Everything posted by ResidentialBusiness

-

Paramount escalates hostile takeover bid of Warner Bros. with new board slate

Paramount Skydance is taking another step in its hostile takeover bid of Warner Bros. Discovery, saying Monday that it will name its own slate of directors before the next shareholder meeting of the Hollywood studio. Paramount also filed a suit in Delaware Chancery Court seeking to compel Warner Bros. to disclose to shareholders how it values its bid and the competing offer from Netflix. Warner Bros. is in the middle of a bidding war between Paramount and Netflix. Warner’s leadership has repeatedly rebuffed overtures from Skydance-owned Paramount — and urged shareholders to back the sale of its streaming and studio business to Netflix for $72 billion. Paramount, meanwhile, has made efforts to sweeten its $77.9 billion hostile offer for the entire company. Last week, Warner Bros. Discovery said its board determined Paramount’s offer is not in the best interests of the company or its shareholders. It again recommended shareholders support the Netflix deal. David Ellison, the chairman and CEO of Paramount Skydance, said Monday that it’s committed to seeing through its tender offer. “We do not undertake any of these actions lightly,” he said in a letter to shareholders of Warner Bros. Warner Bros. has yet to schedule its annual meeting or a special meeting to consider the Netflix offer, and Paramount did not name any potential candidates for the board. —Associated Press View the full article

-

Trump announces 25% tariff on countries ‘doing business’ with Iran

Levies to be applied immediately by US could affect nations such as China, Russia and India View the full article

-

WooCommerce WordPress Plugin Exploit Enables Fraudulent Charges via @sejournal, @martinibuster

80,000+ WooCommerce Square WordPress plugin installations vulnerable to fraudulent charges flaw The post WooCommerce WordPress Plugin Exploit Enables Fraudulent Charges appeared first on Search Engine Journal. View the full article

-

This Smart Ring Tracks Sleep Apnea, and It’s $60 Off Right Now

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. While the market today is flooded with smart-health-tracking rings, few monitor detailed sleep stats like sleep apnea risks, which is where one truly stands out—especially if your priority is quality zzz’s. Right now, the RingConn Gen 2 smart ring is 20% off in gold, future silver, and rose gold at $239.20 (originally $299), making this wearable the perfect tech-meets-jewelry gift for yourself or a partner with Valentine’s Day on the horizon. RingConn Gen 2 $239.20 at Amazon $299.00 Save $59.80 Get Deal Get Deal $239.20 at Amazon $299.00 Save $59.80 Sizing is especially important with a smart ring since the sensors need consistent skin contact to track activity accurately. Ring Conn offers a free sizing kit to help you accurately gauge this, and they also have an easy-to-follow sizing chart. Gen 2 is RingConn’s full-featured model, compared to the more entry-level, budget-friendly Gen Air 2, which was reviewed by PCMag. Its 12-day battery life (double that of its predecessor) is one of the biggest perks, as it has a lightweight, ultra-thin design that isn’t noticeable, especially when you’re sleeping. With data and insights included with the purchase, it offers an alternative to subscription-based health tracking like the Oura. The RingConn Gen 2 measures stats like heart rate, blood oxygen, HRV/stress index, and activity, as well as sleep stages and sleep apnea monitoring, which is a relatively new innovation in the wearable category. It also lasts up to 100 meters underwater, making it suitable for shower use or swimming. This smart ring is compatible with both Android and iOS, and it works with both Google Fit and Apple Health. That said, some users say the app isn’t as user-friendly as competitors and certain insights require you to interpret trends on your own rather than getting actionable coaching that some rivals provide. It also may be prone to scratching over time compared to more rugged options like the Oura Ring Gen 4, but it comes with a 12-month warranty. If you’re looking for a long-lasting wearable health tracker that doesn’t require a subscription but still has similar core features as pricier competitors, the RingConn Gen 2 smart ring is a great option. While its data presentation may be slightly less polished and lacks coaching features, it offers the same basic-to-advanced health metrics as better-known brands at a lower upfront cost and with no recurring fees—especially at the current discount. Our Best Editor-Vetted Tech Deals Right Now Apple AirPods Pro 3 Noise Cancelling Heart Rate Wireless Earbuds — $229.99 (List Price $249.00) Apple Watch Series 11 [GPS 46mm] Smartwatch with Jet Black Aluminum Case with Black Sport Band - M/L. Sleep Score, Fitness Tracker, Health Monitoring, Always-On Display, Water Resistant — $329.00 (List Price $429.00) Amazon Fire TV Stick 4K Plus — (List Price $24.99 With Code "FTV4K25") Samsung Galaxy Watch 8 — $279.99 (List Price $349.99) Samsung Galaxy Tab A9+ 10.9" 64GB Wi-Fi Tablet (Graphite) — $149.99 (List Price $219.99) Deals are selected by our commerce team View the full article

-

Tories vow to defend ‘vital’ role of UK fiscal watchdog

Shadow chancellor Mel Stride will also propose reforms to OBR aimed at ‘fully capturing’ impact of tax cuts on growth View the full article

-

Muhammad Ali to be honored with a commemorative U.S. postage stamp

Muhammad Ali once joked that he should be a postage stamp because “that’s the only way I’ll ever get licked.” Now, the three-time heavyweight champion’s quip is becoming reality. Widely regarded as the most famous and influential boxer of all time, and a cultural force who fused athletic brilliance with political conviction and showmanship, Ali is being honored for the first time with a commemorative U.S. postage stamp. “As sort of the guardian of his legacy, I’m thrilled. I’m excited. I’m ecstatic,” Lonnie Ali, the champ’s wife of nearly 30 years, told The Associated Press. “Because people, every time they look at that stamp, they will remember him. And he will be in the forefront of their consciousness. And, for me, that’s a thrill.” A fighter in the ring and compassionate in life Muhammad Ali died in 2016 at the age of 74 after living with Parkinson’s disease for more than three decades. During his lifetime and posthumously, the man known as The Greatest has received numerous awards, including an Olympic gold medal in 1960, the United Nations Messenger of Peace award in 1998 and the Presidential Medal of Freedom in 2005. Having his face on a stamp, Lonnie Ali said, has a particular significance because it’s a chance to highlight his mission of spreading compassion and his ability to connect with people. “He did it one person at a time,” she said. “And that’s such a lovely way to connect with people, to send them a letter and to use this stamp to reinforce the messaging in that life of connection.” Stamp to be publicly unveiled A first-day-of-issue ceremony for the Muhammad Ali Forever Stamp is planned for Thursday in Louisville, Kentucky, the birthplace of the famed boxer and home to the Muhammad Ali Center, which showcases his life and legacy. That’s when people can buy Muhammad Ali Forever Stamps featuring a black-and-white Associated Press photo from 1974 of Ali in his famous boxing pose. Each sheet of 20 stamps also features a photo of Ali posing in a pinstripe suit, a recognition of his work as an activist and humanitarian. Twenty-two million stamps have been printed. Once they sell out, they won’t be reprinted, U.S. Postal Service officials said. The stamps are expected to generate a lot of interest from collectors and noncollectors. Because they’re Forever Stamps, the First-Class Mail postage will always remain valid, which Lonnie Ali calls an “ultimate” tribute. “This is going to be a Forever Stamp from the post office,” she said. “It’s just one of those things that will be part of his legacy, and it will be one of the shining stars of his legacy, getting this stamp.” Creating a historic stamp Lisa Bobb-Semple, the USPS director of stamp services, said the idea for a Muhammad Ali stamp first came about shortly after his death almost a decade ago. But the process of developing a stamp is a long one. The USPS requires people who appear on stamps to be dead for at least three years, with the exception of presidents. As the USPS was working behind the scenes on a stamp, a friend of Ali helped to launch the #GetTheChampAStamp campaign, which sparked public interest in the idea. “We are really excited that the stars were able to align that allowed us to bring the stamp to fruition,” said Bobb-Semple, who initially had to keep the planned Ali stamp secret until it was official. “It’s one that we’ve always wanted to bring to the market.” Members of the Citizen Stamps Advisory Committee, appointed by the postmaster general, are responsible for selecting who and what appears on stamps. Each quarter, they meet with Bobb-Semple and her team to review suggestions submitted by the public. There are usually about 20 to 25 commemorative stamp issues each year. Once a stamp idea is selected, Bobb-Semple and her team work with one of several art directors to design the postage. It then goes through a lengthy final approval process, including a rigorous review by the USPS legal staff, before it can be issued to the public. Antonio Alcalá, art director and designer of the Muhammad Ali stamp, said hundreds of images were reviewed before the final choices were narrowed to a few. Finally, the AP image, taken by an unnamed photographer, was chosen. It shows Ali in his prime, posing with boxing gloves and looking straight into the camera. Alcalá said there’s a story behind every USPS stamp. “Postage stamps are miniature works of art designed to reflect the American experience, highlight heroes, history, milestones, achievements and natural wonders of America,” he said. “The Muhammad Ali stamps are a great example of that.” A candid figure on war, civil rights and religion Beyond the boxing ring, Ali was outspoken about his beliefs when many Black Americans were still fighting to be heard. Born Cassius Clay Jr., Ali changed his name after converting to Islam in the 1960s and spoke openly about race, religion and war. In 1967, he refused to be inducted into the U.S. Army, citing his religious beliefs and opposition to the Vietnam War. That stance cost Ali his heavyweight championship title and barred him from boxing for more than three years. Convicted of draft evasion, he was sentenced to five years in prison but remained free while appealing the case. The conviction was overturned by the U.S. Supreme Court in 1971, further cementing his prominence as a worldwide figure. Later in life, Ali emerged as a global humanitarian and used his fame to promote peace, religious understanding and charitable causes, even as Parkinson’s disease limited his speech and movement. Ali’s message during a time of strife The commemorative postage stamp comes at a time of political division in the U.S. and the world. Lonnie Ali said if her husband were alive today, he’d probably “block a lot of this out” and continue to be a compassionate person who connects with people every day. That approach, she said, is especially important now. “We have to mobilize Muhammad’s life and sort of engage in the same kinds of acts of kindness and compassion that he did every day,” she said. —Susan Haigh, Associated Press View the full article

