Everything posted by ResidentialBusiness

-

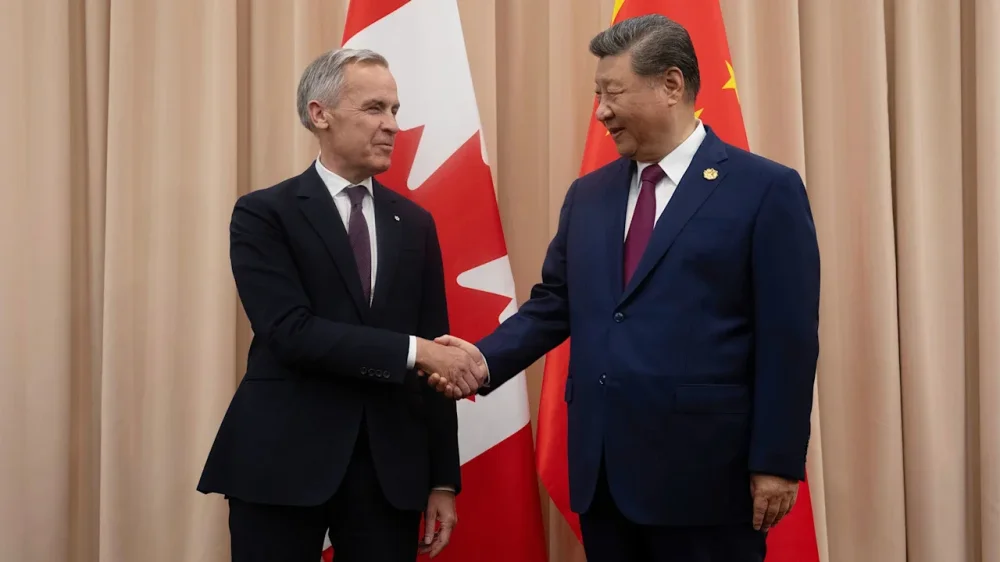

As U.S-Canada relations strain, P.M. Mark Carney looks to rebuild ties with China

A leader of the Canadian government is visiting China this week for the first time in nearly a decade, a bid to rebuild his country’s fractured relations with the world’s second-largest economy — and reduce Canada’s dependence on the United States, its neighbor and until recently one of its most supportive and unswerving allies. The push by Prime Minster Mark Carney, who arrives Wednesday, is part of a major rethink as ties sour with the United States — the world’s No. 1 economy and long the largest trading partner for Canada by far. Carney aims to double Canada’s non-U.S. exports in the next decade in the face of President Donald The President’s tariffs and the American leader’s musing that Canada could become “the 51st state.” “At a time of global trade disruption, Canada is focused on building a more competitive, sustainable, and independent economy,” Carney said in a news release announcing his China visit. “We’re forging new partnerships around the world to transform our economy from one that has been reliant on a single trade partner.” He will be in China until Saturday, then visit Qatar before attending the annual meeting of the World Economic Forum in Switzerland next week. The President’s tariffs have pushed both Canada and China to look for opportunities to strengthen international cooperation, said Zhu Feng, the dean of the School of International Studies at China’s Nanjing University. “Carney’s visit does reflect the new space for further development in China-Canadian relations under the current U.S. trade protectionism,” he said. But he cautioned against overestimating the importance of the visit, noting that Canada remains a U.S. ally. The two North American nations also share a deep cultural heritage and a common geography. New leaders have pivoted toward China Carney has been in office less than a year, succeeding Justin Trudeau, who was prime minister for nearly a decade. He is not the first new leader of a country to try to repair relations with China. Australian Premier Anthony Albanese has reset ties since his Labor Party came to power in 2022. Relations had deteriorated under the previous conservative government, leading to Chinese trade restrictions on wine, beef, coal and other Australian exports. Unwinding those restrictions took about 18 months, culminating with the lifting of a Chinese ban on Australian lobsters in late 2024. British Prime Minister Keir Starmer has sought to repair ties with China since his Labour Party ousted the Conservatives in 2024. He is reportedly planning a visit to China, though the government has not confirmed that. The two governments have differences, with Starmer raising the case of former Hong Kong media magnate Jimmy Lai, a British citizen, in talks with Chinese leader Xi Jinping in late 2024 in Brazil. The President, who has said he will come to China in April, has indicated he wants a smooth relationship with China, though he also launched a tit-for-tat trade war, with tariffs rising to more than 100% before he backed down. Bumpy relations, with Washington in the middle In Canada, The President’s threats have raised questions about the country’s longstanding relationship with its much more powerful neighbor. Those close ties have also been the source of much of Canada’s friction with China in recent years. It was Canada’s detention of a Chinese telecommunications executive at the request of the U.S. that started the deterioration of relations in late 2018. The U.S. wanted the Huawei Technologies Co. executive, Meng Wenzhou, to be extradited to face American charges. China retaliated by arresting two Canadians, Michael Kovrig and Michael Spavor, on spying charges. While they were imprisoned, Meng was under house arrest in Vancouver, a Canadian city home to a sizable Chinese population. All three were released under a deal reached in 2021. More recently, Canada followed the U.S. in imposing a 100% tariff on electric vehicles and a 25% tariff on steel and aluminum from China. China, which is Canada’s second-largest trading partner after the U.S., has hit back with tariffs on Canadian exports including canola, seafood and pork. It has indicated it would remove some of the tariffs if Canada were to drop the 100% charge on EVs. An editorial in China’s state-run Global Times newspaper welcomed Carney’s visit as a new starting point and called on Canada to lift “unreasonable tariff restrictions” and advance more pragmatic cooperation. Chinese Foreign Ministry spokesperson Mao Ning said Monday that China looks forward to Carney’s visit as an opportunity to “consolidate the momentum of improvement in China-Canada relations.” Canada is also repairing ties with India Carney met Xi in late October in South Korea, where both were attending the annual Asia-Pacific Economic Cooperation (APEC) summit. He has also tried to mend ties with India, where relations deteriorated in 2024 after the Trudeau government accused India of being involved in the 2023 killing of a Sikh activist in Canada. The fallout led to tit-for-tat expulsions of senior diplomats, disruption of visa services, reduced consular staffing and a freeze on trade talks. A cautious thaw began last June. Since then, both sides have restored some consular services and resumed diplomatic contacts. In November, Canadian Foreign Minister Anita Anand said the two countries would move quickly to advance a trade deal, noting the government’s new foreign policy in response to The President’s trade war. Carney is also expected to visit India later this year. Associated Press journalists Sheikh Saaliq in New Delhi and Jill Lawless in London, and researcher Shihuan Chen in Beijing contributed. —Ken Moritsugu, Associated Press View the full article

-

Google’s UCP Checkout Brings New Tradeoffs For Retailers via @sejournal, @MattGSouthern

Google's AI Mode checkout aims to reduce friction, but retailers question what it means for brand control, cross-sells, and customer data. The post Google’s UCP Checkout Brings New Tradeoffs For Retailers appeared first on Search Engine Journal. View the full article

