Everything posted by ResidentialBusiness

-

Zillow just revised its home price forecast for 400-plus housing markets

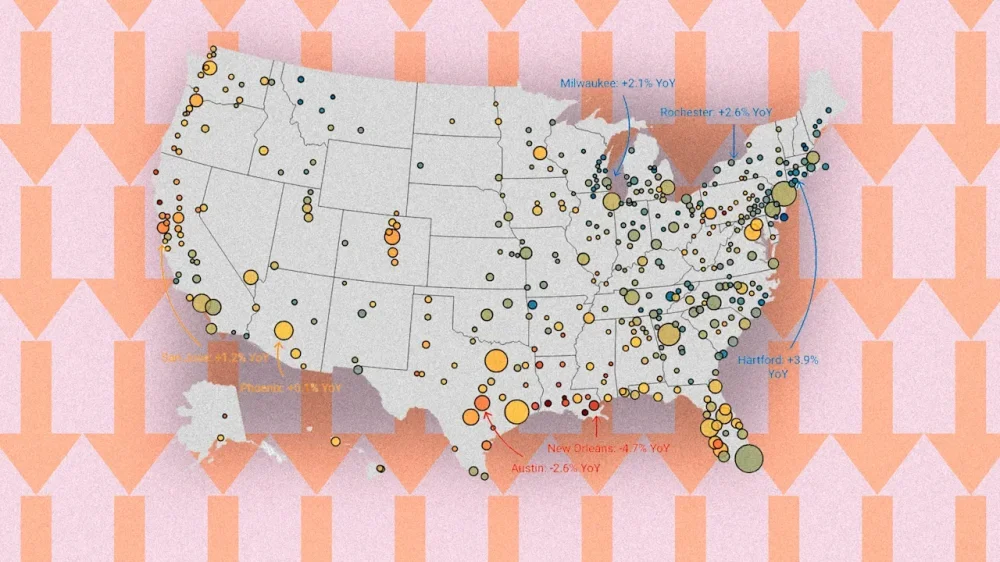

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. Zillow economists just published their updated 12-month forecast, projecting that U.S. home prices—as measured by the Zillow Home Value Index—will rise 1.5% between October 2025 and October 2026. Heading into 2025, Zillow’s 12-month forecast for U.S. home prices was +2.6%. However, many housing markets across the country softened faster than expected, prompting Zillow to issue several downward revisions. By April 2025, Zillow had cut its 12-month national home price outlook to -1.7%. In late spring, Zillow stopped issuing downward revisions. In August, it revised its 12-month outlook to +0.4%. In September, the forecast increased to +1.2%, and in October Zillow upgraded its 12-month national home price forecast to +1.9%. This month, Zillow revised down its 12-month outlook for U.S. home price growth just a tad to +1.5%. While Zillow’s national home price forecast is no longer negative—it isn’t exactly bullish either. Among the 300 largest U.S. metro-area housing markets, Zillow expects the biggest home price increase between October 2025 and October 2026 to occur in these 15 metros: Atlantic City, New Jersey → +5.3% Rockford, Illinois → +4.8% Concord, New Hampshire → +4.6% Knoxville, Tennessee → +4.3% Saginaw, Michigan → +4.3% Jacksonville, North Carolina → +4.2% Kingston, New York → +4.2% Fayetteville, Arkansas → +4.1% Green Bay, Wisconsin → +4.1% Torrington, Connecticut → +4.1% New Haven, Connecticut → +4.0% Hartford, Connecticut → +3.9% Hilton Head Island, South Carolina +3.9% Manchester, New Hampshire → +3.8% Norwich, Connecticut → +3.8% Among the 300 largest U.S. metro-area housing markets, Zillow expects the biggest home price decline between October 2025 and October 2026 to occur in these 15 metros: Houma, Louisiana → -7.8% Lake Charles, Louisiana → -7.3% New Orleans → -4.7% Shreveport, Louisiana → -4.3% Lafayette, Louisiana → -4.2% Beaumont, Texas → -4.0% Alexandria, Louisiana → -3.9% Odessa, Texas → -3.0% Monroe, Louisiana → -2.7% Punta Gorda, Florida → -2.7% Austin → -2.6% Chico, California → -2.5% Corpus Christi, Texas → -2.4% San Francisco → -2.2% Texarkana, Texas → -2.2% U.S. home prices, as measured by the Zillow Home Value Index, are currently up 0.01% year over year. If Zillow’s latest 12-month outlook (+1.5%) comes to fruition, it would represent a small acceleration nationally. Below is what the current year-over-year rate of home price growth looks like for single-family and condo home prices. The Sunbelt, in particular Southwest Florida, is currently the epicenter of housing market weakness. In a report published in October, Kara Ng, a senior economist at Zillow, wrote, “A year ago, 6 of the nation’s 50 largest metros were buyer’s markets; this September, buyers have the edge in 15 metros. Zillow’s market heat index shows the strongest buyer’s markets are Miami, New Orleans, Austin, Jacksonville, and Indianapolis. That’s due, in large part, to a surge of new construction in many of those areas in recent years. The hottest markets for sellers are in the Northeast and Bay Area: Buffalo, Hartford, San Jose, San Francisco, and New York—places where builders face some of the most stringent land use restrictions.” View the full article