-

These two budget airlines just announced a major merger—Amazon’s involved too

Shares of the budget airline Sun Country were flying today after the carrier announced an upcoming merger with Las Vegas-based competitor Allegiant. In a press release published on January 11, Allegiant shared its plan to acquire Minneapolis-based Sun Country in a $1.5 billion cash and stock transaction, which is expected to close in the second half of 2026. Per the release, the merger will bring together a shared customer pool of nearly 22 million annual fliers across 175 cities and more than 650 routes. It will also give Allegiant access to Sun Country’s multi-year partnership delivering packages with Amazon Prime Air, which Allegiant CEO Greg Anderson told CNBC was a major part of the deal. News of the acquisition comes as other budget carriers, like Spirit Airlines, struggle to compete in an increasingly exclusive airline industry. As of market close on Monday, Allegiant’s stock was down about 6%, whereas Sun Country’s shares soared by over 10%. Budget air carriers fight an uphill battle For small, low-cost air carriers, profitable business is a turbulent affair. According to October data from the U.S. Bureau of Transportation, a whopping 68.5% of total airline market share in the U.S. is cornered by four major companies: Delta, American, Southwest, and United. As those four powerhouses leverage their outsized financial power to battle it out over offering more and more premium perks for fliers, smaller companies are left struggling to keep up. One example of this pattern is Spirit Airlines, the beleaguered carrier that has filed for Chapter 11 bankruptcy twice since November 2024. Spirit hasn’t made a profit since 2019—indeed, as of late 2024, it had lost more than $2.4 billion since that time as it was unable to recover from pandemic-based losses. The company attempted to lessen its debt load through a proposed sale to JetBlue, but that ultimately fell through in 2022 when it was challenged by the Department of Justice. In recent months, Spirit has announced its second bankruptcy, canceled all routes to 12 major cities, and furloughed 1,800 flight attendants. While corporate mishandling is certainly partially responsible for Spirit’s troubles, its difficulties reflect larger hurdles for small air carriers in an industry where resources have become increasingly siloed. One way to address those issues is, as demonstrated by Spirit’s attempted sale to JetBlue, to merge with another company. Now, Allegiant and Sun Country appear to be attempting something similar by pooling their aircrafts, routes, and flier bases to meet traveler demands. “The combination will create a leading leisure-focused U.S. airline,” the press release reads, “expanding service to more popular vacation destinations across the United States, as well as international destinations, and providing more people with access to affordable, convenient air travel.” View the full article

-

At the 2026 Golden Globes, politics stayed on the red carpet

On the red carpet of the 2026 Golden Globes, several celebrities used their garments as vehicles of protest against Immigration and Customs Enforcement (ICE) and spoke openly about their dissent against the current The President administration. But on the event’s actual stage, political commentary was noticeably absent compared with years past. Popular American awards shows have long been criticized for primarily uplifting the voices of white, male, affluent creators. But, equally, the stages of these events have been used as platforms for public figures to speak out about current politics and social justice. In 1973, Marlon Brando famously rejected his best actor Oscar at the Academy Awards and sent Sacheen Littlefeather, a Native American woman, to deliver a speech on his behalf. More recently, in 2018, Seth Meyers made numerous jokes at The President’s expense at the Golden Globes. This year, though, political commentary on the Golden Globes stage was kept to a few passing comments and oblique references. It’s a shift that reflects a broader trend of Hollywood’s elite seemingly turning a blind eye to the current state of affairs during The President’s second term. “The most important thing in the world” To glean any kind of political statement from last night’s show, one might’ve needed to perform a close reading. Comedian Nikki Glasser opened the ceremony with a vague allusion to pretty much everything happening outside of Hollywood, calling the Golden Globes, “without a doubt the most important thing happening in the world right now.” Others followed with similarly discreet jabs, including one comment from director Judd Apatow that “I believe we’re in a dictatorship now,” neatly sandwiched within a stream of jokes. Even when the film One Battle After Another—a satire about revolution that critiques anti-immigration groups—won multiple awards, no statement was made directly about the current administration. Compare that tenor to 2017, when, just months after The President was elected for his first term, one of the Golden Globes’ most viral—and impactful—moments came when Meryl Streep used her acceptance speech to publicly call out the president. “Hollywood is crawling with outsiders and foreigners, and if we kick them all out, we’ll have nothing to watch except football and mixed martial arts—which are not the arts,” Streep said. Her speech came years before The President’s National Guard ever brutalized protestors in the streets; before the Department of Homeland Security separated thousands of children from their parents; before ICE agents starting showing up at schools and community centers across the country; and before agent Jonathan Ross shot and killed Minneapolis resident Renee Nicole Good just last week. Yet, somehow, it would’ve looked out of place at last night’s comparatively apolitical event. “Of course, this is for the mother” To be fair, several celebrities did make an effort to speak up. Stars including Wanda Sykes, Natasha Lyonne, and Jean Smart wore pins reading “Be Good” as a reference to Renee Nicole Good. Others sported pins with the phrase “Ice Out.” In a pre-show interview with Variety, Sykes explained of her pin, “Of course this is for the mother who was murdered by an ICE agent, and it’s really sad.” Mark Ruffalo also spoke more directly, telling Entertainment Tonight, “We’ve got, literally, storm troopers running around terrorizing, and as much as I love all this, I don’t know if I can pretend like this crazy stuff isn’t happening.” In another interview with USA Today, he added, “[The President is] a pedophile. He’s the worst human being. If we’re relying on this guy’s morality for the most powerful country in the world, then we’re all in a lot of trouble.” But, notably, these comments were shared on the red carpet, to be consumed by readers at disparate news outlets—rather than on the main stage itself, to millions of viewers at home. When the evening’s stars got their moments in the limelight, they largely opted to stay quiet. “Am I brave, or are they cowards?” The literal sidelining of political commentary at the 2026 Golden Globes may be disappointing to fans who want celebrities to speak out about injustices, but it’s not surprising, given Hollywood’s about-turn since The President’s second term began. Stars like Jennifer Lawrence, Robert de Niro, Barry Jenkins, and more who once strongly criticized the president have lately been quiet. Lawrence herself recently spoke on this change, stating in an interview with The New York Times’ “The Interview” podcast that “we’ve learned election after election, celebrities do not make a difference whatsoever on who people vote for.” But as Refinery 29 aptly observes in a recent article, that’s not entirely true. Taylor Swift’s endorsement of Kamala Harris ahead of the 2024 presidential election drove more than 400,000 people to the vote.gov site in 24 hours, it points out. And Bridgerton actress Nicola Coughlan’s advocacy for Palestine aid organizations has helped raise more than $2 million to date. Speaking to Refinery 29 after this year’s Golden Globes, actress and activist Jameela Jamil refuted the idea that her own advocacy is “brave.” “Am I brave or are they cowards?” she said. “I think they’re being greedy and weird and disappointing. Look at the billions of eyeballs on all of us collectively—there should be no outliers of the industry who are the outspoken ones . . . out there on their own with this amount of privilege.” View the full article

