Everything posted by ResidentialBusiness

-

Shopify Shares More Details On Universal Commerce Protocol (UCP) via @sejournal, @martinibuster

Shopify's Harvey Finkelstein said agentic shopping surfaces products because they fit the user, not because brands can buy visibility. The post Shopify Shares More Details On Universal Commerce Protocol (UCP) appeared first on Search Engine Journal. View the full article

-

Apple Releasing Two New Siri; iOS 26.4 & iOS 27 (Campos, Rave & Fizz)

Apple will reportedly release two new Siri versions, one this year with iOS 26.4 and one next year with iOS 27. Plus, Apple may release an AI pin wearable device in 2027.View the full article

-

OpenAI To Charge Based On Ad View Impressions, Not Clicks

As you know, OpenAI will soon show ads on ChatGPT, but now we are hearing that those ads will be charged on a pay-per-view, impression-based model, not a click-based, cost-per-click model.View the full article

-

This whole city block got an indigenous redesign

The metallic fringe hanging down from the edge of Anishnawbe Health Toronto’s community health center near downtown Toronto is the biggest indication that something different is happening here. Created to provide centralized health care and traditional healing to the 90,000-strong Indigenous population of Toronto, the clinic is the centerpiece of a unique city block of development that was intentionally led by the Indigenous community and designed to reflect its culture. The wraparound fringe of more than 12,000 strands of stainless steel chain—the kind of aesthetic flourish easily targeted for elimination by the value engineers of a typical development—is just one of many elements of the project that put its Indigenous roots on full display on this block. From its services and its building forms to the orientation of its landscaping, the development embodies Indigenous traditions, practices, and principles in a way that’s wholly uncommon in most urban environments. Named the Indigenous Hub, this city block of development includes the aforementioned health center, along with an Indigenous job training center, two mid-rise residential towers, and public and private plazas. Indigenous iconography and material references can be seen across the site, from building facades that reference sacred blanket designs and healing rituals to wall treatments that evoke the bark of trees that once stood as forests on this site. It’s a project that goes to unusual lengths to put these elements on display. And it also required everyone involved in the project, from the developer to the architects and the landscape designers, to rethink their approach to urban development. ‘A place of indigeneity’ Located in a part of the city that was once the floodplain of the Don River, and before that the ancestral lands and hunting grounds for Indigenous people for thousands of years, the site holds deep resonance for the community. The designers of the project, including an Indigenous architecture firm headquartered in a nearby First Nation, put great effort into drawing those connections in the look and feel of the project. “The intent was all about how do we ensure that when people are in this block, they understand that it is a place of indigeneity, and also understand where they are within the city,” says Matthew Hickey, a partner at Two Row Architect, an Indigenous architecture firm that advised on the design of every part of the project. Working closely with Stantec Architecture, Two Row helped create the plan for the block, and then worked alongside Stantec and the architecture firm BDP Quadrangle to guide the design of the buildings and outdoor spaces within the block, including building facades inspired by traditional dress, traditional healing spaces that connect directly to the earth, and a central Indigenous Peoples Garden plaza where medicinal plants are grown. This ambitious, Indigenous-led development has been decades in the making. The charity health care organization Anishnawbe Health Toronto (AHT) had been searching for a place to consolidate and improve services it had been providing to Toronto’s Indigenous population since the 1980s. Then in the late 2000s, when officials in Toronto put in a bid to host the 2015 Pan Am Games, this former floodplain was targeted as a potential site for redevelopment. As part of the plan, and in line with Canada’s Truth and Reconciliation Commission Calls to Action, a two-and-a-half acre section of the redevelopment area was set aside for Indigenous uses. AHT was chosen to use this land as a centralized location for its services, with funding from the Ministry of Health. After some complex negotiations at the provincial level, the project was expanded to build an entire city block of development. The project soon took on the name Indigenous Hub. Joe Hester, the longtime executive director at AHT who died in early 2025, stressed to the design teams that the land wasn’t being granted to the Indigenous community but returned to them. Rather than designing a development that would simply blend into the urban surroundings, the project represented an opportunity to make a mark. “It’s the first time a health center has been built across Canada specifically to house and to care for Indigenous people, which is shocking on one hand, but also amazing on the other,” says Hickey. At the prodding of Hester and AHT, the project’s designers were called on to design a piece of the city that called attention to its Indigenous character, and prodded people to think about Indigenous people and practices. “We were all very conscious that we were working in a different place with different terms of reference and we needed to be sensitive to those things at all times,” says Les Klein, BDP Quadrangle cofounder. The designers considered the project as a landscape first, the oriented the buildings around what became the Indigenous Peoples Garden. “It forms a central amenity and organizing element for the whole block,” says Michael Moxam, project design principal and design culture practice leader for Stantec. The buildings make visual connections to this central space from the street and from within the health center. “In our work in healthcare, we’re always so focused on the health impact of a connection to landscape and the health impact of a connection to natural light and views. That gets right back to the idea of thinking about the whole block as a landscape first,” says Moxam. “There’s indigenous cultural value to that, but there’s also just a health and wellness value to that.” People over parking Some compromises had to be made. The placement of the health center within the block meant that its entrance was in an undesirable location, according to Indigenous principles. “The building entry is on the west side, which we never enter buildings on. It’s the side of death, basically, with the east side being the side of birth,” Hickey says. As a workaround the design team added a three-story atrium to the east side of the health center, facing the central garden. “Orienting the atrium to the rising sun was one of the teachings that’s embedded in there,” Hickey says. The designers even tweaked the building facades surrounding the central garden to reflect more light into that east-facing atrium. “We would not have done that if we hadn’t been talking about it and understanding how important those elements are,” Klein says. This level of intention helped make the health center building so striking. In addition to its metal fringe, the facade is clad in perforated aluminum that’s patterned after a star blanket, which symbolizes connections with ancestors and the cosmos. Inside, conventional clinical spaces are situated alongside traditional healing spaces on each of the clinic’s four floors, with curving rusted steel appearing at the street level to indicate where these spaces are located. In line with an Indigenous principle that healing spaces be in direct contact with the earth, the block’s plan was altered to move all underground parking and basement space outside the footprint of the health center to sit beneath the two housing towers on the block’s edge. “We went to [Hester] and said, you know, it’s going to lose a few parking spaces. And he said, ‘this is what we’re going to do,'” Klein says. “Things that I would normally at least be nervous about going to a developer to talk about just became part of the natural conversation.” Building materials make other references across the development, including multi-colored bricks that mimic the form of a woven basket, and precast concrete panels patterned after the bark of native birch trees. The fringe around the health center is perhaps the most meaningful design choice, and most representative of what makes this development so unique. It’s inspired by the shawls used by fancy dancers at Indigenous powwows, and also by the sound made by the jingle dresses traditionally used during healing rituals. “For a jingle dress dancer, it’s about healing. They dance for people to heal, and that sound is a part of it,” says Hickey. “For us, dancing is not just for dancing or showing off. Like architecture is not about showing off. It’s about what it’s doing.” View the full article

-

Google Search Makes Recipe Results More Publisher Friendly

A few weeks ago, we covered how damaging the Google Search results were for recipe publishers and bloggers. It was nicknamed Frankenstein recipes because it would take pieces of these recipes from bloggers, mash them together and ruin them, all while also mentioning the brand name - hurting the brand. View the full article

-

New GoogleBot: Google Messages

Google added a new crawler, robot, to its list of user-triggered fetchers in the Google crawlers documentation. This specific bot is named Google Messages and it is a fetcher "used to generate link previews for URLs sent in chat messages," Google wrote.View the full article

