Everything posted by ResidentialBusiness

-

Accountants Keep Upgrading Clients

Hours will become obsolete. By Carl George The Rosenberg Survey Go PRO for members-only access to more Carl George. View the full article

-

Accountants Keep Upgrading Clients

Hours will become obsolete. By Carl George The Rosenberg Survey Go PRO for members-only access to more Carl George. View the full article

-

Your AI use policy is solving the wrong problem

When a company with tens of thousands of software engineers found that uptake of a new AI-powered tool was lagging well below 50%, they wanted to know why. It turned out that the problem wasn’t the technology itself. What was holding the company back was a mindset that saw AI use as akin to cheating. Those who used the tool were perceived as less skilled than their colleagues, even when their work output was identical. Not surprisingly, most of the engineers chose not to risk their reputations and carried on working in the traditional way. These kinds of self-defeating attitudes aren’t limited to one company—they are endemic across the business world. Organizations are being held back because they are importing negative ideas about AI from contexts where they make sense into corporate settings where they don’t. The result is a toxic combination of stigma, unhelpful policies, and a fundamental misunderstanding of what actually matters in business. The path forward involves setting aside these confusions and embracing a simpler principle: Artificial intelligence should be treated like any other powerful business tool. This article shares what I have learned over the past six months while revising the AI use policies for my own companies, drawing on the research and insights of my internal working group (Paul Scade, Pranay Sanklecha, and Rian Hoque). Confusing Contexts In educational contexts, it is entirely appropriate to be suspicious about generative AI. School and college assessments exist for a specific purpose: to demonstrate that students have acquired the skills and the knowledge they are studying. Feeding a prompt into ChatGPT and then handing in the essay it generates undermines the reason for writing the essay in the first place. When it comes to artistic outputs, like works of fiction or paintings, there are legitimate philosophical debates about whether AI-generated work can ever possess creative authenticity and artistic value. And there are tough questions about where the line might lie when it comes to using AI tools for assistance. But issues like these are almost entirely irrelevant to business operations. In business, success is measured by results and results alone. Does your marketing copy persuade customers to buy? Yes or no? Does your report clarify complex issues for stakeholders? Does your presentation convince the board to approve your proposal? The only metrics that matter in these cases are accuracy, coherence, and effectiveness—not the content’s origin story. When we import the principles that govern legitimate AI use in other areas into our discussion of its use in business, we undermine our ability to take full advantage of this powerful technology. The Disclosure Distraction Public discussions about AI often focus on the dangers that follow from allowing generative AI outputs into public spaces. From the dead internet theory to arguments about whether it should be a legal requirement to label AI outputs on social media, policymakers and commentators are rightly concerned about malicious AI use infiltrating and undermining the public discourse. Concerns like these have made rules about disclosure of AI use central to many corporate AI use policies. But there’s a problem here. While these discussions and concerns are perfectly legitimate when it comes to AI agents shaping debates around social and political issues, importing these suspicions into business contexts can be damaging. Studies consistently show that disclosed AI use triggers negative bias within companies, even when that use is explicitly encouraged and when the output quality is identical to human-created content. The study mentioned at the start of this article found that internal reviewers assessed the same work output to be less competent when they were told that AI had been used in its production than when they were told it had not been, even when the AI tools in question were known to increase productivity and when their use was encouraged by the employer. Similarly, a meta-analysis of 13 experiments published this year identified a consistent loss of trust in those who disclose their AI use. Even respondents who felt positively about AI use themselves tended to feel higher distrust toward colleagues who used it. This kind of irrational prejudice creates a chilling effect on the innovative use of AI within businesses. Disclosure mandates for the use of AI tools reflect organizational immaturity and fear-based policymaking. They treat AI as a kind of contagion and create stigma around a tool that should be as uncontroversial as using spell-check or design templates—or having the communications team prepare a statement for the CEO to sign off on. Companies that focus on disclosure are missing the forest for the trees. They have become so worried about the process that they’re ignoring what actually matters: the quality of the output. The Ownership Imperative The solution to both context confusion and the distracting push for disclosure is simple: Treat AI like a perfectly normal—albeit powerful—technological tool, and insist that the humans who use it take full ownership of whatever they produce. This shift in mindset cuts through the confused thinking that plagues current AI policies. When you stop treating AI as something exotic that requires special labels and start treating it as you would any other business tool, the path forward becomes clear. You wouldn’t disclose that you used Excel to create a budget or used PowerPoint to design a presentation. What matters isn’t the tool—it is whether you stand behind the work. But here’s the crucial part: Treating artificial intelligence as normal technology doesn’t mean you can play fast and loose with it. Quite the opposite. Once we put aside concepts that are irrelevant in a business context, like creative authenticity and “cheating,” we are left with something more fundamental: accountability. When AI is just another tool in your tool kit, you own the output completely, whether you like it or not. Every mistake, every inadequacy, every breach of the rules belongs to the human who sends the content out into the world. If the AI plagiarizes and you use that text, you’ve plagiarized. If the AI gets facts wrong and you share them, they’re your factual errors. If the AI produces generic, weak, unconvincing language and you choose to use it, you’ve communicated poorly. No client, regulator, or stakeholder will accept “the AI did it” as an excuse. This reality demands rigorous verification, editing, and fact-checking as nonnegotiable components of the AI-use workflow. A large consulting company recently learned this lesson when it submitted an error-ridden AI-generated report to the Australian government. The mistakes slipped through because humans in the chain of responsibility treated AI output as finished work rather than as raw material requiring human oversight and ownership. The firm couldn’t shift blame to the tool—they owned the embarrassment, the reputational damage, and the client relationship fallout entirely. Taking ownership isn’t just about accepting responsibility for errors. It is also about recognizing that once you have reviewed, edited, and approved AI-assisted work, it ceases to be “AI output” and becomes your human output, produced with AI assistance. This is the mature approach that moves us past disclosure theater and toward genuine accountability. Making the Shift: Owning AI Use Here are four steps your business can take to move from confusion about contexts to the clarity of an ownership mindset. 1. Replace disclosure requirements with ownership confirmation. Stop asking “Did you use AI?” and start requiring clear accountability statements: “I take full responsibility for this content and verify its accuracy.” Every piece of work should have a human who explicitly stands behind it, regardless of how it was created. 2. Establish output-focused quality standards. Define success criteria that ignore creation method entirely: Is it accurate? Is it effective? Does it achieve its business objective? Create verification workflows and fact-checking protocols that apply equally to all content. When something fails these standards, the conversation should be about improving the output, not about which tools were used. 3. Normalize AI use through success stories, not policies. Share internal case studies of teams using AI to deliver exceptional results. Celebrate the business outcomes—faster delivery, higher quality, breakthrough insights—without dwelling on the methodology. Make AI proficiency a valued skill on par with Excel expertise or presentation design, not something requiring special permission or disclosure. 4. Train for ownership, not just usage. Develop training that goes beyond prompting techniques to focus on verification, fact-checking, and quality assessment. Teach employees to treat AI output as raw material that requires their expertise to shape and validate, not as finished work. Include modules on identifying AI hallucinations, verifying claims, and maintaining brand voice. The companies that will thrive in the next year won’t be those that unconsciously disincentivize the use of AI through the stigma of disclosure policies. They will be those that see AI for what it is: a powerful tool for achieving business results. While your competitors tie themselves in knots over process documentation and disclosure theater, you can leapfrog past them with a simple principle: Own your output, regardless of how you created it. The question that will separate winners from losers isn’t “Did you use AI?” but “Is this excellent?” If you’re still asking the first question, you are already falling behind. View the full article

-

Beware Potential LOI Issues

Eight ways to derail a merger. By Marc Rosenberg CPA Firm Mergers: Your Complete Guide Go PRO for members-only access to more Marc Rosenberg. View the full article

-

Beware Potential LOI Issues

Eight ways to derail a merger. By Marc Rosenberg CPA Firm Mergers: Your Complete Guide Go PRO for members-only access to more Marc Rosenberg. View the full article

