater emphasis on employee training to boost productivity and maintain a competitive advantage. Over time, training and development shifted from basic skills instruction to thorough strategies that promote employee growth and align with organizational objectives. Significance of Training and Development in Organizations Training and development are crucial for enhancing employee skills and boosting organizational efficiency. When you invest in these initiatives, your workforce becomes more competent, leading to increased productivity and reduced operational costs. Enhancing Employee Skills When organizations prioritize employee skill improvement through training and development, they often experience significant productivity gains. On average, companies that invest in these programs see a 24% increase in productivity. Continuous training leads to higher job satisfaction, with employees 34% more likely to feel content in their roles, contributing to improved retention rates. By focusing on employee development, organizations can reduce turnover by up to 30%, which helps lower recruitment and training costs. In addition, customized training programs can boost performance by an impressive 50%. Companies that emphasize skill improvement through training are likewise 21% more likely to outperform competitors in profitability, showcasing the direct impact of effective training and development initiatives on organizational success. Boosting Organizational Efficiency Organizations recognize that investing in training and development greatly boosts overall efficiency. Research shows that these programs can lead to a 24% increase in employee productivity, which considerably improves operations. When companies allocate funds for employee training, they often see a return of $4.53 for every dollar spent, proving the financial advantages of workforce skill improvement. Moreover, organizations with strong training initiatives experience a 34% reduction in employee turnover, resulting in a more stable workforce. A commitment to continuous learning can increase employee engagement by 37%, directly impacting performance. Improved training programs likewise streamline processes, allowing employees to perform tasks more accurately and reduce errors, ultimately driving overall organizational efficiency. Key Functions of HR in Employee Training In your role, comprehending how HR identifies training needs is essential for effective employee development. By conducting performance evaluations and gathering feedback, HR pinpoints skill gaps that inform the design of targeted training programs. These programs not just align with organizational goals but likewise equip employees with the necessary skills to boost productivity and job satisfaction. Identifying Training Needs Identifying training needs is a vital step in enhancing employee skills and, as a result, overall organizational performance. You can assess current employee skills through interviews, performance data reviews, and surveys, which help uncover areas needing improvement. By conducting a training needs analysis, you compare existing competencies with desired outcomes, establishing specific training goals. HR plays an important role in developing a training plan that outlines objectives, target audience, methodologies, and timelines based on these identified gaps. Continuous evaluation of training effectiveness is fundamental, as you gather feedback from performance metrics and employee surveys. Customized training sessions that address individual gaps lead to a more skilled workforce, in the end, boosting organizational performance and productivity. Designing Training Programs Designing effective training programs is critical for enhancing employee skills and aligning them with organizational objectives. HR plays a significant role in evaluating training needs, identifying gaps between current skills and required competencies through interviews and performance data reviews. Tailoring content and delivery methods to different learning styles guarantees that training is relevant and impactful. Creating clear objectives for training sessions is likewise fundamental, as it keeps the content engaging and interactive, facilitating better retention of knowledge. Continuous evaluation of training outcomes allows HR to monitor employee progress and adjust programs based on feedback and performance metrics. Finally, HR professionals act as facilitators, providing resources and support for smooth implementation and nurturing a culture of continuous learning. Processes Involved in Training and Development Comprehending the processes involved in training and development is essential for maximizing employee potential and aligning skills with organizational goals. The training process typically includes several key steps: Assessment of Needs: Identify gaps between current skills and required competencies. Motivation: Encourage engagement among both trainers and trainees to improve learning experiences. Program Design: Tailor training programs to meet specific employee needs using various methods, such as e-learning and workshops. Delivery and Evaluation: Utilize diverse formats like lectures and role-playing as well as continuously evaluating training effectiveness to make necessary adjustments. Types of Training Programs Offered Training programs play a crucial role in enhancing employee capabilities and ensuring that they meet organizational expectations. There are several types of training programs offered. Orientation training helps new employees acclimate to the company culture and understand their roles, promoting a smooth shift. Job training focuses on enhancing existing skills, allowing employees to perform their duties more effectively. For those aiming for promotions, promotional training prepares them for higher positions by equipping them with necessary skills and knowledge. Refresher training keeps employees updated on the latest practices relevant to their roles, which is critical in a swiftly evolving industry. Companies like