-

CFPB, DOJ withdraw Biden-era opinion on immigrants and credit

Continuing to retreat from Biden-era rules, the Consumer Financial Protection Bureau and Department of Justice withdrew a 2023 advisory opinion that had cautioned about denying credit to immigrants. View the full article

-

The Out-of-Touch Adults' Guide to Kid Culture: Do You Have a 'Choppelganger'?

This weekly trip through the youth pop culture landscape takes us from turmoil in Stranger Things fandom, where many fans refuse to let the show end, to the kids' Wild West of Roblox, where age-verification is changing the landscape in a massive way, and all the way to Africa, where online mega-celebrity IShowSpeed is livestreaming a fascinating travelogue that people are watching all over the world. What is "Conformity Gate?"The final episode of Netflix sci-fi series Stranger Things aired on Dec. 31 and it seems that many fans are not happy (shocking, right?). Some feel that the finale left too many loose ends, some that it all happened too easily, or that it was rushed, sloppy, and that it just kind of sucked. Some fans were so unhappy with the end of the series that they concluded it couldn't really be the end; there has to be more to it. Thus was born "Conformity Gate," the fan-conspiracy-theory that states there is a secret, real ending to Stranger Things that Netflix hasn't released yet. In a nutshell, Conformity Gate imagines that the events depicted in the last episode didn't actually happened in reality. The show's antagonist, Vecna, is in control of the story, and the seeming ending is an illusion that the characters (and audience) have been fed. The evidence is scant—props are slightly different from season to season or episode to episode, characters get small details wrong in dialogue, and other small differences. These are, I'm confident, the result of continuity and editing errors mixed with fans overanalyzing. I suspect the overarching issue with the end of Stranger Things is the same problem that has plagued other ambitious TV shows—Lost, Game of Thrones, The Sopranos, etc. There isn't a fully worked out ending when the show is pitched, leaving the show's creators to try to "work something out" for the ending, as opposed to going into it knowing exactly how it's going to come out. This is also why the first seasons of good shows are almost always better than the seasons that follow: The show's creators have fully plotted out the arc of the first season, but future events are more vague so the story feels slapdash instead of inevitable. Anyway, Charlie Heaton, who plays Jonathan Byers in Stranger Things, called the Conformity Gate theory "insane," and the bio on Stranger Thing's X account was changed to read "ALL EPISODES OF STRANGER THINGS ARE NOW PLAYING (all-caps are theirs.) This doesn't close the case on Stranger Things, though. There's still money to be made on the franchise, so I'd bet we see new content at some point; it just probably won't be a new ending. Roblox age verification launchedThe new year brings a world-shaking event to videogame Roblox: mandatory ID or facial verification. It works like this: if unverified users try to chat on Roblox, they are directed to give the game permissions to use their camera, then follow a series of online instructions so a verification algorithm can divine their age group based on their features. Users over 13 can submit a photo of an identification card instead. Roblox promises any images or videos taken during the verification process will be deleted after it is complete. Players who don't want to verify can still play Roblox, but they won't be able to use communication features within it. Once Roblox knows users' ages, it only allows them to chat with others in similar age groups. Here's how the company breaks down who may chat with whom: Credit: Roblox The move is in response to longtime concerns about child safety within Roblox, which include organized groups of online predators like 764 using the game to recruit victims, Roblox mini-games with questionable content that are/were open to younger players, and at least 24 reported arrests of sex predators using Roblox to find victims. An age-verified Roblox account is a positive step, but it's far from perfect. Videos like this are popping up on TikTok, where users seem to be sharing ways to get around the filter system. I have no idea if this would work, but if it does, not only would it let kids have more "grown up" accounts, it also could lead to grown-ups getting "younger" accounts. Online groomers often mimic the age group they're interested in, and a verified account seems like it would make this much easier. Another area of concern: Last week, users on X were linking to eBay accounts specifically advertised as "13-15 age group accounts." Those auctions seem to have been taken down by eBay, but in the darker corners of the internet, I have no doubt that trade in verified Roblox accounts is brisk. What is a Choppelganger? This week's slang word combines the words "chopped" and "doppelgänger" to deliver a massive insult. "Chopped" (as you can read in Lifehacker's glossary of Gen Z and Gen A slang) describes a person who is ugly, and doppelgänger means "a ghostly duplicate of a living person," so a choppelganger is someone who looks like you, but worse. The term was coined in this post on X : This Tweet is currently unavailable. It might be loading or has been removed. And it was soon adopted by TikTokers who posted videos like these: It's probably not the most widely used slang—there aren't too many places where the idea actually would come up—but it's definitely clever. Viral video of the week: Speed does Africa These are dark days for humanity, but there's some sunlight breaking through. This week's conformation of the essential goodness of people comes from YouTube legend IShowSpeed, who is in the middle of posting an epic series of livestream videos documenting a trip to Africa. The internet is responding, both in America and in Africa, with tens of millions of views. So far, Speed has visited Rwanda, Zambia, Kenya (where he and his crew went on safari and visited the Maasai Mara where Speed got a traditional tattoo, among other adventures) and more. Many more stops are planned in the coming days, including Liberia, Morocco, and Botswana. Speed is like an informal ambassador for America's people, and his open, honest, hilarious videos are acting as a cultural exchange program or a bridge between two worlds. The comments are amazing, with African people posting things like, "No words can capture the depth of what we feel as Africans. By simply revealing our humanity, you have compelled the world to witness the true brilliance of our continent—its beauty, its dignity, its spirit," and Americans saying things like, "I didn’t know Zimbabwe was lit like that" and posting emotional reaction videos like this: If you need some hopium, you should definitely go to IShowSpeed's YouTube channel and follow along on his adventures, even if you're an old fart like me. View the full article