-

As AI becomes pervasive, CTOs need to talk to clients and educate their bosses

Hello and welcome to Modern CEO! I’m Stephanie Mehta, CEO and chief content officer of Mansueto Ventures. This bonus newsletter from Davos explores the strategic relationship between CEOs and chief technology officers. If you received this newsletter from a friend, you can sign up to get it yourself every Monday morning. In my previous life as a technology journalist, I wrote and edited countless stories about corporate chief technology officers (CTOs) emerging as key partners to their counterparts in the C-suite. When marketing functions became more data-driven, chief marketing officers clamored for attention from product and engineering. Today, chief financial officers (CFOs) push tech leaders to drive companies’ productivity gains from software and automation even as they scrutinize tech buying decisions. Now, as artificial intelligence (AI) and agents become pervasive at companies, CTOs have another executive to collaborate with: their bosses. In an interview with Fast Company editor-in-chief Brendan Vaughan during the World Economic Forum annual meeting in Davos, Switzerland, Cloudflare cofounder and CEO Matthew Prince and CTO Dane Knecht made the case for technology chiefs as strategic partners to CEOs. The C-suite syncs up Prince says Knecht has been instrumental in pushing him to adopt AI beyond fun use cases, such as creating amusing images for company slide presentations or invitations for his kid’s birthday party. “The best CTOs in the world are going to be the ones that are saying to even the 51-year-old or 61-year-old or 71-year-old CEOs, ‘You can do this too,’” says Prince, whose company provides customers with tools to protect and improve the performance of their websites. “And if you can do that, it’s going to actually help you build better companies.” It’s a sentiment echoed by Nacho De Marco, CEO of global software development company BairesDev. (BairesDev partnered with Fast Company on the event featuring Prince and Knecht.) He says his clients, who turn to the company to help scale their engineering teams, see AI as essential to their future. “When the CEO and CTO are aligned, that transition usually goes really well,” he says. Knecht, who started out as Cloudflare’s first product manager, eventually took a role building and leading the company’s emerging technologies and innovation (ETI) unit. Prince carved out 10% of the product and engineering budget for innovations that aren’t on any customer’s road map—and might even challenge Cloudflare’s existing business model. Prince credits the division with propelling the company’s growth, saying: “If Dane and the ETI team hadn’t existed, Cloudflare would be yet another CDN [content delivery network].” Knecht, in turn, says Prince always nudges him to be more ambitious. “You really don’t ever bring Matthew an idea where he says, ‘That’s a good idea,’” Knecht says. “He’ll say, ‘Eh, think bigger.’ It’s always, ‘Think bigger.’” Two roles, one strategy Prince says he was somewhat reluctant to promote Knecht to CTO because Knecht was doing such a good job running the innovation skunkworks. However, Prince was impressed with how well he interacted with customers. Knecht has, for now, retained the ETI team as part of his responsibilities. Indeed, the ability to build relationships with customers is essential for CTOs intent on proving their strategic value to their CEOs. Tal Cohen, president of Nasdaq, says CTOs need to be able to understand how clients use the products their tech teams are building. He also encourages CTOs to become tech translators for their CEOs, helping their bosses understand major technology shifts, whether it’s the latest announcement from Nvidia or a breakthrough in their own industry. “You need to demonstrate that you’re three-dimensional,” adds Cohen, who leads Nasdaq’s Market Services and Financial Technology divisions. Working with your tech leads CEOs, how do you engage your CTO on strategy? And CTOs, how do you make sure that you are included in strategic conversations with your CEO? Send your examples and anecdotes to me at stephaniemehta@mansueto.com. We’ll share helpful examples in a future edition of the newsletter. Read more: the evolving C-suite What’s behind the surge in CFOs becoming CEOs Why so few human resources leaders become CEOs I’m a CMO who’s friends with my CFO View the full article

-

‘I don’t like banks very much’: Farage defends plan to end BoE payments on reserves

Reform leader cites ‘debanking’ episode in comments at DavosView the full article

-

What is ‘brand well-being?’ And can it give you a competitive advantage?

People know when a brand genuinely cares about well-being—for employees, customers, and humanity at large. In many cases, it’s an intangible truth they can simply feel—in how they’re treated, how decisions get made, and whether a company’s stated values actually show up in practice. Plenty of brands talk about purpose and people. Fewer live it. And the difference is increasingly obvious. That gap is why “brand well-being” is emerging as a meaningful framework for companies that want to build durable growth—not just short-term performance. At its core, brand well-being recognizes that a brand isn’t a logo or a campaign. It’s a living ecosystem made up of people, culture, purpose, and consumer relationships. When one part breaks down, the entire system weakens. When all three are healthy, the brand becomes more resilient, trusted, and relevant over time. Importantly, this isn’t abstract. It’s a leadership choice—and one companies can control. What Is Brand Well-Being? Brand well-being is a holistic concept that encourages companies to prioritize wellness across three critical dimensions. Employee well-being asks a basic question: is work designed in a way that supports people’s physical, mental, and emotional health, or does it quietly drain them? Culture well-being examines whether a company operates with meaning and humanity—and whether employees feel genuinely connected to each other and the work itself. Consumer well-being focuses on how brands show up in people’s lives: are they improving them in tangible ways, or simply competing for attention? If well-being is the equivalent of organizational health, the logic is straightforward. Healthier employees perform better. Purpose-driven cultures retain talent. Trust-based consumer relationships last longer. No business would argue against those outcomes. What company wouldn’t want its workforce to be healthier, its culture more purposeful, and its consumer relationships more authentic? Yet many still treat well-being as a side initiative rather than a core strategy. The Business Case: Wellness Drives Work For years, wellness initiatives were framed as “perks”—a nice box to check and a headline to score PR points. Too often, a company’s wellness strategy is a daily app reminder that feels more like an annoying interruption or chore. The data tells a different story when well-being is approached consistently and strategically. A Cigna-commissioned study found that employer well-being programs delivered an average ROI of 47%, returning $1.47 for every dollar invested. According to Wellhub, 99% of HR leaders say wellness programs improve employee productivity. Meta-analyses show reductions in absenteeism and healthcare costs with ROI approaching 148%, saving hundreds of dollars per employee annually. Companies investing in well-being also see meaningful drops in turnover—sometimes by as much as 25%. Well-being is no longer a bonus. It’s a business strategy—one that drives loyalty, retention, and performance at scale. One of the strongest validations comes from Indeed’s Work Wellbeing 100, a data-driven ranking developed with Oxford University that evaluates publicly traded companies based on extensive employee survey data. Many of the companies that score highest on employee well-being also outperform the market and regularly appear on the Fortune 500. The correlation is hard to ignore: organizations that invest in well-being tend to outperform those that don’t. Well-being isn’t a cost—it’s a competitive advantage. Bringing Brand Well-Being to Life The challenge, of course, is moving from intent to impact. Brand well-being doesn’t come from a single program or campaign. It requires expertise, lived experiences, and real feedback loops—inside and outside the organization. Done correctly, it can play a transformative role not only in deepening consumer relationships, but also in boosting cultural energy within the company itself—and yes, ultimately, productivity. Forward-thinking companies are starting to treat well-being as an integrated ecosystem. They bring credible experts into leadership and employee learning, focusing on sustainable performance, stress management, communication, and burnout prevention. They engage consumers through real-world experiences that foster connection rather than spectacle. And they create safe, personal environments—events, retreats, and small-group forums—where people not only learn about mental and physical health, stress management, personal sustainability and nutrition, they feel comfortable sharing honest insights about their lives, needs, and expectations. Those insights, when fed back into product design, workplace culture, and brand strategy, become far more valuable than traditional surveys or focus groups. They allow brands to understand not just what people say, but how they actually feel. Importantly, the most effective brands integrate well-being naturally. Products and services show up as part of the experience, not as forced marketing moments. The goal isn’t to sell wellness. It’s to support it authentically. I’ve seen brands like L’Oréal, the NBA, BlackRock, Bayer, Morgan Stanley, Volvo, Hackensack Meridian Health, and Wells Fargo experiment with this model through internal offsites, community experiences, and retreats hosted in well-being-focused environments. The result isn’t just better morale—it’s stronger relationships, higher trust, and clearer insight into both employees and consumers. Over time, the impact drives increased happiness long after the event ends. The Leadership Question Every company says it wants to evolve. But evolution requires trade-offs. It means leading with care, connection, and long-term thinking in a system still optimized for speed and short-term returns. Some leaders already understand that investing in well-being is inseparable from investing in brand performance. Others still treat it as an optional expense—something to revisit when margins allow. The market is increasingly clear about which group is winning. Brand well-being isn’t about being nice. It’s about building organizations that people want to work for, buy from, and believe in—again and again. The question facing today’s leaders isn’t whether well-being matters. It’s whether they’re willing to lead knowing it does. View the full article