-

The New Dyson Purifier Hot+Cool Is Nearly 25% Off Right Now

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. Winter makes the comfort gaps in your home impossible to ignore. Cold corners, stale air, rooms that never feel evenly warm, no matter how long the heater runs. You can try smaller fixes first—blocking drafts, layering rugs, or improving airflow, which actually helps rooms feel warmer without cranking the thermostat. But if you’re still juggling space heaters, fans, and an air purifier, this deal on the Dyson Purifier Hot+Cool HP1 is worth a closer look. It’s currently $499.95, down from $659.99, and price trackers show this is the lowest it’s ever been. Dyson Purifier Hot+Cool HP1 $499.95 at Amazon $659.99 Save $160.04 Get Deal Get Deal $499.95 at Amazon $659.99 Save $160.04 In winter, the heating mode does most of the heavy lifting. The HP1 warms up quickly and pushes heat out evenly instead of blasting one hot stream at your ankles. Its wide oscillation (up to 350 degrees) helps circulate warm air throughout the room, which can make a space feel comfortable faster and more consistently. That circulation also keeps the air from feeling heavy or damp, especially in closed-up winter homes. When the heater isn’t needed, it works as a cooling fan, and year-round it runs as a sealed HEPA air purifier. Cooking smells, pet dander, and lingering indoor air all clear out faster than you’d expect. That said, filters need replacing about once a year, at around $79.99, which adds to the long-term cost. Living with it day to day feels very Dyson. The HP1 is tall but slim, with a small base that doesn’t eat up floor space. At about 12 pounds, it’s light enough to carry from room to room. The front-facing LED screen shows temperature, air quality, fan speed, and remaining filter life without forcing you into the app. Most controls happen through the magnetized remote, which snaps to the top of the unit, making the MyDyson app optional. The real benefit of the app is being able to control the HP1 remotely, which is useful if you want the room warmed up before you get there. This still isn’t a small purchase, even on sale, but for homes short on space or anyone tired of juggling separate heaters, fans, and purifiers, it does make daily life simpler without demanding much attention once it’s set up. Our Best Editor-Vetted Tech Deals Right Now Apple AirPods Pro 3 Noise Cancelling Heart Rate Wireless Earbuds — $229.99 (List Price $249.00) Apple Watch Series 11 [GPS 46mm] Smartwatch with Jet Black Aluminum Case with Black Sport Band - M/L. Sleep Score, Fitness Tracker, Health Monitoring, Always-On Display, Water Resistant — $329.00 (List Price $429.00) Amazon Fire TV Stick 4K Plus — (List Price $24.99 With Code "FTV4K25") Samsung Galaxy Watch 8 — $279.99 (List Price $349.99) Samsung Galaxy Tab A9+ 10.9" 64GB Wi-Fi Tablet (Graphite) — $149.99 (List Price $219.99) Deals are selected by our commerce team View the full article

-

Google opens Olympic live sports inventory to biddable CTV buys

Live sports advertising is getting more programmatic — and more measurable. Driving the news. Google is rolling out new biddable live sports capabilities in Display & Video 360, including programmatic access to NBCUniversal’s Olympic Winter Games inventory, ahead of a packed 2026 global sports calendar. Why we care. Live sports remain one of the few media environments that consistently deliver massive, attentive audiences. By bringing premium sports inventory into biddable CTV, Google is giving advertisers more control, better measurement, and easier activation — without sacrificing reach. What’s new. Advertisers can now combine Google audience signals with NBCUniversal’s live sports CTV inventory to reach fans on the big screen and re-engage them across YouTube and other Google surfaces. New cross-device frequency management uses household-level signals to limit overexposure, while Google AI-powered cross-device conversion tracking links CTV impressions to downstream purchases — at no added cost. Google is also simplifying access to live sports through a redesigned Marketplace, allowing marketers to activate curated sports packages in just a few clicks rather than navigating fragmented media buys. The big picture. As fans move fluidly between connected TV, YouTube, Search and social feeds, advertisers are under pressure to follow attention across screens. Google is positioning Display & Video 360 as the hub that connects those moments, from the living room to mobile. The bottom line: By unlocking Olympic and live sports inventory inside Display & Video 360, Google is making premium sports advertising easier to buy, easier to measure, and far more accountable. View the full article

-

Former Fed chiefs attack DoJ probe into Jay Powell

Statement accuses The President administration of behaving like an emerging marketView the full article

-

Hargreaves Lansdown hires Vanguard executive as new boss

Matt Benchener to replace Richard Flint as boss of UK’s biggest ‘DIY’ investment siteView the full article

-

What Is a Microbusiness Loan and How Can It Benefit You?