-

Why the Fed’s independence from the White House is guarded so closely

The Justice Department has threatened the Federal Reserve with a criminal indictment over the testimony of Fed Chair Jerome Powell this summer regarding its building renovations, Powell said over the weekend. It is a major escalation by the administration after repeated attempts by President Donald The President to exert greater control over the independent institution. The President has repeatedly attacked Powell for not cutting the short-term interest rate, and even threatened to fire him. Powell’s caution has infuriated The President, who has demanded the Fed cut borrowing costs to spur the economy and reduce the interest rates the federal government pays on its debt. That anger has not subsided even after the Fed cut interest rates in three of the final four months of 2025. The President has also accused Powell of mismanaging the U.S. central bank’s $2.5 billion building renovation project. In a sharp departure from his previous responses to attacks by The President, Powell described the threat of criminal charges as simple “pretexts” to undermine the Fed’s independence when it comes to setting interest rates. While there has been a limited response from Republican lawmakers, there have been several early breaks with the party. “If there were any remaining doubt whether advisers within the The President Administration are actively pushing to end the independence of the Federal Reserve, there should now be none,” said North Carolina Sen. Thom Tillis, who sits on the Banking Committee, which oversees Fed nominations. The President is already seeking to fire Federal Reserve Governor Lisa Cook over unproven allegations that she committed mortgage fraud. The allegation was made over the summer by Bill Pulte, a The President appointee to the Federal Housing Administration. Here are some reasons why the independence of the U.S. Federal Reserve is guarded so closely. Why the Fed’s independence matters The Fed wields extensive power over the U.S. economy. By cutting the short-term interest rate it controls — which it typically does when the economy falters — the Fed can make borrowing cheaper and encourage more spending, accelerating growth and hiring. When it raises the rate — which it does to cool the economy and combat inflation — it can weaken the economy and cause job losses. Economists have long preferred independent central banks because they can more easily take unpopular steps to fight inflation, such as raise interest rates, which makes borrowing to buy a home, car, or appliances more expensive. The importance of an independent Fed was cemented for most economists after the extended inflation spike of the 1970s and early 1980s. Former Fed Chair Arthur Burns has been widely blamed for allowing the painful inflation of that era to accelerate by succumbing to pressure from President Richard Nixon to keep rates low heading into the 1972 election. Nixon feared higher rates would cost him the election, which he won in a landslide. Paul Volcker was eventually appointed chair of the Fed in 1979 by President Jimmy Carter, and he pushed the Fed’s short-term rate to the stunningly high level of nearly 20%. (It is currently 3.6%, the lowest it has been in nearly three years.) The eye-popping rates triggered a sharp recession, pushed unemployment to nearly 11%, and spurred widespread protests. Yet Volcker didn’t flinch. By the mid-1980s, inflation had fallen back into the low single digits. Volcker’s willingness to inflict pain on the economy to throttle inflation is seen by most economists as a key example of the value of an independent Fed. Investors are watching closely An effort to fire Powell would almost certainly cause stock prices to fall and bond yields to spike higher, pushing up interest rates on government debt and raising borrowing costs for mortgages, auto loans, and credit card debt. The interest rate on the 10-year Treasury is a benchmark for mortgage rates. All major U.S. markets slid Monday at the opening bell, bond yields edged higher and the value of the U.S dollar declined. Most investors prefer an independent Fed, partly because it typically manages inflation better without being influenced by politics, but also because its decisions are more predictable. Fed officials often publicly discuss how they would alter interest rate policies if economic conditions changed. If the Fed was more swayed by politics, it would be harder for financial markets to anticipate — or understand — its decisions. While the Fed controls a short-term rate, financial markets determine longer-term borrowing costs for mortgages and other loans. And if investors worry that inflation will stay high, they will demand higher yields on government bonds, pushing up borrowing costs across the economy. In Turkey, for example, President Recep Tayyip Erdogan forced the central bank to keep interest rates low in the early 2020s, even as inflation spiked to 85%. In 2023, Erdogan allowed the central bank more independence, which has helped bring down inflation, but short-term interest rates rose to 50% to fight inflation, and remain high. The Fed’s independence doesn’t mean it’s unaccountable Fed chairs like Powell are appointed by the president to serve four-year terms, and have to be confirmed by the Senate. The president also appoints the six other members of the Fed’s governing board, who can serve staggered terms of up to 14 years. Those appointments can allow a president over time to significantly alter the Fed’s policies. Former president Joe Biden appointed four of the current seven members: Powell, Cook, Philip Jefferson, and Michael Barr. A fifth Biden appointee, Adriana Kugler, stepped down unexpectedly on Aug. 1, about five months before the end of her term. The President has already nominated his top economist, Stephen Miran, as a potential replacement, though he will require Senate approval. Cook’s term ends in 2038, so forcing her out would allow The President to appoint a loyalist sooner. The President will be able to replace Powell as Fed chair in May, when Powell’s term expires. Yet 12 members of the Fed’s interest-rate setting committee have a vote on whether to raise or lower interest rates, so even replacing the Chair doesn’t guarantee that Fed policy will shift the way The President wants. Congress, meanwhile, can set the Fed’s goals through legislation. In 1977, for example, Congress gave the Fed a “dual mandate” to keep prices stable and seek maximum employment. The Fed defines stable prices as inflation at 2%. The 1977 law also requires the Fed chair to testify before the House and Senate twice every year about the economy and interest rate policy. Could the president fire Powell before his term ends? The Supreme Court last year suggested in a ruling on other independent agencies that a president can’t fire the chair of the Fed just because he doesn’t like the chair’s policy choices. But he may be able to remove him “for cause,” typically interpreted to mean some kind of wrongdoing or negligence. It’s a likely reason the The President administration has zeroed in on the building renovation, in hopes it could provide a “for cause” pretext. Still, Powell would likely fight any attempt to remove him, and the case could wind up at the Supreme Court. —Christopher Rugaber, AP economics writer View the full article

-

What Is a Customer Rewards Program and How Does It Work?