-

Peloton Equipment Is Up to $1,500 Off for Black Friday

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. Black Friday sales officially start Friday, November 28, and run through Cyber Monday, December 1, and Lifehacker is sharing the best sales based on product reviews, comparisons, and price-tracking tools before it's over. Follow our live blog to stay up-to-date on the best sales we find. Browse our editors’ picks for a curated list of our favorite sales on laptops, fitness tech, appliances, and more. Subscribe to our shopping newsletter, Add to Cart, for the best sales sent to your inbox. Sales are accurate at the time of publication, but prices and inventory are always subject to change. With Black Friday, Cyber Monday, and various other pre-holiday sales approaching, it's a good time to shop for anything—but with the new year on the way, it's an especially good time to shop for fitness equipment. Is 2026 the year you'll crush your health and wellness goals? There is only one way to find out, and you can start off on the right foot by checking out Peloton's Black Friday sale, which can save you up to $1,500 on fitness equipment from the brand, including the upgraded Cross Training series of Bikes, Treads, and Rows. Peloton's best Black Friday dealsWhat's included in Peloton's big sale? Here are your best bets: The Cross Training Bike+ is $1,995 instead of $2,695, while a Starter Package that includes the Cross Training Bike+, a water bottle, cleats, a mat, and hand weights will run you $2,150 instead of $2,900 (or $2,390 instead of $3,100 if you want a foam roller and three more sets of weights). A refurbished original Bike+ is $1,595 instead of $1,995. The Cross Training Tread+ is $5,295 instead of $6,695 (or $5,485 instead of $6,935 or $5,605 instead of $7,105, depending on the Starter Package you want). The Cross Training Row+ is $3,295 instead of $3,495 (or $3,475 instead of $3,725 or $3,670 instead of $3,970 if you're getting a Starter Package). The Cross Training Bike is $1,395 instead of $1,695 (or $1,550 instead of $1,900 or $1,790 instead of $2,190 if you want the bundle). A refurbished original Bike is just $695 instead of $1,145, which competes directly with the price you'd get if you bought a Bike on Peloton's resale marketplace, except this one has been factory refurbished, and those haven't. A Cross Training Tread is $2,795 instead of $3,295 (or $2,985 instead of $3,535 or $3,105 instead of $3,705, depending on your bundle preference). Each of the above also comes with a free month of All Access Membership, an additional $50 value. Moreover, accessories like cycling cleats, dumbbells, and mats are also marked down, some as low as 50% off. Finally, these deals are also reflected on the brand's Amazon storefront, so if you prefer to buy that way, go for it. What to know about Peloton's different models before you buyIn October, Peloton overhauled its fleet, which is why you see "Cross Training" and "+" up in that list. If you're not sure what those words mean or how the new devices compare to the older versions (which, in the case of the Bike+ and Bike, are also on sale for Black Friday), I wrote a whole guide for you here. Peloton Cross Training Series Bike+ $2,695.00 at Peloton Get Deal Get Deal $2,695.00 at Peloton Basically, the new Cross Training series features comfort adjustments, like a better Bike seat, attached phone holders, and swiveling touchscreens so you can move more seamlessly from, say, a treadmill run to a floor stretch or lift. The + series includes all that as well as an AI component, which powers a movement-tracking camera designed to help you with your workouts. I've played around with the new tech and do enjoy it, but I admit it's usually pretty pricey. These deals are a solid entry point if you've been wanting to upgrade or even just buy your first Peloton device. For what it's worth, even without a Cross Training or + series Bike, I am a daily user and couldn't imaging a morning without the Peloton app. How long do Black Friday deals really last?Black Friday sales officially begin Friday, November 28, 2025, and run throughout “Cyber Week,” the five-day period that runs from Thanksgiving through Cyber Monday, December 1, 2025. But Black Friday and Cyber Monday dates have expanded as retailers compete for customers. You can get the same Black Friday sales early, and we expect sales to wind down by December 3, 2025. Does Apple do Black Friday?Yes, Apple participates in Black Friday, though you may want to compare their sales with other retailers like Best Buy and Walmart. Apple is offering an exclusive $250 gift card for eligible purchases, but so far, the best Black Friday sale on an Apple product is the M4 MacBook on sale for cheaper than ever. Does Amazon have Black Friday deals?Yes, Amazon has Black Friday sales, but prices aren’t always what they seem. Use a price tracker to make sure you’re getting the best deal, or refer to guides like our live blog that use price trackers for you. And if you have an Amazon Prime membership, make the most of it. Apple AirPods Pro 3 Noise Cancelling Heart Rate Wireless Earbuds — $219.99 (List Price $249.00) Apple iPad 11" 128GB A16 WiFi Tablet (Blue, 2025) — $274.00 (List Price $349.00) Amazon Fire HD 10 (2023) — $69.99 (List Price $139.99) Sony WH-1000XM5 — $248.00 (List Price $399.99) Blink Outdoor 4 1080p Wireless Security Camera (5-Pack) — $159.99 (List Price $399.99) Amazon Fire TV Stick 4K Plus — $24.99 (List Price $49.99) NEW Bose Quiet Comfort Ultra Wireless Noise Cancelling Headphones — $298.00 (List Price $429.00) Shark AI Ultra Matrix Clean Mapping Voice Control Robot Vacuum with XL Self-Empty Base — $249.99 (List Price $599.00) Apple Watch Series 11 (GPS, 42mm, S/M Black Sport Band) — $339.00 (List Price $399.00) WD 6TB My Passport USB 3.0 Portable External Hard Drive — $134.99 (List Price $179.99) Deals are selected by our commerce team View the full article

-

My Favorite Amazon Deal of the Day: These Sony Over-Ear Headphones

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. Black Friday sales officially start Friday, November 28, and run through Cyber Monday, December 1, and Lifehacker is sharing the best sales based on product reviews, comparisons, and price-tracking tools before it's over. Follow our live blog to stay up-to-date on the best sales we find. Browse our editors’ picks for a curated list of our favorite sales on laptops, fitness tech, appliances, and more. Subscribe to our shopping newsletter, Add to Cart, for the best sales sent to your inbox. Sales are accurate at the time of publication, but prices and inventory are always subject to change. Sony's 1000X series has been around since 2016, improving on the previous iteration to eventually land on the Sony WH-1000XM6 in 2025, which are the best over-ear headphones I tested in 2025 (and ever, really). You can get the WH-1000XM6 headphones for $398 (originally $459.99), their lowest price they've ever been during the Black Friday sale, according to price-tracking tools. Sony WH-1000XM6 Headphones $398.00 at Amazon $459.99 Save $61.99 Get Deal Get Deal $398.00 at Amazon $459.99 Save $61.99 The XM6 headphones improve on what were already excellent headphones (the XM5s are also at their lowest price right now). Sony upped the count of microphones from eight to 12 when compared to the XM5, which improves more than just how well you sound to someone on a phone call. The microphones are used in almost all of its features, like ANC, Adaptive Sound Control, and the headphones' Ambient Sound mode. They hear your surroundings to adapt their features accordingly. If you switch from a noisy room to a quiet one, the XM6 can switch from ANC to aware mode (if you have Adaptive Sound Control on). These headphones have a lot more features that you can nerd out on in their companion app. The audio quality is second to none, with the fully customizable EQ giving you plenty of options to get the sound how you like it. I really like being able to see what codec you're listening to in the app's main menu. That way, there's no guessing if you're getting the best audio quality or not. They will give you 30 hours of battery life with ANC on and 40 hours of juice with ANC off. There's an AUX (3.5mm) jack for wired listening, which is a nice touch for audiophiles who still rock iPod Classics (or is that just me?). The XM6s are not just the best headphones of 2025, but are likely to be the best ones for years to come. For $398, you'll be securing the best for a record low price we likely won't see again for a while. What stores have the best sales on Black Friday?Nowadays, both large retailers and small businesses compete for Black Friday shoppers, so you can expect practically every store to run sales through Monday, December 1, 2025. The “best” sales depend on your needs, but in general, the biggest discounts tend to come from larger retailers who can afford lower prices: think places like Amazon, Walmart, Target, Best Buy, and Home Depot. You can find all the best sales from major retailers on our live blog. Are Black Friday deals worth it?In short, yes, Black Friday still offers discounts that can be rare throughout the rest of the year. If there’s something you want to buy, or you’re shopping for gifts, it’s a good time to look for discounts on what you need, especially tech sales, home improvement supplies, and fitness tech. Of course, if you need to save money, the best way to save is to not buy anything. Are Cyber Monday deals better than Black Friday?Black Friday used to be bigger for major retailers and more expensive tech and appliances, while Cyber Monday was for cheaper tech and gave smaller businesses a chance to compete online. Nowadays, though, distinction is almost meaningless. Every major retailer will offer sales on both days, and the smart move is to know what you want, use price trackers or refer to guides like our live blog that use price trackers for you, and don’t stress over finding the perfect timing. Our Best Editor-Vetted Early Black Friday Deals Right Now Apple AirPods Pro 3 Noise Cancelling Heart Rate Wireless Earbuds — $219.99 (List Price $249.00) Apple iPad 11" 128GB A16 WiFi Tablet (Blue, 2025) — $274.00 (List Price $349.00) Amazon Fire HD 10 (2023) — $69.99 (List Price $139.99) Sony WH-1000XM5 — $248.00 (List Price $399.99) Blink Outdoor 4 1080p Wireless Security Camera (5-Pack) — $159.99 (List Price $399.99) Amazon Fire TV Stick 4K Plus — $24.99 (List Price $49.99) NEW Bose Quiet Comfort Ultra Wireless Noise Cancelling Headphones — $298.00 (List Price $429.00) Shark AI Ultra Matrix Clean Mapping Voice Control Robot Vacuum with XL Self-Empty Base — $249.99 (List Price $599.00) Apple Watch Series 11 (GPS, 42mm, S/M Black Sport Band) — $339.00 (List Price $399.00) WD 6TB My Passport USB 3.0 Portable External Hard Drive — $134.99 (List Price $179.99) Deals are selected by our commerce team View the full article

