Everything posted by ResidentialBusiness

-

Badenoch tries to revive Tory fortunes with plan to boost UK economy

Leader will pitch Conservatives as the party of spending control with pledge to drive down Britain’s deficitView the full article

-

People do well if they can

There’s a line I heard recently from Mel Robbins that’s been echoing in my head ever since: “People do well if they can.” It’s deceptively simple. The kind of phrase you nod at, maybe even repost. But when you sit with it, really sit with it, it starts to challenge a lot of the assumptions we make every day. Especially when it comes to financial health. Not lazy, just locked out Let’s be honest: It’s easy to judge what we don’t understand. We look at people struggling with money and tell ourselves stories. They’re reckless. They don’t care. They should know better. But here’s the thing: Most people do care. They want to pay off debt. They want to build credit. They want to save for the future, buy homes, support their families, live with dignity. What they often don’t have is access, or a roadmap. That’s not laziness. That’s infrastructure failure. You wouldn’t expect someone to drive to a job interview without a car, a license, or a GPS. So why do we expect people to navigate complex financial systems with zero guidance and very few guardrails? Skill, not will I grew up in a community where financial literacy wasn’t part of the conversation; not at school, not at home, not even at the bank. I didn’t learn what a credit score was until I had already messed mine up. And let me tell you, the learning curve wasn’t gentle. So I get frustrated when financial challenges are framed as a lack of personal responsibility. That framing is lazy. Let me say that again: That framing is lazy. Not the people. Not the effort. The framing. Because once you believe that people are doing the best they can with the tools they have, everything changes. You stop asking, “Why don’t they just fix it?” and start asking, “What’s missing from the toolbox?” The illusion of equal opportunity We love to talk about “equal access” in this country, but the truth is, access is rarely equal. It’s shaped by geography, race, internet speed, ZIP code, history, policy, and yes, banking systems. You can’t teach people to swim and then throw them into a pool with no ladder. That’s what we do when we say, “Just build credit.” But we don’t acknowledge that millions of people are credit invisible or have a thin file because their rent, utility payments, or side hustle income doesn’t get counted. And then we wonder why so many people feel stuck. Let’s redesign the system like we believe in people What would it look like if we actually operated from the belief that people want to do well, and will, if given the right support? In my role at FICO, we’re constantly asking that question. We don’t just talk about financial inclusion. We’re reshaping how our tools show up in communities, how our education reaches people, and how our partnerships remove friction, not create more. We’ve launched programs that meet people where they are. Not just where we think they should be. We partner with nonprofit organizations, elected officials, and even local credit unions to host free credit education sessions, translated, and culturally relevant. Because accessibility isn’t just about logging in. It’s about feeling safe enough to show up. And what about the kids? This mindset shift isn’t just for adults, either. I’m a mom. And I’ve seen firsthand how easy it is to label kids as difficult, especially neurodivergent kids, when they’re just overwhelmed or unsupported. They don’t lack motivation. They lack tools, patience, and sometimes, a grown-up who gets it. Sound familiar? Adults are no different. Most of us are still carrying money habits, shame, and silence from childhood. If we weren’t taught how to manage money at 7, why do we expect everyone to have it figured out at 37? A better way forward So where do we go from here? We start by telling the truth: – Financial hardship isn’t a character flaw. – Credit education isn’t a luxury. – Access to opportunity should not depend on what side of the city you live on. And then we build programs, products, and policies that reflect that truth. That means working with communities, not on them. It means bringing empathy into corporate boardrooms. It means seeing people as capable, not broken. Because if we believe people do well if they can, then it’s on us to make sure they can. A final thought There’s someone out there right now who wants to fix their credit, get out of debt, or open their first savings account. They’re not lazy. They’re not unmotivated. They just haven’t had a fair shot. We don’t need to change people. We need to change how we see them, and what we give them to work with. Because people do well if they can. And they’re counting on us to act like it. Rukiya Kelly is global head of corporate impact and engagement at FICO. View the full article

-

5 Essential Questions for Employee Retention Surveys to Boost Engagement

In relation to employee retention, comprehending their needs is vital. You should consider asking five important questions in your surveys. These inquiries can reveal insights about career development, managerial support, work-life balance, recognition, and specific areas for improvement. By focusing on these aspects, you can create a more engaged workforce. Nonetheless, the challenge lies in crafting these questions effectively to obtain meaningful responses. Let’s explore how to do this. Key Takeaways What opportunities for career development do you value most, and how can we support your growth? How satisfied are you with the support and feedback you receive from your manager? Do you feel your work-life balance needs are being met, and what improvements would you suggest? How would you rate your relationships with coworkers, and do you feel collaboration is encouraged? What recognition do you feel you deserve for your contributions, and how can we better celebrate achievements? Understanding Employee Commitment and Satisfaction Comprehending employee commitment and satisfaction is crucial for any organization aiming to retain talent and boost productivity. To grasp these concepts, you must differentiate between satisfaction and engagement, as satisfied employees may not necessarily be engaged. Regularly using employee retention survey questions can help uncover insights into their experiences and frustrations. When employees understand how their roles align with company goals, their emotional investment increases, leading to higher commitment. Engaged employees are 87% less likely to leave, highlighting the importance of nurturing loyalty. By measuring satisfaction through targeted surveys, you can identify areas needing improvement, addressing issues before they lead to turnover. Prioritizing these surveys guarantees you create a supportive environment that values employee contributions. Assessing Career Development Opportunities Comprehending how career development opportunities impact employee retention can greatly inform your retention strategies. When conducting an employee retention survey, it’s essential to assess how employees perceive growth prospects within your organization. Consider these key points: Employees valuing career development are 15% more likely to stay. Regular training programs can reduce turnover rates by 34%. Open-ended questions can reveal aspirations and support gaps. 70% of employees cite advancement potential as important for engagement. Tailoring development strategies to individual needs improves retention. Evaluating Managerial Support and Team Dynamics Evaluating managerial support and team dynamics is essential for comprehending how these factors influence employee retention and engagement within your organization. Effective managerial support improves job satisfaction, whereas strong coworker relationships drive engagement. To gather insights, consider employee retention questions that address communication, feedback, and collaboration within teams. Employees who feel supported by their managers and peers are more likely to be committed and productive. A Gallup study highlights that engaged teams experience 21% greater productivity, emphasizing the significance of positive team dynamics. Regular feedback and open dialogue with managers additionally cultivate a more connected workforce. By addressing any team-related issues, you can improve morale and create an environment where employees thrive, in the end boosting retention. Measuring Work-Life Balance and Recognition How can measuring work-life balance and recognition impact employee retention? Comprehending these factors is vital, as nearly half of employees prioritize work-life balance over career advancement. To improve retention, you should consider the following retention survey questions: Are flexible work schedules available to you? How easy is it to request time off? Do you feel recognized for your contributions? How often are employee achievements celebrated? Is there open communication regarding work-life balance needs? Identifying Areas for Improvement Through Feedback Employee retention surveys serve as a valuable tool for organizations to pinpoint specific areas needing improvement based on employee feedback. By asking targeted retention questions, you can uncover common frustrations and dissatisfaction, such as lack of training or poor communication, that lead to turnover. Here’s a breakdown of key areas to explore: Area of Improvement Description Training Opportunities Identify gaps in employee training Communication Evaluate clarity and frequency of updates Skill Gaps Reveal deficiencies within teams Engagement Trends Monitor satisfaction over time Demographic Insights Tailor strategies to specific groups Regularly evaluating these areas through structured surveys enables your organization to adjust strategies and encourage a culture of continuous improvement. Frequently Asked Questions What Questions to Ask in an Employee Engagement Survey? To create an effective employee engagement survey, ask questions that cover key areas. You might include scaled questions like, “How satisfied are you with your current role?” or open-ended queries such as, “What changes would you suggest to improve your work experience?” Additionally, inquire about growth opportunities, communication effectiveness, and whether employees feel their feedback is valued. These questions help identify strengths and areas for improvement, boosting overall engagement and retention. What Are 5 Good Survey Questions for Employees? When crafting survey questions for employees, consider these five effective options: How likely are you to recommend our company to a friend? What growth opportunities do you see within the organization? How satisfied are you with the feedback you receive from management? Do you feel recognized for your contributions? Finally, what changes would you suggest to improve our workplace? These questions can help gauge satisfaction and identify areas for improvement. What Are Good Retention Questions? Good retention questions focus on comprehension of employee satisfaction and engagement. You might ask about their likelihood of recommending the company to friends, assess perceptions of growth opportunities, and evaluate fairness in compensation. Open-ended questions can invite suggestions for improvement, whereas scaled questions can measure satisfaction with feedback and communication from leadership. These inquiries help identify areas needing attention, finally enhancing employee experience and reducing turnover. What Are the 3 R’s of Employee Retention? The three R’s of employee retention are Recruitment, Retention, and Recognition. Recruitment involves attracting candidates who fit the company culture and possess the necessary skills. Retention focuses on keeping employees engaged through effective communication, growth opportunities, and addressing their needs. Recognition emphasizes acknowledging employees’ contributions, which can greatly improve engagement and loyalty. Conclusion Incorporating these five crucial questions into employee retention surveys can greatly improve engagement and satisfaction. By focusing on career development, managerial support, work-life balance, recognition, and open feedback, you can gain valuable insights into your team’s needs. Addressing these areas not only assists in retaining talent but also encourages a positive workplace culture. In the end, regularly evaluating these key factors allows you to implement targeted strategies that promote commitment and improve overall employee experience. Image Via Envato This article, "5 Essential Questions for Employee Retention Surveys to Boost Engagement" was first published on Small Business Trends View the full article