A customer rewards program is a structured approach that businesses use to promote customer loyalty by offering incentives for repeat purchases. Typically, customers earn points for each dollar they spend or through engagement activities, which can then be redeemed for discounts or exclusive offers. These programs vary widely in structure and benefits, making it crucial to understand how they operate and their potential impact on customer behavior. Let’s explore the various elements that contribute to their success. Key Takeaways A customer rewards program incentivizes repeat purchases through various benefits, enhancing customer engagement and loyalty. Members typically earn points for every dollar spent, which can be redeemed for discounts or exclusive rewards. Tiered systems offer escalating perks as spending increases, motivating customers to reach higher spending levels. Personalized rewards boost brand loyalty, with consumers more likely to trust companies they are loyal to. Regular communication about points and rewards fosters transparency, enhancing customer satisfaction and trust in the program. Definition of a Customer Rewards Program A customer rewards program is a strategic initiative intended to improve customer engagement and encourage repeat purchases by offering various incentives, such as discounts or exclusive benefits, in exchange for loyalty. To create a successful rewards program, you need to identify the best rewards program perks that resonate with your target audience. These can include point-based systems, tiered rewards, or exclusive access to events. By rewarding specific activities like making purchases or referring friends, you can boost brand recall and increase purchase frequency. Historically, these programs have evolved from basic punch-card systems to sophisticated digital platforms that track customer behavior. Research shows that members often spend up to 18% more than non-members, highlighting the financial benefits of implementing a well-designed customer rewards program. How Customer Rewards Programs Work When you join a customer rewards program, you typically start by registering your information, which allows the system to track your points as you make purchases and engage in other qualifying activities. Most of the best rewards programs operate on a point-based system, where you earn points for each dollar spent and for engaging in activities like social media shares or referrals. These points can later be redeemed for discounts or free products. Furthermore, many programs use tiered systems that improve your loyalty for retail, offering better perks as you spend more. Comprehending how to start a loyalty program involves recognizing these elements to maximize your rewards potential and increase your overall spending in the long run. Benefits of Customer Rewards Programs Customer rewards programs offer considerable advantages for both businesses and consumers. They can increase customer spending by up to 18%, boosting sales considerably. These programs improve customer retention, keeping existing customers engaged through enticing rewards. As 95% of consumers trust a company they’re loyal to, it’s clear that encouraging brand loyalty is crucial. Benefit Explanation Example Increased Spending Members spend more than non-members Customer best rewards Improved Retention Incentives keep customers coming back Salon loyalty program examples Differentiation Personalized rewards set you apart from competitors How to make a loyalty program Types of Customer Rewards Programs When exploring customer rewards programs, you’ll encounter various types intended to improve your shopping experience. Points-based rewards systems let you earn points for purchases, which you can later redeem for discounts or free items. Furthermore, tiered membership benefits offer different levels of rewards based on your spending, whereas referral incentive programs encourage you to bring in new customers by providing bonuses for successful referrals. Points-Based Rewards System A points-based rewards system is an effective strategy that enables brands to boost customer engagement by allowing you to earn points through various activities, such as making purchases, signing up for newsletters, or interacting with the brand on social media. With a well-structured POS system with membership cards, you can track your points easily. These points can be redeemed for rewards like discounts, free products, or exclusive offers, encouraging you to engage more with the brand. The complexity of earning points can vary; some programs reward multiple interactions, whereas others focus solely on purchases. Research indicates that members in such programs tend to spend 18% more, as they’re motivated to reach higher reward thresholds for greater benefits. Tiered Membership Benefits Tiered membership benefits in customer rewards programs offer a structured approach to incentivize higher spending and cultivate brand loyalty. In these programs, you progress through various levels based on your spending, revealing rewards like increased point multipliers and exclusive discounts. For instance, you may start at the Silver level, earning 1 point per dollar spent, then move to Gold for 1.5 points, and finally reach Platinum for 2 points per dollar. Higher tiers often include perks such as free shipping and personalized offers. Research indicates that tiered programs can boost customer retention rates considerably, with engaged customers spending up to 20% more than those in non-tiered systems. Tier Level Points Earned per Dollar Silver 1 point Gold 1.5 points Platinum 2 points Referral Incentive Programs How can businesses effectively utilize the strength of their existing customer base? Referral incentive programs offer a potent solution. These programs reward customers for bringing in new clients, often giving discounts or loyalty points to both the referrer and the new customer. You’ll typically share a unique referral link or code, which the business can track easily. Research shows that referred customers are 18% more likely to remain loyal and make additional purchases compared to those acquired through traditional marketing. By implementing referral programs, businesses can considerably lower customer acquisition costs. Many successful brands integrate these programs into their loyalty strategies, enhancing customer engagement and boosting word-of-mouth marketing. This approach effectively leverages existing relationships to drive growth. Examples of Customer Rewards Programs Many businesses implement customer rewards programs to nurture loyalty and encourage repeat purchases, and several well-known examples illustrate the effectiveness of these initiatives. Starbucks Rewards allows you to earn stars with every purchase, redeeming them for free drinks and food, which keeps you engaged. Sephora‘s Beauty Insider program offers points for every dollar spent, revealing exclusive rewards and personalized offers. Marriott Bonvoy lets you earn points not just for hotel stays but likewise for car rentals and flights, providing diverse travel rewards. Amazon Prime operates as a paid loyalty program, giving members free shipping and exclusive discounts. Finally, Delta SkyMiles Medallion features tiered rewards that improve traveler loyalty through benefits like priority boarding and complimentary upgrades. Creating an Effective Customer Rewards Program Creating an effective customer rewards program requires a strategic approach that aligns with your business objectives as it appeals to your customers’ preferences. Start by clearly defining your goals, such as enhancing customer retention or increasing transaction values. A tiered rewards structure can motivate your customers to spend more, as they aim to reach the next level for added benefits. Incorporate diverse earning methods, like points for purchases, social media interactions, and referrals, to boost participation and satisfaction. Regularly review performance metrics, including retention rates and Net Promoter Scores, to adapt your offerings based on feedback. Finally, guarantee clear communication about how customers can earn and redeem rewards, as 85% of consumers say loyalty programs influence their shopping decisions. Strategies for Maximizing Customer Engagement What strategies can you employ to maximize customer engagement in your rewards program? First, consider implementing tiered rewards, as 70% of consumers engage more with brands that recognize loyalty through different reward levels. Next, offer personalized rewards customized to customer preferences; 80% of consumers are more likely to purchase when they receive personalized experiences. Furthermore, utilize social media and referral programs, which can boost customer acquisition by 30% through word-of-mouth marketing. Regular communication about points balances and available rewards keeps customers informed—83% appreciate knowing their progress. Finally, hosting exclusive events for loyalty members nurtures community and belonging, resulting in a 20% increase in repeat purchases among engaged customers. These strategies can greatly improve your rewards program’s effectiveness. Common Challenges and Solutions in Rewards Programs In rewards programs, managing program complexity and ensuring consistent customer engagement can pose significant challenges. You might find that if earning and redeeming points is too complicated, customers could become frustrated, so simplifying these processes is crucial. Furthermore, consistently engaging customers through personalized rewards can keep them motivated to participate, in the end enhancing the program’s success. Program Complexity Management Managing program complexity in customer rewards programs requires careful consideration of how to balance user-friendliness with engaging features. Common challenges include unclear communication about earning and redeeming points, which can lead to decreased engagement. Integration with existing systems can as well pose difficulties, demanding significant investment and maintenance. Regular analysis and feedback collection are vital, as 70% of companies that monitor customer input see improved satisfaction. Implementing tiered rewards can simplify the experience by offering clear milestones. Here’s a summary of common challenges and solutions: Challenge Solution Outcome Unclear program rules Simplify rules and communication Increased customer engagement System integration issues Invest in compatible software Seamless operation Lack of feedback analysis Regularly collect customer feedback Improved program satisfaction Complexity in rewards Use tiered rewards Increased spending by 20% Engagement Consistency Strategies To cultivate consistent engagement in customer rewards programs, businesses must identify and address common challenges that can hinder participation. One issue is low program participation; incorporating gamification elements, like point challenges or tiered rewards, can greatly boost customer motivation. Furthermore, studies show that customers find value in regularly updated rewards, making them 2.5 times more likely to stay engaged. Clear communication is vital, as 62% of customers forget about their rewards without reminders, leading to disengagement. To combat this, consider utilizing customer feedback to refine your offerings, ensuring they remain relevant and appealing. By focusing on personalization and maintaining open lines of communication, you can improve engagement and keep customers invested in your rewards program. Frequently Asked Questions What Is a Customer Rewards Program? A customer rewards program is a structured initiative that encourages you to make repeat purchases by offering points or benefits in return for your loyalty. You earn these points through various activities, like shopping or engaging with the brand on social media. Over time, you can redeem points for rewards such as discounts, free products, or exclusive offers, ultimately improving your shopping experience and encouraging ongoing engagement with the brand. How Do Rewards Programs Make Money? Rewards programs generate revenue by encouraging you to make repeat purchases, which often leads to increased spending. For instance, members typically spend up to 18% more than non-members. Companies collect data through these programs, allowing them to create targeted marketing that boosts conversion rates. Furthermore, tier-based structures motivate you to spend more for greater benefits, whereas referral incentives help acquire new customers through word-of-mouth, all contributing to a company’s bottom line. How to Set up a Rewards Program for Customers? To set up a rewards program for customers, start by defining your goals based on customer needs and business objectives. Choose a program type, like a points system or tiered benefits, that fits your audience. Implement user-friendly technology for tracking rewards, and market the program through channels like email and social media. Finally, regularly review its performance using metrics like retention rates and adjust based on customer feedback to guarantee ongoing success. How Effective Are Rewards Programs? Rewards programs are highly effective for businesses. They drive customer engagement, with about 75% of consumers more likely to stay loyal to a brand offering a loyalty program. These programs can increase customer spending by up to 18%, whereas companies often see a 20% boost in retention rates. Additionally, clear communication about benefits can improve participation by 30%, demonstrating the importance of effectively showcasing rewards to influence consumer behavior positively. Conclusion In conclusion, a customer rewards program is a strategic tool designed to boost customer loyalty through incentives like points and exclusive perks. By comprehending how these programs work and their various types, you can create an effective system customized to your audience. Implementing targeted engagement strategies can maximize participation, whereas being aware of common challenges allows for proactive solutions. Finally, a well-structured rewards program can greatly improve customer retention and drive repeat business for your brand. Image via Google Gemini This article, "What Is a Customer Rewards Program and How Does It Work?" was first published on Small Business Trends View the full article

-

What Is a Customer Rewards Program and How Does It Work?