-

Why HR needs to step up its game

A century ago, work was unsafe and openly adversarial. Strikes were common. Turnover was extreme. Productivity suffered. HR—then called personnel—was created to manage this instability. Its job wasn’t to make work fulfilling. It was to reduce friction between employees and the company, keep people on the job, and protect output. As companies matured, so did HR. The function expanded to include hiring, pay, benefits, training, grievance handling, and legal compliance. On paper, this evolution gave HR a broad view of how people experienced work—and the potential authority to shape it. But that authority was never fully claimed. Instead, HR generally settled into administering systems and policies designed by others—especially the C-Suite. In a recent Wall Street Journal interview, University of Virginia business school professor Allison Elias explains how this history is experienced today. Employees don’t see HR as a driver of better leadership or a healthier workplace. They see a function that listens but rarely acts, collects feedback but seldom follows through, and lacks the authority—or the courage—to intervene when leadership behavior is the root of the problem. Employees today doubt whether HR has the power and standing to influence how individual leaders actually lead—especially when leadership behavior openly undermines trust, clarity, dignity, or psychological/emotional safety. Over time, that gap between listening and acting has become the narrative. The good news: HR now has the opportunity to reinvent its role in organizations—but it must step fully into it. Well-being drives performance Over the past year, remarkable research has shown that employee well-being has a direct and profoundly positive impact on organizational performance. The newest study comes from Irrational Capital: drawing on more than a decade of public and private data, they found companies ranking highest in employee well-being significantly outperform their peers in long-term stock appreciation. Over an 11-year period, firms in the top tier of employee well-being outperformed those in the bottom tier by nearly six percentage points. By contrast, companies that excelled primarily on pay and benefits outperformed by just over two points. What’s now empirically clear is that how people feel about their day-to-day work experience—and their direct managers—matters far more than what they are paid to tolerate it. And, if well-being drives performance, then feedback must be continuous, actionable, and tied directly to leadership accountability. A real voice What employees are craving is a real voice. They want to be routinely asked for honest feedback—not once a year or even semi-annually via traditional engagement surveys proven to have little if any impact—but through focused pulse surveys that capture how they are experiencing work week-to-week. They want to know that their input is heard, considered, and has real influence. That feedback should flow not just to individual managers and senior leadership, but also to HR itself—so the function can monitor patterns, hold leaders accountable, and ensure employee well-being is protected at every level of the organization. When survey results show managers are consistently uncaring, unsupportive, or otherwise undermining employee well-being, HR must willingly intervene—coaching leaders to improve or, when necessary, removing them. This is where HR can finally claim the role it has long been empowered to play: shaping how leaders lead, embedding well-being into daily work, and ensuring organizations operate for people, not just for goal achievement. The ‘How’ The tools for this already exist. Pulse surveys can be deployed one day and summarized the next, delivering real-time insights to managers, senior leaders, and HR. This immediacy creates a rare opportunity: HR doesn’t need to wait months for engagement reports to act. Every piece of feedback becomes a lever to correct course, reinforce positive leadership, and make tangible improvements in how people experience work. What’s critical is that HR can—and must—be the true guardian of this ecosystem. That means more than administering surveys or running reports. It means owning the operation—owning well-being. It means creating a culture where employees know their voice carries weight—and consequences. It means ensuring that workplace leaders understand the practices that contribute to well-being and that there are real teeth—accountability—in its oversight. It must celebrate managers who excel, coach managers who fall short, weed out those who don’t improve, and embed well-being metrics into how leaders are evaluated and rewarded. It must be clearly understood that this is not merely a moral imperative; it’s a business imperative. When people have their needs consistently met for belonging, safety, growth, appreciation, and respect (the key drivers of well-being), organizations see measurable gains in retention, commitment, collaboration, creativity, and profitability. Claiming power The truth is workplace leadership practices are in dire need of transformation. Evidence abounds that traditional methods deplete people rather than energize them—and HR has both the access and authority to lead the needed change throughout their organizations. For HR leaders, the question is simple: will you fully claim the power your role affords? Will you leverage real-time feedback, hold leaders accountable, and transform the employee experience? Doing so will not only improve performance and profitability—it will permanently elevate HR from a back-office function to the strategic force every modern organization needs. The moment is now. Employees are speaking. The data is clear. The tools exist. HR, step into your power! Shape how leaders lead. Protect well-being. Drive performance. Make your mark: ensure work is safe, meaningful, humane—and create organizations that truly flourish. View the full article

-

Burnham set for Westminster comeback as MP agrees to retire

Andrew Gwynne’s decision to stand down will mean by-election opening for rival to Keir StarmerView the full article

-

What Are Customer Journey Touchpoints and Why Do They Matter?