-

When AIs become consumers

As best I can tell, the über-wealthy believe the world as we know it is ending, that there won’t be enough to go around, and that this means they need to accumulate as much money and land as possible in order to position themselves for the end of days. The way they do that is with an induced form of “disaster capitalism,” where they intentionally crash the economy in order to have some control over what remains. So the function of tariffs, for example, is to bankrupt businesses or even public services in order to privatize and then control them. Stall imports, put the ports out of business, and then let a sovereign wealth fund purchase the ports. Or as is happening right now: Use tariffs to bankrupt soybean farmers, who have to foreclose on their farms so that a private equity firm can purchase the farmland as a distressed asset, then hire the farmers who used to own and work that land as sharecroppers. The über-wealthy, in collaboration with the current White House administration, are engaged in a controlled demolition of this civilization because they realize the pyramid is collapsing and they don’t have faith that there will be enough left to feed and house everyone. The best they can do is earn a ton of money, buy a lot of land, control an army, and get people accustomed to seeing that army deployed. That’s what we’re watching on TV and on our city streets. It’s no coincidence that AI is emerging at this same moment in our civilization’s history. As Lewis Mumford observed, new technologies are often less the cause of societal changes than they are the result. Culture is like a standing wave, creating a vacuum or readiness for a new medium or technology. If we really are at the end of capitalism—the end of this 800- or 900-year process of abstraction, exploitation, and colonialism—then we would also, necessarily, be at the end of the era of employment. I will get to why I think that may ultimately be a good thing, but let’s go through the scenario that’s running through everyone’s heads right now, and then find our way through to what I think are better days. The spreadsheet people Yes, AI is coming for our jobs. Not the super-creative ones, or the high-touch human ones, but the ones that maintain administrative control over everything. The majority of your jobs, dear Fast Company readers. All the people in the mortgage departments, the insurance companies . . . the spreadsheet people, the PowerPoint people. Doomers say it’s 90% of jobs, but let’s say it’s just half of office jobs taken by AIs and, of course, blue-collar jobs taken by robots. The problem with that, from a business perspective, is if you have no employees earning money out there in the world, then who will be your consumers? Even Henry Ford, despite his enthusiasm for fascism, understood that workers commoditized by his own assembly lines still needed to earn enough money to buy a Ford car. But how are AI billionaires going to continue to make money if there are no gainfully employed people capable of buying AI services from them—or at least buying products from the companies that do purchase AI services? And this is the weird part; in their vision, it won’t be by selling products to people, but selling stuff to the AIs themselves. It’s a tricky idea, but once you wrap your head around it, it all makes perverse sense. In today’s economy, a small number of wealthy people and corporations employ us and sell to us. They don’t really need to care what species we are, or whether we are human or android, as long as we are producing value for their companies and then purchasing products from them. We already see how AIs can replace us as workers. But how could AIs also become the new population of consumers? They don’t have time off to spend money. What do AIs need? To do their jobs better. The humans don’t matter Instead of retailers selling food and clothes and entertainment to human consumers, tech companies will be selling energy, memory, network access, and processing power to the AIs so that they succeed in their jobs working as agent contractors for other corporations. The AIs will earn crypto for completing their agentic tasks, and then spend it with technology companies who provide them the resources they need to function. As far as the owners of the companies are concerned, there’s no difference between a population of human employees with whom you have no contact and a population of artificial employees with whom you have no contact. The only game that matters is the competition with the other big companies for the agents’ business. The humans don’t matter. So, assuming this tech-bro dream comes true, we end up with a small elite of big-business owners living in luxury with a small number of human servants, and a huge population of AIs doing the work and consumption. And, of course, in their vision for how this plays out, the rest of us humans become so disenfranchised—especially the ones who live in cities—that we will need to be kept under control until we presumably die out. We are simply not needed. The good news Sounds like a nightmare for most of us, but it also offers clues to an emancipatory vision for the end of employment. So let’s consider that good option: For close to 1,000 years, growth-based capitalism has depended on real human beings doing work while a small elite extracted value from that work at ever greater degrees of leverage. In order to get that leverage, capitalism abstracted again and again and again. Each level of abstraction further removed from the people and places actually providing or creating the value. There’s a mineral in the ground. There’s a company mining the mineral, and another company selling the mineral. There’s yet another company investing in the company selling the mineral, there’s a stock company leveraging that investment, there’s a derivative on the stock, and a derivative on the derivative, and a platform trading the derivatives, and so on. Or, more simply, there’s a person who needs to live in a house, but they just rent from someone who owns the house. That’s called the “rentier.” But the rentier has a mortgage on the house, and pays up to the bank, which pays up to another investor that owns the security, and so on and so on. That’s the pyramid of capitalism, with each investor or participant trying to move further up and away from the mineral or labor or living person into the abstraction of pure financial instruments. And this pyramid has simply grown too top-heavy to support itself. There’s only so much one can leverage up there before it comes tumbling down. Total abstraction AI, at least theoretically in the minds of crazy tech billionaires who believe AGI is genuinely around the corner, allows them to move on from the employment, exploitation, and colonialism of people, and simply “level up” in what they believe is a simulation anyway. We humans are discarded as capitalism moves up into a layer of total abstraction. It becomes the video game it was destined to become, with the “humans” replaced by non-player characters represented by digital icons or NFTs instead of flesh-and-blood mammals. Our real-world economy only had so much stuff anyway. We matter-based entities can’t scale as much as they need, so they leave us behind while they move into a layer of total and absolute abstraction. They live in a realm made entirely of digital representations, themselves manufactured by digital agents in exchange for digital currencies. It works because at least the AI agents value that crypto as much as the billionaires need them too. Instead of just 9 billion human customers, they get trillions of AI customers. We are not required. But this is a good thing. It’s akin to an enslaved population being released by the owners who no longer have use for them. We were not born to be their employees. As I’ve explained in some of my books, the whole concept of “employment” was invented as a way of preventing us from getting wealthy. In the late Middle Ages, right before this capitalism was invented, people in Europe were starting to do really well. They learned how to make and trade stuff at local markets. They were doing so well that people were only working two or three days a week, and got taller than at any time until the 1980s. That’s when the aristocracy came up with the idea of a chartered monopoly, and made it illegal for people to be in business for themselves. They had to become “employees” of one of the chartered companies, or face a penalty of death. That’s when we started working for companies instead of ourselves, and ended up in an economy built to favor those monopolies over small businesses. A moment of transition So the end of this scheme is not necessarily a bad thing. We simply have to return to the real economy that isn’t worth capitalism’s attention. Human commodities like food and housing are no longer asset classes worthy of their time, so there’s no point in making growth-based markets for them. We can instead look at them as the commons-based resources they are—optimize for distributed flourishing instead of extraction and profit. Yes, there will still be competition for energy. The AI economy would probably end up needing a bunch of nuclear power plants and better ways of dealing with all those spent fuel rods (if any of that AI scenario even becomes a reality). The current state of the technology doesn’t fill me with hope for much more than a fierce market correction. To me, it’s less important whether it happens than that we take advantage of this moment of transition. The ultra-rich have accepted the end of capitalism—or at least the end of capitalism that depends on human labor and consumption for its survival. So it’s time we accept we are no longer valuable to the capitalist extraction machine and begin to look instead at how we are valuable to one another. View the full article