-

5 Essential Questions for Employee Retention Surveys to Boost Engagement

In relation to employee retention, comprehending their needs is vital. You should consider asking five important questions in your surveys. These inquiries can reveal insights about career development, managerial support, work-life balance, recognition, and specific areas for improvement. By focusing on these aspects, you can create a more engaged workforce. Nonetheless, the challenge lies in crafting these questions effectively to obtain meaningful responses. Let’s explore how to do this. Key Takeaways What opportunities for career development do you value most, and how can we support your growth? How satisfied are you with the support and feedback you receive from your manager? Do you feel your work-life balance needs are being met, and what improvements would you suggest? How would you rate your relationships with coworkers, and do you feel collaboration is encouraged? What recognition do you feel you deserve for your contributions, and how can we better celebrate achievements? Understanding Employee Commitment and Satisfaction Comprehending employee commitment and satisfaction is crucial for any organization aiming to retain talent and boost productivity. To grasp these concepts, you must differentiate between satisfaction and engagement, as satisfied employees may not necessarily be engaged. Regularly using employee retention survey questions can help uncover insights into their experiences and frustrations. When employees understand how their roles align with company goals, their emotional investment increases, leading to higher commitment. Engaged employees are 87% less likely to leave, highlighting the importance of nurturing loyalty. By measuring satisfaction through targeted surveys, you can identify areas needing improvement, addressing issues before they lead to turnover. Prioritizing these surveys guarantees you create a supportive environment that values employee contributions. Assessing Career Development Opportunities Comprehending how career development opportunities impact employee retention can greatly inform your retention strategies. When conducting an employee retention survey, it’s essential to assess how employees perceive growth prospects within your organization. Consider these key points: Employees valuing career development are 15% more likely to stay. Regular training programs can reduce turnover rates by 34%. Open-ended questions can reveal aspirations and support gaps. 70% of employees cite advancement potential as important for engagement. Tailoring development strategies to individual needs improves retention. Evaluating Managerial Support and Team Dynamics Evaluating managerial support and team dynamics is essential for comprehending how these factors influence employee retention and engagement within your organization. Effective managerial support improves job satisfaction, whereas strong coworker relationships drive engagement. To gather insights, consider employee retention questions that address communication, feedback, and collaboration within teams. Employees who feel supported by their managers and peers are more likely to be committed and productive. A Gallup study highlights that engaged teams experience 21% greater productivity, emphasizing the significance of positive team dynamics. Regular feedback and open dialogue with managers additionally cultivate a more connected workforce. By addressing any team-related issues, you can improve morale and create an environment where employees thrive, in the end boosting retention. Measuring Work-Life Balance and Recognition How can measuring work-life balance and recognition impact employee retention? Comprehending these factors is vital, as nearly half of employees prioritize work-life balance over career advancement. To improve retention, you should consider the following retention survey questions: Are flexible work schedules available to you? How easy is it to request time off? Do you feel recognized for your contributions? How often are employee achievements celebrated? Is there open communication regarding work-life balance needs? Identifying Areas for Improvement Through Feedback Employee retention surveys serve as a valuable tool for organizations to pinpoint specific areas needing improvement based on employee feedback. By asking targeted retention questions, you can uncover common frustrations and dissatisfaction, such as lack of training or poor communication, that lead to turnover. Here’s a breakdown of key areas to explore: Area of Improvement Description Training Opportunities Identify gaps in employee training Communication Evaluate clarity and frequency of updates Skill Gaps Reveal deficiencies within teams Engagement Trends Monitor satisfaction over time Demographic Insights Tailor strategies to specific groups Regularly evaluating these areas through structured surveys enables your organization to adjust strategies and encourage a culture of continuous improvement. Frequently Asked Questions What Questions to Ask in an Employee Engagement Survey? To create an effective employee engagement survey, ask questions that cover key areas. You might include scaled questions like, “How satisfied are you with your current role?” or open-ended queries such as, “What changes would you suggest to improve your work experience?” Additionally, inquire about growth opportunities, communication effectiveness, and whether employees feel their feedback is valued. These questions help identify strengths and areas for improvement, boosting overall engagement and retention. What Are 5 Good Survey Questions for Employees? When crafting survey questions for employees, consider these five effective options: How likely are you to recommend our company to a friend? What growth opportunities do you see within the organization? How satisfied are you with the feedback you receive from management? Do you feel recognized for your contributions? Finally, what changes would you suggest to improve our workplace? These questions can help gauge satisfaction and identify areas for improvement. What Are Good Retention Questions? Good retention questions focus on comprehension of employee satisfaction and engagement. You might ask about their likelihood of recommending the company to friends, assess perceptions of growth opportunities, and evaluate fairness in compensation. Open-ended questions can invite suggestions for improvement, whereas scaled questions can measure satisfaction with feedback and communication from leadership. These inquiries help identify areas needing attention, finally enhancing employee experience and reducing turnover. What Are the 3 R’s of Employee Retention? The three R’s of employee retention are Recruitment, Retention, and Recognition. Recruitment involves attracting candidates who fit the company culture and possess the necessary skills. Retention focuses on keeping employees engaged through effective communication, growth opportunities, and addressing their needs. Recognition emphasizes acknowledging employees’ contributions, which can greatly improve engagement and loyalty. Conclusion Incorporating these five crucial questions into employee retention surveys can greatly improve engagement and satisfaction. By focusing on career development, managerial support, work-life balance, recognition, and open feedback, you can gain valuable insights into your team’s needs. Addressing these areas not only assists in retaining talent but also encourages a positive workplace culture. In the end, regularly evaluating these key factors allows you to implement targeted strategies that promote commitment and improve overall employee experience. Image Via Envato This article, "5 Essential Questions for Employee Retention Surveys to Boost Engagement" was first published on Small Business Trends View the full article

-

What Is Operational Risk Management and Its Importance?