Amazon and AT&T provide customized programs, such as Machine Learning University and AT&T University, to address specific employee development needs. Examples of Successful Training and Development Initiatives Organizations recognize the importance of effective training programs, and many have implemented successful initiatives that not just improve employee skills but also drive overall performance. Here are a few notable examples: Amazon: Upskilled over 300,000 employees through initiatives like Machine Learning University and various apprenticeships. AT&T: Promotes continuous education with AT&T University, offering personalized training to improve employee skills and career growth. Google: The “g2g” program encourages employees to teach one another, nurturing a collaborative learning environment. Starbucks: Invests in thorough training for partners, covering barista skills and leadership development, which boosts retention rates. These initiatives highlight how organizations can effectively improve employee capabilities as they enhance overall business performance. Identifying and Assessing Training Needs Identifying training needs is vital for ensuring that your workforce is equipped with the skills necessary to meet organizational goals. You can assess current employee skills against required competencies through interviews, surveys, and performance data reviews. This helps pinpoint areas for improvement. Conducting a training needs analysis enables you to understand specific skills and knowledge gaps within your workforce, forming the foundation for targeted training programs. Continuous evaluation of these needs is important, as it allows you to adapt initiatives based on changing industry standards and employee feedback. Moreover, gathering insights from employee surveys improves engagement by tailoring methods to individual learning preferences. Establishing clear goals during the assessment process aligns training efforts with organizational objectives, promoting a culture of continuous learning. Trends Shaping the Future of Training and Development As workforce dynamics evolve, new trends are emerging in the domain of training and development that reflect the changing needs of employees and organizations. Here are some key trends to evaluate: Remote and hybrid work environments are driving the adoption of e-learning platforms, offering flexible training opportunities. Personalized learning experiences, energized by AI, allow organizations to tailor training to individual employee preferences. Continuous learning is essential, as 41% of employees value career growth opportunities highly, prompting companies to invest more in development. There’s an increasing focus on soft skills training, with 92% of talent professionals recognizing its importance alongside technical skills. These trends highlight the necessity for organizations to adapt their training strategies to remain competitive and meet employee expectations. Frequently Asked Questions What Is the Primary Goal of Training and Development in HR Management? The primary goal of training and development in HR management is to improve employee performance. You’re equipped with necessary skills and knowledge to meet job requirements effectively. This process aligns your capabilities with organizational objectives, ensuring you contribute to the company’s success. Furthermore, it focuses on upskilling, which increases productivity and reduces errors. In the end, cultivating a culture of continuous learning helps both you and the organization adapt to evolving market demands and technological advancements. How to Do Training and Development in HR? To implement effective training and development in HR, start by evaluating current employee skills and identifying gaps. Use interviews, questionnaires, and performance data for thorough evaluations. Next, design customized training programs that incorporate various teaching methods like lectures and e-learning. Monitor the training process by collecting feedback to measure effectiveness. Regularly update training materials to guarantee relevance, and maintain open communication for addressing employees’ training needs and supporting career advancement. Why Is Training Such an Important Role of the HR Department? Training is essential for the HR department as it directly impacts employee retention and engagement. When you provide employees with opportunities to grow, they feel valued and are more likely to stay. Effective training improves productivity and guarantees employees develop the necessary skills to adapt to changes in the industry. What Is the Function of HR Training and Development Programs Focus On? HR training and development programs focus on enhancing your skills and knowledge to improve job performance. They assess your training needs through performance data reviews and employee surveys, tailoring sessions to address specific gaps. By offering opportunities for career growth, these programs increase your job satisfaction and retention. Effective training boosts company productivity by enhancing efficiency and reducing errors, nurturing a culture of continuous learning that keeps you engaged and adaptable to changes. Conclusion In conclusion, training and development are crucial components of Human Resource Management that improve employee skills, boost productivity, and promote organizational growth. By effectively evaluating needs and implementing customized training programs, HR professionals guarantee that employees remain engaged and capable of meeting market demands. As the business environment evolves, staying committed to continuous training will not just improve service quality but will additionally strengthen employee retention, eventually contributing to the organization’s long-term success. Image Via Envato This article, "What Is the Role of Training and Development in Human Resource Management?" was first published on Small Business Trends View the full article

-

What Is the Time Blocking Method and How Can It Boost Productivity?