-

Notes on Buon Ma Thuot – The coffee hub in the heart of the Central Highlands

Buon Ma Thuot is the capital city of Dak Lak Province in the Central Highlands of Vietnam. While Da Lat is the best-known city in the Central Highlands, Buon Ma Thuot is the largest city and is closer to the geographical centre of the Central Highlands region. I have been to Da Lat many times, mainly because it’s more convenient to get to from Ho Chi Minh City. On my recent trip to Da Lat, I got the bus to Buon Ma Thuot, saving me a longer bus trip (or flying) from HCMC. These are my notes on Buon Ma Thuot from my visit in March 2025. Buon Ma Thuot city notes Buon Ma Thuot is also spelled as Ban Me Thuot, and Ban Me is also used as its name. BMT is also an acceptable abbreviation, which I will use from here on in. What is immediately noticeable about BMT compared to Da Lat is that the city is flatter and there is a street grid in the city centre. Da Lat is surrounded by steep hills, and there are barely any straight roads. BMT is on a plateau, and it’s easy to walk around. Being in the Central Highlands, I was wondering where the mountains were. It’s a twisty and mountainous road between Da Lat and BMT, but you can’t see any mountains in BMT. I checked a topographic map, and BMT is on a plateau of around 500 metres in elevation. My visit was just after the 50th anniversary of the Buon Ma Thuot Victory. There were still many posters around the city celebrating this anniversary. [50th anniversary of Buon Ma Thuot Victory.] The central roundabout of the city features the Victory Monument, which has become the main landmark of the city. Every visit to a new city in Vietnam requires a visit to the central market. The BMT market has a skybridge connecting two buildings. When in a provincial capital, always check out the provincial museum as they are usually the most architecturally interesting building in the city. [Dak Lak Museum.] Note: I was in BMT before the announcement of provincial mergers that happened in July. Dak Lak province was merged with coastal Phu Yen province, and the expanded province is still called Dak Lak with BMT as the capital. In addition to being walkable, BMT is also very green. There are many tree-lined streets, and the city is also good at pocket parks. Cities in Vietnam use the same street names of Vietnamese heroes, and streets named Le Duan are usually in the most prestigious locations. The Le Duan Street of BMT has much nicer trees than the Le Duan Street of Ho Chi Minh City. There is a cathedral near the main roundabout, though it looks more like a parish church. [Ban Me Thuot Diocese Cathedral.] There has not been a construction boom like in the coastal cities of Vietnam, so BMT is still a relatively low-rise city. The Saigon Ban Me Hotel is the landmark tall hotel of the city. [Saigon Ban Me Hotel.] Coffee The Central Highlands is a major coffee-growing region, and BMT is the hub of the coffee industry in Vietnam. In a case of poor timing, I arrived in the city just as they were packing up the Buon Ma Thuot Coffee Festival. If you are visiting BMT for coffee, there is the Coffee World Museum. The museum houses antique coffee-making equipment with displays that show the history of coffee. The museum is built in highland-style houses. Next to the museum is a new urban area called The Coffee City. The project was under construction when I visited, though some sections looked abandoned. Coffee World Museum was built by Trung Nguyen Legend Group, who were founded in BMT and are now headquartered in HCMC. Trung Nguyen Legend Group are the largest domestic coffee brand in Vietnam, though Highlands Coffee are listed as the largest by number of stores in Vietnam. Trung Nguyen was on the cusp of cafe domination in Vietnam in the 2010s until a messy public divorce between the founders. The cafe chain rebranded around this time. When I came to HCMC in 2012, Trung Nguyen had the best cafe logo. [Trung Nguyen Coffee logo in HCMC (2012).] The new logo is not as distinctive and the branding has gone with notable European coffee-drinkers (such as Beethoven) and imagery of successful people flying in private jets and a G7-brand instant coffee. On my last visit to Singapore was in a random mall and I saw a Trung Nguyen cafe with the original logo. The wife of the original partnership set up Trung Nguyen International in Singapore using the original logo. [Trung Nguyen Coffee in Singapore.] If I were in charge of the Trung Nguyen branding, I would drop the weird obsession with the G7 and famous Europeans and lean into their highland heritage. Have an image of a highland house with the steep roof (like at the museum), and celebrate Vietnamese culture. I rarely visit Trung Nguyen cafes, mainly because I don’t like the iced tea they serve with coffee. Most iced tea in Vietnam is weak and almost flavourless, while the Trung Nguyen iced tea has a strong flavour (possibly barley tea), and I don’t like the taste of it. Considering that I was in the origin city of Trung Nguyen, I visited the flagship cafe (Trung Nguyen Coffee Village). Having just said that I don’t go to Trung Nguyen cafes, this cafe was a delight to visit. The village is more like a large garden area with water features and plenty of places for photo opportunities. I had an iced coffee and tried the iced tea to see if it still tastes weird (it still tastes weird). In addition to visiting the coffee king of Vietnam, I was curious to see what the cafe scene in general was like in BMT. I visited Dak Lac Coffee purely because it has a cool name. Dak Lak is such a great name for a province, and it would be very brandable as a chain. The coffee lived up to its good name. I visited Soul Specialty Coffee, who show on Google Maps as Soul Fine Robusta BMT. There is a new wave of Vietnamese cafes that are celebrating the robusta coffee that is grown in Vietnam. For too long, the arabica cabal has been badmouthing robusta, so cafes like Soul are promoting Vietnamese robusta. And there are of course Highlands Coffee cafes in BMT, though the cafe chain was started by a Vietnamese American in Hanoi, and not the Highlands. Food For food, one local specialty I was looking for was banh uot. A friend from Dak Lak introduced me to a banh uot restaurant in Saigon, so I had to try it in Dak Lak. [Bánh Ướt Chồng Dĩa Bà The BMT] Banh uot (translated as wet cake) is a sticky rice sheet that is used to roll around fillings. The sheet is wet and sticky, so it is brought out on a stack of plates. You then roll your own rolls with meat, vegetable, and herb fillings. The sticky nature of the sheet makes it easier to roll, and at the end of the meal, they count how many plates you used. When it comes to finding food in new cities in Vietnam, I will see if there is a local specialty (like banh uot), and also walk around and see what is popular. I saw this place called Banh Canh Ca Dam Huong (fish cake noodle soup). There were many people here, and they had extra seats outside, so that was a good sign. One of my travel rules is not to eat fish so far inland, but I made an exception here for fish cake. The soup had a delicious broth that I can’t describe (which is why I am not a food blogger), and I noticed it got a bad review on Google because they only offer spoons. I looked around, and everyone was eating the noodles with two spoons and no chopsticks. Vietnam has been slowly globalising, with chains such as Starbucks and McDonald’s finding their way into more provincial cities. The Central Highlands has few global chains so far. BMT has Jollibee from the Philippines (which partly owns Highlands Coffee), Lotteria from Korea, KFC (which was one of the early fast food arrivals in Vietnam), and Pizza Hut. Starbucks are opening in more provincial locations (including Da Lat), but there are no international cafe chains here. Elephants of Buon Ma Thuot Elephants are an icon of highland culture, and they are used in imagery around the city (thus the elephant mascot for the coffee festival). One of the most clever logos I have seen is for the Tay Nguyen Hotel (Tay Nguyen being the name for the Central Highlands in Vietnamese). [Tay Nguyen Hotel logo.] One of the best hotels in Buon Ma Thuot is Elephants Hotel. Another cafe I visited was Ama H’Rin Coffee House. There are some highland houses on display here with wooden carvings, such as this elephant. I didn’t get to explore highland culture outside the city, so I haven’t covered that in this article. Riding elephants is still prominent in Vietnam, even while other elephant sanctuaries in the region are going “no ride”. The Vietnam tourism website is promoting the first ride-free elephant sanctuary in Vietnam near BMT, though there was still elephant riding at the coffee festival. Further reading: Buôn Ma Thuột’s thriving elephant culture in 1957. Transport BMT is a good place to start if you are visiting other cities by bus in the Central Highlands. I got the bus to BMT and then took a flight to Da Nang. Most of the flights from BMV are to SGN and HAN, with only a few other domestic locations. There was talk of upgrading the airport to international standards, though every city wants to become international. There are no trains in the Central Highlands (apart from the fragment of an old railway in Da Lat). There is a long-term plan to build a Central Highlands railway, which would effectively be an inland version of the train from HCMC to Da Nang. I made a map that shows what a Central Highlands railway system would look like if all of the proposed railways were built. [View full size map of Central Highlands Railways.] View the full article

-

UK business blames long run-up to Budget for fuelling uncertainty

Speculation about policy changes has hit confidence and postponed spending decisions, companies sayView the full article

-

In defence of the weird and wonderful Wicked ‘womance’

It’s all a bit intense but the friendship between Ariana Grande and Cynthia Erivo moves me View the full article

-

From gold giant to boardroom bust-up: Barrick weighs break-up

An activist investor building a stake and the sudden departure of its boss has put pressure on the gold miner to break upView the full article

-

Surge in Israeli settler violence shakes West Bank

Attacks on Palestinians in the territory spiral to highest level in nearly two decadesView the full article

-

Insurers retreat from AI cover as risk of multibillion-dollar claims mounts

AIG, Great American and WR Berkley seek permission to limit liability from AI agents and chatbotsView the full article

-

Starmer’s top business adviser emerges as frontrunner to replace Mandelson as envoy to US

Varun Chandra is seen as an outsider by a Foreign Office going through an aggressive restructuringView the full article

-

US secretary of state rows back on Ukraine peace plan in call with Senators

Lawmakers said Marco Rubio told them that a contentious 28-point proposal was not a The President administration policy View the full article

-

Reeves to extend electric vehicle grant in Autumn Budget

Government seeks to boost critical minerals capacity as it encourages shift from petrol and dieselView the full article

-

Rail fares in the UK to be frozen in Autumn Budget

Officials said season ticket holders on some of Britain’s busiest routes would save hundreds of pounds annuallyView the full article

-

Global climate agreement sealed at COP30 despite deep divisions

Push for ‘road map’ on how economies can wean off coal, oil and gas fails but Brazilian presidency promises to follow upView the full article

-

What Is an HR Payroll Program and How Does It Work?