Customer experience touchpoints are the key interactions between your brand and customers throughout their experience, influencing how they perceive and engage with your business. These touchpoints occur at various stages, such as awareness, purchase, and retention, and can greatly impact customer satisfaction and loyalty. Comprehending these interactions is essential for optimizing the customer experience. As you explore this topic further, you’ll discover the various types of touchpoints and how to effectively manage them for better outcomes. Key Takeaways Customer journey touchpoints are critical interactions throughout a customer’s lifecycle, influencing perceptions, satisfaction, and brand loyalty. Touchpoints include various stages such as awareness, consideration, purchase, onboarding, and retention, each shaping the overall customer experience. Effective management of touchpoints can significantly reduce customer abandonment rates, as negative experiences lead to a loss of brand trust. Optimizing touchpoints through personalized interactions and proactive support fosters emotional connections, enhancing customer satisfaction and loyalty. Continuous feedback collection and performance evaluation of touchpoints are essential for identifying improvement areas and ensuring a seamless customer experience. Understanding Customer Journey Touchpoints Comprehending customer experience pathways is crucial for any brand aiming to improve its customer experience. Customer experience pathways represent specific interactions throughout a customer’s lifecycle, from initial awareness to post-purchase retention. These pathways can be categorized into various stages, including awareness, consideration, purchase, onboarding, and retention. Each stage presents unique opportunities to engage with customers and influence their perceptions. For instance, direct interactions like customer support calls and website visits directly impact customer satisfaction, whereas indirect influences such as social media posts and online reviews can shape brand image. Statistics reveal that 59% of customers abandon brands after multiple negative experiences, emphasizing the importance of optimizing each customer touchpoint. The Importance of Customer Journey Touchpoints As you navigate your customer pathway, grasping the importance of touchpoints becomes vital, since these critical interactions greatly influence your overall experience with a brand. Customer experience touchpoints represent pivotal moments throughout your buying process. Each interaction shapes perceptions and satisfaction levels, making it fundamental to optimize these touchpoints. Statistics reveal that 59% of customers will leave a brand after multiple poor experiences, highlighting the need for intentional design and management of touchpoints. By focusing on customer experience mapping, you can identify areas for improvement, ensuring each touchpoint exceeds expectations. Positive interactions cultivate trust and emotional connections, directly impacting brand loyalty. Companies often lose customers because of poor experiences rather than product quality, which underscores the significance of enhancing each customer interaction. In the end, improving customer experience touchpoints can lead to greater satisfaction, increased loyalty, and business growth. Different Types of Customer Journey Touchpoints Comprehension of the different types of customer pathway touchpoints is essential for businesses aiming to improve their customer experience. Customer touch points can be categorized into several stages: awareness, deliberation, purchase, onboarding, and retention. During the awareness stage, marketing touchpoints like Google ads and blog content introduce potential customers to your brand. As they move to deliberation, product comparison pages and customer reviews play a significant role in shaping their perceptions. The purchase stage involves direct interactions through checkout forms. Once the purchase is made, onboarding touchpoints, such as in-app product tours, help customers acclimate to your offerings. Finally, retention is supported by ongoing customer support interactions. Each of these touchpoints can be direct, like in-person meetings, or indirect, such as third-party reviews. Grasping these diverse interactions helps businesses identify areas for improvement and tailor experiences that meet customer needs effectively. How Touchpoints Influence Customer Experience Touchpoints play a vital role in shaping how you perceive a brand throughout your experience. Each interaction, whether positive or negative, can build or hinder your loyalty, influencing your willingness to engage further. Impact on Perception Customer experience touchpoints play a pivotal role in shaping how you perceive a brand and its offerings. Each interaction is a significant part of the customer experience, acting as an emotional breadcrumb that can either build or erode trust. With 59% of people likely to leave after multiple poor experiences, it’s vital to focus on optimizing touch points. Customer touchpoint mapping helps identify pain points and highlights areas for improvement. Positive interactions, like effective onboarding and responsive support, improve customer satisfaction and retention rates. By comprehending and refining these touchpoints, businesses can create stronger connections with you, ultimately influencing brand perception and loyalty. Consistent, personalized engagement across these interactions nurtures deeper relationships and a more favorable view of the brand. Building Brand Loyalty During the process of exploring their path with a brand, consumers encounter various touchpoints that greatly influence their overall experience and loyalty. In customer experience marketing, these client touch points are critical; they shape perceptions and can determine whether a customer remains loyal or walks away. Research indicates that 59% of consumers will abandon a brand after multiple poor experiences, emphasizing the importance of optimizing each interaction. Positive touchpoints, like seamless onboarding and effective support, cultivate emotional connections, whereas negative experiences can lead to churn. By intentionally designing and enhancing touchpoints, brands can exceed customer expectations, transforming satisfied buyers into loyal advocates who’ll promote the brand through word-of-mouth referrals, eventually driving sustained loyalty. Enhancing Engagement Opportunities How can Brandwatch effectively improve engagement opportunities throughout the customer experience? By focusing on customer experience map touchpoints, you can identify critical moments that greatly influence perceptions and emotions. Each marketing touch point, whether it’s direct like customer support or indirect like social media, plays a role in shaping how customers feel about your brand. Mapping these touchpoints helps reveal friction points where customers may struggle or feel unsatisfied, allowing for targeted improvements. Optimizing each interaction not just meets customer needs but can as well exceed their expectations, nurturing deeper connections. Continuous engagement, through follow-up emails and feedback requests, keeps customers involved and valued, boosting their likelihood to return and recommend your brand to others. Identifying and Mapping Customer Journey Touchpoints Mapping customer experience touchpoints is essential for comprehending how customers interact with your brand at various stages, such as awareness, consideration, purchase, onboarding, and support. A touchpoint map visualizes these interactions, allowing you to identify each point of contact with your customers. By carefully mapping these touchpoints, you can evaluate their performance and pinpoint potential areas for improvement. Consider key questions during the creation of your touchpoint map. Is the experience helpful? Does the channel align with customer needs? Are there moments where customers lose interest or get confused? Research shows that 59% of consumers abandon a brand after multiple negative experiences, emphasizing the need for effective identification and optimization of touchpoints. Continuous iteration based on customer feedback is fundamental for increasing satisfaction, retention, and loyalty. In the domain of customer experience digital marketing, a well-structured touchpoint map can vastly improve your overall customer experience. Best Practices for Optimizing Customer Journey Touchpoints To optimize customer experience touchpoints effectively, organizations should first understand the entire customer experience, identifying critical interaction points that directly impact conversion, retention, and satisfaction rates. Start by mapping the customer path to identify customer touch points, focusing on high-impact moments like onboarding and post-purchase support. Regularly collecting and acting on customer feedback at each touchpoint allows you to pinpoint pain points and improve the overall experience. Implementing an omnichannel strategy guarantees a seamless experience across all touch points examples, increasing customer engagement and loyalty. Utilize tools like Customer Experience Mission Statements and path mapping to align your touchpoints with customer needs and expectations. Prioritizing these strategies not only helps you improve customer satisfaction but likewise promotes long-term brand loyalty, making it crucial to continuously assess and refine your approach at each stage of the customer path. The Impact of Touchpoints on Brand Loyalty and Retention Customer touchpoints play a vital role in building trust and nurturing emotional connections with your brand. By ensuring consistent and positive interactions, you can improve customer satisfaction, which leads to increased loyalty and repeat engagement. Recognizing the impact of these touchpoints on your customers’ experiences is fundamental for improving retention and encouraging long-term relationships. Building Trust Through Interactions Building trust through interactions is vital for nurturing brand loyalty and retention, as each touchpoint serves as an opportunity to strengthen the relationship between a business and its customers. Positive consumer touchpoints, such as personalized emails and proactive support, greatly impact customer experiences. With 59% of consumers leaving a brand after multiple poor experiences, optimizing touchpoints is fundamental. Touchpoint Type Impact on Trust Personalized Emails Improve engagement Proactive Support Build reliability Customer Feedback Encourage improvement Consistent Messaging Strengthen loyalty Enhancing Emotional Connections Emotional connections between consumers and brands are greatly shaped by customer experience touchpoints, as each interaction can evoke feelings that influence loyalty and retention. Comprehending touch point meaning is crucial; they represent every moment a consumer interacts with your brand. For instance, examples of touchpoints include personalized emails, responsive customer service, and engaging social media interactions. When these touchpoints are optimized, brands can see up to a 20% increase in customer satisfaction, which improves loyalty considerably. Positive interactions at these touchpoints cultivate trust, making consumers 77% more likely to recommend your brand. Fostering Repeat Engagement Every interaction you have with a brand can shape your loyalty and influence your decision to return. Contact point marketing emphasizes the importance of optimizing each touchpoint to improve customer retention. Research shows that 59% of consumers abandon brands after multiple poor experiences, highlighting the need for positive interactions. By utilizing CRM touchpoints examples, such as personalized emails or responsive customer service, you can create meaningful connections that promote loyalty. Each touchpoint is an opportunity to exceed expectations, and consistent engagement can transform customers into advocates. Remember, even a single negative experience can lead to disengagement, so it’s vital to strategically manage these interactions to enhance satisfaction and encourage repeat business. Frequently Asked Questions Why Do Customer Journey Touchpoints Matter? Customer experience touchpoints matter as they define critical interactions between you and a brand. Each touchpoint shapes your experience and influences your perception. If you encounter multiple negative interactions, you’re likely to abandon the brand. Well-managed touchpoints can improve satisfaction, cultivate loyalty, and lead to repeat business. What Is a Customer Journey and Why Is It Important? A customer experience is the complete series of interactions a customer has with your brand, from the moment they first hear about it to post-purchase experiences. Comprehending this experience is essential as it helps you identify key touchpoints that shape customer perceptions. Each interaction influences satisfaction and loyalty, so knowing how customers move through these phases allows you to tailor experiences effectively, address pain points, and in the end improve retention and engagement. What Are Customer Touch Points? Customer touchpoints are specific interactions between you and a brand throughout your expedition. These moments can occur during various stages, such as awareness through ads or social media, consideration via reviews, and purchase at checkout. Each touchpoint considerably impacts your overall experience and perception of the brand. What Is the Rule of 7 Touchpoints? The Rule of 7 Touchpoints states that customers typically need to engage with a brand at least seven times before making a purchasing decision. This repeated exposure builds familiarity and trust, crucial for converting leads into customers. Each touchpoint—whether through ads, social media, or direct interactions—reinforces brand recognition. To effectively implement this rule, guarantee your marketing strategies deliver consistent messaging across these touchpoints, enhancing overall customer engagement and experience. Conclusion In summary, comprehension and managing customer journey touchpoints is essential for enhancing brand loyalty and customer satisfaction. By identifying and optimizing these interactions, you can create positive experiences that influence customer perceptions at every stage of their voyage. From initial awareness to post-purchase engagement, each touchpoint plays a significant role in shaping relationships with your brand. Prioritizing these elements not just nurtures trust but additionally drives retention, ensuring long-term success for your business. Image via Google Gemini This article, "What Are Customer Journey Touchpoints and Why Do They Matter?" was first published on Small Business Trends View the full article