-

The fracturing of the world economy

Will the US or China abandon their current follies sooner?View the full article

-

English cities to be allowed to impose tourism taxes

Local mayors will gain powers to bring in levies on both hotels and Airbnb-style holiday rentalsView the full article

-

7 Best Places for Discount Craft Supplies

When you’re looking for discount craft supplies, knowing where to shop can save you money and broaden your options. Local craft shops often have clearance sections filled with unique materials. Online marketplaces provide bulk purchasing opportunities at reduced prices. Furthermore, community events and craft swaps offer sustainable ways to gather supplies. Exploring thrift stores can likewise yield diverse, low-cost items. Each of these options presents distinct benefits for your crafting needs. What other strategies can improve your supply shopping experience? Key Takeaways Local craft shops often have clearance sections with significant discounts on supplies, making them ideal for budget-conscious crafters. Online marketplaces like Etsy offer bulk purchasing options, resulting in substantial savings on craft materials. Major retailers such as Joann, Michaels, and Hobby Lobby frequently run seasonal sales and promotions, providing discounts ranging from 20% to 70%. Community events and craft swaps allow crafters to exchange surplus materials, promoting sustainability while saving money on supplies. Thrift stores offer a diverse selection of affordable craft supplies, including fabric, yarn, and tools, often at lower prices than retail outlets. Local Craft Shops With Clearance Sections Local craft shops often present excellent opportunities for budget-conscious crafters by featuring clearance sections filled with discounted supplies. For instance, you can find Chunky Glitter Fabric Sheets priced between $1.19 and $1.67, which were originally $1.49 to $2.79. Stiffened Felt Sheets are another budget-friendly option at just $0.59, down from $0.99. If you’re into slime projects, look for items like Fluffuccino Slime available for $3.59, considerably lower than the original $5.99. Furthermore, seasonal discounts on items such as Glitter and Mosaic Gems provide excellent value. These local shops regularly host sales on discount craft supplies, encouraging you to explore unique offerings and clearance items that can improve any crafting project, including wholesale floral crafts. Online Marketplaces for Bulk Purchasing When you’re looking to save on craft supplies, online marketplaces offer excellent bulk purchasing options that can lead to significant discounts. Many platforms feature various sellers who provide bulk discounts, making it easier for you to stock up on materials at a lower cost per item. Moreover, consider the shipping and delivery options available, as these can affect your overall savings and project timelines. Bulk Discounts Availability Online marketplaces have become crucial for crafters seeking bulk discounts on craft supplies, offering significant savings for various materials. You can find excellent deals on fundamental items, making it easier to stock up for your projects. Here are four key benefits of shopping for bulk discounts online: Wholesale Prices: Websites like Etsy and specialized craft stores often have sections for bulk items, allowing you to buy at lower rates. Larger Order Discounts: Many retailers provide discounts for larger purchases, which is perfect for schools or groups. Promotions: Popular craft supply sites frequently run sales events that augment your savings. Newsletters: Subscribing to newsletters alerts you to exclusive bulk discounts and flash sales customized for crafters. Shipping and Delivery Options Shipping and delivery options play a crucial role in the overall experience of purchasing craft supplies online, especially when you’re buying in bulk. Many online marketplaces, like Etsy and specialized craft supply stores, offer bulk purchasing opportunities that can save you money through volume discounts and special promotions. You’ll often find shipping deals, such as free shipping on orders over a certain amount, making bulk purchases even more economical. Moreover, retailers frequently run sales events, including seasonal discounts and clearance sales, where buying in larger quantities can lead to significant savings. Consider subscription boxes dedicated to craft supplies, too; they provide regular deliveries of discounted materials, ensuring you have necessities during the process of discovering new products to improve your crafting projects. Community Events and Swap Meets Attending local craft swap events can be a great way for you to exchange materials and tools as well as meeting fellow crafters in your community. These gatherings often include seasonal craft fairs and workshops that provide exclusive discounts on supplies, making them perfect for budget-conscious creators. Local Craft Swap Events Local craft swap events offer a unique opportunity for crafters to exchange surplus supplies as they nurture a sense of community and sustainability. Organized by local community centers, libraries, or art groups, these events are easily accessible. You can bring your unused or excess craft materials to swap for items you need, leading to a diverse selection of supplies at little to no cost. Here are four benefits of attending these events: Diverse Materials: Access a variety of craft supplies that you mightn’t find elsewhere. Networking: Connect with fellow crafters, share ideas, and inspire each other. Workshops: Participate in workshops to learn new skills during the swapping. Community Building: Encourage local connections and support sustainable practices in crafting. Community Engagement Opportunities Engaging with your community through craft-related events can greatly improve your creative experience as well as providing numerous benefits. Participating in workshops and local swap meets allows you to connect with fellow crafters, exchange ideas, and obtain new materials. For instance, the upcoming Little Craft Fest on March 8, 2025, will showcase local artists and offer opportunities for hands-on learning. Furthermore, the Creative Reuse Center encourages donations of clean, reusable materials for workshops, promoting sustainability. Here’s a summary of community engagement opportunities: Event Type Benefits Example Workshops Skill development and networking Local craft stores Swap Meets Material exchange and sustainability Neighborhood events Community Fest Showcasing local art and connection Little Craft Fest Seasonal Craft Fairs Seasonal craft fairs provide an excellent opportunity to discover unique craft supplies at discounted prices, especially when local artisans and vendors come together to showcase their work. These events not only allow you to purchase materials but also facilitate trading unused supplies, promoting creativity and sustainability. By participating, you can as well benefit from exclusive sales and promotions from local suppliers. Furthermore, many fairs offer workshops and demonstrations, helping you learn new techniques. Here are four reasons to attend seasonal craft fairs: Find unique supplies from local artisans. Trade unused materials at swap meets. Learn new skills through workshops and demos. Access exclusive sales from local vendors. These factors make seasonal craft fairs a valuable resource for crafters. Specialty Stores for Unique Supplies When you’re on the hunt for unique craft supplies, specialty stores can offer a treasure trove of items that you won’t find in typical retail outlets. For instance, the Creative Reuse Center provides clean, reusable materials that help divert waste from landfills during supporting local artists. You can find discounted items like Chunky Glitter Fabric Sheets priced between $1.19 and $1.67, perfect for budget-friendly projects. Moreover, Little Craft Place features a diverse selection of affordable craft supplies, including paints, kits, and books for all ages. If you’re an enthusiast, consider specialty tools like the TWSBI ECO Espresso Fountain Pen, which offers a piston filler mechanism for easy ink filling, blending quality with reasonable pricing. Seasonal Sales and Promotions As you explore options for craft supplies, taking advantage of seasonal sales and promotions can lead to significant savings. Many stores offer discounts during holiday seasons, making it an ideal time to stock up on your favorite materials. For example, you can find: Chunky Glitter Fabric Sheets priced between $1.19 and $1.67, down from $1.49 to $2.79. Slime products like Fluffuccino Slime and Extreme Strength Accelerator on sale for $3.59, reduced from $5.99. A variety of glitter and mosaic gems with lowered prices. Unique materials at the Creative Reuse Center, promoting sustainability and savings during special events. Discount Craft Supply Websites Finding discount craft supply websites can greatly improve your crafting experience without straining your budget. Many of these sites, like Joann, Michaels, and Hobby Lobby, offer a vast selection of products, including paper, fabric, and embellishments, often at lower prices than retail stores. They frequently provide online coupons and promotional discounts, maximizing your savings. Furthermore, some sites focus on clearance items and overstock supplies, giving you access to quality materials at reduced prices. Subscribing to newsletters can grant early access to exclusive discounts and seasonal sales. User reviews on these platforms likewise help you make informed purchasing decisions. Website Special Features Average Discount Rate Joann Online coupons, clearance section 30% – 60% Michaels Weekly ads, loyalty program 20% – 50% Hobby Lobby Seasonal sales, online exclusives 25% – 70% Thrift Stores and Donation Centers Thrift stores and donation centers present excellent opportunities for crafters to explore a diverse range of affordable craft supplies. You’ll often find items at considerably reduced prices compared to traditional retail outlets. Here are some excellent finds you might encounter: Fabric: Look for various textiles perfect for quilting or sewing projects. Yarn: Discover different types and colors of yarn for your knitting or crocheting endeavors. Tools: Pick up vital crafting tools like scissors, glue guns, or paintbrushes. Unique materials: Visit donation centers like the Creative Reuse Center for clean, reusable art supplies that support sustainability. Shopping at these locations not just saves you money but additionally promotes recycling and reusing materials, reducing landfill waste during your crafting experience. Frequently Asked Questions Is Michaels or Hobby Lobby Better for Craft Supplies? When deciding between Michaels and Hobby Lobby for craft supplies, consider your specific needs. Michaels offers a broader selection, including seasonal items and a robust online shopping experience. Hobby Lobby, known for its frequent sales, often provides better discounts on various categories. Both stores have loyalty programs, but Michaels allows you to earn points on purchases, whereas Hobby Lobby gives a first-time email subscriber discount. Ultimately, your choice depends on convenience and the type of supplies you need. What Are Some Other Stores Like Hobby Lobby? If you’re looking for stores similar to Hobby Lobby, consider Michaels and Joann Fabrics. Michaels offers a diverse selection of craft supplies, art materials, and home décor, often with sales and coupons. Joann Fabrics specializes in fabrics and sewing supplies, featuring frequent promotions and a loyalty program. Moreover, Craft Warehouse provides competitive prices and clearance items, in addition to Dollar Tree being excellent for budget-friendly basic supplies, all ideal for your crafting needs. Does Dollar General Have Craft Supplies? Yes, Dollar General does have craft supplies. You’ll find crucial items like glue, scissors, stickers, and construction paper, perfect for basic projects. They likewise offer seasonal craft supplies, ideal for holiday decorations. Furthermore, you may discover DIY kits, painting supplies, and yarn, catering to various crafting interests. Keep in mind that inventory can vary by location, so it’s best to check your local store for availability and specific items. Does the Salvation Army Take Craft Supplies? Yes, the Salvation Army does accept craft supplies, but you need to follow specific guidelines. They only accept donations by appointment and don’t accept craft supplies during July and August. You can start scheduling donations for September on August 26th. Donating helps redirect materials from landfills and supports local community programs. Check their website or contact them for detailed guidelines before preparing your items for donation. Conclusion In conclusion, finding discount craft supplies is achievable with the right strategies. Explore local craft shops, online marketplaces, and community events to uncover unique and affordable materials. Seasonal sales at major retailers like Joann and Michaels can considerably reduce costs, as thrift stores offer diverse options for creative projects. By utilizing these resources, you can gather quality supplies without exceeding your budget, ensuring your crafting experience remains enjoyable and financially manageable. Image via Google Gemini This article, "7 Best Places for Discount Craft Supplies" was first published on Small Business Trends View the full article