An HR payroll program is a software solution that automates the intricacies of employee compensation. It handles tasks like calculating wages, managing tax withholdings, and ensuring compliance with labor laws. By integrating attendance tracking, the program processes payroll based on hours worked or salary agreements, further enhancing accuracy. With features like self-service portals for employees, it streamlines operations and reduces errors. Comprehending these functionalities can help you choose the right system for your organization. Key Takeaways An HR payroll program automates employee compensation management, including wage calculations and tax withholdings, ensuring accuracy and compliance. It integrates attendance tracking to calculate wages based on hours worked or salary agreements, improving payroll precision. The software provides employee self-service portals for accessing pay stubs and updating personal information, enhancing transparency. It ensures compliance with tax regulations through automatic updates and necessary filings, minimizing the risk of penalties. By streamlining payroll processes, it increases operational efficiency, reducing administrative workload for HR staff and saving time. Understanding HR Payroll Programs When you consider the intricacies of managing employee compensation, an HR payroll program becomes an essential tool for any organization. This software application automates employee compensation management, handling tasks like calculating wages, tax withholdings, and issuing payments. By integrating attendance tracking and timekeeping, it guarantees accurate calculations based on hours worked or salary agreements. Additionally, HR payroll programs help organizations maintain compliance with tax regulations by automatically updating tax rates and generating necessary filings for local, state, and federal authorities. Many systems likewise feature employee self-service portals, allowing staff to access pay stubs and update personal information, which improves overall satisfaction. In the end, a thorough human capital management software solution streamlines the entire human capital management payroll process, increasing operational efficiency. Key Features of HR Payroll Software HR payroll software offers a range of key features that streamline payroll processing and improve overall efficiency in managing employee compensation. One significant aspect is automated payroll processing, which reduces manual calculations and lessens the administrative burden of timesheet compilation. Attendance tracking guarantees accurate wage calculations by recording employee work hours and absences, helping maintain compliance with labor regulations. Recruitment management tools facilitate the hiring process by allowing HR to manage job postings and applicant databases efficiently. Onboarding features enable new hires to complete documentation digitally, speeding up their integration into the organization. Furthermore, extensive benefits management capabilities within HR payroll software help track and update employee perks effectively, contributing to higher employee satisfaction and retention, fundamental components of effective HCM solutions. Benefits of Implementing an HR Payroll Program Implementing an HR payroll program brings several benefits that can transform your payroll processes. You’ll save time and increase efficiency, as automated systems can handle tasks in minutes rather than hours, allowing your HR team to focus on more strategic initiatives. Furthermore, accurate tax compliance and improved employee transparency through self-service options can lead to a more satisfied workforce and a smoother operational flow. Time Savings and Efficiency By automating payroll processing, an HR payroll program can greatly reduce the time spent on payroll tasks, allowing your HR department to operate more efficiently. This automation not only saves you time—averaging a 30% reduction compared to manual methods—but furthermore minimizes human error, ensuring accurate and timely employee payments. Streamlining time tracking and attendance management allows your team to focus on core responsibilities instead of administrative duties. In addition, self-service portals empower employees to manage their personal information, further alleviating the administrative burden on HR staff. Key benefits include: Improved accuracy in payroll processing Increased employee satisfaction and morale Higher overall business productivity Reduced administrative workload for HR staff Implementing an HR payroll program can greatly boost your operational efficiency. Accurate Tax Compliance Guaranteeing accurate tax compliance is vital for any business, especially when maneuvering through the intricacies of federal, state, and local regulations. An HR payroll program automates tax calculations, guaranteeing correct withholdings for all applicable taxes. This automation minimizes the risk of errors that can lead to penalties from the IRS. By incorporating updated tax rates and compliance regulations, the software alleviates the burden of manual tax management, allowing you to focus on your core operations. Regular updates and alerts help you stay compliant with changing tax laws, providing timely notifications for necessary adjustments. Furthermore, accurate record-keeping guarantees all employee earnings, deductions, and tax filings are well-documented, significant for audits and compliance reviews, ultimately avoiding costly fines and enhancing financial stability. Enhanced Employee Transparency A well-designed HR payroll program greatly improves employee transparency, empowering workers to take control of their payroll information. With access to self-service portals, you can view and manage your payroll details, including pay stubs and tax documents. This transparency cultivates trust and reduces confusion about payments. Key benefits include: Accurate and timely payments because of automated wage and deduction calculations. Easy tracking of accrued benefits like paid time off (PTO) and sick leave. Automated notifications for payroll changes or discrepancies, enabling prompt issue resolution. Increased employee satisfaction, as timely access to compensation details alleviates financial stress. How HR Payroll Programs Streamline Payroll Processing As organizations seek to improve efficiency and reduce errors in payroll processing, HR payroll programs emerge as a crucial solution. These programs automate payroll calculations, which greatly cuts down the time spent on manual data entry as well as minimizing traditional errors. By integrating attendance tracking, they guarantee accurate computation of hours worked, overtime, and absences, directly impacting payroll accuracy. Automating tax withholdings and filings helps maintain compliance with federal and state regulations, reducing the risk of costly penalties. Employee self-service portals empower staff to access their payroll information and manage personal data, enhancing transparency. Additionally, real-time reporting capabilities provide valuable insights into payroll expenses, enabling better financial planning and budget oversight for your organization. Integration With Other HR Functions Integrating HR payroll programs with other HR functions creates a seamless flow of information that boosts overall operational efficiency. This integration streamlines processes and improves data accuracy, which ultimately benefits your organization. Here are some key advantages: Automates payroll calculations using attendance and time tracking data, minimizing errors. Links with benefits management systems for automatic updates on employee compensation packages. Facilitates onboarding by connecting with applicant tracking systems (ATS), allowing new hires to enter their information directly. Generates real-time reports across HR functions, providing insights into workforce costs, absenteeism, and employee engagement. Choosing the Right HR Payroll Program for Your Organization How do you guarantee that your organization selects the most suitable HR payroll program? Start by evaluating your specific needs, including the number of employees, payroll frequency, and any unique compliance requirements. Confirm the software integrates well with your existing accounting and HR management tools to streamline operations. Assess the scalability of the program, as it should support future growth, new contracts, and regional expansions. Look for a user-friendly interface and strong customer support to assist your HR team during implementation and beyond. Finally, consider the total cost of ownership, including licensing fees, maintenance costs, and potential expenses for updates or support, confirming the program fits your budget while meeting all required functionalities. Common Challenges and Solutions in HR Payroll Management Managing HR payroll effectively comes with its own set of challenges that organizations must address to secure accuracy and compliance. Here are some common issues you might face, along with solutions to contemplate: Inaccurate data entry: Implement automated systems to reduce human error and improve accuracy. Compliance with changing laws: Choose payroll systems that offer real-time alerts for legal changes, making certain you stay compliant and avoid penalties. Scalability issues: Select payroll software adaptable to various employment contracts and international regulations to future-proof your operations. Timely processing: Adopt automated payroll solutions to streamline calculations and guarantee employees receive their pay on time. The Future of HR Payroll Programs As you look toward the future of HR payroll programs, you’ll notice a significant shift toward automation and efficiency gains, making payroll processing quicker and more accurate. With advancements in data analytics integration, you’ll have the tools to analyze payroll data for better financial planning, as well as adapting to the needs of a remote workforce, ensuring compliance with various labor laws. These changes will empower employees through self-service portals, enhancing their ability to manage payroll information transparently and efficiently. Automation and Efficiency Gains Automation in HR payroll programs not just streamlines processes but also transforms the way organizations manage their payroll functions. By implementing automation, you can greatly reduce manual data entry errors, enhancing accuracy in payroll calculations and records. This shift allows your HR team to focus on strategic initiatives instead of repetitive tasks, improving overall efficiency. Key benefits include: Cost savings: Avoid costly errors that can save your business thousands annually. Streamlined operations: Free up time for HR staff to concentrate on important projects. Compliance assurance: Keep up with changing tax laws, reducing the risk of penalties. Data-driven insights: Utilize real-time analytics to optimize workforce management and budgeting. Embracing automation positions your organization for future success. Data Analytics Integration The integration of data analytics into HR payroll programs is reshaping how organizations approach workforce management and payroll processing. By tracking and analyzing employee performance, attendance, and payroll trends, you can make more informed decisions. Advanced payroll software now uses predictive analytics, enabling you to forecast payroll costs and labor needs based on historical data. This integration helps identify discrepancies in payroll processing, mitigating compliance risks and improving operational efficiency. Furthermore, it improves employee engagement by providing insights into compensation trends, allowing you to tailor benefits and incentives to retain top talent. As payroll programs evolve, expect real-time data analytics to automate reporting, enhancing accuracy and reducing the administrative burden on your HR department. Remote Workforce Adaptability In today’s swiftly evolving work environment, adapting HR payroll programs to accommodate remote employees has become essential for businesses aiming to maintain efficiency and compliance. By embracing remote workforce adaptability, you can streamline payroll management across various locations as you guarantee adherence to local tax regulations and labor laws. Key features to look for in advanced payroll systems include: Seamless integration with time-tracking and project management tools for accurate wage calculations. Self-service portals that let remote employees access payroll information and update personal data. Cloud-based solutions providing real-time data access for consistent payroll processing. Automated compliance alerts to navigate multi-state employment laws and tax implications. These elements help improve employee engagement and make sure your payroll processes remain efficient and accurate. Frequently Asked Questions What Is the HR Payroll System? An HR payroll system manages employee payments efficiently. It calculates wages based on hours worked or salaries, ensuring compliance with tax regulations. You’ll appreciate features like direct deposit and check issuance, which guarantee timely payments. This system in addition offers self-service portals for accessing important documents and tracking attendance, reducing the administrative load on HR. How to Do HR Payroll? To do HR payroll effectively, you need to gather employee data, including time records and tax forms. Calculate wages based on hours worked or salaries, ensuring compliance with tax laws. Establish a consistent payroll schedule, whether biweekly or monthly, to meet legal requirements and employee preferences. Utilizing payroll management software can streamline data entry, automate tax calculations, and allow employees to access their pay stubs and tax documents easily. What Are the Three Types of Payroll? The three main types of payroll are in-house manual payroll, in-house payroll software, and outsourced payroll services. In-house manual payroll uses spreadsheets to calculate wages, which can lead to errors. In-house payroll software automates calculations, reducing mistakes and integrating with other systems. Outsourced payroll services let you delegate payroll tasks to third-party providers, ensuring compliance as you focus on your core business functions. Each option has its advantages, depending on your business needs. Is HR Payroll Difficult? Yes, HR payroll can be challenging because of the intricacies involved. You need to track employee hours, wages, and various deductions accurately. Calculating taxes and complying with regulations like the Fair Labor Standards Act requires attention to detail. Manual processing is time-consuming and often prone to errors. Whereas HR payroll software can simplify tasks, it demands proper setup and ongoing management to guarantee accuracy and compliance, which can be intimidating for those inexperienced. Conclusion In summary, an HR payroll program is vital for efficiently managing employee compensation and ensuring compliance with labor laws. By automating wage calculations, tax withholdings, and attendance tracking, it markedly reduces manual errors and improves operational efficiency. Choosing the right program customized to your organization’s needs can streamline payroll processing and integrate seamlessly with other HR functions. As the workplace evolves, investing in advanced payroll solutions will be important for maintaining accuracy and enhancing employee satisfaction. Image via Google Gemini This article, "What Is an HR Payroll Program and How Does It Work?" was first published on Small Business Trends View the full article