-

What Are Customer Journey Touchpoints and Why Do They Matter?

Customer experience touchpoints are the key interactions between your brand and customers throughout their experience, influencing how they perceive and engage with your business. These touchpoints occur at various stages, such as awareness, purchase, and retention, and can greatly impact customer satisfaction and loyalty. Comprehending these interactions is essential for optimizing the customer experience. As you explore this topic further, you’ll discover the various types of touchpoints and how to effectively manage them for better outcomes. Key Takeaways Customer journey touchpoints are critical interactions throughout a customer’s lifecycle, influencing perceptions, satisfaction, and brand loyalty. Touchpoints include various stages such as awareness, consideration, purchase, onboarding, and retention, each shaping the overall customer experience. Effective management of touchpoints can significantly reduce customer abandonment rates, as negative experiences lead to a loss of brand trust. Optimizing touchpoints through personalized interactions and proactive support fosters emotional connections, enhancing customer satisfaction and loyalty. Continuous feedback collection and performance evaluation of touchpoints are essential for identifying improvement areas and ensuring a seamless customer experience. Understanding Customer Journey Touchpoints Comprehending customer experience pathways is crucial for any brand aiming to improve its customer experience. Customer experience pathways represent specific interactions throughout a customer’s lifecycle, from initial awareness to post-purchase retention. These pathways can be categorized into various stages, including awareness, consideration, purchase, onboarding, and retention. Each stage presents unique opportunities to engage with customers and influence their perceptions. For instance, direct interactions like customer support calls and website visits directly impact customer satisfaction, whereas indirect influences such as social media posts and online reviews can shape brand image. Statistics reveal that 59% of customers abandon brands after multiple negative experiences, emphasizing the importance of optimizing each customer touchpoint. The Importance of Customer Journey Touchpoints As you navigate your customer pathway, grasping the importance of touchpoints becomes vital, since these critical interactions greatly influence your overall experience with a brand. Customer experience touchpoints represent pivotal moments throughout your buying process. Each interaction shapes perceptions and satisfaction levels, making it fundamental to optimize these touchpoints. Statistics reveal that 59% of customers will leave a brand after multiple poor experiences, highlighting the need for intentional design and management of touchpoints. By focusing on customer experience mapping, you can identify areas for improvement, ensuring each touchpoint exceeds expectations. Positive interactions cultivate trust and emotional connections, directly impacting brand loyalty. Companies often lose customers because of poor experiences rather than product quality, which underscores the significance of enhancing each customer interaction. In the end, improving customer experience touchpoints can lead to greater satisfaction, increased loyalty, and business growth. Different Types of Customer Journey Touchpoints Comprehension of the different types of customer pathway touchpoints is essential for businesses aiming to improve their customer experience. Customer touch points can be categorized into several stages: awareness, deliberation, purchase, onboarding, and retention. During the awareness stage, marketing touchpoints like Google ads and blog content introduce potential customers to your brand. As they move to deliberation, product comparison pages and customer reviews play a significant role in shaping their perceptions. The purchase stage involves direct interactions through checkout forms. Once the purchase is made, onboarding touchpoints, such as in-app product tours, help customers acclimate to your offerings. Finally, retention is supported by ongoing customer support interactions. Each of these touchpoints can be direct, like in-person meetings, or indirect, such as third-party reviews. Grasping these diverse interactions helps businesses identify areas for improvement and tailor experiences that meet customer needs effectively. How Touchpoints Influence Customer Experience Touchpoints play a vital role in shaping how you perceive a brand throughout your experience. Each interaction, whether positive or negative, can build or hinder your loyalty, influencing your willingness to engage further. Impact on Perception Customer experience touchpoints play a pivotal role in shaping how you perceive a brand and its offerings. Each interaction is a significant part of the customer experience, acting as an emotional breadcrumb that can either build or erode trust. With 59% of people likely to leave after multiple poor experiences, it’s vital to focus on optimizing touch points. Customer touchpoint mapping helps identify pain points and highlights areas for improvement. Positive interactions, like effective onboarding and responsive support, improve customer satisfaction and retention rates. By comprehending and refining these touchpoints, businesses can create stronger connections with you, ultimately influencing brand perception and loyalty. Consistent, personalized engagement across these interactions nurtures deeper relationships and a more favorable view of the brand. Building Brand Loyalty During the process of exploring their path with a brand, consumers encounter various touchpoints that greatly influence their overall experience and loyalty. In customer experience marketing, these client touch points are critical; they shape perceptions and can determine whether a customer remains loyal or walks away. Research indicates that 59% of consumers will abandon a brand after multiple poor experiences, emphasizing the importance of optimizing each interaction. Positive touchpoints, like seamless onboarding and effective support, cultivate emotional connections, whereas negative experiences can lead to churn. By intentionally designing and enhancing touchpoints, brands can exceed customer expectations, transforming satisfied buyers into loyal advocates who’ll promote the brand through word-of-mouth referrals, eventually driving sustained loyalty. Enhancing Engagement Opportunities How can Brandwatch effectively improve engagement opportunities throughout the customer experience? By focusing on customer experience map touchpoints, you can identify critical moments that greatly influence perceptions and emotions. Each marketing touch point, whether it’s direct like customer support or indirect like social media, plays a role in shaping how customers feel about your brand. Mapping these touchpoints helps reveal friction points where customers may struggle or feel unsatisfied, allowing for targeted improvements. Optimizing each interaction not just meets customer needs but can as well exceed their expectations, nurturing deeper connections. Continuous engagement, through follow-up emails and feedback requests, keeps customers involved and valued, boosting their likelihood to return and recommend your brand to others. Identifying and Mapping Customer Journey Touchpoints