Operational Risk Management (ORM) is vital for organizations aiming to minimize losses from internal and external failures. It helps you identify potential risks, streamline processes, and improve overall decision-making. By nurturing a culture of awareness, ORM not just supports compliance and efficiency but furthermore builds stakeholder trust. Grasping its components and processes is important for effective implementation. Are you aware of the specific steps that can strengthen your organization’s ORM framework? Key Takeaways Operational Risk Management (ORM) minimizes losses from inadequate internal processes, human errors, systems, or external events through a structured framework. A proactive ORM approach fosters a culture of risk awareness, enhancing mission effectiveness and protecting organizations from potential threats. Effective ORM ensures regulatory compliance, reducing legal penalties and reputational damage while improving operational efficiency through streamlined processes. Continuous monitoring of Key Risk Indicators (KRIs) allows for timely interventions, enhancing decision-making and increasing overall stability and profitability. Technology integration in ORM facilitates automation, analytics, and collaboration, making it essential for proactive risk management and continuous improvement. Understanding Operational Risk Management Operational risk management (ORM) is fundamental for organizations aiming to minimize losses stemming from inadequate or failed internal processes, people, systems, or external events. By implementing an operational risk management framework, you can systematically identify potential hazards through an operational risk evaluation. This process includes five critical steps: identifying risks, evaluating their impact and likelihood, prioritizing them, mitigating identified risks, and continuously monitoring the effectiveness of your strategies. Utilizing Key Risk Indicators (KRIs) helps measure the likelihood and impact of these operational risks, guiding your decision-making. A robust ORM process not only reduces operational losses but likewise improves compliance and cultivates a risk-aware culture, ultimately supporting the organization’s strategic objectives and resilience in a dynamic environment. The Importance of Operational Risk Management Comprehending the importance of Operational Risk Management (ORM) is essential for enhancing mission effectiveness and reducing financial losses. By systematically identifying and mitigating risks, you can guarantee smoother operations and better decision-making. Implementing strong ORM practices not merely protects your organization from potential threats but likewise cultivates a culture of awareness and accountability among team members. Enhances Mission Effectiveness By minimizing disruptions to daily operations, effective risk management greatly improves mission effectiveness across organizations. Implementing operational risk management steps guarantees that potential hazards are recognized and addressed before they escalate. This proactive approach cultivates a culture of risk awareness, encouraging employees to identify and mitigate operational risks that could hinder critical processes. By employing robust operational risk mitigation strategies, you improve decision-making capabilities and operational efficiency at all management levels. Furthermore, strong ORM practices support crisis preparedness by establishing contingency plans, safeguarding assets, and guaranteeing business continuity during unforeseen disruptions. In the end, organizations committed to operational risk management not merely comply with regulatory requirements but likewise maintain stakeholder trust, which is crucial for achieving mission effectiveness. Reduces Financial Losses Effective operational risk management (ORM) plays a vital role in minimizing financial losses for organizations. By proactively identifying and mitigating potential disruptions, you can protect your assets and improve overall stability. Here are three key benefits of ORM: Reduced Loss Events: Companies with strong ORM practices can see up to a 30% reduction in loss events, according to studies. Early Risk Detection: Continuous monitoring of key risk indicators (KRIs) allows for timely interventions, preventing costly incidents. Enhanced Decision-Making: A culture of risk awareness leads to better decision-making, ultimately increasing profitability. Understanding operational risk management meaning and definition is fundamental, as it encompasses various operational risk examples and employs specific operational risk management tools to safeguard your organization’s financial health. Key Components of Operational Risk Operational risk management (ORM) encompasses a variety of critical components that organizations must address to safeguard their operations and minimize potential losses. The primary sources of operational risk include people, processes, systems, and external events. Each of these sources requires customized mitigation strategies to effectively manage risk. Key risk indicators (KRIs) play an essential role in ORM, offering measurable metrics that help you track operational risks and evaluate the effectiveness of your risk management practices. Furthermore, employee conduct is a significant aspect of operational risk, as human errors and intentional wrongdoing can lead to substantial financial losses and operational disruptions. Steps in the Operational Risk Management Process When you approach the operational risk management process, you’ll begin by identifying potential risks that could impact your mission. Next, you’ll develop risk mitigation strategies to address these vulnerabilities, ensuring you have a plan in place. Finally, continuous monitoring practices are crucial to track the effectiveness of your controls and adapt to any changes in your environment. Risk Identification Techniques Risk identification serves as the cornerstone of the Operational Risk Management (ORM) process, enabling organizations to pinpoint vulnerabilities and threats that could disrupt daily operations. To effectively identify risks, you can employ various risk identification techniques: Scenario Analysis: Assess possible future scenarios to uncover potential operational risks. Risk Assessment Matrix: Categorize identified risks by likelihood and impact, classifying them into operational risk categories such as high, moderate, or low. Continuous Monitoring: Implement systems to track risks over time, ensuring you can adapt to emerging threats. These techniques help clarify the operational risk definition and guide organizations in developing robust risk mitigation strategies, eventually leading to safer and more efficient operations. Risk Mitigation Strategies Developing effective risk mitigation strategies is vital to the success of the Operational Risk Management (ORM) process, as it enables you to address identified risks systematically. During the assess step of the ORM process, you evaluate risks based on their likelihood and impact, which informs your mitigation approach. You can transfer risk through insurance, avoid it by altering processes, accept it when benefits outweigh losses, or mitigate it through improved controls and procedures. Utilizing a risk assessment matrix helps categorize risks as high, moderate, or low, allowing for prioritized action. To guarantee ongoing effectiveness, continuous monitoring of identified risks using Key Risk Indicators (KRIs) is fundamental, enabling you to adapt strategies as the operational environment evolves. Continuous Monitoring Practices Continuous monitoring practices are essential to the effectiveness of the Operational Risk Management (ORM) process, as they enable organizations to adapt to evolving risks and maintain robust controls. To implement effective continuous monitoring, consider these key elements: Utilize Key Risk Indicators (KRIs): Track measurable metrics that signal potential operational risk events, allowing for timely interventions. Automate Data Collection: Implement automated systems to improve efficiency, enabling real-time identification of risk trends and anomalies. Establish Reporting Protocols: Guarantee regular reports to senior leadership on operational risk status and mitigation effectiveness, cultivating a proactive risk management culture. Benefits of Effective Operational Risk Management Though many organizations may overlook the significance of Operational Risk Management (ORM), implementing effective ORM practices can yield substantial benefits that improve overall performance. By cultivating a risk-aware culture, you encourage proactive identification and reporting of risks, which boosts organizational performance. Effective ORM helps reduce costs, as it identifies and mitigates potential losses, preventing financial setbacks from operational disruptions. Furthermore, strong ORM frameworks position your organization to maintain regulatory compliance, minimizing legal penalties and reputational damage. You’ll find that thorough ORM strategies increase operational efficiency; streamlined processes and better risk controls lead to more agile and resilient operations. In the end, these benefits not only elevate your organization’s performance but likewise improve stakeholder relationships and customer loyalty. Common Challenges in Operational Risk Management Operational Risk Management (ORM) faces several common challenges that can hinder its effective implementation within organizations. Addressing these obstacles is essential for enhancing your risk management strategies: Insufficient Resources: Many organizations fail to allocate adequate resources for ORM, limiting their ability to identify and mitigate risks effectively. Limited Awareness: A lack of comprehension about ORM’s importance among boards and executives can prevent it from being treated as a strategic priority, affecting overall resilience. Communication Issues: Poor communication within the organization can lead to diminished prioritization of ORM, resulting in weak implementation of risk management strategies. Examples of Operational Risks Comprehending the various examples of operational risks is crucial for effectively managing and mitigating potential threats within an organization. One major type of operational risk involves employee conduct, where human errors or intentional wrongdoing can lead to fraud or operational failures. Cybersecurity threats are another significant concern, with data breaches jeopardizing sensitive information and damaging reputations. Technology-related risks, such as system outages, can disrupt business operations, especially in industries reliant on automation. Furthermore, business process inefficiencies may increase operational costs and result in missed opportunities. External events, including natural disasters or regulatory changes, likewise pose operational risks, directly impacting an organization’s ability to maintain business continuity and comply with legal requirements, especially evident in operational risk in banks. The Role of Technology in Operational Risk Management In today’s fast-paced business environment, technology is vital for enhancing the effectiveness of Operational Risk Management (ORM). By utilizing advanced tools, you can streamline processes and improve risk assessment. Here are three key ways technology supports ORM: Operational Risk Management Software: Automates monitoring and reporting, making risk assessments more efficient. Advanced Analytics: Employs machine learning algorithms to detect patterns and anomalies, helping you manage risks proactively. Cloud-Based Solutions: Facilitates collaboration across departments, ensuring a unified approach to ORM and allowing for quick adjustments to evolving risks. Integrating Key Risk Indicators (KRIs) into your technology platforms provides real-time insights, enabling informed decision-making and timely interventions. Embracing these technological advancements is fundamental for effective operational risk management. Building a Strong Operational Risk Management Framework Establishing a strong Operational Risk Management (ORM) framework is essential for any organization aiming to navigate the intricacies of today’s business environment. This framework helps you systematically identify, assess, and mitigate operational risks by establishing clear policies and procedures. Regular risk assessments using a Risk Assessment Matrix categorize risks as high, moderate, or low, ensuring you prioritize mitigation efforts effectively. Incorporating Key Risk Indicators (KRIs) allows you to monitor these risks continuously, providing early warning signals that enable timely responses to potential disruptions. Furthermore, a focus on continuous improvement within the ORM framework encourages adaptability to changing environments and emerging risks, ultimately enhancing decision-making, resource allocation, and overall organizational performance aligned with strategic business objectives. Frequently Asked Questions What Is the Importance of Operational Risk Management? Operational risk management is essential for maintaining organizational stability and efficiency. It helps you identify potential risks within processes, systems, and personnel, allowing you to mitigate them before they escalate. What Are the 4 Principles of ORM? The four principles of Operational Risk Management (ORM) are vital for effective risk management. First, you should encourage a risk-aware culture, prompting everyone to recognize and report potential risks. Second, implementing effective internal controls helps minimize operational failures. Third, continuous risk assessment and monitoring are critical for identifying emerging risks and evaluating controls. Finally, promote proactive risk mitigation strategies, developing contingency plans that improve resilience against operational disruptions, ensuring your organization adapts effectively. What Are the 4 Operational Risks? You should be aware that there are four main operational risks: people, processes, systems, and external events. People risk involves human error or intentional misconduct, which can lead to considerable failures. Process risk pertains to inefficiencies within organizational procedures, affecting performance. Systems risk relates to vulnerabilities in technology that could disrupt operations. Finally, external events risk includes unpredictable factors, such as natural disasters or regulatory changes, that can greatly impact business continuity. What Are the 4 Ps of Operational Risk? The 4 Ps of operational risk are People, Processes, Systems, and External Events. People risks involve human errors or misconduct that can lead to operational failures. Process risks stem from inefficiencies in internal procedures, potentially causing disruptions. Systems risks relate to technological failures or cybersecurity threats affecting data integrity. Ultimately, External Events risks encompass outside factors, such as natural disasters or regulatory changes, which can impact your organization’s operational continuity and effectiveness. Conclusion In summary, operational risk management is vital for organizations seeking to minimize potential losses and improve overall effectiveness. By systematically identifying and addressing risks, you can cultivate a culture of awareness, enhance decision-making, and maintain compliance. A robust ORM framework both safeguards assets and operations while bolstering stakeholder trust. Embracing technology further supports your efforts in managing risks efficiently. In the end, effective ORM is a key driver in achieving strategic objectives in a constantly changing environment. Image Via Envato This article, "What Is Operational Risk Management and Its Importance?" was first published on Small Business Trends View the full article