-

What Is an HR Payroll Program and How Does It Work?

An HR payroll program is a software solution that automates the intricacies of employee compensation. It handles tasks like calculating wages, managing tax withholdings, and ensuring compliance with labor laws. By integrating attendance tracking, the program processes payroll based on hours worked or salary agreements, further enhancing accuracy. With features like self-service portals for employees, it streamlines operations and reduces errors. Comprehending these functionalities can help you choose the right system for your organization. Key Takeaways An HR payroll program automates employee compensation management, including wage calculations and tax withholdings, ensuring accuracy and compliance. It integrates attendance tracking to calculate wages based on hours worked or salary agreements, improving payroll precision. The software provides employee self-service portals for accessing pay stubs and updating personal information, enhancing transparency. It ensures compliance with tax regulations through automatic updates and necessary filings, minimizing the risk of penalties. By streamlining payroll processes, it increases operational efficiency, reducing administrative workload for HR staff and saving time. Understanding HR Payroll Programs When you consider the intricacies of managing employee compensation, an HR payroll program becomes an essential tool for any organization. This software application automates employee compensation management, handling tasks like calculating wages, tax withholdings, and issuing payments. By integrating attendance tracking and timekeeping, it guarantees accurate calculations based on hours worked or salary agreements. Additionally, HR payroll programs help organizations maintain compliance with tax regulations by automatically updating tax rates and generating necessary filings for local, state, and federal authorities. Many systems likewise feature employee self-service portals, allowing staff to access pay stubs and update personal information, which improves overall satisfaction. In the end, a thorough human capital management software solution streamlines the entire human capital management payroll process, increasing operational efficiency. Key Features of HR Payroll Software HR payroll software offers a range of key features that streamline payroll processing and improve overall efficiency in managing employee compensation. One significant aspect is automated payroll processing, which reduces manual calculations and lessens the administrative burden of timesheet compilation. Attendance tracking guarantees accurate wage calculations by recording employee work hours and absences, helping maintain compliance with labor regulations. Recruitment management tools facilitate the hiring process by allowing HR to manage job postings and applicant databases efficiently. Onboarding features enable new hires to complete documentation digitally, speeding up their integration into the organization. Furthermore, extensive benefits management capabilities within HR payroll software help track and update employee perks effectively, contributing to higher employee satisfaction and retention, fundamental components of effective HCM solutions. Benefits of Implementing an HR Payroll Program Implementing an HR payroll program brings several benefits that can transform your payroll processes. You’ll save time and increase efficiency, as automated systems can handle tasks in minutes rather than hours, allowing your HR team to focus on more strategic initiatives. Furthermore, accurate tax compliance and improved employee transparency through self-service options can lead to a more satisfied workforce and a smoother operational flow. Time Savings and Efficiency By automating payroll processing, an HR payroll program can greatly reduce the time spent on payroll tasks, allowing your HR department to operate more efficiently. This automation not only saves you time—averaging a 30% reduction compared to manual methods—but furthermore minimizes human error, ensuring accurate and timely employee payments. Streamlining time tracking and attendance management allows your team to focus on core responsibilities instead of administrative duties. In addition, self-service portals empower employees to manage their personal information, further alleviating the administrative burden on HR staff. Key benefits include: Improved accuracy in payroll processing Increased employee satisfaction and morale Higher overall business productivity Reduced administrative workload for HR staff Implementing an HR payroll program can greatly boost your operational efficiency. Accurate Tax Compliance Guaranteeing accurate tax compliance is vital for any business, especially when maneuvering through the intricacies of federal, state, and local regulations. An HR payroll program automates tax calculations, guaranteeing correct withholdings for all applicable taxes. This automation minimizes the risk of errors that can lead to penalties from the IRS. By incorporating updated tax rates and compliance regulations, the software alleviates the burden of manual tax management, allowing you to focus on your core operations. Regular updates and alerts help you stay compliant with changing tax laws, providing timely notifications for necessary adjustments. Furthermore, accurate record-keeping guarantees all employee earnings, deductions, and tax filings are well-documented, significant for audits and compliance reviews, ultimately avoiding costly fines and enhancing financial stability. Enhanced Employee Transparency A well-designed HR payroll program greatly improves employee transparency, empowering workers to take control of their payroll information. With access to self-service portals, you can view and manage your payroll details, including pay stubs and tax documents. This transparency cultivates trust and reduces confusion about payments. Key benefits include: Accurate and timely payments because of automated wage and deduction calculations. Easy tracking of accrued benefits like paid time off (PTO) and sick leave. Automated notifications for payroll changes or discrepancies, enabling prompt issue resolution. Increased employee satisfaction, as timely access to compensation details alleviates financial stress. How HR Payroll Programs Streamline Payroll Processing As organizations seek to improve efficiency and reduce errors in payroll processing, HR payroll programs emerge as a crucial solution. These programs automate payroll calculations, which greatly cuts down the time spent on manual data entry as well as minimizing traditional errors. By integrating attendance tracking, they guarantee accurate computation of hours worked, overtime, and absences, directly impacting payroll accuracy. Automating tax withholdings and filings helps maintain compliance with federal and state regulations, reducing the risk of costly penalties. Employee self-service portals empower staff to access their payroll information and manage personal data, enhancing transparency. Additionally, real-time reporting capabilities provide valuable insights into payroll expenses, enabling better financial planning and budget oversight for your organization. Integration With Other HR Functions Integrating HR payroll programs with other HR functions creates a seamless flow of information that boosts overall operational efficiency. This integration streamlines processes and improves data accuracy, which ultimately benefits your organization. Here are some key advantages: Automates payroll calculations using attendance and time tracking data, minimizing errors. Links with benefits management systems for automatic updates on employee compensation packages. Facilitates onboarding by connecting with applicant tracking systems (ATS), allowing new hires to enter their information directly. Generates real-time reports