A microbusiness loan is a financing option designed for small-scale entrepreneurs, providing funds typically between $100 and $50,000. It caters to individuals with limited credit histories and offers competitive interest rates ranging from 8% to 13%. Beyond financial support, these loans often include resources like business training, which can improve your operational skills. Comprehending the specifics of microbusiness loans can help you determine if this funding solution aligns with your goals and needs. Key Takeaways Microbusiness loans provide funding ranging from $100 to $50,000 for small businesses and entrepreneurs needing capital. They feature competitive interest rates, generally between 8% and 13%, making them affordable options. These loans are accessible to individuals with limited credit histories, often requiring a minimum score of 620. Many microbusiness loans include additional support services, such as business training, enhancing entrepreneurial skills and capabilities. The application process is typically simpler and quicker than traditional loans, requiring less documentation and faster access to funds. Definition and Overview of Microbusiness Loans Microbusiness loans, which are designed to support small businesses and entrepreneurs, offer a practical financial solution for those in need of capital. If you wanna start a business, these loans can range from $100 to $50,000, making them suitable for various financial needs. They typically feature lower interest rates compared to traditional loans, which helps make repayment more manageable. Microbusiness loans are particularly beneficial for individuals with limited or poor credit histories, promoting entrepreneurship in underserved communities. Although repayment terms can vary, you can expect to repay the loan within six years, depending on the lender. Furthermore, many microbusiness loans come with additional support services, such as business training, enhancing your chances of success in your venture. Eligibility Criteria for Microbusiness Loans To qualify for a microbusiness loan, you need to guarantee your business is registered as a for-profit entity or, in some cases, a nonprofit child care center. Most lenders look for a credit score of at least 620, even though some may accept lower scores, which can be beneficial if you have limited credit history. Moreover, you’ll likely need to present a solid business plan and financial projections to show that you can repay the loan. Business Registration Requirements What’re the vital business registration requirements for securing a microbusiness loan? To qualify, you must be registered as a for-profit business or a nonprofit child care center, adhering to specific legal requirements. This guarantees that your operation is legitimate and compliant with local laws. Furthermore, lenders often request a detailed business plan and financial projections, demonstrating your ability to repay the loan and showcasing your business’s viability. It’s significant to highlight that some lenders may have extra criteria, such as no recent bankruptcies or tax delinquencies. Microbusiness loans particularly aim to support underserved communities, including women– and minority-owned businesses, promoting equitable access to funding. Meeting these registration requirements is fundamental for your loan eligibility. Credit Score Considerations When applying for a microbusiness loan, credit score considerations play a significant role in determining your eligibility. Most lenders usually require a minimum personal credit score of around 620, even though some may accept lower scores because of more lenient standards. Microbusiness loans are often designed to be accessible for individuals with limited credit histories or poor scores, making them ideal for startups and underserved communities. The SBA microloan program particularly supports businesses owned by women and minorities, who may face greater challenges in securing traditional financing. While you’ll need to demonstrate your ability to repay the loan, lenders commonly place less emphasis on your credit history. Always review particular eligibility criteria and documentation required by individual lenders. Benefits of Microbusiness Loans Microbusiness loans provide a range of benefits that can greatly aid small-scale entrepreneurs and startups in their path to success. These loans typically offer financing up to $50,000, making it easier for you to access the initial capital you need. With competitive interest rates between 8% and 13%, they present a cost-effective alternative to traditional bank loans. Furthermore, flexible eligibility requirements allow individuals with lower credit scores to qualify, supporting underserved communities. Beyond funding, many microbusiness loans include resources like business training and support services, enhancing your entrepreneurial skills. For instance, the average SBA microloan in fiscal year 2024 was about $16,124, which aligns well with the smaller financial needs of new and growing businesses. Sources of Microbusiness Loans Accessing microbusiness loans involves various sources customized to meet the needs of small entrepreneurs. The U.S. Small Business Administration (SBA) offers loans up to $50,000 through approved intermediaries, with interest rates between 8% and 13%. Nonprofit organizations and community development financial institutions (CDFIs) focus on providing microloans to support underserved communities. Online platforms like Kiva facilitate peer-to-peer microloans, allowing you to borrow between $1,000 and $15,000 without a minimum credit score. Furthermore, the USDA’s Farm Service Agency (FSA) provides specific microloans for small to mid-sized farms, totaling up to $100,000. Microfinance institutions likewise offer loans to low-income entrepreneurs, often including training services to promote business growth and sustainability. How to Apply for a Microbusiness Loan To apply for a microbusiness loan, you first need to determine your specific business needs, which will help guide your application process. Next, gather the necessary documentation, including a business plan, personal guarantees, and financial projections to show that you can repay the loan. With this information in hand, you’ll be better equipped to approach an SBA-approved intermediary lender for customized options. Determine Your Needs How can you effectively determine your needs when applying for a microbusiness loan? Start by completing a detailed questionnaire that assesses your business requirements. This will help you identify the right loan amount, which can be as high as $50,000. Consider your specific needs, whether it’s funding for equipment, inventory, or operational costs. Next, consult with SBA-approved intermediary lenders, often nonprofit organizations, to discuss customized options suited to your situation. They can guide you through the application process and clarify any lender-specific requirements. Remember, the average loan amount in fiscal year 2024 was about $16,124, with repayment terms extending up to seven years. Comprehending these factors will help streamline your application process. Gather Required Documentation When applying for a microbusiness loan, gathering the required documentation is essential to streamline the process and meet lender expectations. To start, complete a questionnaire to assess your business needs and eligibility. Typically, you’ll need a business plan, financial projections, personal guarantees, and collateral agreements, but this can vary by lender. Furthermore, you may have to provide evidence of positive cash flow or projections to show your ability to repay the loan. To help you, here’s a quick reference table: Documentation Type Purpose Business Plan Outlines your business strategy Financial Projections Demonstrates expected cash flow Personal Financial History Assesses creditworthiness Collateral Agreements Secures the loan with assets Microbusiness Loan Features Microbusiness loans come with several key features designed to support small businesses in their growth and development. Typically ranging from $100 to $50,000, these loans provide vital capital for startup costs, inventory, and operational expenses. They often offer lower interest rates than traditional loans, making them more accessible for entrepreneurs with limited credit history or poor credit scores. Repayment terms are usually flexible, extending up to six or seven years, which helps you manage your cash flow effectively. Although many loans require collateral and a personal guarantee for security, they may likewise come with additional resources, such as business training and support services, to empower you in enhancing your operational skills and achieving success in your venture. Pros and Cons of Microbusiness Loans During the evaluation of your financing options, comprehending the pros and cons of microbusiness loans is crucial for making an informed decision. These loans offer unique benefits, but they too come with limitations. They provide accessible funding ranging from $100 to $50,000, ideal for small businesses and startups. Competitive interest rates between 8% and 13% can lower your borrowing costs compared to other options. The application process is simpler, requiring less documentation and enabling quicker access to capital. Nevertheless, the maximum loan amount mightn’t be sufficient for larger projects, potentially restricting your business growth. Understanding these factors can help you determine if a microbusiness loan aligns with your financial needs and future goals. Alternatives to Microbusiness Loans Exploring alternatives to microbusiness loans can open up various funding avenues that might better suit your business’s specific needs. Business credit cards offer quick access to funds, though their higher annual percentage rates (APRs) can be a drawback. Traditional small business loans typically provide larger amounts, often exceeding $50,000, but they require more stringent eligibility criteria and extensive documentation. Online business loans present faster financing options with flexible qualification requirements compared to traditional banks. Peer-to-peer lending platforms, like Kiva, connect you directly with individual lenders, offering interest-free microloans during the need for social proof of creditworthiness. Finally, community development financial institutions (CDFIs) offer customized loan products and support services, particularly to underserved communities, promoting local economic growth. Considerations Before Applying for a Microbusiness Loan Before you plunge into applying for a microbusiness loan, it’s essential to take a step back and evaluate your financial needs carefully. Consider the following factors to guarantee you make an informed decision: Assess the specific loan amount you need, as microloans range from $100 to $50,000. Review the loan’s terms, including interest rates that typically range from 8% to 13%, and associated fees up to 3%. Prepare necessary documentation, like a solid business plan and financial projections, to demonstrate your repayment ability. Consider the repayment schedule, as terms can extend up to six to seven years, impacting your cash flow. Frequently Asked Questions What Are the Benefits of a Micro Loan? Microloans offer several benefits that can improve your business’s growth. They provide access to small amounts of capital, typically up to $50,000, which is perfect for covering startup costs, inventory, or operational expenses. With competitive interest rates ranging from 8% to 13%, you can secure funding at a lower cost compared to traditional loans. Moreover, many microloan programs offer business training and support, helping you develop skills essential for your success. What Is the Monthly Payment on a $50,000 Business Loan? The monthly payment on a $50,000 business loan can vary based on the interest rate and term length. For instance, at a 10% interest rate over seven years, you’d pay approximately $780 monthly. If the rate increases to 12%, your payment could rise to about $860. Don’t forget to contemplate potential fees, which can add up to 3% of the loan amount, impacting your overall borrowing costs and monthly payments. Who Typically Uses Micro Lending? Micro lending is typically used by startups and small businesses that struggle to secure traditional financing. Entrepreneurs with limited credit histories or lower credit scores often turn to these loans, as they’ve more lenient qualification standards. Significantly, women-owned businesses frequently participate in micro lending. Various sectors, including retail and agriculture, utilize these funds for startup costs, inventory, and operational expenses, making micro loans essential for nurturing entrepreneurship in underserved communities. What Is Considered a Micro Business Loan? A microbusiness loan is a small financial product designed particularly for entrepreneurs and small businesses seeking funding between $100 and $50,000. These loans are typically characterized by lower interest rates and accessible terms, making them suitable for individuals with limited credit histories. You can use these funds for startup costs, inventory, or operational expenses. Eligibility usually requires you to be a registered business or entrepreneur, demonstrating repayment ability, especially in underserved communities. Conclusion In conclusion, microbusiness loans offer vital financial support for budding entrepreneurs and small businesses, typically ranging from $100 to $50,000. With competitive interest rates and additional resources like business training, these loans can greatly improve your operational capabilities. When considering a microbusiness loan, weigh the eligibility criteria, benefits, and potential drawbacks carefully. By comprehending your options and preparing adequately, you can leverage this funding to drive growth and achieve your business goals effectively. Image via Google Gemini This article, "What Is a Microbusiness Loan and How Can It Benefit You?" was first published on Small Business Trends View the full article

-

What Is a Microbusiness Loan and How Can It Benefit You?