Mapping customer experience touchpoints is essential for comprehending how customers interact with your brand at various stages, such as awareness, consideration, purchase, onboarding, and support. A touchpoint map visualizes these interactions, allowing you to identify each point of contact with your customers. By carefully mapping these touchpoints, you can evaluate their performance and pinpoint potential areas for improvement. Consider key questions during the creation of your touchpoint map. Is the experience helpful? Does the channel align with customer needs? Are there moments where customers lose interest or get confused? Research shows that 59% of consumers abandon a brand after multiple negative experiences, emphasizing the need for effective identification and optimization of touchpoints. Continuous iteration based on customer feedback is fundamental for increasing satisfaction, retention, and loyalty. In the domain of customer experience digital marketing, a well-structured touchpoint map can vastly improve your overall customer experience. Best Practices for Optimizing Customer Journey Touchpoints To optimize customer experience touchpoints effectively, organizations should first understand the entire customer experience, identifying critical interaction points that directly impact conversion, retention, and satisfaction rates. Start by mapping the customer path to identify customer touch points, focusing on high-impact moments like onboarding and post-purchase support. Regularly collecting and acting on customer feedback at each touchpoint allows you to pinpoint pain points and improve the overall experience. Implementing an omnichannel strategy guarantees a seamless experience across all touch points examples, increasing customer engagement and loyalty. Utilize tools like Customer Experience Mission Statements and path mapping to align your touchpoints with customer needs and expectations. Prioritizing these strategies not only helps you improve customer satisfaction but likewise promotes long-term brand loyalty, making it crucial to continuously assess and refine your approach at each stage of the customer path. The Impact of Touchpoints on Brand Loyalty and Retention Customer touchpoints play a vital role in building trust and nurturing emotional connections with your brand. By ensuring consistent and positive interactions, you can improve customer satisfaction, which leads to increased loyalty and repeat engagement. Recognizing the impact of these touchpoints on your customers’ experiences is fundamental for improving retention and encouraging long-term relationships. Building Trust Through Interactions Building trust through interactions is vital for nurturing brand loyalty and retention, as each touchpoint serves as an opportunity to strengthen the relationship between a business and its customers. Positive consumer touchpoints, such as personalized emails and proactive support, greatly impact customer experiences. With 59% of consumers leaving a brand after multiple poor experiences, optimizing touchpoints is fundamental. Touchpoint Type Impact on Trust Personalized Emails Improve engagement Proactive Support Build reliability Customer Feedback Encourage improvement Consistent Messaging Strengthen loyalty Enhancing Emotional Connections Emotional connections between consumers and brands are greatly shaped by customer experience touchpoints, as each interaction can evoke feelings that influence loyalty and retention. Comprehending touch point meaning is crucial; they represent every moment a consumer interacts with your brand. For instance, examples of touchpoints include personalized emails, responsive customer service, and engaging social media interactions. When these touchpoints are optimized, brands can see up to a 20% increase in customer satisfaction, which improves loyalty considerably. Positive interactions at these touchpoints cultivate trust, making consumers 77% more likely to recommend your brand. Fostering Repeat Engagement Every interaction you have with a brand can shape your loyalty and influence your decision to return. Contact point marketing emphasizes the importance of optimizing each touchpoint to improve customer retention. Research shows that 59% of consumers abandon brands after multiple poor experiences, highlighting the need for positive interactions. By utilizing CRM touchpoints examples, such as personalized emails or responsive customer service, you can create meaningful connections that promote loyalty. Each touchpoint is an opportunity to exceed expectations, and consistent engagement can transform customers into advocates. Remember, even a single negative experience can lead to disengagement, so it’s vital to strategically manage these interactions to enhance satisfaction and encourage repeat business. Frequently Asked Questions Why Do Customer Journey Touchpoints Matter? Customer experience touchpoints matter as they define critical interactions between you and a brand. Each touchpoint shapes your experience and influences your perception. If you encounter multiple negative interactions, you’re likely to abandon the brand. Well-managed touchpoints can improve satisfaction, cultivate loyalty, and lead to repeat business. What Is a Customer Journey and Why Is It Important? A customer experience is the complete series of interactions a customer has with your brand, from the moment they first hear about it to post-purchase experiences. Comprehending this experience is essential as it helps you identify key touchpoints that shape customer perceptions. Each interaction influences satisfaction and loyalty, so knowing how customers move through these phases allows you to tailor experiences effectively, address pain points, and in the end improve retention and engagement. What Are Customer Touch Points? Customer touchpoints are specific interactions between you and a brand throughout your expedition. These moments can occur during various stages, such as awareness through ads or social media, consideration via reviews, and purchase at checkout. Each touchpoint considerably impacts your overall experience and perception of the brand. What Is the Rule of 7 Touchpoints? The Rule of 7 Touchpoints states that customers typically need to engage with a brand at least seven times before making a purchasing decision. This repeated exposure builds familiarity and trust, crucial for converting leads into customers. Each touchpoint—whether through ads, social media, or direct interactions—reinforces brand recognition. To effectively implement this rule, guarantee your marketing strategies deliver consistent messaging across these touchpoints, enhancing overall customer engagement and experience. Conclusion In summary, comprehension and managing customer journey touchpoints is essential for enhancing brand loyalty and customer satisfaction. By identifying and optimizing these interactions, you can create positive experiences that influence customer perceptions at every stage of their voyage. From initial awareness to post-purchase engagement, each touchpoint plays a significant role in shaping relationships with your brand. Prioritizing these elements not just nurtures trust but additionally drives retention, ensuring long-term success for your business. Image via Google Gemini This article, "What Are Customer Journey Touchpoints and Why Do They Matter?" was first published on Small Business Trends View the full article