across HR functions, providing insights into workforce costs, absenteeism, and employee engagement. Choosing the Right HR Payroll Program for Your Organization How do you guarantee that your organization selects the most suitable HR payroll program? Start by evaluating your specific needs, including the number of employees, payroll frequency, and any unique compliance requirements. Confirm the software integrates well with your existing accounting and HR management tools to streamline operations. Assess the scalability of the program, as it should support future growth, new contracts, and regional expansions. Look for a user-friendly interface and strong customer support to assist your HR team during implementation and beyond. Finally, consider the total cost of ownership, including licensing fees, maintenance costs, and potential expenses for updates or support, confirming the program fits your budget while meeting all required functionalities. Common Challenges and Solutions in HR Payroll Management Managing HR payroll effectively comes with its own set of challenges that organizations must address to secure accuracy and compliance. Here are some common issues you might face, along with solutions to contemplate: Inaccurate data entry: Implement automated systems to reduce human error and improve accuracy. Compliance with changing laws: Choose payroll systems that offer real-time alerts for legal changes, making certain you stay compliant and avoid penalties. Scalability issues: Select payroll software adaptable to various employment contracts and international regulations to future-proof your operations. Timely processing: Adopt automated payroll solutions to streamline calculations and guarantee employees receive their pay on time. The Future of HR Payroll Programs As you look toward the future of HR payroll programs, you’ll notice a significant shift toward automation and efficiency gains, making payroll processing quicker and more accurate. With advancements in data analytics integration, you’ll have the tools to analyze payroll data for better financial planning, as well as adapting to the needs of a remote workforce, ensuring compliance with various labor laws. These changes will empower employees through self-service portals, enhancing their ability to manage payroll information transparently and efficiently. Automation and Efficiency Gains Automation in HR payroll programs not just streamlines processes but also transforms the way organizations manage their payroll functions. By implementing automation, you can greatly reduce manual data entry errors, enhancing accuracy in payroll calculations and records. This shift allows your HR team to focus on strategic initiatives instead of repetitive tasks, improving overall efficiency. Key benefits include: Cost savings: Avoid costly errors that can save your business thousands annually. Streamlined operations: Free up time for HR staff to concentrate on important projects. Compliance assurance: Keep up with changing tax laws, reducing the risk of penalties. Data-driven insights: Utilize real-time analytics to optimize workforce management and budgeting. Embracing automation positions your organization for future success. Data Analytics Integration The integration of data analytics into HR payroll programs is reshaping how organizations approach workforce management and payroll processing. By tracking and analyzing employee performance, attendance, and payroll trends, you can make more informed decisions. Advanced payroll software now uses predictive analytics, enabling you to forecast payroll costs and labor needs based on historical data. This integration helps identify discrepancies in payroll processing, mitigating compliance risks and improving operational efficiency. Furthermore, it improves employee engagement by providing insights into compensation trends, allowing you to tailor benefits and incentives to retain top talent. As payroll programs evolve, expect real-time data analytics to automate reporting, enhancing accuracy and reducing the administrative burden on your HR department. Remote Workforce Adaptability In today’s swiftly evolving work environment, adapting HR payroll programs to accommodate remote employees has become essential for businesses aiming to maintain efficiency and compliance. By embracing remote workforce adaptability, you can streamline payroll management across various locations as you guarantee adherence to local tax regulations and labor laws. Key features to look for in advanced payroll systems include: Seamless integration with time-tracking and project management tools for accurate wage calculations. Self-service portals that let remote employees access payroll information and update personal data. Cloud-based solutions providing real-time data access for consistent payroll processing. Automated compliance alerts to navigate multi-state employment laws and tax implications. These elements help improve employee engagement and make sure your payroll processes remain efficient and accurate. Frequently Asked Questions What Is the HR Payroll System? An HR payroll system manages employee payments efficiently. It calculates wages based on hours worked or salaries, ensuring compliance with tax regulations. You’ll appreciate features like direct deposit and check issuance, which guarantee timely payments. This system in addition offers self-service portals for accessing important documents and tracking attendance, reducing the administrative load on HR. How to Do HR Payroll? To do HR payroll effectively, you need to gather employee data, including time records and tax forms. Calculate wages based on hours worked or salaries, ensuring compliance with tax laws. Establish a consistent payroll schedule, whether biweekly or monthly, to meet legal requirements and employee preferences. Utilizing payroll management software can streamline data entry, automate tax calculations, and allow employees to access their pay stubs and tax documents easily. What Are the Three Types of Payroll? The three main types of payroll are in-house manual payroll, in-house payroll software, and outsourced payroll services. In-house manual payroll uses spreadsheets to calculate wages, which can lead to errors. In-house payroll software automates calculations, reducing mistakes and integrating with other systems. Outsourced payroll services let you delegate payroll tasks to third-party providers, ensuring compliance as you focus on your core business functions. Each option has its advantages, depending on your business needs. Is HR Payroll Difficult? Yes, HR payroll can be challenging because of the intricacies involved. You need to track employee hours, wages, and various deductions accurately. Calculating taxes and complying with regulations like the Fair Labor Standards Act requires attention to detail. Manual processing is time-consuming and often prone to errors. Whereas HR payroll software can simplify tasks, it demands proper setup and ongoing management to guarantee accuracy and compliance, which can be intimidating for those inexperienced. Conclusion In summary, an HR payroll program is vital for efficiently managing employee compensation and ensuring compliance with labor laws. By automating wage calculations, tax withholdings, and attendance tracking, it markedly reduces manual errors and improves operational efficiency. Choosing the right program customized to your organization’s needs can streamline payroll processing and integrate seamlessly with other HR functions. As the workplace evolves, investing in advanced payroll solutions will be important for maintaining accuracy and enhancing employee satisfaction. Image via Google Gemini This article, "What Is an HR Payroll Program and How Does It Work?" was first published on Small Business Trends View the full article

-

SBA Resumes Loan Programs After Federal Shutdown, Unlocking $5B for Small Businesses