A microbusiness loan is a financing option designed for small-scale entrepreneurs, providing funds typically between $100 and $50,000. It caters to individuals with limited credit histories and offers competitive interest rates ranging from 8% to 13%. Beyond financial support, these loans often include resources like business training, which can improve your operational skills. Comprehending the specifics of microbusiness loans can help you determine if this funding solution aligns with your goals and needs. Key Takeaways Microbusiness loans provide funding ranging from $100 to $50,000 for small businesses and entrepreneurs needing capital. They feature competitive interest rates, generally between 8% and 13%, making them affordable options. These loans are accessible to individuals with limited credit histories, often requiring a minimum score of 620. Many microbusiness loans include additional support services, such as business training, enhancing entrepreneurial skills and capabilities. The application process is typically simpler and quicker than traditional loans, requiring less documentation and faster access to funds. Definition and Overview of Microbusiness Loans Microbusiness loans, which are designed to support small businesses and entrepreneurs, offer a practical financial solution for those in need of capital. If you wanna start a business, these loans can range from $100 to $50,000, making them suitable for various financial needs. They typically feature lower interest rates compared to traditional loans, which helps make repayment more manageable. Microbusiness loans are particularly beneficial for individuals with limited or poor credit histories, promoting entrepreneurship in underserved communities. Although repayment terms can vary, you can expect to repay the loan within six years, depending on the lender. Furthermore, many microbusiness loans come with additional support services, such as business training, enhancing your chances of success in your venture. Eligibility Criteria for Microbusiness Loans To qualify for a microbusiness loan, you need to guarantee your business is registered as a for-profit entity or, in some cases, a nonprofit child care center. Most lenders look for a credit score of at least 620, even though some may accept lower scores, which can be beneficial if you have limited credit history. Moreover, you’ll likely need to present a solid business plan and financial projections to show that you can repay the loan. Business Registration Requirements What’re the vital business registration requirements for securing a microbusiness loan? To qualify, you must be registered as a for-profit business or a nonprofit child care center, adhering to specific legal requirements. This guarantees that your operation is legitimate and compliant with local laws. Furthermore, lenders often request a detailed business plan and financial projections, demonstrating your ability to repay the loan and showcasing your business’s viability. It’s significant to highlight that some lenders may have extra criteria, such as no recent bankruptcies or tax delinquencies. Microbusiness loans particularly aim to support underserved communities, including women– and minority-owned businesses, promoting equitable access to funding. Meeting these registration requirements is fundamental for your loan eligibility. Credit Score Considerations When applying for a microbusiness loan, credit score considerations play a significant role in determining your eligibility. Most lenders usually require a minimum personal credit score of around 620, even though some may accept lower scores because of more lenient standards. Microbusiness loans are often designed to be accessible for individuals with limited credit histories or poor scores, making them ideal for startups and underserved communities. The SBA microloan program particularly supports businesses owned by women and minorities, who may face greater challenges in securing traditional financing. While you’ll need to demonstrate your ability to repay the loan, lenders commonly place less emphasis on your credit history. Always review particular eligibility criteria and documentation required by individual lenders. Benefits of Microbusiness Loans Microbusiness loans provide a range of benefits that can greatly aid small-scale entrepreneurs and startups in their path to success. These loans typically offer financing up to $50,000, making it easier for you to access the initial capital you need. With competitive interest rates between 8% and 13%, they present a cost-effective alternative to traditional bank loans. Furthermore, flexible eligibility requirements allow individuals with lower credit scores to qualify, supporting underserved communities. Beyond funding, many microbusiness loans include resources like business training and support services, enhancing your entrepreneurial skills. For instance, the average SBA microloan in fiscal year 2024 was about $16,124, which aligns well with the smaller financial needs of new and growing businesses. Sources of Microbusiness Loans Accessing microbusiness loans involves various sources customized to meet the needs of small entrepreneurs. The U.S. Small Business Administration (SBA) offers loans up to $50,000 through approved intermediaries, with interest rates between 8% and 13%. Nonprofit organizations and community development financial institutions (CDFIs) focus on providing microloans to support underserved communities. Online platforms like Kiva facilitate peer-to-peer microloans, allowing you to borrow between $1,000 and $15,000 without a minimum credit score. Furthermore, the USDA’s Farm Service Agency (FSA) provides specific microloans for small to mid-sized farms, totaling up to $100,000. Microfinance institutions likewise offer loans to low-income entrepreneurs, often including training services to promote business growth and sustainability. How to Apply for a Microbusiness Loan To apply for a microbusiness loan, you first need to determine your specific business needs, which will help guide your application process. Next, gather the necessary documentation, including a business plan, personal guarantees, and financial projections to show that you can repay the loan. With this information in hand, you’ll be better equipped to approach an SBA-approved intermediary lender for customized options. Determine Your Needs How can you effectively determine your needs when applying for a microbusiness loan? Start by completing a detailed questionnaire that assesses your business requirements. This will help you identify the right loan amount, which can be as high as $50,000. Consider your specific needs, whether it’s funding for equipment, inventory, or operational costs. Next, consult with SBA-approved intermediary lenders, often nonprofit organizations, to discuss customized options suited to your situation. They can guide you through the application process and clarify any lender-specific requirements. Remember, the average loan amount in fiscal year 2024 was about $16,124, with repayment terms extending up to seven years. Comprehending these factors will help streamline your application process. Gather Required Documentation When applying for a microbusiness loan, gathering the required documentation is essential to streamline the process and meet lender expectations. To start, complete a questionnaire to assess your business needs and eligibility. Typically, you’ll need a business plan, financial projections, personal guarantees, and collateral agreements, but this can vary by lender. Furthermore, you may have to provide evidence of positive cash flow or projections to show your ability to repay the loan. To help you, here’s a quick reference table: Documentation Type Purpose Business Plan Outlines your business strategy Financial Projections Demonstrates expected cash flow Personal Financial History Assesses creditworthiness Collateral Agreements Secures the loan with assets Microbusiness Loan Features Microbusiness loans come with several key features designed to support small businesses in their growth and development. Typically ranging from $100 to $50,000, these loans provide vital capital for startup costs, inventory, and operational expenses. They often offer lower interest rates than traditional loans, making them more accessible for entrepreneurs with limited credit history or poor credit scores. Repayment terms are usually flexible, extending up to six or seven years, which helps you manage your cash flow effectively. Although many loans require collateral and a personal guarantee for security, they may likewise come with additional resources, such as business training and support services, to empower you in enhancing your operational skills and achieving success in your venture. Pros and Cons of Microbusiness Loans During the evaluation of your financing options, comprehending the pros and cons of microbusiness loans is crucial for making an informed decision. These loans offer unique benefits, but they too come with limitations. They provide accessible funding ranging from $100 to $50,000, ideal for small businesses and startups. Competitive interest rates between 8% and 13% can lower your borrowing costs compared to other options. The application process is simpler, requiring less documentation and enabling quicker access to capital. Nevertheless, the maximum loan amount mightn’t be sufficient for larger projects, potentially restricting your business growth. Understanding these factors can help you determine if a microbusiness loan aligns with your financial needs and future goals. Alternatives to Microbusiness Loans Exploring alternatives to microbusiness loans can open up various funding avenues that might better suit your business’s specific needs. Business credit cards offer quick access to funds, though their higher annual percentage rates (APRs) can be a drawback. Traditional small business loans typically provide larger amounts, often exceeding $50,000, but they require more stringent eligibility criteria and extensive documentation. Online business loans present faster financing options with flexible qualification requirements compared to traditional banks. Peer-to-peer lending platforms, like Kiva, connect you directly with individual lenders, offering interest-free microloans during the need for social proof of creditworthiness. Finally, community development financial institutions (CDFIs) offer customized loan products and support services, particularly to underserved communities, promoting local economic growth. Considerations Before Applying for a Microbusiness Loan Before you plunge into applying for a microbusiness loan, it’s essential to take a step back and evaluate your financial needs carefully. Consider the following factors to guarantee you make an informed decision: Assess the specific loan amount you need, as microloans range from $100 to $50,000. Review the loan’s terms, including interest rates that typically range from 8% to 13%, and associated fees up to 3%. Prepare necessary documentation, like a solid business plan and financial projections, to demonstrate your repayment ability. Consider the repayment schedule, as terms can extend up to six to seven years, impacting your cash flow. Frequently Asked Questions What Are the Benefits of a Micro Loan? Microloans offer several benefits that can improve your business’s growth. They provide access to small amounts of capital, typically up to $50,000, which is perfect for covering startup costs, inventory, or operational expenses. With competitive interest rates ranging from 8% to 13%, you can secure funding at a lower cost compared to traditional loans. Moreover, many microloan programs offer business training and support, helping you develop skills essential for your success. What Is the Monthly Payment on a $50,000 Business Loan? The monthly payment on a $50,000 business loan can vary based on the interest rate and term length. For instance, at a 10% interest rate over seven years, you’d pay approximately $780 monthly. If the rate increases to 12%, your payment could rise to about $860. Don’t forget to contemplate potential fees, which can add up to 3% of the loan amount, impacting your overall borrowing costs and monthly payments. Who Typically Uses Micro Lending? Micro lending is typically used by startups and small businesses that struggle to secure traditional financing. Entrepreneurs with limited credit histories or lower credit scores often turn to these loans, as they’ve more lenient qualification standards. Significantly, women-owned businesses frequently participate in micro lending. Various sectors, including retail and agriculture, utilize these funds for startup costs, inventory, and operational expenses, making micro loans essential for nurturing entrepreneurship in underserved communities. What Is Considered a Micro Business Loan? A microbusiness loan is a small financial product designed particularly for entrepreneurs and small businesses seeking funding between $100 and $50,000. These loans are typically characterized by lower interest rates and accessible terms, making them suitable for individuals with limited credit histories. You can use these funds for startup costs, inventory, or operational expenses. Eligibility usually requires you to be a registered business or entrepreneur, demonstrating repayment ability, especially in underserved communities. Conclusion In conclusion, microbusiness loans offer vital financial support for budding entrepreneurs and small businesses, typically ranging from $100 to $50,000. With competitive interest rates and additional resources like business training, these loans can greatly improve your operational capabilities. When considering a microbusiness loan, weigh the eligibility criteria, benefits, and potential drawbacks carefully. By comprehending your options and preparing adequately, you can leverage this funding to drive growth and achieve your business goals effectively. Image via Google Gemini This article, "What Is a Microbusiness Loan and How Can It Benefit You?" was first published on Small Business Trends View the full article