-

7 Best Places for Discount Craft Supplies

When you’re looking for discount craft supplies, knowing where to shop can save you money and broaden your options. Local craft shops often have clearance sections filled with unique materials. Online marketplaces provide bulk purchasing opportunities at reduced prices. Furthermore, community events and craft swaps offer sustainable ways to gather supplies. Exploring thrift stores can likewise yield diverse, low-cost items. Each of these options presents distinct benefits for your crafting needs. What other strategies can improve your supply shopping experience? Key Takeaways Local craft shops often have clearance sections with significant discounts on supplies, making them ideal for budget-conscious crafters. Online marketplaces like Etsy offer bulk purchasing options, resulting in substantial savings on craft materials. Major retailers such as Joann, Michaels, and Hobby Lobby frequently run seasonal sales and promotions, providing discounts ranging from 20% to 70%. Community events and craft swaps allow crafters to exchange surplus materials, promoting sustainability while saving money on supplies. Thrift stores offer a diverse selection of affordable craft supplies, including fabric, yarn, and tools, often at lower prices than retail outlets. Local Craft Shops With Clearance Sections Local craft shops often present excellent opportunities for budget-conscious crafters by featuring clearance sections filled with discounted supplies. For instance, you can find Chunky Glitter Fabric Sheets priced between $1.19 and $1.67, which were originally $1.49 to $2.79. Stiffened Felt Sheets are another budget-friendly option at just $0.59, down from $0.99. If you’re into slime projects, look for items like Fluffuccino Slime available for $3.59, considerably lower than the original $5.99. Furthermore, seasonal discounts on items such as Glitter and Mosaic Gems provide excellent value. These local shops regularly host sales on discount craft supplies, encouraging you to explore unique offerings and clearance items that can improve any crafting project, including wholesale floral crafts. Online Marketplaces for Bulk Purchasing When you’re looking to save on craft supplies, online marketplaces offer excellent bulk purchasing options that can lead to significant discounts. Many platforms feature various sellers who provide bulk discounts, making it easier for you to stock up on materials at a lower cost per item. Moreover, consider the shipping and delivery options available, as these can affect your overall savings and project timelines. Bulk Discounts Availability Online marketplaces have become crucial for crafters seeking bulk discounts on craft supplies, offering significant savings for various materials. You can find excellent deals on fundamental items, making it easier to stock up for your projects. Here are four key benefits of shopping for bulk discounts online: Wholesale Prices: Websites like Etsy and specialized craft stores often have sections for bulk items, allowing you to buy at lower rates. Larger Order Discounts: Many retailers provide discounts for larger purchases, which is perfect for schools or groups. Promotions: Popular craft supply sites frequently run sales events that augment your savings. Newsletters: Subscribing to newsletters alerts you to exclusive bulk discounts and flash sales customized for crafters. Shipping and Delivery Options Shipping and delivery options play a crucial role in the overall experience of purchasing craft supplies online, especially when you’re buying in bulk. Many online marketplaces, like Etsy and specialized craft supply stores, offer bulk purchasing opportunities that can save you money through volume discounts and special promotions. You’ll often find shipping deals, such as free shipping on orders over a certain amount, making bulk purchases even more economical. Moreover, retailers frequently run sales events, including seasonal discounts and clearance sales, where buying in larger quantities can lead to significant savings. Consider subscription boxes dedicated to craft supplies, too; they provide regular deliveries of discounted materials, ensuring you have necessities during the process of discovering new products to improve your crafting projects. Community Events and Swap Meets Attending local craft swap events can be a great way for you to exchange materials and tools as well as meeting fellow crafters in your community. These gatherings often include seasonal craft fairs and workshops that provide exclusive discounts on supplies, making them perfect for budget-conscious creators. Local Craft Swap Events Local craft swap events offer a unique opportunity for crafters to exchange surplus supplies as they nurture a sense of community and sustainability. Organized by local community centers, libraries, or art groups, these events are easily accessible. You can bring your unused or excess craft materials to swap for items you need, leading to a diverse selection of supplies at little to no cost. Here are four benefits of attending these events: Diverse Materials: Access a variety of craft supplies that you mightn’t find elsewhere. Networking: Connect with fellow crafters, share ideas, and inspire each other. Workshops: Participate in workshops to learn new skills during the swapping. Community Building: Encourage local connections and support sustainable practices in crafting. Community Engagement Opportunities Engaging with your community through craft-related events can greatly improve your creative experience as well as providing numerous benefits. Participating in workshops and local swap meets allows you to connect with fellow crafters, exchange ideas, and obtain new materials. For instance, the upcoming Little Craft Fest on March 8, 2025, will showcase local artists and offer opportunities for hands-on learning. Furthermore, the Creative Reuse Center encourages donations of clean, reusable materials for workshops, promoting sustainability. Here’s a summary of community engagement opportunities: Event Type Benefits Example Workshops Skill development and networking Local craft stores Swap Meets Material exchange and sustainability Neighborhood events Community Fest Showcasing local art and connection Little Craft Fest Seasonal Craft Fairs Seasonal craft fairs provide an excellent opportunity to discover unique craft supplies at discounted prices, especially when local artisans and vendors come together to showcase their work. These events not only allow you to purchase materials but also facilitate trading unused supplies, promoting creativity and sustainability. By participating, you can as well benefit from exclusive sales and promotions from local suppliers. Furthermore, many fairs offer workshops and demonstrations, helping you learn new techniques. Here are four reasons to attend seasonal craft fairs: Find unique supplies from local artisans. Trade unused materials at swap meets. Learn new skills through workshops and demos. Access exclusive sales from local vendors. These factors make seasonal craft fairs a valuable resource for crafters. Specialty Stores for Unique Supplies When you’re on the hunt for unique craft supplies, specialty stores can offer a treasure trove of items that you won’t find in typical retail outlets. For instance, the Creative Reuse Center provides clean, reusable materials that help divert waste from landfills during supporting local artists. You can find discounted items like Chunky Glitter Fabric Sheets priced between $1.19 and $1.67, perfect for budget-friendly projects. Moreover, Little Craft Place features a diverse selection of affordable craft supplies, including paints, kits, and books for all ages. If you’re an enthusiast, consider specialty tools like the TWSBI ECO Espresso Fountain Pen, which offers a piston filler mechanism for easy ink filling, blending quality with reasonable pricing. Seasonal Sales and Promotions As you explore options for craft supplies, taking advantage