The time blocking method is a strategic approach to time management that helps you allocate specific periods for tasks. By focusing on one activity at a time, you can reduce distractions and boost your concentration. This technique transforms vague to-do lists into structured schedules, allowing for better prioritization and minimizing procrastination. As you explore the benefits and implementation of time blocking, you may discover how it can fundamentally improve your productivity. What’s more, there are various techniques to contemplate. Key Takeaways Time blocking is a time management technique that allocates specific periods for tasks, enhancing focus and productivity. It minimizes distractions by converting open-ended to-do lists into structured schedules for prioritization. By setting self-imposed deadlines, time blocking reduces procrastination and alleviates anxiety about task completion. Scheduling personal time and breaks improves work-life balance and ensures responsibilities are effectively managed. Regularly reviewing and adjusting your schedule optimizes effectiveness and helps identify time-wasting activities. Understanding Time Blocking Time blocking is a potent time management technique that helps you take control of your day by allocating specific periods for particular tasks. By using the time blocking method, you can create structured schedule blocks that improve your focus and productivity. This approach allows you to group similar tasks together, minimizing context-switching and enabling deeper concentration on high-impact work. It likewise provides clarity on how your time is allocated, helping to prevent burnout by ensuring you include breaks for rest and self-care. If you’re looking for efficiency, consider trying the best free time blocking app to visualize your tasks and commitments. This visual representation encourages accountability and prioritization, making it easier to assess your productivity and adjust your plans as needed. Key Benefits of Time Blocking Utilizing the time blocking method offers several key benefits that can greatly improve your productivity. First, it provides a structured approach, allowing you to focus on specific tasks without distractions, which notably boosts efficiency. By converting open-ended to-do lists into concrete schedules, you can prioritize tasks effectively and guarantee important work is completed on time. Furthermore, time blocking helps reduce procrastination by setting self-imposed deadlines, alleviating anxiety connected to unfinished work, and nurturing a sense of accomplishment. This method likewise improves your awareness of time usage, enabling you to identify and eliminate time-wasting activities. Finally, regular practice can enhance your work-life balance by ensuring personal time and breaks are intentionally scheduled, reducing the risk of burnout. How to Implement Time Blocking Effectively To implement time blocking effectively, you should start by creating a detailed schedule that outlines your tasks for the week. Choosing the right tools, like digital planners, can streamline this process and help you visualize your time blocks. Be mindful of common mistakes, such as overloading your schedule or neglecting to include breaks, as these can hinder your productivity. Steps to Create Schedule Creating an effective schedule using the time blocking method involves several key steps that can greatly boost your productivity. Start by listing all tasks, including meetings and breaks, then prioritize them based on importance and urgency. This creates a clear action plan. Next, estimate the time needed for each task realistically, allowing for slight overestimations to guarantee feasibility. Use a digital calendar or task management tool to create visible time blocks, making sure you additionally include breaks and buffer time for interruptions. Regularly review and adjust your schedule to optimize effectiveness, aligning it with your productivity levels and evolving priorities. Consider techniques like task batching or day theming to improve focus and efficiency within your time blocks, further increasing overall productivity. Choosing Time Blocking Tools Choosing the right tools for time blocking can greatly improve your productivity and streamline your workflow. Start by listing all your tasks, prioritizing them based on urgency and importance, and estimating the time needed for each one. Digital tools like Todoist or monday.com can help you visualize your schedule, allowing for easy task management through drag-and-drop features. Consider techniques like task batching to group similar activities, which minimizes context-switching, and day theming to focus on specific types of work each day. Regularly review and adjust your time-blocked schedule to guarantee it remains effective and flexible, accommodating unexpected tasks. Finally, protect your time blocks by marking them on shared calendars with titles like “Do Not Book” to maintain focus. Common Mistakes to Avoid Even though implementing time blocking can greatly improve your productivity, several common mistakes can undermine its effectiveness. Here are some pitfalls to avoid: Mistake Description Underestimating Task Durations This can lead to scheduling conflicts; track your time to create more accurate estimates. Overscheduling Without Breaks Not incorporating breaks can cause burnout; add regular short breaks to maintain focus. Being Too Rigid A strict schedule can increase