-

Google expands Shopping promotion rules ahead of 2026

Google is broadening what counts as an eligible promotion in Shopping, giving merchants more flexibility heading into next year. Driving the news. Google is update its Shopping promotion policies to support additional promotion types, including subscription discounts, common promo abbreviations, and — in Brazil — payment-method-based offers. Why we care. Promotions are a key lever for visibility and conversion in Shopping results. These changes unlock more promotion formats that reflect how consumers actually buy today, especially subscriptions and cashback offers. Greater flexibility in promotion types and language reduces disapprovals and makes Shopping ads more competitive at key decision moments. For retailers relying on subscriptions or local payment incentives, this update creates new ways to drive visibility and conversion on Google Shopping. What’s changing. Google will now allow promotions tied to subscription fees, including free trials and percent- or amount-off discounts. Merchants can set these up by selecting “Subscribe and save” in Merchant Center or by using the subscribe_and_save redemption restriction in promotion feeds. Examples include a free first month on a premium subscription or a steep discount for the first few billing cycles. Google is also loosening restrictions on language. Common promotional abbreviations like BOGO, B1G1, MRP and MSRP are now supported, making it easier for retailers to mirror real-world retail messaging without risking disapproval. In Brazil only, Google will now support promotions that require a specific payment method, including cashback offers tied to digital wallets. Merchants must select “Forms of payment” in Merchant Center or use the forms_of_payment redemption restriction. Google says there are no immediate plans to expand this change to other markets. Between the lines. These updates signal Google’s intent to better align Shopping promotions with modern retail models — especially subscriptions and localized payment behaviors — while reducing friction for merchants. The bottom line. By expanding eligible promotion types, Google is giving advertisers more room to compete on value, not just price, when Shopping policies update in January 2026. View the full article

-

Pentagon invests $150mn in US gallium company to secure strategic supplies

Equity stake in Atlantic Alumina Co is part of drive to counter Chinese dominance of critical metal supply chains View the full article

-

How this psychologist teaches Olympic athletes to approach success and failure

If winning gold medals were the only standard, almost all Olympic athletes would be considered failures. A clinical psychologist with the United States Olympic and Paralympic Committee, Emily Clark’s job when the Winter Games open in Italy on Feb. 6 is to help athletes interpret what it means to be successful. Should gold medals be the only measure? Part of a 15-member staff providing psychological services, Clark nurtures athletes accustomed to triumph but who invariably risk failure. The staff deals with matters termed “mental health and mental performance.” They include topics such as motivation, anger management, anxiety, eating disorders, family issues, trauma, depression, sleep, handling pressure, travel and so forth. Clark’s area includes stress management, the importance of sleep and getting high achievers to perform at their best and avoid the temptation of looking only at results. “A lot of athletes these days are aware of the mental health component of, not just sport, but of life,” Clark said in an interview with The Associated Press. “This is an area where athletes can develop skills that can extend a career, or make it more enjoyable.” Redefining success The United States is expected to take about 235 athletes to the Winter Olympics, and about 70 more to the Paralympics. But here’s the truth. “Most of the athletes who come through Team USA will not win a gold medal,” Clark said. “That’s the reality of elite sport.” Here are the numbers. The United States won gold medals in nine events in the last Winter Games in Beijing in 2022. According to Dr. Bill Mallon, an esteemed shoulder surgeon and Olympic historian, 70.8% of Winter and Summer Olympic athletes go to only one Olympics. Few are famous and successful like swimmer Michael Phelps, or skiers Mikaela Shiffrin or Lindsey Vonn. Clark said she often delivers the following message to Olympians and Paralympians: This is a once-in-a-lifetime chance. Focus on the process. Savor the moment. “Your job is not to win a gold medal, your job is to do the thing and the gold medal is what happens when you do your job,” she said. “Some of this might be realigning what success looks like,” she added. “And some of this is developing resilience in the face of setbacks and failure.” Clark preaches staying on task under pressure and improving through defeat. “We get stronger by pushing ourselves to a limit where we’re at our maximum capacity — and then recovering,” she said. “When we get stressed, it impacts our attention. Staying on task or staying in line with what’s important is what we try to train for.” A few testimonials Kendall Gretsch has won four gold medals at the Summer and Winter Paralympics. She credits some of her success to the USOPC’s mental health services, and she described the value this way. “We have a sports psychologist who travels with us for most our season,” she said. “Just being able to touch base with them … and getting that reminder of why are you here. What is that experience you’re looking for?” American figure skater Alysa Liu is the 2025 world champion and was sixth in the 2022 Olympics. She’s a big believer in sports psychology and should be among the favorites in Italy. “I work with a sport psychologist,” she said without giving a name. “She’s incredible — like the MVP.” Of course, MVP stands — not for Most Valuable Person or Most Valuable Player — for “Most Valuable Psychologist.” “I mean, she’s very helpful,” Liu added. Vonn: “I just did it myself” American downhill skier Vonn will race in Italy in her sixth Olympics. At 41, she’s coming off nearly six years in retirement and will be racing on a knee made of titanium. Two-time Olympic champion Michaela Dorfmeister has suggested in jest that Vonn “should see a psychologist” for attempting such a thing in a very dangerous sport where downhill skiers reach speeds of 80 mph (130 kph). Vonn shrugged off the comments and joked a few months ago that she didn’t grow up using a sport psychologist. She said her counseling came from taping messages on the tips of her skis that read: “stay forward or hands up.” “I just did it myself,” she said. “I do a lot of self-talk in the starting gate.” On sleep “Sleep is an area where athletes tend to struggle for a number of reasons,” Clark said, listing issues such as travel schedules, late practices, injuries and life-related stress. “We have a lot of athletes who are parents, and lot of sleep is going to be disrupted in the early stages of parenting,” she said. “We approach sleep as a real part of performance. But it can be something that gets de-prioritized when days get busy.” Clark suggests the following for her athletes — and the rest of us: no caffeine after 3 p.m., mitigate stress before bedtime, schedule sleep at about the same time daily, sleep in a dark room and get 7-9 hours. Dani Aravich is a two-time Paralympian — she’s been in both the Summer and Winter Games — will be skiing in the upcoming Paralympics. She said in a recent interview that she avails herself of many psychological services provided by the USOPC. “I’ve started tracking my sleep,” she said, naming Clark as a counselor. “Especially being an athlete who has multiple jobs, sleep is going to be your No. 1 savior at all times. It’s the thing that — you know — helps mental clarity.” Ditto Clark. “Sleep is the cornerstone of healthy performance,” she added. Follow AP’s Be Well coverage, focusing on all aspects of wellness, at https://apnews.com/hub/be-well —Stephen Wade, Associated Press View the full article