-

What Is Operational Risk Management and Its Importance?

Operational Risk Management (ORM) is vital for organizations aiming to minimize losses from internal and external failures. It helps you identify potential risks, streamline processes, and improve overall decision-making. By nurturing a culture of awareness, ORM not just supports compliance and efficiency but furthermore builds stakeholder trust. Grasping its components and processes is important for effective implementation. Are you aware of the specific steps that can strengthen your organization’s ORM framework? Key Takeaways Operational Risk Management (ORM) minimizes losses from inadequate internal processes, human errors, systems, or external events through a structured framework. A proactive ORM approach fosters a culture of risk awareness, enhancing mission effectiveness and protecting organizations from potential threats. Effective ORM ensures regulatory compliance, reducing legal penalties and reputational damage while improving operational efficiency through streamlined processes. Continuous monitoring of Key Risk Indicators (KRIs) allows for timely interventions, enhancing decision-making and increasing overall stability and profitability. Technology integration in ORM facilitates automation, analytics, and collaboration, making it essential for proactive risk management and continuous improvement. Understanding Operational Risk Management Operational risk management (ORM) is fundamental for organizations aiming to minimize losses stemming from inadequate or failed internal processes, people, systems, or external events. By implementing an operational risk management framework, you can systematically identify potential hazards through an operational risk evaluation. This process includes five critical steps: identifying risks, evaluating their impact and likelihood, prioritizing them, mitigating identified risks, and continuously monitoring the effectiveness of your strategies. Utilizing Key Risk Indicators (KRIs) helps measure the likelihood and impact of these operational risks, guiding your decision-making. A robust ORM process not only reduces operational losses but likewise improves compliance and cultivates a risk-aware culture, ultimately supporting the organization’s strategic objectives and resilience in a dynamic environment. The Importance of Operational Risk Management Comprehending the importance of Operational Risk Management (ORM) is essential for enhancing mission effectiveness and reducing financial losses. By systematically identifying and mitigating risks, you can guarantee smoother operations and better decision-making. Implementing strong ORM practices not merely protects your organization from potential threats but likewise cultivates a culture of awareness and accountability among team members. Enhances Mission Effectiveness By minimizing disruptions to daily operations, effective risk management greatly improves mission effectiveness across organizations. Implementing operational risk management steps guarantees that potential hazards are recognized and addressed before they escalate. This proactive approach cultivates a culture of risk awareness, encouraging employees to identify and mitigate operational risks that could hinder critical processes. By employing robust operational risk mitigation strategies, you improve decision-making capabilities and operational efficiency at all management levels. Furthermore, strong ORM practices support crisis preparedness by establishing contingency plans, safeguarding assets, and guaranteeing business continuity during unforeseen disruptions. In the end, organizations committed to operational risk management not merely comply with regulatory requirements but likewise maintain stakeholder trust, which is crucial for achieving mission effectiveness. Reduces Financial Losses Effective operational risk management (ORM) plays a vital role in minimizing financial losses for organizations. By proactively identifying and mitigating potential disruptions, you can protect your assets and improve overall stability. Here are three key benefits of ORM: Reduced Loss Events: Companies with strong ORM practices can see up to a 30% reduction in loss events, according to studies. Early Risk Detection: Continuous monitoring of key risk indicators (KRIs) allows for timely interventions, preventing costly incidents. Enhanced Decision-Making: A culture of risk awareness leads to better decision-making, ultimately increasing profitability. Understanding operational risk management meaning and definition is fundamental, as it encompasses various operational risk examples and employs specific operational risk management tools to safeguard your organization’s financial health. Key Components of Operational Risk Operational risk management (ORM) encompasses a variety of critical components that organizations must address to safeguard their operations and minimize potential losses. The primary sources of operational risk include people, processes, systems, and external events. Each of these sources requires customized mitigation strategies to effectively manage risk. Key risk indicators (KRIs) play an essential role in ORM, offering measurable metrics that help you track operational risks and evaluate the effectiveness of your risk management practices. Furthermore, employee conduct is a significant aspect of operational risk, as human errors and intentional wrongdoing can lead to substantial financial losses and operational disruptions. Steps in the Operational Risk Management Process When you approach the operational risk management process, you’ll begin by identifying potential risks that could impact your mission. Next, you’ll develop risk mitigation strategies to address these vulnerabilities, ensuring you have a plan in place. Finally, continuous monitoring practices are crucial to track the effectiveness of your controls and adapt to any changes in your environment. Risk Identification Techniques Risk identification serves as the cornerstone of the Operational Risk Management (ORM) process, enabling organizations to pinpoint vulnerabilities and threats that could disrupt daily operations. To effectively identify risks, you can employ various risk identification techniques: Scenario Analysis: Assess possible future scenarios to uncover potential operational risks. Risk Assessment Matrix: Categorize identified risks by likelihood and impact, classifying them into operational risk categories such as high, moderate, or low. Continuous Monitoring: Implement systems to track risks over time, ensuring you can adapt to emerging threats. These techniques help clarify the operational risk definition and guide organizations in developing robust risk mitigation strategies, eventually leading to safer and more efficient operations. Risk Mitigation Strategies Developing effective risk mitigation strategies is vital to the success of the Operational Risk Management (ORM) process, as it enables you to address identified risks systematically. During the assess step of the ORM process, you evaluate risks based on their likelihood and impact, which informs your mitigation approach. You can transfer risk through insurance, avoid it by altering processes, accept it when benefits outweigh losses, or mitigate it through improved controls and procedures. Utilizing a risk assessment matrix helps categorize risks as high, moderate, or low, allowing for prioritized action. To guarantee ongoing effectiveness, continuous monitoring of identified risks using Key Risk Indicators (KRIs) is fundamental, enabling you to adapt strategies as the operational environment evolves. Continuous Monitoring Practices Continuous monitoring practices are essential to the effectiveness of the Operational Risk Management (ORM) process, as they enable organizations to adapt to evolving risks and maintain robust controls. To implement effective continuous monitoring, consider these key elements: Utilize Key