A customer rewards program is a structured approach that businesses use to promote customer loyalty by offering incentives for repeat purchases. Typically, customers earn points for each dollar they spend or through engagement activities, which can then be redeemed for discounts or exclusive offers. These programs vary widely in structure and benefits, making it crucial to understand how they operate and their potential impact on customer behavior. Let’s explore the various elements that contribute to their success. Key Takeaways A customer rewards program incentivizes repeat purchases through various benefits, enhancing customer engagement and loyalty. Members typically earn points for every dollar spent, which can be redeemed for discounts or exclusive rewards. Tiered systems offer escalating perks as spending increases, motivating customers to reach higher spending levels. Personalized rewards boost brand loyalty, with consumers more likely to trust companies they are loyal to. Regular communication about points and rewards fosters transparency, enhancing customer satisfaction and trust in the program. Definition of a Customer Rewards Program A customer rewards program is a strategic initiative intended to improve customer engagement and encourage repeat purchases by offering various incentives, such as discounts or exclusive benefits, in exchange for loyalty. To create a successful rewards program, you need to identify the best rewards program perks that resonate with your target audience. These can include point-based systems, tiered rewards, or exclusive access to events. By rewarding specific activities like making purchases or referring friends, you can boost brand recall and increase purchase frequency. Historically, these programs have evolved from basic punch-card systems to sophisticated digital platforms that track customer behavior. Research shows that members often spend up to 18% more than non-members, highlighting the financial benefits of implementing a well-designed customer rewards program. How Customer Rewards Programs Work When you join a customer rewards program, you typically start by registering your information, which allows the system to track your points as you make purchases and engage in other qualifying activities. Most of the best rewards programs operate on a point-based system, where you earn points for each dollar spent and for engaging in activities like social media shares or referrals. These points can later be redeemed for discounts or free products. Furthermore, many programs use tiered systems that improve your loyalty for retail, offering better perks as you spend more. Comprehending how to start a loyalty program involves recognizing these elements to maximize your rewards potential and increase your overall spending in the long run. Benefits of Customer Rewards Programs Customer rewards programs offer considerable advantages for both businesses and consumers. They can increase customer spending by up to 18%, boosting sales considerably. These programs improve customer retention, keeping existing customers engaged through enticing rewards. As 95% of consumers trust a company they’re loyal to, it’s clear that encouraging brand loyalty is crucial. Benefit Explanation Example Increased Spending Members spend more than non-members Customer best rewards Improved Retention Incentives keep customers coming back Salon loyalty program examples Differentiation Personalized rewards set you apart from competitors How to make a loyalty program Types of Customer Rewards Programs When exploring customer rewards programs, you’ll encounter various types intended to improve your shopping experience. Points-based rewards systems let you earn points for purchases, which you can later redeem for discounts or free items. Furthermore, tiered membership benefits offer different levels of rewards based on your spending, whereas referral incentive programs encourage you to bring in new customers by providing bonuses for successful referrals. Points-Based Rewards System A points-based rewards system is an effective strategy that enables brands to boost customer engagement by allowing you to earn points through various activities, such as making purchases, signing up for newsletters, or interacting with the brand on social media. With a well-structured POS system with membership cards, you can track your points easily. These points can be redeemed for rewards like discounts, free products, or exclusive offers, encouraging you to engage more with the brand. The complexity of earning points can vary; some programs reward multiple interactions, whereas others focus solely on purchases. Research indicates that members in such programs tend to spend 18% more, as they’re motivated to reach higher reward thresholds for greater benefits. Tiered Membership Benefits Tiered membership benefits in customer rewards programs offer a structured approach to incentivize higher spending and cultivate brand loyalty. In these programs, you progress through various levels based on your spending, revealing rewards like increased point multipliers and exclusive discounts. For instance, you may start at the Silver level, earning 1 point per dollar spent, then move to Gold for 1.5 points, and finally reach Platinum for 2 points per dollar. Higher tiers often include perks such as free shipping and personalized offers. Research indicates that tiered programs can boost customer retention rates considerably, with engaged customers spending up to 20% more than those in non-tiered systems. Tier Level Points Earned per Dollar Silver 1 point Gold 1.5 points Platinum 2 points Referral Incentive Programs How can businesses effectively utilize the strength of their existing customer base? Referral incentive programs offer a potent solution. These programs reward customers for bringing in new clients, often giving discounts or loyalty points to both the referrer and the new customer. You’ll typically share a unique referral link or code, which the business can track easily. Research shows that referred customers are 18% more likely to remain loyal and make additional purchases compared to those acquired through traditional marketing. By implementing referral programs, businesses can considerably lower customer acquisition costs. Many successful brands integrate these programs into their loyalty strategies, enhancing customer engagement and boosting word-of-mouth marketing. This approach effectively leverages existing relationships to drive growth. Examples of Customer Rewards Programs Many businesses implement customer rewards programs to nurture loyalty and encourage repeat purchases, and several well-known examples illustrate the effectiveness of these initiatives. Starbucks Rewards allows you to earn stars with every purchase, redeeming them for free drinks and food, which keeps you engaged. Sephora‘s Beauty Insider program offers points for every dollar spent, revealing exclusive rewards and personalized offers. Marriott Bonvoy lets you earn points not just for hotel stays but likewise for car rentals and flights, providing diverse travel rewards. Amazon Prime operates as a paid loyalty program, giving members free shipping and exclusive discounts. Finally, Delta SkyMiles Medallion features tiered rewards that improve traveler loyalty through benefits like priority boarding and complimentary upgrades. Creating an Effective Customer Rewards Program Creating an effective customer rewards program requires a strategic approach that aligns with your business objectives as it appeals to your customers’ preferences. Start by clearly defining your goals, such as enhancing customer retention or increasing transaction values. A tiered rewards structure can motivate your customers to spend more, as they aim to reach the next level for added benefits. Incorporate diverse earning methods, like points for purchases, social media interactions, and referrals, to boost participation and satisfaction. Regularly review performance metrics, including retention rates and Net Promoter Scores, to adapt your offerings based on feedback. Finally, guarantee clear communication about how customers can earn and redeem rewards, as 85% of consumers say loyalty programs influence their shopping decisions. Strategies for Maximizing Customer Engagement What strategies can you employ to maximize customer engagement in your rewards program? First, consider implementing tiered rewards, as 70% of consumers engage more with brands that recognize loyalty through different reward levels. Next, offer personalized rewards customized to customer preferences; 80% of consumers are more likely to purchase when they receive personalized experiences. Furthermore, utilize social media and referral programs, which can boost customer acquisition by 30% through word-of-mouth marketing. Regular communication about points balances and available rewards keeps customers informed—83% appreciate knowing their progress. Finally, hosting exclusive events for loyalty members nurtures community and belonging, resulting in a 20% increase in repeat purchases among engaged customers. These strategies can greatly improve your rewards program’s effectiveness. Common Challenges and Solutions in Rewards Programs In rewards programs, managing program complexity and ensuring consistent customer engagement can pose significant challenges. You might find that if earning and redeeming points is too complicated, customers could become frustrated, so simplifying these processes is crucial. Furthermore, consistently engaging customers through personalized rewards can keep them motivated to participate, in the end enhancing the program’s success. Program Complexity Management Managing program complexity in customer rewards programs requires careful consideration of how to balance user-friendliness with engaging features. Common challenges include unclear communication about earning and redeeming points, which can lead to decreased engagement. Integration with existing systems can as well pose difficulties, demanding significant investment and maintenance. Regular analysis and feedback collection are vital, as 70% of companies that monitor customer input see improved satisfaction. Implementing tiered rewards can simplify the experience by offering clear milestones. Here’s a summary of common challenges and solutions: Challenge Solution Outcome Unclear program rules Simplify rules and communication Increased customer engagement System integration issues Invest in compatible software Seamless operation Lack of feedback analysis Regularly collect customer feedback Improved program satisfaction Complexity in rewards Use tiered rewards Increased spending by 20% Engagement Consistency Strategies To cultivate consistent engagement in customer rewards programs, businesses must identify and address common challenges that can hinder participation. One issue is low program participation; incorporating gamification elements, like point challenges or tiered rewards, can greatly boost customer motivation. Furthermore, studies show that customers find value in regularly updated rewards, making them 2.5 times more likely to stay engaged. Clear communication is vital, as 62% of customers forget about their rewards without reminders, leading to disengagement. To combat this, consider utilizing customer feedback to refine your offerings, ensuring they remain relevant and appealing. By focusing on personalization and maintaining open lines of communication, you can improve engagement and keep customers invested in your rewards program. Frequently Asked Questions What Is a Customer Rewards Program? A customer rewards program is a structured initiative that encourages you to make repeat purchases by offering points or benefits in return for your loyalty. You earn these points through various activities, like shopping or engaging with the brand on social media. Over time, you can redeem points for rewards such as discounts, free products, or exclusive offers, ultimately improving your shopping experience and encouraging ongoing engagement with the brand. How Do Rewards Programs Make Money? Rewards programs generate revenue by encouraging you to make repeat purchases, which often leads to increased spending. For instance, members typically spend up to 18% more than non-members. Companies collect data through these programs, allowing them to create targeted marketing that boosts conversion rates. Furthermore, tier-based structures motivate you to spend more for greater benefits, whereas referral incentives help acquire new customers through word-of-mouth, all contributing to a company’s bottom line. How to Set up a Rewards Program for Customers? To set up a rewards program for customers, start by defining your goals based on customer needs and business objectives. Choose a program type, like a points system or tiered benefits, that fits your audience. Implement user-friendly technology for tracking rewards, and market the program through channels like email and social media. Finally, regularly review its performance using metrics like retention rates and adjust based on customer feedback to guarantee ongoing success. How Effective Are Rewards Programs? Rewards programs are highly effective for businesses. They drive customer engagement, with about 75% of consumers more likely to stay loyal to a brand offering a loyalty program. These programs can increase customer spending by up to 18%, whereas companies often see a 20% boost in retention rates. Additionally, clear communication about benefits can improve participation by 30%, demonstrating the importance of effectively showcasing rewards to influence consumer behavior positively. Conclusion In conclusion, a customer rewards program is a strategic tool designed to boost customer loyalty through incentives like points and exclusive perks. By comprehending how these programs work and their various types, you can create an effective system customized to your audience. Implementing targeted engagement strategies can maximize participation, whereas being aware of common challenges allows for proactive solutions. Finally, a well-structured rewards program can greatly improve customer retention and drive repeat business for your brand. Image via Google Gemini This article, "What Is a Customer Rewards Program and How Does It Work?" was first published on Small Business Trends View the full article