-

The 100 Most Searched People on Google in 2026

These are the 100 most searched people, along with their monthly search volumes. In almost every industry, there are celebrities, professionals, or influencers that other people want to emulate. For example, an amateur tennis player might want to know which…Read more ›View the full article

-

Apple is finally upgrading Siri, and Google Gemini will power it

Apple is teaming up with Google to power its next generation of AI features, including a long-awaited Siri upgrade. What’s happening: Apple will use Google’s Gemini AI models and cloud infrastructure to support future Apple Foundation Models. The multi-year partnership is expected to roll out later this year. Why we care. With Gemini powering Siri, Apple’s assistant should become a true AI answer engine. That will likely change how millions of iOS users find information, ask questions, and interact with search. Driving the news. Apple said it chose Google after a “careful evaluation,” calling Gemini the “most capable foundation” for its AI ambitions. We learned in September that Apple was in talks to use a custom Gemini model to power a revamped Siri. Apple delayed its Siri AI upgrade last year, despite marketing the feature. The delay intensified scrutiny of Apple’s AI strategy. What they’re saying. Here’s a statement Google shared via X: Apple and Google have entered into a multi-year collaboration under which the next generation of Apple Foundation Models will be based on Google’s Gemini models and cloud technology. These models will help power future Apple Intelligence features, including a more personalized Siri coming this year. After careful evaluation, Apple determined that Google’s Al technology provides the most capable foundation for Apple Foundation Models and is excited about the innovative new experiences it will unlock for Apple users. Apple Intelligence will continue to run on Apple devices and Private Cloud Compute, while maintaining Apple’s industry-leading privacy standards. The bigger picture. Google briefly crossed a $4 trillion market cap last week, surpassing Apple for the first time since 2019. Google’s Gemini 3 model launched late last year as part of its broader AI push. Apple largely stayed out of the AI arms race that followed ChatGPT’s launch in late 2022 while rivals poured billions into models, chips, and cloud infrastructure. View the full article

-

HR told me to carry a non-viable pregnancy to term

A reader writes: I’m currently 12 weeks pregnant with my first baby, and my husband and I received some devastating news that the pregnancy may not be viable. We will get testing to confirm either way, but if it’s definitely not viable we would make the very difficult and heartbreaking decision to terminate this very wanted baby. We won’t find out until 17-18 weeks, which will make it physically and emotionally quite difficult and necessitate some time off. This week I reached out to the head of employee entitlements in HR and asked about leave options in the event I have to terminate a non-viable pregnancy. Pregnancy loss leave and stillbirth leave are fortunately available to me, but one is only a couple of days and the other is a couple of months so I wanted to get correct info to help me plan for the worst. The lady (let’s call her Mary) said it was hard for her to give impartial advice as I was “butting up against her values.” I asked her to clarify and she said her advice would always be to carry the pregnancy to term. I reiterated that this would be in the event of a non-viable pregnancy (although in my opinion my reasons are none of her business), and Mary said sometimes doctors don’t know what they’re talking about, and she has friends who delivered healthy babies after doctors said they weren’t viable. Mary confirmed that I would get plenty of additional leave to recover if I carried the baby to term and that if didn’t I could use my own accrued sick and vacation leave if I wanted to recover. Mary said following the pregnancy to the end would always be her recommendation. I don’t like giving HR a bad name, as I’m in HR and in my team we really care and try our best to help, but this is so unbelievably unacceptable to me that I don’t know how to proceed. I’ve told her boss (my grandboss, wonderful and on my side about this) and there is likely to be a bit of fallout there, but: 1. My team works closely with her team. How on earth can I work with her going forward as I try to navigate this difficult pregnancy? 2. What do I say if she keeps trying to convince me to carry the baby even if they’re not viable? 3. Is this a big deal or am I just upset right now? How far should I demand this be taken, noting we still have to work together? I’m stunned because I wouldn’t give that advice to my worst enemy. And I was only asking about leave entitlements, not seeking her input into this very personal matter. I’m so sorry, this is awful! The last thing you need when you’re dealing with devastating personal news like this is someone inserting their opinion without invitation and trying to influence you about something that’s (a) deeply personal and (b) unquestionably none of their business. That would be true of any colleague, but Mary’s remarks are particularly egregious because she’s in HR, where part of her job is to handle personal situations with respect, good judgment, and discretion. She’s done the opposite of that. So first, I’m very glad you told her boss — because not only was was Mary’s unsolicited advice outrageously inappropriate, but her decision to share it was squarely at odds with what should be expected of her in her role. Moreover, her declaration that she wouldn’t be able to give you impartial advice about your benefits because of her own values … is basically a declaration that she’s not willing to do an essential part of her job, and her boss is really going to need to explore exactly what that means going forward. So yes, this is a big deal, and you are right to be shocked and upset by it. As for what to say if she starts in again: it’s worth preemptively taking steps to ensure that doesn’t happen. Go back to Marty’s boss and say you appreciate her handling the situation, and you’d also like her help in ensuring Mary never raises this topic with you again — and better yet, if there’s someone else who can handle your benefits usage from here, you’d like them to be your contact so that you don’t ever need to discuss this with Mary again. That’s a reasonable request, and she would be foolish not to jump at the opportunity to set that up for you. But if Mary ever does raise it with you again, you should (a) icily and immediately shut it down with “I’m not looking for opinions about my private medical choices” and (b) report it to her boss again immediately. As for working with her going forward (on things other than your use of benefits surrounding this situation because, again, you should be offered a non-Mary path for that): you are entitled to minimize interaction with her as much as you can, and to stick solely to topics necessitated by your work. Frankly, Mary should be the one who has to worry about repairing the relationship, not you, and that’s a point her boss should make to her as well. The post HR told me to carry a non-viable pregnancy to term appeared first on Ask a Manager. View the full article