Risk Indicators (KRIs): Track measurable metrics that signal potential operational risk events, allowing for timely interventions. Automate Data Collection: Implement automated systems to improve efficiency, enabling real-time identification of risk trends and anomalies. Establish Reporting Protocols: Guarantee regular reports to senior leadership on operational risk status and mitigation effectiveness, cultivating a proactive risk management culture. Benefits of Effective Operational Risk Management Though many organizations may overlook the significance of Operational Risk Management (ORM), implementing effective ORM practices can yield substantial benefits that improve overall performance. By cultivating a risk-aware culture, you encourage proactive identification and reporting of risks, which boosts organizational performance. Effective ORM helps reduce costs, as it identifies and mitigates potential losses, preventing financial setbacks from operational disruptions. Furthermore, strong ORM frameworks position your organization to maintain regulatory compliance, minimizing legal penalties and reputational damage. You’ll find that thorough ORM strategies increase operational efficiency; streamlined processes and better risk controls lead to more agile and resilient operations. In the end, these benefits not only elevate your organization’s performance but likewise improve stakeholder relationships and customer loyalty. Common Challenges in Operational Risk Management Operational Risk Management (ORM) faces several common challenges that can hinder its effective implementation within organizations. Addressing these obstacles is essential for enhancing your risk management strategies: Insufficient Resources: Many organizations fail to allocate adequate resources for ORM, limiting their ability to identify and mitigate risks effectively. Limited Awareness: A lack of comprehension about ORM’s importance among boards and executives can prevent it from being treated as a strategic priority, affecting overall resilience. Communication Issues: Poor communication within the organization can lead to diminished prioritization of ORM, resulting in weak implementation of risk management strategies. Examples of Operational Risks Comprehending the various examples of operational risks is crucial for effectively managing and mitigating potential threats within an organization. One major type of operational risk involves employee conduct, where human errors or intentional wrongdoing can lead to fraud or operational failures. Cybersecurity threats are another significant concern, with data breaches jeopardizing sensitive information and damaging reputations. Technology-related risks, such as system outages, can disrupt business operations, especially in industries reliant on automation. Furthermore, business process inefficiencies may increase operational costs and result in missed opportunities. External events, including natural disasters or regulatory changes, likewise pose operational risks, directly impacting an organization’s ability to maintain business continuity and comply with legal requirements, especially evident in operational risk in banks. The Role of Technology in Operational Risk Management In today’s fast-paced business environment, technology is vital for enhancing the effectiveness of Operational Risk Management (ORM). By utilizing advanced tools, you can streamline processes and improve risk assessment. Here are three key ways technology supports ORM: Operational Risk Management Software: Automates monitoring and reporting, making risk assessments more efficient. Advanced Analytics: Employs machine learning algorithms to detect patterns and anomalies, helping you manage risks proactively. Cloud-Based Solutions: Facilitates collaboration across departments, ensuring a unified approach to ORM and allowing for quick adjustments to evolving risks. Integrating Key Risk Indicators (KRIs) into your technology platforms provides real-time insights, enabling informed decision-making and timely interventions. Embracing these technological advancements is fundamental for effective operational risk management. Building a Strong Operational Risk Management Framework Establishing a strong Operational Risk Management (ORM) framework is essential for any organization aiming to navigate the intricacies of today’s business environment. This framework helps you systematically identify, assess, and mitigate operational risks by establishing clear policies and procedures. Regular risk assessments using a Risk Assessment Matrix categorize risks as high, moderate, or low, ensuring you prioritize mitigation efforts effectively. Incorporating Key Risk Indicators (KRIs) allows you to monitor these risks continuously, providing early warning signals that enable timely responses to potential disruptions. Furthermore, a focus on continuous improvement within the ORM framework encourages adaptability to changing environments and emerging risks, ultimately enhancing decision-making, resource allocation, and overall organizational performance aligned with strategic business objectives. Frequently Asked Questions What Is the Importance of Operational Risk Management? Operational risk management is essential for maintaining organizational stability and efficiency. It helps you identify potential risks within processes, systems, and personnel, allowing you to mitigate them before they escalate. What Are the 4 Principles of ORM? The four principles of Operational Risk Management (ORM) are vital for effective risk management. First, you should encourage a risk-aware culture, prompting everyone to recognize and report potential risks. Second, implementing effective internal controls helps minimize operational failures. Third, continuous risk assessment and monitoring are critical for identifying emerging risks and evaluating controls. Finally, promote proactive risk mitigation strategies, developing contingency plans that improve resilience against operational disruptions, ensuring your organization adapts effectively. What Are the 4 Operational Risks? You should be aware that there are four main operational risks: people, processes, systems, and external events. People risk involves human error or intentional misconduct, which can lead to considerable failures. Process risk pertains to inefficiencies within organizational procedures, affecting performance. Systems risk relates to vulnerabilities in technology that could disrupt operations. Finally, external events risk includes unpredictable factors, such as natural disasters or regulatory changes, that can greatly impact business continuity. What Are the 4 Ps of Operational Risk? The 4 Ps of operational risk are People, Processes, Systems, and External Events. People risks involve human errors or misconduct that can lead to operational failures. Process risks stem from inefficiencies in internal procedures, potentially causing disruptions. Systems risks relate to technological failures or cybersecurity threats affecting data integrity. Ultimately, External Events risks encompass outside factors, such as natural disasters or regulatory changes, which can impact your organization’s operational continuity and effectiveness. Conclusion In summary, operational risk management is vital for organizations seeking to minimize potential losses and improve overall effectiveness. By systematically identifying and addressing risks, you can cultivate a culture of awareness, enhance decision-making, and maintain compliance. A robust ORM framework both safeguards assets and operations while bolstering stakeholder trust. Embracing technology further supports your efforts in managing risks efficiently. In the end, effective ORM is a key driver in achieving strategic objectives in a constantly changing environment. Image Via Envato This article, "What Is Operational Risk Management and Its Importance?" was first published on Small Business Trends View the full article