of seasonal sales and promotions can lead to significant savings. Many stores offer discounts during holiday seasons, making it an ideal time to stock up on your favorite materials. For example, you can find: Chunky Glitter Fabric Sheets priced between $1.19 and $1.67, down from $1.49 to $2.79. Slime products like Fluffuccino Slime and Extreme Strength Accelerator on sale for $3.59, reduced from $5.99. A variety of glitter and mosaic gems with lowered prices. Unique materials at the Creative Reuse Center, promoting sustainability and savings during special events. Discount Craft Supply Websites Finding discount craft supply websites can greatly improve your crafting experience without straining your budget. Many of these sites, like Joann, Michaels, and Hobby Lobby, offer a vast selection of products, including paper, fabric, and embellishments, often at lower prices than retail stores. They frequently provide online coupons and promotional discounts, maximizing your savings. Furthermore, some sites focus on clearance items and overstock supplies, giving you access to quality materials at reduced prices. Subscribing to newsletters can grant early access to exclusive discounts and seasonal sales. User reviews on these platforms likewise help you make informed purchasing decisions. Website Special Features Average Discount Rate Joann Online coupons, clearance section 30% – 60% Michaels Weekly ads, loyalty program 20% – 50% Hobby Lobby Seasonal sales, online exclusives 25% – 70% Thrift Stores and Donation Centers Thrift stores and donation centers present excellent opportunities for crafters to explore a diverse range of affordable craft supplies. You’ll often find items at considerably reduced prices compared to traditional retail outlets. Here are some excellent finds you might encounter: Fabric: Look for various textiles perfect for quilting or sewing projects. Yarn: Discover different types and colors of yarn for your knitting or crocheting endeavors. Tools: Pick up vital crafting tools like scissors, glue guns, or paintbrushes. Unique materials: Visit donation centers like the Creative Reuse Center for clean, reusable art supplies that support sustainability. Shopping at these locations not just saves you money but additionally promotes recycling and reusing materials, reducing landfill waste during your crafting experience. Frequently Asked Questions Is Michaels or Hobby Lobby Better for Craft Supplies? When deciding between Michaels and Hobby Lobby for craft supplies, consider your specific needs. Michaels offers a broader selection, including seasonal items and a robust online shopping experience. Hobby Lobby, known for its frequent sales, often provides better discounts on various categories. Both stores have loyalty programs, but Michaels allows you to earn points on purchases, whereas Hobby Lobby gives a first-time email subscriber discount. Ultimately, your choice depends on convenience and the type of supplies you need. What Are Some Other Stores Like Hobby Lobby? If you’re looking for stores similar to Hobby Lobby, consider Michaels and Joann Fabrics. Michaels offers a diverse selection of craft supplies, art materials, and home décor, often with sales and coupons. Joann Fabrics specializes in fabrics and sewing supplies, featuring frequent promotions and a loyalty program. Moreover, Craft Warehouse provides competitive prices and clearance items, in addition to Dollar Tree being excellent for budget-friendly basic supplies, all ideal for your crafting needs. Does Dollar General Have Craft Supplies? Yes, Dollar General does have craft supplies. You’ll find crucial items like glue, scissors, stickers, and construction paper, perfect for basic projects. They likewise offer seasonal craft supplies, ideal for holiday decorations. Furthermore, you may discover DIY kits, painting supplies, and yarn, catering to various crafting interests. Keep in mind that inventory can vary by location, so it’s best to check your local store for availability and specific items. Does the Salvation Army Take Craft Supplies? Yes, the Salvation Army does accept craft supplies, but you need to follow specific guidelines. They only accept donations by appointment and don’t accept craft supplies during July and August. You can start scheduling donations for September on August 26th. Donating helps redirect materials from landfills and supports local community programs. Check their website or contact them for detailed guidelines before preparing your items for donation. Conclusion In conclusion, finding discount craft supplies is achievable with the right strategies. Explore local craft shops, online marketplaces, and community events to uncover unique and affordable materials. Seasonal sales at major retailers like Joann and Michaels can considerably reduce costs, as thrift stores offer diverse options for creative projects. By utilizing these resources, you can gather quality supplies without exceeding your budget, ensuring your crafting experience remains enjoyable and financially manageable. Image via Google Gemini This article, "7 Best Places for Discount Craft Supplies" was first published on Small Business Trends View the full article

-

Tesla faces lawsuit for these lethal design flaws in Washington State crash

Design flaws caused a Tesla Model 3 to suddenly accelerate out of control before it crashed into a utility pole and burst into flames, killing a woman and severely injuring her husband, a lawsuit filed in federal court alleges. Another defect with the door handle design thwarted bystanders who were trying to rescue the driver, Jeff Dennis, and his wife, Wendy, from the car, according to the lawsuit filed Friday in U.S. District Court for the Western District of Washington. Wendy Dennis died in the Jan. 7, 2023, crash in Tacoma, Washington. Jeff Dennis suffered severe leg burns and other injuries, according to the lawsuit. Messages left Monday with plaintiffs’ attorneys and Tesla were not immediately returned. The lawsuit seeks punitive damages in California since the Dennis’ 2018 Model 3 was designed and manufactured there. Tesla also had its headquarters in California at the time before later moving to Texas. Among other financial claims, the lawsuit seeks wrongful death damages for both Jeff Dennis and his late wife’s estate. It asks for a jury trial. Tesla doors have been at the center of several crash cases because the battery powering the unlocking mechanism shuts off in case of a crash, and the manual releases that override that system are known for being difficult to find. Last month, the parents of two California college students killed in a Tesla crash sued the carmaker, saying the students were trapped in the vehicle as it burst into flames because of a design flaw that prevented them from opening the doors. In September, federal regulators opened an investigation into complaints by Tesla drivers of problems with stuck doors. Jeff and Wendy Dennis were running errands when the Tesla suddenly accelerated for at least five seconds. Jeff Dennis swerved to miss other vehicles before the car hit the utility pole and burst into flames, the lawsuit says. The automatic emergency braking system did not engage before hitting the pole, the lawsuit alleges, even though it is designed to apply the brakes when a frontal collision is considered unavoidable. Bystanders couldn’t open the doors because the handles do not work from the outside because they also rely on battery power to operate.. The doors also couldn’t be opened from inside because the battery had shut off because of the fire, and a manual override button is hard to find and use, the lawsuit alleges. The heat from the fire prevented bystanders from getting close enough to try to break out the windows. Defective battery chemistry and battery pack design unnecessarily increased the risk of a catastrophic fire after the impact with the pole, the lawsuit alleges. Thiessen reported from Anchorage, Alaska. —Mark Thiessen, Associated Press View the full article