-

Law Firm SEO: Top Tactics, Average Costs, & What to Avoid

Learn how law firm SEO can help your legal practice improve its online visibility and get more clients. View the full article

-

So you tried to buy a country . . .

The President’s Greenland experience shows the problem with difficult marketsView the full article

-

How to Submit a Sitemap to Google (in 3 Simple Steps)

To submit your sitemap to Google, add its URL to Google Search Console‘s “Sitemaps“ report. View the full article

-

Crypto won’t fix America’s affordability crisis

Economists increasingly describe today’s economy as “K-shaped”: Households with higher incomes and assets are pulling ahead, while many middle- and lower-income families struggle to keep up. Prices for housing, healthcare, and everyday necessities have risen faster than paychecks, leaving millions of Americans feeling squeezed, exposed, and uncertain about the future. For many families, affordability is not an abstract concern, it is the daily challenge of covering essentials while trying to stay afloat. You would expect that reality to shape what Congress prioritizes in response to economic anxiety. Instead, “affordability” is being invoked to justify making crypto market structure—the rules governing how digital assets are regulated and integrated into the broader financial system—a legislative priority, rather than addressing the more pressing sources of financial strain facing most families. Crypto offers a story about upside and progress, but it does not answer the underlying problems of unstable incomes, fragile savings, and rising exposure to risk. Affordability is not about access to new financial products. It is about whether households can reliably pay for basics, absorb shocks, and plan for the future without taking on more volatility. Supporters argue that regulation can turn risky markets into engines of opportunity, especially for communities long excluded from traditional finance. But while regulation may promise harm reduction, it cannot turn speculation into a vehicle for broad-based wealth-building. Congress’s focus on conferring legitimacy on crypto reflects a troubling substitution of financial speculation for the harder work of rebuilding the real economy. Wealth that lasts The reason becomes clearer when you start with what wealth-building actually requires. Wealth that lasts is built on stability, not volatility. It looks like a paycheck that covers the mortgage, a retirement account that compounds quietly over decades, and savings that remain after a medical bill or a layoff. For most households, it’s accumulated gradually through retirement savings, pensions, and home equity. These systems are deeply imperfect, and trust in them has eroded for good reason. While wages rose after the pandemic, the cost of housing, healthcare, and other necessities rose faster, leaving many households feeling less secure. But the failure of existing systems does not make volatility a solution. It makes stability more, not less, important. Falling short Measured against those standards, crypto falls short. Crypto markets are organized around speculation rather than value creation. Tokens do not generate cash flows like businesses or bonds; their prices move on hype and momentum rather than economic fundamentals. An economy that already feels precarious does not need more ways for households to absorb financial risk. That speculative structure tends to reward those who can enter early and exit first. When crypto prices surge, new investors rush in—often drawn by recent gains—while larger, better-positioned holders are more likely to sell into the rally. Many ordinary households arrive later, buying at elevated prices amid extreme volatility. Research shows that lower-income investors in particular tend to enter later and at worse price points. Over time, this dynamic functions less as a wealth-building system and more as a wealth transfer from late-arriving households to earlier and more sophisticated participants—reinforcing the same uneven gains that already define today’s K-shaped economy. The limits of regulation Regulation is often presented as the solution, but not all regulation reduces risk. Strong guardrails can in principle reduce fraud, limit spillovers, and protect the broader financial system. The problem is not regulation itself, but how it’s being pursued. Much of the current market structure debate is defined less by nonnegotiable safeguards than by pressure to reach a deal quickly, even if key protections are weakened, deferred, or left unresolved. Even strong regulation has limits. It does not change what crypto is or transform speculative assets into a reliable vehicle for long-term wealth-building. Even a well-regulated casino is still a casino. Rules can make gambling safer; they do not make it a retirement strategy. That distinction matters beyond individual investors. When volatile assets are granted legitimacy without firm safeguards, risk migrates into retirement systems, financial institutions, and local economies. And when those risks spread, they do not fall evenly. Communities of color are especially exposed to systemic shocks because they have far less generational wealth to fall back on when credit tightens or savings are hit. Losses are harder to absorb and recovery takes longer, even for households that never touch crypto. At the same time, these communities are often targeted directly by financial marketers and intermediaries promoting high-risk products. We have seen this pattern of predatory inclusion before. In the years leading up to the financial crisis, risky mortgage products were sold to Black and Latino households as pathways to opportunity, only to shift disproportionate risk onto families least able to absorb losses. Today, similar language surrounds crypto. “Access” is framed as empowerment, but access to volatility is not affordability, and exposure to risk is not safe wealth-building. Stablecoins are the point where these risks become policy. Congress’s recent handling of stablecoins offers a case study in prioritizing crypto expansion over the real economy. Less than two weeks after passing sweeping legislation that cut healthcare, food assistance, and student aid, lawmakers moved quickly to advance stablecoin legislation framed as a consumer protection measure. In practice, it prioritized industry growth and speed over downstream consequences for credit, banking, and communities, leaving key safeguards weakened or unresolved. Real consequences Those legislative choices have real economic consequences. If deposits migrate out of banks and into stablecoins, some economists estimate the shift could translate into roughly $250 billion less lending across the economy. If stablecoins function as yield-bearing substitutes for bank deposits, potential credit losses could rise sharply, possibly into the trillions of dollars. Those losses would hit community banks first, along with the small businesses, rural areas, and communities of color that rely on relationship-based lending. Congress should not confuse legislative movement with economic progress. In an economy already split between those who are gaining ground and those struggling to stay afloat, lawmakers should be clear-eyed about what this legislation actually does. It does not make wealth more accessible or everyday life more affordable. It does not make families safer. It normalizes dangerous financial risk while leaving the real economy’s wealth-building failures unaddressed—at a moment when ordinary Americans can least afford to lose. View the full article

-

UWM, executive deny influence over AIME in Sweeney lawsuit

The wholesale giant, fully entangled in the legal fight over a six-figure bonus, emphasized it's only the title sponsor of the broker trade group. View the full article

-

More Sites Blocking LLM Crawling – Could That Backfire On GEO? via @sejournal, @martinibuster

New data shows an increase in AI assistant crawling alongside declining AI model training access. The post More Sites Blocking LLM Crawling – Could That Backfire On GEO? appeared first on Search Engine Journal. View the full article

-

Trump’s chaos is forcing the usually methodical chips industry to learn how to pivot quickly

A week is a long time in politics. But in Donald The President’s world, even a day can feel like an eon. On Tuesday last week, the United States approved the export of Nvidia’s H200 GPUs—the second-most advanced computer chips powering the generative AI revolution—to markets that include China. The decision was granted with caveats. Supplies could be forestalled if the U.S. began running short, for one thing. But it was an approval. Then, 24 hours later, the White House levied a 25% tariff against the same chips at the point they’re imported into the United States. That matters because, under the rules The President instigated on Tuesday, all those H200 chips that could be exported to mainland China after being fabricated in Taiwan must first make their way to the United States to be tested before being re-exported to customers. That adds up to a bigger bill for Chinese tech companies wanting to import cutting edge chips into their country. (To avoid this, China is building up its domestic AI chip development and manufacturing capacity, and recently issued its own counter‑ban on the import and use of H200 chips.) But it also causes chaos for the chipmakers themselves. Because AI hardware is now the backbone of national competitiveness, even small shifts in U.S. trade policy ripple across trillion‑dollar markets and global supply chains. The latest chopping and changing is a total overhaul of the normal way of doing business, says Willy Shih, professor of management practice at Harvard Business School. “Business, like sports, is conducted on a playing field, where there are rules and regulations, and also norms,” he says. “These days, with the tariff situation changing almost every day, I tell people to imagine being a coach of a football team, and the rules change every minute,” Shih jokes. “That’s what it feels like.” The impact on markets from such uncertainty can be significant, he adds. “When you see people hold up investments waiting for some stability, that’s why. It’s hard to make long-term investment commitments when the rules could change tomorrow.” Because companies don’t know the price they’re going to have to pay to bring tariffs into their factories, they’re often reluctant to splash the cash on new purchases. A series of chip-adjacent companies has previously complained about lower-than-expected orders because of unpredictable tariff policy. European lithography firm ASML missed expectations in the first quarter of 2025 by more than $1 billion thanks to tariff uncertainty, their CEO said at the time. And markets reflected the chaos of The President’s tariff about-turn this year immediately: Nvidia dropped more than 3% after the 25% levy was introduced, suggesting investors were jittery about the repeated policy pivots. The issue is that it isn’t just buyers who are making those long-term commitments on spending. Chip manufacturers rely on trying to understand future demand in order to build out their production capacity—something that can be imperilled with quick-moving changes to tariffs implemented by The President. “My general belief is that most, or frankly all, semiconductor management and actual visibility of what is going on with demand is precisely zero,” says Stacy Rasgon, managing director and senior analyst at Bernstein. “They have absolutely no idea. All they see are the orders in front of their face.” Being able to rampup or rampdown production capacity in such a geopolitical environment makes things even more challenging. And Nvidia’s H200 chips are particularly tricky to make, meaning that the company—alongside other manufacturers of major chips affected by the The President tariff changes—has to think carefully about how it plans buildout of factories and capacities. Less than a month ago, Nvidia was asking its suppliers if they could step up demand to account for H200 demand totalling 185% of the firm’s current stock levels. The situation puts more pressure on the people running chip companies, says Srividya Jandhyala, professor of management at ESSEC Business School, and changes the skills they need to navigate the constant changes. “As companies find themselves and their products squarely in the midst of geopolitical tensions, the job description of their top managers has changed,” he says, pointing to the way that Nvidia CEO Jensen Huang has had to mutate how he works. “His job today is about being an effective corporate diplomat, crisscrossing the world to convince policymakers that his company’s products have a place in the vision policymakers have for their countries,” Jandhyala says. But that vision may have to contend with rapidly shifting realities in a world where Donald The President’s whims dictate international trade. View the full article