-

I built an AI notetaker to capture every meeting

Last week, I walked into a meeting where AI notetakers outnumbered humans three to one. The irony wasn’t lost on me—I built one of them. As CEO of Fireflies, I’ve helped put AI in millions of meetings. And I believe AI should be in every meeting—because knowledge shouldn’t vanish the moment we hang up. But having the right privacy controls to protect sensitive moments is key to using an AI notetaker. THE PRIVACY-FIRST DECISION FRAMEWORK Before your next meeting, ask yourself three questions: Who controls the data? Every meeting should be captured, but not every recording needs to be shared. Use private meeting settings, control access permissions, and set retention policies that auto-delete after a certain number of days. Who needs access? The power of AI is capturing everything. The responsibility is controlling who sees what. Share broadly for team updates, narrowly for performance reviews, not at all for sensitive discussions. What’s the exit strategy? Even in meetings that should be recorded, participants need an out. Make it easy to kick out the bot mid-meeting, delete recordings immediately, or set auto-expiration dates. MAKE SMARTER CHOICES The proliferation of AI meeting assistants means you’re no longer just choosing whether to use one—you’re choosing which one protects your conversations. Thoughtful professionals are asking the right questions: Does this tool train on my company’s data? Can I delete recordings immediately? Who actually has access to my conversations? The answers matter. The difference between a tool that respects your privacy and one that doesn’t isn’t always obvious in the demo. Look for providers who are transparent about their data practices. The ones who make security boring and straightforward, not the ones who make it complicated. YOUR IMPLEMENTATION ROADMAP If you’re ready to be more intentional about AI in meetings, here’s a simple approach: Week 1-2: Assess. Look at your calendar. Which meetings generate clear action items? Which are primarily about building relationships? Start identifying patterns. Week 3-4: Pilot. Try AI assistants in information-heavy meetings first—trainings, quarterly reviews, customer calls. Week 5-6: Establish principles. Based on what worked, create simple guidelines for your team. Not rigid rules—just shared understanding about when AI helps and when it doesn’t. Ongoing: Iterate. As AI capabilities evolve from passive note-taking to active participation, keep refining your approach. The goal isn’t perfection; it’s progress. YOUR NEXT MEETING Tomorrow, you’ll likely face the same choice millions of knowledge workers face daily: Should I add an AI notetaker to this meeting? Now you have a brief framework for capturing everything while protecting what matters. That’s also why Fireflies published guidelines for responsible AI meeting use. Because being intentional about privacy isn’t limiting AI—it’s using it wisely. The future isn’t about choosing which meetings deserve AI—they all do. It’s about having sophisticated enough controls to protect privacy while preserving knowledge. Capture everything. Share thoughtfully. Delete when appropriate. Krish Ramineni is CEO and cofounder of Fireflies.ai View the full article

-

What accessible bathrooms can teach every entrepreneur

When most people hear the word luxury, they think of exclusivity: high-end materials, bespoke finishes, and designs tailored for the few. But a quiet revolution is underway. The true measure of luxury today is accessibility: designing environments that are beautiful, functional, safe, and empowering for every body. Nowhere is this more urgent, or more overlooked, than in the bathroom. According to the CDC, the bathroom is the most dangerous room in the house. There are 234,000 annual bathroom-related injuries in the U.S, with 81% caused by falls. For older adults, those falls can trigger a cascade of consequences: loss of independence, costly healthcare expenses, and a diminished quality of life. And yet, despite the bathroom being one of the most hazardous rooms in the home, its design has long been guided by aesthetics alone or, at the opposite extreme, clunky, clinical looking “solutions” that compromise dignity. At Michael Graves Design, we’ve sought to lead a paradigm shift proving that the future of luxury is accessibility. In our second collaboration with Pottery Barn, we’ve introduced a collection of accessible bathroom products: a vanity with integrated grab bar, a new “grab frame” inspired by garden trellises combining architectural elegance with versatile safety support, and discreet grab bars built into a towel bar and a toilet paper holder. The collection shows how safety and style can, and must, live side by side. ACCESSIBLE LUXURY ACROSS LIFE’S FULL ARC For decades, accessibility was treated as an afterthought, bolt-on products carrying the stigma of hospitals and institutions. This reinforced the false idea that you can either have a safe bathroom or a beautiful one, but not both. Our new collection challenges that assumption. A vanity can be refined, inviting, and intuitive while also being easy to navigate with limited mobility. A grab frame can be an interior design feature as much as a safety tool. Grab bars integrated into everyday accessories can blend seamlessly with surrounding materials, enhancing the overall space rather than detracting from it. But bathrooms aren’t only sites of risk; they are deeply emotional spaces. They’re where we begin and end our days, where children learn independence, where parents find a moment of solitude, and where older adults maintain dignity and autonomy. Designing items for the bathroom means designing for life’s most intimate transitions. That’s why we think about the bathroom as both a present day necessity and a long-term investment in lifespan design. More households today are multigenerational, blending the needs of children, parents, and grandparents under one roof. Aging-in-place is a growing aspiration with enormous market implications. And temporary conditions, from injury to pregnancy to recovery from surgery, remind us accessibility is a universal human experience. The same toilet paper holder with integrated grab bar that provides peace of mind for an older adult may also serve a child learning to balance or a teenager recovering from an injury. The same vanity that feels luxurious to one person also offers essential reach, stability, and comfort to another. This is design as foresight: solutions that adapt gracefully to evolving household needs rather than forcing costly renovations later. By reframing accessibility as an essential part of luxury, not a limitation on it, we elevate the daily rituals of bathing, grooming, and self-care into experiences that feel dignified and restorative for every member of the household. This product strategy extends beyond the bathroom, presenting opportunities to address the activities of daily living more broadly. DESIGN AS ANTICIPATION To that end, the lesson extends beyond bathrooms. Design, at its best, is a form of anticipation, a way of seeing around corners and preparing for the moments when people need support most. Accessibility is about creating resilient environments that hold up under real-life pressures. For businesses, this shift has profound implications. The companies that anticipate and meet the needs of diverse users will build deeper loyalty, longer product life cycles, and more durable brands. Those who continue to design for a “typical” user will miss opportunities hiding in plain sight. 5 LESSONS FOR EVERY ENTREPRENEUR Not every business will design bathroom fixtures, but the principles that guide accessible luxury apply across industries. Here are five takeaways: Redefine luxury through accessibility The strongest brands of the future will be those that make people feel included and empowered. Design for lifespan, not a snapshot Products and services that adapt and anticipate customers’ evolving needs earn lasting loyalty. Use constraints as creativity catalysts Accessibility challenges often spark breakthroughs that benefit everyone. Blend purpose with personality People may buy for function, but they become brand loyalists when design delivers dignity, joy, and peace of mind. Expand your perspective beyond the “average” user There is no average customer; designing for edge cases often reveals universal value. TOWARD A NEW STANDARD We stand at a crossroads. Demographic shifts, cultural expectations, and personal experiences are reshaping how we define the modern home. For some, accessibility is already a necessity. For others, it is an inevitability. For all of us, it should be an expectation. The bathroom may be one of the smallest rooms in the house, but it carries outsized importance in our health, independence, and dignity. By reimagining it through the lens of accessible luxury and lifespan design, we can transform not just a room, but the very idea of what it means to live well. Luxury is no longer about gold-plated fixtures or marble countertops. Luxury is being able to live comfortably, safely, and beautifully, at every age, in every circumstance, for every body. That is the standard we should all be designing toward. Ben Wintner is CEO of Michael Graves Design. View the full article