-

Bessent calls for simplified Fed as he ends candidate interviews

The administration has previously said the finalists are Fed Governors Christopher Waller and Michelle Bowman, former Governor Kevin Warsh, National Economic Council Director Kevin Hassett and BlackRock Inc. executive Rick Rieder. View the full article

-

The 30 Best Christmas Movies on Netflix Right Now

We may earn a commission from links on this page. Gone are the days when you watched one Christmas movie a year, and it was either about a guy trying to jump off of a bridge or a child setting traps to kill the two grown men who want to murder him. Now there’s a lot more where those came from—many of them available for streaming on Netflix year-round. Here are some of the best the streamer has on offer during the festive season—however early or late yours starts. (And while this is a roundup of holiday movies, yes, it’s heavily skewed toward Christmas; Netflix’s current offerings are heavy on Santa and light on everything else.) Champagne Problems (2025) Minka Kelly stars here as Sydney, a hard-driving American executive who heads off to Paris in order to acquire a Champagne brand for her company—and it needs to happen before Christmas. C'est pas possible! She brings along the precocious family dog, Bulles (a West Highland Terrier who's already become a bit of a fan favorite), but that's not the only complication: The heir to the company just happens to be a French hunk played by Tom Wozniczka, and, évidemment, their swoony romance puts the big deal on the line. Stream Champagne Problems. Champagne Problems (2025) Learn More Learn More The Merry Gentlemen (2024) It might not be entirely traditional, but there's absolutely no rule against adding a little beefcake to your holiday feast. Britt Robertson plays Ashley, a professional dancer who finds herself out of a job and so makes her way home for Christmas—only to discover that the bank is about to shut down the sketchy local performing venue run by her parents. Naturally, it's time to put on a show! An all-male revue, specifically, including an array of middle-aged hunks like Chad Michael Murray and Maxwell Caulfield who'll heat up a holiday gathering for you and your mom. Stream The Merry Gentlemen. The Merry Gentlemen (2024) Learn More Learn More Jingle Jangle: A Christmas Journey (2020) As kids’ holiday fare goes, this one’s a little different, both in style and in pedigree. It’s a straight-up fantasy (rather than the more traditional romantic variety) with a toymaker inventing a living matador fighting for his right to individuality. The pedigree includes playwright David E. Talbert in the director’s chair and an all-Black cast that includes Forest Whitaker, Keegan-Michael Key, and Anika Noni Rose, all having a lot of fun in a colorful (and musical!) adventure. Stream Jingle Jangle. Jingle Jangle (2020) Learn More Learn More Last Christmas (2019) Emilia Clarke and America’s sweetheart Henry Golding have tremendous chemistry as a down-on-her-luck aspiring singer and the slightly mysterious man with whom she shares a lovely and inspiring holiday season. The twist ending here will either work for you, or it really won’t (either way, it’s hilarious on paper). I was prepared to chuckle, but it still got me in the end. Stream Last Christmas. Last Christmas (2019) Learn More Learn More Dolly Parton’s Christmas on the Square (2020) It’s the holidays, and Regina Fuller (Christine Baranski!) is on her way home, to evict a bunch of people so she can sell some land to a mall developer. Naturally, she’s got some learning to do, with help from Jenifer Lewis—and Dolly herself (typecast as an all-singing angel). Dolly wrote all the musical numbers, and it’s dorky fun in the best ways. The whole cast is several cuts above, as are the dance numbers, choreographed by Debbie Allen—it's a goofy good time, and I mean that in the best way. Stream Christmas on the Square. Dolly Parton’s Christmas on the Square (2020) Learn More Learn More Klaus (2019) A charming, bespoke Santa origin story based on nothing in particular, Klaus finds the lazy son of a postmaster general in 19th-century Norway banished to a distant island town where he’s tasked with delivering 6,000 letters within a year, lest he be cut off from the family fortune. Arriving there, he discovers the two primary feuding families can’t be bothered to send letters for him to deliver, but that an elderly widower might be able to help him in a scheme he’s concocted to convince the town’s children to write letters in the hopes of receiving toys in return—toys crafted by old Klaus, in search of the family he never had. It’s all beautifully hand-animated, and the genuine emotion wrings tears, Pixar-style. Stream Klaus. Klaus (2019) Learn More Learn More The Holiday Calendar (2018) Kat Graham stars as struggling photographer Abby Sutton, who gets an old Advent calendar from her grandfather—she’s very not into it initially, until the calendar reveals a tiny pair of boots on day one, and later that day, her friend Josh (Quincy Brown) gives her a real pair of boots. As the calendar’s gifts seem to line up with things that actually happen, Abby begins to suspect that there’s magic, and romance, in the air. Ethan Peck (Star Trek) also stars. Stream The Holiday Calendar. The Holiday Calendar (2018) Learn More Learn More Jingle Bell Heist (2025) A sharp-witted retail worker (Olivia Holt) and a repairman who's seen better days (Connor Swindells) realize that they both have designs on the titular holiday heist: they're going to rob London's biggest department store during the seasonal rush. With no choice but to team up, they reluctantly scheme together—before the two mismatched thieves start to find that their feelings are getting in the way of the perfect score. Stream Jingle Bell Heist. Jingle Bell Heist (2025) Learn More Learn More Let It Snow (2019) Not to be confused with Hallmark’s 2013 Let It Snow, which is also a Christmas movie, but not a particularly (or at all) diverse one. Nor is this the 2020 snowboarding horror movie of the same name. Based on a novel by Maureen Johnson, John Green, and Lauren Myracle that intertwines three distinct stories, this Let It Snow involves a large and fairly diverse cast of characters figuring into holiday romances both straight and queer, all taking place in the same small town. Stream Let It Snow. Let It Snow at Netflix Learn More Learn More at Netflix Hot Frosty (2024) A perfect pairing with The Merry Gentlemen for your lightly horny holiday, Hot Frosty stars Lacey Chabert as a widow running a cafe in the tiny made-up town of Hope Springs, New York. One day she picks up a scarf at a secondhand store and places it around the neck of a particularly chiseled snowman because, while all snowman bodies are valid, it's gonna take abs to score free winter apparel. The snowman, quite naturally, comes to life, leading to a series of wacky misunderstandings but also a little holiday romance. Stream Hot Frosty. Hot Frosty (2024) at Netflix Learn More Learn More at Netflix My Secret Santa (2025) Alexandra Breckinridge hops over from Netflix's long-running romantic drama, Virgin River, to take the lead in this Christmas movie, Here, she's a struggling single mom trying to raise the cash to send her daughter off to snowboarding camp at a luxury resort (which: OK?). What are you gonna do but get a job at the resort playing Santa, requiring that she first masquerade as an old man—which is almost certainly some kind of statement about sex- and gender essentialism in the ski-resort-Santa business. When she gets the hots for her new boss (New Amsterdam's Ryan Eggold), shenanigans ensue. Stream My Secret Santa. My Secret Santa (2025) Learn More Learn More Chicken Run (2000) The holidays are in the background of this funny, fowl take on The Great Escape, with a reminder that Christmas is less fun if you’re stuck laying eggs on the farm. The sharp Aardman Brothers comedy has some incredibly fun stop-motion animation, and an awful lot of chickens. It remains the top-grossing stop-motion animated movie of all time. (Netflix also has the two-decades-later sequel, Chicken Run: Dawn of the Nugget.) Stream Chicken Run. Chicken Run (2000) Learn More Learn More Operation Christmas Drop (2020) Congressional aide Erica Miller (Kat Graham) drops everything for a mission to visit a beachside Air Force base—and find reasons to defund it. She clashes with the studly pilot assigned to escort her around, who is particularly involved in one of the base’s pet projects: an annual airdrop of supplies and gifts to various Micronesian islands. You know where this is all going, but that’s part of the fun. Stream Operation Christmas Drop. Operation Christmas Drop (2020) at Netflix Learn More Learn More at Netflix Carry-On (2024) Sometimes you want a Christmas movie with all the trimmings, and sometimes you need a break from all the tinsel. And so: Carry-On, a thriller that takes place on Christmas Eve. At the airport—literally the worst place to be during the holidays! Taron Edgerton is a TSA agent who's blackmailed into allowing Jason Bateman onto a flight with a very dangerous