-

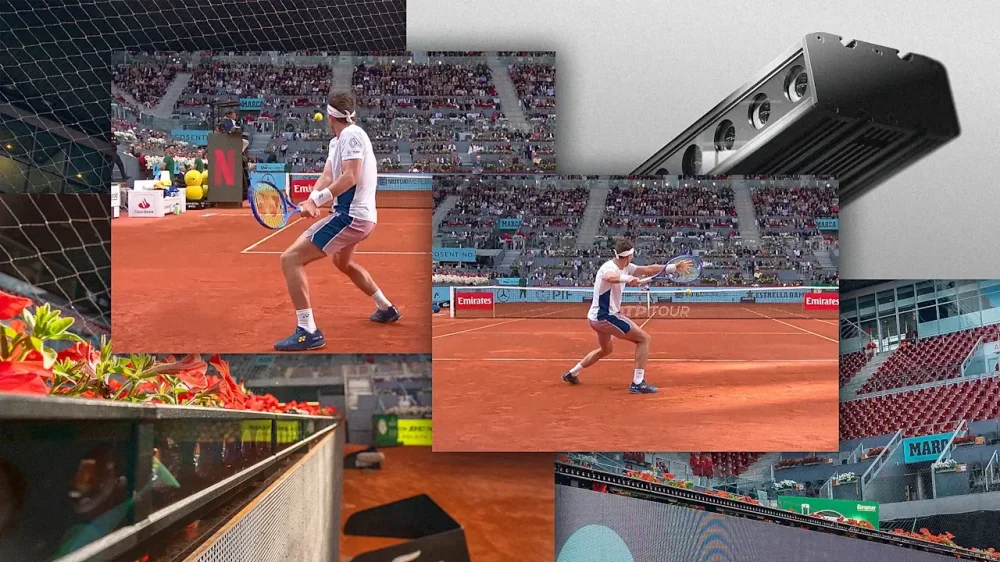

This ingenious ‘weightless camera’ is changing live sports forever

Several times during the men’s final of the Madrid Open tennis tournament between Casper Ruud and Jack Draper last spring, TV viewers were treated to a remarkable camera perspective. They watched the match from just behind the baseline, effortlessly following the player’s movement step for step and glimpsing his perfect angle on the ball with every shot. With no discernible blur or delays, the smoothly flowing live footage had the hyper-real feel of a video game. Tennis TV “I love the footwork by the cameraman,” wrote one YouTube commenter. The company now uses the comment in its investor pitch deck. In reality, these uncanny tracking shots didn’t involve any human camera operators at all. No robotic cameras or drones, either. Instead they were generated, in real time, with a software-based camera system developed by startup Muybridge, based in Oslo. Founded by Håkon Espeland and Anders Tomren in 2020, Muybridge has spent nearly five years developing real-time computer vision technology that uses software to create a “weightless” camera, with no moving parts, that captures the speed and motion of live sports in a way that our eyes aren’t accustomed to. In the coming year, viewers of televised sports will get to see many more of these revelatory perspectives—both in tennis and beyond. Muybridge has shifted the paradigm—twice “Four hundred years of camera history is ending here,” explains Espeland, standing beside a framed black-and-white portrait of motion-picture pioneer Eadweard Muybridge, the company’s namesake, at the company’s headquarters in Oslo’s hip Grünerløkka neighborhood during Oslo Innovation Week last fall. “I see a lot of resemblance [in what we’re doing] to what he did with sequenced triggers to actually create motion” says Espeland. To create his groundbreaking images of a galloping white horse in the 1870s, the English American photographer set up a line of cameras that were triggered by a trip wire as the horse ran past them, creating multiple images that each captured a different phase of the horse’s stride; by overlapping the images, he made a picture that appeared to move. “It’s a similar way of thinking,” says Espeland. “How can you distribute sensors and use that data in a smart way?” Espeland had a long history with automated systems; he started working on them as a 16-year-old apprentice on oil and gas rigs in the North Sea. After getting a master’s degree in cybernetics and robotics, he joined a Norwegian company building robotic camera systems for live TV production. While there, he had an epiphany. “With computational photography, we could get rid of 300 kilos of metal and robots,” he says. “It was like removing gravity. We’re not covered by any physical limitation.” Instead of using big, expensive cameras that you move to “chase” whatever’s happening on the court or sports field, Muybridge puts hundreds of small, inexpensive video sensors all over the place—and uses software to create smooth tracking shots and conjure any angle on demand. In practice, this looks like extra-long speaker bars packed with a row of oversize smartphone camera lenses. These arrays come in two-meter lengths that can be connected to form what amounts to a single continuous camera of virtually any length. “We’re going to build future digital stadiums full-360,” says Espeland. And unlike traditional cameras, which can obstruct spectators’ views at live events, Muybridge’s clamp unobtrusively to any wall or structure, capturing the action on the court, field, or rink unnoticed. “Our biggest issue at the U.S. Open was that the coaches of the athletes sat on it,” Espeland says. “They didn’t realize it was a camera along the ad boards.” Made from commodity electronics components, the sensors themselves are relatively inexpensive. “We are lucky that the consumer [electronics] and mobile industry consume so [many] cameras,” says Espeland. “They’ve taken the costs down. There’s a reason why there are three cameras on an iPhone now.” Mobile phone makers have also advanced the capacity of computational photography, keeping the sensors largely unchanged while improving algorithms to create better pictures. “We’re piggybacking on that.” To meet the demands of live broadcast, Muybridge brings an updated approach to the reconstruction of 3D images. “The rest of the world has been throwing more and more compute at the problem, running math on the GPU layer to try to fill in the blanks,” explains Espeland. “That’s led to something much faster than it was 20 years ago, but it can still take eight minutes to process the images for a replay. Our focus has always been [doing it] in real time, and we wanted it to be able to run on a laptop, in the cloud, or on a mobile phone.” That’s where all of those little cameras come in. “We have more pixels, more angles, more overlap,” says Espeland. “That allows us to have a cleaner mathematical approach to determine exact color, perspective, and all of those things. Everything is backed by pixel data—we don’t do any approximation.” Finding the camera angle Tennis has been an effective launchpad for the company’s technology. “When we lowered [the cameras] all the way down to the lowest ad boards, social media just exploded,” says Espeland. Muybridge systems were deployed last year at the Miami Open, the Madrid Open, and the U.S. Open. The company has an exclusive partnership with Sony, through its live sports subsidiary Hawk-Eye Innovations, to power all of the ATP Masters tournaments in 2026 (which kick off March 4 with the BNP Paribas Open in Indian Wells, California). “I guess I can say that we will be seen in nearly every tennis tournament [this] year.” Now the company is targeting additional sports. The key is finding unique perspectives where the technology’s value proposition becomes obvious, providing a vantage point that makes the sport better when you watch it at home than in the arena. For soccer—Muybridge recently ran a test that went live on air with Sky Sports in Germany—that could mean behind the goal and even in the goalposts. For Nascar or Formula 1, producers might actually ring the entire track with sensors (though early discussions have focused on capturing critical turns and pit stops). For baseball, viewers could look out on the field from the dugout. For hockey—Muybridge is currently working with the NHL and Fox Sports—cameras could be set in the dasher boards, along the ad boards, or up in the concourse to create a “virtual drone” that appears to zoom around the rink from above. Crucially, “there’s no speed limitation” with Muybridge, Espeland says. “You can instantly move to wherever you want, and we’re creating all of the millions of pictures in between, just like our eyes do.” “Muybridge inside” Sports, for Muybridge, could just be the start. The company is currently involved in a pilot program that installs its cameras on the ceiling and walls of ambulances, allowing a remote ER doctor with a VR headset to virtually “move around” a patient to evaluate them. Security and surveillance represent additional avenues for potential VR expansion, as does an IRL version of the metaverse. “VR headsets never really took off because we always have to visit this virtual world,” Espeland says. “We jump into a room, you’re an avatar, I’m an avatar, but we want to interact with real people.” News broadcasting and other live studio productions are another developing use case. The CBS Morning Show ran a test of Muybridge’s technology on its New York set in December 2025. Moving forward, says Espeland, he has an “Intel inside” philosophy: “We have the core technology, and we look for partners who can represent the next strategic product and bring it into the market.” View the full article

-

How Peacock’s Gold Zone is energizing Olympics coverage