-

For Prime Day, Amazon Is Unloading Its Echo Smart Glasses for a Big Discount

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. Amazon Big Deal Days is October 7-8, and Lifehacker is sharing the best bargains, based on product reviews, comparisons, and price-tracking tools. Follow our live blog to stay up to date on the best sales we find. Subscribe to our shopping newsletter, Add to Cart, for the best sales sent to your inbox. New to Prime Day? We have a primer on everything you need to know. Sales are accurate at the time of publication, but prices and inventory are always subject to change. You have to be careful with sales; retailers will often jack up the prices before the sale to make the discount seem big—but that is not the case with these Echo smart glasses. Amazon really seems to be trying to unload a serviceable-but-unpopular product, so they're selling 'em for very cheap. The Big Deals day price is $119.99, marked down from $329.99. That's a 64% savings on perfectly respectable audio sunglasses and prescription-ready frames. Amazon Echo Frames, an Alexa device (newest model), Smart glasses with Alexa, Round frames in Blue Tortoise with polarized sunglass lenses $119.99 at Amazon $329.99 Save $210.00 Get Deal Get Deal $119.99 at Amazon $329.99 Save $210.00 These are Gen 3 Echo glasses that came out in 2023, so they're not hopelessly outdated, they just didn't sell as well as Amazon might have hoped. But they're not bad. They connect hands-free with any Alexa devices, so you can bark out "Hey, Alexa" and use Amazon's agent like you would on any device—play some music, answer a question, control your smart home—all that stuff, right from your glasses. Are they as cool and useful as Ray-Ban Metas? Not even close, but nobody is selling Metas for $119. I mean, that's a low price for a pair of dumb glasses that don't do anything but help you see better, so if you're in the market for a second pair of eyeglasses or sunglasses, and/or you use Alexa, I recommend taking advantage of this deal. Looking for something else? Retailers like Walmart and Best Buy have Prime Day competition sales that are especially useful if you don’t have Amazon Prime. Walmart’s Prime Day competition sale runs from Oct. 6 at 7 p.m. ET through Oct. 12 and includes deals up to 50% off. It’s an especially good option if you have Walmart+. Best Buy’s Prime Day competition sale runs from Sept. 27 through Oct. 12, and has some of the best tech sales online. It’s an especially good option if you’re a My Best Buy “Plus” or “Total” member. Target’s Prime Day competition sale runs from Oct. 5 through Oct. 11, and it has deals going up to 50% off. You can become a Circle member for free. Our Best Editor-Vetted Prime Day Deals Right Now Apple AirPods Pro 2 Noise Cancelling Wireless Earbuds — $169.99 (List Price $249.00) Meta Quest 3S 128GB All-In-One VR Headset — $249.00 (List Price $299.99) Apple iPad 11" 128GB A16 WiFi Tablet (Blue, 2025) — $279.00 (List Price $349.00) DJI Mini 4K 3-Axis Gimbal Camera Drone (Under 249 Grams) — $239.00 (List Price $299.00) Samsung Galaxy Tab A9+ 10.9" 64GB Wi-Fi Tablet (Graphite) — $148.94 (List Price $219.99) Blink Mini 2 1080p Indoor Security Camera (2-Pack, White) — $34.99 (List Price $69.99) Ring Battery Doorbell Plus — $79.99 (List Price $149.99) Shark AV2501S AI Ultra Robot Vacuum with HEPA Self-Empty Base — $229.99 (List Price $549.99) Amazon Fire HD 10 (2023) — $69.99 (List Price $139.99) Wyze Cam v4 2K Wired Wi-Fi Smart Security Camera (White) — $25.95 (List Price $35.98) Deals are selected by our commerce team View the full article

-

Pelotons Are on Sale for Prime Day

We may earn a commission from links on this page. Deal pricing and availability subject to change after time of publication. Amazon Big Deal Days is coming October 7-8, and Lifehacker is sharing the best sales based on product reviews, comparisons, and price-tracking tools before it’s over. Follow our live blog to stay up to date on the best sales we find. Subscribe to our shopping newsletter, Add to Cart, for the best sales sent to your inbox. New to Prime Day? We have a primer on everything you need to know. Sales are accurate at the time of publication, but prices and inventory are always subject to change. Last week, Peloton rolled out a whole bunch of new updates on everything from its software to its famous at-home workout equipment. This week, the company is joining the ranks of those offering steep discounts to shoppers during Amazon's Prime Big Deal Days, which run from Tuesday, October 7, through Wednesday, October 8. If you're in the market for some exercise equipment, this is your moment. The original Peloton Bike and Bike+ are 28% offNo, the new equipment line (known as the Cross Training series) isn't on sale, but you can still get one of the classic Peloton offerings at a great price right now. The Bike+, a stationary cycle I personally love, is 28% off right now, making it $1,795 instead of $2,495. Peloton Bike+ $1,795.00 at Amazon $2,495.00 Save $700.00 Get Deal Get Deal $1,795.00 at Amazon $2,495.00 Save $700.00 The classic Bike is also down 28%, making it $1,045 instead of 1,445. To understand the differences between these discounted offerings and the new models (which retail for $2,695 and $1,695, respectively), read my explainer here. Want to know the differences between the discounted models themselves? I have you covered again. Basically, the new, upgraded models have some tweaks like phone holders and cushier seats, as well as a motion-tracking camera and a full swivel screen that can help you as you move from cycling to other exercises, like strength training or yoga. They also have better audio and wifi and Bluetooth connectivity. Importantly, the new software updates—which include things like an AI-powered coaching program I've been loving—run just fine on older models, so you're not missing out there if you have or choose to get one of the non-Cross Training pieces of equipment. The Bike+, even in its older iteration, has auto-adjusting resistance, which the regular Bike lacks. Peloton accessories on saleBut that's not all! Accessories are also marked down. Cycling shoes from the brand are down 20% to $99, a mat for underneath your bike is 15% off at $64, and dumbbells are also down 15% to $47. Check out the Peloton Amazon storefront here to see what your home gym setup is missing—and what you can get on the cheap during the shopping holiday. Looking for something else? Retailers like Walmart and Best Buy have Prime Day competition sales that are especially useful if you don’t have Amazon Prime. Walmart’s Prime Day competition sale runs from Oct. 6 at 7 p.m. ET through Oct. 12 and includes deals up to 50% off. It’s an especially good option if you have Walmart+. Best Buy’s Prime Day competition sale runs from Sept. 27 through Oct. 12, and has some of the best tech sales online. It’s an especially good option if you’re a My Best Buy “Plus” or “Total” member. Target’s Prime Day competition sale runs from Oct. 5 through Oct. 11, and it has deals going up to 50% off. You can become a Circle member for free. Our Best Editor-Vetted Prime Day Deals Right Now Apple AirPods Pro 2 Noise Cancelling Wireless Earbuds — $169.99 (List Price $249.00) Meta Quest 3S 128GB All-In-One VR Headset — $249.00 (List Price $299.99) Apple iPad 11" 128GB A16 WiFi Tablet (Blue, 2025) — $279.00 (List Price $349.00) DJI Mini 4K 3-Axis Gimbal Camera Drone (Under 249 Grams) — $239.00 (List Price $299.00) Samsung Galaxy Tab A9+ 10.9" 64GB Wi-Fi Tablet (Graphite) — $148.94 (List Price $219.99) Blink Mini 2 1080p Indoor Security Camera (2-Pack, White) — $34.99 (List Price $69.99) Ring Battery Doorbell Plus — $79.99 (List Price $149.99) Shark AV2501S AI Ultra Robot Vacuum with HEPA Self-Empty Base — $229.99 (List Price $549.99) Amazon Fire HD 10 (2023) — $69.99 (List Price $139.99) Wyze Cam v4 2K Wired Wi-Fi Smart Security Camera (White) — $25.95 (List Price $35.98) Deals are selected by our commerce team View the full article

-

Tesla now has cheaper Model Y and 3 cars, but are they still too expensive?