package. And yet I can't get through with my belt. Stream Carry-On. Carry-On (2024) Learn More Learn More Love Hard (2021) Natalie (Nina Dobrev) gets catfished for Christmas (fun!). The poor woman travels across the country to see the guy she met on an app, and discovers that Josh (Jimmy O. Yang) was using pictures of his friend Tag (Darren Barnet) the whole time. She gets something going with Tag, but soon has to decide which of the two guys she really has feelings for. Stream Love Hard. Love Hard (2021) Learn More Learn More Scrooge: A Christmas Carol (2022) It might not replace all of the many, many earlier Dickens adaptations in your holiday heart, but this computer-animated musical version boasts some fun songs, and a strong voice cast led by Luke Evans and Olivia Colman. It’s slightly less scary and maudlin than many other takes, so it might not be a bad way to introduce young kids to the holiday tale. Stream Scrooge: A Christmas Carol. Scrooge: A Christmas Carol (2022) at Netflix Learn More Learn More at Netflix That Christmas (2024) This fairly delightful all-ages animated Christmas boasts an impressive cast: Brian Cox as Santa is joined by Fiona Shaw, Jodie Whittaker, and Bill Nighy (among other British luminaries). A record-breaking blizzard in the coastal town of Wellington-on-Sea throws Santa's plans into chaos, but also threatens to separate several families, physically and emotionally, in a series of intertwined stories that blend a bit of comedy with some sincere emotional beats. Stream That Christmas. That Christmas (2024) at Netflix Learn More Learn More at Netflix Tangerine (2015) Just your typical girlfriend/buddy/revenge comedy movie about two trans sex workers on the hunt for the man who did one of them wrong. As heartfelt as it is madcap, it all takes place on a wild Christmas Eve in Hollywood (so don’t expect snow). Shot on a couple of iPhones, director Sean Baker and company make a virtue of the intimacy and immediacy that modern technology can bring. Stream Tangerine. Tangerine (2015) at Netflix Learn More Learn More at Netflix Merry Liddle Christmas (2019) Kelly Rowland produced and stars in the first of what has become a series (four movies, so far), though Netflix currently only has the first one. Here, Rowland plays Jacquie Liddle, a tech entrepreneur who’s got it all together until her incredibly messy family shows up for Christmas. Still, she’s determined to put together a marketing video that shows her vision of a perfect Christmas, which goes about as well as you can imagine. Complicating things further is her hot new neighbor Tyler (Thomas Carrot). Like Jacquie herself, the whole movie is a bit more impressively put together than the standard quickie Christmas movie, with a competence and charm that’s made those cozy sequels rather welcome. Stream Merry Liddle Christmas. Merry Liddle Christmas (2019) Learn More Learn More Meet Me Next Christmas (2024) Veteran TV and movie director Rusty Cundieff (Tales from the Hood and Chappelle's Show, among many other credits) helms Meet Me Next Christmas, starring Christina Milian as a woman who finds herself rushing around New York City in search of sold-out Pentatonix tickets (oddly specific, but sure). You see, she met a guy named James last year at Christmas, and they'd agreed to reunite at the concert, An Affair to Remember-style—but wait! The handsome ticket concierge (Devale Ellis) helping her out is pretty cute, too. Stream Meet Me Next Christmas. Meet Me Next Christmas (2024) Learn More Learn More Holidate (2020) Sloane (Emma Roberts) and Jackson (Luke Bracey) have figured out how to deal with all the questions that arise (apparently?) when you’re single and you show up at family gatherings: They’re going to be each other’s platonic plus-ones at holiday meals. Would it be much of a holiday movie if something other than friendship weren’t in the offing? Stream Holidate. Holidate (2020) Learn More Learn More Falling for Christmas (2022) Speaking of Christmas casting coups, this one saw the return of Lindsay Lohan in a lead role after a decade. She plays a snotty heiress who loses her memory following a ski accident and learns lessons about love and life while recovering in a ski lodge run by earthy Jake Russell (Chord Overstreet). Stream Falling for Christmas. Falling for Christmas (2022) Learn More Learn More The Princess Switch (2018) Stacy De Novo (Vanessa Hudgens) is a pastry chef from Chicago off to fictional Belgravia to compete in a holiday baking contest. There she meets a duchess, who’s also the fiancee of the local prince (Sam Palladio)—and who happens to look exactly like Stacy (surprise: They’re both played by Hudgens). The two decide it might be fun to see how the other half lives, and so they swap lives, which (unsurprisingly) complicates things with the prince. If you like this one, the series continues in two more movies that add yet another Hudgens. Stream The Princess Switch. The Princess Switch (2018) Learn More Learn More A Christmas Prince (2017) Another trilogy, you say? Look, sometimes you just want to sink into the couch for hours of holiday schmaltz. No problem: Here, an American journalist (Rose McIver) heads to fictional Aldovia on the hunt for a scoop. A case of mistaken identity leads to her being mistaken for the tutor to the young princess. And, of course, she’s soon cozying up to the prince (Ben Lamb). It goes well enough that they get two more movies out of it. (Yes, all these movies have nearly identical plots, which is a cozy feature, not a bug.) Stream A Christmas Prince. A Christmas Prince (2017) Learn More Learn More The Noel Diary (2022) This one’s more of a comedy/drama in a holiday vein, so it’s less generally goofy and a bit less predictable than some of the other modern Christmas movies (whether that’s a pro or con will largely depend on your mood). Writer Jake (Justin Hartley) returns home for Christmas to settle his late mother’s estate; he’s just in time to meet Rachel (Barrett Doss), who’s looking for information about her birth mother, who’d been Jake’s nanny. Stream The Noel Diary. The Noel Diary (2022) Learn More Learn More The Christmas Chronicles (2018) A deeply cute Christmas adventure finds a couple of kids (Judah Lewis and Darby Camp) accidentally crashing Santa’s sleigh (Santa here is played by Kurt Russell). It’s got plenty of family-friendly action, and Russell seems to be having a ton of fun. If you like this one, the sequel is approximately as good. Stream The Christmas Chronicles. The Christmas Chronicles (2018) Learn More Learn More Holiday Rush (2019) Another dramedy, Holiday Rush finds widowed hip-hop radio DJ Rush (Romany Malco) losing his job and heading back to his old home with a plan to buy the local station where he got his start alongside his producer, Roxy (Sonequa Martin-Green). The professional plans don’t run particularly smoothly, but the pair do discover that their feelings might not be all business. Stream Holiday Rush. Holiday Rush (2019) Learn More Learn More Our Little Secret (2024) Lindsay Lohan is back in her third Netflix movie, following her big comeback in 2022's Falling for Christmas. Here she joins a stacked cast, including Kristin Chenoweth, Ian Harding, Jon Rudnitsky, and Chris Parnell, in the story of a couple of exes forced to spend the holiday together (her new boyfriend's sister is dating her old boyfriend, and neither of them wants anyone to know). Seasonal shenanigans ensue! Stream Our Little Secret. Our Little Secret (2024) Learn More Learn More Christmas Bloody Christmas (2022) Christmas Carnage, as a genre, is at least as venerable as the holiday rom-com (Black Christmas predates every single one of those cozy Hallmark-style movies), and there's nothing wrong with adding some blood and guts to your holiday display. Here, Riley Dandy plays Tori Tooms, a record store owner closing up for Christmas Eve, and heading out for drinks with her flirtatious employee and a couple of pals. Those friends happen to run a toy store that has in stock a Santa robot—one that's been recalled because of its original military programming. You probably won't be surprised to learn that this particular robot is about to malfunction, and cut a bloody swath through the holiday season. Not quite as scary as more modern AI, but still best not mess with robot Santa. Stream Christmas Bloody Christmas. Christmas Bloody Christmas (2022) Learn More Learn More Single All the Way (2021) Peter (Michael Urie) is in a high-stress LA-type job on his way home to New Hampshire for the holidays. Sick of questions about being single, he decides to invite his best friend Nick (Philemon Chambers) to pose as more than his roommate. A tried-and-true setup! Complications ensue when his mom (Kathy Najimy) sets him up with her fitness instructor, James (Luke Macfarlane), before learning about the fake boyfriend who’s soon on his way to becoming a maybe real boyfriend. The fun cast also includes Barry Bostwick and Jennifer Coolidge. Stream Single All the Way. Single All the Way at Netflix Learn More Learn More at Netflix View the full article

-

how do I deal with badly timed questions as a manager?