stress; include buffer time for unexpected interruptions. Ignoring Energy Levels Align demanding tasks with your peak energy periods for better performance. Failing to Review Time Blocks Regular reassessment allows for adjustments based on actual productivity outcomes. Different Time Blocking Techniques When exploring different time blocking techniques, you’ll find that traditional time blocking is a foundational method that allocates fixed slots for specific tasks, enhancing your focus. Conversely, task batching allows you to group similar tasks together, reducing the need to switch gears constantly and improving your overall efficiency. Both strategies can greatly impact your productivity by creating a more organized and intentional approach to your day. Traditional Time Blocking Traditional time blocking is an effective method to improve productivity by dividing your workday into specific time slots dedicated to particular tasks. This approach helps you focus and minimizes distractions by providing a clear structure for your day. One technique you might consider is day theming, where you assign specific themes to each day; for example, Mondays could be for meetings, whereas Thursdays focus on project work. You can additionally employ time boxing, which sets fixed limits for tasks, like writing for 25 minutes, to prevent work from broadening unnecessarily. Task Batching Techniques Task batching is an effective time management strategy that can greatly improve your productivity by grouping similar tasks together. By minimizing context switching, this technique allows you to focus better and work more efficiently. Here are three task batching techniques to evaluate: Email Management: Set specific times to check and respond to emails, rather than reacting throughout the day. Phone Calls: Designate a block for making all necessary calls, which helps maintain focus and reduces interruptions. Creative Work: Group tasks that require similar cognitive resources, like brainstorming or writing, into one time block. Implementing these methods can streamline your workflow, amplify focus, and potentially boost your productivity by up to 40%, allowing you to accomplish more in less time. Task Batching Explained One effective method to improve productivity is through task batching, a strategy that involves grouping similar activities to streamline your workflow. By minimizing context switching, you can maintain focus and increase efficiency, making it easier to complete related tasks in a single time block. For instance, setting aside a specific time to answer emails or make phone calls can lead to quicker responses and a more organized day. Research indicates that this approach can boost productivity by up to 40%, as it allows you to concentrate on one type of activity without the distractions of switching tasks frequently. In the end, task batching reduces cognitive fatigue and enhances overall efficiency, leading to a more productive workday. The Concept of Day Theming When you adopt the concept of day theming, you can improve your productivity by dedicating each day of the week to a specific theme or type of work. This method helps reduce context switching and allows you to focus on related tasks. Here are three benefits of day theming: Enhanced Focus: By concentrating on similar tasks, you minimize distractions and increase efficiency. Better Energy Management: Align your daily themes with your energy levels, tackling more demanding tasks when you feel most productive. Clearer Weekly Overview: With a structured workflow, you can prioritize and allocate time effectively for various responsibilities. What Is Time Boxing? Time boxing is a potent time management technique that allocates a fixed duration to complete specific tasks, nurturing a sense of urgency and preventing tasks from stretching unnecessarily. Unlike time blocking, it focuses on individual tasks, making it especially useful for those fighting perfectionism or procrastination. This method encourages intense focus, often resulting in higher output than when tasks lack constraints. You can even combine time boxing with the Pomodoro Technique, using 25-minute intervals of focused work followed by short breaks to improve attention and avoid burnout. Research shows that setting specific time limits can greatly enhance productivity and time utilization. Task Time Box (minutes) Status Write report 30 In progress Email responses 15 Not started Team meeting prep 20 Completed Research topic 25 In progress Enhancing Focus With Deep Work Deep work stands at the forefront of productivity strategies, emphasizing the importance of focused, uninterrupted engagement with cognitively demanding tasks. By incorporating time blocking into your schedule, you can improve your ability to achieve deep work. Here’s how: Allocate Specific Time Blocks: Set aside dedicated periods for deep work, minimizing distractions and interruptions. Reduce Context-Switching: By focusing on one task at a time, you’ll experience less mental fatigue and clearer thinking. Develop a Habit: Regularly practicing deep work can refine your skills and effectiveness in complex tasks. Research shows that individuals engaging in deep work can achieve up to 5x more output compared to shallow work, leading to significant productivity gains. Embrace these strategies to maximize your focus and results. Managing Shallow Work Efficiently How can you manage shallow work efficiently within your busy