-

UK armed forces not ready for ‘full-scale’ conflict, says military chief

Richard Knighton warns MPs of budget shortfall and the need for difficult decisionsView the full article

-

Throw away these recalled dietary supplements right now. They may contain a ‘life-threatening’ ingredient

Fitness brand Modern Warrior has voluntarily recalled all lots of its dietary supplement Modern Warrior Ready after testing revealed the presence of “undeclared ingredients,” one of which could be potentially life threatening. The product was sold over a period of three years as capsule-based dietary supplements. Consumers nationwide could buy them directly online. The voluntary recall was announced on Friday, January 9, the same day that a recall notice was published on the website of the Food and Drug Administration (FDA). Here’s what you need to know. What does the recalled product look like? The recalled dietary supplement, Modern Warrior Ready, is sold in a black plastic supplement bottle with a black screw-top lid sealed with black and gold temper-evident shrink wrap. Each bottle contains 60 capsules. The bottle’s front label features the Modern Warrior (MW) logo in gold at the top. The name “Body Repair Plan” is centered on the front label, in gold lettering. Below that, the word “Ready” appears with a small sunrise icon followed by the phrase “Mental Clarity.” The recalled dietary supplement was distributed and sold online to customers nationwide from April 2022 until December 8, 2025. Some undeclared ingredients pose serious risks Some of the ingredients found during what was described as regulatory testing have a risk of causing serious side effects, including “life-threatening events.” The FDA recall notice explains the following potential health risks: Tianeptine: Tianeptine can cause “life-threatening events,” according to the FDA notice, including suicide ideation or behavior in children, adolescents, and adults aged 25 and younger. Additionally, overdose of this ingredient “carries serious and potentially life-threatening risks,” the FDA notice states, including confusion, seizure, drowsiness, dry mouth, and shortness of breath, which can be exacerbated by alcohol use. The notice further states that “Using tianeptine in combination with monoamine oxidase inhibitor (MAOl) antidepressants could lead to life-threatening complications including stroke and death.” 1,4-DMAA: 1,4-DMAA can cause stimulant effects. Using 1,4-DMAA can cause elevated blood pressure, which could lead to cardiovascular problems, like, heart attack, shortness of breath, and tightening of the chest. What should I do if I have this product? If you purchased the recalled dietary supplement, you should stop using it. The FDA recall notice states that Modern Warrior has immediately ceased distribution of the recalled product and has removed it from sale. A recall notice could not immediately be found on Modern Warrior’s website. The impacted product was listed as “sold out” as of Monday morning. Fast Company has reached out to Modern Warrior for comment and will update this post if we hear back. If you have any questions about the recall, call Modern Warrior at 314-713-1984 or email theviking@modernwarrior.life. View the full article

-

Alphabet hits $4tn valuation on AI hopes

Latest Gemini artificial intelligence model has fuelled investor optimism over competitiveness with OpenAI’s ChatGPTView the full article

-

Trump signals plans for ExxonMobil in Venezuela after White House meeting

President Donald The President said Sunday that he is “inclined” to keep ExxonMobil out of Venezuela after its top executive was skeptical about oil investment efforts in the country after the toppling of former President Nicolás Maduro. “I didn’t like Exxon’s response,” The President said to reporters on Air Force One as he departed West Palm Beach, Florida. “They’re playing too cute.” During a meeting Friday with oil executives, The President tried to assuage the concerns of the companies and said they would be dealing directly with the U.S., rather than the Venezuelan government. Some, however, weren’t convinced. “If we look at the commercial constructs and frameworks in place today in Venezuela, today it’s uninvestable,” said Darren Woods, CEO of ExxonMobil, the largest U.S. oil company. An ExxonMobil spokesperson did not immediately respond Sunday to a request for comment. Also on Friday, The President signed an executive order that seeks to ensure that Venezuelan oil revenue remains protected from being used in judicial proceedings. The executive order, made public on Saturday, says that if the funds were to be seized for such use, it could “undermine critical U.S. efforts to ensure economic and political stability in Venezuela.” Venezuela has a history of state asset seizures, ongoing U.S. sanctions and decades of political uncertainty. Getting U.S. oil companies to invest in Venezuela and help rebuild the country’s infrastructure is a top priority of the The President administration after Maduro’s capture. The White House is framing the effort to “run” Venezuela in economic terms, and The President has seized tankers carrying Venezuelan oil, has said the U.S. is taking over the sales of 30 million to 50 million barrels of previously sanctioned Venezuelan crude, and plans to control sales worldwide indefinitely. Kim reported from West Palm Beach, Florida. —Seung Min Kim and Julia Nikhinson, Associated Press View the full article

-

What Is Small Business Accounting Software Consulting?