Tesla rolled out “affordable” versions of its best-selling Model Y SUV and its Model 3 sedan, but the starting prices of $39,990 and $36,990 struck some as too high to attract a new class of buyers to the electric vehicle brand. Tesla’s stock fell 4% and Tesla bull Dan Ives, an analyst at Wedbush, said he was disappointed that the cars were only about $5,000 cheaper than the next trims of the models. The new versions, called Standard, cost more than what the previous models started at, including a $7,500 tax credit that expired at the end of September. The much-awaited unveiling is crucial for Tesla as it pushes to reverse falling sales and waning market share amid rising competition in Europe and China, and the loss of the U.S. tax credit. CEO Elon Musk has for years promised mass-market vehicles, though last year he canceled plans for an all-new $25,000 EV, Reuters first reported. Instead, he chose to build lower-priced versions based on Tesla’s current models, sparking concerns among investors and analysts that the cheaper cars would cannibalize sales of existing vehicles and limit growth. “It’s basically a pricing lever and not much of a product catalyst,” said Shay Boloor, chief market strategist at research firm Futurum Equities. “I don’t see it as unlocking new demand at scale.” Both Standard versions offer 321 miles (516 km) of range and less powerful acceleration than the current higher trims called Premium. They can be ordered immediately, with deliveries set to start between December 2025 and January 2026 for many locations, Tesla’s website showed. The Standard versions do not come with Autosteer, Tesla’s driver assistance system, or touchscreens for rear passengers. Tesla has also removed the LED lightbar in the cheaper Model Y. Both come with textile seats, with vegan leather available for the Model 3, and manually adjusted side-view mirrors. Late last year, Musk said the vehicle would be priced below the “key threshold” of $30,000 including U.S. EV tax credits. In the United States, prices effectively rose by $7,500 at the end of last month, when the credit ended. Quarterly sales rose to a record as consumers rushed to take advantage of the credit while they could, but expectations are that they will slow down for the rest of the year, unless the affordable car comes to the rescue. “The desire to buy the car is very high. (It’s) just (that) people don’t have enough money in the bank account to buy it,” Musk said in July during Tesla’s second-quarter earnings call. “So the more affordable we can make the car, the better.” Tesla had posted two clips on X over the weekend, igniting excitement among fans. One video shows headlights peering out of the dark and another shows what looks like a wheel spinning for a few seconds, followed by “10/7” — the U.S. format for the date October 7. Crucial to $1 trillion pay plan Musk initially promised that production of the vehicle would start by the end of June. But Tesla only made what it called “first builds” of the car, it said in July, adding that it would be available for customers sometime in the last three months of the year. Tesla has already been grappling with slowing sales of its aging lineup as competition has grown rapidly, especially in China and Europe, where Musk’s far-right political views have also undermined brand loyalty. Earlier this year, Tesla launched a refreshed version of the Model Y with improvements including new light bars and a rear touchscreen. Musk has been pivoting the company toward artificial intelligence, focusing on robotaxis and humanoid robots. Tesla has said it will launch more affordable vehicles in its lineup but has not provided details. Affordable cars will also be key to Tesla delivering 20 million vehicles over the next decade – one of the several operational and valuation milestones set by the company’s board as part of its proposed $1 trillion pay package for Musk. (Reporting by Abhirup Roy in San Francisco and Akash Sriram and Harshita Mary Varghese in Bengaluru; Editing by Peter Henderson, Richard Chang, Sriraj Kalluvila and Alan Barona) View the full article

-

Listeria fears spread to HelloFresh pasta and turkey meals: USDA warning joins list of recent recalls

The U.S. Department of Agriculture’s Food Safety and Inspection Service (FSIS) issued a public health alert on Monday for FreshRealm’s ready-to-eat meals— shipped directly to consumers by HelloFresh—due to possible contamination from listeria. HelloFresh is a German-based meal-kit company operating in the United States and globally in Europe, Australia, Canada, and New Zealand. FreshRealm notified FSIS that the spinach used in the products tested positive for listeria bacteria. So far, no illnesses have been reported. However, FSIS said it expected additional products will be affected, and asked consumers to check this public health alert frequently as the agency will update it when more information becomes available. Last month, FreshRealm said tests confirmed that pasta used in linguine dishes sold at Walmart contained the same strain of listeria linked to a deadly outbreak in June, originally tied to chicken fettucine alfredo, that killed at least four people and sickened 20, the Associated Press noted. Here’s what to know about this week’s alert. What is listeria, and what are the symptoms of infection? According to the Food and Drug Administration (FDA), Listeria monocytogenes is a type of disease-causing bacteria that is generally transmitted when food is harvested, processed, prepared, packed, transported, or stored in manufacturing or production environments contaminated with the bacteria. Infection can lead to severe symptoms, such as abdominal pain, fever, nausea, and diarrhea, and poses a particular risk to vulnerable populations, including pregnant women, the elderly, and those with weakened immune systems. What is the product information for the alert? Here are the details of the products mentioned in the alert: Product Name: HELLO FRESH READY MADE MEALS CHEESY PULLED PORK PEPPER PASTA Establishment number and lot codes: Est. 47718 and lot code 49107, or Est. 2937, and lot code 48840 Package size and type: 10.1-oz. containers Product Name: HELLO FRESH READY MADE MEALS UNSTUFFED PEPPERS WITH GROUND TURKEY Establishment number and lot codes: Establishment number P-47718 and lot codes 50069, 50073, or 50698 Package size and type: 10-oz. containers What if I have these products in my refrigerator or freezer? Consumers who have purchased these products are urged not to consume them. Instead, these products should be thrown away or returned to the place of purchase. Consumers with questions may contact FreshRealm’s customer service hotline at 1-888-244-1562 or customerservice@freshrealm.com. View the full article

-

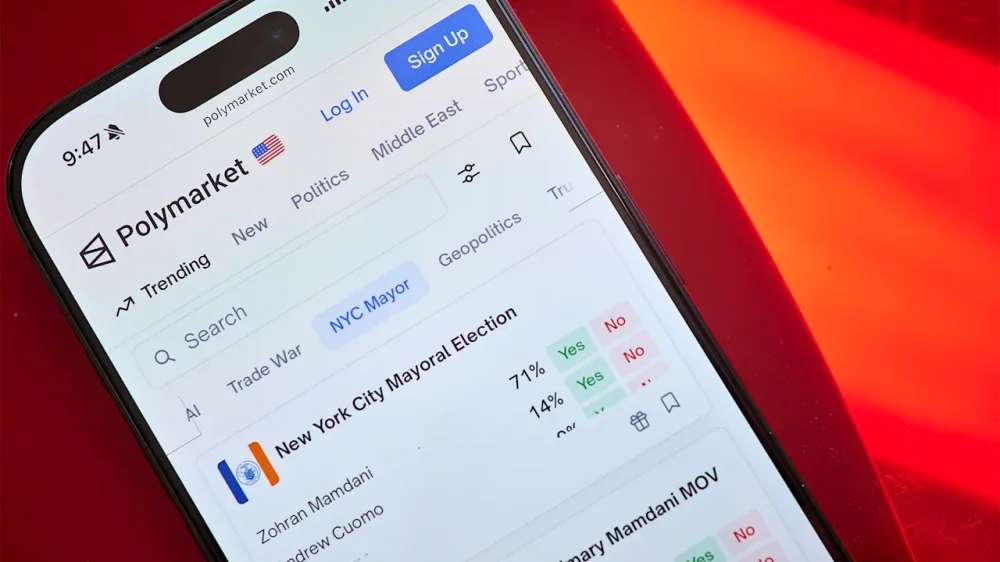

The New York Stock Exchange owner wants in on election betting—what that means for the industry