-

Aldi is opening 180+ new stores — here’s what’s driving the sudden surge

Americans stressed by high grocery bills have one bright spot to look forward to in 2026. Value-minded grocery chain Aldi is coming to more cities around the country, with 180 new stores set to open in the U.S. this year. Aldi is a compelling option for grocery shoppers on a budget. Founded in Germany, the company envisioned itself as a discount grocery store from day one. Aldi’s aggressive U.S. expansion will meet the needs of more shoppers seeking a no-frills grocery experience without compromising on quality – a niche shared by Aldi competitors like Costco and Trader Joe’s. The budget grocery chain currently operates in 39 states across more than 2,600 stores in the U.S. By the end of 2026, it plans to add 180 new stores, with some states getting their first Aldi, including a new location in Portland, Maine. The grocer is expanding aggressively in the West in particular, with 50 stores planned for Denver and Colorado Springs alone over the next five years. Phoenix will get 10 new Aldi locations in 2026, with 40 planned by the end of 2030 and four new Las Vegas area stores are on the way in the next few years as well. “These strategic investments are all about making sure customers can continue to count on us for the quality, affordable groceries and enjoyable shopping experience they love,” Aldi CEO Atty McGrath said in a press release. “As we look ahead to our next 50 years in the U.S., we’ll continue to earn shopper loyalty by staying true to what’s made ALDI successful: keeping things simple and delivering real value.” Beyond the West, Aldi is pushing deeper into the Southeast U.S. through its 2024 acquisition of Southeastern Grocers, the parent company of grocery chain Winn-Dixie. The company will continue converting many of those locations into Aldi stores, with 200 set to be finished by the end of next year. Aldi builds its brand As America’s fastest-growing grocer, Aldi is focused on entering new markets, but the company is also refining aspects of its brand in the process. Late last year, Aldi began putting its own brand on its in-house products, communicating more clearly with customers that they can only buy many of the things they enjoy at Aldi. “Private label is the core of what we do,” Scott Patton, Aldi’s chief commercial officer, told Fast Company. “I’m not going to say we invented it; I would say we’ve perfected it.” More than 90% of the grocer’s offerings are private label, but that fact isn’t always apparent to shoppers – a problem the company plans to solve. “The overall sentiment was, on average, customers didn’t know that was an Aldi brand,” Kristy Reitz, Aldi’s director of brand and design, told Fast Company. “Now if they shop us a little less frequently, they think they can find that brand elsewhere, and in fact it’s a private-label brand to Aldi.” The K-shaped economy and Aldi Aldi’s booming business isn’t a coincidence. Its stores command a loyal following by combining high quality with affordability, but it’s the latter that’s really weighing on the minds of U.S. shoppers right now. According to a poll by the Associated Press last year, an overwhelming majority of American households are worried about the high cost of groceries. Around half of people polled said that the high cost of groceries was a “major” stressor, with only 14% reporting that they weren’t worried about how much they pay to stock the fridge. No matter what you call it, rich Americans are getting richer while much of the rest of the country is struggling to make ends meet. That “K-shaped” economy is taking shape in a number of ways, but the crux of it is that lower and middle income consumers are wrestling with a higher cost of living taking a bigger bite out of their earnings while the wealthiest Americans, buoyed by stock market highs, just keep spending. Because the cost of basic needs like food and housing has soared in recent years and American wages haven’t kept up, many people in the U.S. feel left in the lurch. That leaves a lot of potential Aldi shoppers hunting for deals on the essentials. Other stripped down discount shopping options are also booming. Costco’s share price has more than doubled since the current inflationary streak began, with shoppers flocking en masse into its warehouses to stock up on high quality, low markup goods and groceries. It’s no surprise that refreshingly non-predatory brands are inspiring small armies of devoted followers who evangelize about the good deals they find. People stressed about their grocery bills have found a safe haven with stores like Aldi and Costco – and for anyone who isn’t, there’s always Erewhon. View the full article