Small business accounting software consulting helps you assess your unique financial needs and identify software solutions that can streamline your bookkeeping processes. This service evaluates your current operations and recommends customized software options to improve efficiency and compliance. Furthermore, it provides necessary training and ongoing support to guarantee you can effectively use these tools. Comprehending these elements is vital, as they can greatly impact your financial management and overall business performance. So, what should you consider when selecting the right software? Key Takeaways Small business accounting software consulting analyzes unique financial needs to recommend tailored software solutions for efficient bookkeeping. It focuses on automation, compliance, and operational efficiency to streamline financial processes and reduce errors. Consultants provide training and ongoing support to ensure effective software utilization and maximize productivity. Customized reporting features help businesses monitor cash flow and profitability, adapting to specific requirements. The consulting service enhances financial management and decision-making through real-time data access and integration with existing tools. Understanding Small Business Accounting Software Consulting When you’re traversing the intricacies of managing a small business, comprehending small business accounting software consulting can greatly streamline your financial processes. An accounting software consultant analyzes your specific needs, like invoicing and expense tracking, to recommend the best software solutions. By focusing on customized options, they help simplify bookkeeping for consultants, ensuring compliance and enhancing efficiency. Popular tools like QuickBooks and Xero offer features that support project tracking and multi-user access, making financial oversight easier. Effective consulting leads to significant time and cost savings, allowing you to concentrate on core operations instead of getting lost in financial details. Furthermore, these services often include training and ongoing support, maximizing the benefits of your chosen accounting software for your business operations. Key Features to Consider in Accounting Software When choosing accounting software, it’s vital to focus on fundamental features that can greatly improve your business operations. Look for automated invoicing to streamline payment processes and a user-friendly interface for easy navigation, both of which can save you time and reduce errors. Furthermore, consider how well the software integrates with other tools you already use, as this can enhance your overall workflow and efficiency. Essential Accounting Features Selecting the right accounting software for your small business is crucial, as it can greatly impact your financial management and overall efficiency. Key features to contemplate include automated invoicing, which speeds up payment processing, exemplified by FreshBooks and Bonsai. Real-time financial reporting lets you effectively monitor cash flow and profitability, as seen in Xero and QuickBooks. If you’re in consulting, time tracking tools help you allocate billable hours accurately, with FreshBooks excelling in this aspect. Furthermore, integrating with third-party applications improves functionality, streamlining workflows—FreshBooks integrates with over 100 apps. Finally, a user-friendly interface and customizable reports, found in Less Accounting and Wave, guarantee the software adapts to your specific business needs, making it easier to manage your finances. User-Friendly Interface Design A well-designed user interface in accounting software is important for improving your experience, as it allows small business owners like you to navigate features effortlessly without needing extensive training. Key design elements include intuitive dashboards that provide quick access to critical financial information, promoting efficient decision-making. Features such as drag-and-drop functionality and customizable layouts streamline tasks, making data entry less time-consuming. Clear labeling throughout the interface helps you understand functions even though you’re unfamiliar with accounting terminology. Moreover, a visually appealing design with organized menus improves usability. Mobile compatibility is necessary, enabling you to manage your accounting tasks from smartphones or tablets, which boosts productivity, especially when you’re on the go. The Importance of Tailored Solutions for Small Businesses In relation to managing your small business finances, personalized accounting solutions can greatly improve your operations. These customized tools address your unique business needs, allowing you to track project profitability and manage expenses more effectively. Unique Business Needs Comprehending that small businesses have distinct accounting needs is crucial for effective financial management. Unlike larger enterprises, your operations require solutions customized to your unique circumstances. Here are some critical features to take into account: Project profitability tracking to guarantee you understand which ventures are financially viable. Automated invoicing to save time and reduce errors in billing. Real-time cash flow monitoring for keeping tabs on your financial health. Customizable reporting tools that help you analyze expenses and performance effectively. Selecting the right accounting software isn’t just about features; it must likewise align with your daily tools and future growth plans, guaranteeing a seamless workflow that supports your business objectives. Streamlined Financial Management Streamlined financial management is crucial for small businesses aiming to optimize their operations and improve profitability. By utilizing customized accounting software, you can automate invoicing, payment processing, and expense tracking, which saves valuable time. Bespoke solutions cater to your specific needs, allowing for precise project profitability tracking and real-time cash flow management. Platforms like FreshBooks and QuickBooks offer user-friendly interfaces, making financial tasks less intimidating. Moreover, integration with other business tools improves data transfer and collaboration, leading to informed decision-making. In the end, effective accounting software not only reduces costs but also provides insights that guide your growth strategies. Feature Benefit Example Automation Saves time Automated invoicing Customization Meets specific needs Customized reporting User-friendly Reduces complexity Simple navigation Integration Improves efficiency Sync with CRM tools Cost savings Optimizes operations Reduced manual labor Evaluating Different Accounting Software Options As you navigate the terrain of accounting software options, it’s crucial to evaluate each platform based on key features that align with your business needs. Consider the following aspects: Tailored solutions: Platforms like FreshBooks and QuickBooks cater to various business sizes, focusing on project profitability and expense tracking. Cloud access: Software such as Xero and Wave Accounting enables you to manage finances from anywhere, enhancing flexibility. Pricing structures: Options vary widely; Wave offers free basic features, whereas Xero starts at $19/month for advanced capabilities. Integration capabilities: FreshBooks and QuickBooks allow seamless connections with third-party applications, streamlining your workflows. Implementing Accounting Software for Maximum Efficiency Implementing accounting software effectively can transform your financial processes and lead to significant efficiency gains for your business. By automating tasks like invoicing, payment tracking, and expense management, you’ll cut down on manual entry time. Options like FreshBooks and QuickBooks allow seamless integration with third-party applications, improving overall operational efficiency. Utilizing cloud-based solutions provides real-time access to your financial data, boosting decision-making and collaboration within your team. Furthermore, software such as Xero and Wave Accounting simplifies tax preparation, ensuring accurate reporting and reducing stress during tax season. Choosing the right software customized to your specific needs can likewise improve project profitability tracking and provide valuable insights into cash flow management, eventually enhancing your financial health. Navigating Software Compatibility and Integration Achieving maximum efficiency with accounting software often requires a sharp comprehension of software compatibility and integration. To streamline your workflows and improve data accessibility, you’ll want to integrate your accounting software with other business tools. Consider the following key aspects: APIs for Custom Integrations: Many solutions, like FreshBooks and Xero, offer APIs for customized setups. Reduced Manual Data Entry: Tools like Wave Accounting allow automatic imports from bank accounts and payment processors. Third-Party Integration Assessment: Evaluate available integrations to guarantee alignment with your existing technology stack. Real-Time Data Synchronization: Effective integration enables accurate financial reporting and decision-making. Best Practices for Ongoing Accounting Software Management To effectively manage your accounting software over time, it’s crucial to adopt a set of best practices that guarantee efficiency and accuracy. Regularly update your software to access the latest features and security improvements, which help safeguard data integrity. Conduct monthly reconciliations of accounts to catch discrepancies early, allowing you to maintain accurate financial records. Utilize reporting features to generate insights on cash flow and profitability, enabling informed decision-making. Implement a consistent schedule for backing up financial data using cloud-based solutions to protect against data loss. Finally, train your team on the software’s functionalities to maximize its potential, improve efficiency, and make sure everyone is aligned on financial management practices. Empowering Businesses Through Financial Insights Comprehending your financial data is essential for making informed business decisions, especially in today’s dynamic market. Small business accounting software consulting empowers you by providing customized insights that improve your financial management. With effective solutions, you can: Track project profitability seamlessly, ensuring you know where your money goes. Automate invoicing and expense tracking, saving time on tedious administrative tasks. Collaborate in real-time, allowing your team to access and share financial information effortlessly. Stay compliant with tax regulations, simplifying report preparation and reducing stress during tax season. Frequently Asked Questions What Is Small Business Consulting? Small business consulting involves providing customized advice to help you improve your operations and achieve growth. Consultants assess your business, identify challenges, and develop strategic plans to elevate performance. They may focus on areas like marketing, finance, or operations, ensuring their solutions meet your specific needs. Who Are the Big 4 Accounting Consultants? The Big 4 accounting consultants are Deloitte, PwC, EY, and KPMG. Deloitte leads with over $50 billion in annual revenue, primarily from audit and consulting services. PwC follows closely, generating more than $45 billion, focusing on audit and tax. EY ranks third with about $40 billion, emphasizing advisory services. KPMG, though the smallest, still earns around $30 billion, offering audit and tax services with a strong focus on technology solutions. How Much Does Accounting Software Cost for a Small Business? Accounting software for small businesses can range in cost considerably. Basic plans, like Outright, start around $10/month, whereas more extensive options, such as Xero and FreshBooks, begin at $19 and $20/month, respectively. Wave Accounting offers free services, but charges for payroll features. Many providers offer free trials, letting you test their features before committing. Be aware that additional costs may arise for features like payroll processing or multiple users, impacting your overall expenses. What Are the Three Types of Accounting Software? There are three main types of accounting software: cloud-based, on-premise, and hybrid. Cloud-based software lets you access financial data from anywhere, which is great for remote work. On-premise software is installed on your local machines, giving you more control over data security but requiring higher upfront costs and maintenance. Hybrid solutions combine both, offering flexibility while keeping sensitive data secure on-site. Each type includes features like invoicing, expense tracking, and financial reporting. Conclusion In conclusion, small business accounting software consulting plays an essential role in enhancing your financial management. By evaluating your unique needs, consultants help you choose the right software and provide necessary training. This customized approach not just streamlines operations but also guarantees compliance and improves efficiency. Regularly reviewing and managing your accounting software can lead to better financial insights, empowering you to make informed decisions that drive your business forward. Investing in this consulting service eventually optimizes your overall performance. Image via Google Gemini This article, "What Is Small Business Accounting Software Consulting?" was first published on Small Business Trends View the full article

-

What Is Small Business Accounting Software Consulting?