The recent federal shutdown interrupted services critical to small businesses, but the U.S. Small Business Administration (SBA) has now resumed operations, ready to deliver much-needed capital back into the economy. The shutdown, which lasted 43 days, impacted the SBA’s ability to approve loans, costing an estimated $5.3 billion in funding that would have supported over 10,000 small business owners. During fiscal year 2025, the SBA saw record demand for loans, guaranteeing approximately 84,400 7(a) and 504 loans and delivering a staggering $45 billion to small businesses nationwide. This surge was largely driven by a confident economic backdrop, characterized by rising wages, increased private sector investment, and low inflation. However, the benefits of this economic growth faced a significant setback as the shutdown halted approvals within crucial lending programs that small businesses rely on for expansion, hiring, and operational needs. “Thousands of American jobs and livelihoods were jeopardized during the longest shutdown in American history – inflicting pain on everyone from our military communities to Main Street,” said Kelly Loeffler, SBA Administrator. This downshift in momentum forced many entrepreneurs to make challenging decisions, including cutting hours for employees or postponing expansion plans. The immediate reopening of SBA programs means that business owners can access financing options again, allowing them to proceed with hiring, funding projects, or addressing everyday operational costs. The 7(a) and 504 programs, which are vital for small businesses, provide federally guaranteed loans that are crucial for growth and sustainability. As consumer confidence was high before the shutdown, small business owners had begun to prepare for future investments. However, as federal furloughs took effect, consumer spending in certain areas witnessed declines. This not only put a strain on small business owners but also affected federal contractors, who reportedly lost at least $12 billion in revenue from federal projects. With the government back to full operation, the SBA is prioritizing support for small businesses to help them regain the momentum lost during the shutdown. “Now that the shutdown has finally ended, the SBA is immediately resuming its operations and rapidly returning to the mission of supporting the historic economic growth agenda of the The President Administration,” Loeffler emphasized. What does this mean for small business owners moving forward? The resumption of SBA operations will allow entrepreneurs to access previously unavailable capital, assisting them with their growth strategies in an expanding economy. However, some may face challenges in navigating the backlog of pending loan applications led by demand during the shutdown. Business owners should remain proactive in communicating with lenders and keeping abreast of any updates from the SBA about loan availability and processes. It’s essential for small business owners to take advantage of the loans offered, considering how much they can contribute to hiring and investing in expansion. The restored access to funds can fuel hiring initiatives, facilitate growth strategies, and potentially stabilize businesses that have been adversely affected by recent economic fluctuations. For those who managed to stay afloat during the shutdown, now is the time to explore opportunities for scaling—whether that involves hiring new employees, expanding product lines, or investing in marketing efforts. As the economy continues to bounce back, being prepared to take immediate action can position small businesses for long-term success. In a time where continued access to capital aligns with broader economic goals, owners interested in financing through the SBA would benefit from immediate outreach to lenders and understanding both the opportunities and challenges that lie ahead. The SBA’s commitment to supporting small businesses remains steadfast, and it marks a pivotal moment for entrepreneurs ready to capitalize on the returning momentum. For further details on the SBA’s operations and resources, visit the official announcement here. Image via Google Gemini This article, "SBA Resumes Loan Programs After Federal Shutdown, Unlocking $5B for Small Businesses" was first published on Small Business Trends View the full article

-

SBA Resumes Loan Programs After Federal Shutdown, Unlocking $5B for Small Businesses

The recent federal shutdown interrupted services critical to small businesses, but the U.S. Small Business Administration (SBA) has now resumed operations, ready to deliver much-needed capital back into the economy. The shutdown, which lasted 43 days, impacted the SBA’s ability to approve loans, costing an estimated $5.3 billion in funding that would have supported over 10,000 small business owners. During fiscal year 2025, the SBA saw record demand for loans, guaranteeing approximately 84,400 7(a) and 504 loans and delivering a staggering $45 billion to small businesses nationwide. This surge was largely driven by a confident economic backdrop, characterized by rising wages, increased private sector investment, and low inflation. However, the benefits of this economic growth faced a significant setback as the shutdown halted approvals within crucial lending programs that small businesses rely on for expansion, hiring, and operational needs. “Thousands of American jobs and livelihoods were jeopardized during the longest shutdown in American history – inflicting pain on everyone from our military communities to Main Street,” said Kelly Loeffler, SBA Administrator. This downshift in momentum forced many entrepreneurs to make challenging decisions, including cutting hours for employees or postponing expansion plans. The immediate reopening of SBA programs means that business owners can access financing options again, allowing them to proceed with hiring, funding projects, or addressing everyday operational costs. The 7(a) and 504 programs, which are vital for small businesses, provide federally guaranteed loans that are crucial for growth and sustainability. As consumer confidence was high before the shutdown, small business owners had begun to prepare for future investments. However, as federal furloughs took effect, consumer spending in certain areas witnessed declines. This not only put a strain on small business owners but also affected federal contractors, who reportedly lost at least $12 billion in revenue from federal projects. With the government back to full operation, the SBA is prioritizing support for small businesses to help them regain the momentum lost during the shutdown. “Now that the shutdown has finally ended, the SBA is immediately resuming its operations and rapidly returning to the mission of supporting the historic economic growth agenda of the The President Administration,” Loeffler emphasized. What does this mean for small business owners moving forward? The resumption of SBA operations will allow entrepreneurs to access previously unavailable capital, assisting them with their growth strategies in an expanding economy. However, some may face challenges in navigating the backlog of pending loan applications led by demand during the shutdown. Business owners should remain proactive in communicating with lenders and keeping abreast of any updates from the SBA about loan availability and processes. It’s essential for small business owners to take advantage of the loans offered, considering how much they can contribute to hiring and investing in expansion. The restored access to funds can fuel hiring initiatives, facilitate growth strategies, and potentially stabilize businesses that have been adversely affected by recent economic fluctuations. For those who managed to stay afloat during the shutdown, now is the time to explore opportunities for scaling—whether that involves hiring new employees, expanding product lines, or investing in marketing efforts. As the economy continues to bounce back, being prepared to take immediate action can position small businesses for long-term success. In a time where continued access to capital aligns with broader economic goals, owners interested in financing through the SBA would benefit from immediate outreach to lenders and understanding both the opportunities and challenges that lie ahead. The SBA’s commitment to supporting small businesses remains steadfast, and it marks a pivotal moment for entrepreneurs ready to capitalize on the returning momentum. For further details on the SBA’s operations and resources, visit the official announcement here. Image via Google Gemini This article, "SBA Resumes Loan Programs After Federal Shutdown, Unlocking $5B for Small Businesses" was first published on Small Business Trends View the full article