A reader writes: I’m student work head at a university library — basically, I’m a student managing the regular student workers as a way of getting experience in management, leadership, etc. One of the workers has a bad habit of asking questions about everything. Usually it isn’t too bad, and of course curiosity should usually be encouraged, though it can derail conversations. But recently, there was an incident where some of our just-put-up Christmas decorations were stolen. Naturally, I was upset, and I happened to mutter, “Whoever did this is a real berk.” (I don’t know why I chose that word — it was just the first that leapt to mind.) Overhearing this, she asked, “What does that mean? What did you say? Is it like the f-word?” (The last was in response to my attempt to answer by saying simply that it was a rude British word.) She would not stop asking about it, and given that I was already in a bad mood from the stolen decorations, I started getting upset. I managed to get away before blowing my lid, but I am utterly perplexed that, seeing that I was upset, she decided it was time to begin an interrogation. How should I (a) apologize for any offense I gave in my hasty departure, and (b) explain to her that there are times (such as when somebody’s upset) when it’s not appropriate to badger them with questions? Was your quick departure actually rude? Because unless you were outright rude to her, this doesn’t sound like something you need to go back and apologize for. If I’m wrong and it was ruder than it sounds, then just be straightforward: “I’m sorry that I was short with you the other day after the decorations were stolen. I was caught up in addressing what had happened, and I wasn’t in a place to answer language questions, but I should have been clearer about that.” For your second question, I wouldn’t go back now and chastise her about what she did; it doesn’t sound that egregious, more like she just misread what was happening on your end of the conversation. But since it’s part of a larger pattern of her derailing conversations, you can resolve to address that the next time there’s a natural opportunity for it. For example, the next time she’s intensely questioning something in a way that’s disruptive, you can say, “I need to focus on figuring out X right now, so can you hold those questions for now?” or “Right now we need to get through topics X and Y, so I don’t want us to get sidetracked on Z” or so forth. In other words, think about what you can do on your end to manage these conversations more assertively. In fact, I think the “berk” situation would have been a lot less frustrating for you if you’d done that! You probably would have come away less irritated if early on in that conversation you’d said something like, “Sorry, I’m right in the middle of dealing with this theft and I need to focus on that — give me some time to take care of this.” I think the fact that you’re not managing these conversations in the moment is making it more aggravating. If addressing it case-by-case in the moment doesn’t solve it, then you can have a larger-picture conversation with her explaining that while you’re happy to answer questions in general, you won’t always be able to pivot to answering them right in the moment if something more pressing needs to be taken care of first. But that’s very much about the bigger pattern and not about the “berk” interrogation. The post how do I deal with badly timed questions as a manager? appeared first on Ask a Manager. View the full article

-

US homesellers pull stale listings off market as interest fades

Nearly 85,000 sellers removed their properties in September, the highest number for that month in eight years, according to Redfin. View the full article

-

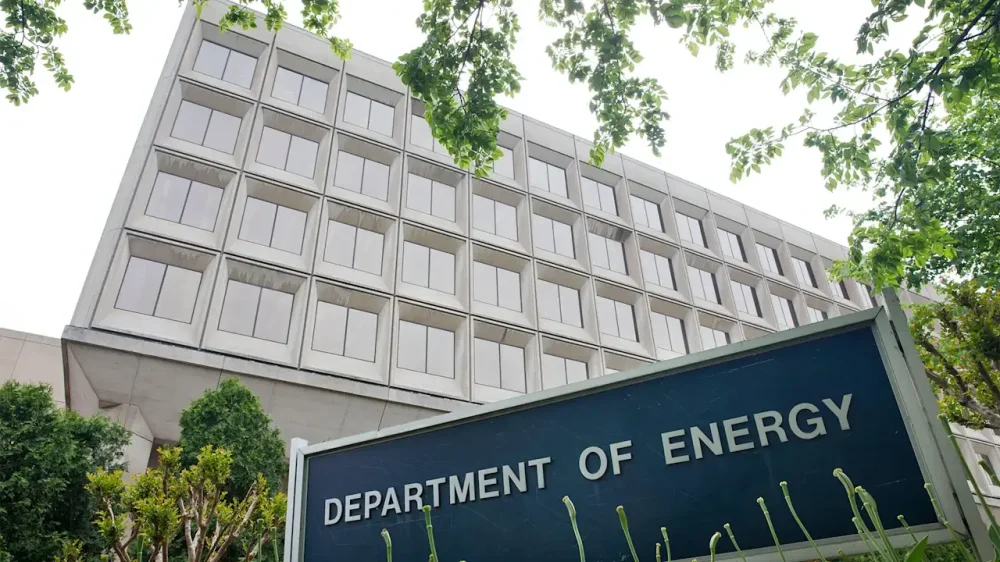

What to know about Trump’s order for the AI project ‘Genesis Mission’

President Donald The President is directing the federal government to combine efforts with tech companies and universities to convert government data into scientific discoveries, acting on his push to make artificial intelligence the engine of the nation’s economic future. The President unveiled the “Genesis Mission” as part of an executive order he signed Monday that directs the Department of Energy and national labs to build a digital platform to concentrate the nation’s scientific data in one place. It solicits private sector and university partners to use their AI capability to help the government solve engineering, energy and national security problems, including streamlining the nation’s electric grid, according to White House officials who spoke to reporters on condition of anonymity to describe the order before it was signed. Officials made no specific mention of seeking medical advances as part of the project. “The Genesis Mission will bring together our Nation’s research and development resources — combining the efforts of brilliant American scientists, including those at our national laboratories, with pioneering American businesses; world-renowned universities; and existing research infrastructure, data repositories, production plants, and national security sites — to achieve dramatic acceleration in AI development and utilization,” the executive order says. The administration portrayed the effort as the government’s most ambitious marshaling of federal scientific resources since the Apollo space missions of the late 1960s and early 1970s, even as it had cut billions of dollars in federal funding for scientific research and thousands of scientists had lost their jobs and funding. The President is increasingly counting on the tech sector and the development of AI to power the U.S. economy, made clear last week as he hosted Saudi Arabia’s Crown Prince Mohammed bin Salman. The monarch has committed to investing $1 trillion, largely from the Arab nation’s oil and natural gas reserves, to pivot his nation into becoming an AI data hub. For the U.S.’s part, funding was appropriated to the Energy Department as part of the massive tax-break and spending bill signed into law by The President in July, White House officials said. As AI raises concerns that its heavy use of electricity may be contributing to higher utility rates in the nearer term, which is a political risk for The President, administration officials argued that rates will come down as the technology develops. They said the increased demand will build capacity in existing transmission lines and bring down costs per unit of electricity. Data centers needed to fuel AI accounted for about 1.5% of the world’s electricity consumption last year, and those facilities’ energy consumption is predicted to more than double by 2030, according to the International Energy Agency. That increase could lead to burning more fossil fuels such as coal and natural gas, which release greenhouse gases that contribute to warming temperatures, sea level rise and extreme weather. The project will rely on national labs’ supercomputers but will also use supercomputing capacity being developed in the private sector. The project’s use of public data including national security information along with private sector supercomputers prompted officials to issue assurances that there would be controls to respect protected information. —Thomas Beaumont, Associated Press View the full article

-

How to Get Money for Your Franchise – A Step-by-Step Guide