-

What ideas might be on the table as housing measures expand

A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico. View the full article

-

Meta taps Dina Powell McCormick as president and vice chairman

Facebook owner Meta has named Dina Powell McCormick, a former The President administration adviser and longtime finance executive, as president and vice chairman of the tech giant. Powell McCormick previously served on Meta’s board of directors — where, the company notes, she was “deeply engaged” in accelerating its artificial intelligence push across platforms. In her new management role, Meta says Powell McCormick will help guide its overall strategy, including the execution of multi-billion-dollar investments. The news, announced Monday, quickly gained the applause of U.S. President Donald The President. In a post on his social media platform Truth Social, the Republican president said the move was a “great choice” by Meta CEO Mark Zuckerberg — and noted that Powell McCormick had “served the The President Administration with strength and distinction.” Zuckerberg said in a statement that Powell McCormick’s experience in global finance, “combined with her deep relationships around the world,” made her “uniquely suited to help Meta” in its future growth. Powell McCormick is a veteran of two presidential administrations and the Republican National Committee. She worked as a national security adviser at the start of The President’s first term, and also held roles in the White House and the Secretary of State’s office under President George W. Bush. She is married to U.S. Sen. David McCormick, who served in high-level positions in the Commerce and Treasury departments under Bush — before he joined hedge fund Bridgewater Associates and rose to become CEO. And Powell McCormick has a long background in finance. She spent 16 years in senior leadership at Goldman Sachs, but was most recently vice chair, president and head of global client services at merchant bank BDT & MSD Partners. She’s also held a handful of other corporate board positions — including at oil giant Exxon Mobil. According to a securities filing, Powell McCormick had previously resigned from Meta’s board in December, eight months after joining as a director. The addition of Powell McCormick to Meta’s management team arrived amid wider efforts from California-based Meta to boost its ties with The President, who was once banned from Facebook. Like other powerful tech CEOs, Zuckerberg has dined with the president at the White House and doubled down on U.S. investment promises worth hundreds of billions of dollars. Last year, the company also appointed Ultimate Fighting Championship CEO Dana White to its board, another familiar figure in The President’s orbit. —Wyatte Grantham-Philips, AP business writer AP Reporter Marc Levy contributed to this report. View the full article

-

DoJ’s probe into Powell galvanises Fed leaders to repel Trump attacks

Central bank chair could stay on board beyond this year in effort to protect central bank’s independence View the full article

-

Why X changed its Iranian flag emoji

Iran hasn’t changed its flag, but the emoji for it has changed on X, the social network previously known as Twitter. Iran’s tricolor flag features green, white, and red horizontal stripes, with the country’s national emblem displayed in its center white stripe. But some opposition groups use a historical flag that instead shows a golden lion holding a sword in front of a sun. Since ongoing anti-government demonstrations erupted in Iran in December, that lion-and-sun version of the flag has been used as a symbol of protest around the world, including in demonstrations over the weekend in Los Angeles and London, where one protester held the flag at the Iranian embassy after taking down the national flag. Now it’s also on X. After an X user asked the site’s head of product, Nikita Bier, to update the flag last Thursday, Bier responded, “Give me a few hours.” The updated emoji appeared first on the web browser version of the site before rolling out to iOS devices. Other emoji vendors like Google and Facebook still use the standard emoji of Iran’s national flag, so the lion-and-sun flag isn’t available on most platforms, and it’s also not available for X on Android devices. The change on X, though, meant that accounts tied to Iran’s Ministry of Foreign Affairs suddenly found their bios displaying an emoji that could be construed as anti-regime. Iran’s foreign ministry has since removed the emoji from its bio. X previously used default Apple emoji on iOS, but since 2023, it has used its own native emoji, according to Emojipedia. X last redesigned an emoji in 2024, when it changed its pistol emoji from a green water pistol back to an actual pistol. Protests in Iran began on December 28 over deteriorating economic conditions. They have reached every province in the country. At least 572 people have died, and more than 10,600 people have been detained, according to the Human Rights Activists News Agency (HRANA), a U.S.-based nongovernmental organization. X users in the country haven’t had much of a chance to use or sound off about the new emoji, as Iran shut down internet access and telephone lines last Thursday. View the full article

-

Card debt hits record amount as providers charge high rates

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting. View the full article

-

Microsoft Is Finally Working on a Worthy Answer to Apple's 'Handoff' Feature

Love it or hate it, the Apple ecosystem really does have its perks. Take "Handoff," for example. With this feature, you can be working in one app on one of your devices, then continue on in the same app on one of your other devices. You can start an article in Safari on your iPhone, then finish it on your Mac, without needing to google the piece and scroll to find your spot. It isn't 100%, but when it works, it's pretty great. Microsoft actually offers a similar feature over on Windows, though it's so limited, you might not even know it exists. The feature is called Resume, and the idea is to allow you to pick up your place in an app from another device on your PC. For the most part, that means Android apps; so if you have a PC and an Android phone, Resume could offer the same benefits as someone with a Mac and an iPhone. However, so few apps actually work with Resume, that it's effectively useless. Microsoft's "Handoff" moment is coming As spotted by Windows Latest, Microsoft is making some serious updates to Resume. The company recently updated the Resume support document, which confirms Microsoft is opening the feature up to more Android apps. The support document doesn't specify what apps might be coming, but it doesn't necessarily have to for this news to be exciting; rather, the development alone implies that many more Android apps will likely be on the way—assuming their developers simply get on board. As Windows Latest explains, the reason Resume has been so limited is due to how restrictive Microsoft's API is. The only apps that can currently tap into Resume are ones that have access to the "Link to Windows" API. Many Android developers either don't know how to develop with this API, or simply can't, since their apps are not compatible. The latest update to Resume offers developers another option, however: Now, developers can use Windows Notification System (WNS), a built-in API that is far more common and supports far more apps. That said, developers can't just update their apps with the WNS and expect to be compatible with Resume. Microsoft tells Windows Latest that developers need to reach out to Microsoft directly for approval. That application needs to include the developer's WNS registration, the app's Package SID, a summary of what the app does, and screenshots of the app in action. It's basically like signing up for TSA PreCheck: Most of us who apply will likely get approved, but they don't just let anyone decide to join. You need to provide proof you qualify and submit for screening before you get there. That will likely end up working well for anyone who's interested in using Resume: The apps that will be available will all be vetted by Microsoft, so there should only be legitimate and useful apps offering that linking capability. How to enable Resume on WindowsThese changes probably won't roll out for some time on Windows. However, you can set yourself up for success now by turning the feature on. To start, head to Settings > Apps, then scroll until you find "Resume." Here, turn on the feature. Right now, you'll probably see the only app that is compatible is OneDrive. You can connect it if you wish, which will let you work on a document across both your Android device and your PC. View the full article

-

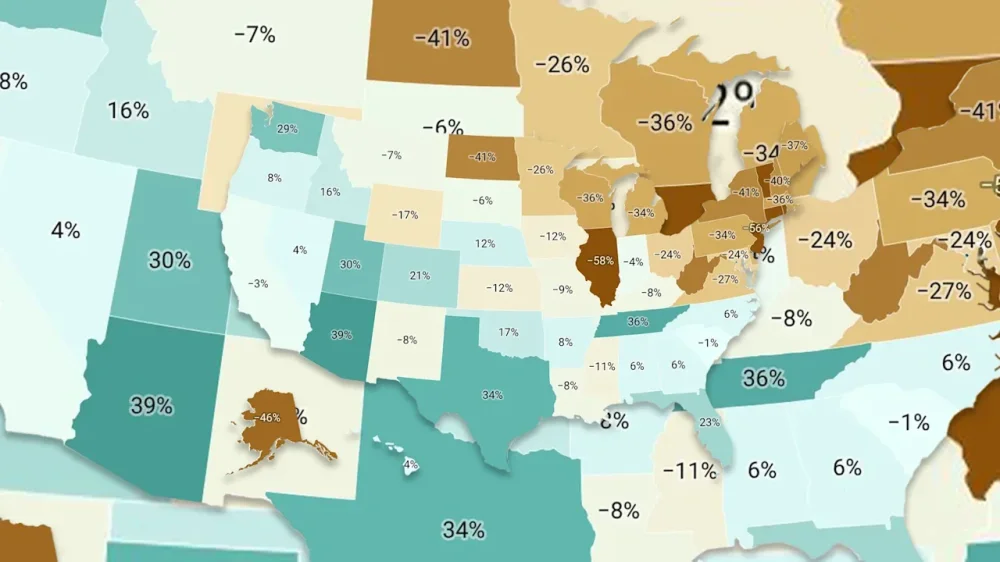

Housing markets where homebuyers are gaining power heading into spring 2026