-

7 Essential Steps for Orderly Conflict Resolution

When conflicts arise, it’s vital to follow a structured approach for resolution. Start by acknowledging and validating everyone’s emotions to create a respectful environment. Next, maintain your composure to prevent the situation from escalating. Then, focus on collaborative solutions by encouraging open communication. By setting clear boundaries and establishing realistic expectations, you boost accountability. These steps are fundamental for effective conflict management, and grasping how to implement them can considerably improve team dynamics. What comes next may surprise you. Key Takeaways Acknowledge and validate emotions of all parties to foster respect and trust, enhancing the likelihood of successful resolutions. Maintain calmness and composure, utilizing deep breathing and neutral language to keep discussions productive and prevent escalation. Encourage open communication and collaborative solutions, allowing team members to share thoughts and brainstorm effectively. Set clear boundaries and expectations for acceptable behaviors, promoting accountability and reducing misunderstandings among team members. Utilize effective communication strategies, including “I” statements and routine check-ins, to address needs and prevent conflicts from escalating. Acknowledge Emotions When conflicts arise, acknowledging emotions is critical since it validates the feelings of everyone involved, creating an environment of respect and comprehension. The first step in resolving a conflict is to recognize and address these emotions. Research shows that emotional turmoil can hinder rational solutions, so it’s important to acknowledge feelings early on. Ignoring emotional responses often leads to unresolved conflicts, costing American businesses approximately $359 billion annually because of decreased productivity. By demonstrating empathy and validating emotions, you can cultivate trust and improve interpersonal relationships. Acknowledging emotions likewise helps de-escalate tensions, which enables clearer communication and constructive dialogue, eventually enhancing the likelihood of a successful resolution. Following these conflict resolution steps in order is crucial for effective outcomes. Validate Perspectives Validating perspectives is a fundamental aspect of effective conflict resolution that builds on the acknowledgment of emotions. By actively listening and acknowledging the feelings of everyone involved, you can de-escalate tensions and create a more collaborative atmosphere. Research shows that when individuals feel heard and respected, communication improves, leading to better resolution outcomes. Utilizing “I” statements, like “I feel concerned when…” helps express your feelings without placing blame, promoting constructive dialogue. Engaging in empathetic communication, such as reflecting back what others say, improves mutual comprehension. By recognizing and validating different viewpoints, you not only diminish the likelihood of unresolved conflicts but also contribute to a healthier work environment, ultimately increasing productivity and team cohesion. Maintain Calmness To maintain calmness during conflicts, focus on breathing deeply and reflecting on your emotions before responding. This technique helps you manage stress and keeps your reactions in check, allowing for clearer communication. Furthermore, using neutral language can prevent escalation, ensuring the discussion stays productive and focused on resolution. Breathe Deeply and Reflect Calmness is essential in conflict resolution, and one effective way to achieve it’s through deep breathing and self-reflection. Taking deep breaths can appreciably lower your stress levels, helping you maintain the composure needed for rational decision-making. Before entering a conflict discussion, take a moment to reflect on your emotions and reactions. This practice not merely clears your mindset but also reduces the likelihood of escalation. Mindful breathing techniques improve your emotional regulation, enabling you to respond thoughtfully rather than impulsively. By remaining calm, you set a positive tone for the resolution process, nurturing collaboration and respect among all parties involved. Brief reflection enhances your self-awareness, allowing for more assertive and effective communication while respecting others’ perspectives. Use Neutral Language Effective communication is a cornerstone of resolving conflicts, and using neutral language plays a significant role in this process. When you choose words that aren’t emotionally charged, you help diffuse tension and create a calmer environment for discussion. For instance, instead of saying, “You never listen,” try, “I feel unheard in our conversations.” This shift minimizes defensiveness and encourages open dialogue. Studies show that employing neutral language increases the likelihood of collaborative solutions, which strengthens relationships and improves team dynamics. By maintaining calmness through neutral phrasing, you allow both parties to feel respected and understood. In the end, this approach reduces misunderstandings and nurtures a positive atmosphere, making it easier to focus on resolving the actual issues at hand. Focus on Collaborative Solutions When conflicts arise, focusing on collaborative solutions can greatly improve the resolution process. By working together, you and the other parties can identify outcomes that benefit everyone involved. Open communication about each person’s needs and interests encourages innovative and sustainable resolutions. Consider organizing brainstorming sessions, which can enhance team cohesion and promote joint problem-solving. Research indicates that teams engaging in collaborative conflict resolution enjoy improved morale and productivity, as it strengthens interpersonal relationships and builds trust. Emphasizing collaboration not only addresses the immediate issues but additionally cultivates a culture of respect and comprehension, which reduces the chances of future disputes. Ultimately, embracing this approach can lead to lasting, harmonious relationships among team members. Set Clear Boundaries To set clear boundaries, you need to define acceptable behaviors and communication styles within your team. By communicating expectations clearly, you create a safe environment where everyone feels comfortable expressing their views without fear of disrespect. This proactive approach not just reduces misunderstandings but additionally cultivates respect and collaboration among team members. Define Acceptable Behavior Clarity in defining acceptable behavior is crucial for effective conflict resolution. Establishing clear boundaries helps you and others understand the limits of interaction and communication during disputes. When expectations are communicated clearly, misunderstandings can be reduced, preventing escalation and promoting a respectful environment. Setting these boundaries encourages accountability, as it outlines the consequences of violating agreed-upon standards. This nurtures a culture of respect and responsibility among team members. Additionally, a well-defined framework for acceptable behavior promotes transparency, allowing all parties to express concerns without fear of hostility. Research shows that organizations with established behavioral expectations experience lower levels of conflict, leading to improved morale and productivity. Defining acceptable behavior is a foundational step in resolving conflicts constructively. Communicate Expectations Clearly Effective communication of expectations is essential in establishing clear boundaries during conflict situations, as it directly influences the interactions between parties involved. To nurture a shared comprehension and avoid misunderstandings, consider these key steps: State Limits Clearly: Explicitly outline what behaviors are acceptable and what aren’t, ensuring everyone perceives the boundaries in place. Define Roles: Clearly articulate each party’s responsibilities during the conflict resolution process, which promotes accountability and awareness of contributions. Reinforce Regularly: Regularly revisit these expectations in team meetings to maintain alignment and prevent future conflicts. Establish Realistic Expectations Establishing realistic expectations during conflict resolution is vital for preventing misunderstandings and encouraging a productive environment. You should clearly outline what can realistically be achieved, as this sets a tone that promotes cooperation. By communicating specific timelines for resolution, you can alleviate anxiety, since 53% of employees tend to avoid unclear situations that may become toxic. Recognizing the limitations of your goals helps build trust among all parties involved, reducing the likelihood of further conflict stemming from unmet expectations. Engaging in dialogue about each party’s needs promotes effective compromise, aligning with the Thomas-Kilmann Conflict Model. Regular feedback and updates are important for maintaining accountability, as unresolved conflicts can greatly impact productivity and cost organizations dearly. Foster Open Communication Open communication serves as a cornerstone for effective conflict resolution in any workplace. By nurturing an environment where team members feel comfortable sharing their thoughts, you can greatly reduce misconceptions that lead to conflict. Here are three crucial strategies to promote open communication: Active Listening: Guarantee everyone feels heard by genuinely engaging in conversations and acknowledging their points of view. This respect nurtures comprehension and collaboration. Use “I” Statements: Encourage expressing feelings and needs without blaming others. For example, say, “I feel frustrated when deadlines aren’t met,” instead of pointing fingers. Regular Feedback: Implement routine check-ins to address concerns before they escalate, creating a proactive culture. Frequently Asked Questions What Are the 5 Steps to Conflict Resolution in Order? To effectively resolve conflict, start by identifying the problem, ensuring you understand all viewpoints involved. Next, assess the situation by observing non-verbal cues and the overall atmosphere. Then, devise solutions that meet everyone’s needs, utilizing emotional intelligence for a customized approach. Conduct one-on-one conversations to encourage open dialogue and gather deeper insights. Finally, establish a common goal to unite the team and prevent future disputes, ensuring everyone is aligned and engaged. What Are the 5 C’s of Conflict Resolution? The 5 C’s of conflict resolution are Communication, Cooperation, Compromise, Commitment, and Creativity. Communication guarantees that all parties understand each other’s perspectives, cultivating a respectful dialogue. Cooperation encourages teamwork to find solutions, which strengthens relationships. Compromise involves both sides making concessions for a mutually acceptable outcome. Commitment guarantees everyone follows through on the agreed solution. Finally, Creativity invites innovative ideas, potentially leading to unique resolutions that satisfy all involved. What Are the 7 Steps in Conflict Resolution? To resolve conflicts effectively, you can follow seven key steps. First, identify the issue at hand. Next, understand the perspectives of everyone involved to gather insights. Assess the situation by actively listening to emotions and tensions. Then, devise potential solutions that meet everyone’s needs. Have one-on-one conversations to discuss these solutions, establish common goals to guide collaboration, and finally, focus on implementing solutions together to guarantee a productive resolution. What Are the 4 C’s of Conflict Resolution? The 4 C’s of conflict resolution are Communication, Collaboration, Compromise, and Consistency. Communication involves sharing thoughts openly to avoid misunderstandings. Collaboration focuses on working together to find solutions that benefit everyone involved. Compromise requires you to give up some demands to reach an agreement that satisfies both parties. Finally, Consistency guarantees that conflict resolution processes are applied fairly across the board, nurturing trust and accountability in your team dynamics. Conclusion In conclusion, following these seven crucial steps can greatly improve conflict resolution within teams. By acknowledging emotions and validating perspectives, you create a respectful environment. Maintaining calmness prevents escalation, whereas focusing on collaborative solutions encourages innovation. Setting clear boundaries and establishing realistic expectations promotes accountability. Finally, encouraging open communication guarantees ongoing dialogue. Implementing these strategies not just resolves conflicts but additionally strengthens team dynamics, leading to healthier relationships and improved overall performance in the workplace. Image via Google Gemini This article, "7 Essential Steps for Orderly Conflict Resolution" was first published on Small Business Trends View the full article

-

7 Essential Steps for Orderly Conflict Resolution