schedule? Time blocking is an effective strategy for this. By allocating specific time slots for tasks like responding to emails and scheduling meetings, you can batch similar activities, which minimizes context switching and boosts efficiency. This method helps you stay focused, reducing distractions and allowing more time for deep work. Moreover, setting strict time limits on shallow tasks can combat perfectionism, preventing them from consuming too much of your mental energy. Regularly reviewing these time blocks improves productivity, as it reveals time-wasting habits. Ultimately, being conscious of how much time you spend on lower-impact activities enhances your overall time management skills. Common Challenges in Time Blocking Managing shallow work efficiently sets the stage for implementing time blocking, but it’s important to recognize the common challenges that can emerge with this method. Here are three key issues you might face: Planning Fallacy: You might underestimate the time needed for tasks, leading to scheduling conflicts and increased stress. Rigidity: Sticking too strictly to your schedule can be stressful when unexpected interruptions or shifting priorities occur. Overbooking: Filling your calendar without breaks can lead to burnout, reducing overall productivity. Additionally, failing to take into account your natural energy fluctuations can result in scheduling demanding tasks during low-energy periods. Regularly reviewing and adjusting your time-blocked schedule is crucial for maintaining productivity and adapting to unforeseen changes. Tools to Support Time Blocking To effectively implement the time blocking method, utilizing the right tools can make a significant difference in your productivity. Tools like Todoist offer calendar layouts particularly designed for time blocking, letting you drag and drop tasks into designated slots for better organization. AI-driven tools such as Reclaim.ai automate scheduling by dynamically adjusting your time blocks based on shifting priorities, which helps maintain focus. Monday.com provides a visual board format that allows you to allocate time estimates for tasks and integrate them with calendar views. Moreover, time blocking apps like Focus Booster and Forest use techniques like the Pomodoro Method to improve focus through timed work sessions. Combining task management software with calendar applications improves overall visibility and time management effectiveness. Frequently Asked Questions How Does Time Blocking Improve Productivity? Time blocking improves productivity by providing a clear structure for your day. By allocating specific time slots for tasks, you minimize distractions and reduce decision fatigue. This method encourages you to focus on high-priority activities without interruptions, enhancing efficiency. Furthermore, it transforms vague to-do lists into concrete schedules, helping you accurately estimate task durations. With defined time limits, you’re more likely to commit to completing tasks, reducing procrastination and increasing accountability. What Are the Benefits of Blocks of Time? Using blocks of time helps you organize your day effectively. By dedicating specific periods to tasks, you can improve focus and reduce distractions. This method allows you to batch similar activities, minimizing context switching, which often drains your energy. You’ll furthermore gain a better comprehension of how you spend your time, leading to improved efficiency. Regularly scheduled breaks can further prevent burnout, ensuring you maintain a sustainable work-life balance throughout your day. What Is the Time Box Method of Productivity? The time box method involves setting a specific time frame to complete a task, enhancing focus and reducing procrastination. By allocating exact start and end times, you create urgency, which helps you stay on track. This method aligns with Parkinson’s Law, as it limits the time available, encouraging quicker decision-making. You can likewise combine time boxing with techniques like the Pomodoro Technique, optimizing your work periods and incorporating necessary breaks for better productivity. What Is the 5 Time Blocking Method? The 5 Time Blocking Method divides your workday into five focused blocks, each lasting 60 to 90 minutes. You assign specific tasks or themes to each block, which helps you concentrate deeply and minimizes interruptions. This structure allows you to prioritize high-impact tasks while reducing context switching. Incorporating breaks between blocks is essential, as it keeps your energy levels up and prevents burnout, enhancing your overall productivity and efficiency throughout the day. Conclusion To summarize, the time blocking method is an effective strategy for managing your tasks and enhancing productivity. By structuring your day into focused time periods, you can minimize distractions and prioritize crucial activities. Implementing various techniques, like task batching and deep work, allows for efficient handling of both complex and straightforward tasks. Although challenges may arise, utilizing appropriate tools can support your efforts. Overall, time blocking can lead to improved focus, reduced procrastination, and a better work-life balance. Image Via Envato This article, "What Is the Time Blocking Method and How Can It Boost Productivity?" was first published on Small Business Trends View the full article

-

What Is the Time Blocking Method and How Can It Boost Productivity?